With inflation fading, the US Federal Reserve continues to the fight against… inflation!

The question is ‘why?’. Why do Jerome Powell and the Federal Reserve continue to tilt against the fading enemy known as inflation?

Wikimedia (w/ my mark up)

The obvious answer is that the Fed knows how much money it created out of nothing (other than net debt, which taken literally is less than nothing) that they pumped into the economy. That was when a locked down society, following the lead of the monetarily inflating Fed and the fiscally stimulating government simply tapped the heels of its ruby slippers and wished for an economic resurgence to come true. But… Nothing + Less Than Nothing + New Money + Temporary Growth = Even more Less Than Nothing Later. You see?

Dorothy’s actual ruby slippers – Smithsonian (si.edu)

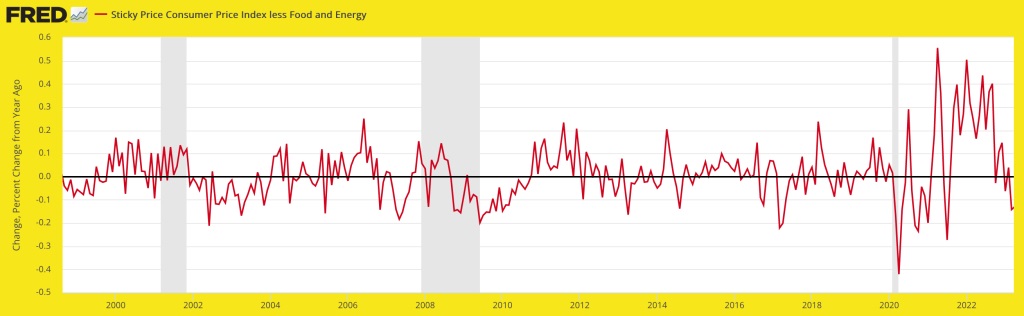

The Fed continues to tilt at its windmill despite the change in even “sticky” prices tanking from a year ago. These are the more persistent inflationary effects. While they have begun rolling over from extreme levels when viewed literally, the change from a year ago is striking. As you can see, such weakness in these prices usually coincide with a recession (shaded) either sooner or not much later.

St. Louis Fed

Food prices sure are not an issue globally, although you might find your local grocer and/or its supply chain gouging as long as they can, given the major media hype that inflation still enjoys.

World Food Price Index (TradingEconomics.com)

The inflation rate has bumped up within its declining trend from Q4, 2022, which we anticipated back then as one of the rationale for a coming stock market rally. *

Inflation Rate (TradingEconomics.com)

* The others being extremely over-bearish market sentiment at the time along with the mid-term election cycle, which is positive, on average.

The reason for the July bump up? Well, crude oil, which drives the CRB Commodity index, rose strongly in July. Now, is this inflation or is it the result of price rigging by a desperate OPEC+? I’ll take ‘B’, desperation, Alex.

TradingEconomics.com

So what is driving the Fed’s policy? Could it actually be chasing outlier issues like a market manipulating OPEC? Unlikely. OPEC’s manip is not making Americans feel richer. If anything, it would stress them more, financially.

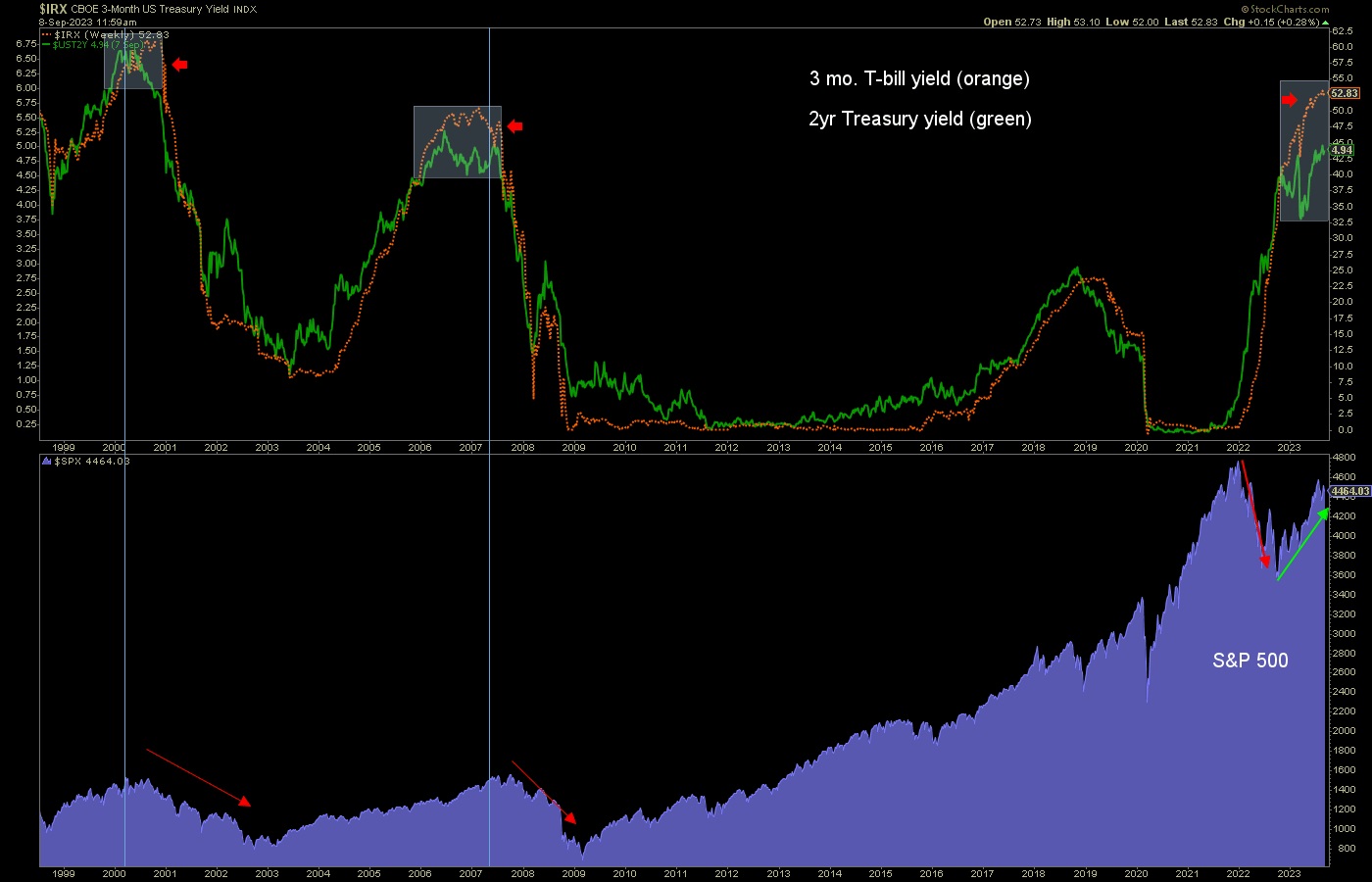

Is it the very stock market bubble that the Fed itself created and sustained for the last many years? Well, insofar as it has made Americans feel relatively wealthy (or kept many from feeling destitute), just maybe the Fed would like to see an extreme moderation in this inflated mess. The stock market has been a major beneficiary of previous inflationary policy. You could say that the Fed literally printed bull markets in 2002, 2008 and 2020 through various means of MMT (Modern Monetary Theory) also known as TMM (Total Market Manipulation).

Is it the bond market rebellion, shoving inflation signals right up the Fed’s keister from inflation cycles past? Very possibly. It could be the point of saturation whereby the license to inflate in the future has been withdrawn or severely limited by the bond market.

Maybe that is what the Fed is primarily reacting to. Trying to restore its good name as a financial steward. But of course, if you’ve been paying attention during the course of the decades old continuum you know that the Fed’s name has not been good.

It’s name is Nosferatu, and it has simply been sucking the blood out of the financial system and economy by taking the license granted by the bond market’s disinflationary signaling and printing asset bull markets as needed by increasing the supply of funny munny relative to said assets.

It’s name is Nosferatu, and it has simply been sucking the blood out of the financial system and economy by taking the license granted by the bond market’s disinflationary signaling and printing asset bull markets as needed by increasing the supply of funny munny relative to said assets.

To use another image, the Vampire needs to be invited into your home in order to do its business. Referring to the continuum above, my theory is that the bond market is withdrawing its standing invitation for the Fed to inflation at will and as needed.

Again, license revoked?

Meanwhile, the 2 year Treasury yield keeps dragging the Fed hawkish on the short end of the bond market, even though the divergence currently in play will likely lead directly to a bear market, as has been the historical norm.

Sure, the US government is debt spending on roads, bridges and all manner of other interests in order to grease the pump for the next presidential election. That is fiscal policy and when it is promoted by creating new debt it is not altogether different than the Fed’s monetary policy fueled inflation cycles. Is the Fed fighting the government’s actions in this case? To a degree, I suppose.

But the bottom line is that the financial markets have handcuffed the Fed to the degree that for whatever the reason, it was forced into its hawk suit (recall how stubbornly they refused to acknowledge the inflation problem… “transitory, transitory, TRANSITORY I tell you… oh wait, NOT transitory!!”). And until something breaks, it may not be released from that suit.

Meanwhile, with a constrained inflationary benefactor, AKA the Federal Reserve, what do you suppose the bombed out Gold/SPX ratio will do when the bear arrives? Gold is near all-time highs and thus vulnerable, you say? Well, perhaps to a degree, within the volatile post-2020 handle consolidation. But that green ratio is going to bottom and turn up, which the 10yr-2yr yield curve is already posturing to do. A steepening yield curve usually goes with the “bust” side of the boom/bust cycle.

There will be plenty of reason to value gold in this coming environment where markets could be set relatively free of the type of destructive, inflationary and bubble making environment we’ve had most intensely for over two decades now.

Gold is the anti-bubble, after all.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

*********