Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

I’m not going to lie — at times, I find the stock market baffling. When Tesla released its Q2 delivery and production numbers, my main thought was: this looks bad, very bad. The stock market, however, thought it was great news and the stock price exploded. The rationale for that was that the delivery figures were slightly better than what Wall Street expected.

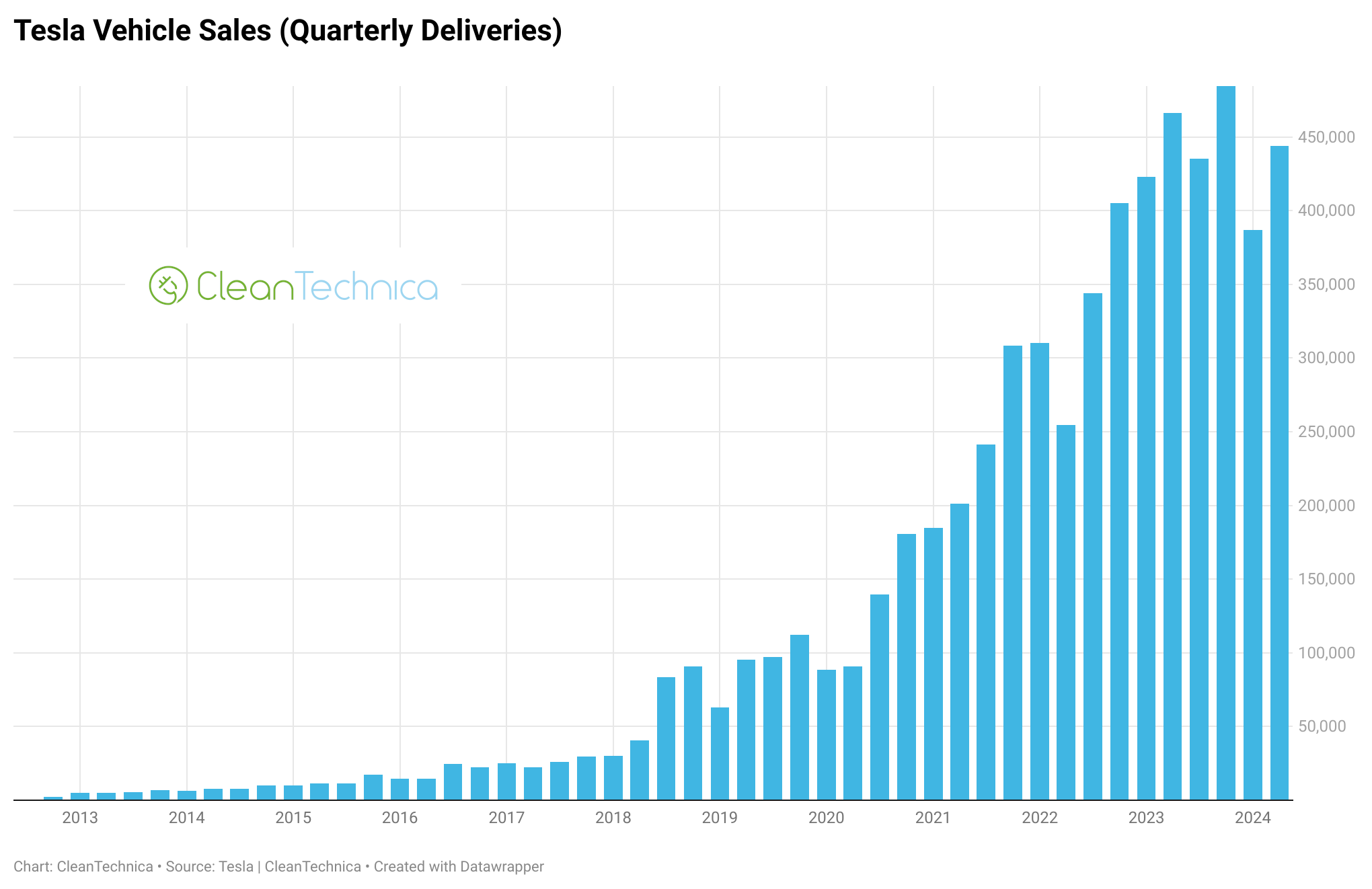

Tesla’s deliveries in the second quarter were down significantly compared to Q2 2023 — 443,956 versus 466,149. This is after a similarly bad first quarter — 386,810 versus 422,875. This is also after Tesla had cut prices, offered various incentives, subsidized interest rates, etc. It was also on the back of massive investments into AI hardware in operations aimed at getting Tesla cars to true Full Self Driving. To me, it seemed obvious that Tesla’s finances were getting crunched, even without doing any math.

And then there’s also the fact that Tesla went and implemented sudden, mass layoffs and a big halt or slowdown to expansion plans for new Supercharger stations (to soften the blow, Elon Musk indicated they would focus more on expanding the number of stalls at existing stations). These are signs of a company facing a serious financial crunch.

So, it seemed obvious that Q2 financials were not going to be particularly uplifting. Nonetheless, for some reason, after Tesla released those initial Q2 delivery and production numbers, the stock soared. I found it baffling. Now that Tesla has released its full Q2 financials, the stock has crashed, even “helping” to bring the stock market to its worst day since 2022. It was also the worst one-day stock drop for Tesla since 2020 — it dropped 12%.

With the quarterly update, Tesla reported its worst quarterly profit margin in five years (with automotive gross margin, excluding regulatory credits, falling from 16.4% even in the first quarter of this year to 14.6% in the second quarter). Of course, that’s a sign things are going in the wrong direction. But it also seems painfully obvious that this was coming.

But the bigger reason why the stock surge earlier this month baffled me is that there hasn’t been any significant news showing stronger long-term demand, and Tesla has been struggling with demand issues for many months. Tesla was supposed to be seeing 50% annual growth, on average, less than a year ago. Has the market forgotten that? Sales have shrunk, not grown, and Tesla is facing serious demand challenges in all three of its main markets: the USA, China, and Europe. In the USA, there seems to be a combination of major markets becoming saturated and Elon Musk driving away a lot of potential buyers with his dive into deep-right politics and conspiracy theories. In fact, Tesla sales in California (its main market) were down 24% in Q2 and were down 17% in the first half of 2024 as a whole. Musk needs a story for how those will rebound, but instead, he’s gone on to trash talk California and say he’s moving SpaceX and X headquarters from there to Texas. That should help rebuild consumer demand, right? In China, the market has become hyper-competitive, and aside from needing to engage in a price war, an EV company has to regularly roll out new models and significant upgrades to existing models, but Tesla is relatively slow to do this compared to its Chinese competitors. In Europe, it’s a similar story of growing competitiveness from other brands, perhaps residents not liking what Musk tweets, and certain sudden policy changes (in Germany) that have thrown a wrench into the market. All in all, though, this was clear before Tesla’s Q2 financials report and conference call. So, color me confused about what Wall Street discovered on Tuesday that wasn’t already obvious.

Elon Musk reiterated that a more affordable Tesla will be coming … someday. The aim is for it to be on the market next year. But we’ve been hearing about this new model for years, and it seems like Tesla’s approach to it has changed a few times. Also, naturally, a cheaper model doesn’t guarantee higher profits. Many buyers of the Model 3 and Model Y could become buyers of the cheaper Tesla, and sales of the former could slump more. Presumably, that would hurt Tesla’s profit margins. The trick for Tesla is going to be maintaining demand levels for the 3 and Y, or even increasing them, while rolling out a more affordable model. No one has any guarantee that’s going to work.

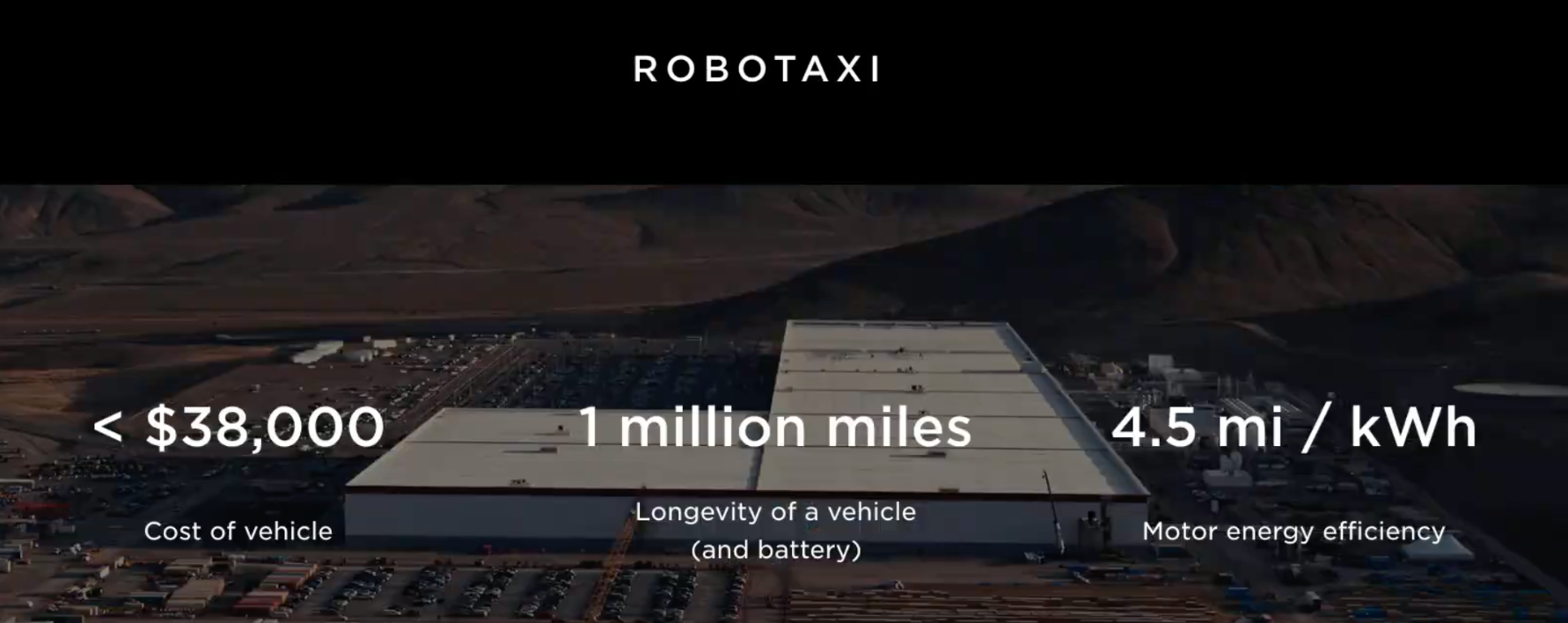

Then we get to the big, big matter. Somehow, I’ve gone this far without discussing Tesla AI and robotaxis. Elon Musk has been saying for months that no one should be invested in Tesla if they don’t believe in Tesla’s approach to AI and robotaxis. Tesla is supposed to achieve revolutionary, broad robotaxi capability with its Full Self Driving (FSD) suite at some point that will be like turning on a money-printing machine. Because, suddenly, Tesla owners (and Tesla) are supposed to be able to make money by sending their self-driving Tesla taxis out to driving people around. The 2019 Tesla Model 3 in my garage should, suddenly, become something that can make me money instead of just cost me money. This is part of where Tesla’s money has been going — into developing the hardware and software to make this possible. The problem is that Tesla has been hyping this up for I think around 8 years (but I have to admit that I’ve lost track a bit). The bigger problem is that Elon Musk has been claiming for years that we’d be at that point much sooner than we clearly will be — the target year for truly driverless Teslas has been pushed back multiple times. Meanwhile, while my 2019 Tesla hasn’t needed any new hardware, Tesla has poured billions of dollars into the facilities being built at the company level to enable the compute-intensive AI system behind Tesla’s FSD. (Ironically, as well, building such facilities in much hotter Texas — compared to California — might result in much higher electricity bills to keep all of those computers cool.)

At the end of the day, it’s hard to see how Tesla is supposed to regain consumer demand growth, let alone get it back to 50% a year. It’s also hard to guess when a true juncture for FSD/robotaxis could be, and it doesn’t help that Tesla’s robotaxi concept reveal event has been pushed back from August 8th to sometime in October. So, overall, where is the grounded optimism for super-growth supposed to come from and how can one justify Tesla’s immense stock price and market cap without that optimism? As Reuters reports, “Tesla’s stock has recently traded at 85 times its 12-month forward earnings estimates, compared to 7 for legacy automaker Ford Motor (F.N).” What truly justifies that massive difference at this point?

To end, I’ll just note again that nothing really seems to have changed from the beginning of July, when Tesla’s stock price soared, to this week, when it crashed. And hence why I continue to find the stock market baffling. And I’m not the only one. Here’s a quote from someone working on Wall Street essentially saying the same thing:

“The disconnect from reality means anything can happen,” said Mike O’Rourke, chief market strategist at Jonestrading. “While it is understandable Tesla shares traded off following the report, it remains hard to understand why they were at such levels prior to the report.”

Exactly.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy