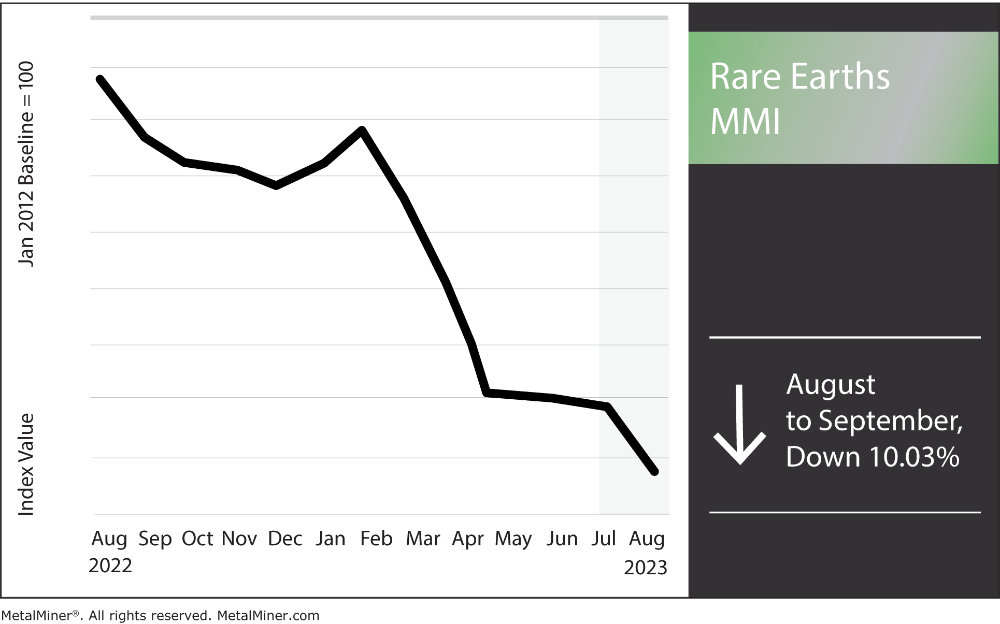

Month-over-month, the Rare Earths MMI (Monthly Metals Index) broke its short-term sideways trend and once again spiked down. Overall, the index witnessed a 10.03% decrease as reduced short-term demand continues to cause more and more supply to build up. This leaves rare earth prices struggling to find support. However, the prospect of China offering a stimulus plan could add support to rare earths prices, particularly rare earth magnets. That said, a stimulus plan would not provide long-term bullish sentiment. In order for this to occur, demand must rise, and stockpiles must deplete to a certain extent.

How should rare earth purchasing companies grapple with dropping demand? Read our free resource Squeezing Out Costs in a Falling Demand Market.

Chinese Stimulus and Rare Earths

China is considering a broad stimulus package that includes both real estate support and interest rate cuts. This stimulus package might provide price support for rare earths both in China and elsewhere. China continues to consider consolidating its rare earths industry to control pricing, improve efficiency, and achieve strategic, economic, and sustainability objectives. For example, the merger of three state entities forming the China Rare Earth Group Co. Ltd is the world’s largest of its kind. The newly formed megafirm will also supply roughly 62% of China’s national heavy rare earths supplies. Key elements such as dysprosium and terbium will most likely feel the impact of increased pricing power for the SOE, potentially impacting the global rare earths supply chain.

In the past, China has urged rare earths companies to return prices to a “reasonable” level. If China’s stimulus plan successfully boosts the economy, it may increase demand for rare earths, leading to higher prices. This outcome could benefit both Chinese and global rare earths companies. However, it is important to note that several factors, including supply and demand dynamics, geopolitical tensions, and technological advancements, repeatedly influence rare earths prices.

Empower your rare earth purchasing power with the latest market analysis and strategic advice during times of falling demand. Sign up for MetalMiner’s free weekly newsletter here.

When Will Demand for Rare Earth Magnets Return?

In 2021, the market valued rare earth metals at USD $5.3 billion, and analysts expect it to increase. Many anticipate the growth to exceed USD $9.6 billion by 2026. This includes a CAGR of 12.3% from 2021 to 2026. Most expect the rare-earth metals market to receive a boost from the growing usage of rare-earth magnets in permanent applications for electronics. Indeed, the market continues to experience rapid growth in APAC due to increased production and consumption in China.

According to Adamas Intelligence, global magnet rare earth oxide consumption will increase more than fivefold by 2040. This is a rise of $4.5 billion in 2020 to $22.8 billion by 2040. However, analysts expect global production of didymium, dysprosium, and terbium (referred to as rare earth magnets) to grow at a slower CAGR of just 5.2% during the same period, as the supply side of the market struggles to keep up with rapidly-increasing demand.

The primary factors driving the market’s growth are rising demand from growing economies and “Green Technologies” reliance on rare earth elements. Additionally, experts predict that the rare earth elements market growth will see a significant boost from increased demand for lithium-ion batteries.

Rare Earth MMI: Notable Price Trends

- Chinese neodymium traded sideways, only moving down about 1% in price. Prices as of August 1 sat at $79,948.83 per metric ton.

- Chinese praseodymium neodymium oxide rose by 4.72, bringing prices to $65,850.31.

- Finally, terbium oxide dropped by a significant 16.02%, leaving prices at $1,006.67 per kilogram.

Enjoy this article? MetalMiner’s monthly MMI report gives you price updates, market trends and industry insight for rare earths and 9 other metal industries. Sign up for free.