Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

EVs Now 18% of World Auto Sales

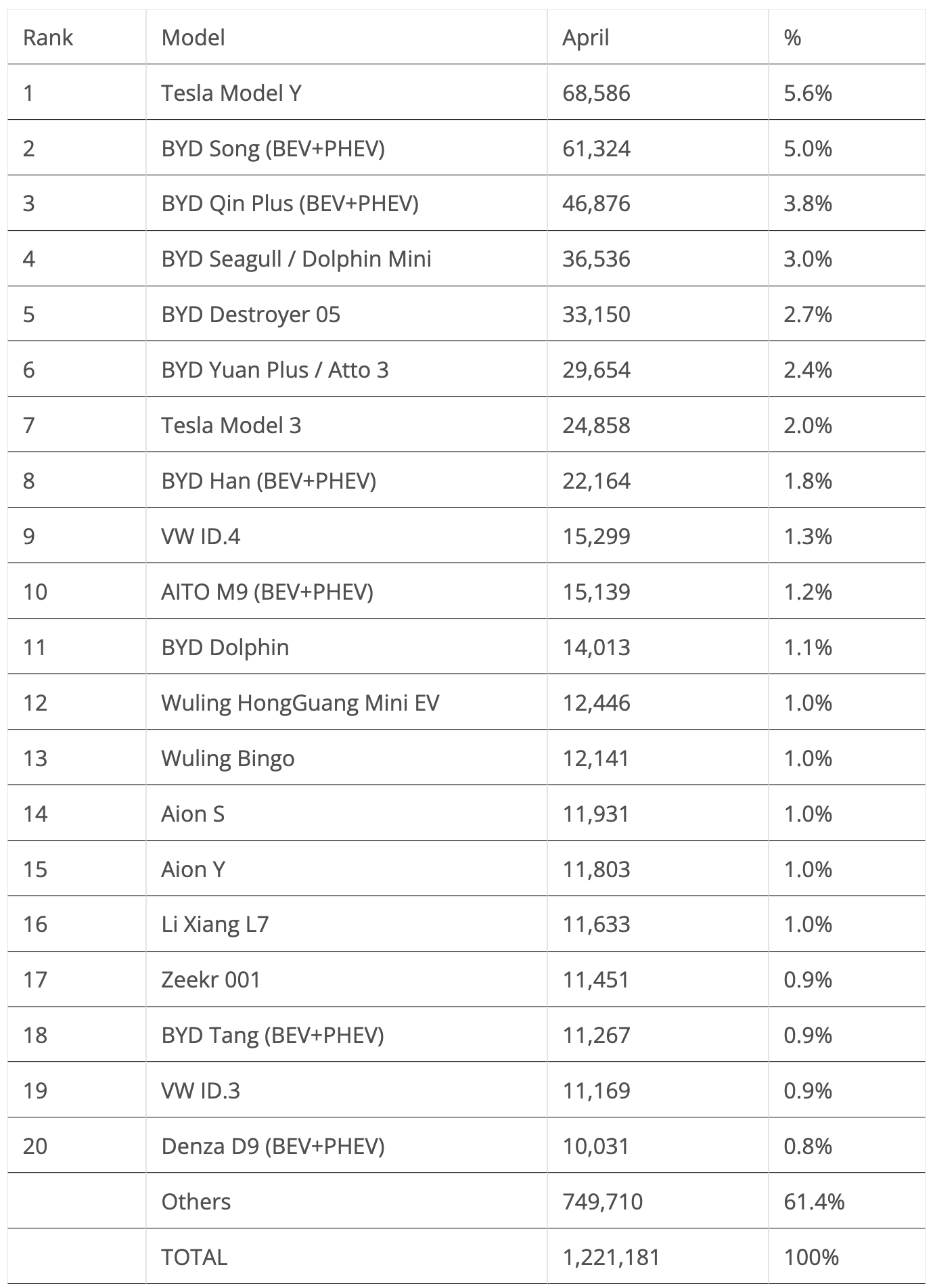

Global plugin vehicle registrations were up 25% in April 2024 compared to April 2023. There were 1.2 million registrations. BEVs were up by 14% YoY, while plugin hybrids jumped 51% YoY.

In the end, plugins represented 18% share of the overall auto market (12% BEV share alone). This means that the global automotive market remains in the Electric Disruption Zone.

Year to date, plugin electric vehicle market share was up by 1%, to 17% (11% BEV).

Full electric vehicles (BEVs) represented 65% of plugin registrations in April, pulling the year-to-date tally to 64% share.

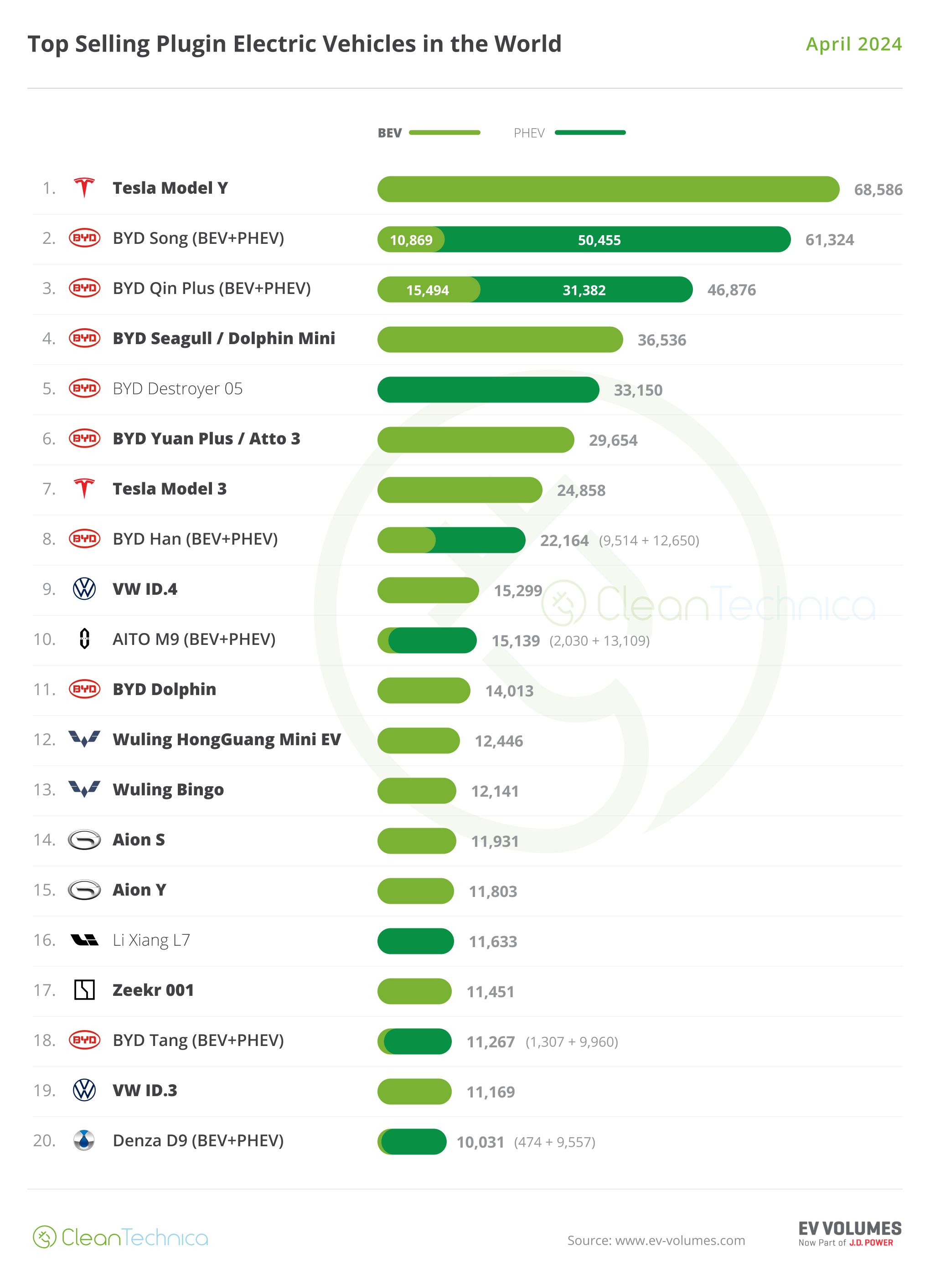

20 Best Selling EV Models in the World in April

Looking at April best sellers, while the Tesla Model Y is in the lead (as usual), with some 69,000 registrations, it is down 7% YoY. Below it we have five BYD models, the #2 Song, #3 Qin Plus, and #4 Seagull/Dolphin Mini. For its part, the Tesla Model 3 was relegated to 7th with 25,000 registrations, down a worrying 36% YoY.

In fact, the Shenzhen make placed 6 representatives in the top 10! Among these, the highlight is the BYD Destroyer 05, the bad boy sibling of the Qin Plus. The Destroyer 05 scored a record 33,150 registrations in April. This is no doubt another model that is benefitting from BYD’s recently introduced War on ICE (aka price cut war).

Besides the Tesla and BYD fleets, the two other models running at a top 10 pace were the AITO M9, with the Huawei-backed model ending the month in 10th with a record 15,139 sales, and the VW ID.4, which was 9th, in a rare occasion where we see a Volkswagen model on the top half of the table.

Zeekr saw its flagship 001 model jump to #17 from a record 11,451 sales, thanks to the recent refresh.

Off the table, the highlights came from the Volvo stable, with the recently introduced EX30 hitting 9,074 registrations in only its 4th month on the market! Expect it to be in the top 20 soon. Meanwhile, the veteran XC60 PHEV surprised again with a brilliant result — 9,153 registrations.

Finally, a reference goes out to the Toyota BZ4X, which scored a record 8,836 registrations in April. Is this a sign that the Japanese juggernaut is awakening?

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

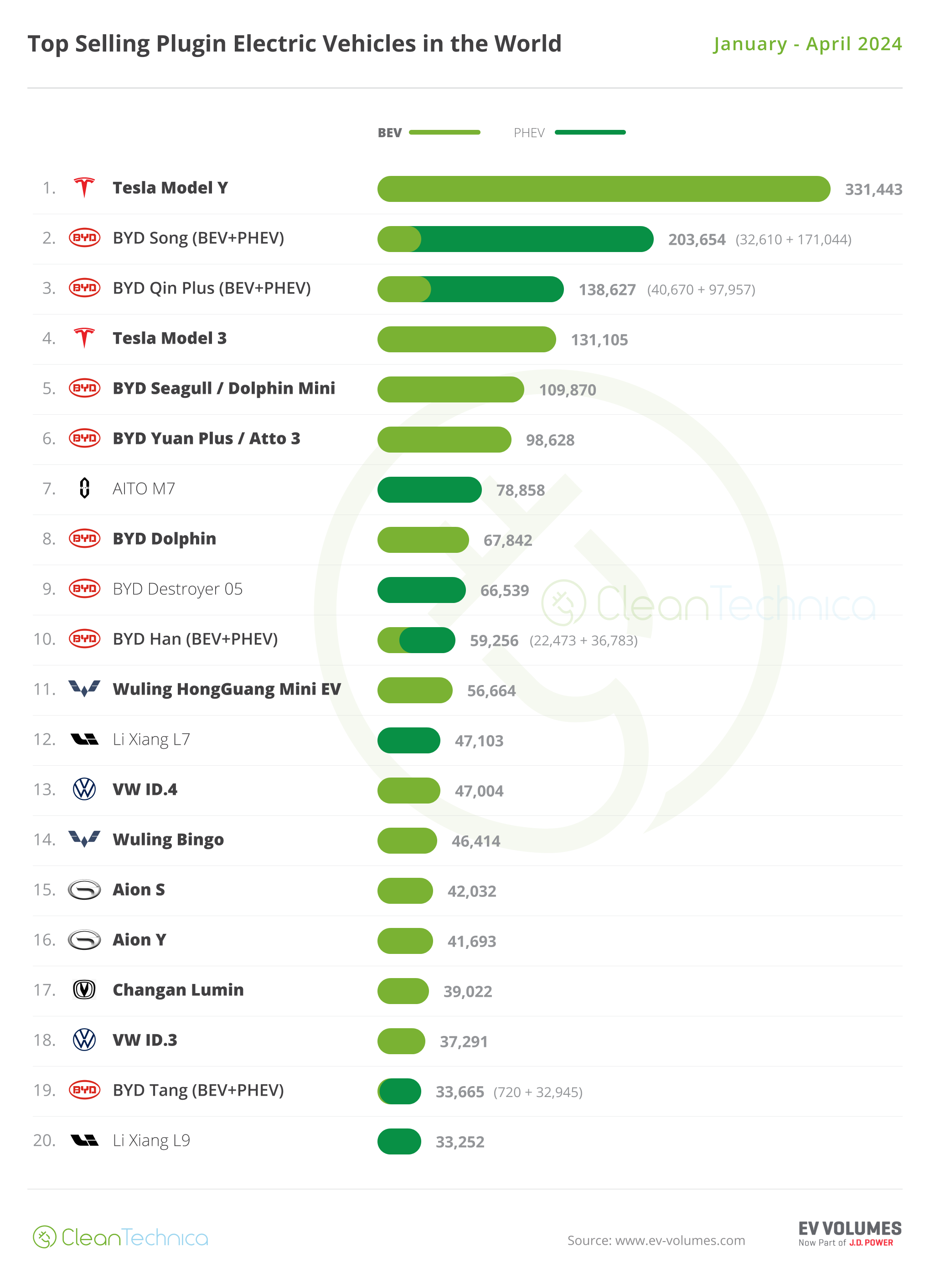

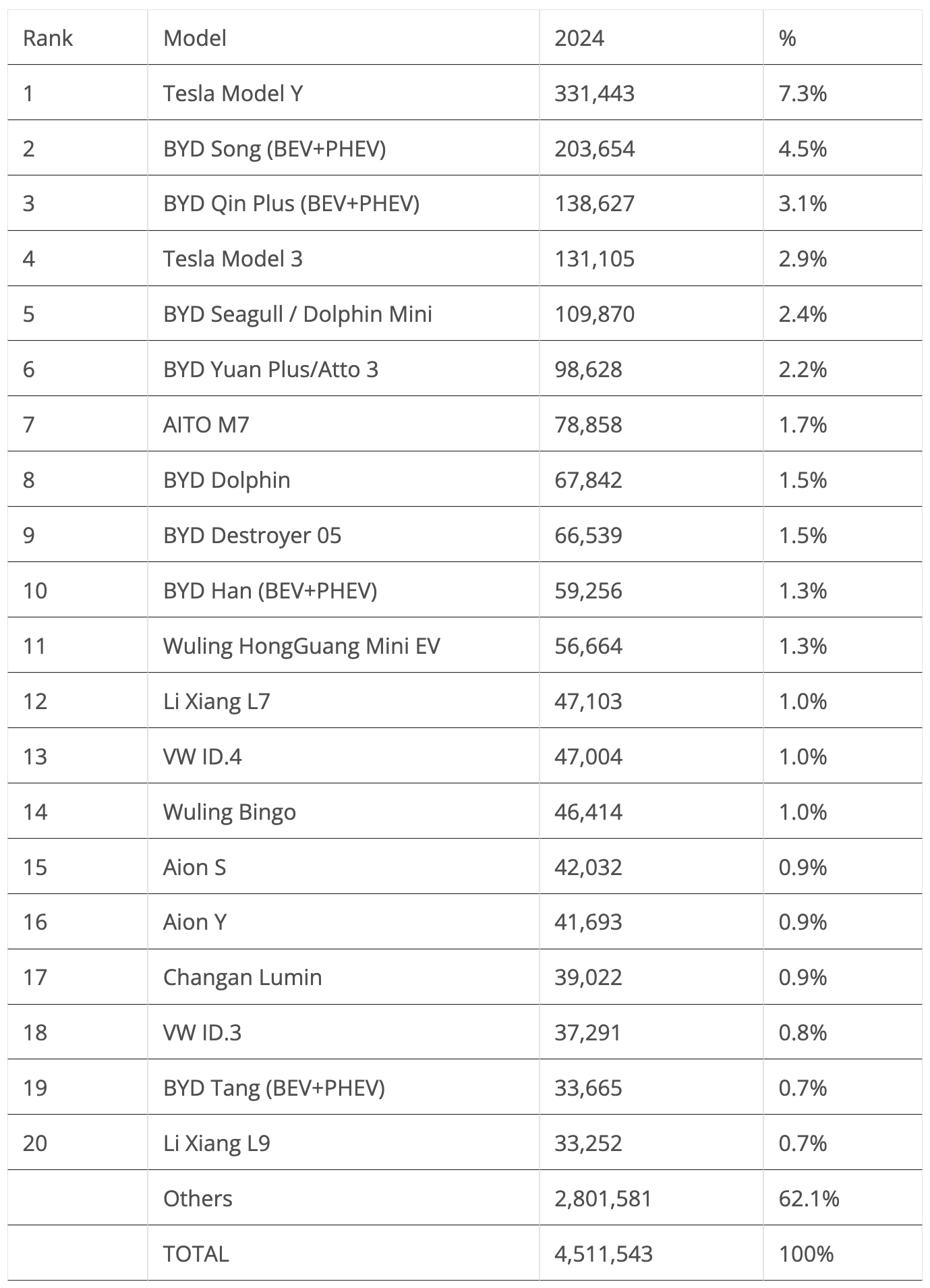

Top 20 EV Models YTD

In the year-to-date (YTD) table, the biggest news is BYD’s rise and rise. With the BYD Yuan Plus/Atto 3 climbing one position, to 6th, and the BYD Destroyer 05 jumping four positions, to 9th, we now have 7 BYD models in the top 10!

Still on the topic of BYD, the BYD Tang returned to the top 20, to #19, thus putting 8 BYDs in the 2024 table. Also, the Destroyer 05 jumped onto the table, right into the 13th position.

Elsewhere, GAC’s Aion models recovered some positions in April, with the S sedan climbing to #15 and the Y crossover-MPV to #16. Thanks to a strong month in May, the VW ID.4 jumped two positions, to #13.

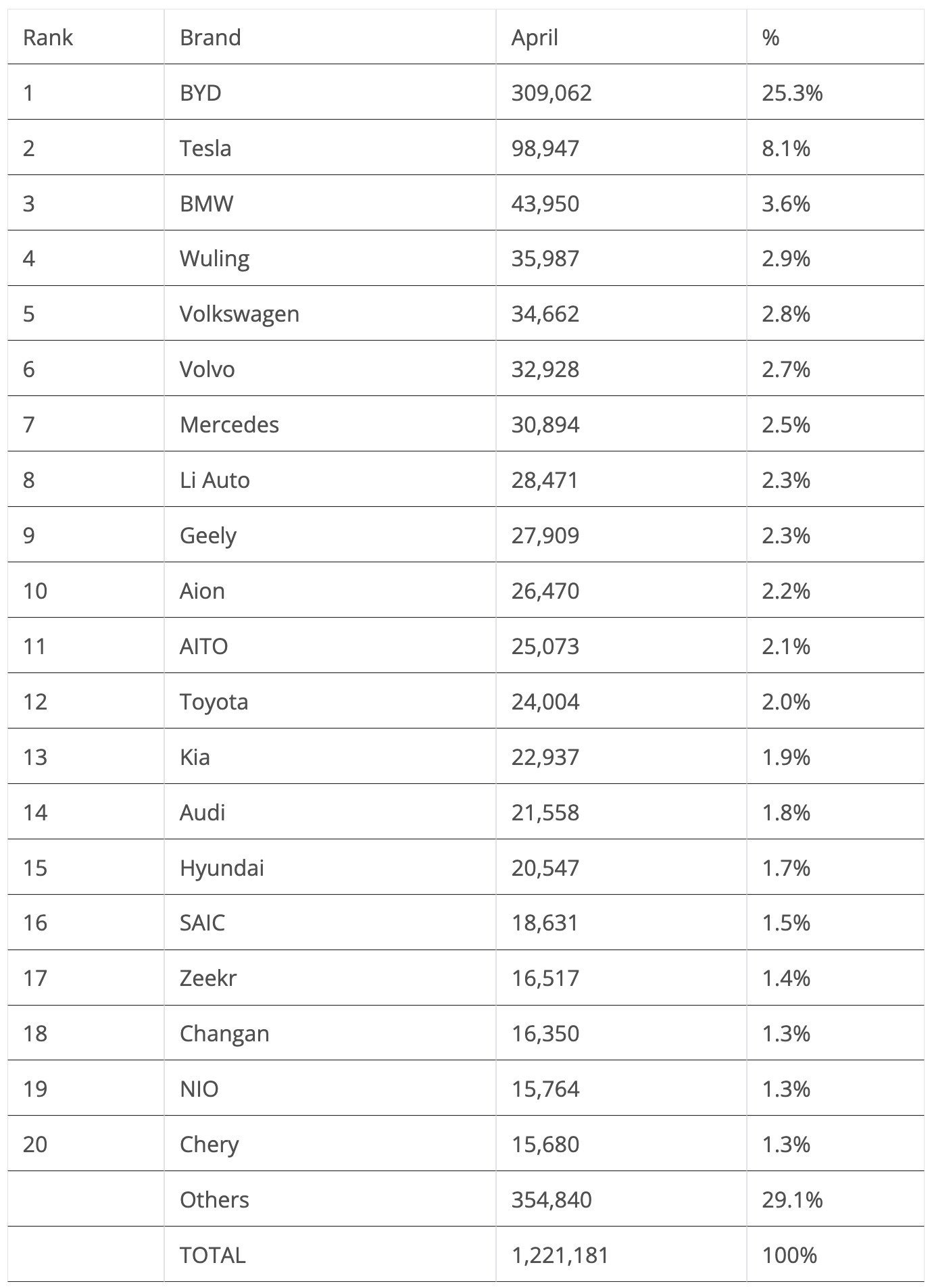

Top Selling Brands

In April, #1 BYD, now deep into pricing out the ICE competition (and quite a few other EVs on the way…), didn’t disappoint. It scored some 309,000 registrations. Expect its sales to continue steadily rising throughout the year. Although, if that sales climb does not materialize, then BYD wasted profit margins for nothing.

As for Tesla, after the sales drop in Q1, the April result continued to disappoint, with the almost 99,000 registrations representing a 15% drop compared to the same month last year. But it still had double the sales of #3 BMW….

Yes, below the top two galactics, BMW won the last position on the podium. Volkswagen, surprisingly, ended in 5th with 34,662 registrations — much thanks to good results from its star players, the ID.4 and ID.3.

The second half of the table saw a surprising Toyota perform a near-record result, with 24,004 registrations, much thanks to the good results of the globally sold BZ4X (8,800 registrations). Expect the Japanese make to continue scoring record results this year, especially if attractive models like the recently shown BZ3C land in Toyota’s main markets….

With Toyota currently the 3rd largest brand in China (it was 2nd before the rise of BYD), it needs to ramp up its EV operations fast — or else it could say bye-bye to the million-plus units it sells in that market.

A final mention goes out to Zeekr, which joined the best sellers table in #17 with 16,517 registrations. Is this another Chinese brand to follow closely?

In April, known brands like Ford, Peugeot, and Jeep were left out of the top 20, being replaced by more Chinese brands, like NIO, which ended the month at #19 with 15,764 registrations. Overall, China had 11 brands in the top 20.

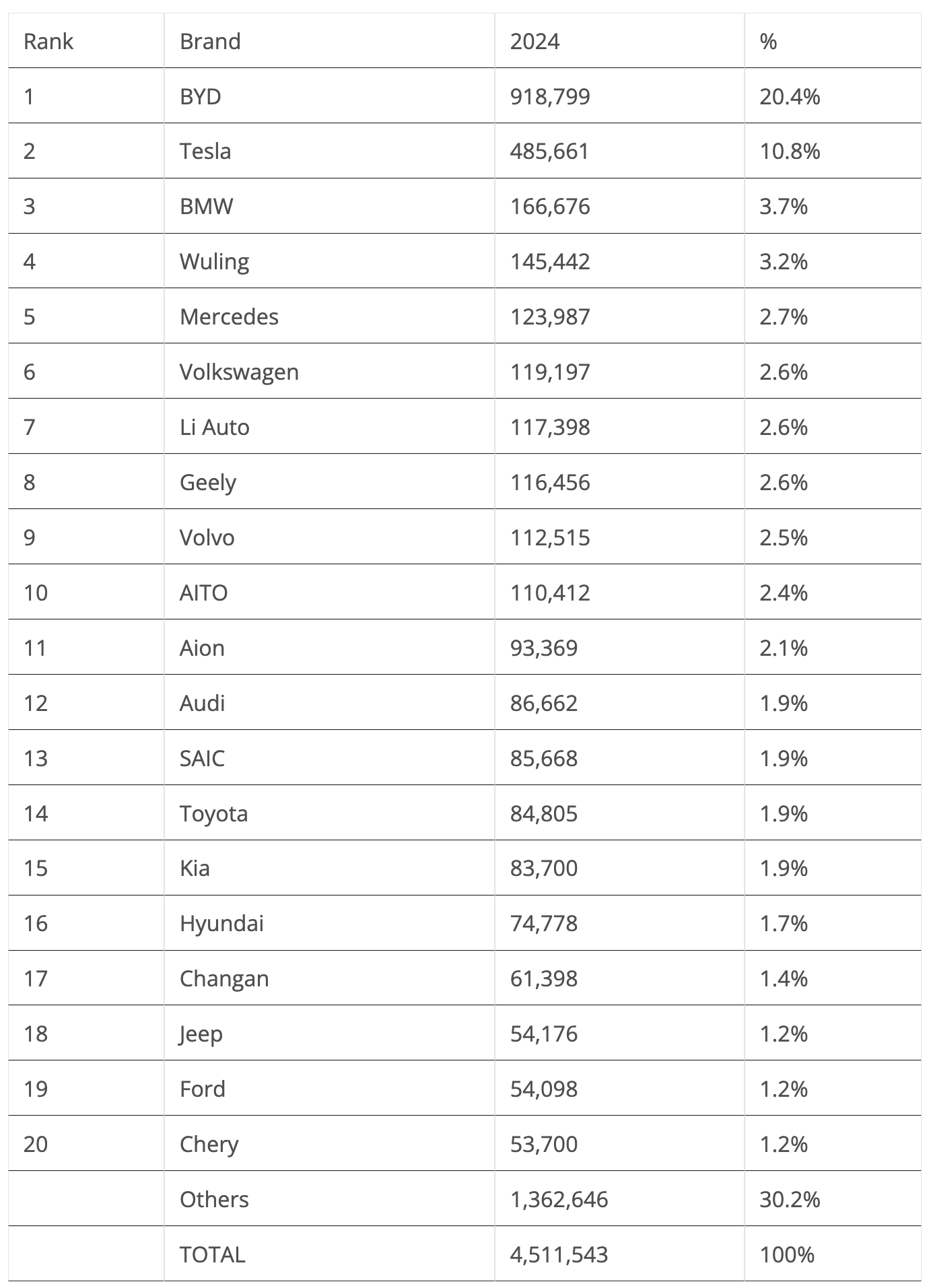

In the YTD table, there wasn’t much to report at the top. BYD is ahead of Tesla, and the US brand has two times as many registrations as #3 BMW. But while BYD continues to grow by double digits, Tesla’s sales are down 10% in 2024….

Far below these two, which are really in a league of their own, BMW and Wuling stayed in their positions, while Volkswagen benefitted from a strong month of April to jump three positions into 6th.

Volvo is benefitting from its strong sales to climb one position, to 9th.

In the second half of the table, Aion signaled the return to form of its dynamic duo, the Aion S and Aion Y, jumping three positions into 11th place.

The remaining highlight came from Toyota, which jumped two positions, to 14th. We might see the Japanese make join the top half of the table by the end of the year.

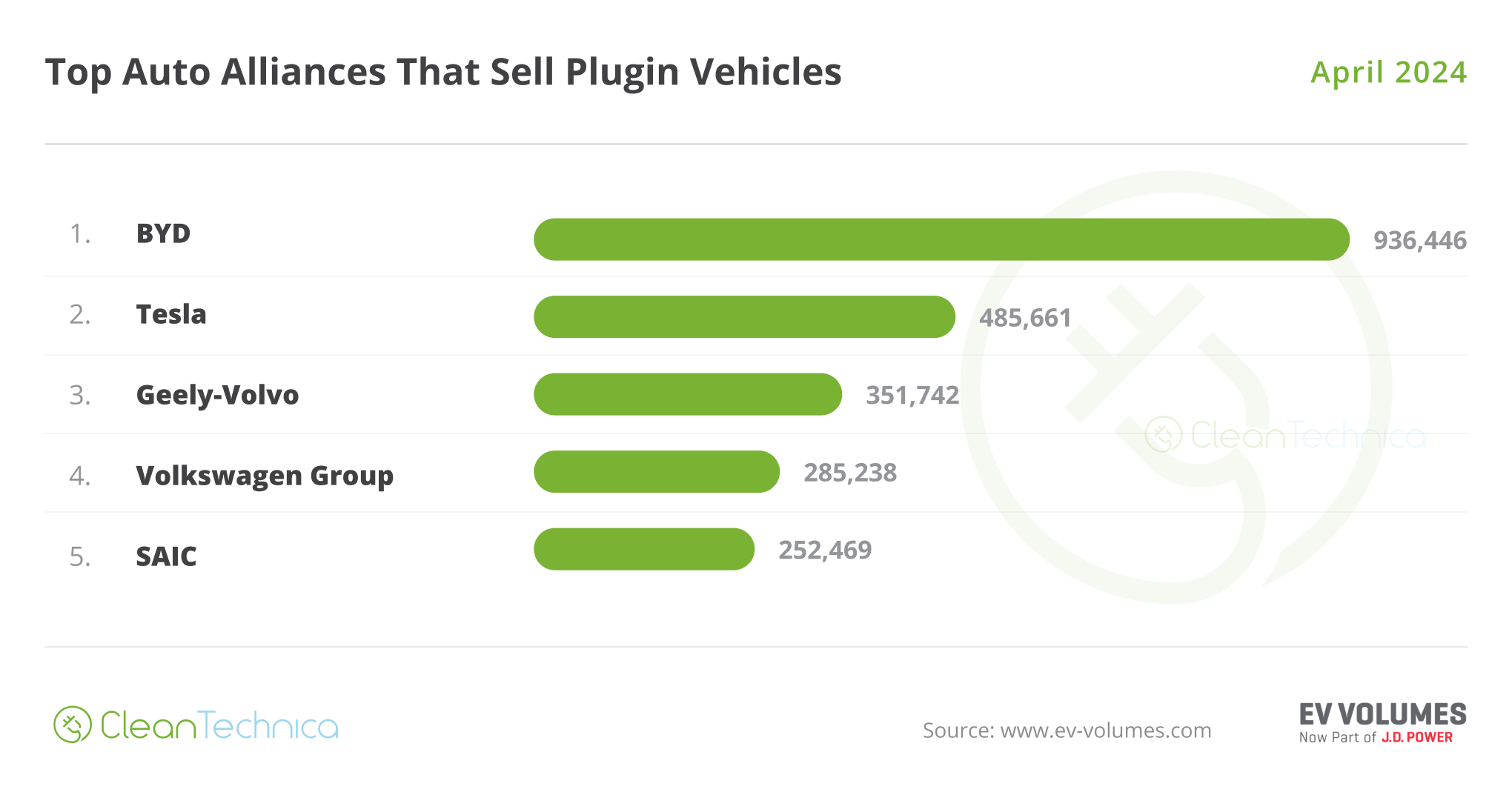

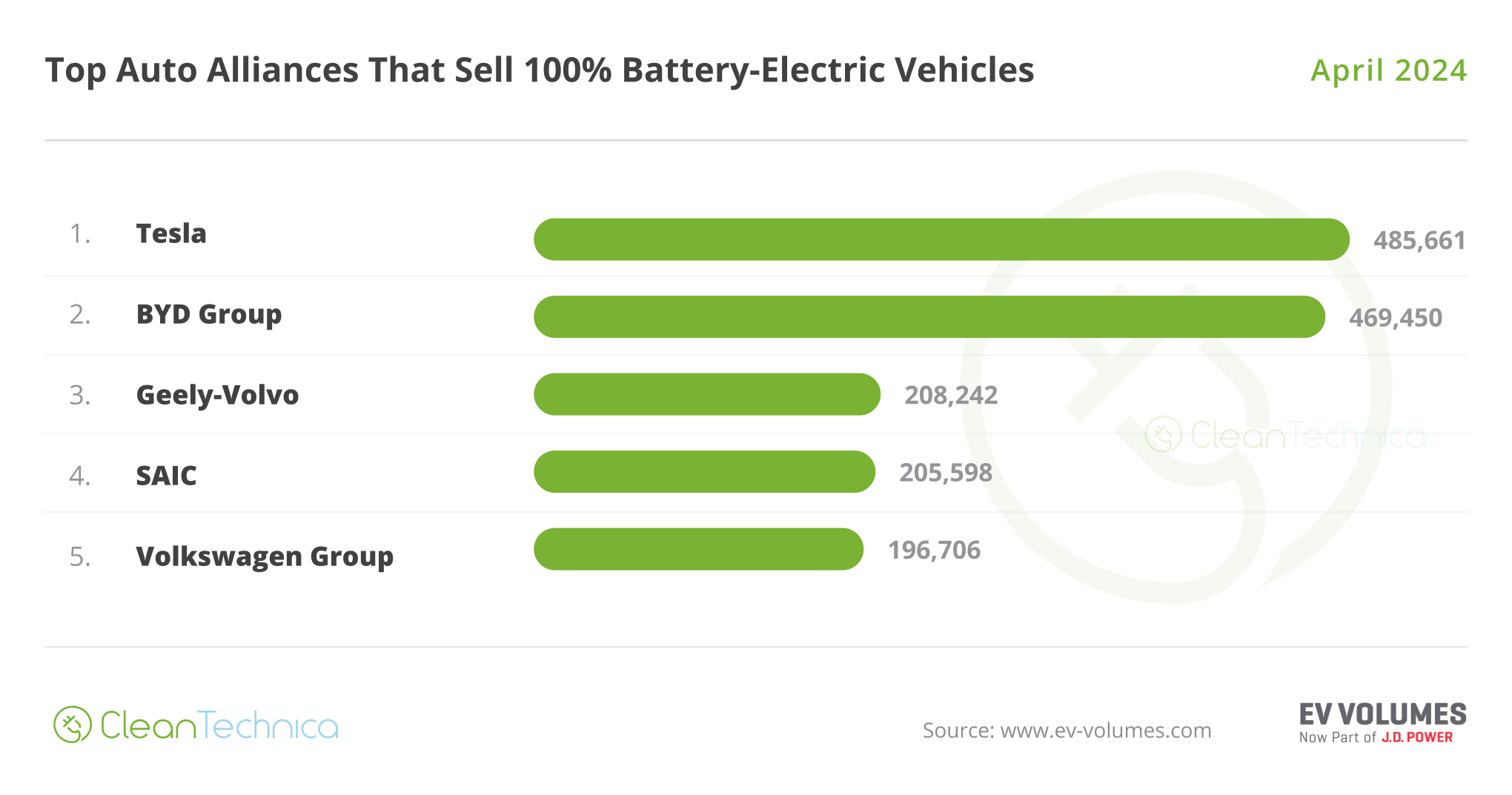

Top Selling OEMs for EV Sales

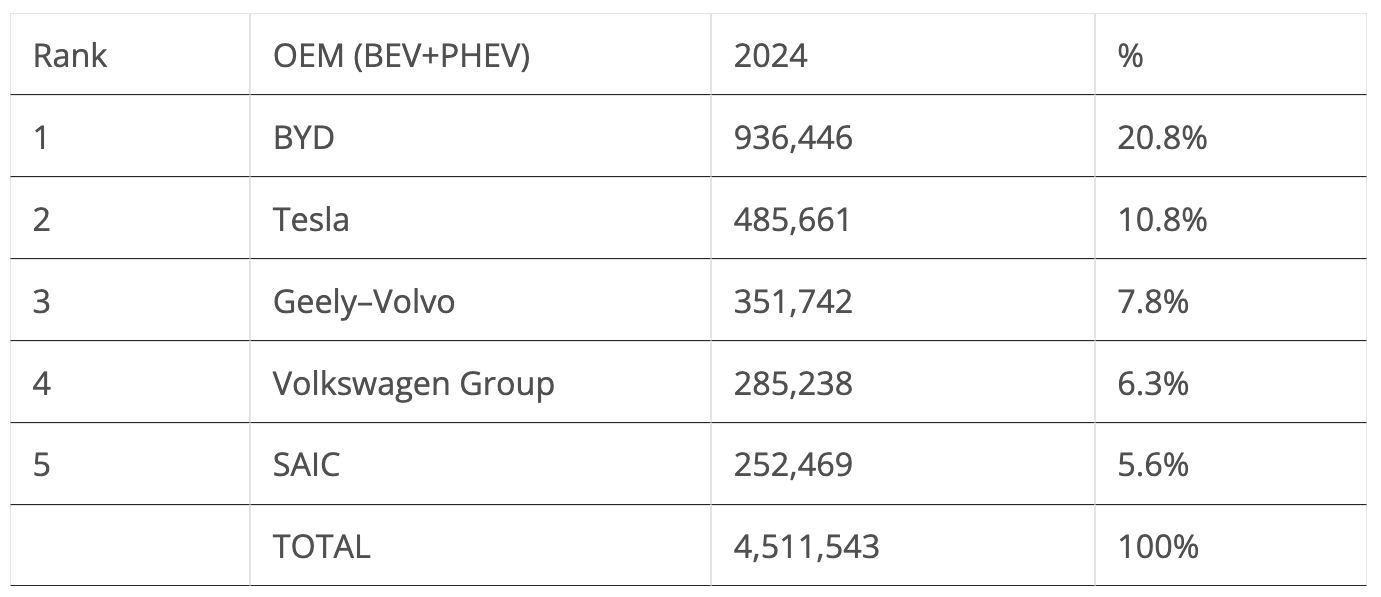

Looking at registrations by OEM, #1 BYD gained share thanks to its recent price cuts, going from 19.4% to its current 20.8% (it had 21.6% a year ago), while Tesla ended April with 10.8% share (it had 15.4% in the same period of 2023).

3rd place is in the hands of Geely–Volvo, with the OEM stable at 7.8%. Still, the Chinese OEM is the one that most progressed in the top 5, going from 6.2% in April 2023 to its current 7.8%.

Considering Tesla’s recent share drop and Geely’s significant growth, will we see the Chinese juggernaut threaten Tesla’s silver medal by year end?

Meanwhile, both #4 Volkswagen Group (6.3%, down from 6.4%) and #5 SAIC (5.6%, down from 5.9%) were down. Although, comparing results with the same period of 2023, while the German OEM is down by 1% share, SAIC has remained stable.

Below SAIC, Stellantis (4%, down from 4.3%) is in the 6th spot, but has lost significant share compared to April 2023, when it had 4.8%.

In the race for 7th, BMW Group (3.9%, up 0.1% compared to March) surpassed Changan (3.8%, up from 4%), with #8 Hyundai–Kia (3.6%, up from 3.5% in April) getting closer to these two.

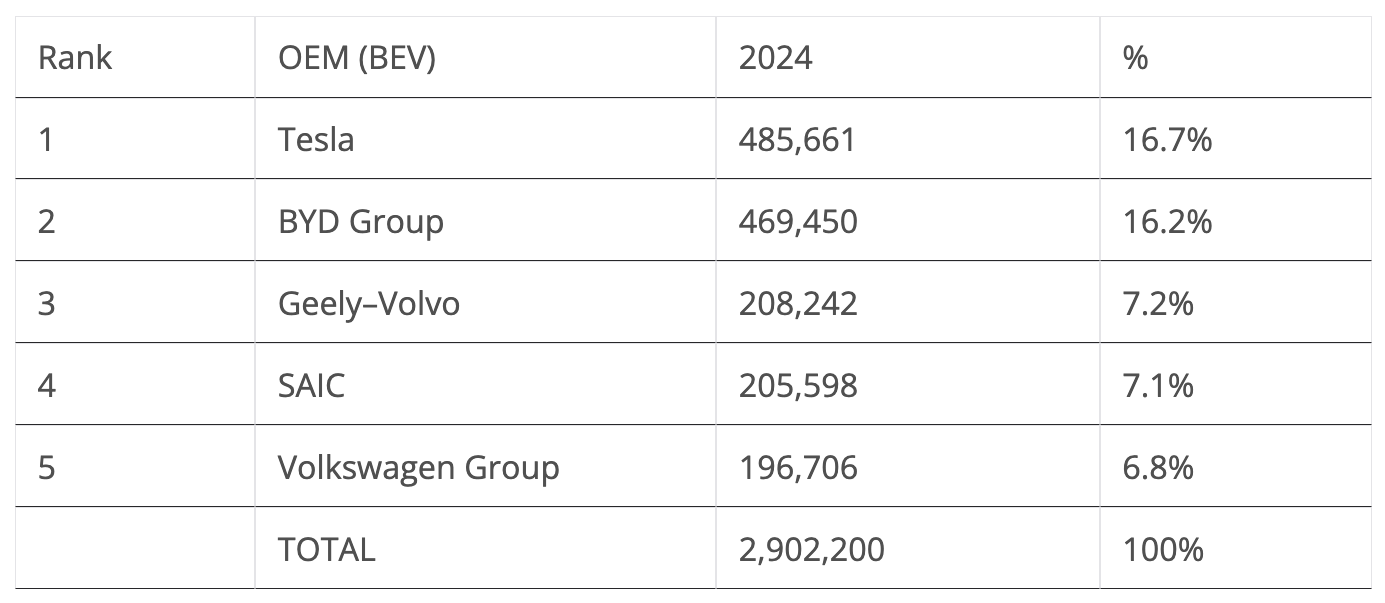

Looking just at BEVs, Tesla remained in the lead with 16.7%, but it has lost 6.6% share compared to the same period last year. With this, the US make is still ahead of BYD (16.2%, up 1.4%). With Tesla losing share at a rapid pace, though, we might see BYD surpass it around Q3.

Geely–Volvo (7.2%, down 0.2%) kept its advantage over SAIC (7.1%, down from 7.3%), allowing it to keep the bronze medal.

In 5th we have Volkswagen Group, with 6.8%, up 0.1%. The German OEM is looking to reach the two players ahead of it, but it still has a ways to climb. Still, with #6 BMW Group (4.1%) at a safe distance, the German conglomerate could try to recover on lost time in the coming months.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.