It’s almost comical to watch policy makers of all stripes and country codes caught in a corner yet pretending we don’t notice.

Children In Charge

I’m reminded of the kid with his hand in the cookie jar while pretending his parents can’t see him—denying his guilt despite the crumbs falling from his face.

Again: It’s almost comical.

But there’s really nothing funny at all about major economies crawling into recession (Germany, Japan, UK, China) or denying recession (USA) while our mental midgets from DC to the EU play with bonds, inflation currency and war like kindergarteners with gas and matches.

Can’t Hide the Debt Cookie Crumbs

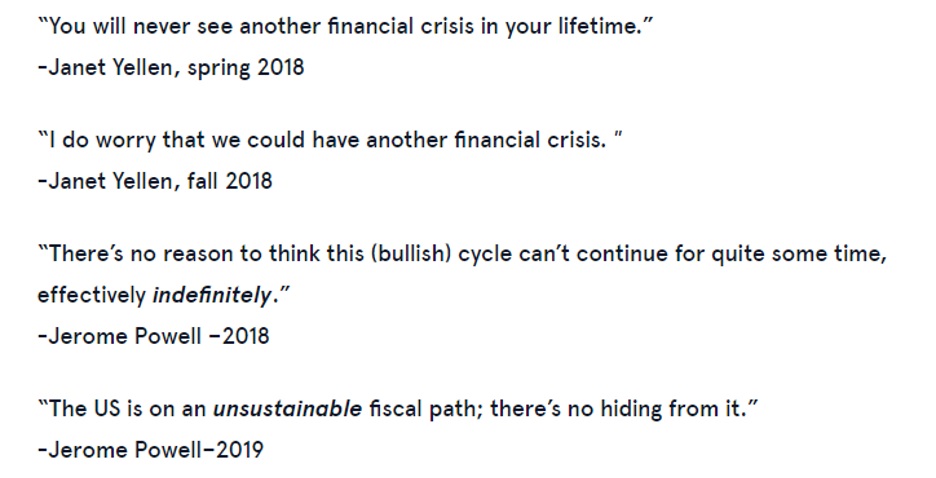

Speaking of kids caught with crumbs on their face while denying responsibility, it seems that even our central bankers can’t keep hiding the facts of now “unsustainable debt” (Powell) with clever lies, such as they had tried to do in the past:

In short, the days of hiding bad math behind empty words are now coming to an end, as most recently evidenced by another comical treasury market auction (below).

Keep It Simple: Debt & Bonds

As we’ve repeated ad nauseum, “the bond market is the thing,” and its survival, like a diesel V8 engine, lives and dies on liquidity/grease—i.e. dollars.

After trillions in outright grotesque QE grease following the bond crisis of 2020 and a hidden TBTF bank bailout (disguised as pandemic relief), the combined efforts of the Fed and Treasury Dept (i.e., the yin and yang of Powell and Yellen) to provide backdoor liquidity to this thirsty market are both tragic and remarkable.

Despite Powell’s headline tightening since 2022, the level of direct Fed liquidity is still tens of billions per month, and the hundreds of billions provisionally drawn from the reverse repo markets, the Treasury General Account (TGA), the Bank Term Funding Program (BTFP) are just QE by another pathway.

In addition to these tricks, tack on Yellen’s desperate attempt to issue trillions from the short end of the yield curve to take supply (and price) pressure off the sacred U.S. 10-Year, we can trace more examples of open desperation and backdoor liquidity by another name.

But at some point, all these liquidity tricks (as well as liquidity) run dry.

And when this “grease” runs out, that is when the bond engine stalls and the global financial system, led by a broke(n) U.S.A, starts its slow stall to the side of the proverbial road as the engine hisses, coughs and then dies.

Stated otherwise, the kids in DC are running out of cookies and jars (i.e., liquidity), and their lies and excuses are getting harder to hide.

Don’t believe it? Just look at the unloved US bond market.

A Very Telling & Embarrassing Treasury Auction

Having issued too many IOU’s (T-Bills) from the short end of the yield curve, Yellen’s Treasury Dept recently tried to auction off some IOUs from the longer end, namely the US 20Y UST.

Folks: It was embarrassing.

Foreign bidders for Uncle Sam’s 20-Year bond dropped to under 60% (they were 74% of the bidders in November).

This means that primary dealers (i.e., big banks) were forced to fill the gap by purchasing almost 22% of Uncle Sam’s increasingly unloved bar-tab of 20Y IOUs…

In simple speak, this is an open sign that the bond market is cracking. In fact, however, it has been cracking for a while…

Memories are short, as many have already forgotten the extreme dysfunction on the short end of the curve in Q1 of 2023 (not to mention the bank failures that followed, and with more to come, as warned…).

A similar disfunction is now openly obvious on the long-end of the bond curve, at least for those paying attention.

When bonds are unloved, their prices begin to fall, and their yields, which move inversely to price, start to rise, which means their interest rates rise too—adding more pressure (and cost) on Uncle Sam’s ability to repay the same.

Fiscal Dominance—More Than Just a Term of Art

This moment of interest expense “uh-oh” for DC is what the St. Louis Fed described in June of last year as “Fiscal Dominance,” namely that point where rising rates (and debt costs) get so high (i.e., dysfunctional), that the only option (and source) for more “greasy liquidity” (i.e., USDs) to support those ugly bonds is with money “clicked” out of thin air.

In short: More QE to the moon is inevitable, not debatable.

This QE inevitability is inherently inflationary, and this by the way, is the end-game for the Dis-United States, even if we experience a dis-inflationary recession somewhere in the middle of this tragic playing field.

Dollar Debasement—Right Before Our Eyes

Needless to say, such fake liquidity in the from an increasingly weaponized (and hence unloved) USD, places even more negative pressure on a DXY, which at the time of the aforementioned (and embarrassing) auction, was at 104, down from its 110+ levels of Q3 2022…

In the last four years of increasing bond dysfunction in the wake of drying liquidity, DC has shown five times in a row that it will come quickly and aggressively to the rescue to provide more fake grease (again, from the TGA, the BTFP, the repo markets etc.) to “save” the bond market at the expense of the currency.

Soon, we’ll just see plain ol’ QE, which will debase the USD even more, regardless of its “relative strength” to other equally, if not more, debased global currencies.

Such currency debasement, again, fits the pattern of all nations slowly dying from their own debt sins.

For now, of course, the markets are expecting Powell’s promised rate cuts to become actual rate cuts.

As a result, these markets are just giddy in anticipation and have recently hit all-time-highs on Powell words rather than Fed actions.

These already dangerously bloated markets will rise even further whenever the Fed has no choice but to hit the QE red button at the Eccles Building.

Tread Carefully You Top-Chasers

For those few, very few, who know how to trade nose-bleed tops without getting burned when net-incomes/margins trend south, the speculation and momentum trade juices are flowing.

But as I recently warned with evidence rather than hyperbole, today’s S&P, which is little more than a glorified tech ETF lead by 5 names, is the most dangerous bubble I’ve ever seen, traded or studied.

That Clever Pet Rock

Gold, meanwhile, will clearly get, and is already getting, the last laugh as stock bubbles inflate and bond markets scream for more debased USD grease.

The recent 20Y bond auction, above, with its foretelling of rising yields, should have been a massive headwind for that “yield-less pet rock.”

But as I argued from Vancouver in January, gold is breaking away from the standard correlations to rate, currency and inflation/deflation indicators.

Why?

For the simple reason that the overall system is now so openly broken, cracked, and dis-trusted that gold’s historically trusted (as well as speculator-ignored) role as a provider of real value (and 52-week highs) in world of diluted yet inflated currencies and bubble assets is becoming more obvious.

Again, this easily explains why central banks are stacking (and TRUSTING) this pet rock and dumping Uncle Sam’s IOUs at record levels.

That is, the world’s central banks (and leaders) see a US Humpty Dumpty about to fall off a wall, and when it does, gold will do far more to protect investors and sovereigns than bad IOUs and bubble assets measured in paper “money.”

Not surprisingly, the 0.5% of global financial assets allocated to gold are and will be rewarded not because they are just “contrarian for contrarian’s sake,” but because this remarkably small/informed minority are wise enough to think ahead rather just follow the sell-side sirens (and the crowd).

Which Needle Will Pop the Red Debt Ballon?

For now, and in the surreal backdrop of spiking markets and a Main Street on its knees and waiting for the “wealth effect” of a feudalistic rather that capitalistic financial system, all we can do is stare at the greatest debt bubble in history and guestimate which needle will “pop” it…

Will it be spiking rates colliding with the white swan of unprecedented global debt? A derivative market implosion? A geopolitical black swan? Another war? A collapsing Japan? China? America? A fractured/fragile EU? An immigration-lead fracturing of social order?

Who knows.

With so many needles pointed at a now historically unfathomable (and mathematically unpayable) red debt balloon, the actual needle that pricks us is rarely the one we see coming…

A Bank Needle?

As in 2008, the next crisis may come from where most crises are born, namely behind the glass doors of our stupid (and system-protected) banks…

The commercial real estate (CRE) crisis, of which I warned as far back as 2020, is anything but a minor matter.

The CRE losses on non-performing loans (NPLs) now exceeds the loss reserves at many of the largest US banks (Citi, Goldman, Wells, Morgan Stanley, JP Morgan etc.)

The Fed’s Real Mandate

Ironically, however, I don’t worry about these silly banks, because their Rich Uncle Fed’s real mandate is not inflation and employment, but making sure the foregoing banks, from which the Fed was un-naturally spawned, do not fail.

Bank regulators, who are just former bank executives, will meet FOMC and Treasury “experts” in DC and paste-together more back-room extend and pretend programs (which is how all failed banks deal with their failing loans and leadership) to provide the bigger boys with needed “grease” (i.e., liquidity) to stay alive (via forced yet subsidized UST, MBS and syndicated CRE/ABS purchases) as the Fed, once again, decides between saving the banking system or the currency.

Needless to stay, the suspense is hardly killing any of us who know how DC and Wall Street work.

In other words, expect more mouse-clicked trillions to save Uncle Fed’s spoiled banking nephews in a NYC which has slowly become not only a den of thieves, but a half-way house for millions of illegals which we like to call “asylum seekers” …

Ah, the American Dream, ah, the city that never sleeps…and the nightmare that never ends for every inflation-braced Main Street from Sea to Shining Sea.

Big Trouble in Little China

Of course, the US is not alone with yet another real estate cancer. China’s CRE crisis is arguably and mathematically worse.

But is that any real consolation to those facing an increasingly debased Greenback and unloved UST?

Are we supposed to be happy that our currency and bonds, though awful, are still better (for now, at least) than China’s?

Well, if our Dollar and IOU are so relatively special, why are the yields on our 10Y UST spiking 200 basis points above the CGB (Chinese Government Bond) yields?

Well, unlike the US, China is not pretending to be above total control over its markets and people, a trend which will come to the West once its childish leaders are forced into a debt corner.

History’s Sad Pattern

As I’ve warned for years, the syllogism from debt-crisis to market-crisis to currency and inflation crisis, followed by social unrest and then increased centralization from the extreme left or right is a pattern as old as history itself.

China has no shame about overt capital controls or state-owned banking.

But are our Fed-supported TBTF banks any less “centralized” just because their CEO’s get paid like capitalists despite being bailed out like state-sponsored entities?

We have had Wall Street socialism for years, but have put a nice “free market” lipstick on what is in essence just an “insider” pig.

Based on the trends above, and the pattern just described, the slow-drip toward more currency debasement, inflation and centralized (and capital) controls (think CBDC) in the wake of social unrest (from truckers and tractors fighting their “lords” from NYC to Berlin) is not only here and now, but the tragic road ahead.

This pattern of centralization, sadly, is just history and math. The cycles will play out. And gold, though no cure-all for all the overt and covert sins of our failed leadership, will at least be a cure for our failed currency.

Article courtesy of VONGREYERZ.GOLD

*********