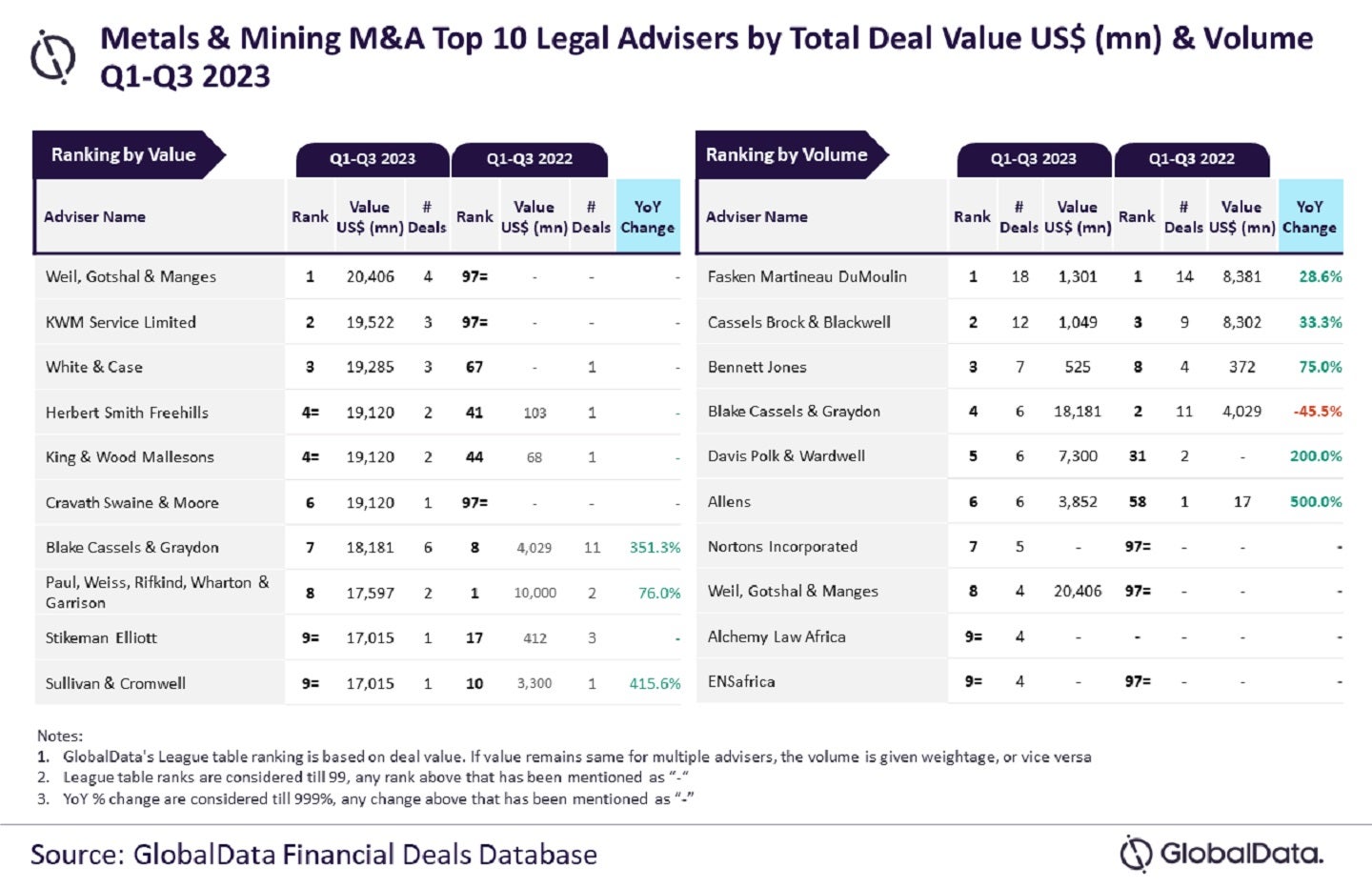

Weil, Gotshal & Manges and Fasken Martineau DuMoulin have occupied the leading positions as legal advisers for mergers and acquisitions (M&A) in the metals & mining sector in the first three quarters (Q1-Q3) of 2023, revealed GlobalData’s latest league table.

According to the data and analytics company’s Financial Deals Database, Weil, Gotshal & Manges took the top spot, by value, after advising on $20.4bn of deals.

KWM Service Limited, which advised on deals valued at a total of $19.5bn, secured the second rank.

White & Case took the third position after advising on deals worth $19.3bn. It was followed by Herbert Smith Freehills and King & Wood Mallesons, each of which advised on deals worth $19.1bn.

Fasken Martineau DuMoulin advised on 18 deals during Q1-Q3 of 2023 to top the list, by volume.

Cassels Brock & Blackwell was ranked second by advising on 12 deals, while Bennett Jones came third with seven deals.

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

It was followed by Blake Cassels & Graydon and Davis Polk & Wardwell, each advising on six deals.

GlobalData lead analyst Aurojyoti Bose said: “Fasken Martineau DuMoulin was the top adviser by volume in Q1-Q3 2022 and also managed to retain the top spot by this metric in Q1-Q3 2023 as well. Interestingly, it was among the only two advisers with double-digit deal volume during Q1-Q3 2023.

“Meanwhile, Weil, Gotshal & Manges witnessed a significant jump in its ranking by value during Q1-Q3 2023. In fact, it was the only adviser to surpass $20bn in total deal value during Q1-Q3 2023.”

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.