Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

We published our report on the world’s top selling EV models yesterday. Now, let’s look at which auto brands and auto groups sold the most plugin vehicles and the most BEVs in September.

Top Selling Brands

In September, #1 BYD, now deep into pricing out the competition (fossil fueled and electric…) didn’t disappoint. It scored some 399,000 registrations, which is, of course, a new record. With sales at this level already, one starts to wonder how high the Shenzhen make’s sales could go. Would 900,000 units per month be possible?

As for Tesla, it continues randomly switching between black and red, between growth and dropping sales. After an 11% drop in August, the company returned to black, jumping by 24% in September. As of 2024, there were four growth months (January, May, July, and September) and five months in the red (February, March, April, June, and August). As it is, the jury is still out on whether 2024 could be the first year of dropping sales for the US make.

Regardless of what happens in 2024, expect 2025 to be a year of growth, with the Model Y refresh, the Cybertruck ramp-up, and (maybe) a new, cheaper model in the second half of the year — with the question now being: “By how much?”

Below the top two, we have three Chinese brands in record setting mode, with Wuling winning the last position on the podium with close to 68,000 registrations, beating #4 Li Auto’s score of 55,000 registrations.

The third Chinese make to score a record performance was the #5 Geely, which got 53,000 registrations, and this performance is the most important of the three, as Geely has a number of models ramping up (Geely Galaxy E5) or in the pipeline (Geely Galaxy Starship 7). Expect it to continue rising in the table, probably ending the year in 3rd.

Despite ending the month in 6th, Volkswagen actually had a good month, with the 44,000 units of September representing its best score this year. The new VW ID.7 (a record 5,600 units) helped along the ID.3 and ID.4 in keeping the German make afloat.

In the second half of the table, highlights also came from China, with four brands scoring record results. The #11 Leap Motor scored 33,000 registrations, its second record performance in a row, #13 Chery had a record 29,000 registrations, much thanks to the Fengyun T9 PHEV, in #17 we have Zeekr hitting 22,000 units, with the new 7X SUV landing with over 4,000 registrations, and finally, at #19, XPeng had a record 20,609 registrations, with the new Mona M03 representing half of XPeng’s deliveries.

In the YTD table, there wasn’t much to report regarding the podium. BYD has double the sales of Tesla, and the US brand has three times as many registrations as #3 BMW. But while BYD continues to grow by double digits, Tesla’s sales are stagnant in 2024.

Far below these two, which are really in a league of their own, BMW, the #1 premium brand in the ranking, stayed in its podium position, but with a rising #4 Wuling only 17,000 units behind, and #5 Li Auto shortening the distances from 39,000 units in August to 26,000 units now, BMW should end the year in 5th, thus losing the bronze medal it won in 2023.

The 6th position of Volkswagen is also in danger, as rising Geely, which was up to 7th in September, could surpass it by the end of the year.

In the second half of the table, Toyota benefitted from a bad month from Audi and climbed to 13th. The Ingolstadt-based make needs to be less dependent on the Audi Q4 e-tron, so the ramp-up of the new Q6 e-tron and A6 e-tron need to happen sooner than later.

Leap Motor profited from a record streak of performances to continue climbing in the table, rising one position to 17th.

Top Selling OEMs for EV Sales

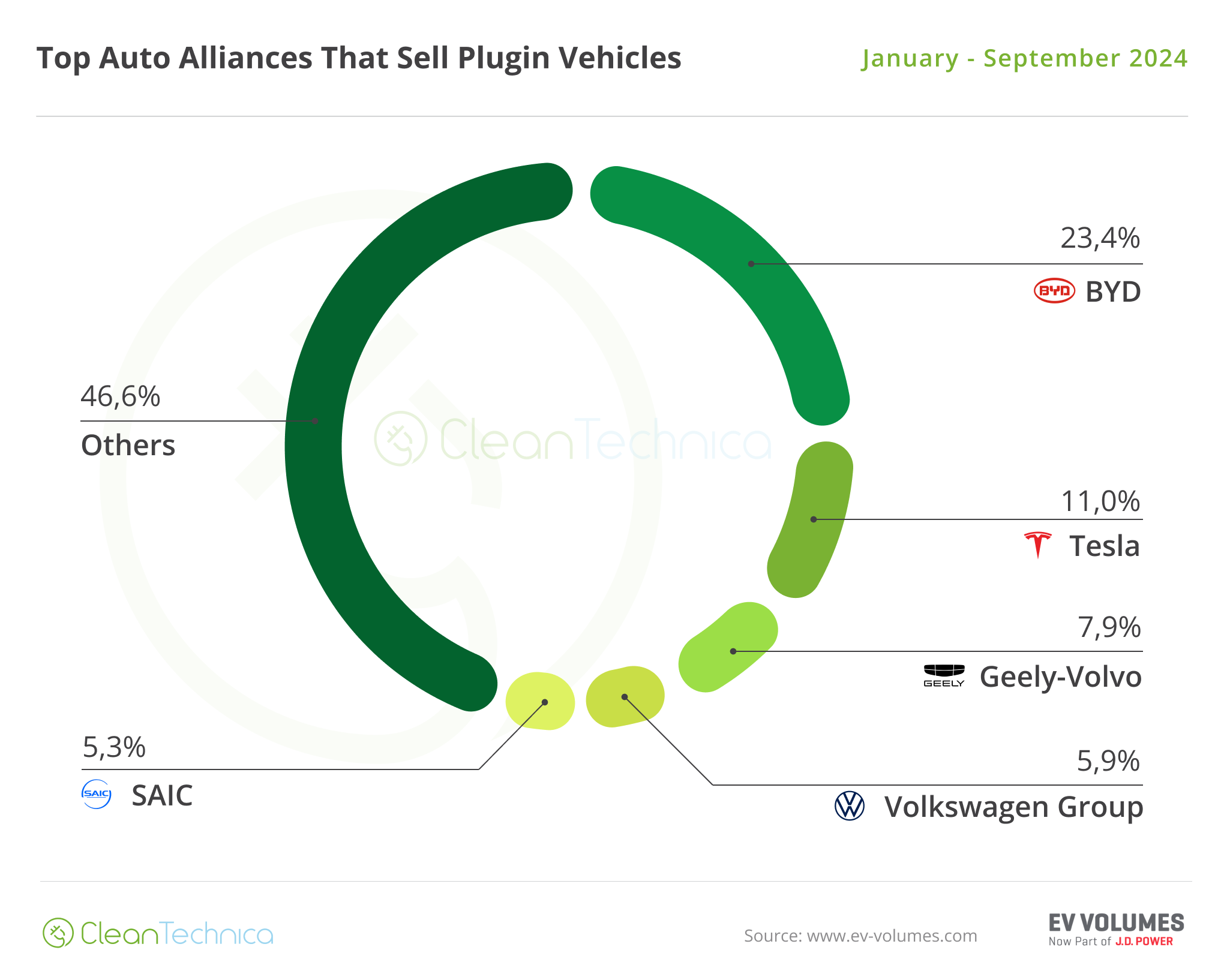

Looking at registrations by OEM, #1 BYD again gained share, thanks to its recent price cuts and new model launches, going from 23.2% to its current 23.4% (it had 21.9% a year ago), while Tesla ended September with 11 % share (it had 14% in the same period of 2023).

3rd place is in the hands of Geely–Volvo, with the OEM growing by 0.1%, to 7.9% share. The Chinese OEM is the one that most progressed in the top 5, going from 6.1% in September 2023 to its current 7.9%.

Considering Tesla’s recent share drop and Geely’s significant growth, will we see the Chinese juggernaut threaten Tesla’s silver medal in the near future? This year is unlikely, but in the second half of next year … it could very well happen.

Meanwhile, Volkswagen Group (5.9%) stayed in 4th, but lost distance over #5 SAIC (5.3%, up from 5.2%). Thanks to Wuling’s positive month, the Shanghai-based OEM managed to compensate for the slow month from the rest of the lineup.

Below SAIC, #6 BMW Group (3.6%, down from 3.7% in August) lost ground over the competition, with #7 Changan (also down to 3.6%) now just 4,000 units behind the German OEM.

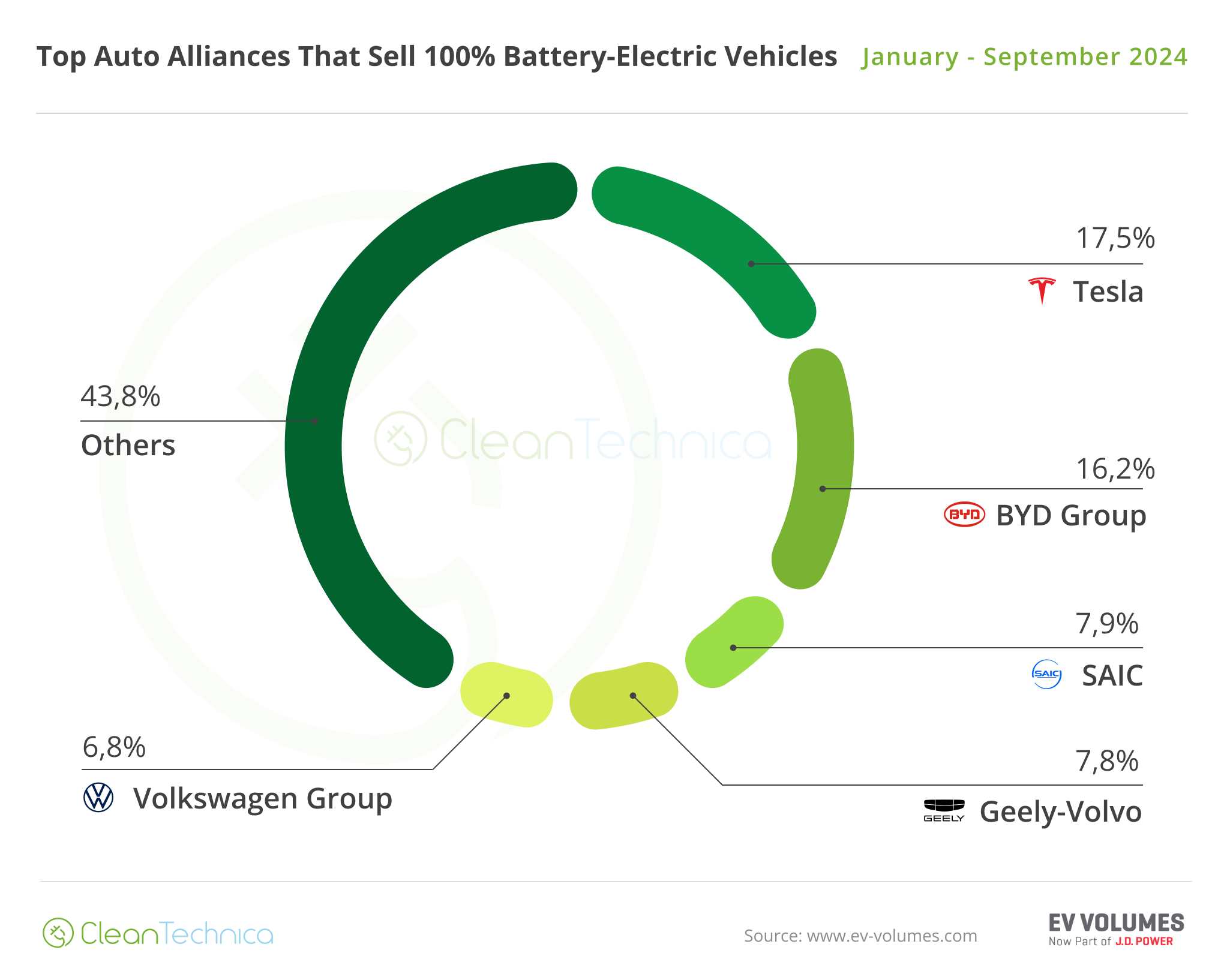

Looking just at BEVs, Tesla remained in the lead with 17.5% share, but it has lost 2.6% share compared to the same period last year. In second is BYD (16.2%, up from 15.9% in August). With Tesla losing share, we might see BYD surpass it in the first half of 2025. It is not doing so sooner, because the Shenzhen OEM is now focusing on PHEVs, so expect only significant growth on its BEV side next year.

Geely–Volvo (7.8%, up from 7.6%) was up thanks to good results across its long lineup of brands. Comparing the OEM’s performance to where it was 12 months ago, the progress is visible, jumping from 5.6% share in September 2023 to its current 7.6%!

But with SAIC (7.9%, up from 7.6% in August) also on the rise, much thanks to Wuling, the Shanghai OEM surpassed Geely and is now in 3rd place.

The Volkswagen Group (6.8%) is stable in 5th, and should remain there until the end of the year.

Below the top 5, BMW Group (4.2%, down from 4.3% in August) is steady in 6th, followed by #7 Hyundai–Kia (4.1%).

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy