Texas passed two laws in 2021 that restrict government contracts with companies that take what state officials regard as punitive stances toward the fossil fuels and firearm industries. They’re among the many new laws pushed by Republicans in states across the US to oppose ESG investing and financing, which they’ve made into a culture war target. Under one of the laws, Texas has barred some state entities, including pensions, from investing in roughly 350 funds that the Texas comptroller says engage in “boycotts” of fossil fuels. The legislation has also prompted state officials to prohibit Citigroup Inc. and Barclays Plc from helping the state and its local governments raise money for infrastructure projects through bond deals, and BlackRock Inc. from managing investments for a fund that supports the state’s schools.

1. What is ESG?

An abbreviation for environmental, social and governance, ESG refers to a set of standards that some money managers and bankers use to screen potential investments and financings for their environmental efforts or societal impact. Companies have been pressured by consumers, activists, investors and regulators to good stewards not only be of financial capital but also of natural and social capital, according to a Deloitte primer on ESG. Some examples of criteria that may fall under the environmental pillar of ESG are projects that cut greenhouse gas emissions, curb water pollution or use recycled material. Socially conscious investors may consider how a company manages its labor diversity or risk policies regarding firearms.

2. Why do many Republicans oppose ESG investing?

Conservatives have been attacking the strategy, which accounts for ESG risks as well as policies that Corporate America has taken on to combat climate change, such as those pushed by the United Nations-backed Net Zero Banking Alliance. To many Republicans, screening potential investments for their environmental and social impact is a symptom of the left’s efforts to impose their “woke” political views on the masses. These critics also view companies’ adherence to ESG as anti-capitalist. For example, after a series of mass shootings, many US banks decided to limit business with companies that manufacture military-style weapons for civilian use, citing the risk they posed to the banks’ business. Some conservative lawmakers chastised the banks in response, likening their ESG policies to discrimination. Many companies have also pledged to lower their greenhouse gas emissions, a step Texas lawmakers regard as a threat to the oil-producing state’s economy. The rhetoric around ESG is heated. Republican megadonor Peter Thiel said, “ESG is just a hate factory. It’s a factory for naming enemies,” while former Vice President Mike Pence said investment firms were pushing a “radical ESG agenda.”

3. What is Texas doing?

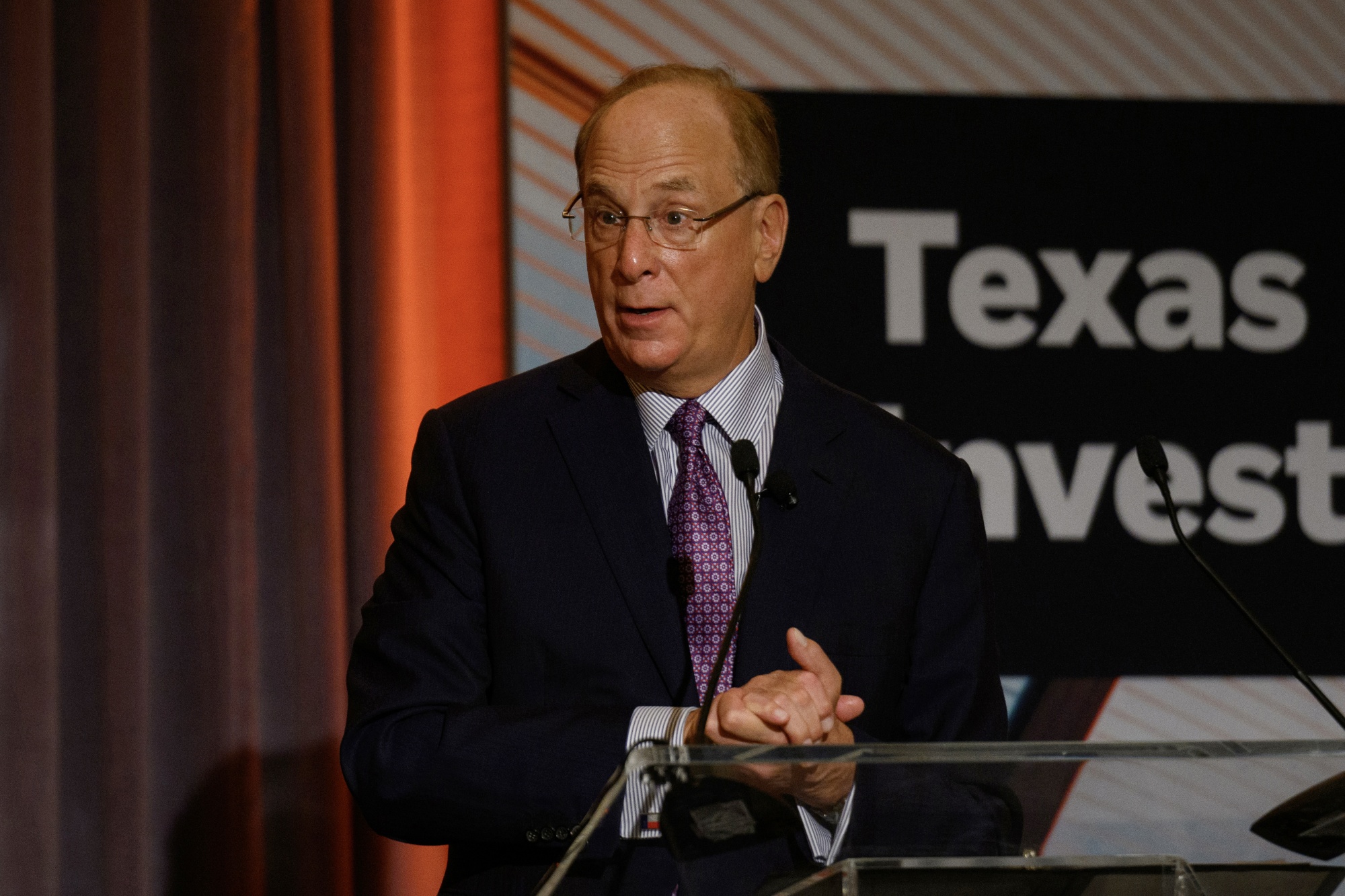

One of the 2021 laws restricts most government contracts with companies that “discriminate” against firearms entities, and the other places similar restrictions on companies that “boycott” energy. The laws were designed to punish Wall Street banks for policies Texas Republican lawmakers disagreed with. The firearms law requires any government contract worth at least $100,000 to include a written verification that the company doesn’t and won’t “have a practice, policy, guidance, or directive that discriminates against a firearm entity or firearm trade association,” according to the law. The energy law has a similar contracting provision — but also requires the Texas comptroller to maintain a divestment list of financial companies he deems as energy boycotters. If a company — or an individual fund — is included on that list, state entities such as pension funds have to divest from holdings of those assets. Some of the ice between Wall Street and Texas seemed to be thawing, with Lt. Governor Dan Patrick taking the stage with BlackRock Chief Executive Officer Larry Fink in February at a summit focused on shoring up the state’s fragile power grid. But in March, the chairman of the State Board of Education said that a state fund had divested $8.5 billion from BlackRock, citing the investment firm’s fossil fuel policies.

4. What do the blacklisted companies say?

Many companies embroiled in these debates say they don’t employ any discriminatory practices and don’t engage in boycotts. “We don’t discriminate or boycott anybody, neither for political affiliation nor for anything else,” Jamie Dimon, chief executive officer of JPMorgan Chase & Co., said in a November interview with Bloomberg News. “We do make risk, legal, credit and reputational decisions, which is our legal right — and my obligation as chairman and CEO of JPMorgan Chase.” Dimon said Texas’ ESG laws risked undermining its reputation as a business-friendly state. After BlackRock was dropped by the education board, it criticized the board’s chairman, a Republican, for a “unilateral” decision that would hurt Texas schools. “As a fiduciary, politics should never outweigh performance, especially for taxpayers,” the firm said in a written statement.

5. What about other states?

West Virginia lawmakers passed a similar law to Texas’ that bars some companies from banking contracts after Treasurer Riley Moore found firms including BlackRock and JPMorgan Chase engaged in a so-called boycott of the fossil fuels industry. Governor Ron DeSantis of Florida signed legislation that bars the sale of ESG-labeled bonds and restricted public money from being deposited in financial institutions that are deemed as pursuing “social, political or ideological interests” in their investment decisions. In Louisiana, state officials have debated whether to ban some banks from a state bond sale because of their corporate policies on fossil fuels and firearms.

6. Which banks are banned by Texas?

UBS was included on a list of energy boycotters, which effectively barred it from the state’s municipal bond market. Texas Attorney General Ken Paxton, who oversees the state’s booming bond market, has also found Citigroup to be in violation of the firearms law. And in January, Paxton disqualified Barclays from underwriting municipal bond deals after the bank declined to provide information about its carbon emission commitments as part of a review by the attorney general’s office. The uncertainty cast over the muni bond market has resulted in some local governments choosing to do business with banks that have avoided politics. Jefferies Financial Group Inc. was the No. 1 ranked municipal bond manager in Texas in 2023, climbing nine spots from three years earlier, according to data compiled by Bloomberg.

7. Are the bans affecting bond sales by municipalities and schools?

Yes. Texas’ municipal bond market has changed dramatically since the anti-ESG legislation became law. The muni market is where towns, cities and school districts raise money to pay to build things. Paxton has outsize authority to bar banks because his office signs off on state and local bond deals before they’re able to close. If Paxton rejects a sale because it includes an underwriter he has barred, the government essentially has to start the transaction over. That’s what happened to the Normangee Independent School District, which was forced to redo an $18 million bond sale that had been underwritten by UBS. The district asked for a refund of the money lost for having to do the sale twice and received $850,000 from UBS in a settlement agreement. Research by a professor at the University of Pennsylvania and a Federal Reserve economist found that the Texas laws caused municipalities to incur $300 million to $500 million of additional interest expenses on their borrowing in the eight months after the rules took effect.

8. What’s the Net Zero Banking Alliance, and which banks are members?

The Net Zero Banking Alliance is a group of banks that have committed to “financing ambitious climate action to transition the real economy to net zero greenhouse gas emissions by 2050.” More than 130 banks are members of the alliance, according to its website. In October, Paxton started a review of banks that were members of the alliance to determine whether they violate the state’s oil and gas boycotter law. NZBA is a part of the Glasgow Financial Alliance for Net Zero. GFANZ is co-chaired by Mark Carney, who is the chair of Bloomberg Inc.’s board and a former Bank of England governor, and Michael R. Bloomberg, the founder of Bloomberg News parent Bloomberg LP.

The Reference Shelf

— With assistance from Amanda Albright

Share This: