You are paying more and getting less thanks to persistent price inflation.

Politicians and talking heads on financial news networks often point to “strong” retail sales data to support the claim that the economy is doing great.

“You see! The economy is rolling right along! Americans are out there spending!”

Retail sales were up 2.67 percent on an annual basis in April. If you didn’t know better, you might get the impression that American consumers bought over two-and-a-half percent more stuff than last year. That sounds pretty good, doesn’t it?

But retail sales don’t tell the whole story because the data isn’t adjusted for price inflation. In reality, Americans are forking out more money than they were last year, but they’re actually buying less stuff.

According to the CPI data, prices were up 3.4 percent on an annual basis in April. That accounts for the entire increase in retail sales and then some.

Retail sales data always reflects rising and falling prices, along with the volume of stuff consumers buy.

When price inflation is high, retail sales tick higher, unless consumers cut back spending enough to offset rising prices. During deflationary periods (falling prices), retail sales fall, all things being equal, unless people up their volume of purchases enough to offset falling prices.

In other words, just because dollar widget sales increase doesn’t mean people bought more widgets. It could be that they bought fewer widgets but paid a lot more for them. Conversely, falling sales could reflect price drops and don’t necessarily mean people purchased fewer widgets.

An example using simple numbers clarifies this concept.

Let’s say a widget costs $10. If consumers bought 100 widgets, retail sales would be $1,000. Now let’s say the cost of a widget increased to $12. If people still bought 100 widgets, retail sales would increase to $1,200. Headlines would trumpet a great retail sales report and a “robust” economy. But people weren’t better off. They purchased the same number of widgets; they just paid more for them.

When you put recent retail sales data into this context, it’s logical to conclude that American consumers haven’t been spending more because they’re confident about the economy. They’re not better off because they’re getting more stuff. They’re just shelling out a lot more money for the same amount of stuff they were getting before — and in some cases even less stuff.

American consumers have been spending more because they have to. This is an involuntary spending spree. American consumers are spending hand-over-fist in an effort to keep up with surging prices.

And based on the latest data with retail sales rising even slower than price inflation, it appears they’re tapped out and cutting back on the amount of stuff they’re buying to boot.

Even More Bad News

The news is even worse when you consider how consumers have kept up with surging price inflation.

As prices skyrocketed last year, Americans blew through their savings to make ends meet. Aggregate savings peaked at $2.1 trillion in August 2021. As of June 2023, the San Francisco Fed estimated that aggregate savings had dropped to $190 billion.

In other words, Americans ran through $1.9 trillion in savings in just two years.

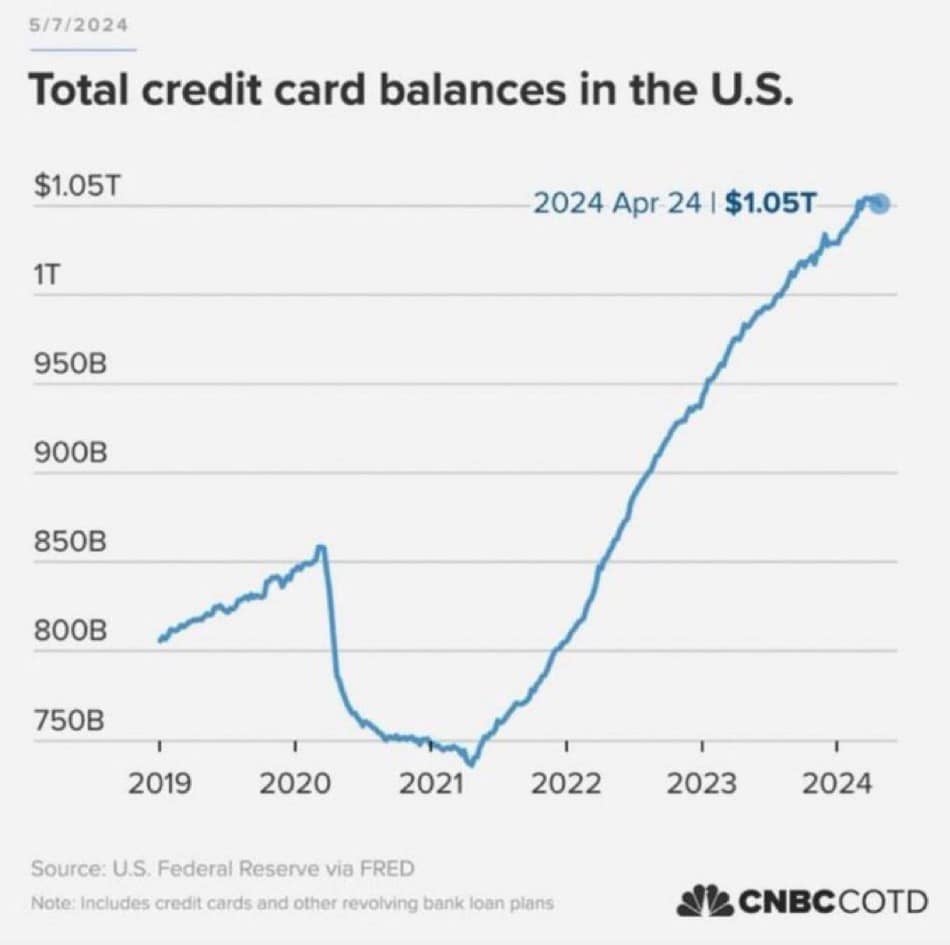

Then they turned to credit cards.

Consumer debt topped $5 trillion for the first time ever in January.

Credit card spending cratered in March.

As of the end of April, Americans owed over $1 trillion in credit card debt alone.

Of course, credit card spending is unsustainable. They have this nasty thing called a limit, and it appears American consumers might be bumping up against it.

This could indicate that Americans have reached their limit and are having to drastically cut back on the amount of goods and services they’re consuming. This could also account for the tepid first-quarter GDP growth.

So, just because you see strong retail sales numbers, don’t assume it means the economy is great. As with most things, you have to dig a little deeper and keep things in context.

**********