Global plugin vehicle registrations were up 38% in June 2023 compared to June 2022, rising to 1,260,00 units. In the end, plugins represented 19% share of the overall auto market (13% BEV share alone). This means that the global automotive market is firm in the Electric Disruption Zone. Add another 900,000 units coming from plugless hybrids, and we have almost one third of global registrations having some form of electrification!

Year to date, plugin electric vehicle market share was up to 15% (10% BEV).

Full electric vehicles (BEVs) represented 70% of plugin registrations in March, keeping the year-to-date tally also at 70% share.

As a side note, fuel cell electric vehicles (FCEVs) are down 25% year over year (YoY), and if 2023 ends with a drop in fuel cell vehicle sales, it will already be the second year in a row with falling sales. Was 2021 the peak year for fuel cells?…

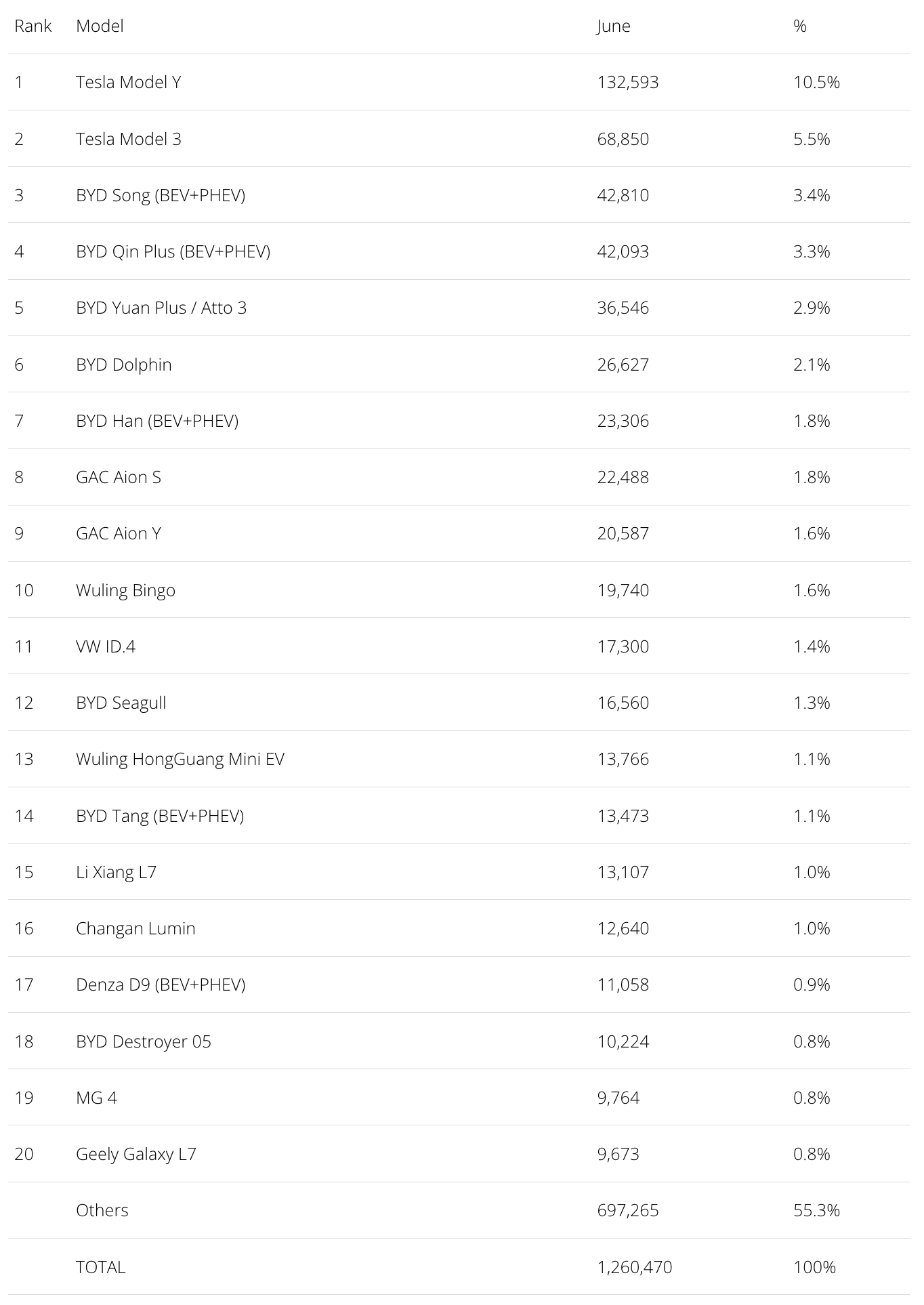

20 Best Selling EV Models in the World in June

Looking at June best sellers, there were no surprises on the podium. The Tesla Model Y was high above everyone else, while behind it, the Tesla Model 3 won the race over the BYD Song and Qin Plus, profiting from Tesla’s end-of-quarter peak month. Although, one could say that at 68,850 units, it was a higher tide than usual, with the midsize sedan scoring its best result since March ’22.

Regarding record performances, the most important was the #10 Wuling Bingo, with 19,740 registrations. It looks like the small EV is becoming a success story for the joint venture. In #12, we now have the recently introduced BYD Seagull, with the littlest BYD set to join the top 10 soon.

The #15 Li Xiang L7 scored 13,107 registrations. It looks like it is now close to surpassing the BYD Tang as the best selling full size SUV. The other record performances sit at bottom of the table and belong to the BYD Destroyer 05, #18, with 10,224 registrations, the #17 Denza D9, and the MG 4 joining the table, in #19, thanks to a record 9,764 registrations.

One of the surprises of the month was the official landing of the Geely Galaxy L7, with the plugin hybrid model debuting directly in #20 globally. Will it stay there? Hmmm….

Outside the top 20, there is plenty to talk about. Going from the biggest to the smallest, despite the Li Xiang L7’s success, the other yachts models from the startup are hanging on with notable volumes, as proven by the 8,451 registrations of the Escalade-like L9 and the 9,618 registrations of the slightly less offensive L8 SUV.

In the midsize category, the highlight is the third record performance in a row for the Leap Motor C11 SUV. Thanks to its new EREV version, it reached 8,934 registrations, providing the struggling startup some much needed volume.

As for the compact category, we salute the return of Great Wall’s Ora Good Cat to decent performances. It scored 9,061 registrations this month, its best score in 18 months, thanks to rising volumes in export markets and a step-up in deliveries in its home China. That allowed it to sell at the same pace as the VW ID.3 (9,245 registrations). There’s also good news in the Volkswagen stable, as the Audi Q4 e-tron scored a record 9,519 registrations while the value for money king Skoda Enyaq also had a record performance, 7,293 registrations.

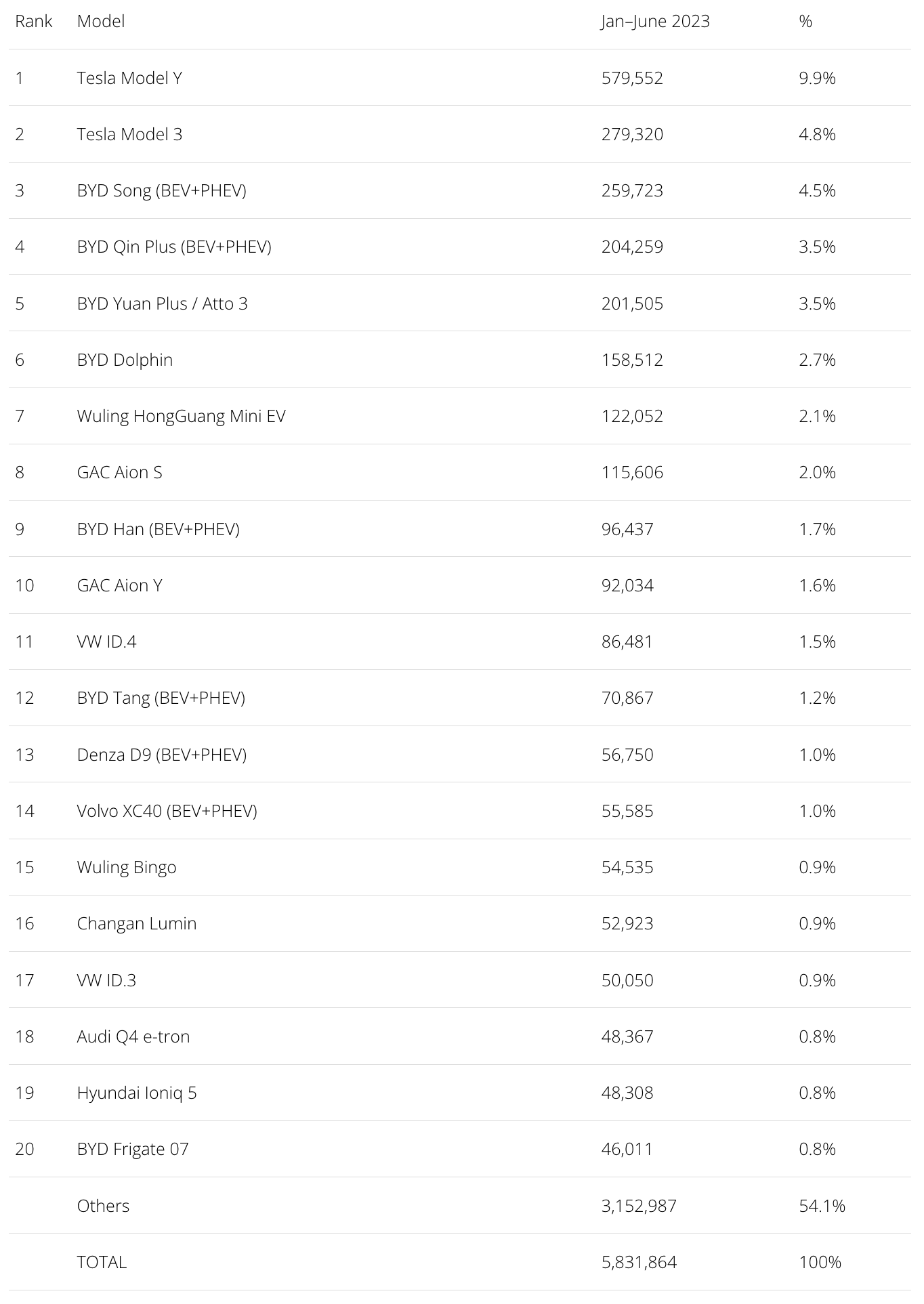

Top 20 EV Models YTD

In the year-to-date (YTD) table, the big news was the Tesla Model 3 returning to the #2 spot, allowing Tesla to again have a #1 plus #2 ranking.

In the remaining podium positions, the #3 Tesla Model 3 recovered some ground (400 units) over the #2 BYD Song, so Tesla’s midsizer could profit from June’s peak performance to try to displace the Chinese SUV from the runner-up spot.

Another position change happened right at the 4th spot, with the BYD Qin Plus climbing one position.

The remaining positions stayed the same, with the exception being the small Wuling Bingo, which debuted on the best sellers table in #15.

Top Selling Brands

In May, BYD had a record 240,000-unit performance, which was enough to beat Tesla in an end-of-quarter month. Having said that, Tesla also hit a record month, with 211,000 registrations.

Below the top two galactics, GAC ended in 5th, thanks to 45,028 registrations, its 4th record score in a row. While the upcoming Aion SSR (don’t call me a Tesla Roadster killer) is not going to move the needle, GAC’s other upcoming model, the ultra-aerodynamic Aion Hyper GT sports sedan, could ruffle some feathers in the full size segment. Times are looking good for GAC’s Aion brand….

#8 Li Auto also had a record month, its 3rd in a row, with over 32,000 registrations, thanks to strong results across the lineup. With the startup brand still supply constrained, expect the high-end make to continue beating records regularly in the near future. But the real fun will start when the L6 and L5 midsized models land sometime next year.

The second half of the table saw Hyundai score a record result, thanks to good results from the Ioniq 5 & 6.

But the biggest surprise of the month, when it comes to the brand ranking, was another record performance from … Toyota!

Yep, the Japanese automaker scored 14,529 registrations, its second record score in a row, mostly thanks to the ramp-up of its Chinese operations (bZ4X and bZ3), and also aided by steady results from the RAV4 PHEV and the introduction of the new Prius PHEV. Could it be that the reports of Toyota’s death have been greatly exaggerated?

In the Stellantis stable, Jeep continued to profiting from strong sales of the Wrangler PHEV (thanks in no small part to IRA incentives) and the production ramp-up of the Grand Cherokee PHEV, thus posting a record score of 14,587 registrations. That means it is regularly beating its US counterparts Ford and Chevrolet! And with the Jeep Avenger EV having just landed in Europe, expect its sales across the pond to recover in the coming months. The US make has everything needed to collect more record performances in the near future.

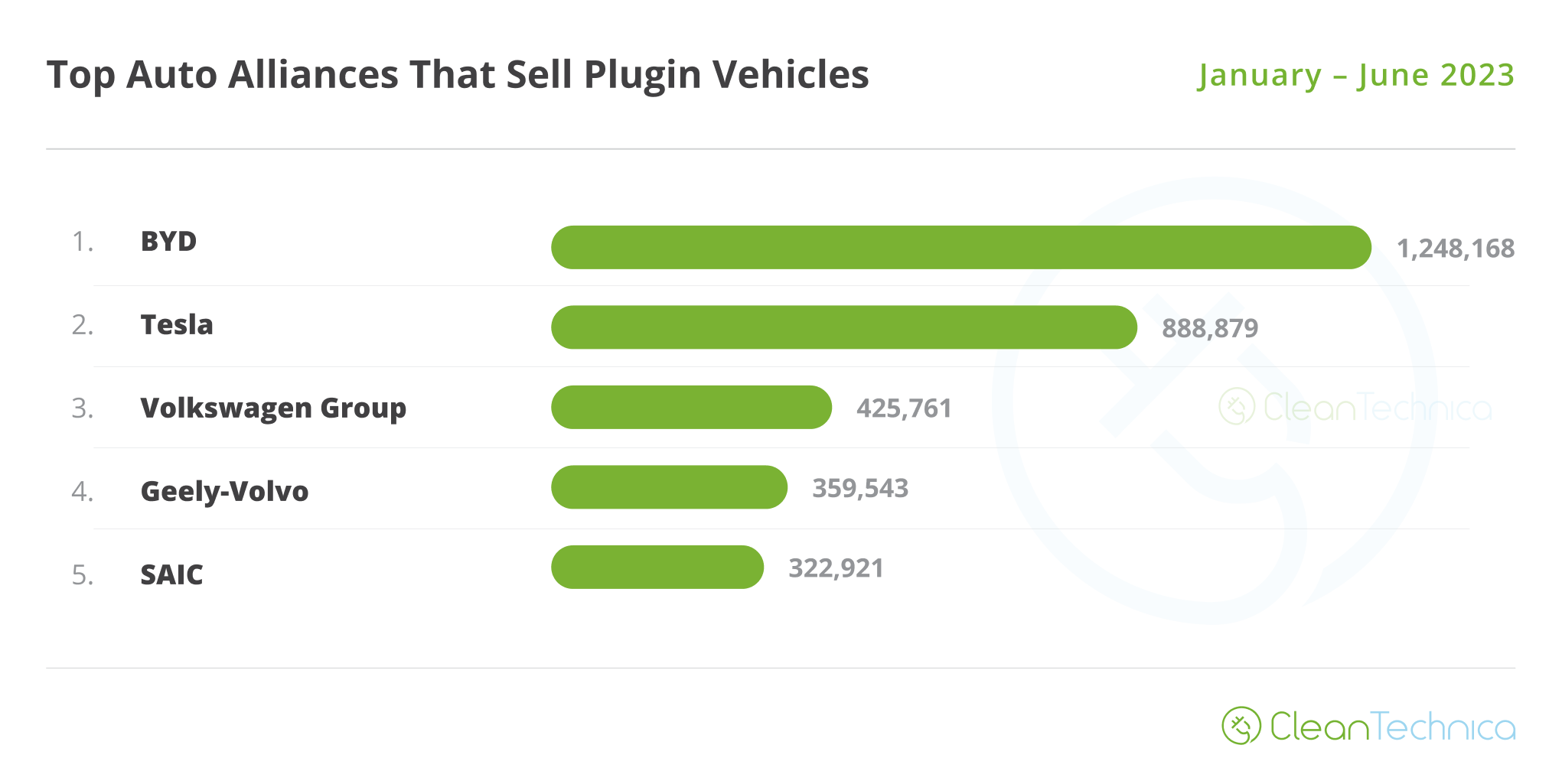

In the YTD table, there wasn’t much to report regarding the podium. BYD is ahead of Tesla, with the two makes together responsible for more than one third of the global plugin vehicle market.

Far below these two, which are really in a league of their own, BMW is still comfortable in the 3rd spot, but below it, the hot hot hot GAC Aion surpassed Volkswagen in May. Will GAC be able to displace #3 BMW from the podium sometime in the future?

Li Auto’s rise also continued, climbing to 8th, and the Chinese brand is without a doubt the hottest startup brand in 2023.

In the second half of the table, the highlight was Hyundai, which climbed one position to #12.

Looking at registrations by OEM, leader BYD lost share, going from 21.9% to its current 21.4%, while Tesla was up, as expected — to 15.2% share.

Compared to what was happening a year ago, both BYD (+6% share) and Tesla (+1.6%) were the big winners. Although, in the case of the latter, that is entirely on the shoulders of the Model Y, while the Shenzhen OEM profited from a never-ending wave of new models.

3rd place is in the hands of Volkswagen Group, keeping a good distance from #4 Geely–Volvo. But the “Chinese Volkswagen Group” was one of the winners YoY, increasing its share by 0.5% compared to the same period last year, when it was 6th overall.

As for #5 SAIC (5.5%), the recent success of the Wuling Bingo allowed it to stop the sales bleed.

Below SAIC, Stellantis (4.8%) is firmly in the 6th spot, a comfortable distance ahead of #7 BMW Group (4.3%).

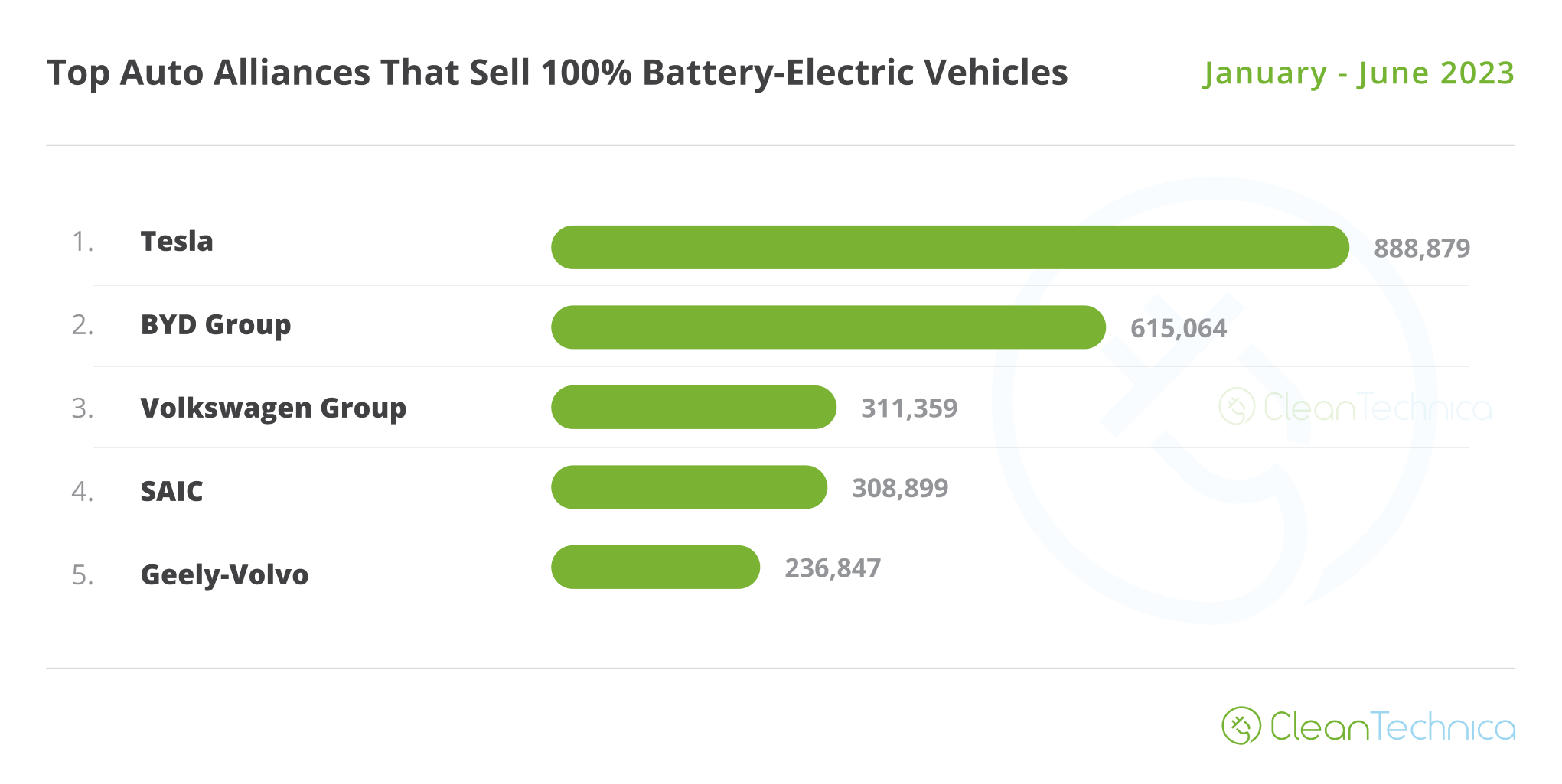

Looking just at BEVs, Tesla remained in the lead with 21.8%, up from 21.2% in May. The US make has a comfortable lead over BYD (15.1%, down from 15.4%), making it unlikely the Chinese automaker will be able to remove Tesla from the BEV throne this year.

The last place on the podium saw a position change, with Volkswagen Group surpassing SAIC, allowing it to recover the bronze medal position. Expect an entertaining race between these two in the remainder of the year.

In 5th we have Geely–Volvo, with 5.8%, down from 6%. The Chinese OEM would like to reach #4 Volkswagen Group but still has a ways to climb. Geely should primarily look in the rear-view mirror and watch out for #6 GAC (5.4%, down from 5.5%).

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …