Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Global plugin vehicle registrations were up 36% in October 2024 compared to October 2023. There were 1.74 million registrations, which is a new record. BEVs were up by 23% YoY (year over year), to over one million units. Plugin hybrids did even better, jumping 65% YoY, its 5th record month in a row!

In the end, plugins represented 26% share of the overall auto market (16% BEV share alone).

Year to date, plugin electric vehicle market share was up to 20% (13% BEV), or 13.46 million units (of which 8.5 million were BEVs).

Full electric vehicles (BEVs) represented 62% of plugin registrations in October, slightly below the year-to-date average (63%).

Taking a closer look, if we remove China from the October tally, plugin sales were up a more moderate 13% YoY, but instead of PHEVs pulling the numbers up, it’s pure electrics doing so. BEVs grew by 16% YoY outside of China while plugin hybrids grew by just 4%. This says a lot about the importance of plugin hybrids in China’s current growth.

Countering the common rhetoric that EV sales are down, if we divide sales in four economic blocks (China, North America, Europe, Rest of the World), sales grew everywhere. China jumped by 67% YoY, nothing really surprising to see there. North America was up 10% YoY, so despite moderate growth, sales are indeed up, not down. Europe returned to growth in the past two months, with October signaling a 2% growth rate.

The really interesting part is the 35% growth rate in the remaining markets. While North America and, to a lesser degree, Europe are building barriers to a quick electrification process, the rest of the world is moving on, no doubt helped by Chinese EV makers. Chinese EV producers after conquering their domestic market and will no doubt do the same in export markets that do not have a strong local automotive cluster, leaving US and European OEMs with their domestic markets and … not much else.

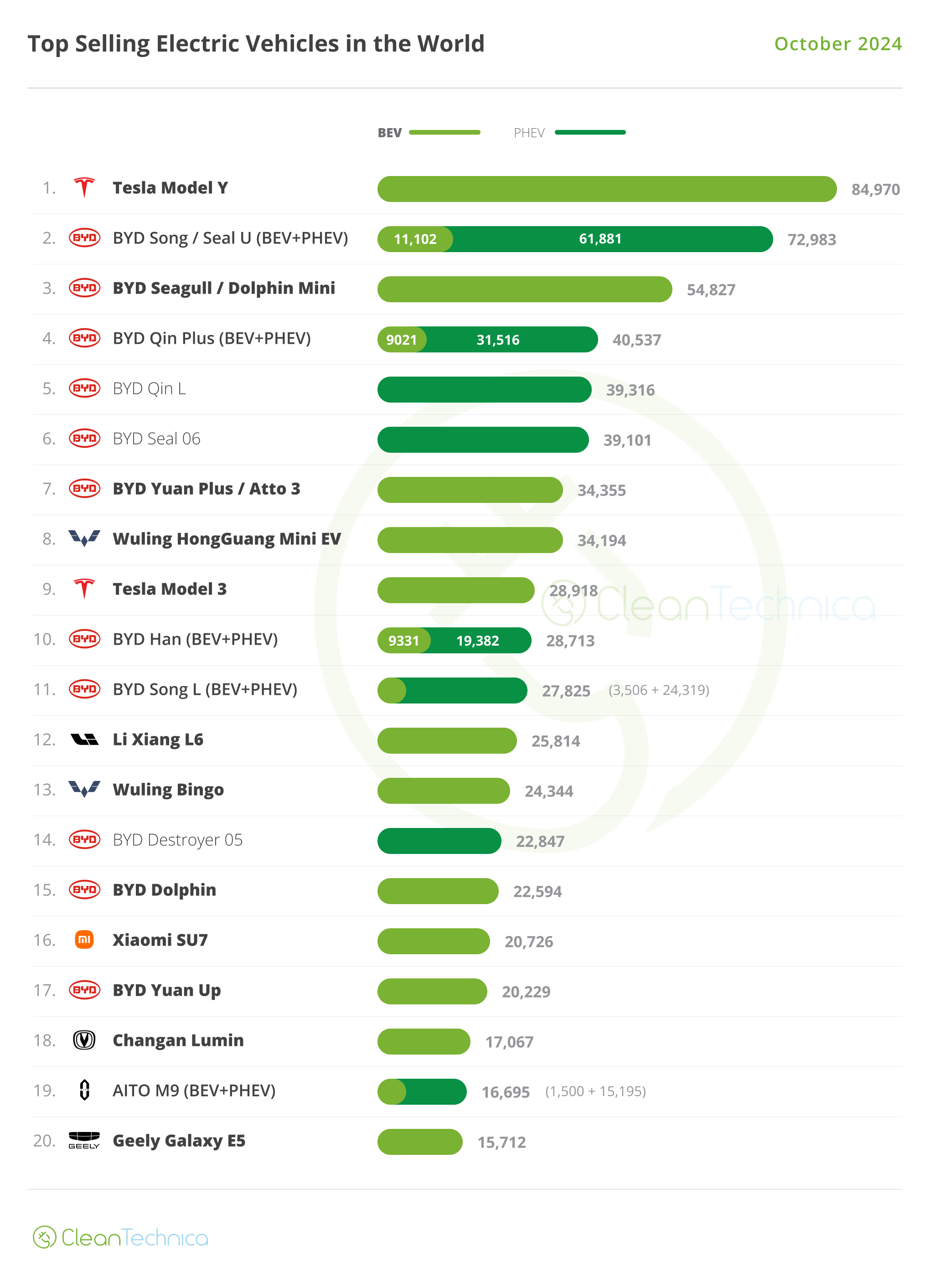

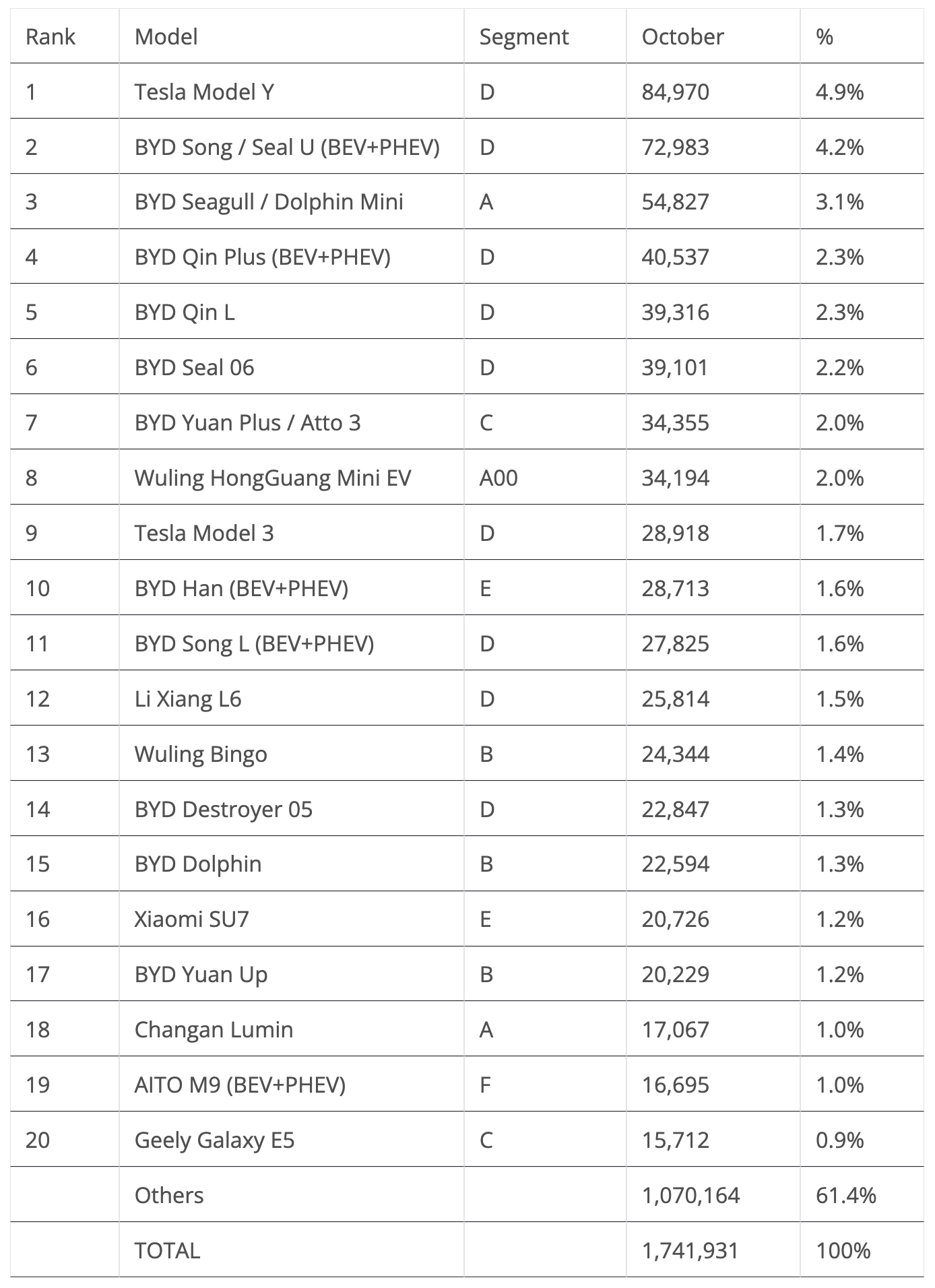

20 Best Selling EV Models in the World in October

Back to September’s best sellers, the Tesla Model Y was in the lead (as usual) with some 85,000 registrations, which represented 9% growth YoY. On the other hand, the Tesla Model 3 ended September only in 9th, with some 29,000 registrations, down 10% YoY.

As for BYD, the Shenzhen make placed 11 representatives in the top 20! BYD’s 2024 push is indeed paying dividends.

The best selling non-Tesla and non-BYD was the tiny Wuling Mini EV, which surged to 8th with 34,000 registrations, its best result since 2022.

Elsewhere, the highlights were the #16 Xiaomi SU7, with a record 20,726 units, and it will be interesting to see if the sports sedan will be able to surpass the category leader BYD Han in either November or December.

Another model shining was the recently introduced Geely Galaxy E5, which ended the month at #20 with a record 15,712 units.

Off the table, and speaking of Geely, it was another positive month for the brand. The Panda Mini ended the month at #21, ending less than 100 units behind its sibling, the Galaxy E5. Meanwhile, the Geome Xingyuan hatchback landed with an impressive 15,130 deliveries. The little hatch could be another hit for the Chinese make.

With a looong lineup of brands and models, there was another model shining, with its premium wing Zeekr delivering 11,643 units of its 7X midsize SUV, a sizeable number for a model still in its 3rd month on the market. Will it also reach the table?

Regarding other Chinese OEMs, FAW’s tiny Bestune Xiaoma is ramping up, having reached 12,633 registrations in October. On the startup side, the XPeng Mona M03 scored 10,203 registrations, in its second month on the market.

On the legacy OEM side, they didn’t have any representatives in October’s top 20. Their best selling EV was the VW ID.3, with 14,893 units delivered, while the only other model worthy of mention was the Hyundai IONIQ 5, which got 10,165 registrations, its best result in over a year.

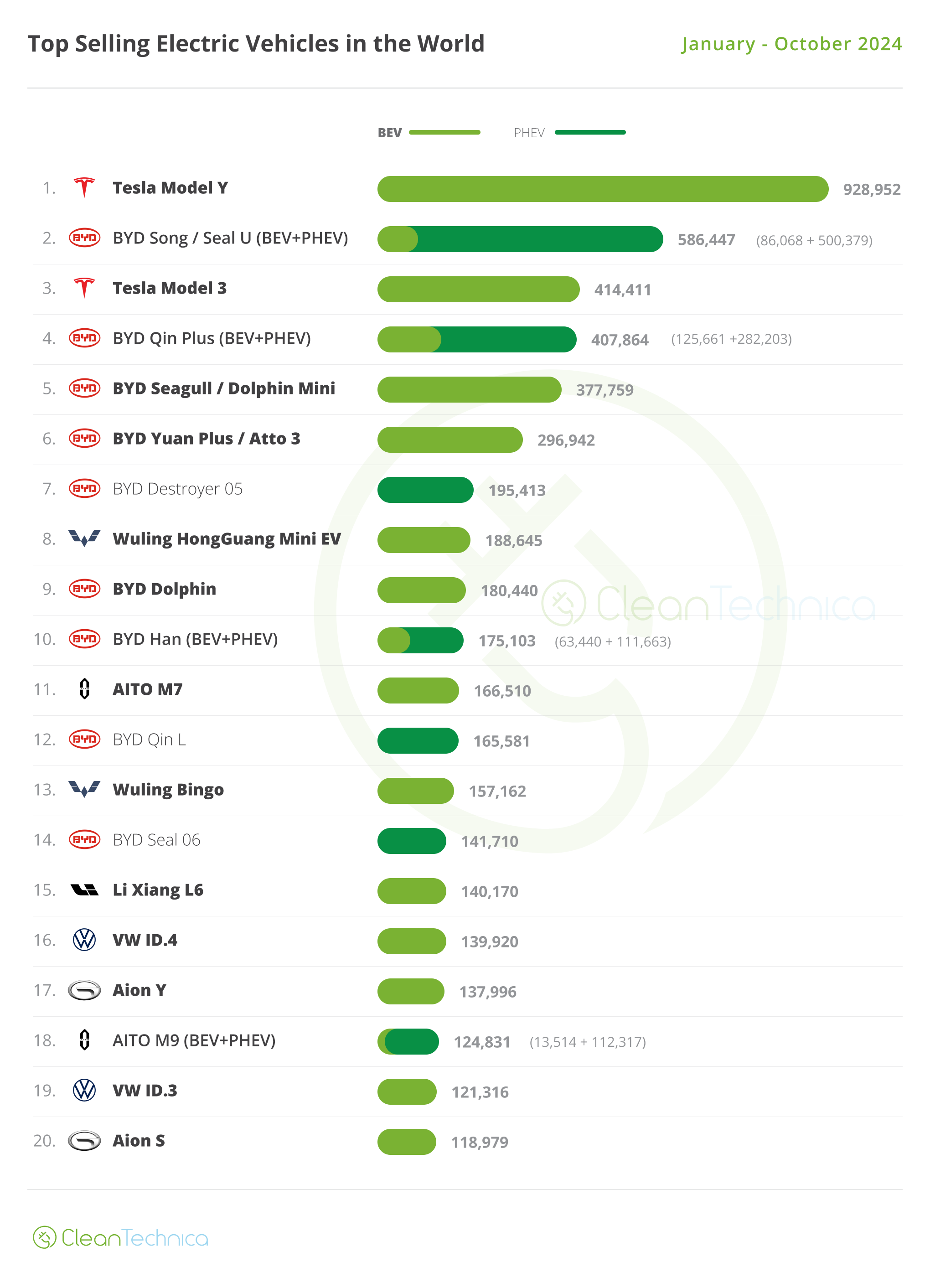

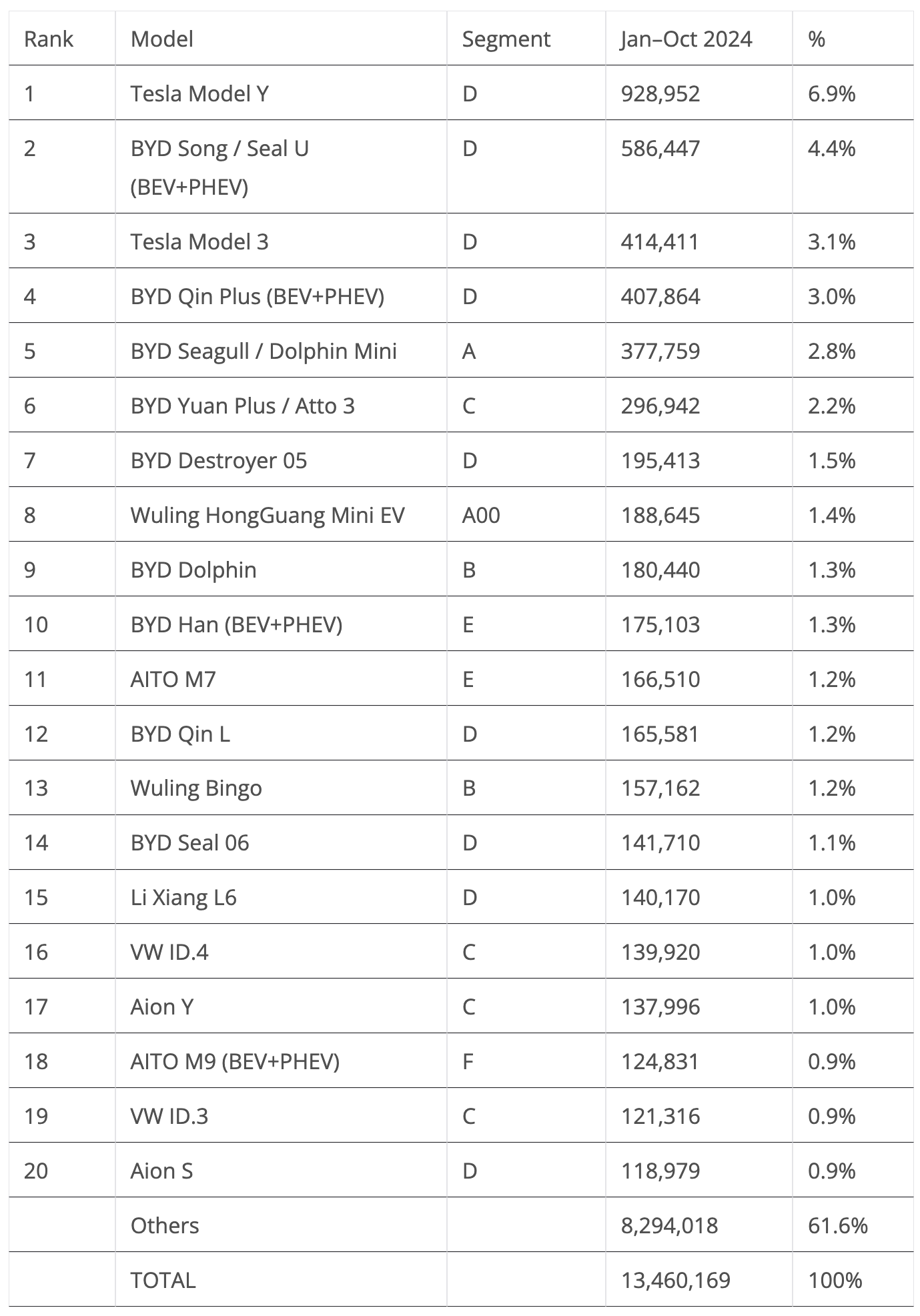

Top 20 EV Models YTD

In the year-to-date (YTD) table, the Tesla Model Y and BYD Song continue firmly in the top positions, while the #3 Tesla Model 3 kept some distance (7,000 units) over the #4 BYD Qin Plus, despite this being Tesla’s usual off month. So, expect the US sedan to end the year in 3rd, which will be its 3rd consecutive bronze medal and seventh straight year on the best sellers podium.

2025, though? It’s hard to say. Sales in 2024 are stagnant (-1% YoY), and with the refreshed Model Y probably stealing some if its sales next year, BYD will have a battery of models aimed at stealing the Tesla Model 3’s bronze medal (the Seagull, Qin L, Seal 06, and maybe even the good ol’ Qin Plus).

The following positions seem all secure until the 8th position, where the Wuling Mini EV surpassed the BYD Dolphin in October.

But not all is bad news for BYD. Far from it, actually. While the Dolphin was down, the Han flagship sedan was up to #10, thanks to its recent refresh. The Qin L continues to climb positions in the table, now at #12. Will it get a top 10 position in November? All while its sportier looking sibling, the Seal 06, joined the table at #14.

Finally, the Li Xiang L6 is also on the rise, climbing one position in October to #15. Will the midsize SUV climb a couple more positions by year end?

That’s it for the top selling electric vehicle models globally, but stay tuned for our report on the top selling auto brands and auto groups.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy