Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

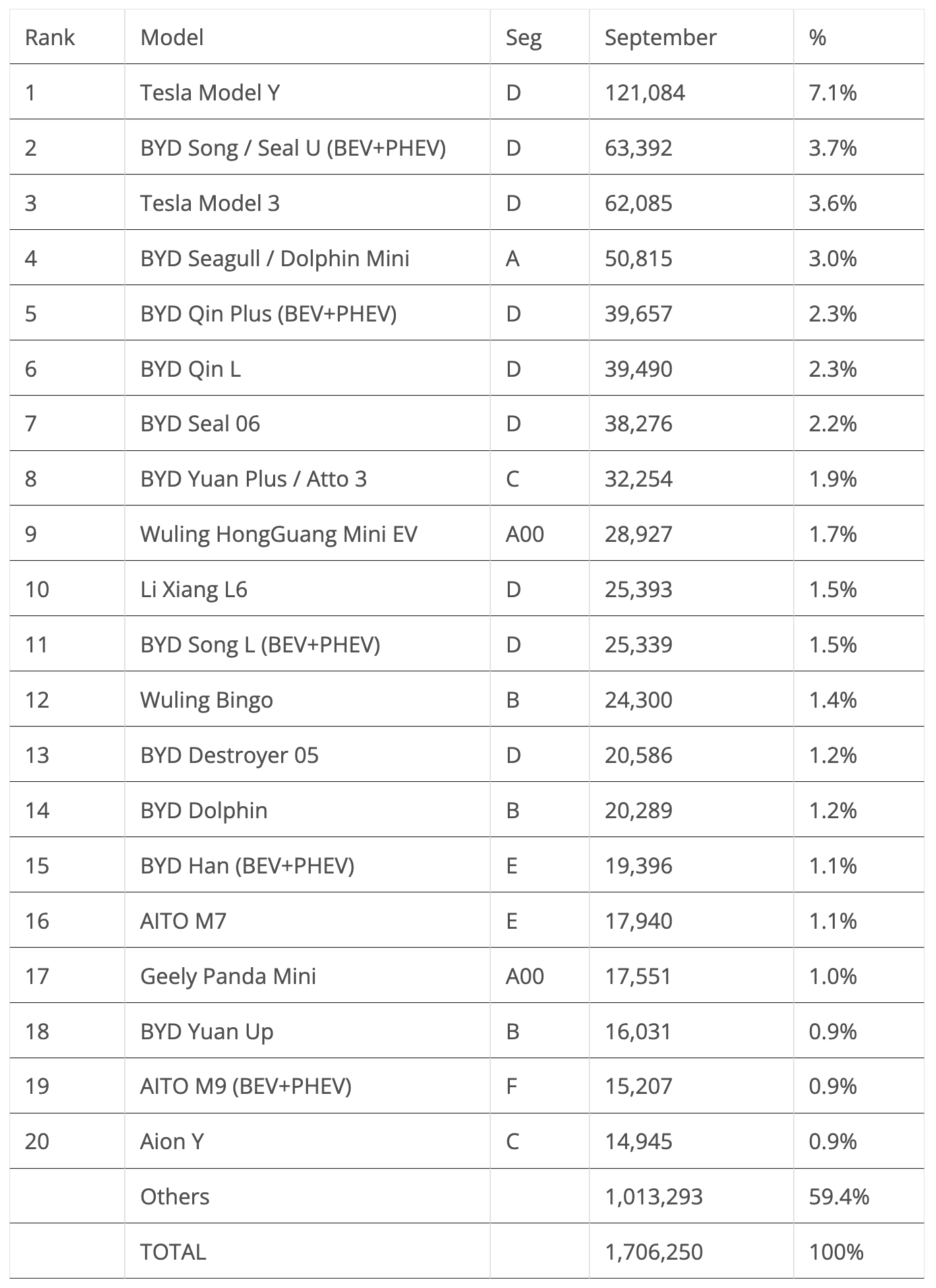

Global plugin vehicle registrations were up 33% in September 2024 compared to September 2023. There were 1.7 million registrations, which is a new record. BEVs were up by 12% YoY (year over year), to over one million units, but plugin hybrids did even better, jumping 57% YoY, selling over 0.6 million units.

In the end, plugins represented 26% share of the overall auto market (16% BEV share alone).

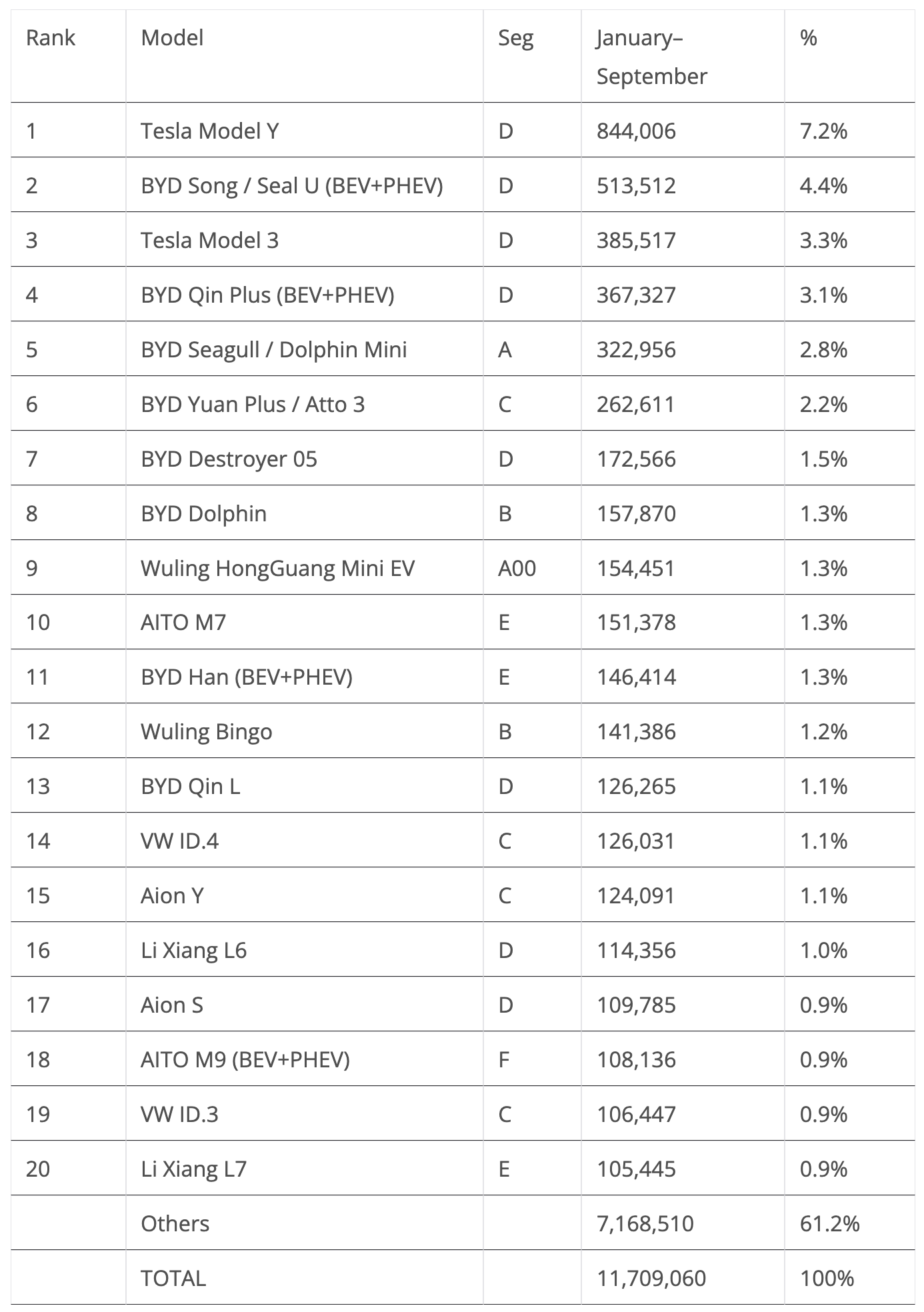

Year to date, plugin electric vehicle market share was up to 20% (12% BEV), or 11.7 million units (of which 7.3 million were BEVs).

Full electric vehicles (BEVs) represented 63% of plugin registrations in September, in line with the year-to-date tally. A year ago, BEVs owned 70% of the plugin market.

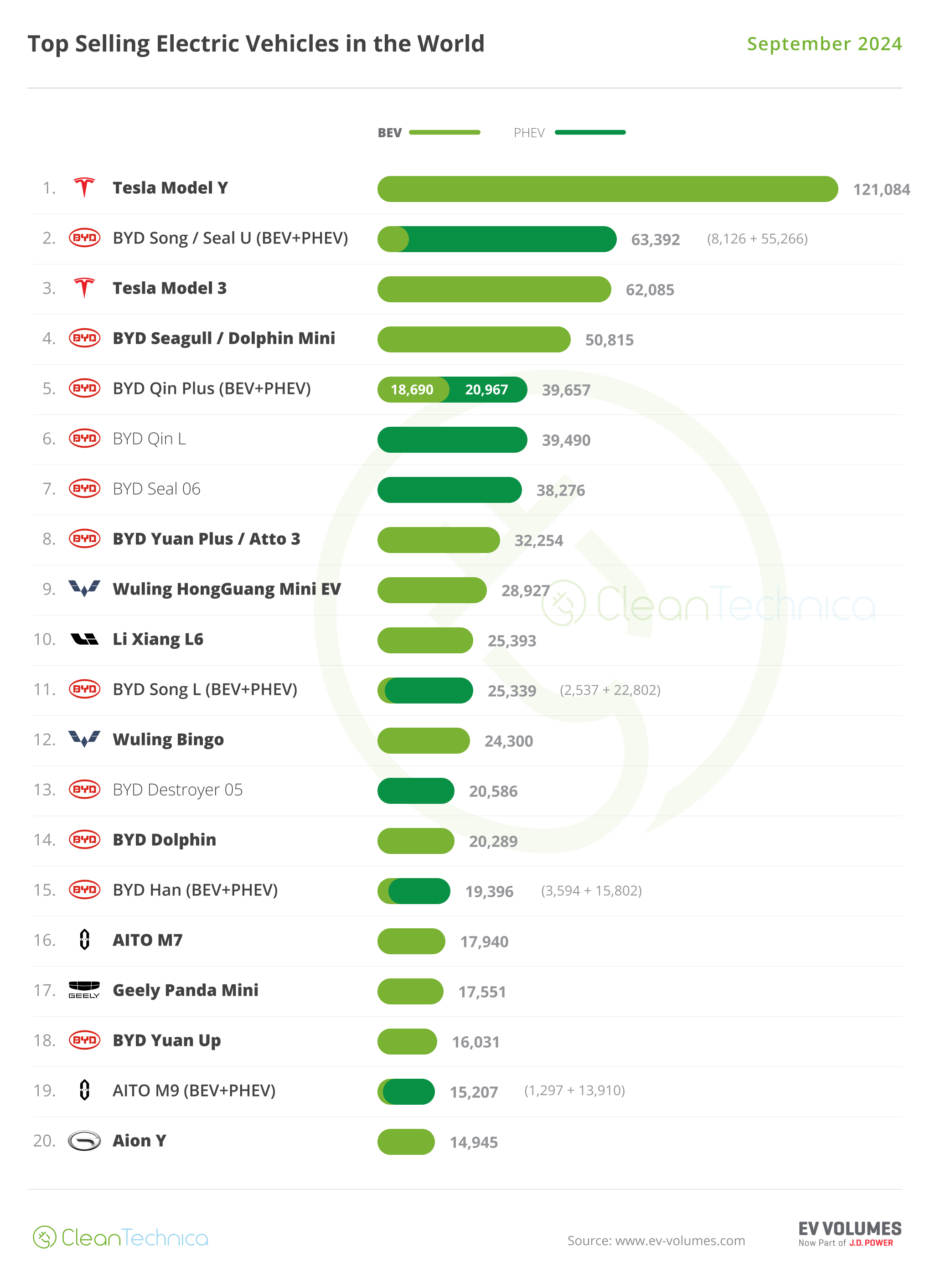

20 Best Selling EV Models in the World in September

Back to September’s best sellers, the Tesla Model Y was in the lead (as usual) with some 121,000 registrations, which is basically flat YoY. Meanwhile, the Tesla Model 3 ended September in 3rd, with some 62,000 registrations, more than doubling the numbers of September 2023.

As for BYD, the Shenzhen make placed 11 representatives in the top 20! BYD’s 2024 push is indeed paying dividends.

The best selling non-Tesla and non-BYD this time wasn’t the Li Xiang L6, which ended the month in 10th with 25,000 units, but the tiny Wuling Mini EV, which surged to 9th with 29,000 registrations, its best result since February 2023.

In BYD’s extensive lineup, the highlights were the little Lambo Seagull (aka Dolphin Mini in some markets), reaching a record 50,815 units, and the new Qin L, which continues to ramp up, scoring 39,000 registrations in only its 4th month on the market. The new Seal 06, its more outgoing twin sibling, is also ramping up, to 38,000 registrations, in its 3rd month on the market. There was another incredible performance from the BYD Song L (#11, 25,339 registrations), its second record score in a row.

Elsewhere, the #12 Wuling Bingo (24,300 units, a new year best) managed to beat the BYD Dolphin, with the SGMW JV hatchback beating the Shenzhen rival by some 4,000 units, proving that BYD (and Tesla) can be beaten.

Another model shining was the Geely Panda Mini, which ended the month in #17, with a record 17,551 units.

Off the table, and speaking of Geely, the highlight comes from another model from the same stable, with the just introduced Galaxy E5 hitting 14,250 registrations in only its second month on the market. This is one of the best entries on the market, which speaks volumes about Geely’s expectations for its compact crossover. With a looong lineup of brands and models, the truth is that the Chinese OEM still has to find one best seller model that manages to stay in the top 20 for more than a few months. Will the Galaxy E5 be it?

Regarding other Chinese OEMs, Chery’s Fengyun T9 PHEV is ramping up, with the midsize SUV hitting 11,156 units in only its fourth month on the market, while on the startup field, the Li Xiang L7 had 13,476 registrations, its best result since January, and the Huawei-backed Luxeed S7 scored a record 14,674 registrations, the sedan’s first five-digit score.

The XPeng Mona M03 landed on the market with a bang, by delivering 10,023 units, so expect the sedan-that-really-is-a-hatchback to join the top 20 soon.

With a world leading Cd of 0.194 aerodynamics and LPF batteries, sourced by BYD, it is being sold at half the price of a Tesla Model 3, but you don’t get half the car — far from it.

On the legacy OEM side, the big news is that they didn’t have any representative in September’s top 20. A mere blip, or is this the new normal?

Still, it wasn’t all doom and gloom, as the Skoda Enyaq scored a record 10,669 units in September. So, Volkswagen Group had four models (VW ID.3, VW ID.4, Audi Q4 and Skoda Enyaq) above 10,000 units. So, while the German OEM is facing troubling times, the truth is that the MEB platform has become a success story.

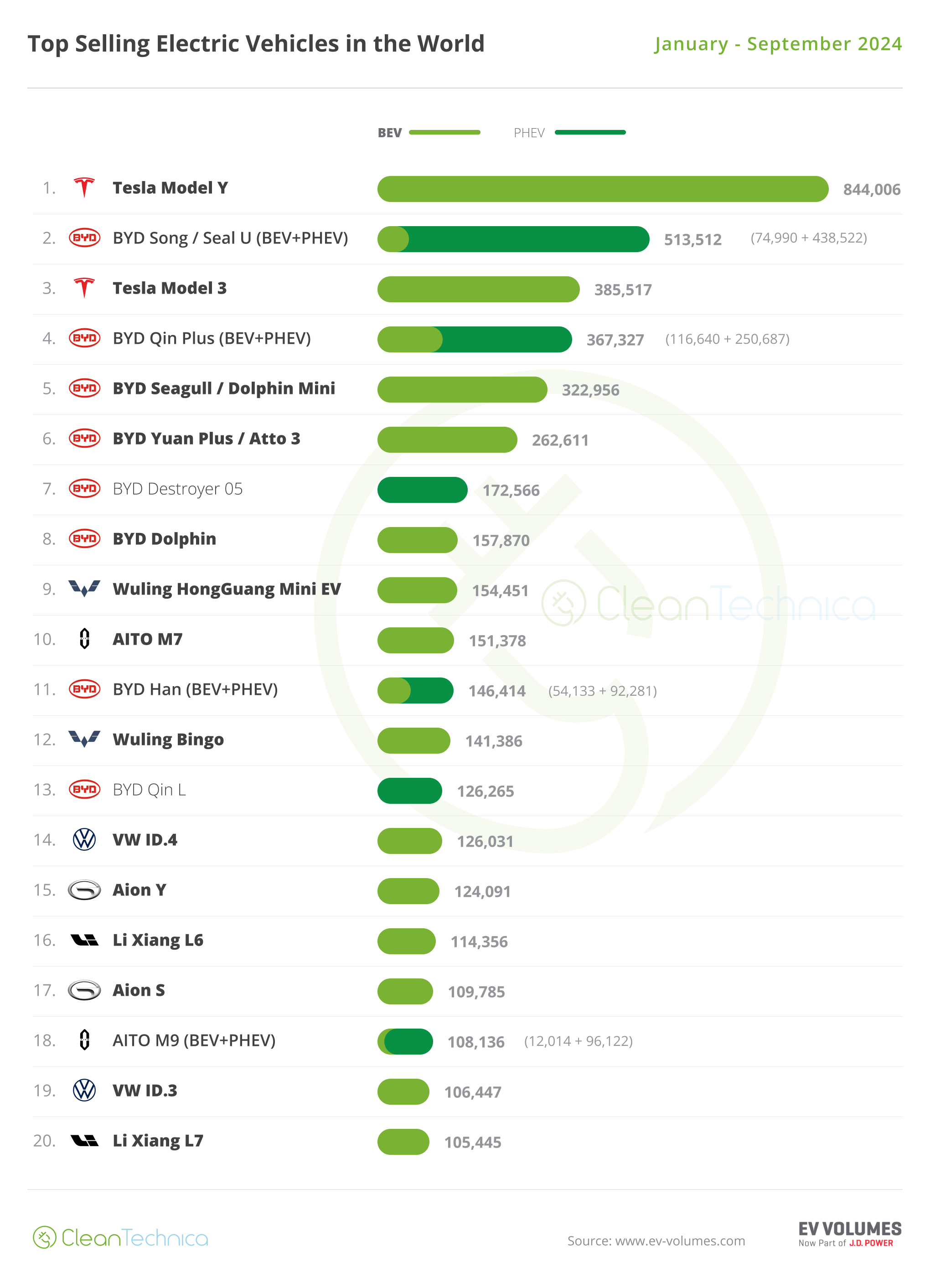

Top 20 EV Models YTD

In the year-to-date (YTD) table, the Tesla Model Y and BYD Song continue firm in the top positions, while the Tesla Model 3 recovered the 3rd spot from the BYD Qin Plus, now ahead of the Chinese sedan by 18,000 units.

Expect the Tesla sedan to retain the bronze medal, for the 3rd time in a row, and the 2024 model ranking should be the same (#1 Tesla Model Y, #2 BYD Song, #3 Tesla Model 3) as in 2023 and 2022.

Expect this status quo to be contested in 2025, though, as the BYD Seagull will continue to grow and threaten the Tesla Model 3’s bronze medal, and maybe even the runner-up status of the BYD Song.

The following positions seem all secure until the 8th position of the BYD Dolphin, but with the Wuling Mini EV now experiencing a new wind, the tiny four-seater was up two positions in September, to #9. Expect the BYD hatchback to have a hard time securing its 8th spot.

The Wuling Bingo jumped two positions, to the 12th spot, while right behind it, the BYD Qin L joined the table in #13, and should climb a few more positions in October, as the new generation Qin is preparing to win a top 5 position next year.

Finally, the Li Xiang L6 is also on the rise, having jumped four positions in September, to #16. Expect the midsize SUV to climb a few more positions by the end of the year.

Stay tuned for Part 2 of our September World EV Sales Report.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy