Vietnam ranks fourth in Asia (behind China, India, and Indonesia) for the use two-wheelers (motorcycles and mopeds) for transport. The majority of these are petrol powered and contribute to greenhouse gas emissions and pollution. The national government is relying on a transition to electric two-wheelers to meet its targets for reducing greenhouse gas emissions. By 2040, it aims to end the production, assembly, and import of cars, motorcycles, and mopeds powered by fossil fuels, and by 2050, it wants all motorized road vehicles to be electric and powered by green energy. Vietnam leads the ASEAN region in electrification of two-wheelers and is second in the world, only behind China. As reported recently, the world is on track for 100 million electric two-wheelers by 2027.

Image courtesy of ICCT.

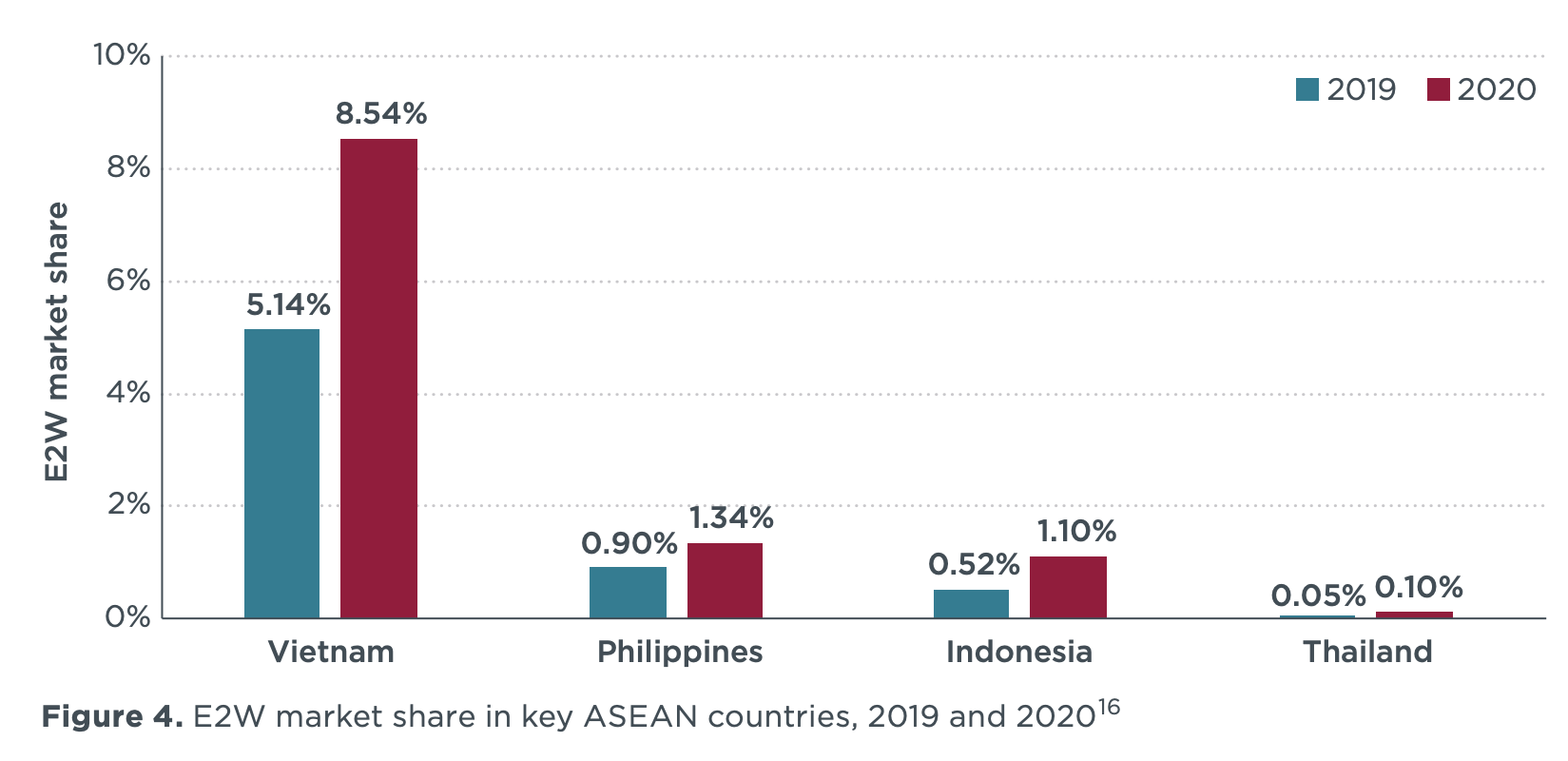

A briefing paper by the International Council on Clean Transportation (ICCT) highlights the long and bumpy road Vietnam has to navigate to achieve this. In 2020, there were over 65 million two-wheelers — that is, two for every three people in the country. There may be more now. However, some feel that Vietnam has reached saturation point. Approximately 3 million have sold per year for the past 15 years. During COVID, sales of electric two-wheelers surged in a contracting market. In 2019, electric two-wheelers had a 5.4% market share; in 2020, it was 8.5%; it was 10% in 2021; and it was likely to have reached 14% in 2022. So, the trajectory is there.

Image courtesy of ICCT.

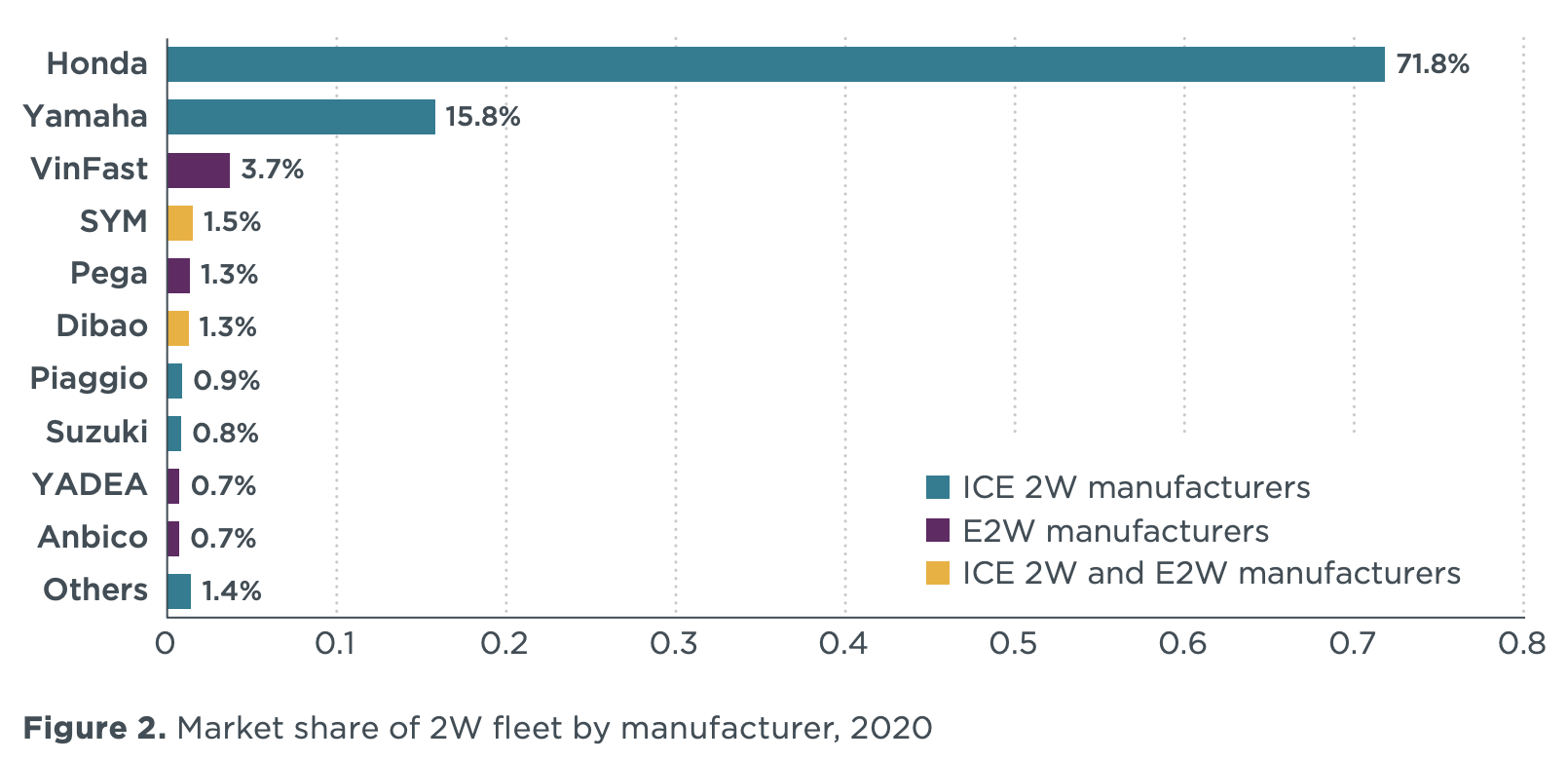

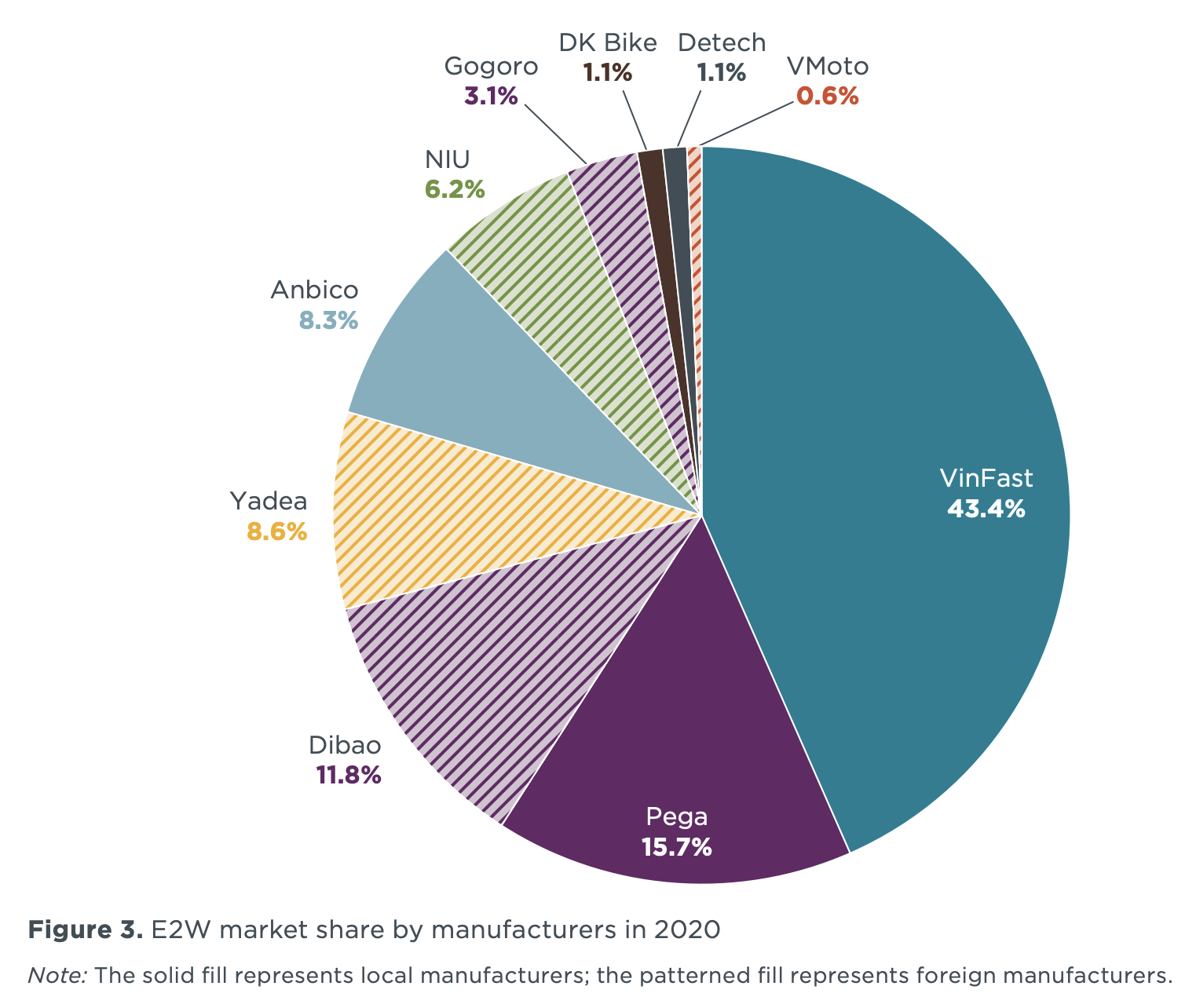

The Vietnamese two-wheeler market is dominated by two Japanese manufacturers, Honda and Yamaha. Ironically, they both manufacture electric two-wheelers, but mainly for export. It is the domestic manufacturers — VinFast, Pega, Yadea, and Anbico — that are offering electric two-wheelers to the people of Vietnam, with VinFast and Pega owning 60% of the electric two-wheeler (E2W) market. Will Honda respond to this market opportunity and offer its electric two-wheelers to the local market? Yamaha has introduced the E01 and it appears to be available in Vietnam. It has a lithium-ion battery and a range of 80 km.

Image courtesy of ICCT.

Honda has a global target to become carbon neutral by 2050. Electrifying motorcycles is one of the company’s stated strategies. “The first Honda E2W model was put on the market in 1994, and in 2018, Honda introduced its PCX electric motorcycle in Japan and several ASEAN countries (e.g., Indonesia: 1,353 vehicles in 2020; Philippines: 228 vehicles in 2020; and Thailand: 19 vehicles in 2020), but not in Vietnam,” ICCT writes. “In 2020, Honda introduced three electric models for business use (for goods delivery), including the BENLY e, an E2W; GYRO e, an E3W; and GYRO CANOPY e, an E3W. Although Honda has not offered its E2Ws in Vietnam, it has taken several actions to investigate the potential deployment of E2Ws in Vietnam.” These include: a research program to evaluate the performance of E2Ws in Vietnamese traffic conditions over a three-year period, renting 70 E2Ws to Vietnam Post Corporation with battery swapping capability, allowing several Honda Exclusive Authorized Dealers to rent E2Ws to collect customer feedback.

Yamaha is also aiming to achieve carbon neutrality by 2050. When you consider that Yamaha’s targets for electrification of two-wheelers are 2.6% by 2030, 20% by 2035, and 90% by 2050, it is certainly a slow walk. Let’s hope that the E01 can pick up the pace.

VinFast has a current annual production capacity of 250,000 vehicles, with plans to expand to 1 million. This might mean that exports to other ASEAN countries are possible. It must be noted that the majority of E2W models from all manufacturers are e-mopeds (54 models); only 14 are e-motorcycles (8 of these models are from VinFast).

Only 12 of the 68 models are equipped with lithium-ion batteries. These are mostly from VinFast. Several of VinFast’s E2W models are powered by LFP (lithium ferrous phosphate) batteries that have been developed by VinFast (in collaboration with Gotion High Tech from China). “VinES Energy Solutions, a unit of Vietnam’s largest conglomerate Vingroup JSC and China’s Gotion High-Tech, have commenced construction of a $275 million battery factory in the Southeast Asian country,” according to Vingroup in late November.

“The factory in the central province of Ha Tinh will annually produce 30 million LFP battery cells.” Production is expected to start towards the end of 2023.

VinFast is also planning to build a battery factory in North Carolina.

“Prices of E2Ws equipped with lithium-ion batteries are much higher than those equipped with lead-acid batteries,” ICCT writes. “However, E2Ws powered by lithium-ion batteries have a longer lifespan, and are lighter, than E2Ws powered by lead-acid batteries, and their batteries are replaced less frequently. The maximum speed of most electric vehicle models ranges from 40 km/h to 50 km/h, with the fastest electric motorcycle (Theon S 200 from VinFast) registering a maximum speed of 99 km/h.”

Without government subsidies to encourage E2W uptake, prices can range from US$580 for the cheapest model, the Espero 133I from Detech, to around US$3,820 for the most expensive model, the Theon S from VinFast.

Vietnam is facing similar issues to all emerging EV markets. Charging networks and battery swapping sites are limited. Most charging is done at home. VinFast appears to be the leader in providing charging infrastructure, planning to install 150,000 charging ports across the country at commercial centers, gas stations (like PV Oil), supermarkets, bus stations, public parking spaces, apartment buildings, offices, and universities. Partners are sought for this enterprise. No other E2W manufacturer appears to have plans to follow suit.

Batteries, controllers, and electric motors still need to be imported, but it is believed that there is a capacity to produce these locally. Vietnamese enterprises such as Pinaco and 365 Creative Joint Stock Company have the potential to produce batteries for E2Ws. Motors are currently imported from Bosch or Chinese and Taiwanese manufacturers.

Why are Honda and Yamaha slipping their clutches? Why are they dragging their chains? Lack of government support for E2Ws and high profits from ICE vehicles are two likely answers.

There is government support for the introduction of electric cars: such as reducing the special consumption tax and elimination of registration fees. But there is no policy support for E2Ws. They are still subject to the same taxes and fees as ICE two-wheelers. Safety concerns, range, and price are the top 3 reasons given for not buying an E2W in Vietnam.

“[P]olicies that provide financial incentives for owning and operating E2Ws, such as vehicle purchase subsidies, tax exemptions, or tax reduction, could potentially increase purchases of E2Ws. Non-fiscal incentives such as prioritized parking places or implementing low-emission zones could also increase the attractiveness of E2Ws over ICE 2Ws. In addition, public campaigns to raise awareness and gain people’s trust on E2W technology are also essential to increase E2W uptake.”

Manufacturers need to be incentivized to produce affordable, quality electric 2-wheelers. Tightened emission standards would play a role, as would mandating E2W production targets. Thailand and Indonesia have set targets for EVs. For example, Indonesia aims to achieve a stock of 2 million electric passenger vehicles and 13 million E2Ws by 2030.

Currently, E2Ws powered by lead-acid batteries and battery capacity smaller than 4 kW dominate the E2W market in Vietnam, with 75% market share. They are mainly sold to the elderly and students. They are cheap and do require a license to drive. In other ASEAN countries, including Thailand and Indonesia, E2Ws with lithium-ion batteries dominate the E2W market.

Until there is government policy support — mandated targets in conjunction with emission standards and a widespread re-education of the populace — it will continue to be difficult to accelerate the uptake of E2Ws. Perhaps the bright star on the horizon is VinFast.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Have a tip for CleanTechnica, want to advertise, or want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Former Tesla Battery Expert Leading Lyten Into New Lithium-Sulfur Battery Era:

CleanTechnica uses affiliate links. See our policy here.