On June 20, the Canada Energy Regulator released its Canada’s Energy Future 2023 report which explores how possible energy futures might unfold for Canadians. This federal series is typically released every year, but the Energy Future 2023 report is the first to explore net-zero scenarios to “help Canadians and policy makers see what a net-zero world could look like.”

The Energy Future 2023 report analyses three scenarios:

- The Canada Net-Zero Scenario accounts for established, planned and future measures to ensure Canada achieves net-zero emissions by 2050, but the rest of the world moves more slowly to reduce GHG emissions.

- The Current Measures Scenario offers a glimpse into Canada’s future if no additional action is taken to combat climate change beyond the current measures in place.

- The Global Net-Zero Scenario assumes Canada achieves net-zero emissions by 2050. It also assumes the rest of the world reduces emissions enough to limit global warming to 1.5 Celsius.

The federal government and each of the four Atlantic provinces have committed to reach net-zero emissions by 2050 (2040 in Prince Edward Island). It is important to understand what this report predicts the energy future in Atlantic Canada to be, but also how these forecasts align (or not) with those undertaken by governments and utilities across the region.

Canada’s Energy Future 2023 – Key findings (Canada):

- In our net-zero scenarios, the types of energy Canadians use changes dramatically, including using a lot more electricity.

- The electricity system, which decarbonizes by 2035 and achieves net-negative emissions thereafter, is the backbone of our net-zero scenarios.

- A portfolio of emerging technologies plays a key role in our net-zero scenarios, especially to address more difficult-to-reduce emissions.

- Canada’s oil and natural gas industry significantly reduces its emissions in our net-zero scenarios and, while production declines, the pace of global climate action determines by how much.

- Reaching net-zero in our scenarios is driven by increasingly strong climate policies, in Canada and abroad.

Canada’s Energy Future 2023 – Takeaways for Atlantic Canada:

The Atlantica Centre for Energy is still analysing the latest Energy Future report. Preliminary takeaways for the region in the Canada Net-Zero Scenario include:

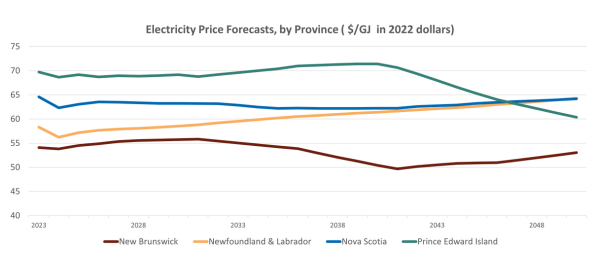

- In terms of future electricity prices, only Newfoundland and Labrador would see a higher price in 2050 than 2023 of the four Atlantic provinces. Prince Edward Island’s price would decrease over this period.

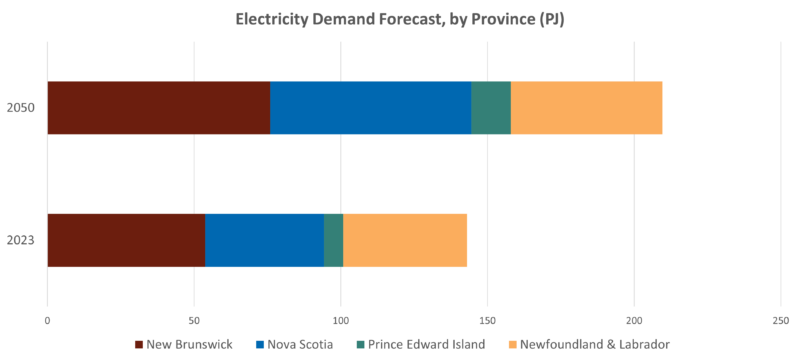

- Electricity demand would increase between 2023 and 2050 in each of the four provinces.

- Solar generation would not see a significant build-out at grid-scale. Most demand increases would be met using additional wind and/or nuclear generation.

- New Brunswick’s electricity generation mix would remain diversified. Nuclear power would remain an important component in the province’s electricity system.

- Prince Edward Island would see nuclear generation added to its electricity system. PEI would also have the highest percentage electricity demand increase in the region.

- Newfoundland and Labrador would remain an electricity exporter with its hydropower resources. NL would have the lowest electricity demand percentage increase in the region.

- Nova Scotia’s electricity generation mix would transition to be dominated by wind power. Nova Scotia would see petroleum products used decreasing from roughly 97PJ in 2023 to 27PJ in 2050 (all four provinces show similar declines).

- Offshore oil production would increase between 2025 and the early 2030s, with the Bay du Nord offshore project forecasted to come online in the 2020s (this project has no current timeline). However, production would decline rapidly from the early 2030s to 2050 to almost zero.

- In the Global Net-Zero Scenario, Nova Scotia would see significant grid-connected offshore wind generation (Canadian total reaching 23 TWh by 2050). Atlantic Canada (Newfoundland and Labrador and Nova Scotia) would produce 3 MT of hydrogen for export in 2050 in this scenario.

How do Canada’s Net-Zero Scenario findings align local modelling work?

Nova Scotia Power recently released its 2022 Evergreen Integrated Resource Plan Final Modeling Results and Modeling Scenarios – Descriptions. This modeling work was very public and the utility sought feedback from stakeholders on several occasions before finalizing the scenarios and results.

While there were some differences in scenario assumptions form the Energy Future 2023 report, several key assumptions were accounted for including the incoming Clean Electricity Regulations. Nova Scotia Power’s modeling included 24 scenarios. In CE1-E1-R1, which included an Atlantic Loop, new resource capacities would be dominated by building additional wind resources, followed in order by new natural gas generation, solar, imports and battery. Without an Atlantic Loop in place, modeling would see nuclear generation added.

Annual generation would increase from 11,292 GWh in 2025 to 14,775 GWh in 2050, which is lower than the increase forecasted in the Canada Net-Zero Scenario.

In the CE1-E1-R1 scenario, the net present value revenue requirement would be roughly $9.5 billion between 2025 and 2035. Between 2025 and 2050, this NPVRR would be $18,760 (and $25,960 with end effects).

NB Power is in the process of finalizing its new Integrated Resource Plan and the Government of Prince Edward Island, with the PEI Energy Corporation, are developing a new PEI Energy Blueprint (Energy Strategy).

What does this mean for Atlantic Canada?

Comparing scenario findings between Canada’s Energy Future 2023 and Nova Scotia Power’s 2022 Evergreen Integrated Resource Plan, leaves many questions to be answered. There are some similarities, but the documents might produce different outcomes for ratepayers when it comes to future costs and generation.

What is consistent though between the two documents is the transition to net-zero will take a herculean effort in the electricity sector and undoubtedly elsewhere in the energy sector. These modeling exercises are important to help utilities, governments, policy makers, residents, and businesses to better plan for a net-zero future. Hopefully as many Atlantic Canadians as possible learn more about the clean energy transition and how it will impact them.

Share This: