Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

EVs Now 19% of World Auto Sales

Global plugin vehicle registrations were up 19% in March 2024 compared to March 2023. There were 1.3 million registrations. BEVs were up by 7% YoY, while plugin hybrids jumped 50% YoY, with March being its second best month ever.

In the end, plugins represented 19% share of the overall auto market (13% BEV share alone). This means that the global automotive market remains in the Electric Disruption Zone.

Add the 1.1 million plugless hybrids registered in March, a new record, and we have a staggering 35% of global sales in March having some kind of electrification….

Year to date, plugin electric vehicle market share was up by 2%, to 16% (10% BEV).

Full electric vehicles (BEVs) represented 65% of plugin registrations in March, keeping the year-to-date tally at 63% share.

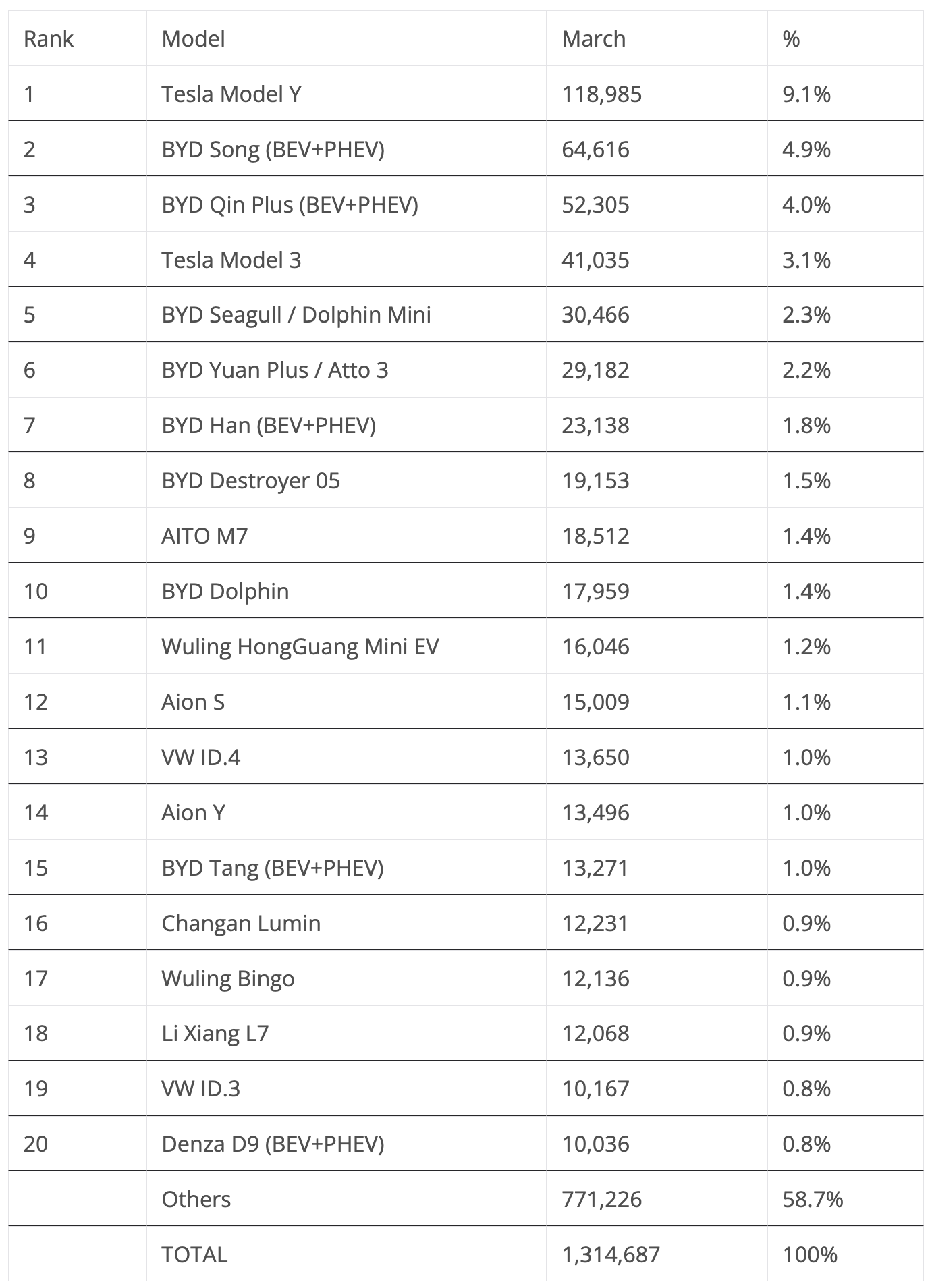

20 Best Selling EV Models in the World in March

Looking at March best sellers, while the Tesla Model Y is in the lead (as usual), with some 119,000 registrations, below it we have two BYD models, the #2 Song and #3 Qin Plus. The Qin Plus hit a record 52,305 registrations, allowing it to end the month ahead of the Tesla Model 3, which was relegated to 4th with 41,000 registrations.

In fact, the Shenzhen make placed 7 representatives in the top 10! Among these, the highlight is the BYD Destroyer 05, the bad boy sibling of the Qin Plus. The Destroyer 05 scored a record 19,153 registrations in March. This is no doubt another model that is benefitting from BYD’s recently introduced War on ICE (aka price cut war).

Besides the Tesla and BYD fleets, the only other model running at a top 10 pace was the AITO M7, with the Huawei-backed model ending the month in 8th.

Volkswagen Group placed two models in the top 20. The VW ID.4 ended the month in 13th and the VW ID.3 ended in 19th, while the Audi Q4 e-tron wasn’t too far behind, ending in 21st with 9,765 registrations.

Off the table, the highlights came from the Volvo stable, with the recently introduced EX30 hitting 8,000 registrations in only its 3rd month on the market! Expect it to be in the top 20 soon. Meanwhile, the veteran XC60 PHEV surprised everyone with a record result — 9,626 registrations.

Finally, a reference goes out to the Jeep Wrangler PHEV, which scored 8,117 registrations in March, its best result since June 2021. This is a sign that plugin hybrids continue to be popular in the USA.

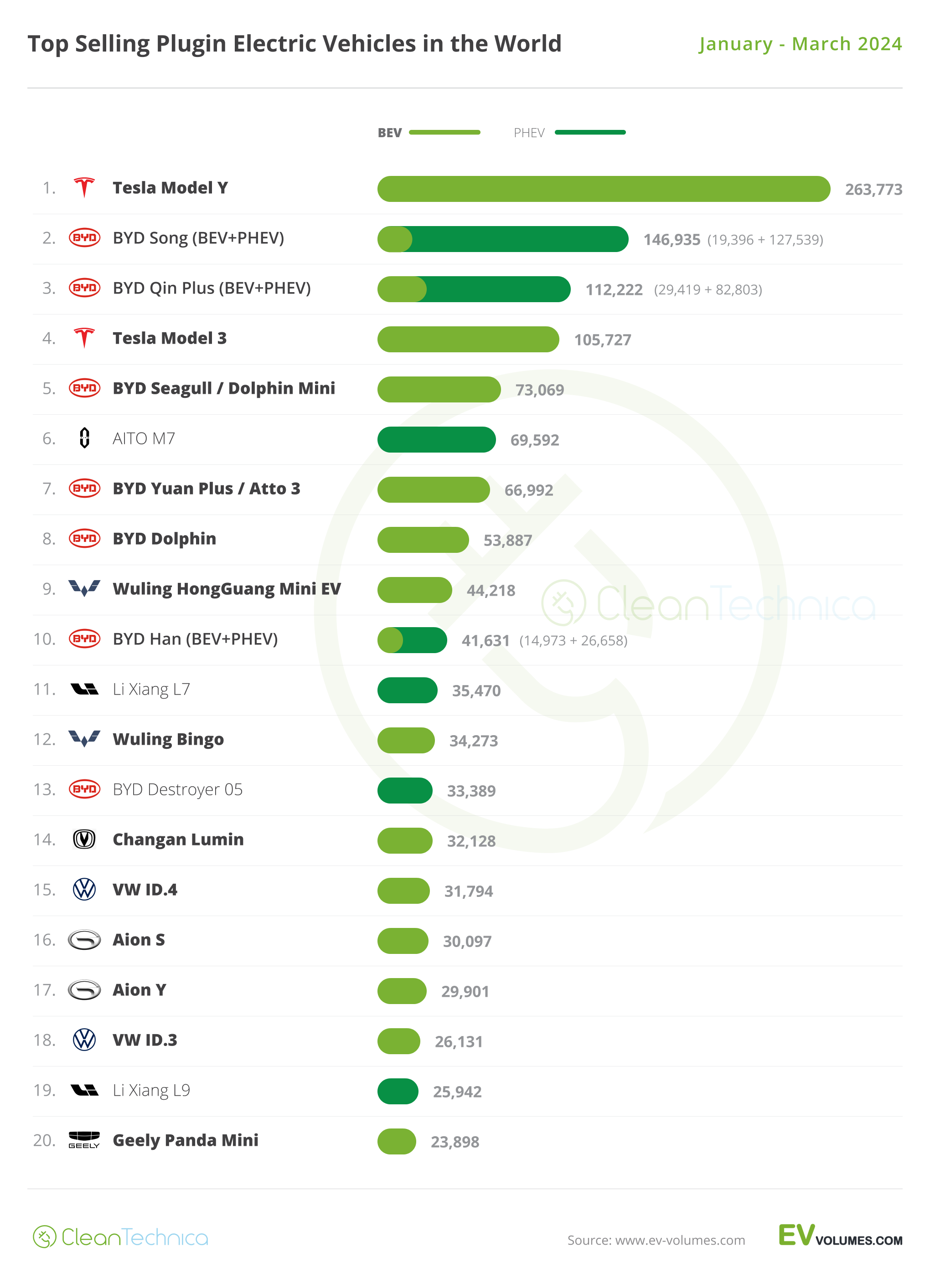

Top 20 EV Models YTD

In the year-to-date (YTD) table, the biggest news is coming from the podium. As usual, the Tesla Model Y is ruling supreme above the BYD Song, and the Chinese SUV is comfortable in the runner-up position, but below these two, something big happened.

The BYD Qin Plus benefitted from its record result in March to surpass the Tesla Model 3 and ended the first quarter of the year ahead of Tesla’s sedan. Does this mean that the Tesla sedan will be left off of the podium by the end of the year? Hard to say at this moment. With a new BYD Qin L landing soon and possibly stealing the thunder from the Qin Plus, the US model could benefit from BYD’s fierce internal competition, but if it does happen and the Model 3 gets left off of the podium, it will be the first time since 2017 that such a thing happened….

Following the same trend as in China, the Tesla Model 3 is not having a good start of the year, having seen its global deliveries drop by 20% YoY, a worrying sign for a model that was refreshed not that long ago — especially considering that the unrefreshed Model Y was down by just 6% during the same period….

Just off the podium, the #4 Seagull/Dolphin Mini surpassed the AITO M7. And with the #7 BYD Yuan Plus/Atto 3 less than 3,000 units behind AITO’s big SUV, BYD’s crossover could surpass it already in May.

Still on the topic of BYD, the BYD Han jumped three positions, to #10, thus putting 6 BYDs in the 2024 top 10. Also, the Destroyer 05 jumped onto the table, right into the 13th position.

Elsewhere, GAC’s Aion S recovered some positions in March, jumping from #20 in February into #16 in March.

Thanks to another strong month in May, the Audi Q4 e-tron is getting closer to the top 20, now fewer than 300 units behind the #20 Geely Panda Mini.

Top Selling Brands

In March, #1 BYD, now deep into pricing out the ICE competition (and quite a few other EVs on the way…), didn’t disappoint. It scored some 287,000 registrations. Expect its sales to continue steadily rising throughout the year. Although, if that sales climb does not materialize, then BYD wasted profit margins for nothing.

As for Tesla, with the “unwinding of the delivery wave” and the sales drop in Q1, the March result wasn’t much to celebrate, but it still tripled the sales of #3 BMW….

Yes, below the top two galactics, BMW won the last position on the podium, and then a surprising Mercedes ended in 5th with a record 38,069 registrations — much thanks to good results across its long lineup, like the EQA and EQB scoring 6,000 units each and the recently introduced Mercedes GLC PHEV getting 4,200.

Another premium make to score a record result was #6 Volvo. Thanks to the ramp-up of the new EX30 and good results from the XC60 PHEV and XC40, Volvo had 34,651 registrations.

The second half of the table saw a surprising Toyota perform a best ever result, with 25,449 registrations, much thanks to the good results of the China-only BZ3 sedan (5,700 units) and the globally-sold BZ4X (6,100 units). Expect the Japanese make to continue scoring record results this year, especially if attractive models like the recently shown BZ3C land in Toyota’s main markets….

With Toyota currently the 3rd largest brand in China (it was 2nd before the rise of BYD), it needs to ramp up its EV operations fast — or else it could say bye-bye to the million-plus units it sells in that market.

A final mention goes out to Changan’s most recent offspring. Despite having landed only a couple of months ago, Qiyuan already joined the best sellers table, in #20 with 15,207 registrations. Is this another Chinese brand to follow closely?

Outside the best sellers table, Leap Motor (14,658 registrations), Peugeot (14,449 registrations, its best score since September), and Zeekr (13,647 registrations) ended close to the top 20 and will be strong candidates to return there in the following months.

In the YTD table, there wasn’t much to report at the top. BYD is ahead of Tesla, and the US brand has three times as much registrations as the #3 BMW.

Far below these two, which are really in a league of their own, BMW and Wuling stayed in their positions, while Mercedes benefitted from its record month of March to jump two positions into 5th.

AITO’s rise was stopped, and by none other than its direct rival, Li Auto, which went up to 7th.

In the second half of the table, Aion signaled the return to form of its dynamic duo, the Aion S and Aion Y, jumping three positions into 11th place.

The remaining highlights come from legacy brands. Kia rose to #14 and Hyundai to #17. Additionally, Ford returned to the best sellers table in #19, and Peugeot did the same in #20. #LegacyOEMsfightingfortheirlives

Still, with Zeekr some 1,300 units behind the French make, this legacy OEM recovery could get derailed already in May….

Top Selling OEMs for EV Sales

Looking at registrations by OEM, #1 BYD gained share thanks to its recent price cuts, going from 17.3% to its current 19.4% (it had 21.3% a year ago), while Tesla ended the quarter at 12% share (it had 16.5 % in the same period of 2023).

3rd place is in the hands of Geely–Volvo, with the OEM losing 0.5% on the way (8.3% a month ago, 7.8% now). Still, the Chinese OEM is the one that most progressed in the top 5, going from 6.1% in Q1 2023 to its current 7.8%.

Considering Tesla’s recent share drop and Geely’s significant growth, will we see the Chinese juggernaut threaten Tesla’s silver medal by year end?

Meanwhile, both #4 Volkswagen Group (6.4%, down from 6.5%) and #5 SAIC (5.9%, down from 6.4%) were down. Although, comparing results with the same period of 2023, while the German OEM is down by 1% share, SAIC has actually progressed by 0.4%.

Below SAIC, Stellantis (4.3%, down from 4.4%) is in the 6th spot, but has lost significant share compared to Q1 2023, when it had 4.9%.

In the race for 7th, BMW Group (3.8%, down 0.2% compared to February) was again surpassed by Changan (4%, up from 3.9%), with #8 Hyundai-Kia (3.5%) getting closer to these two.

Looking just at BEVs, Tesla remained in the lead with 19% but has lost 4.6% share compared to the same period last year. Despite this, the US make still has a comfortable lead over BYD (14.8%, up 0.3%). With Tesla losing share at a rapid pace, we might see BYD surpass it by the end of Q3 or early Q4.

The last place on the podium saw another position change, with Geely–Volvo (7.4%, down 0.3%) surpassing SAIC (7.3%, down from 7.7%) and recovering the bronze medal.

In 5th we have Volkswagen Group, with 6.7%, down 0.2%. The German OEM is looking to reach the two players ahead of it, but it still has a ways to climb. Still, with #6 BMW Group (4.1%) at a safe distance, the German conglomerate could try to recover on the lost time in the coming months.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.