Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

EVs Now 20% of World Auto Sales

Global plugin vehicle registrations were up 23% in May 2024 compared to May 2023. There were 1.3 million registrations. BEVs were up by 17% YoY, while plugin hybrids jumped 37% YoY.

In the end, plugins represented 20% share of the overall auto market (13% BEV share alone). This means that the global automotive market remains in the Electric Disruption Zone.

Year to date, plugin electric vehicle market share was stable, at 17% (11% BEV).

Full electric vehicles (BEVs) represented 66% of plugin registrations in May, keeping the year-to-date tally at 64% share.

With all the talk in some media that EVs are going down, as mentioned above, the numbers show a different story. Plugins are growing at a steady pace — over 20% YoY — and even removing the fast growing Chinese market from the picture (which all by itself represents over 60% of all plugin vehicles sold this year), we still have growth. Albeit, those are more modest numbers, with plugins growing 6% YoY in May (7% for BEVs). But, YTD, the numbers are even better, +12% (+10% for BEVs).

And in news that might shock some, breaking down sales by the other large economic blocks, while Europe was indeed down by 10% in May (no doubt still a reflection of the end of subsidies in a number of markets), the North American market (USA + Canada) was actually up by 18% in May! The shock, the horror….

Even more shocking is the fact that the fastest growing EV markets sit outside China, Europe, and North America!

In fact, if we just discount the markets above, the EV market grew by an amazing 42% in May, which is faster than even China. The highlights are Mexico (+137% YoY), Brazil (+266%), Chile (+102%), Malaysia (+106%), Singapore (+136%), and … Russia (+549% YoY). Wait, what?!?!?!?!?

Yep, you read it right, Russia is currently the fastest growing EV market, and all due to the war in Ukraine….

In a somewhat unexpected turn of events, when legacy OEMs withdrew from the Russian market, due to the sanctions related to the war in Ukraine, local buyers were left with local OEMs that were not ready to fulfill all of the sudden appetite of such a large market (the Russian passenger car market was around 1.8 million units in 2019). This created a golden opportunity for Chinese OEMs to take the Russian automotive market by storm, allowing it to recover volumes (in 2024, the Russian auto market is growing 86% YoY, with 595,000 units sold from January until May).

With the Russian Automotive market now being effectively a satellite market for Chinese brands — this is not limited to cars, China filled other economic sectors in Russia left void by foreign brands (one could say that, in some aspects, Russia is now China’s little b***h) — Russians buy whatever Chinese OEMs provide.

And with China’s automotive landscape being rapidly electrified, the Russian automotive market is also being quickly electrified, in a rare case where supply dictates its choices to demand. You can read more on this topic in the brands ranking. Also see this reader review of a BYD in Russia: Reviewing the BYD Tang EV in Russia — Exclusive.

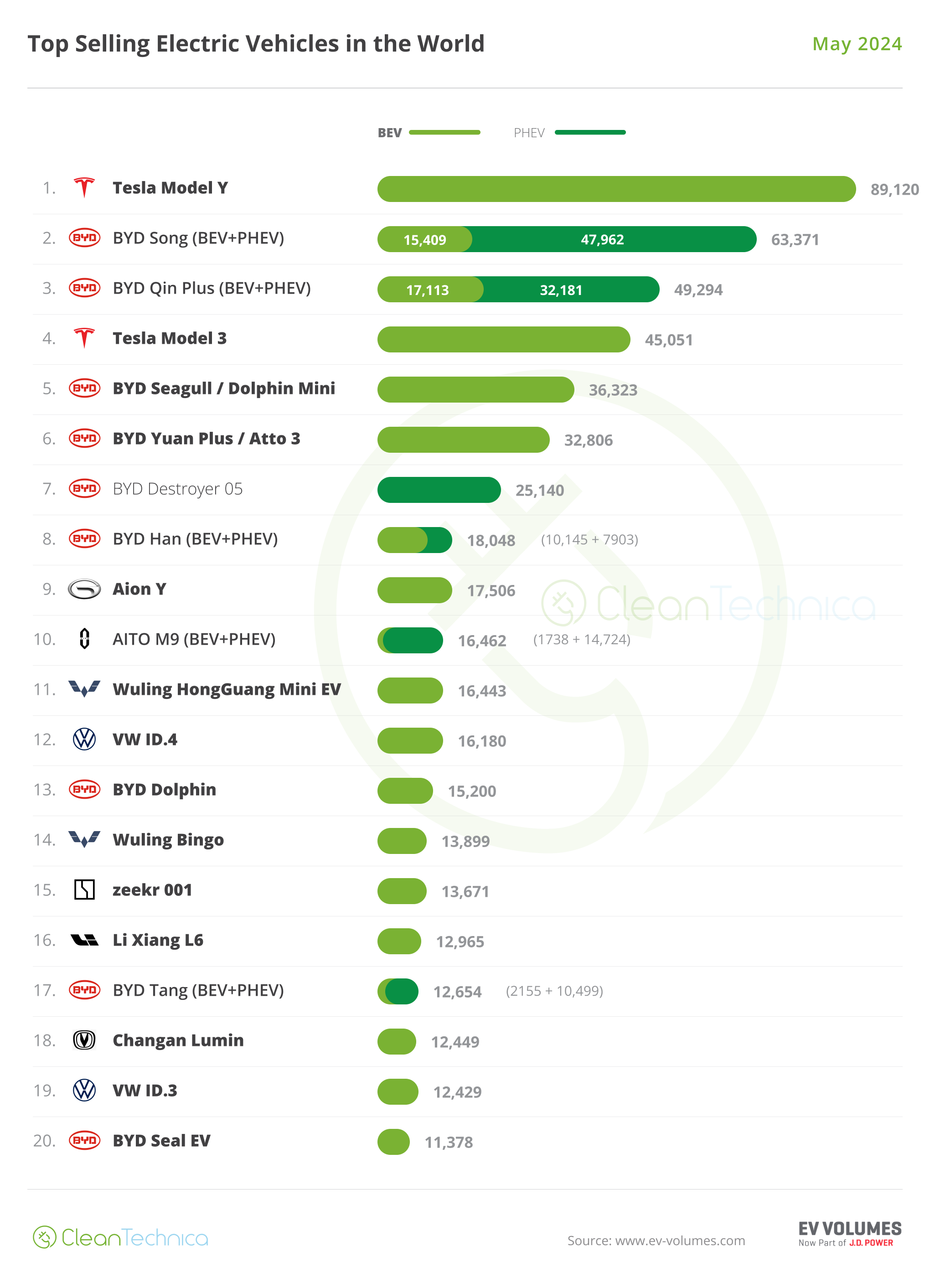

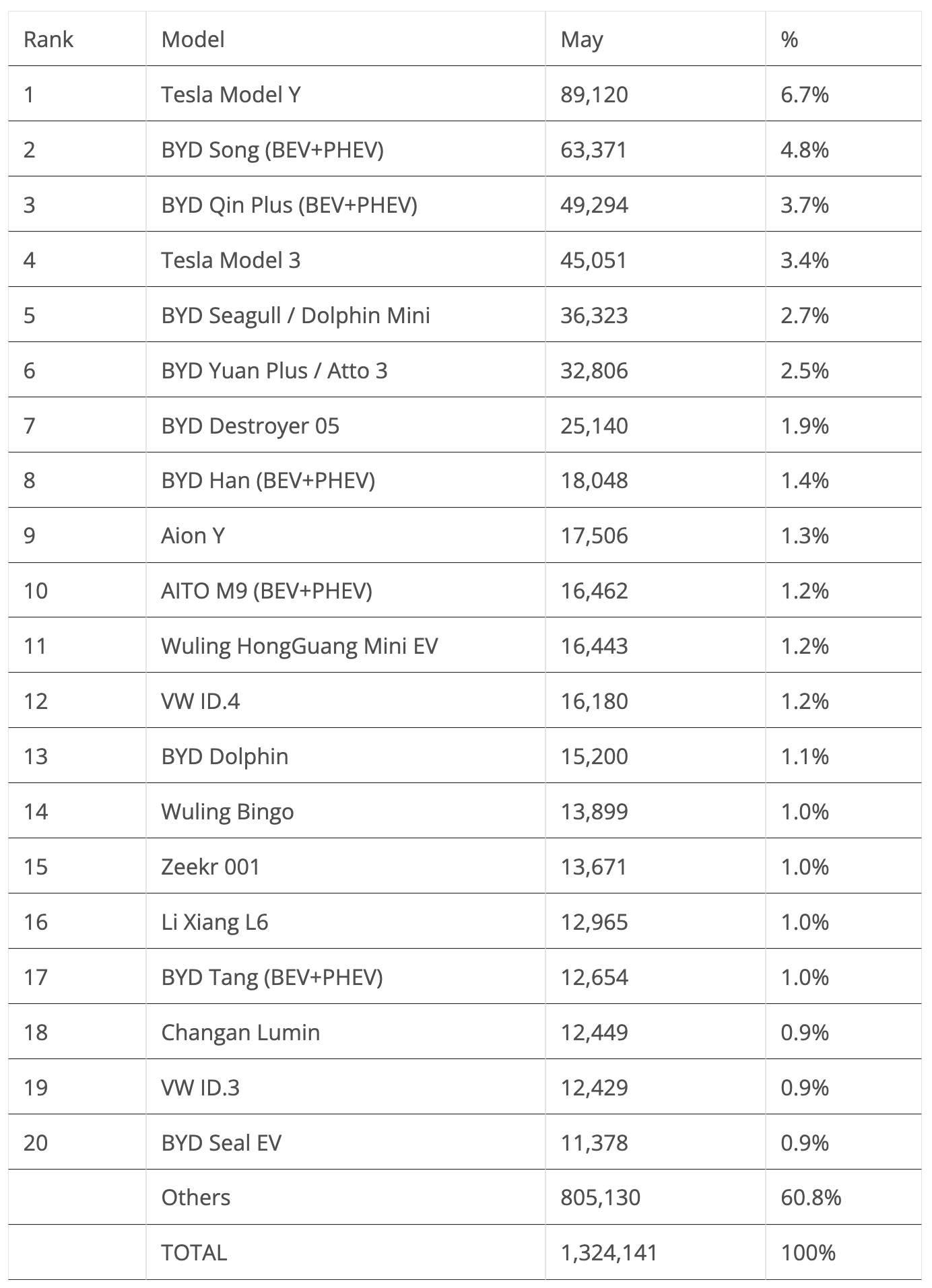

20 Best Selling EV Models in the World in May

Back to May’s best sellers, while the Tesla Model Y is in the lead (as usual), with some 89,000 registrations, it is down 6% YoY. Below it we have two BYD models, the #2 Song and #3 Qin Plus. For its part, the Tesla Model 3 was 4th, with 45,000 registrations, with the sedan growing an encouraging 12% YoY.

Back to BYD, the Shenzhen make placed 6 representatives in the top 8! BYD’s 2024 War on ICE (aka price cut war) is indeed paying dividends.

Besides the Tesla and BYD fleets, the other two models inside the top 10 were the AITO M9, with the Huawei-backed model ending the month in 10th with 16,462 sales, it’s second record month in a row, and GAC’s Aion Y, which was 9th, with the crossover-MPV mashup scoring a year best result of 17,506 units.

Zeekr saw its flagship 001 model jump to 15th, with 13,671 sales, its second record result in a row thanks to the recent refresh of the veteran model (because a model with three years can be considered as such in the Chinese EV industry…).

Elsewhere, Li Auto’s most recent model, the L6 midsize SUV, joined the top 20 in only its second month on the market! The L6 had 12,965 deliveries, allowing it to end 16th, while BYD’s Seal EV returned to the table in 20th thanks to the increased volumes in export markets. There were thus nine (9) BYDs in May’s top 20 — globally.

Still on the top 20, a final mention goes out to Volkswagen’s ID.3 and ID.4, the only two legacy models on this table. The hatchback scored 12,429 sales, a new year best, thus ending in 19th, while the crossover was in 12th with 16,180 sales, also a new year best.

Off the table, the highlight comes from the Volvo stable, with the recently introduced EX30 hitting 10,272 registrations in only its 5th month on the market. With deliveries stabilizing in Europe, the small crossover is now landing with a bang in markets like Mexico (740 units in May), Australia (466), and Brazil (468). Expect it to be in the top 20 soon. Meanwhile, the disruptive Xiaomi SU7 had its second month on the market, delivering 8,646 units, with the sporty sedan looking to join the table soon — if not already in June, then surely in July.

Other models shining were the Hyundai Ioniq 5, with 9,399 sales, its best result since last August. Similarly, NIO’s ES6 SUV will be proud of its 8,125 sales, its best score since August 2023.

Finally, a reference goes out to the Denza D9, which scored a year best 10,158 registrations in May. Is this a sign that the big MPV is returning to the table soon?

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Top 20 EV Models YTD

In the year-to-date (YTD) table, there was nothing new at the top — the Tesla Model Y and BYD Song continue firm in the top positions, while the #4 Tesla Model 3 is looking to surpass the #3 BYD Qin Plus in June. Anything less than that and it would be a bigger surprise than Portugal’s defeat against Georgia in the 2024 Euro.

The first position change happened in #8, with the BYD Destroyer 05 continuing to rise and now switching with its BYD Dolphin sibling to end May in 8th. With the #7 Aito M7 fewer than 500 units below BYD’s bad boy sedan, expect the midsizer to surpass AITO’s SUV and climb to 7th in June.

Elsewhere, GAC’s Aion Y recovered some positions in May, with the Y crossover-MPV jumping two positions to #14. Thanks to a strong month, the VW ID.4 climbed another position, to #12, and the German crossover looks set to break into the top 10 in the near future.

Another model climbing positions was the Wuling Bingo, which was up to #13, providing some much needed good news for Wuling.

Finally, we have a newcomer in the table, with the AITO M9 full size yacht SUV directly replacing a competitor, the Li Xiang L9, in the table at #20. This is all while the Audi Q4 e-tron seems to be suffering from some sort of curse, as it has been spending most of 2024 at #21, always a stone’s throw away from the table, but for some reason not able to get above its current position.

Note: We’ll have another article coming to dive into the top selling brands and OEMs. Stay tuned.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy