Support CleanTechnica’s work through a Substack subscription or on Stripe.

After publishing the summary of the study that assessed 2,000 hydrogen projects worldwide, one finding stood out. Across the total spectrum of use cases, electrification provided roughly 80% better emissions reductions than hydrogen. The data also showed that the overall climate benefit of hydrogen, once all losses and logistics were counted, was marginal in most situations. Predictably, many responses to that study repeated the familiar claim that hydrogen would soon be cheap, a non sequitur on the article’s point about emissions, typical of hydrogen advocates tendency to pivot off of inconvenient discussion points. It is a claim that has persisted for two decades. When examined through the full cost structure and through empirical reality, it does not hold up.

Hydrogen’s cost is best understood through the framework of the Levelized Cost of Hydrogen, or LCOH. This metric combines every part of production and delivery into a single number. It includes the capital cost of electrolyzers and their supporting equipment, the operational costs, the cost of electricity, the capacity factor of the system, the replacement of stacks over time, and the cost of distribution and storage. When all of these are accounted for, it becomes clear that only a fraction of the total cost is influenced by the electrolyzer stack itself. Around 60–70% of total cost is electricity. Another 15–25% is capital equipment and installation. The rest is made up of compression, transport, and storage. That means learning rates for electrolyzers alone cannot make hydrogen cheap unless electricity becomes nearly free, which is unlikely.

The dynamic between electricity cost and capacity factor is at the heart of the problem. If an electrolyzer runs only when renewable electricity is cheap, it will sit idle much of the time. The capital invested in that plant must then be spread across fewer kilograms of hydrogen, raising cost per kilogram. If it runs continuously to improve utilization, it will consume electricity when prices are high. In both cases, total cost per kilogram stays high. There is no easy sweet spot between the two extremes. Lazard used to have a highly useful and informative LCOH report, but then focused in on the US market only and on narrow elements pertinent to selling big hydrogen deals instead of generally making it clear with good material like the table above that hydrogen was a dead end.

Wright’s Law describes how the cost of a manufactured item falls with each doubling of cumulative production. The size of that cost reduction depends on how simple and repetitive the product is. Standard fasteners like screws and washers have learning rates around 27% per doubling because they are easy to automate and mass produce. As systems become more complex, the learning rate drops because the number of components, assembly steps, and custom parts rises. Large engineered systems with chemical, electrical, and thermal subsystems show much lower cost take out per doubling because they cannot benefit from repetition in the same way.

Proponents of a hydrogen cost revolution often compare electrolyzers to solar panels and batteries, pointing to the steep declines in those technologies. That comparison fails because electrolyzers are not manufactured or deployed in the same way. Solar panels and batteries are simple, modular, and mass produced by the millions in fully automated factories. They learn quickly because every doubling of global output drives down cost through repetition and scale. The data shows that solar modules have achieved roughly 20–24% cost decline per doubling, while lithium-ion batteries have averaged about 19%.

Electrolyzers are different. They are complex, high-precision systems with chemical, mechanical, and thermal subsystems that must be integrated and maintained. They are built in small numbers and usually customized for each site. Learning rates are lower. Meta-analyses and industry data place them around 12–15% for PEM electrolyzers and 10–15% for alkaline designs. Manufacturing volumes are small. In 2024, installed global capacity was about 5 GW, and even optimistic projections for 2030 suggest perhaps 40–60 GW actually operating or under construction. That represents only three or four doublings. With such few doublings, and modest learning per doubling, the potential cost decline from experience is limited to roughly 40–55%. By comparison, solar and batteries have experienced dozens of doublings since the early 2000s.

And electrolyzers are one of around 28 components in a complete hydrogen electrolysis facility. The rest are highly commoditized components which have already had their cost curve takeouts. Building more electrolysis facilities will providing learning experience for building electrolysis facilities and will take some costs out of electrolyzers, but it won’t take much cost out of the capital required for the balance of plant.

Material constraints also slow cost reduction. PEM electrolyzers depend on platinum and especially iridium as catalysts. Iridium is extremely scarce, with annual global production measured in a few tons. Loadings are improving, but replacement by cheap alternatives is not yet practical. Alkaline electrolyzers avoid precious metals by using nickel, iron, and cobalt, but they cannot ramp output quickly, making them less compatible with variable renewables. Solid oxide systems operate at high temperature with ceramic materials and offer good efficiency, but they remain at early pilot scale. None of these technologies are poised for the kind of cost collapse that modular electronics achieved.

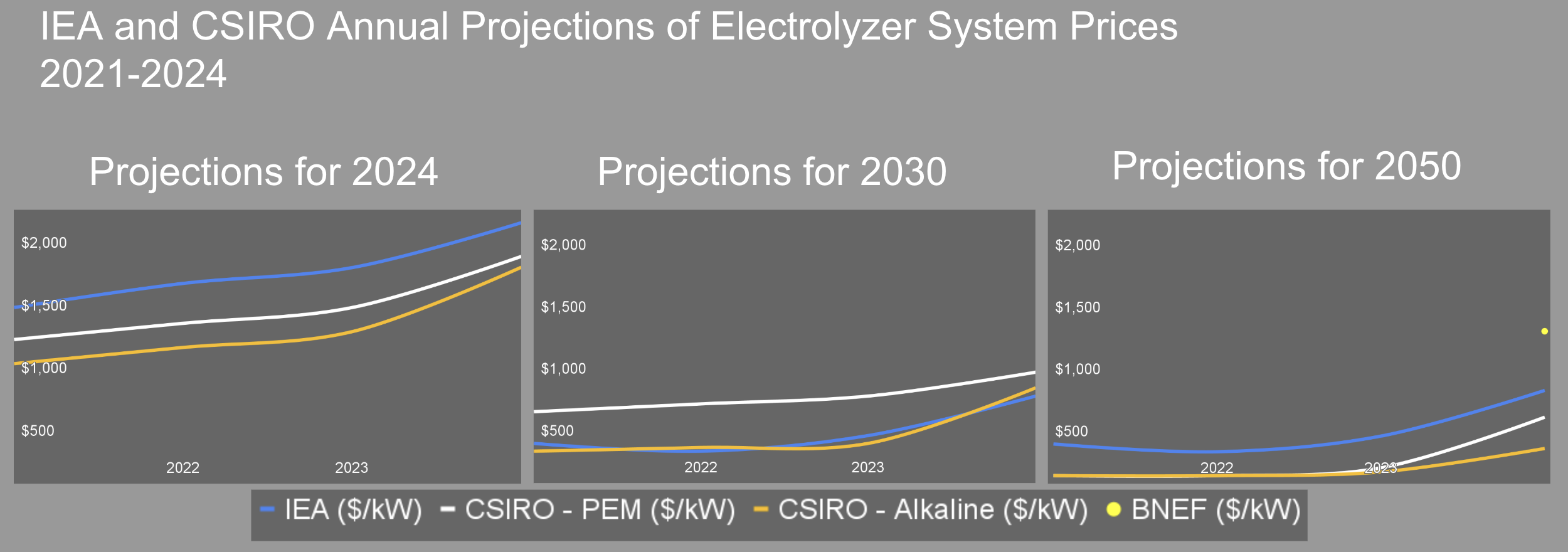

Evidence from major organizations shows that expectations of rapid cost decline are moving in the opposite direction. Studies and forecasts from the IEA, BNEF, and national programs have revised cost outlooks upward. Comparisons of organizational projections to real project data and found that earlier estimates were low by 60–300%. The reason is clear. Materials inflation, iridium scarcity, custom engineering, and higher financing costs have raised rather than reduced capital cost.

Electricity cost dominates the LCOH and will continue to do so. Even if electrolyzer CAPEX fell by half, the cost per kilogram of hydrogen would change little unless electricity were nearly free and continuously available. Studies consistently show that power price and utilization rate are the two strongest drivers of LCOH. The rule of thumb from Hydrogen Europe that improving electrolysis efficiency by 1 kWh per kilogram has the same cost effect as cutting stack cost by roughly $120 per kW illustrates how small a role equipment price plays compared to energy consumption.

Distribution and storage add another layer. Unlike solar panels or batteries, which can be shipped in containers and stored on-site without loss, hydrogen must be compressed, liquefied, or chemically bound. Each step costs energy and money. The U.S. Department of Energy and multiple national studies report that delivery and dispensing alone often add $8–$11 per kilogram today, comparable to production cost. Pipelines can reduce that cost at very high volumes but require immense capital and high throughput to make sense. For dispersed or moderate demand, trucking and compression will remain the norm. That structural cost is unlikely to fall much over time.

When financing costs are included, the picture becomes even tighter. Many low LCOH forecasts assume a weighted average cost of capital around 4–6%, similar to utility-scale solar projects. In practice, few hydrogen projects secure such favorable terms. They face higher technology and market risk, which pushes WACC toward 8–12%. A move from 6% to 10% can raise LCOH by 30–40%. Hydrogen production is capital heavy and therefore highly sensitive to financing conditions.

Blue hydrogen will never undercut black or gray hydrogen because the addition of carbon capture equipment, compression, and sequestration layers costs on top of an already mature production system. While the feedstock and process are the same—natural gas reformed into hydrogen—the capture systems add capital expense, parasitic energy load, and maintenance complexity. Blue hydrogen might still come in cheaper than electrolytic green hydrogen at today’s prices, roughly $3–6 per kilogram versus $6–10 per kilogram for green depending on power costs, but it will remain more expensive than unabated gray hydrogen, typically $1–2 per kilogram. Adding transport, storage, and retail markups pushes pump prices to $13–20 per kilogram in most markets. None of those distribution costs disappear with carbon capture, and the result is an economically unappealing product that can’t compete with direct electrification or even existing fossil pathways without substantial subsidies.

White hydrogen has sparked new headlines, but it doesn’t change the fundamentals. Natural subsurface hydrogen deposits may exist in useful concentrations, but the economics remain anchored in the same constraints that limit all hydrogen pathways. Exploration, extraction, and purification would require entirely new infrastructure, and the gas would still face the same transport and storage costs that make hydrogen uncompetitive in most markets. At best, white hydrogen might support an industrial cluster built directly above a rich geological source, where it could be consumed on site for refining or ammonia production without needing pipelines or liquefaction. Outside that narrow use case, it offers no real cost advantage or scalability, and it will remain a curiosity compared to mature, modular technologies that continue to fall in price through repetition and learning.

Stimulating hydrogen generation in the subsurface has been explored through two main approaches, but neither is likely to scale to meaningful industrial feedstock volumes. The microbial pathway involves injecting nutrients and microbes into depleted oil wells to convert remaining hydrocarbons into hydrogen, but only a small subset of wells have the right temperature, salinity, and chemistry, and the yields are modest. The alternative, generating hydrogen through reactions between injected water and reactive rocks in fracked subsurface volumes, faces the same practical barriers that challenge unconventional resource extraction: drilling, stimulation, logistics, and safe gas handling. Both concepts would still incur the same high costs of compression, purification, transport, and storage that burden all hydrogen systems. While technically interesting, they are unlikely to supply the sustained, high-volume flows required for industrial hydrogen demand and remain more of a laboratory curiosity than a scalable energy solution.

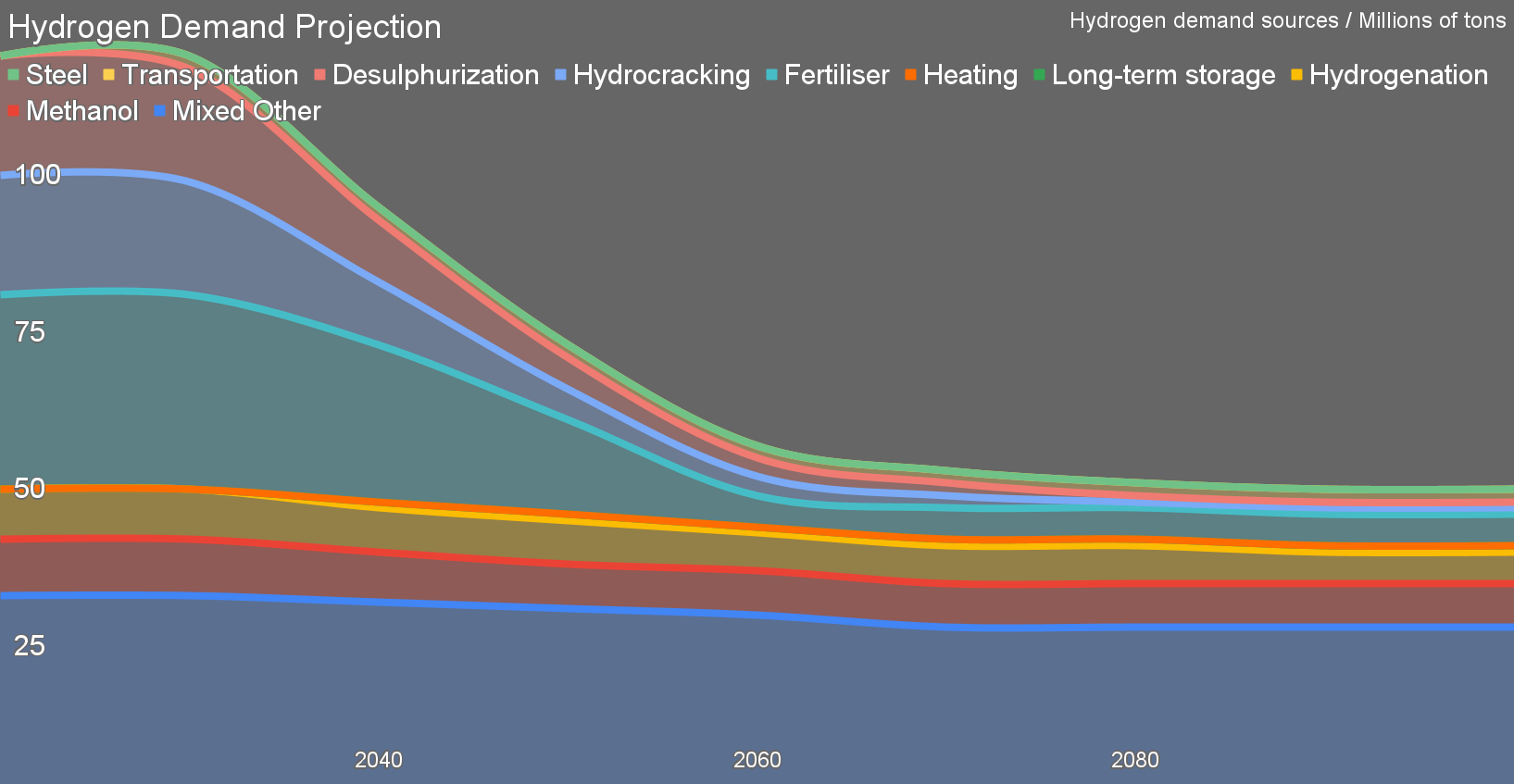

Looking ahead to 2100, hydrogen demand is much more likely to fall steeply rather than rise as many projections would have it. I did the analysis on what drives the levelised cost of hydrogen and likely cost takeouts a decade ago, and so know that hydrogen could be green, but it wouldn’t be cheap. And I knew how ineffective, expensive and limited carbon capture for blue hydrogen would remain. As a result, my projections were based on much higher costs for hydrogen. That has the inevitable result that processes and products that have competitors that do not require hydrogen, or require vastly less, will be much more price competitive and take market share.

That’s going to impact the biggest demand sector as well, refineries. Heavy, high sulfur crude like that of Alberta, Mexico and Venezuela require a lot more hydrogen, about 7.7 kg per barrel than light, low sulfur crude like the Permian Basin’s or Saudi Arabia’s products, which require perhaps 2 kg per barrel. That additional 5.7 kg per barrel costs money, meaning that heavy, sour oil will see a greater and greater quality discount and be driven off the market as oil demand declines, lower hydrogen demand even for the petrochemical industry which will persist.

For ammonia, while it won’t make a different for commercial explosives, it will make a difference for the biggest offtake, fertilizer. We overuse fossil feedstock ammonia fertilizer today because it’s cheap. When low-carbon ammonia is more expensive, we’ll make do with less, putting agrigenetics and precision agriculture deeply into the money.

More expensive hydrogen leads to less hydrogen being used, not more. Just as electrification is much cheaper than hydrogen for energy, there are alternatives in many cases for other things requiring hydrogen, and they’ll drive products requiring more hydrogen out of the market.

The data supports a clear conclusion. Hydrogen is not following the same economic trajectory as solar power or batteries. The fundamental physics of production, the complexity of systems, the scarcity of catalyst materials, and the small scale of deployment all constrain learning. Electricity will remain the largest cost component, and moving and storing hydrogen will stay expensive. While hydrogen will play an important role in specific industrial sectors, it will not become the universal energy carrier that some advocates hope for. It is a specialized tool that will be valuable where nothing else works, and understanding that reality is the key to making it part of a pragmatic decarbonization strategy.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy