Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Under the auspices of the India Smart Grid Forum, the think tank founded as an umbrella organization over India’s 28 state utilities to provide thought leadership, share leading practices, and bring international insights to India, I’m delivering bi-weekly webinars framed by the Short List of Climate Actions That Will Work. With the glories of online recordings and AI transcription tools, it’s relatively easy to share both the transcript and the slides that I used, so I’m making a habit of it.

Reji Pillai (RP): Good morning, good afternoon, good evening to all participants welcoming you all for this 8th edition of our webinar series. Today Michael will be talking about the futility of wasting billions of dollars in subsidies for fossil fuels. On one side we are all talking about net zero, limiting climate change to 1.5 degree by by end of this decade, and on the other side, continuing to subsidize and finance fossil fuels and millions of tons being still excavated and burned. So how do we tackle this? There are very interesting numbers which Michael will be presenting today. So over to you, Michael. I won’t take any more time in the introduction, so over to you and let people ask their questions. We’ll come to the specifics later. Thank you.

Michael Barnard (MB): Thank you, Reji, and thank you as always to the ISGF for giving me the opportunity to provide what insights I can to assist a great country of India, to thread the challenging needle between climate action and bringing the remainder of your population out of poverty. It’s a difficult act and India is working hard on it. I hope to be able to provide some useful insights to enable it to do slightly better. So, yes, despite knowing since the 1850s that CO2 is a greenhouse gas and that fossil fuels have significant problems for health. There’s always been a moral argument, up till recently for continuing to burn fossil fuels. But that moral argument is in the rearview mirror for most of the world.

And so the question is, how little can we spend on fossil fuels, from what sources to enable us to get through the transition? And where should we be spending money? What’s the right balance? I would say right now most of the world has the balance wrong. And so I’ll be talking a bit about that for the next few minutes.

Let’s start with what are subsidies? There’s a lot of arguments about this. A lot of people try to pretend that classes of subsidies aren’t actual subsidies, they’re something else. But I tend to go with the International Monetary Fund definition. From 2010 to 2015, they normalized what they considered to be subsidies, and it’s a big bag.

They talk about direct subsidies, which is the ones everybody thinks about, which is giving money to the fossil fuel industry. They talk about indirect, or, you know, or also giving money to consumers. Indirect subsidies, which is putting a cap on retail prices or under pricing, underpricing fossil fuels at the gas pump or the other stuff, or paying consumers a fee to money to enable them to buy more fossil fuels. Further, we’ve got foregone revenue where taxes are lowered on fossil fuels, so the government isn’t collecting money. These are all fiscal arrangements that are directly related. A lot of people try to exclude indirect. That’s an inappropriate choice.

And of course, there’s the big kicker in the room, the negative externalities. A couple of seminars ago, we talked about carbon pricing and carbon pricing schemes around the world. That is a process that prices negative externalities for the economic, human health and environmental impacts they cause.

And those are very significant as we consider it. We’ve been gaining benefits from fossil fuels for human health and longevity because they’ve been providing purification of water. They’ve been providing lights that enable greater productivity outside of sunlight hours. They’ve been providing power for automation, which enables us to do force leverage so that we have greater economic outcomes. But we’re at very much the point where the negative externalities are outweighing a lot of the advantages, and we have alternatives.

And so once again, that moral argument is in the rear view mirror. It’s time to put the money into things that don’t have nearly the same degree of negative externalities that don’t cause our kids to end up with asthma and various ailments that don’t cause our parents and grandparents to suffer with cardiopulmonary diseases and that don’t destroy the natural environment.

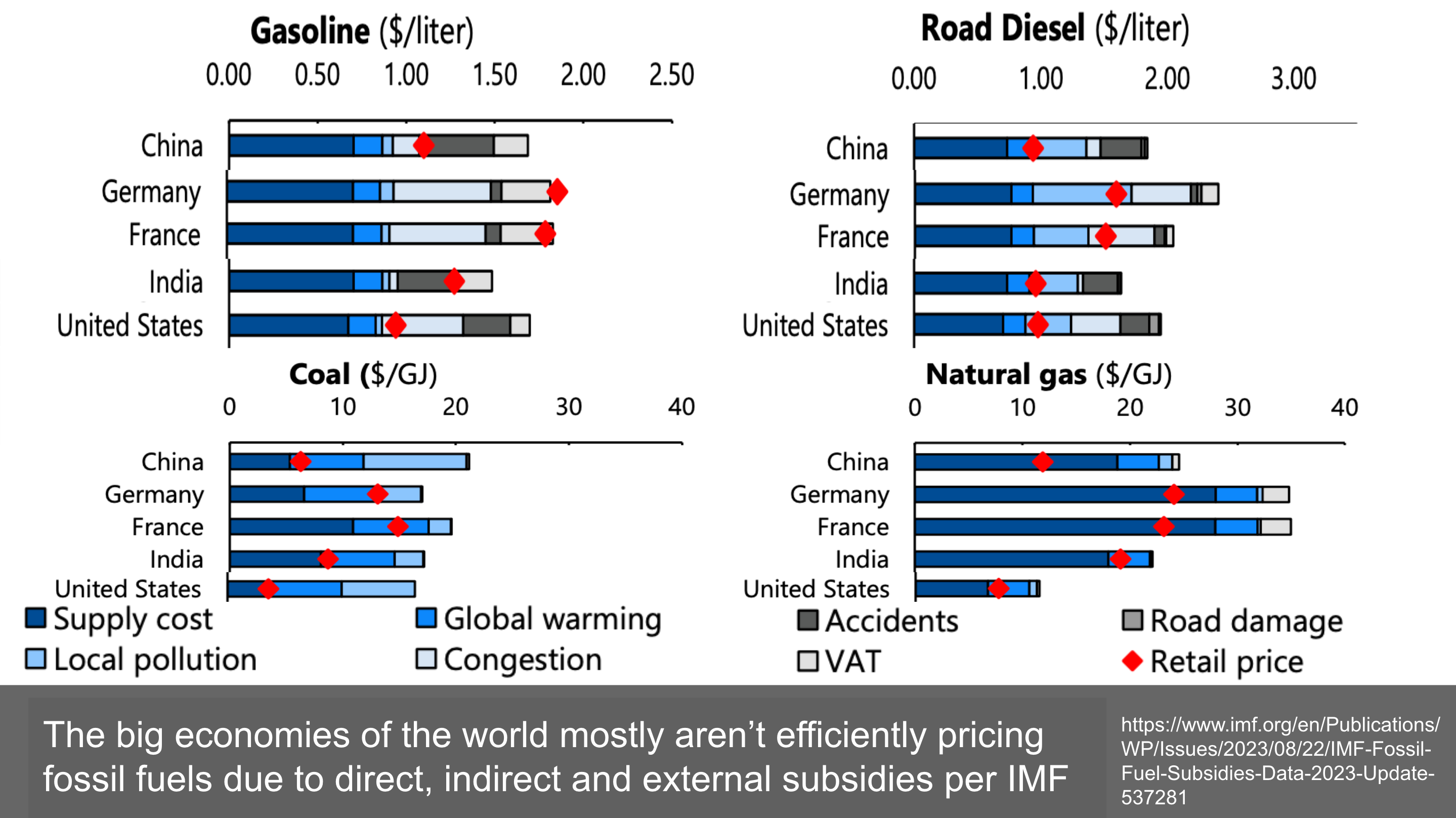

As we look forward, what we ask the question is why are we subsidizing fossil fuels as strongly as we are today? In some cases, there are good reasons, and I’ll try to pull out some of those nuances for India as we talk about this. Let’s talk about the Indian context versus other things. This is International Monetary Fund information from their 2023 update. What it does is it pulls out gasoline, road diesel, coal and natural gas. What I’ve done is I’ve assembled just a subset of the larger tables so that India is contextualized against China, the United States and a couple of representative big economies in Europe. I’m always trying to contextualize India against the larger economies in the world, because that’s where it needs to be contextualized as we move forward.

China, like India, is still in the developing world category. Obviously Europe and the United States aren’t. And obviously Europe and the United States provided the vast majority of the CO2 emissions up until fairly recently. And now the developing economies are increasing their share, especially China.

This red diamond on each of these indicates the actual pricing in those economies for these categories of fossil fuels. And the bars aggregate the different types of costs to an economy for those fossil fuels. So here we see in Germany that their costs are roughly the same as the actual efficient price of that fuel. That means that Germany has internalized all the negative externalities of fossil fuels and is not effectively subsidizing fossil fuels. The same is true of France. China, on the other hand, is subsidizing significant amounts of the costs of fossil fuels by its price point. That is enabling them to have cheaper gasoline than they would otherwise have, and also cheaper diesel. This is the way you read this.

The United States, which purports to be a leader in this space, has significantly underpriced gasoline, which does contribute to their very significant car culture. It’s just dirt cheap to drive around in the United States, and they drive big gas guzzlers in part because they aren’t pricing gasoline efficiently. So similarly, as we consider road diesel, which is much more important for the trucking industry, China once again is not pricing efficiently. India is not pricing efficiently. Germany and France aren’t nearly as virtuous for diesel, which has much higher particulate emissions and much higher health impacts as they are for gasoline. The United States is in the same place, inefficient pricing.

As we get to coal, China and the United States have very poor pricing for coal in terms of its impacts. France and Germany aren’t perfect. India is better than China. United States natural gas, which is, you know, less used in India at present but increasing fairly rapidly, is almost efficiently priced, which is a good sign. The way to think about this is that policy should push the red diamond to the point where the IMF or India’s interpretation of the similar type of data says that the pricing should be to price the product appropriately for the energy. Germany and France are still underpricing natural gas. There are changes in that regard.

Up until recently, Europe has been tending to price both the cost of natural gas and the cost of electricity high to promote efficiency. They’re realizing that’s a false dichotomy now and they are decoupling the cost of electricity from the cost of fossil fuels and providing industrial rates, in the case of Germany, that are much cheaper. Up until last year, industrial rates in Germany were twelve cents US per kilowatt hour. Now they’re exploring for big industrial consumers rates as low as six cents per kilowatt hour. That enables electrification to proceed much more quickly, which is the virtuous path both from an economic perspective and other perspectives. Right now we can start to decouple that because solar water storage and transmission are enabling us to decouple the cost of electricity from the cost of fossil fuels and start really decarbonizing economies of electrification.

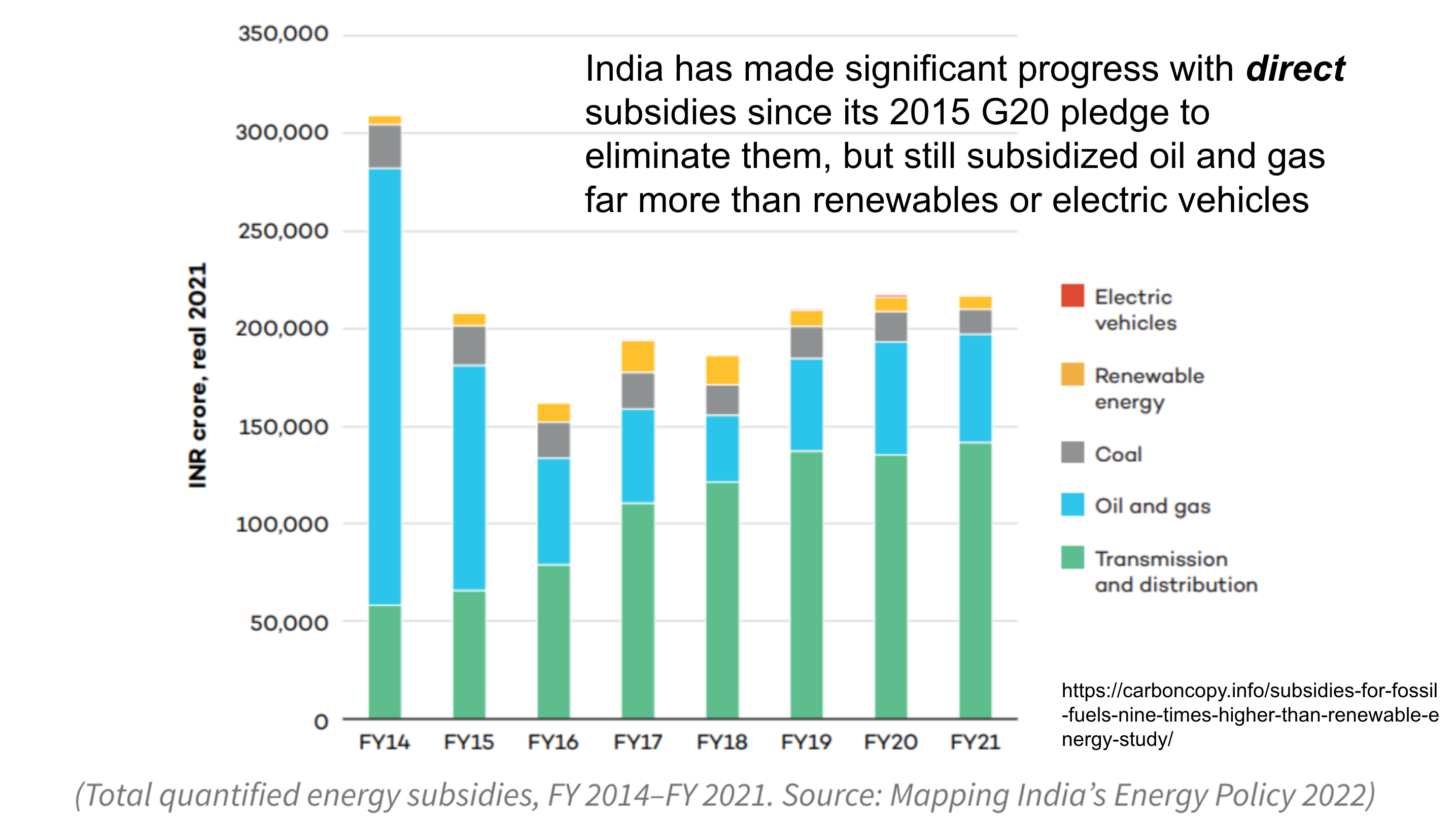

Let’s talk about the next piece. What does that mean for India? So the G7 made a pledge and the G20 made a pledge in 2009 initially. Parts of the G20 made the pledge in 2009 to eliminate fossil fuel subsidies. Most have done a terrible job of it. Canada, where I live, got a little ways into it and then in 2015, when the right government was elected which actually cared about that stuff, as opposed to the previous government which made the pledge, but it was just lip service and didn’t do anything, the government that actually tried to do something was having significant challenges.

India made the pledge in 2015 with the G20, but has only managed to impact direct subsidies. Direct subsidies, as a reminder, are only a portion of subsidies and they’re the direct subsidies to fossil fuel producers, manufacturers, distributors. And so as we consider this, India has been taking good action, but not on indirect or external subsidies. So quite a significant decrease in this blue bar today. However, as we consider this, we’re still at a point where oil and gas and coal have vastly more direct subsidies than renewable energy or electric vehicles. This is the inverse of appropriate subsidization. In the 2020s, in order for India to truly be part of the modern economy, it needs to electrify much more rapidly and invert this.

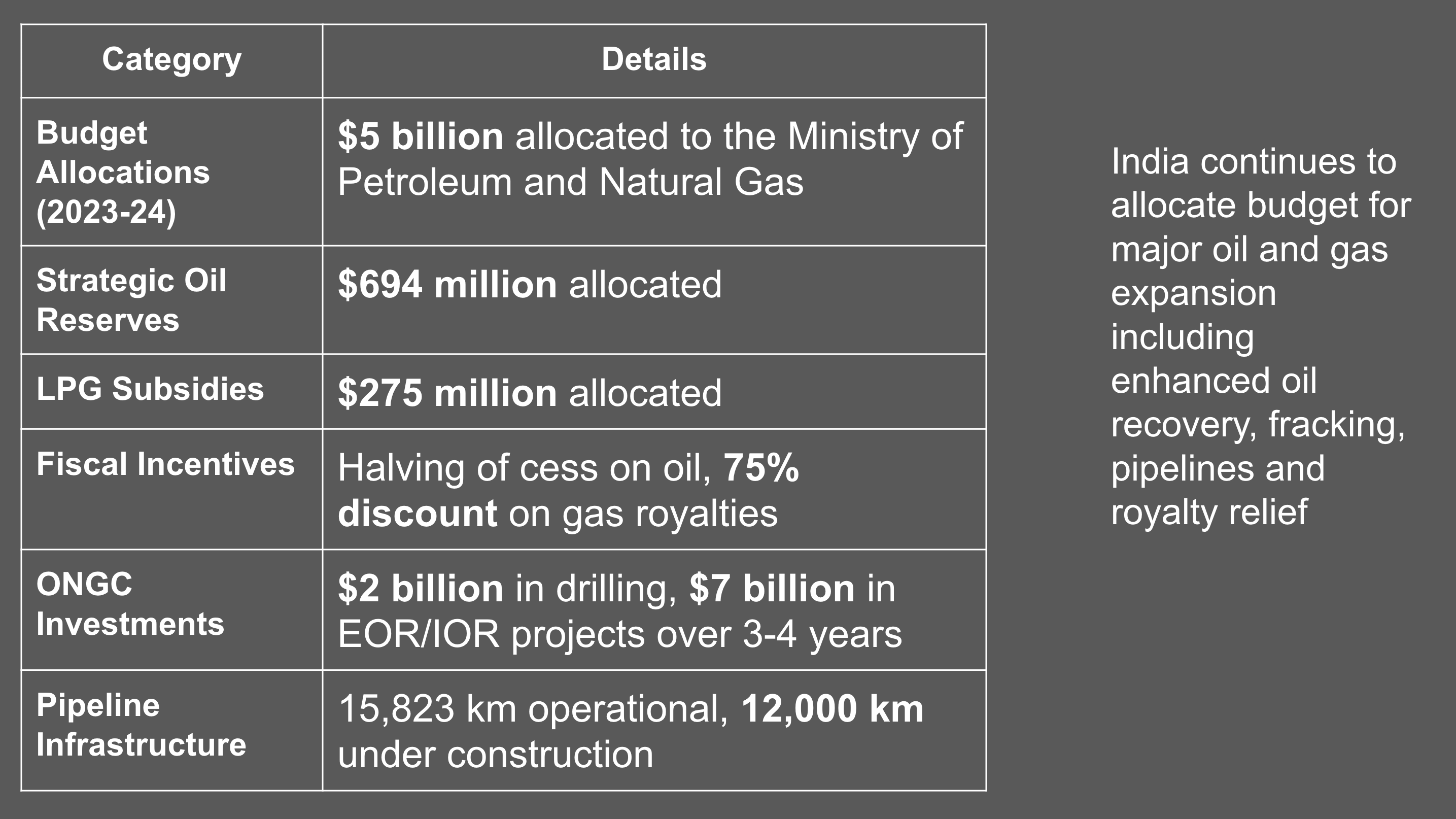

Now, there is still an argument for some fossil fuel subsidies and investment for specific purposes, and I’ll get into that later, but not to this degree. So let’s talk about what those subsidies look like in India. As we see, there’s $5 billion allocated to the Ministry of Petroleum and Natural Gas in the current budget. That’s a lot of money and that’s specifically devoted to expanding extraction of natural gas and petroleum, dominantly using enhanced oil recovery and fracking. For context, enhanced oil recovery goes into an existing oil well that is tapped out as the pressure inside the well is inadequate or the constituency of the crude oil is too sluggish, its leftover tar to be able to be pumped out.

One of the dominant forms of enhanced oil recovery is pumping carbon dioxide into the well, frequently in supercritical form, to loosen the oil and increase pressure and turn into a flowable liquid again, then have the increased pressure and more liquid oil be pumped out the other end. This is not carbon capture and sequestration. This is increasing the output of petroleum with a strong negative impact for climate change. So if anybody tells you that enhanced oil recovery is carbon capture and sequestration, well, that’s pure greenwashing and dominantly it’s what’s been done with carbon capture and sequestration globally. I suspect we might have a full carbon capture and sequestration effort as part of this series, just as we’ll have a full hydrogen session.

There’s another $700 million for strategic oil reserves. I normalized these all, by the way, to US dollars because there were values in my research in both. My apologies that they’re not Indian currency, but I decided it would be more appropriate to at least do it in numbers that I understood and I hope that’s adequate for the audience. So more on getting more oil, more on liquid petroleum products. Now this one, remember the indirect is reducing the tax or reducing governmental revenues to enhance the ability to extract produce, deliver more oil and gas to consumers at a lower price. And so there’s a 75% discount on gas royalties moving forward, which is, to be clear, completely contrary to climate action, but may be justifiable with some aspects for the interim.

But it’s a really tough argument, and policymakers should really have their feet held to the fire over any decision giving a lot of money to oil and gas. The past three years have seen record profits for oil and gas firms globally, so it’s difficult to understand why they need more money from taxpayers. ONGC investments, a couple of billion for drilling, $7 billion in enhanced oil recovery projects. That’s a lot of money. These are big numbers and pipeline infrastructure at this point, pipelines are heading towards being stranded assets. A pipeline is typically a 30 year asset. What this is saying is that there are 12,000 pipelines being built in India which are expected to still be operating in the mid 2050s. Is that realistic?

I would say right now, as I look around the world, most of what I’m seeing is pipeline organizations attempting to pretend that hydrogen will be used in them, which it won’t. And then we’re starting to see strongly that it’s a shutting down of pipelines. We’re starting to see a reduction of pipelines. We’re starting to see intentional sunsetting of pipeline infrastructure, especially in the distribution side, in part because as we move forward, the challenge for gas utilities will be the death spiral, where customers move to induction cooking, heat pumps, full electrification, and in a region where there might be, call it 100 customers in a region, 20 of them go away to electrification, 40 of them go away, and then 50 of them go away. Then they have half the customers.

But all the costs of maintaining the safety and delivery of the product, then they get to 70% and 80%, and they can’t afford to deliver gas for the rates that customers can afford to pay. That’s the utility death spiral. And so what we’re seeing now is organizations around the world, utilities around the world are starting to be forced, typically to sunset gas distribution solutions, gas distribution networks in an intelligent and strategic fashion over the next couple of decades. Utrecht in the Netherlands is a great case study in that, on the other hand, India is rapidly trying to expand its gas utility infrastructure, which is completely contrary to what should be done. It should be electrification first. Gas, well, it should be more expensive, deliver it by bottles for the people who demand it and move on.

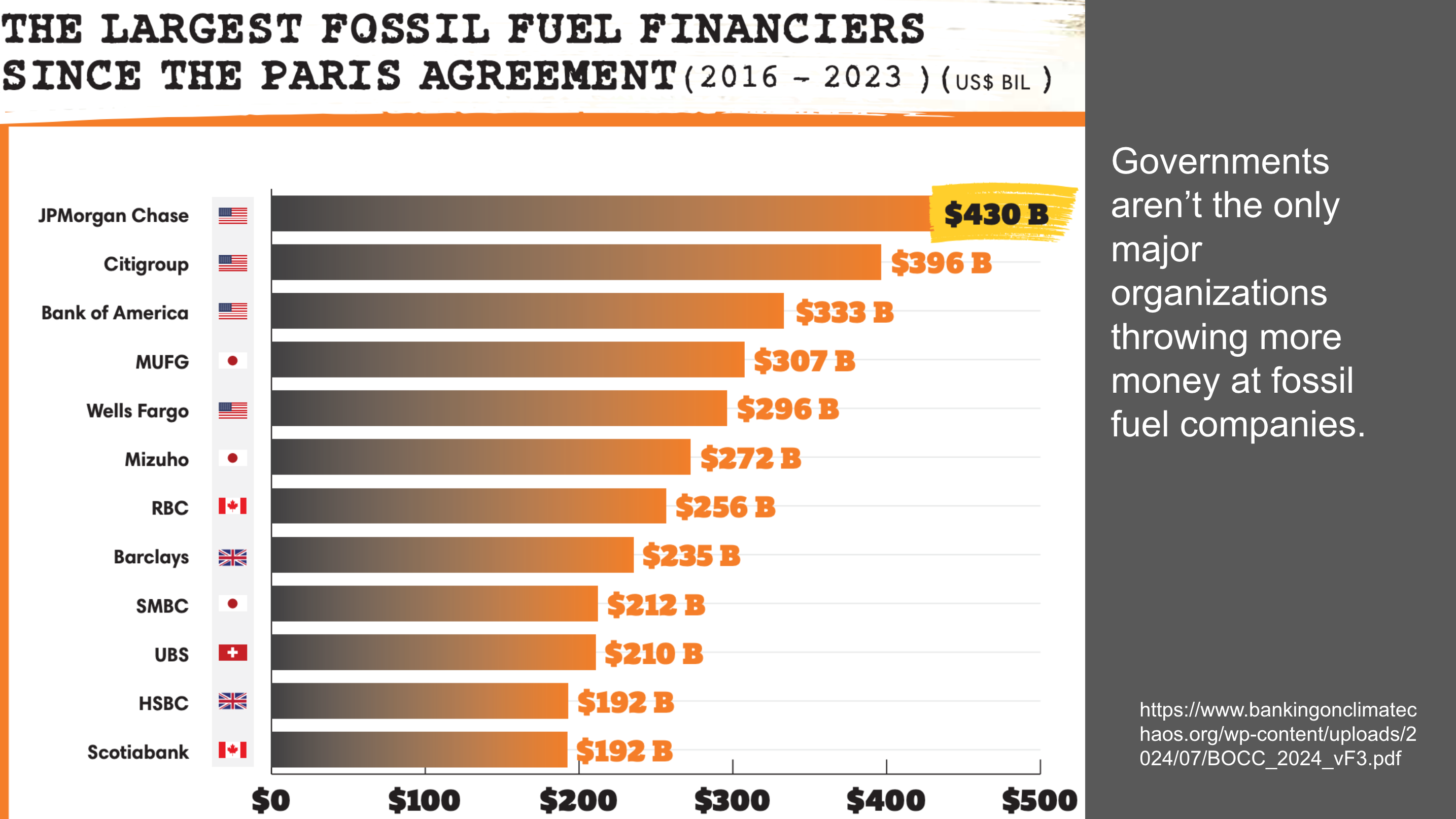

So let’s pivot to banks, because it’s not just governments throwing billions and billions of dollars. In fact, it’s not even billions. The IMF assertion for 2023 was that globally there were $7 trillion of direct, indirect and negative externality subsidies for the fossil fuel industry, $2 trillion of that, which is quite a lot, quite a big number. $2 trillion was direct and indirect subsidies, $5 trillion was negative externalities, to give you a sense of scale. But this is another $2 trillion since 2016, since the Paris agreement was signed from JP Morgan Chase, American banks, Chinese banks, Canadian banks, British banks and a Swiss bank. So we have this problem where major financial institutions globally are continuing to provide investments, that’s debt financing and in many cases equity financing, into the fossil fuel industry. This is enabling those industries to expand extraction, processing, refining and distribution of fossil fuels when we know there’s a crisis.

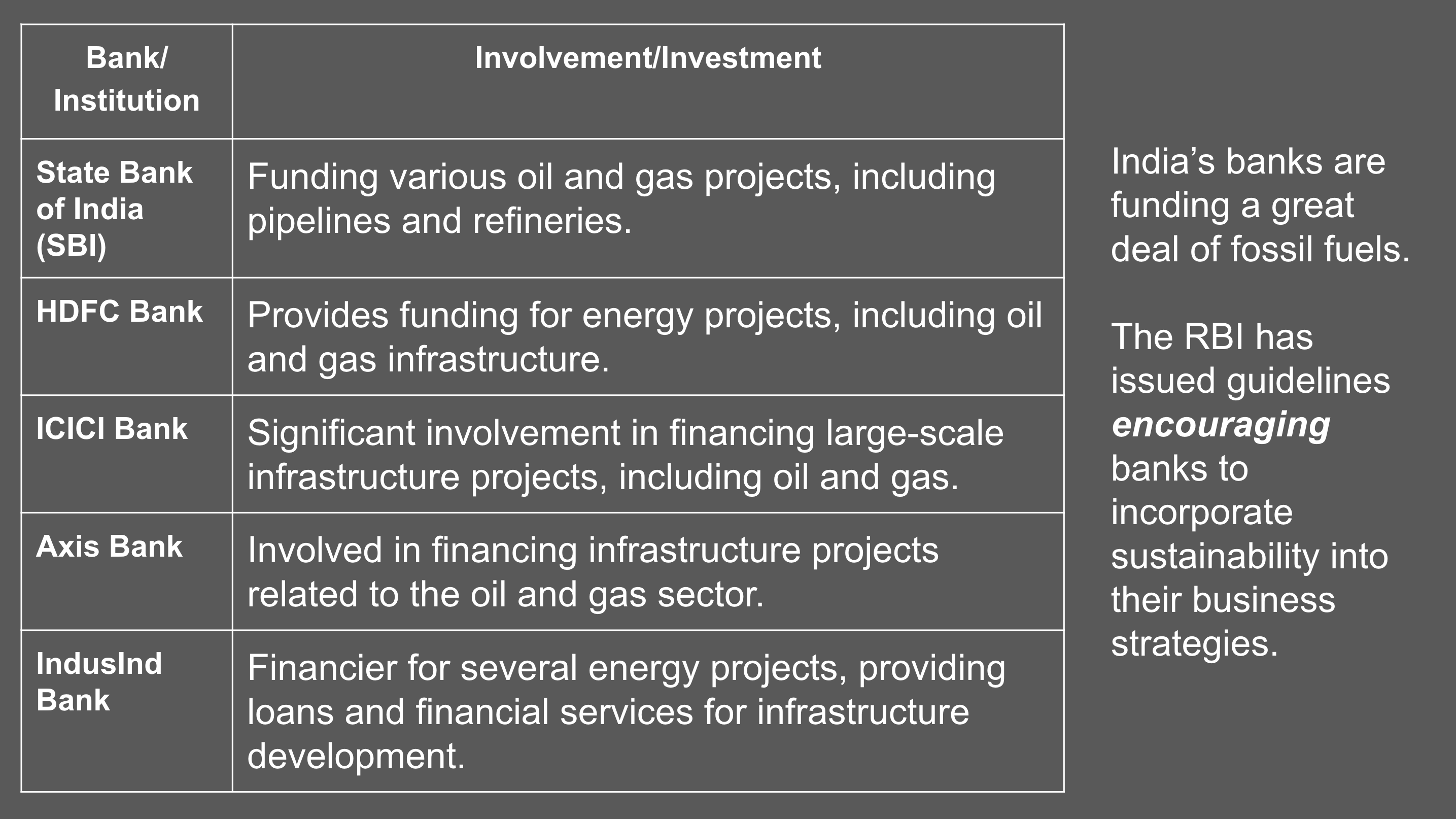

And this is the global view, it’s not a good view, but India’s banks are not on the list of the worst ones, but they’re still doing a lot of funding. State bank is doing a lot of work with pipelines and gas projects. HDFC is doing a lot of work with oil and gas infrastructure. Icici has got some large scale infrastructure. Access is in this space, IndusInd is in here. These are all banks who should be looking at funding renewables, electrification, electric vehicles, electric vehicle fleets, decarbonization of industrial heat, and instead they’re mostly spending a lot more money on fossil fuels.

That means that there’s a significant disconnect between climate goals and the way the banks are looking at this now in the world. We’re starting to see central banks like the RBI, India’s RBI, establishing clear environmental, social and governmental guidelines for banking portfolios. And the best that RBI has done has encouraged it. So from a policy perspective, more teeth are required with that.

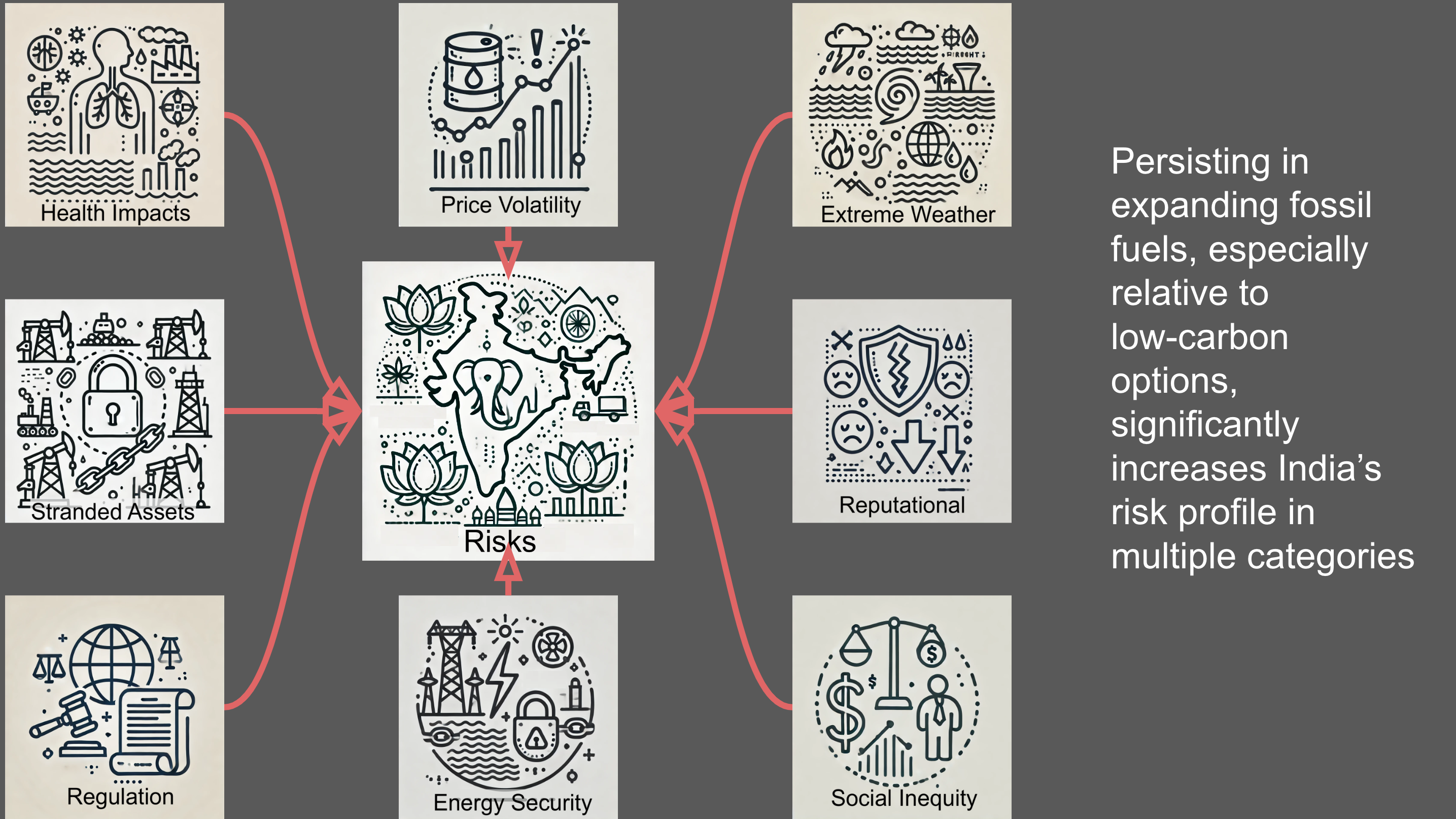

And the reason for that is because there’s strong challenges and risks associated with this as we move forward into a low carbon future. As we move forward into the future, we see risks from an Indian context.

So let’s start parsing around these and end with health impacts just because it’s useful. So probably the global energy crisis that was dominantly a European energy crisis fomented by the invasion of Ukraine by Russia, created energy spikes all over Europe, but also in the rest of the world. Because Russian gas and Russian oil was a cheap commodity like Saudi’s product, it was being consumed globally and then lots of sanctions made it an illegal substance, which means it’s selling less, but that means a lower supply with constant demand, increased costs. We saw significant price spikes. This is a common thing as we look around the world. I can go back to 1972 with the OPEC OilCcrisis, when the major oil producing nations at the time turned off the taps to maximize their profits and costs of energy shot up with renewables.

We don’t have that concern because renewables are inside a country’s domain, much more so than fossil fuels. The price shocks and the concerns about geopolitical concerns, like the war, like the OPEC oil crisis, like other crises of energy over the past decades related to fossil fuels, you can avoid those. When I talked to Australian investment funds, one of the questions they had was, how do we make green steel made with renewables price competitive with natural gas? I said, well, you have to price in the volatility of natural gas, because as we go through the transition away from it, we’re going to see a lot more volatility in natural gas and oil. As mergers and acquisitions occur, as blocks of companies attempt to drive out benefits for themselves, as conflict, like the Houthis blocking the Strait of Hormuz.

Those types of things all drive up the cost of fossil fuels vastly more than they drive up the cost of renewably generated electricity. So avoiding that is a really sensible choice. Obviously, India is just as subject to extreme weather due to climate change, and possibly more so. Every country in the world is seeing radically different weather. Ravi in Toronto and myself in Montreal right now, lived through quite extreme heat last week, unusually high for the cities we’re currently in. But that’s no longer as unusual. Meanwhile, two days ago in Calgary, hail was shattering car windows and destroying windows and buildings, and terrifying residents of the city as it destroyed their windows and was hurtling into their living rooms. And so we’re seeing these types of events globally.

Let’s go back to 2017, into the region where you are. There was the monsoon that flooded Bangladesh and displaced a third of the populace. So these are events which are driven by our consumption of fossil fuels, and we’re making them worse the more we expand fossil fuels. So all the subsidies are subsidizing extreme weather.

There’s reputational risk. India doesn’t need to be the first at the table, but they can’t be in the laggards. As we move forward, India’s global reputation and its cultural expansion and the willingness of people to give it the benefit of the doubt, to persist in trade deals with it, become more at risk the more it spends on fossil fuels. Unlike Saudi Arabia, it’s not an exporter, but if it continues to subsidize fossil fuels, it ends up being potentially considered the way Saudi Arabia does without Saudi Arabia’s economic clout.

The next piece in the risks is social inequity. A fossil fuel economy tends to provide the highest benefit to the highest socioeconomic brackets, and the highest costs, the least benefit to the lowest socioeconomic brackets. This is a reality of the fossil fuel economies. As we look around the world, there’s a strong correlation between GINI indices, the degree of income inequity in a society, and high fossil fuel consumption or petro states. There are outliers, like Norway, which is carefully managed, but it’s an outlier. Look at the United States. It’s now the biggest exporter of fossil fuels in the world, and its inequity has increased substantially since 1980. At the same time, it’s increased its exports. So if we consider social inequity to be a risk, and every government persists at the will of the people, regardless of the political system, social inequity is one of the things to be very concerned about from a policy perspective.

Energy security is an interesting one. As I said, renewables mostly get generated inside a country. India is big enough to generate all the energy it needs, mostly inside of its borders, but it’s also narrow enough that it can’t really take advantage of solar highs and lows. And so at that point, you start needing connections east and west and north. You start needing an HVDC grid to draw energy from the north to the south more efficiently. But energy security is also a place that is an arguable place for current investment in fossil fuels.

As I said, India is now starting to do unconventional extraction of oil and gas to enable it to avoid some of the price volatility in international markets. And I certainly acknowledge that advantage. But it has to be on the merit order. The consumption of that natural gas and oil has to be on a merit order at the bottom of the merit order. Right now, it’s not India, and that needs to transform.

There’s also a regulatory risk. International regulations. As I said, the carbon border adjustment mechanism in Europe, which I talked about a couple of seminars ago, is going to increase. As India expands its use of fossil fuels, as opposed to expanding much more rapidly its electrification, it puts itself at greater risk of ending up on the wrong side of competitive advantages with economies which haven’t been subsidizing fossil fuels, which have been transforming to electrification. And so, as you consider forward for the next decades, increased fossil fuel use is a competitive disadvantage and will be subject to regulatory shocks that will cause challenges. You know, it’s easy to foresee. It’s a gray rhino risk, and India needs to pay attention to it from a policy perspective.

There are also the risks of stranded assets. Those billions of dollars for pipeline expansion and enhanced oil recovery and strategic oil reserves are strongly at risk of being far too big, underutilized or even bankrupting. I’ll compare and contrast Canada, which is equally guilty in this regard. The federal government a few years ago bought a pipeline from the oil producing region of Alberta to the coast so oil from the oil sands could get to water and be shipped. Their hypothesis was that it would go to Asia. Not going to happen. It’s actually going to go to California for a variety of reasons.

But the pipeline, they tripled it in size, to deliver three times as much oil. But it’s going to be a stranded asset. My projection is it’s going to be running at a third of its capacity by 2035 and likely be bankrupt entirely by 2040, which is why the government had to buy it. Kinder Morgan, the firm that owned it, said there’s no real reason to actually triple this because there’s no market for this product. And that’s bearing out. The pipeline is not delivering the value proposition that was articulated, so now they’re pretending it’s doing something else now that it is in operation.

And finally, there are health impacts. Fossil fuel burning causes people to get sick, and it causes a lot more people to get sick, a lot more people to get cancer. It puts a lot greater burden on the health system of India or any other country that does that. And so electrification doesn’t. A healthy populace is a productive populace. A healthy populace is able to engage in extracurricular activities like expanded learning and entrepreneurial activities. An unhealthy populace is just trying to get through the days and won’t be a productive economic driver for India. So for India to be a strongly competitive country in the future, avoiding the health impact risks is probably a good idea.

And then there’s the opportunity costs. Every dollar you’re spending on fossil fuels, you’re not spending on low carbon technology. I tried to make this make a mangrove tree, and I kind of got partway there to get this idea. But this is a fundamental thing. The billions of dollars that the government is throwing at fossil fuels and the indirect subsidies it’s providing for fossil fuels to keep them cheap for consumers are not enabling the transition to low carbon technology.

As I said, there’s an argument for some stuff for energy security. Probably the only argument in the space. But it’s not the right argument. The right argument is electrification, transmission, storage, renewables and funding those things to avoid all those risks.

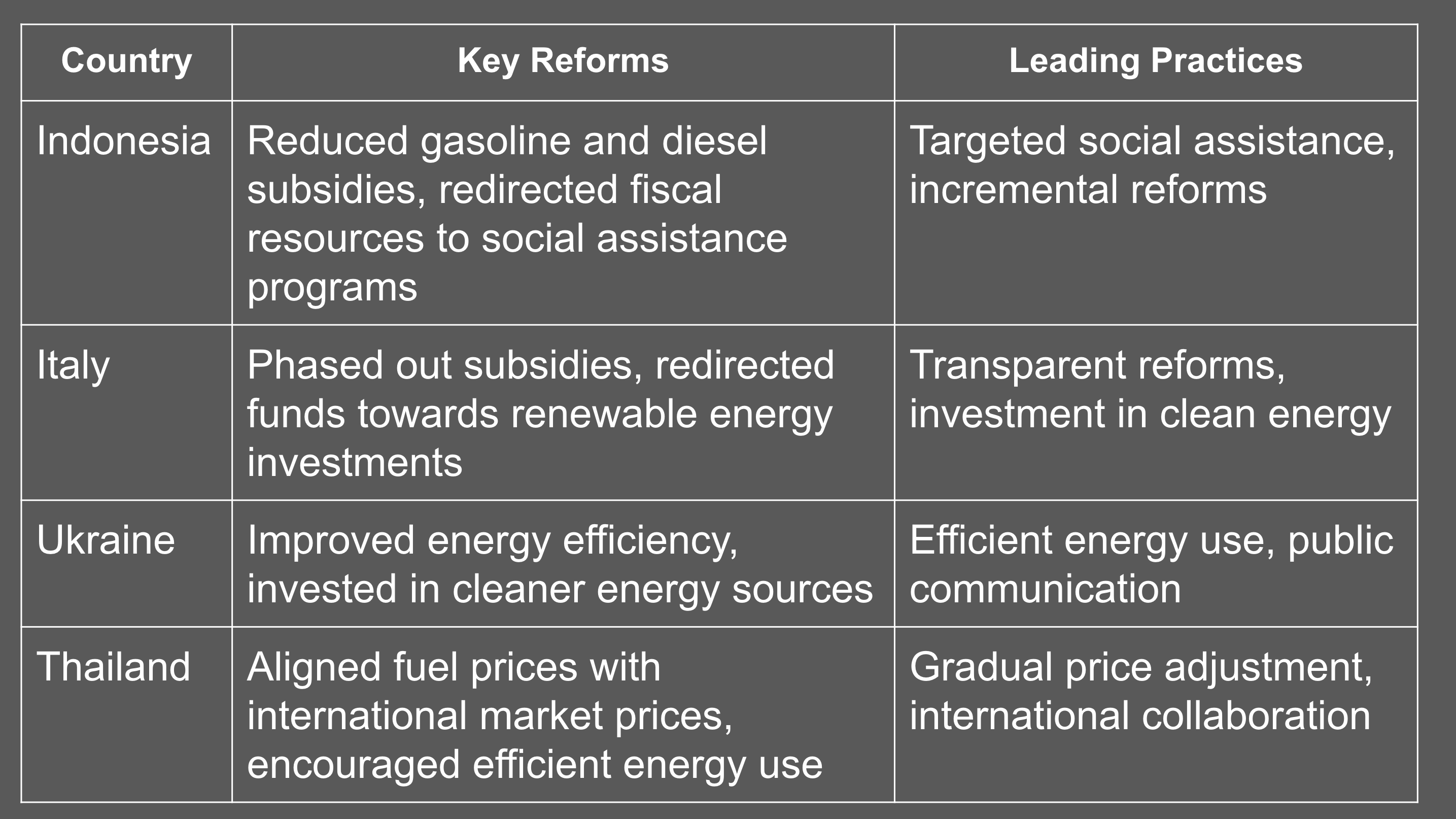

There some countries to look at, and I would recommend the ISGF potentially consider or get another sibling agency who is more targeted this type of stuff to do a study based on this. Go look at Indonesia, which reduced its gasoline and diesel subsidies to increase the price of those things to promote electrification. And it shifted the fiscal resources it used to give to people for gasoline and diesel social assistance programs. So the individuals didn’t lose the money, they just didn’t have it tied to fossil fuels. That’s the right choice. That’s a progressive approach.

You know, the leading practices are listed down the side here. There’s a set of literature on this. Incremental reforms are a key one. That’s the same type of thing for carbon pricing. You have to bring it in low and then increase it annually a bit at a time so that eventually and with consistency, so that strategic investments can be made.

Italy’s done some great stuff. They’ve said, well, we’re not going to throw more money at fossil fuels or as much, but throw it at renewable energies instead. So once again, investing in the technology of the future instead of the technology of the past as much as possible.

Believe it or not, Ukraine continues to do that. To do that. One of the interesting things about Ukraine is that in the early months of the war, something that had been discussed and not acted on for years, which was connecting transmission and connecting Ukraine’s electricity grid to Europe’s electricity, happened in months. It was easy to do. The invasion overcame institutional inertia, and they did that. There was a strong push up until the invasion for Ukraine to become a renewables powerhouse in eastern Europe. It’s a huge, broad plain, much like the regions to east and west of New Delhi. And so there’s a lot of land for wind and solar and good resources. And so they’ve been working along that. And now as they come out of the war in the next year or two and Russia is shoved back behind its borders, it’s going to be interesting to see what the next steps are.

Thailand has been doing good work as well. And so there are leading nations for India to look at, their leading practices for India to consider align with the Indian context and to apply. And so there are solutions right now. India has done a good job since 2015 with one portion of subsidies. Its banks are not the worst banks in the world in terms of investing in fossil fuels, but their hands are still dirty, their hands are still covered in oil. And so there’s a real opportunity here for India to reconsider this and to align more effectively and efficiently with the economy of the future and to avoid all those risks I talked about. So those are my slides. We have about 20 minutes for conversation, so please ask questions.

RP: Brilliant, Michael, brilliant articulation of the fallacy of giving subsidies for fossil fuels at this age, this era, when we are actually experiencing the consequences of climate change. Latest DoE USA paper says there were 28 weather events in 2023 which damaged the grid. We are only talking about the grid. And the economic loss during the year is calculated at $90 billion for the United States from the weather events, which cost outages for up to 24 hours or more. So 28 times it happened last year and this year it may be more. And India and many other developing countries, we are seeing some problems or the other. Every other day. Every other day, some corner of the country is. Any questions?

Ravi: Thank you. Actually, this has been probably one of the most difficult parts of a series of discussions, simply because how do you get a cadre of countries or a region in the world to show cause that there is this methodology that can be adopted and it must be, you have to compliment Michael for that, because it’s a very difficult subject that he’s trying to bring on to say that these small changes in policies, if you will, budget to budget, even though they are larger dollars, they actually establish a pathway for future budgets and future budgets to actually support these so called ill policies, if you will. And so you got to nip this in the bud and say thats not the direction we should go.

But the key aspect that I have, and I don’t have an answer or a comment is how do you kickstart this? Because if you look at all the COPs, there is an understanding that the next COP, because of all the problems in the world, largely conflicts, is not going to attract even the COP 26 measures that were promised several years ago. And so the question, I think, remains in a very difficult way. And maybe Michael can articulate how he hopes that this gospel, if you will, can actually be implemented on a regional basis so that each one shares each other’s experiences? I mean, India would have been a very good catalyst but now, if you look around India, you have all kinds of conflicts.

And so you do not have that stability, political stability around India to be able to say, okay, big brother, small brothers, small sister, big sister kind of approach that SAARC was supposed to create. So East Asia, perhaps, and he had two experiences. There is perhaps one such where there could be promise in forging this. And Reji, maybe in our visits later on, we should think of getting Eddie involved in this, because that’s the way to do it. One country, when they do it, and the other country, neighboring country, does not. You have always had this issue as to. I mean, Canada is one good example of that. He spoke of the pipelines, and yet we are very heavily influenced by US policies. And so that just becomes one area. So I don’t have a comment other than a good observation. A very difficult subject.

I think this is the most difficult in a series of discussions where it involves foresight, policies and some level of leadership. And I don’t see that level. I mean, I go back to Maurice Strong. I mean, he was the chairman of Ontario Hydro at that time, and I was a small guy in the executive office pushing paper. And it took 1992 to 2000 to even come up with the IPCC report. It took another ten years to even come and understand the 1.5 and two degrees and three degrees, the last ten years of which we are seeing all these events actually go up and up and up. But yet, I’m sorry to say, in 2024, we still haven’t got what I would consider as a pathway that is fully understood and accepted by all to say this is the non fossil pathway.

We will go, not even in the United States, not even in Canada. And so we have these debates still as to what constitutes 2.5. And we completely forget that our cities are flooded, hurricanes take place, hail in the middle of summer. I mean, all that is just there for us to see, but yet we have not. Our political system is not absorbing it. I don’t know why, but I don’t have an answer for that. So anyway, who knows the answer for this?

MB: I have an answer why our political system is not accommodating. It’s because the entrenched special interest groups that are the fossil fuel industry, the gas utilities, know that their days are numbered. They have a lot of money, and they’re creating confusion, creating disinformation, creating political ill will, creating a pretense of disagreement where there isn’t actually disagreement, and promoting solutions that are non solutions, like carbon capture and sequestration and hydrogen in order to delay the inevitable, however there is.

Ravi: For Canada, I would accept that. But for India, as you rightfully pointed out, the current budget is sort of going in an area that it hasn’t gone in the past, and it’s committed so much of resources it would have to keep feeding this beast going forward in subsequent budgets. So in a way, it has chosen a fork in the road that it never chose before. And so that itself sort of alarms me. I mean, your thing was so great that it points out that they chose a fork which is the antithesis of all the greenhouse and green energy that India has been promoting and doing for the last five years.

MB: Well, there’s an answer for that. One of the things that I pointed out you started looking at a few years ago was that fracking and shale oil are technologies, and they enable extraction of fossil fuel reserves that were unavailable globally and they would be exported. And so, as I point out, we’re seeing those technologies emerge in both China and India. There’s good news and bad news with that. The good news is that the major oil producing states no longer have a lock on it. So the geopolitics change. The bad news is it enables countries that couldn’t extract a lot of those things to extract a lot of those things. However, the United States experience with fracking and with shale oil will be repeated globally. So let’s talk about that briefly, because it has strong implications for banking and investment and governmental investment in these technologies.

So, brief history. In 1972, there was the OPEC oil crisis. Gerald Ford, the president at the time, in 1974 established the first US national funding for unconventional oil and gas extraction. And 30 years later that became the shale oil and fracking boom for oil and gas, respectively. Basically, pumping pressurized steam and grit and water into underground shale formations to fracture them. Leave behind quartz pebbles that keep the fractures open to enable oil and gas to flow out. In 2019, what we saw in the United States was significant bankruptcies in the shale oil and natural gas industries. Banks were actually not only foreclosing, but seizing assets, which is incredibly unusual. The reason for that is that both fracking fracked gas reserves and shale oils had much shorter lifespans than had originally been assumed or projected.

They were assumed that once you’ve fracked or done a shale oil effort, you’d have a 20 year lifespan or a 30 year lifespan for that asset. But it’s turning out to be two to three years. The heavy capital cost and the heavy upfront cost for those technologies was not paying for itself with the expected fiscal benefits. And that’s a strong lesson for India as it adopts these technologies. There is a significant overstatement of the financial benefits of these technologies and a strong fiscal concern for investments in them. Have to look at them with a very concerned eye.

Similarly, what we’re seeing is insurance rates are going up quite substantially on all sorts of different technologies, industries and stuff. As the insurance industry says, we can’t afford to cover these kinds of liabilities due to increased climate risks.

And so there are fiscal pressures which are going to cause bankruptcies of investors in these places. Right now Canada is trying to sell the pipeline and I’m just trying to figure out who the heck is going to buy it for what buyer, sale price. I’m pretty sure the Canadian taxpayer is going to eat $30 billion of the cost of money that’s put into the pipeline in order to find anybody who wants to buy it. It’s just not worth what’s being spent on it and it won’t last for, as I said, more than another 15 to 20 years. So the stranded assets are coming. The electrification transformation is moving much more rapidly than governments or industry assume.

I spend a lot of time these days looking at energy storage for heat, for industry, residential and commercial space, and I spent a lot of time looking at the low cost of batteries. We have the solutions for all this, but governments are still putting money into the fossil fuel industry because of a short sighted perspective on that risk profile. I think that the risk screen for fossil fuel investments is underappreciated by policymakers and bankers at this point because they’re listening to the wrong advisors.

Other questions or concerns?

Subir: Thank you very much. I had an observation. I mean, of course you drew the attention to the point that there is so much investment happening by the government of India on subsidies to the ONGC for drilling, for exploration and as well as setting up the networks, oil and gas networks. I think that there may be some bigger reasons that so much of investment is going on beyond the share economics and that may be driven by the national security and those aspects which they have to look into rather than just the economics, immediate economics per se. Any thoughts on that?

MB: Well, yeah, if you want to actually create national security and national energy security, renewables, transmission and storage are the way to do it. The point of this is that if we consider that fracked and unconventional gas and oil assets are short term assets, and that enhanced oil recovery of tapped out oil fields is a short term process of getting at the remaining 10% or 20%, those are going to run out quickly, and then you’re going to left with a whole bunch of pipelines from places that don’t have oil and gas to places that expect oil and gas.

But if we instead invest in the pipeline of the future, high voltage direct current transmission and the energy source of the future, wind, solar and water, and the energy strategic reserves of the futures batteries and pumped hydro, then that’s actually future proofing and that’s actually providing strategic energy reserves and energy security from that is not subject to volatile oil shocks. Because committing to the fossil fuel industry means that as prices spike globally, you’re going to see all sorts of other things.

Let’s take an example with the United States. Right now. There’s a big controversy in the United States because in 2015 they had the investment tax credit for wind energy that was going to expire. And so they managed to do a deal between the people on the side of renewables and electrification and the people on the side of fossil fuels that allowed them to export crude oil. That was one of the other things that came out of the OPEC oil crisis. There was legislation put in place that the United States could not export fossil fuels for energy security, which was reasonable at the time, but then the unconventional extraction meant that they had surplus, and so they wanted to do that. Incentives for renewables continued.

What we saw was that natural gas firms in the United States were exporting LN to other markets, and price spikes were spiking inside the United States for energy, even though they had significant local reserves, and that’s significant local production. So what we see is committing to a fossil fuel industry that continues to commit to price volatility from global fossil fuel things. It’s a fairly straight line. It’s one of the key risks. And having domestic reserves does not isolate domestic consumers from that because the rich companies will sell it to the highest bidder. If that highest bidder is in Europe or in China, then Indian consumers will go begging or they’ll be paying global prices for the energy.

And so energy security, I look at this, I look at energy independence, and I always say it’s strategic energy independence. While you have a fractious relationship with Pakistan, you have a good relationship, better relationship with Bangladesh, you know, somewhat challenged relationship with China, interesting relationships with African states. There are still countries you trade with, still countries you trade all sorts of commodities with. I don’t consider putting HVDC into those countries to share electricity across borders any differently than I consider any other commodity or any other luxury good. It’s just something you have to hedge. The more connections you have more broadly with HVDC, the more you hedge any individual connection and the more strategic energy independence you have. But fossil fuels are not the way to energy independence or strategic independence anymore. I hope that answers your question usefully.

Subir: Yeah, thanks for this perspective. I really appreciate that. As an alternative, of course, the HVCC investments are certainly the way to go, but at the same time I feel that, okay, maybe we are considering the fuel economy within the country, but I mean, if I look at it globally, I don’t see that the countries like Qatar and all who have got big reserves, they are going to any day scale down. They will keep on dropping the prices so that they are in the game for many years to come. That’s what I feel. I mean, I would love to hear on this point that at any point in time these are not going to go away for maybe another 50 years. It looks like they’ll keep on dropping the prices to be in the game.

MB: But at that point the highest cost producers start dropping off. Venezuela and Canada both have very heavy sour sulfur. It’s high in bitumen, it’s basically mostly asphalt that’s high in sulfur. And so those are very costly to extract, cost to process, cost to distribute. And as such, as the price of oil diminishes, the oil sands will drop off, the Venezuelans oil will drop off. Shale oil is an expensive oil by comparison, and it will become more expensive as the cost of energy to extract and process it increases due to carbon pricing. Right now, the secret of enhanced oil recovery is that they burn a lot of fossil fuels behind the meter in order to power their processes. So their energy return on energy invested is down around two to four, as opposed to conventional oil, which is ten to 18.

And so they’re spending a lot of money by burning a lot of fossil fuels, but it’s hidden from the cost of that because they’re just burning stuff they have. As we start pricing those emissions, that cost goes up. And so once again we get to a point in the future where light, sweet oil close to water like Saudi Arabia’s, will continue to be extracted for the diminishing demand for oil. And yes, the price will go down, but there will still be significant spikes due to conflicts, due to Strait of Hormuz and the Houthis causing shipping distractions, due to regional conflicts which increase as climate crises cause internal and external displacements of citizens and lead to civil wars. We are entering a period of global instability.

And the best strategic energy is to make as much as possible internal to your country from renewables and use it in high efficiency energy, electricity and sources. It’s hard for me to consider a situation where you’re doing anything with fossil fuels which isn’t as a backup. For that, the primary strategy has to be getting off of fossil fuels and getting out of that route race.

Subir: In my opinion, that’s a very good point, that from the strategic perspective, it makes better sense to have those resources within the boundaries. That’s the ultimate insurance that one country can have, rather than depending on external fuel for sure. So thank you very much for your points, Michael. I really appreciate that.

MB: I’ll share one more data point with you, which is kind of fun. So, Israel. Israel is kind of the ultimate political island state. It’s in the middle of a region where everybody hates it, and that’s playing out again right now. When Mark Z. Jacobson did his 145 country study of 100% renewables by 2050, he grouped them into a set of groups. And some countries, like South Korea and Israel, he considered as isolated entities. In other words, they were not entities which could be part of a regional electricity sharing group. There’s a nuance on that. And so even in Israel, it was cheaper to power it entirely by renewables with storage and transmit electricity just around a small geography of Israel than it was to run the country on fossil fuels. So that’s kind of statement one, statement two.

However, right now, there’s a cable in construction from Greece to Israel, an HVDC cable, undersea cable, to enable Israel to be connected into a larger grid and to share electrons across significant geographical distances. And so even theoretically isolated states like South Korea and Israel, actually with modern HVDC technology, don’t have to be isolated. And once then you choose who you connect to, why? And if you’ve got major sets of trade with domestic, with third parties, why wouldn’t you trade electricity with them as well?

RP: The UK Netherlands HVDC connection, almost 800 kv line was recently commissioned, mostly undersea cable. The ISGF initiated a discussion in 2018 about connecting the South Asia grid with the western part, the Gulf GCC grid, and also with the ASEAN grid in the east. So from Saudi Arabia to Singapore, we have 5 hours of time difference, which could be really an asset in the solar era. So we brought all the six countries in the Gulf, cooperation countries, six of them, they already have a GCC grid. And on the eastern side of India, ten countries in the ASEAN, have an ASEAN grid with six of them are interconnected. One or two more will get connected by 2030. And in South Asia, India, Nepal, Bhutan, Bangladesh are already interconnected, and we are doing power trading amongst this country.

And at some point in time, Sri Lanka also will get connected. So this South Asia grid, connecting to that GCC grid and with the ASEAN grid is some idea which was initiated by ISGF way back in 2018. And in 2019, March, we brought all the key decision makers from the GCC, from ASEAN and India and our South Asia grid people. We had a day long discussion and finally everybody agreed that this is good for everybody in the emerging era. And we will interconnect, starting with two interconnections. One is an undersea cable line from Oman to Gujarat, western part of India. So a 2000 megawatt HVDC line and an overhead line from Manipur to Thailand via Myanmar. These two were mutually agreed by all the parties. I mean, there was a consensus on this and a feasibility study was to happen.

Some international agencies, like the European Union, ADB, World Bank, USAID, all these people expressed interest. Nothing could progress much by the time the COVID came, and it’s two years gone. So now there is a lot of interest in the same area. There have been discussions instead of Oman interconnecting UAE with India and all undersea connections, because our headline will not come obvious, our neighbors problems. So we see that at some point in time, everybody will see logic investing into that interconnection with ASEAN to South Asia to West Asia, and that GCC grid already getting connected to Jordan and other places.

So it’s going to be an interesting time, maybe the gate course, the global energy interconnection, big program of $38 trillion, a 50 year program that may take its own time, but this regional grids getting interconnected is something which will happen at marginal investment and much bigger benefit to all the participants.

So we will stop anybody, any other points? Thank you, it was a wonderful session. And next session will be on 22 August, same time, 07:30 p.m. India time.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy