Support CleanTechnica’s work through a Substack subscription or on Stripe.

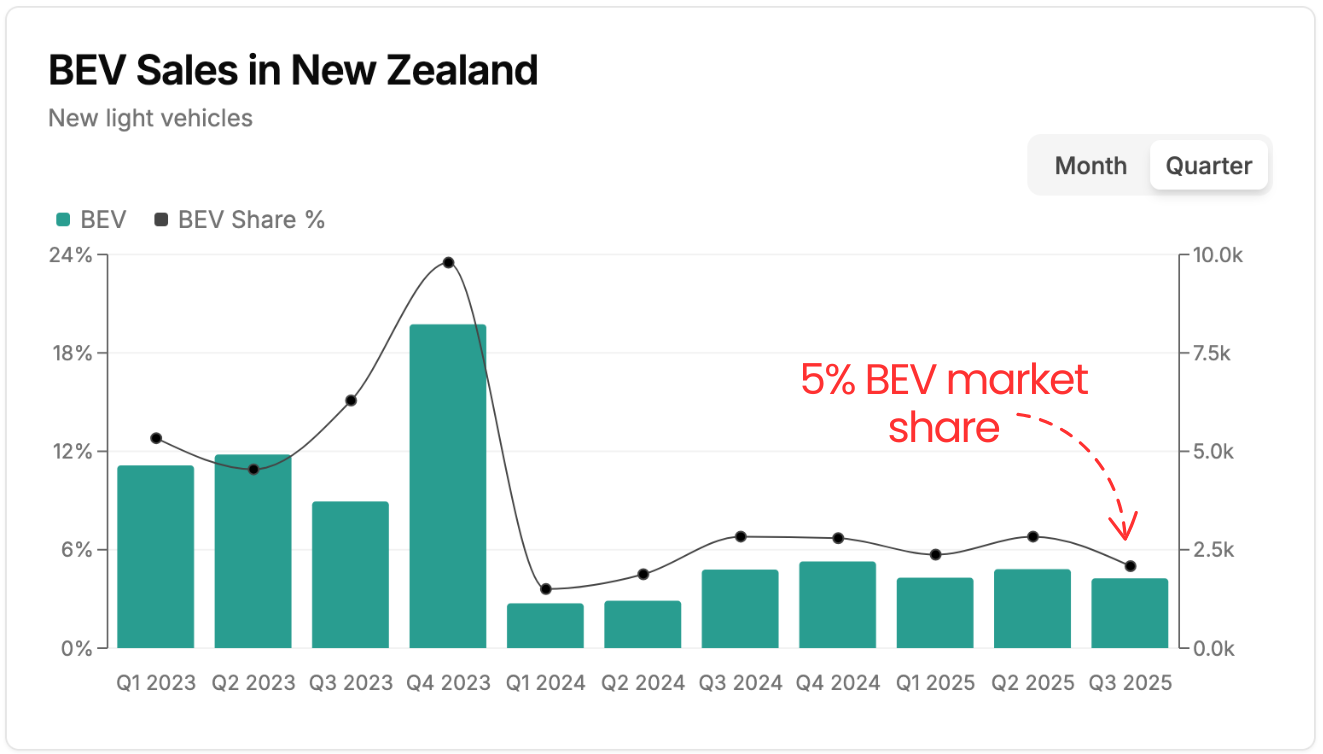

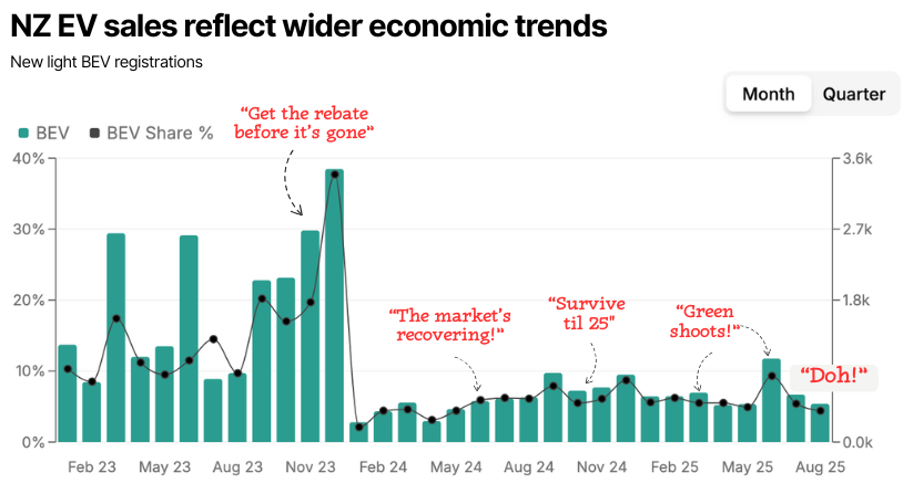

Once touted as having the potential to become the Norway of the Pacific, New Zealand’s electric vehicle sales have plummeted to historic lows. With no domestic production and the end of proactive government action due to a change in the national government, New Zealand’s story shows how quickly things can change.

James from EVDB gives us this potted history:

“In 2021–2023 NZ experienced rapid EV uptake. A feebate scheme (based on vehicle emissions) led to market share resembling an S-curve. Reminiscent of the Garner Hype Cycle — this was the ‘peak of inflated expectations’.

“In 2024 the market entered the ‘trough of disillusionment’ — the feebate scheme was cancelled, and a Road User Charge (RUC) introduced for electric vehicles. EV sales plummeted.

“Now in 2025, over 18 months since policy changes, BEV sales remain flat, while hybrids are slowly increasing market share. In the most recent September quarter, BEVs held just 5% new vehicle market share.”

He asks: Why is the EV market stagnant in New Zealand?

“We can only speculate, but a few reasons stand out.

- Economic conditions are challenging. With GDP growth at -1.1% in 2025, and unemployment rates lifting, there hasn’t been a lot of confidence among business or consumers.

- A lack of positive signalling. Transport policy in 2022–23 sent a message to the marketplace: we’re moving toward electric vehicles. Whether people agreed with the policy or not; the EV became a part of the narrative. This message is now absent.

- Vehicle running costs. Prior to the introduction of RUC, an EV was substantially cheaper to run than any ICE car. Now, the running costs of a small petrol hybrid are about the same as a full EV (provided the EV is charged at home). Petrol prices in New Zealand peaked during 2023, which also made motorists consider going electric. Now, petrol prices are about 20% lower than those peaks.

“What can we learn from the New Zealand situation?

“Without policy-based incentives, EVs need a strong cost-benefit advantage. There also needs to be continued education around the best use-cases for full-electric cars, rather than a myopic one-size-fits-all approach that just focuses on emissions.

“The on-off policy settings of the last few years may have confused potential EV buyers. It’s a bit like the phrase ‘throwing the baby out with the bathwater’. By ignoring EVs as a matter of principle, we’re missing out.

“There’s one particular transport scenario where a BEV makes so much sense it hurts: For 2+ car households (60% of all NZ households), having one smaller EV for all the urban driving is a winner.

- Recharge at home (no fear around range anxiety / public charging).

- No more trips to the petrol station.

- No need for a super expensive EV with a huge heavy battery.

- BEVs excel in efficiency at local stop-go driving.

- Keep the combustion car for all the other stuff.

“Combine this with NZ’s high proportion of renewal electricity generation, and the emerging increase in rooftop solar generation, and you’ve got some compelling reasons to switch to an EV.

“However, we’re lacking a positive, aspirational transport plan that demonstrates how EVs, along with public transport, walking, cycling, can lead to cleaner air and less reliance on fuel imports.

“New Zealand has efficiency regulations (the Clean Car Standard). These regulations are there to encourage vehicle importers to increase supply of cleaner, more efficient cars. However, with nothing to encourage car buyers (the demand side of the equation), the system cannot work as well as it should.

“However, in spite of market conditions, new affordable BEVs are being introduced into the NZ market, leading to more competition and lower prices.

“The Leapmotor B10 (small/medium SUV) has launched at a competitive price point. Great Wall Motors have refreshed the Ora hatchback — the vehicle is now the lowest price new EV (at NZD37,990). Over the next month or two BYD will launch two new cars; the Atto 1 (called the Seagull or Dolphin Surf in other markets) and the Atto 2. These vehicles will increase choice in the lower-priced segment.

“Going forward, a significant shift in consumer sentiment is needed before EV adoption will increase. Only when the market sees the electric car as an object of desire will things change. How this will happen is an unknown.

“But there’s one sure thing in life: Nothing ever stays the same.”

Looking over the figures shared by James on EVDB NZ, September 2025 showed a slight improvement in BEV sales — achieving almost 7% — while PHEVs hit over 5%. Together that is 12%. Year on year, BEV sales increased 28%, and PHEVs had a year-on-year increase of 32%. HEVs increased about 30%. Diesel sales are down over 10%. Perhaps EV sales are turning around. This is within an auto market that sells about 10,000 vehicles a month. We will have to wait for the figures over the next few months before we can predict a trend. The crystal ball is a little misty. To date, almost 3% of the total NZ fleet uses a plug.

The top selling plug in vehicles in New Zealand in September were:

- Tesla Model Y — 190

- BYD Sealion 7 — 42

- Tesla Model 3 — 38

- Kia EV 3 — 33

- BYD Atto 3 — 32

- MG S5 — 31

- Mini Countryman — 23

- Ford E-Transit — 20

- Kia EV 5 — 19

- LDV eDeliver 9 — 17

Despite the complications foisted on the New Zealand auto market, I expect that NZ will continue to have a bright and electric future. Keep your chin up and your data fresh and I will certainly look forward to future news. James also reports on Australia’s EV market. Check out his website here.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy