As of May 1, spot gold was at $2,319 an ounce. The precious metal is up 12.6% year to date despite headwinds.

Source: Kitco

These include a strong US dollar, positive real yields (Treasury yields minus inflation above zero), investors selling their gold ETFs, and inflation coming down from 40-year highs. (gold buyers often purchase bullion as an inflation hedge)

Gold hit a record-high $2,365.09 on Monday, April 8.

Meanwhile, the US 10-year Treasury yield is showing a year-to-date advance of 17.8% and the US dollar index DXY is up 3.3%.

The gold price started to kick higher in October when market sentiment began pricing in three quarter-point rate cuts in 2024. This was confirmed at the Fed’s December meeting, and made even more explicit at the March 19-20 meeting.

There has since been an uptick in inflation and that has diminished hopes for a rate cut in June or September. At its regular meeting on Wednesday, April 30, the central bank held interest rates steady within a range of 5.25 to 5.5%. Reuters quoted Fed Chair Jerome Powell saying it was likely to take longer than previously expected for U.S. central bank officials to gain the “greater confidence” needed for them to kick off interest rate cuts.

Gold was largely unaffected by the decision.

Demand is being driven by strong central bank buying, with developing nations in particular stocking up on bullion as insurance against having their foreign currency reserves frozen like happened to Russia after it invaded Ukraine; and geopolitical instability, with wars in Ukraine and Gaza still raging, and there’s China’s positioning on Taiwan causing stress. Commercial shipping in the Red Sea continues to come under attack from Houthi rebels.

Security concerns

Gold is often purchased during times of political or economic upheaval. Traditionally these have been short-term events, such as wars, economic crises, or health scares such as the covid-19 pandemic.

However, new research by Project Syndicate author Harold James reveals something more structural and long-lasting is going on.

For a full understanding, we need to go back in history. When the gold standard was established in the early 1870s, James argues it ushered in a new international political system. The United States, Germany and Italy were among nations that wanted to stabilize their currencies in the wake of destructive civil wars. Gold replaced the previous monetary standard, silver, following France’s defeat in the Franco-Prussian War.

James sees a parallel in 2024:

The abandonment of a parallel silver currency system in the 1870s might be a precedent for the world of 2024. After all, there is rampant speculation about the imminent dethronement of the dollar, which would be the modern equivalent of the demonetization of silver.

He also believes that “Security concerns are at the heart of the new politics of gold.”

Get this. When the Czech Republic joined NATO in 1999, it immediately sold almost its entire gold stock. It didn’t think it needed bullion under the security blanket of the North Atlantic Alliance. Yet in March of 2023, with war raging in Ukraine, the Czech National Bank bought 19 tons, and has indicated it plans to buy up to 100 tons. James writes:

The message this time is equally clear: NATO membership is not enough. And with its closer proximity to Russia, Poland has also made its motivations clear, so much so that the central bank building currently features a giant poster announcing that it holds 360 tons of gold.

There are other examples of what James calls “the search for golden stability.” China’s central bank had just 395 tons in 2000; it now has 2,260 tons. It increased its bullion reserves substantially in 2009 and 2015, watershed years when the world was growing more skeptical of globalization. Russia and Turkey started building up “massive war chests” in 2015.

Going back further in history, gold was used as a source of stability in 1922, soon after the Soviet Union was established. To ward off inflation, the state issued citizens chervonets, or “red gold” coins.

Gold is also fundamental to Polish statehood, as James explains:

When Poland was reestablished after World War I – following the destruction of the Austrian, German, and Russian empires – its new currency took as its name the Polish word for “golden” (złoty). Then, in September 1939, Poland conducted a dramatic operation to evacuate its gold to France, by way of Romania, Turkey, and Lebanon. That sent the message that Poland still existed, despite the German invasion.

Central banks

A consensus seems to have emerged that the main gold buyers are central banks, which are snapping up gold even though prices are hitting record highs. Retail investors, especially those in the West, have so far stayed out of the gold rally. We know this because there have been net outflows from gold ETFs, which are the main way retail participates in the gold market. If retail was involved, more money would be moving into gold ETFs than out.

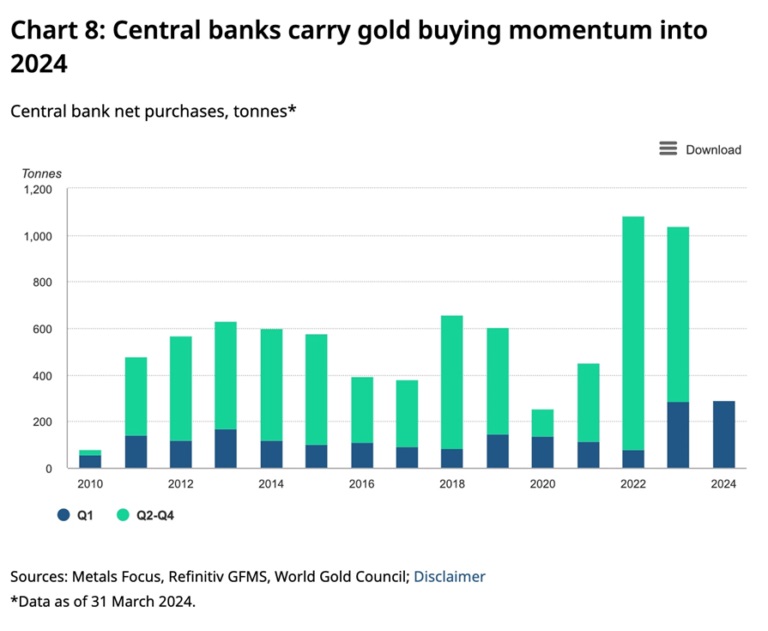

Central bank net demand totaled 290 tonnes in the first quarter of 2024, the strongest start to any year on record, according to the World Gold Council.

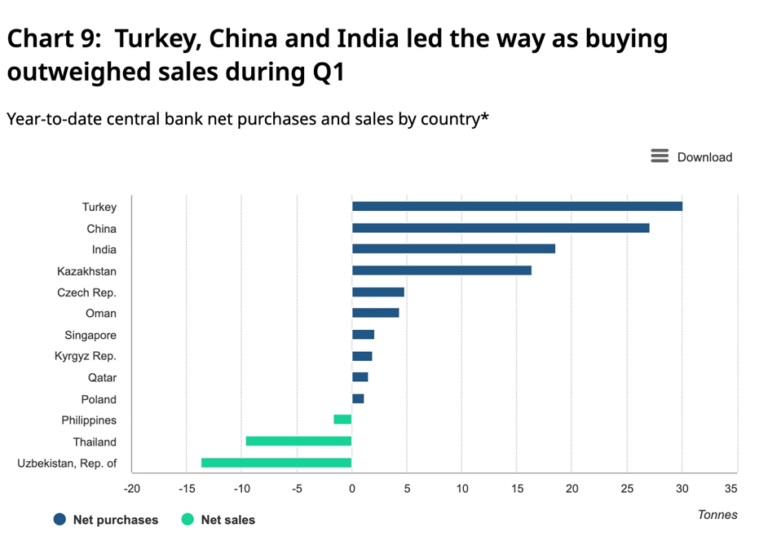

East and Central Asian central banks accounted for the majority of Q1 net purchases. China was singled out by WGC as adding 27t to its reserves, marking the 17th straight month of increases.

Source: World Gold Council

The Telegraph reported this week that China’s USD$170 billion gold stockpile is raising fears that Beijing is preparing to invade Taiwan, and is planning to use gold as a cushion against sanctions.

The Central Bank of Turkey has accumulated gold for 10 consecutive months, purchasing 30t during Q1 and bringing its reserves to 570t.

The Reserve Bank of India bought 19t during the quarter, exceeding last year’s net purchases of 16t. Other notable buyers included Kazakhstan (16t), Singapore (2t), Oman (4t) and the Kyrgyz Republic (2t).

Singapore was the only developed market bank to buy gold during the quarter, adding 2t. The only European nations to buy gold in Q1 were the Czech Republic and Poland, with 5t and 2t, respectively.

This trend favoring Eastern over Western central bank gold buying

isn’t new, but it has accelerated.

Dollar weaponization

Some nations at odds with the United States have accused it of “weaponizing” the US dollar. For good reason.

US and European governments froze 300 billion euros (~$321 billion US dollars) of Russian Central Bank foreign reserves following its invasion of Ukraine. Seven Russian banks were ejected from the SWIFT payment system. One reliable source says 70% of the Russian bank system is under sanctions, with around 20 billion euros (USD$29.4B) of assets of more than 1,500 sanctioned persons and entities frozen.

Freezing countries’ dollar assets and imposing sanctions on them is likely to accelerate the move already under way by many countries to diversify investments into alternative currencies, Reuters reported back in March, 2022, a few weeks after the Ukraine war started.

“The more we use it, the more other countries are going to diversify due to geopolitical reasons,” said Zongyuan Zoe Liu, a fellow for international political economy at the Council on Foreign Relations.

According to the Atlantic Council, The weaponized dollar is already a fact of life in global affairs. The governments of Cuba, Iran, North Korea, and Venezuela can all attest to that fact, as can their civilian populations. In all four countries, dollar sovereignty has been weaponized in a contemporary context. Deeper historical examples abound in Latin America and other parts of the world. At a smaller scale, the wide range of sanctions activity tracked by the Atlantic Council’s Sanctions Dashboard are forms of dollar weaponization as well.

SchiffGold points out that Russia, like China, is doubling its reserves of gold and foreign currencies on its de-dollarization path, further detaching Russia from the petrodollar empire as it reacts to wartime sanctions from the US and EU.

In fact the country has been gradually reducing its dollar holdings since the imposition of Western sanctions following Moscow’s annexation of Crimea in 2014. In 2021 it said it would ditch all US dollar assets in its National Wealth Fund and increase holdings in euros, Chinese yuan and gold, according to Reuters.

China has $3 trillion in forex reserves it wants to keep safe, so Beijing is diversifying out of dollars and into gold.

In April it was reported the Chinese yuan has replaced the US dollar as the most traded currency in Russia.

China and Russia have both set up alternatives to SWIFT. Russia’s System for Transfer of Financial Messages (SPFS) started in 2014, while China’s Cross-Border Interbank Payment System, which processes payments in Chinese yuan, has the potential to replace SWIFT.

Dollar weaponization took a big step recently with the signing of a $5 billion aid package to Ukraine, that allows the Biden administration to seize Russian assets in the US and use them for the benefit of Kiev.

APN News reports The seizures would be carried out under provisions of the REPO Act, short for the Rebuilding Economic Prosperity and Opportunity for Ukrainians Act, that were incorporated into the aid bill…

The new U.S. law requires the president and Treasury Department to start locating Russian assets in the U.S. within 90 days and to report back to Congress within 180 days. A month after that period, the president will be allowed to “seize, confiscate, transfer, or vest” any Russian state sovereign assets, including any interest, within U.S. jurisdictions.

The only limitation on the US president is that he must confer with other G7 member countries before acting.

De-dollarization

De-dollarization is closely related to dollar weaponization but it’s not the same thing. The former is defined as “the process of moving away from the U.S. dollar (USD) as the chief reserve currency.”

The dollar as the world’s reserve currency can only go so low because it will always be in high demand for countries to purchase commodities priced in US dollars, and US Treasuries. Nor should it be allowed to go too low, because that would risk the dollar losing its “exorbitant privilege”.

What does that mean? Because the dollar is the world’s currency, the US can borrow more cheaply than it could otherwise, US banks and companies can do cross-border business using their own currency, and when there is geopolitical tension, central banks and investors buy US Treasuries, keeping the dollar high and other currencies lower. A government that borrows in a foreign currency can go bankrupt; not so when it borrows from abroad in its own currency i.e. through foreign purchases of US Treasury bills. The US can spend as much as it likes, by keeping on issuing Treasuries that are bought continuously by foreign governments. No other country can do this.

The cost of having this privileged status is the country that has it must run a trade deficit with the rest of the world. It can’t have the strongest currency and also keep the currency low to increase exports.

This is what’s known as the Triffin Dilemma.

Is the US willing to give up the world’s reserve currency to fix its trade deficit?

There is movement towards de-dollarization but there is also significant inertia limiting the shift away from USD. We present both sides of the argument. First, the case for de-dollarization.

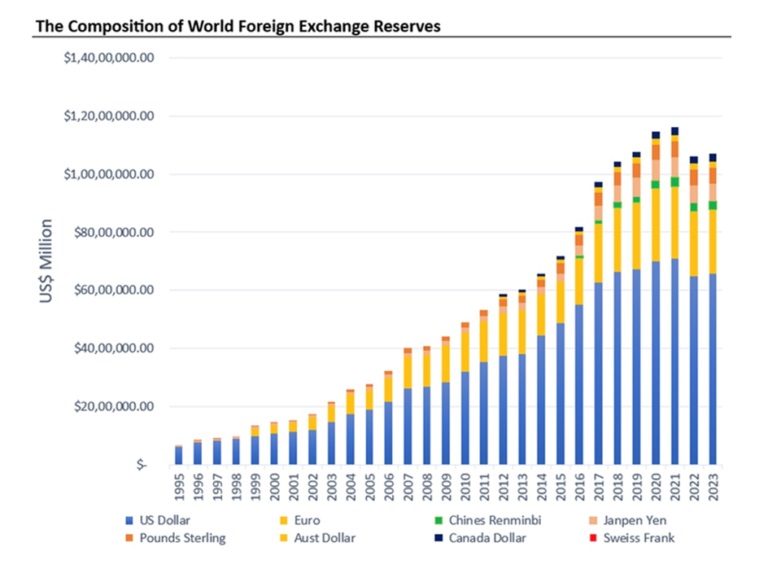

According to IMF data, the dollar’s share of official foreign exchange reserves fell to a 20-year low of 58% in the fourth quarter of 2022.

However, that percentage increased to 59.17% in the third quarter of 2023, the latest data set. The data shows the greenback’s share of global forex reserves has fallen about 6% since 2016.

Meanwhile the Chinese yuan, considered to be the dollar’s strongest competitor, accounted for just 2.37% of reserves, as of Q3 2023. FXC Intelligence predicts the yuan will only reach 6% of global reserves by the end of 2034.

Money Wise notes that between 2016 and 2023, countries have diversified their foreign reserves with a broad range of currencies — not just the yuan but the Japanese yen, the British pound and Canadian and Australian dollars.

Source: Long Finance

Among the countries re-thinking their foreign exchange composition are Saudi Arabia, China, India and Turkey.

Furthermore, commodity-producing countries have started conducting trade in currencies other than the greenback. For example, India has started purchasing Russian oil in UAE dirham and roubles, China paid for $88 billion worth of Russian oil, coal and metal in yuan, and Chinese state-owned oil company CNOOC and France’s TotalEnergies in 2022 completed their first yuan-settled LNG trade.

The Chinese are not only making deals to trade commodities in yuan instead of dollars, but are actively diversifying out of US Treasuries. Beijing holds the most Treasuries besides Japan.

However this week, Watcher.guru reported the latest data from the US Treasury Department shows that China offloaded nearly $74 billion in Treasuries over the past 12 months.

The story says China cuts its holdings from $849 billion to $775 billion, which is the lowest level since 2009, when the BRICS group was formed.

Among other BRICS members dumping Treasuries, India sold $1.4 billion worth, Brazil liquidated $1.2B, and yet-to-be BRICS member Saudi Arabia dumped $300 million in the last four quarters, stated Watcher.guru.

The Daily Bell notes that, as the yuan’s influence increases, other countries will start holding more of it, to trade with China, meaning less demand for dollars.

In this way, China is using the same playbook as the United States in 1944, when the country aggressively whipped the rest of the world into accepting the dollar as the world’s reserve currency.

One of the best examples is French President Macron urging Europe to become independent of US foreign policy and to rely less on the dollar. Despite being one of American’s oldest allies, France, as mentioned, completed its first liquefied natural gas trade settled in yuan.

Most importantly, Saudi Arabia is reportedly open to breaking the petrodollar and to sell oil in yuan. According to the Wall Street Journal,

The talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated [in 2022] as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom, the people said.

Malaysia, meanwhile, struck a deal with India to trade in the rupee and its Prime Minister has proposed an “Asian Monetary Fund” to reduce dependence on the US dollar, The Daily Bell states.

Business Insider outlines three reasons why countries want to break up with the dollar:

- US monetary policy holds too much sway over the rest of the world;

- A strong USD is getting too expensive for emerging nations; and

- Global trade and oil demand is diversifying, putting the petrodollar at risk.

The BRICS led by Russia are trying to escape dollar dominance. Vladimir Putin forecast the “beginning of the end” of the dollar in June 2023. A plan for a BRICS currency was discussed at the BRICS summit last August in Johannesburg, South Africa.

Two more developments in 2023: the UAE and India explored the use of rupees to trade non-oil commodities; and Russia and Iran are working together to launch a cryptocurrency backed by gold.

According to a London School of Economics blog post, based on a talk given at the University of Warwick Economics Summit earlier this year,

Former president of Brazil, Dilma Rousseff, current chair of the New Development Bank, has pledged to “find ways to avoid … being dependent on a single currency”. The Brazilian finance minister has previously called for a South American international currency, beginning with Brazil and Argentina.

Even the European Union has recently shown signs of wanting to escape dollar dominance. The German foreign minister has called for a new EU-based payments system independent of the US and the SWIFT payments system, that would not involve dollar payments.

However, the post by Professor Robert Wade also says “Dollar hegemony will surely end — but not in the foreseeable future.”

Chief among the reasons for the dollar remaining the world’s reserve currency for the foreseeable, is the fact that the vast majority of international transactions are done in dollars:

According to the Bank for International Settlements’ latest triennial survey, the dollar as of 2022 was part of 88 percent of all international transactions. That percentage is only slightly lower than in 1989, testimony to the dollar’s resilience. Meanwhile, the euro accounts for 31 percent of international transactions, the yen 17 percent, the pound 13 percent, the renminbi (RMB) only 7 percent, up from 4 percent in 2019.

Another incumbency advantage is the fact that institutions such as Wall Street and Big Tech give the dollar huge economies of scale, and they have no incentive to de-dollarize.

Wade notes that dollar dominance allows the US to sustain large current account deficits (importing more than it exports), thus fueling the expansion of US corporations around the world, and allowing the US to finance its military activities:

The US has some 700 overseas military bases spread over 80 countries, and a military budget greater than the military budgets of the next 10 countries combined. This is especially relevant to the case of Middle East oil and its pricing in dollars. China does not (yet) have the military capacity to persuade US allies in the Gulf to switch sides.

Conclusion

Returning to gold, the price is surging due to increased geopolitical tensions — wars in Ukraine and Gaza, the Israel-Iran conflict, Houthis firing on commercial ships in the Red Sea, and the threat of a Chinese invasion of Taiwan being the main ones — and continued central bank buying, even though gold is hitting record highs.

Institutional investors (e.g., banks, hedge funds) are also loading up on gold, but retail investors have sat out the current rally. We see this reflected in ETF outflows and lack of interest in gold equities — the latter not surprising in light of the broader stock market pickup.

Countries are seeing increased security concerns as a reason for owning gold, just as they have in the past.

Central bank net demand totaled 290 tonnes in the first quarter of 2024, the strongest start to any year on record. East and Central Asian central banks accounted for the majority of Q1 net purchases. China was singled out by the World Gold Council as adding 27t to its reserves, marking the 17th straight month of increases.

China, Russia and other countries are buying gold and dumping dollars (and US Treasuries) as part of a global de-dollarization initiative. The United States and Europe have only themselves to blame for this trend, having weaponized 300 billion euros worth of Russian Central Bank foreign reserves following Russia’s invasion of Ukraine in early 2022.

The freezing and now the confiscating of Russia’s offshore holdings is scaring the living daylights out of countries at odds with the US, and even some who are allies. They fear it could easily happen to them, and they are divesting dollars and moving their gold back home if it was being stored overseas.

Several countries have done so over the past decade, including Poland, Hungary, Romania and Germany. The Netherlands and Belgium have also initiated repatriation programs, said SchiffGold.

According to the World Gold Council’s 2023 Central Bank Gold Reserve Survey, 68% of the banks surveyed said they are keeping their gold reserves within their countries, up from 50% in 2020.

How worried should investors be about de-dollarization? Not very. While diversification is happening, it’s a slow process. So far there is no obvious replacement for the dollar, which represents about 60% of global foreign exchange reserves, and commands over 85% of international transactions.

Meanwhile gold is a trade that central banks continue to make, and that retail investors have yet to get in on. When they do, expect another big uptick in the gold price.

“Western investors are still on the sidelines. When these investors come back, that’s when the rally [in gold] will accelerate,” said Imaru Casanova, a portfolio manager specializing in gold and precious metals at VanEck, via Barron’s.

She said her firm, which offers gold bullion exposure through ETFs (GDX, GDXJ, OUNZ), could easily justify $2,600 gold if that happens.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

********