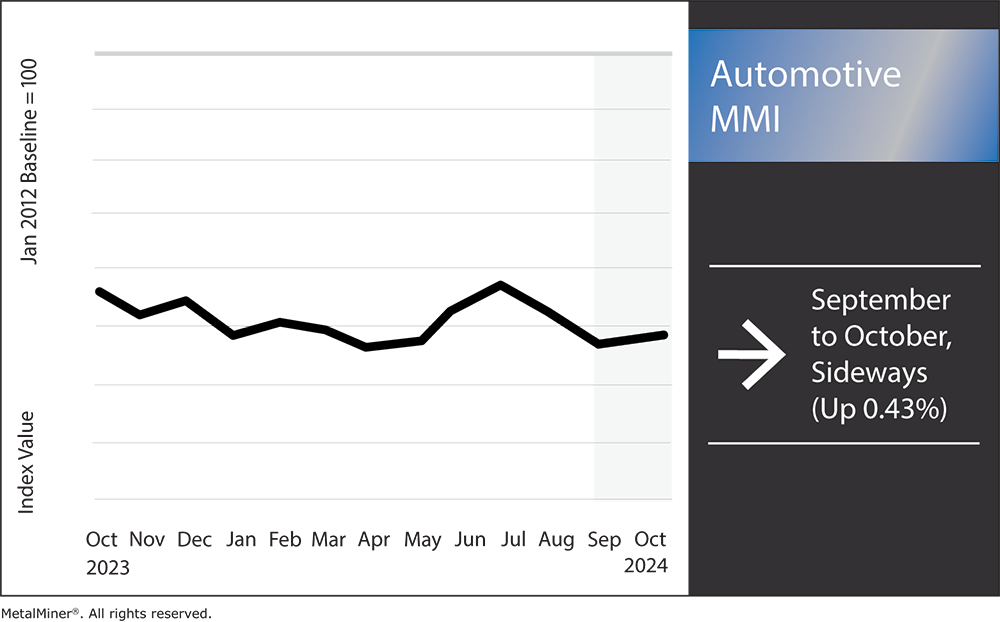

The Automotive MMI (Monthly Metals Index) reduced its downward price action, moving sideways month-over-month by 0.43%. While the automotive industry dodged a bullet with the east coast port strike only lasting 3-4 days, the industry could still face more pressure due to lower steel output. Thanks to ongoing mill maintenance that began in August, hot-dipped galvanized steel prices could witness short-term price increases, which will introduce bullish momentum into the automotive industry.

Get a competitive edge in challenging steel market conditions. Learn game-changing industry insights by opting into MetalMiner’s free weekly newsletter.

How Steel Mill Maintenance Shutdowns Affect Hot-Dipped Galvanized Steel Prices

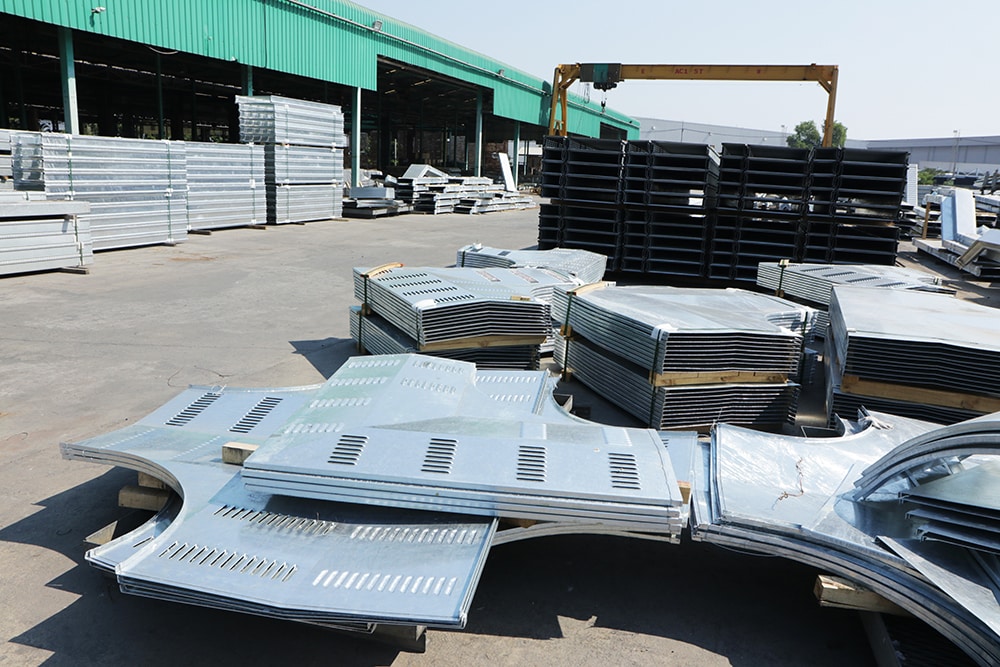

Planned maintenance shutdowns across key steel mills have not only begun to slow steel output, they’re also casting a shadow over critical downstream industries, especially automotive manufacturing. One of the most affected products is hot-dipped galvanized (HDG) steel. As the supply of HDG steel tightens due to reduced mill output, manufacturers are feeling the pressure.

Hot-Dipped Galvanized Steel in Automotive Manufacturing

One of the most essential semi-finished materials in the automobile sector is hot-dipped galvanized steel, which manufacturers mainly use to shield cars against corrosion. As such, HDG steel is a vital component in body panels, frames, and structural reinforcements. Its ability to stop rust not only prolongs the life of cars but also lowers the need for expensive future maintenance.

Impact of Steel Mill Shutdowns on HDG Prices

U.S. steel plants have been conducting a number of scheduled maintenance shutdowns throughout 2024. While these shutdowns carry consequences, they are necessary to maintain the long-term performance and viability of aging infrastructure. However, the timing and duration of these 2024 shutdowns have further complicated an already strained market grappling with shifting demand and pricing constraints.

The automotive sector continues to rebound from previous disruptions, including supply chain bottlenecks and labor shortages, adding a new layer of complexity to the market. The combination of a recovering market, growing vehicle demand and shrinking steel supply could create a problem. This isn’t just about short-term price hikes. Indeed, sustained increases in HDG steel prices could lead to automakers either passing costs onto consumers or reducing their profit margins. In either case, the effects on the broader economy would be noticeable.

Don’t miss out on valuable steel market insights. Subscribe to MetalMiner’s free Monthly Metals index report and gain a competitive edge with comprehensive market analysis for steel and 9 other metal sectors.

Global HDG Steel Market

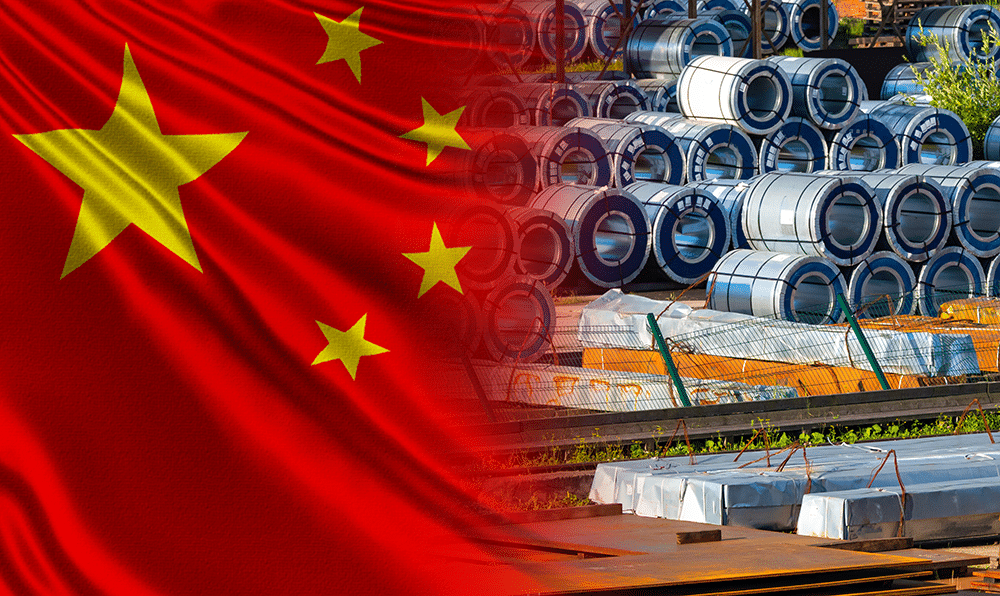

It’s important to recognize that the U.S. isn’t the only player in this market. Global forces, particularly China’s ongoing steel export dumping practices, continue to play a pivotal role in shaping HDG steel prices. In fact, China’s aggressive dumping of steel exports at below-market prices has led to multiple anti-dumping investigations worldwide.

This practice has not only influenced global steel prices but continues to cause volatility in markets where local production cannot compete with China’s lower-priced steel. Even though these exports may provide temporary price relief, they also destabilize the long-term competitiveness of domestic steelmakers.

The Road Ahead

In the future, there will likely be a complex interaction between the production of steel mills and the automotive industry. The effects of the present maintenance shutdowns are likely to last despite estimates that they will lessen once the mills are back online. HDG steel prices will continue to be under pressure if U.S. steelmakers cannot increase production to keep up with the increased demand, especially from the car industry.

As a result, automakers might have to look into different sourcing tactics, bargain for longer-term contracts to protect themselves from price fluctuations or, when practical, even look into material substitutes.

Automotive MMI Price Shifts

Time your steel purchases correctly with expert sourcing advice and watch the savings happen. Lower average costs with precision with the Monthly Metals Outlook report. View a free sample.

- Chinese lead prices moved sideways, dropping 2.42% to $2,369.14 per metric ton.

- Korean 5052 aluminum coil premium over 1050 dropped by 3.23% to $4.15 per kilogram.

- LME copper primary 3 month prices rose thanks to China’s stimulus efforts. In total, prices rose 6.87% to $9,906.50 per metric ton.

- Hot-dipped galvanized steel fell the most out of all components of the index. In total, prices dropped 7.02% to $980 per short ton.