Why don’t I push for tax increases to address the massive budget deficits and the ever-growing national debt?

The answer is simple – Uncle Sam doesn’t have a revenue problem. He has a spending problem.

Did Tax Cuts Pillage the Treasury?

A reader posed the question in response to an article I wrote about the recent budget deal and looming debt ceiling fight. He pointed out that “there are two sides to a balance sheet.”

“All you guys talk about is the runaway spending, ignoring the government cash flow problem.”

He goes on to claim that “taxation relief from Bush II and Trump have pillaged Treasury.”

But have tax cuts really “pillaged” the Treasury?

The Bush Tax Cuts

In 2001, Congress passed the “Economic Growth and Tax Relief Reconciliation Act,” cutting the marginal tax rates for all income brackets and lowering the highest bracket from 39.6 percent to 35 percent.

Congress passed a second round of tax cuts in 2003 through the “Jobs and Growth Tax Relief Reconciliation Act.” This bill primarily reduced tax rates on dividends and capital gains to spur investment.

Federal receipts initially declined by about 10 percent after the enactment of these cuts. But it’s important to note that the U.S. went through a recession in 2001, in the wake of the dot com bust. Declining economic growth in that period also contributed to the reduction in federal revenue.

In fiscal 2001, federal revenues came in at $1.99 trillion. In 2002, receipts dipped modestly to $1.85 trillion. In 2003, they dipped again to $1.78 trillion. But in 2004, federal revenues began climbing again, growing to $1.88 trillion. By 2006, federal receipts were higher than pre-cut levels.

This underscores one of the benefits of a lower tax environment – it tends to be more favorable for economic growth. When individuals and businesses keep more of their money, there is more capital available for investment and consumption. We can debate just how much impact tax cuts have on growth, but it’s certainly greater than zero.

Expanding economic growth benefits the Treasury. More economic activity means more money to tax, boosting federal receipts even in a lower tax rate environment.

As economist Arthur Laffer demonstrated, there is always a tradeoff between taxes, economic growth, and federal receipts. Looking at either extreme reveals this fact.

At a zero percent tax rate, the government gets no revenue because it collects no taxes. On the other hand, a 100 percent tax rate would also yield no revenue because individuals and businesses would have no incentive to work or invest if all of their income is confiscated by the tax man.

The point is that while tax increases raise revenues, at least in the short term, they come with a downside. In fact, tax hikes generally fail to raise as much revenue as projected due to their drag on economic activity. We can debate the scope of that downside, but it should always be considered when contemplating higher taxation.

As far as the Bush-era cuts, the CBO estimates federal revenues would have been higher had they not been enacted. But it’s impossible to say by how much or if the CBO calculations are even accurate, given that we can’t calculate how much economic growth the tax cuts spurred. It’s entirely possible that revenues would have been lower without the tax cuts and their positive impact on economic growth.

Regardless, even if we take the CBO’s guesses at face value, it’s clear that the Bush tax cuts didn’t “pillage” the Treasury. At worst, they caused a temporary dip in federal receipts.

The Trump Tax Cuts

When Donald Trump took office, Congress pushed through another round of tax cuts. Not only did they not pillage the Treasury, they didn’t even reduce federal revenues in dollar terms.

The Trump tax cuts went into effect in 2018. Federal receipts were flat during that fiscal year, nudging slightly higher from $3.31 trillion in fiscal 2017 to $3.32 trillion.

Revenues rose again in fiscal 2019, ticking up to $3.46 trillion.

It’s impossible to know how the tax cuts would have affected revenues in 2020 and 2021, given the government lockdown of the economy for COVID-19, but in 2022, tax receipts surged by 21 percent to just under $5 trillion. Tax receipts that year charted a multi-decade high of 19.6 percent as a share of GDP.

However, people today still blame the massive budget deficits on the Trump tax cuts. To be blunt, this is utter nonsense.

After dipping in 2023 off 2022’s record, Federal revenues were at record levels again in fiscal 2024, coming in at $4.92 trillion. Despite this, the Biden administration managed to run the third-largest budget deficit in history.

It’s The Spending!

Any objective look at federal revenues reveals the real problem – the ever-increasing spending.

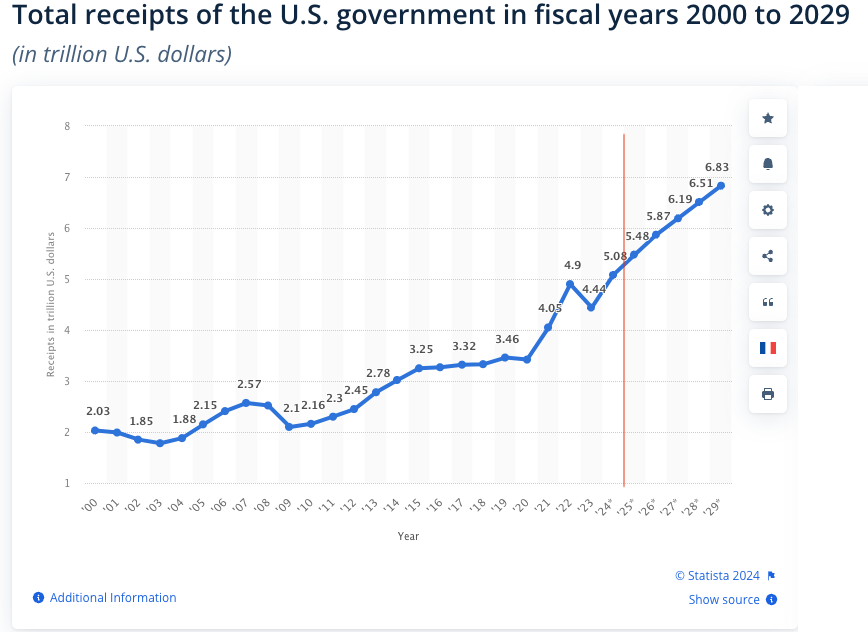

Federal receipts have generally trended upward since 2001 despite tax cuts.

(Note the big drop in revenue in 2008 with the onset of the Great Recession. This highlights the impact of economic activity on federal receipts.)

While revenue has increased, government spending has gone up much faster. The Biden administration blew through $6.75 trillion in fiscal 2024 alone, a 10 percent increase over 2023 spending. Going back to 2023, factoring out the reversal of student loan forgiveness (expensed in 2022 but struck down by the courts), the Biden administration spent $6.46 trillion, an 8.8 percent year-over-year increase in actual spending.

We saw the same trend in the Bush era. As government receipts fell by about 10 percent between 2001 and 2004, government spending rose from $1.86 trillion to $2.29 trillion, a 23 percent increase.

Between fiscal 2001 and fiscal 2024, spending was up 273.1 percent. During the same period, revenues rose 155.3 percent.

This is why I focus on the spending side of the ledger. Until the government gets its spending problem under control, tax increases, no matter how substantial, aren’t going to put a significant dent in the growing national debt.

Political Considerations

There are also political considerations when trying to figure out how to close the gaping federal budget hole. Sure, you could hand the politicians more money through tax increases, but would that guarantee a decrease in budget deficits?

Of course not.

Because politicians with more money are going to find new ways to spend it.

It’s all about incentives.

A politician’s overarching goal is to stay in office. And most politicians aspire to higher offices. In other words, they want votes. And the easiest way to get people to vote for you is to give them stuff. Conversely, politicians will find themselves looking for real jobs if they cause their constituents pain.

So, the incentives drive politicians to keep spending so they can keep delivering goodies to their constituents. Deep down, they probably realize the borrowing and spending is going to morph into a crisis – someday. But why worry about it now when they can kick the can down the road and get reelected for another term? They certainly aren’t motivated to deliver tough love and slash programs their constituents love. (This is also why they don’t really want to raise taxes either – except on the rich. I’ve already shown that taxing billionaires is a red herring.)

You probably wouldn’t hand an alcoholic standing outside of a bar $100, right? Likewise, it’s not a good idea to shower money on politicians who haven’t addressed their spending addiction.

When the political class demonstrates an ability to legitimately slow down the spending train, we can talk about tax increases. Until then, I’m going to keep harping on the spending.

********