Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

In November, global plugin vehicle registrations broke their previous monthly sales record (1,291,000 units), which was just set in September 2023. They reached 1,385,000 units in November. In the end, plugins represented 19% share of the overall auto market (13% BEV share alone)!

So, that sales slowdown narrative we have been hearing about recently … is nothing more than that, narrative. It’s not reality.

The market share growth could have been even higher if the overall ICE market hadn’t also been recovering to pre-COVID levels…. It seems that economic crisis or not, people are still buying cars.

Full electric vehicles (BEVs) grew 25% YoY and represented 69% of plugin registrations in November, in line with the year-to-date tally of 69% share.

Plugin hybrids did even better, jumping 40% compared to November 2022, with the 432,506 units of November representing the PHEVs’ 3rd record month in a row, but much of this is due to the range-extended models that are now popping up everywhere in China, with many of these models having batteries of over 40 kWh — which are much more appealing to the public compared to what buyers were used to before.

20 Best Selling EV Models in the World in November

Looking at November best sellers, there were no surprises at the top. The Tesla Model Y was high above everything else, scoring another 100,000+ performance, 115,192 registrations, but this was just 13% above the result of November 2022, which gives credit to those who say that the Model Y is already close to its demand limits.

Behind the Model Y, we have the BYD Song, with some 63,000 registrations, and the interesting fact that the BEV version is having a records streak. Over 11,000 units were delivered in November, proving that BYD production is tilting progressively into BEVs, even for those models with dual powertrains.

3rd was the Tesla Model 3, with the refreshed Made-in-China version now ramping up. But, interestingly, even with the refresh helping out, the midsized sedan was just 15% above last year’s result in the same period, proving that the Model 3 is now in full maturity, with significant growth rates no longer on the horizon.

Behind the podium we have the usual BYD Armada, with the small Seagull leading the charge in 4th with over 40,000 registrations, ramping up on its way to become the 2nd best selling EV in the world in 2024 (and #1 in 2025?), while its older sibling the Dolphin was 5th, also with a record score, 41,346 units. These two models benefitted from the low levels of competition in their respective segments.

Still on the top half of the table, the #8 Wuling Mini EV was the best selling NTNB (non-Tesla, non-BYD) on the table. But there are NTNB competitors right behind, like the #9 Wuling Bingo and #10 GAC Aion Y.

Elsewhere, and as to be expected in a near record month, there were records galore. In the second half of the table, there were several models hitting record results. Starting with the Li Auto lineup, the highlight in particular was the Li Xiang L7, scoring a record 16,599 registrations. That made it #13 in the table, not that far from the category leader, the #10 BYD Han.

Will we see Li’s L7 become the new leader of the full size category in 2024? Maybe, but then again, maybe not, because a new star is rising in that category. The Huawei-backed AITO M7’s deliveries are currently jumping through the roof, and they hit a new record of 15,327 units in November. That allowed AITO’s Li L7-fighter to end just 1,500 units below its Li Auto counterpart, and 5,000 units behind the category leader, the BYD Han.

Speaking of the flagship BYD model, its more alluring sibling, the BYD Seal PHEV, is probably one of the reasons why Han sales have lost wind from their sails. The new big sedan scored 12,011 registrations in only its 3rd month on the market, allowing it to join the table in #20.

Another model also hit record results. Geely’s Panda Mini, a somewhat cuter take on the Wuling Mini EV formula, scored its second record score in a row, 15,188 registrations, allowing it to be 16th in November.

Outside the top 20, there is plenty to talk about. Going from biggest to smallest, in the 5 meters category, Li Auto’s L9 XXL-SUV was fewer than 100 units from joining the table, ending the month with 11,955 registrations.

In the midsize category, the main highlight is the rise of IM’s LS6 SUV. This is a new take on the Tesla Model Y recipe from SAIC’s JV with Alibaba. It reached a record 8,158 registrations in November. Could this new model reach the top 20 soon?

Another fresh model with top 20 prospects is the Lynk & Co 08 PHEV, an original midsize crossover with a 40 kWh battery. For context, 40 kWh is now looking like the bare minimum for plugin hybrids in China. In only its 4th month on the market, the Lynk & Co 08 PHEV reached 10,019 units, so we could see the midsize model ramping up to a table presence soon.

A mention also goes out to the record score of the BMW i4 (9,145 registrations), which shows BMW’s German arch-rivals that even placeholder models can sell significantly — you only need to actually want to sell them….

As for the compact category, we salute another record performance from the value for money king, the MG4. It scored 10,506 registrations this month. Still in this category, Great Wall’s Ora Good Cat continued on a high note, in no small part thanks to export markets. It got 10,796 registrations, its best score ever. Meanwhile, Buick’s Velite 6 wagon(!) was the best selling GM product(!!), with a record result of 8,083 units(!!!). This bodes well for the careers of the recently introduced Buick Electra E5 and E4, and at this point, Buick is the most successful GM brand in the EV arena … thanks to the success of its Chinese operations. But more on this later….

In the compact crossover category, the Skoda Enyaq (9,163 units) hit another record score, and all this without even joining the Chinese market (C’mon, Volkswagen Group, what are you waiting for?!?!). This helped Volkswagen Group’s fortunes along, all while the Audi Q4 e-tron continued to post positive performances, getting 10,377 deliveries in November.

Finally, in the tiny city EVs category, Chery’s take on the Wuling Mini EV, the originally named QQ Ice Cream, registered 9,219 sales. This was its best result in over a year, confirming the popularity of the tiny Wuling formula in China. Maybe it is time to export the formula to overseas markets?

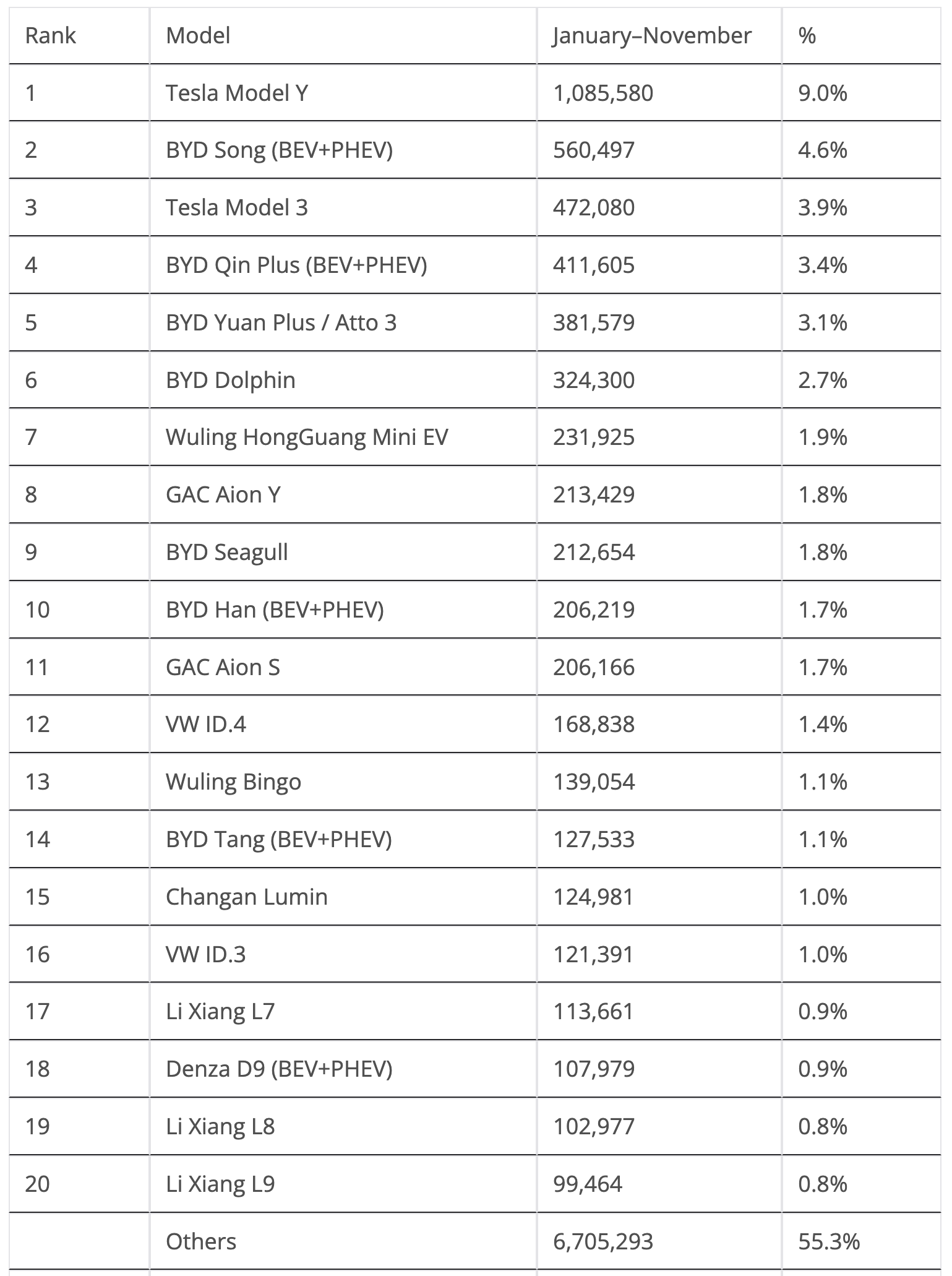

Top 20 EV Models YTD

In the year-to-date (YTD) table, the podium is already pretty much decided. The Tesla Model Y has almost twice the sales of the runner-up BYD Song, while the Chinese model is profiting from a sizable advantage of 88,000 units over the bronze medalist Tesla Model 3, which in turn also has a safe 61,000-unit advantage over the #4 BYD Qin Plus.

This will mean that the 2023 podium will be exactly the same as the 2022 edition. The Tesla Model Y will win its second title in a row, followed by the BYD Song, which will earn its second silver medal, all while the Tesla Model 3 gathers its second consecutive bronze medal — after winning the best seller title four times in a row from 2018 to 2021.

Below the podium, the biggest point of interest is the BYD Seagull, which climbed two more positions to #9. The city model is now poised to climb a couple more positions in December. Although, the 7th position will be a tough call, as the also rising Wuling Mini EV, which jumped two positions to 7th in November, won’t leave that position without a fight.

A few positions below, the Wuling Bingo was also up, in this case to #13. While not experiencing the same level of success as its BYD competitors, the Dolphin and the Seagull, Wuling’s supermini is a much welcome addition to the EV market. And it just begs to be exported. With GM allergic to small cars — just look at the neglect the Bolt got throughout its life — Shanghai Auto could well sell it as an “MG 2” in export markets….

The last positions on the table had a reshuffle in November, with Li Auto’s L7 surpassing the Denza D9, becoming the new #17, and its 7-seat XL sibling, the Li Xiang L9, surpassed the Audi Q4 e-tron and is now 20th in the 2023 table.

But with the Audi Q4 e-tron just 200 units behind (99,261 units) and the rising #22 Geely Panda Mini (97,102) not that far, it will be an entertaining race in December between these models.

Speaking of entertaining races in December, another one will be the race for the 14th spot. With the #14 BYD Tang being sidelined by the competition — both external internal — its spot is up for grabs. Both the #15 Changan Lumin and #16 VW ID.3 are looking to reach that position.

Production Outside China

One of the questions that frequently appears in the comments section is: “What if we take out all the Chinese models? Who are the best selling EVs without China?”

Here’s the answer.

While the top positions do not see many changes compared with the regular ranking, it is relevant to see that, if we take out the Made-in-China Teslas from the tally, the output of both the #1 Model Y and #2 Model 3 gets cut in half — which says a lot about the importance of Giga Shanghai (and why Elon Musk is so…nice to the Chinese authorities, compared to the US ones).

Imagine if things turn sour for some reason between Tesla and the Chinese government (future President Trump-related disputes, some Tesla PR tragedy, a black swan event, etc), and they decided to simply shut down Giga Shanghai. Half of Tesla revenue would just disappear. Now let that sink in….

On a smaller scale, it is the same story for #3 VW ID.4, which also has significant volumes coming from China, representing a third of all of the crossover’s output.

The first model not being affected by a possible Chinese decoupling of the global economy would be the #4 Hyundai Ioniq 5. While it is out of the global top 20, it is the best selling BEV not present in the Chinese market.

As a matter of fact, only half (Hyundai Ioniq 5, Kia EV6, BMW i4, and Skoda Enyaq) of these 8 models do not have local assembly in China, and only Skoda does not sell BEVs or have plans to sell them in China.

(Funny enough, Skoda does have plans to sell the Enyaq in India, starting in 2024. But not in China... The logic of VW management sometimes seems beyond comprehension.)

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.