Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

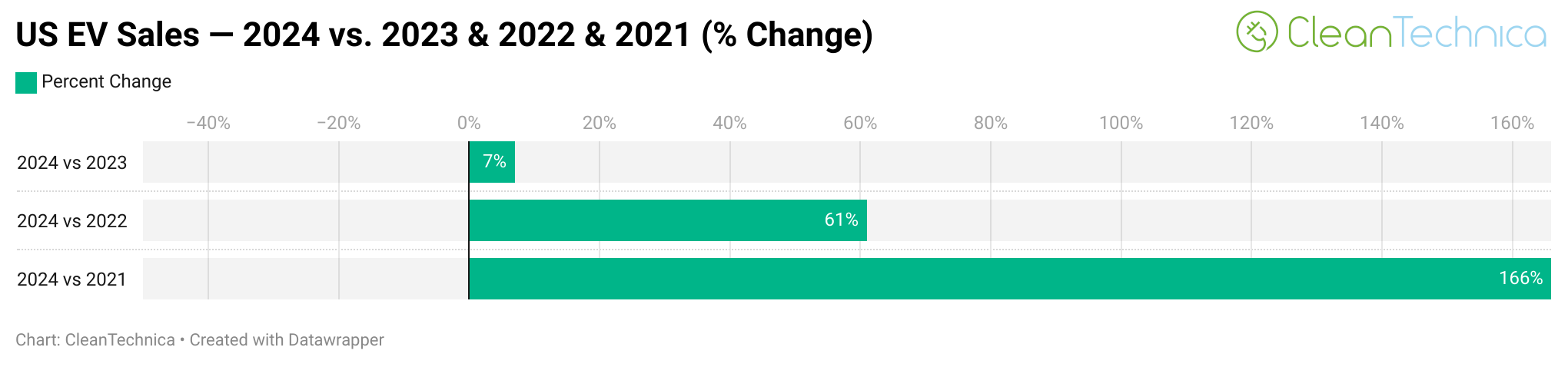

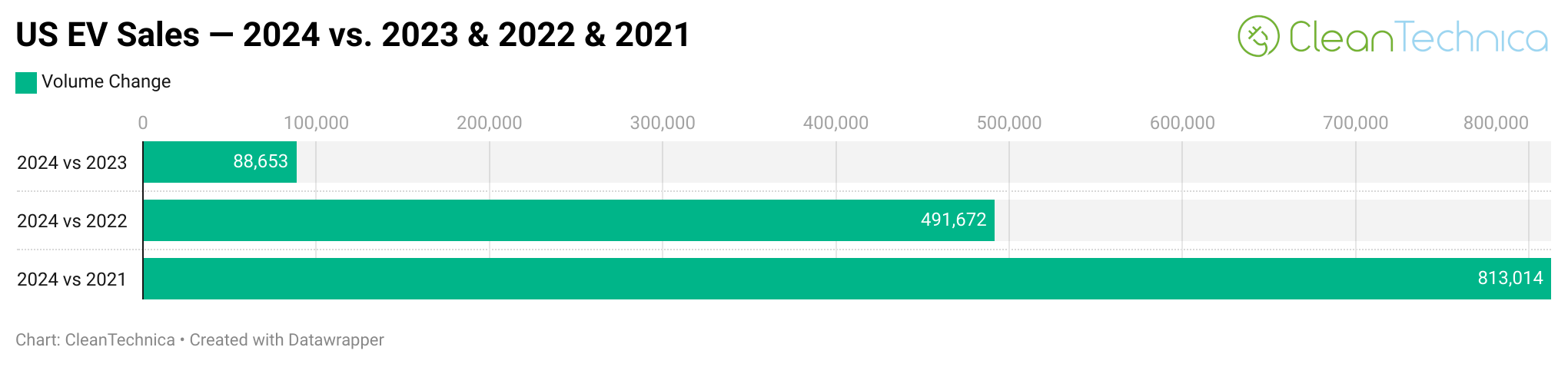

The US electric vehicle market did grow in 2024. It increased 7% over 2023, or by nearly 89,000 units. Compared to 2022, EV sales grew by 61%, or almost 492,000 units. Compared to 2021, EV sales grew by 166%, or more than 813,000 units. So, yes, the US electric vehicle market has been growing strongly — just not as strongly as many of us would like, not as strongly as predicted for a period of time, and not as strongly as other market markets, most notably China and Europe.

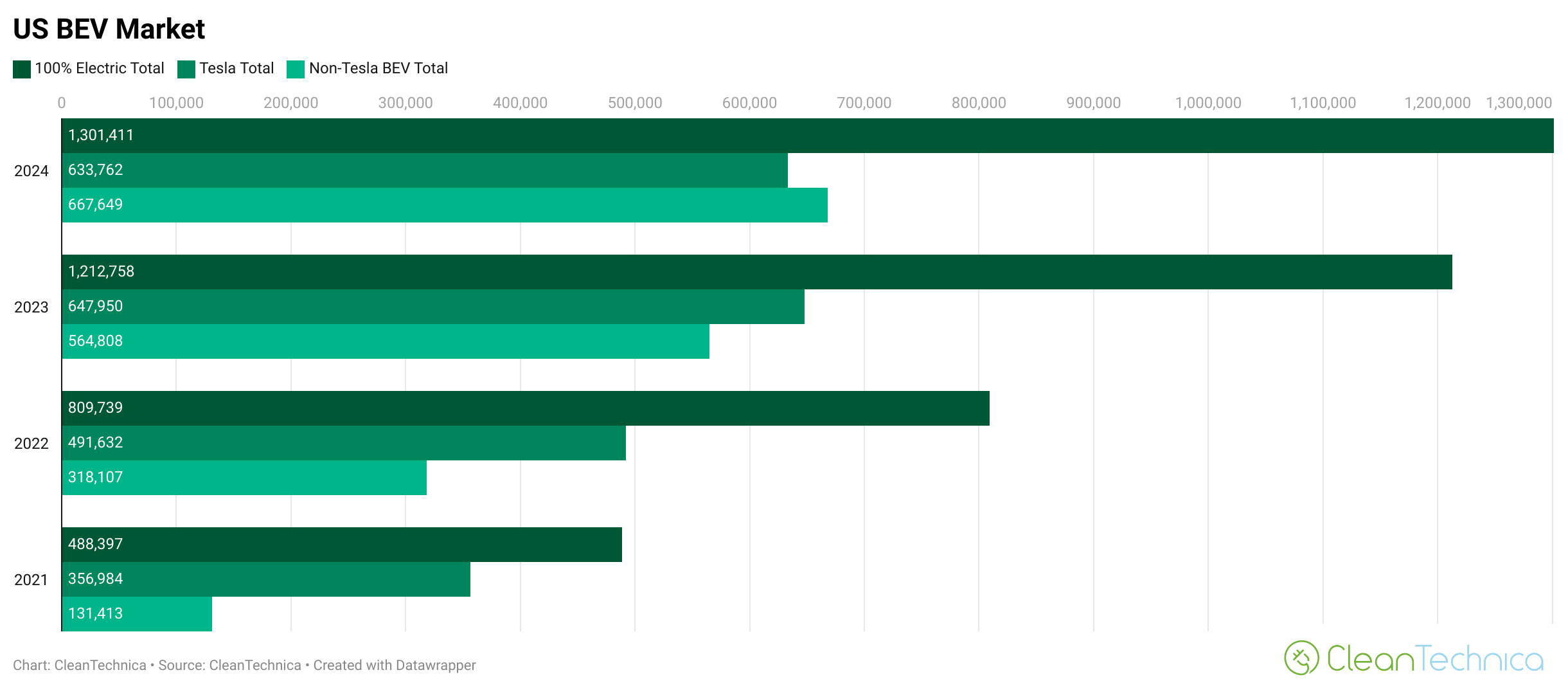

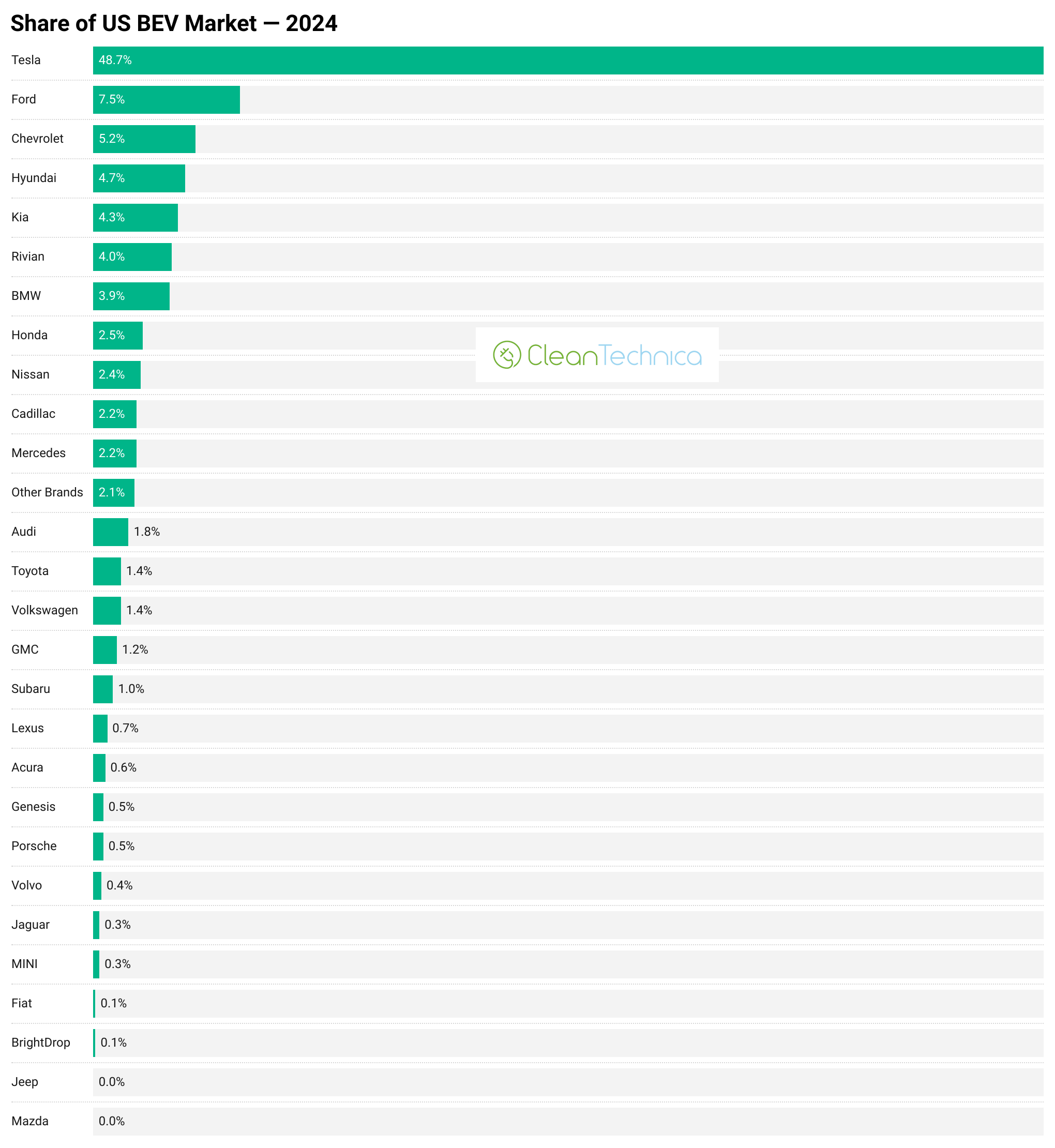

When discussing these matters, though, you really have to tease out Tesla sales. Tesla accounts for nearly 50% of the US EV market, and it as been on an opposite trajectory from the rest of the US EV market recently. In the following chart, if you look closely, you can see that after rising solidly year after year, Tesla sales declined in 2024 compared to 2023. (But you already knew that of course.) Non-Tesla EV sales grew stronger year over year, and still grew solidly in 2024.

That’s the overall story. Let’s dig into the details next — the models, brands, and automotive groups.

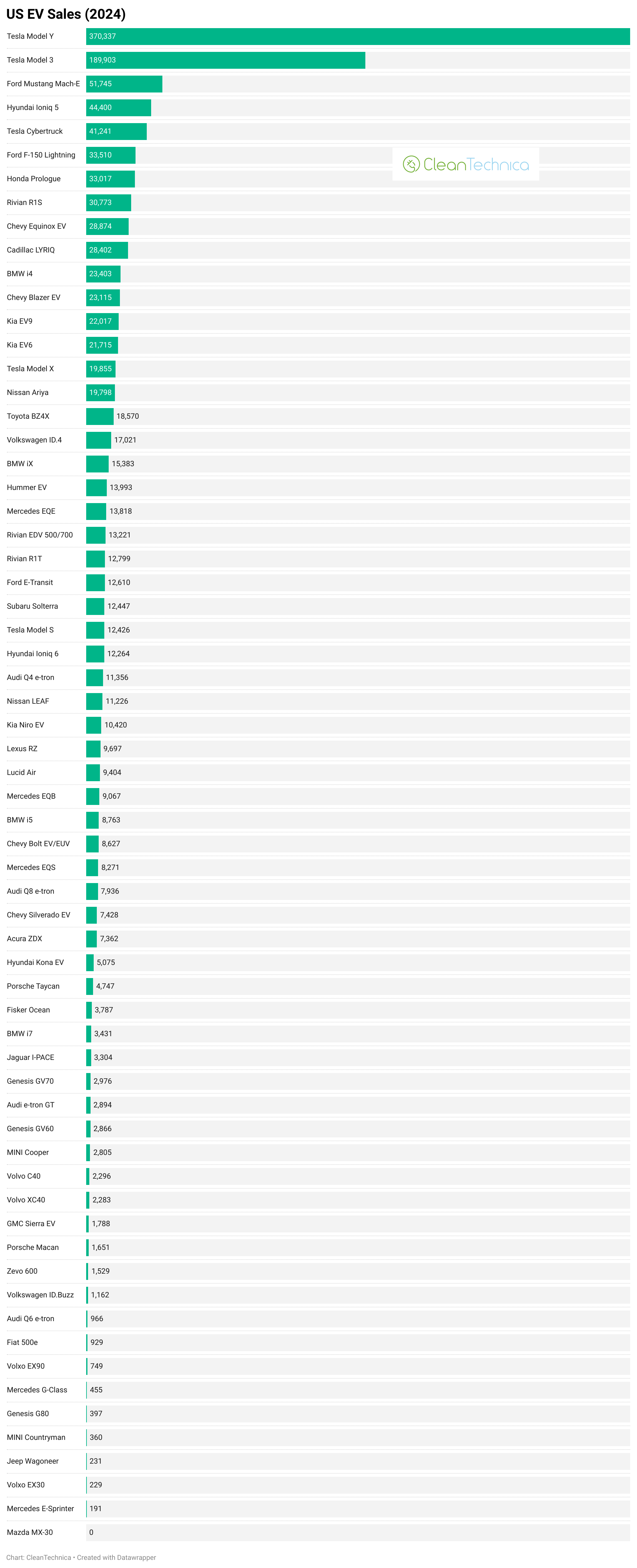

The Tesla Model Y is in a league of its own, and the Tesla Model 3 is too, just one league below the Model Y’s league. Unfortunately, it then takes sales from the next 12 models to approximately match the Model Y’s sales. But at least 1) there’s vast choice now, and 2) there are 30 models getting 10,000 sales or more a year, and 8 models getting more than 30,000 sales a year.

Okay, fine, this is still quite disappointing, but it’s much better than three years ago — 166% better.

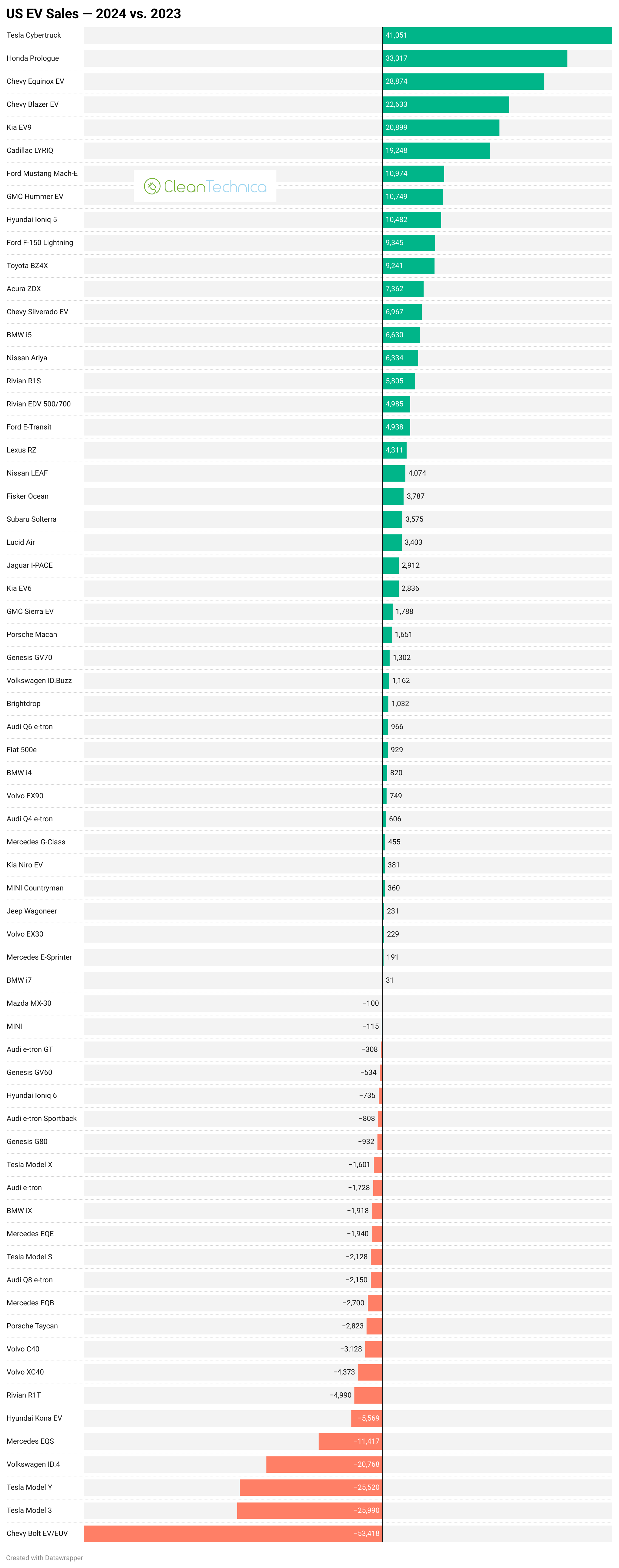

Comparing these models’ sales in 2024 to their sales in 2023, we can also see which models have had the strongest growth or have had the biggest decline. Looking in volume terms, the big winners are basically all new models. Though, among somewhat established models, the Cadillac LYRIQ did quite well, growing by 19,000 units. Ford’s Mustang Mach-E and F-150 Lightning also scored sales growth of about 10,000 units each, as did the Hyundai IONIQ.

On the downside, Tesla’s two main models combined for 50,000 fewer sales in 2024, and the Volkswagen ID.4 and Mercedes EQS also had deep drops.

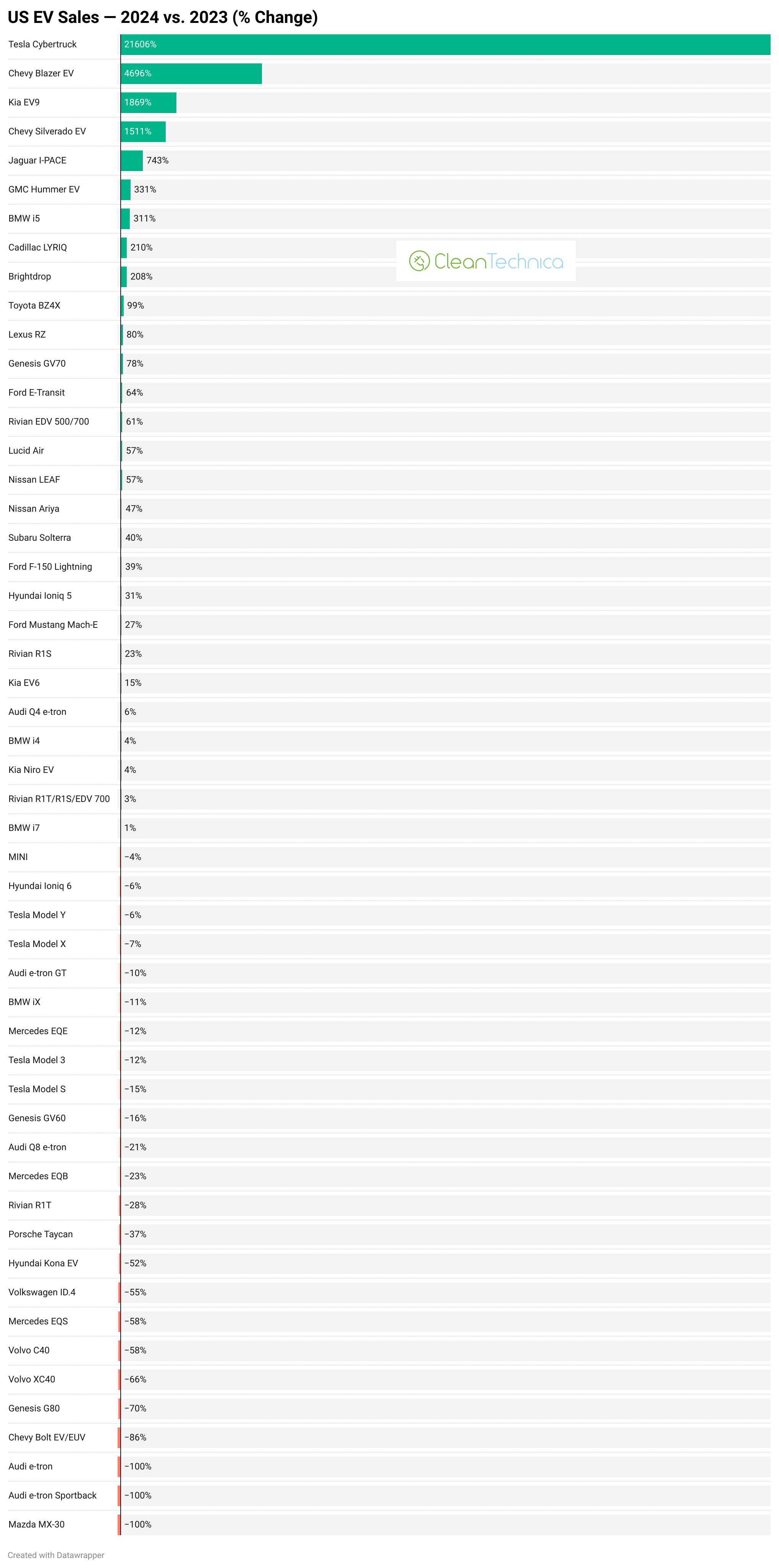

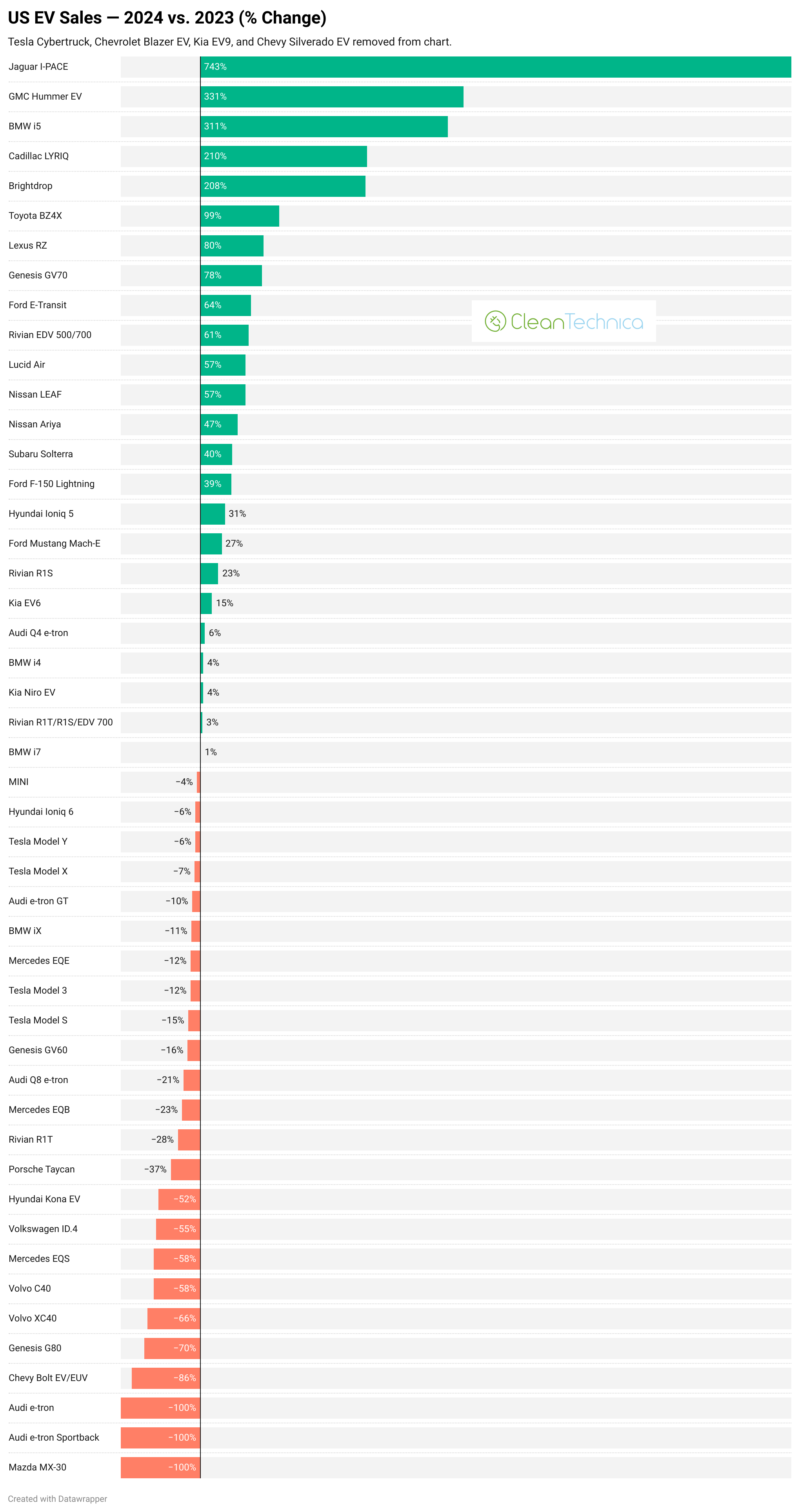

Looking at the models in terms of percentage growth, a handful of models that had only a trickle of sales at the end of 2023 and then volume sales in 2024 warp the chart so much that it’s hard to tell what’s going on otherwise….

… So, here’s another chart below with four models removed. The big winners in terms of percentage growth were clearly luxury models. A few delivery vehicle models also did quite well.

Volvo Cars, for some reason, had a particularly bad year as well.

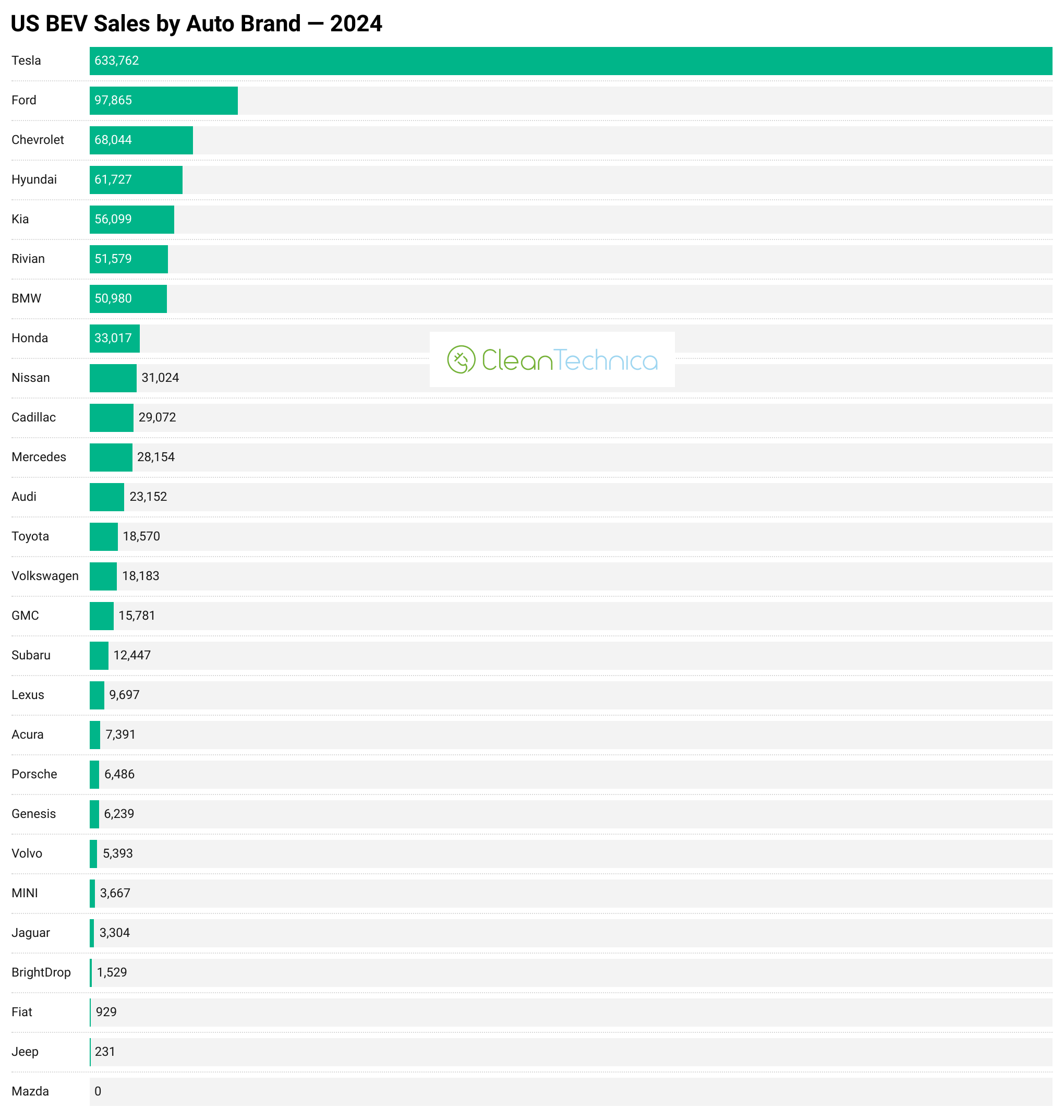

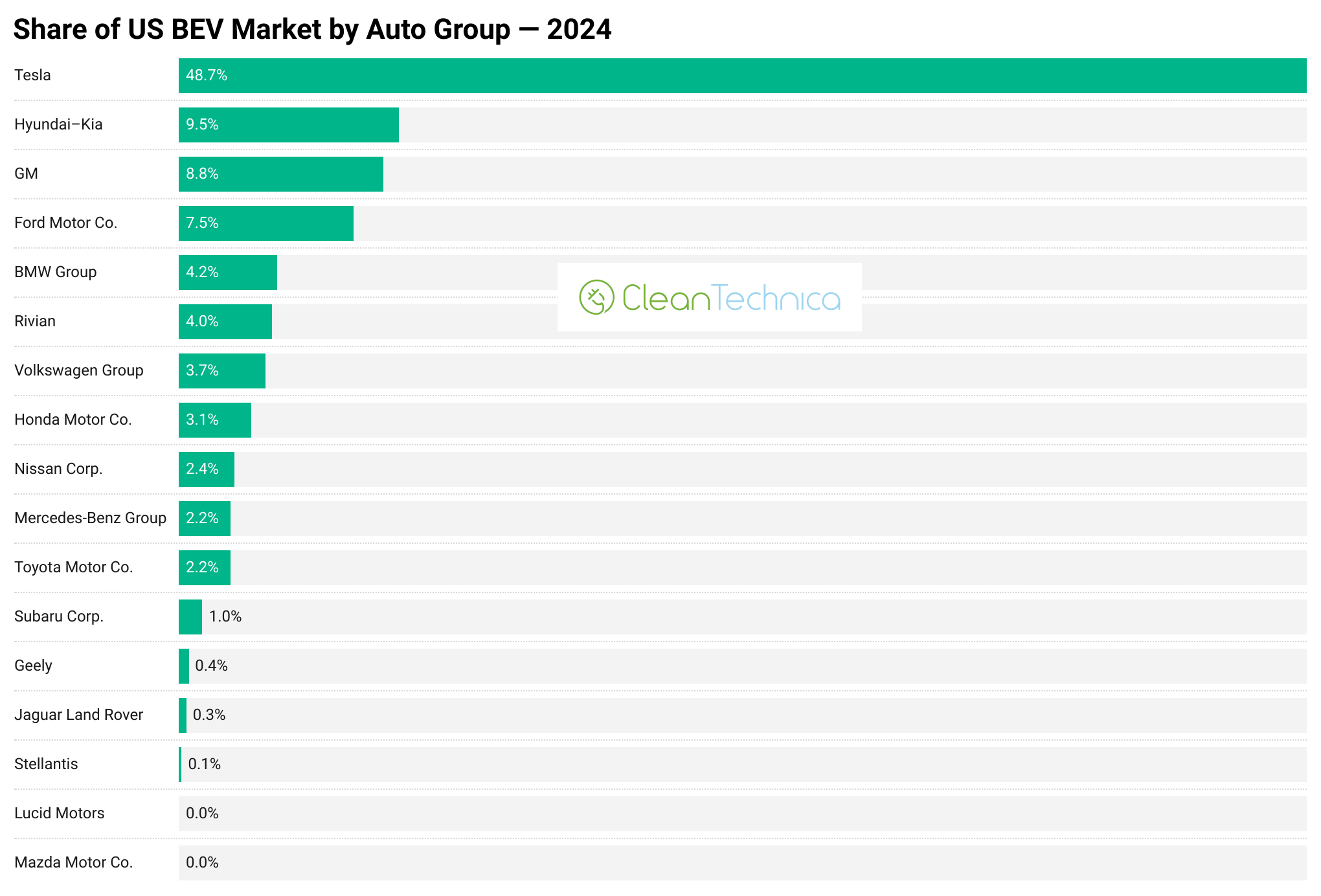

In terms of the auto brands that performed especially well in the US EV market, after Tesla’s dramatic position at the top (48.7% of EV market share), Ford got the solver medal (7.5%), Chevrolet got the bronze (5.2%), and Hyundai (4.7%) and Kia (4.3%) were not far behind Chevrolet rounding out the top 5.

And Ford got nearly 100,000 EV sales in 2024!

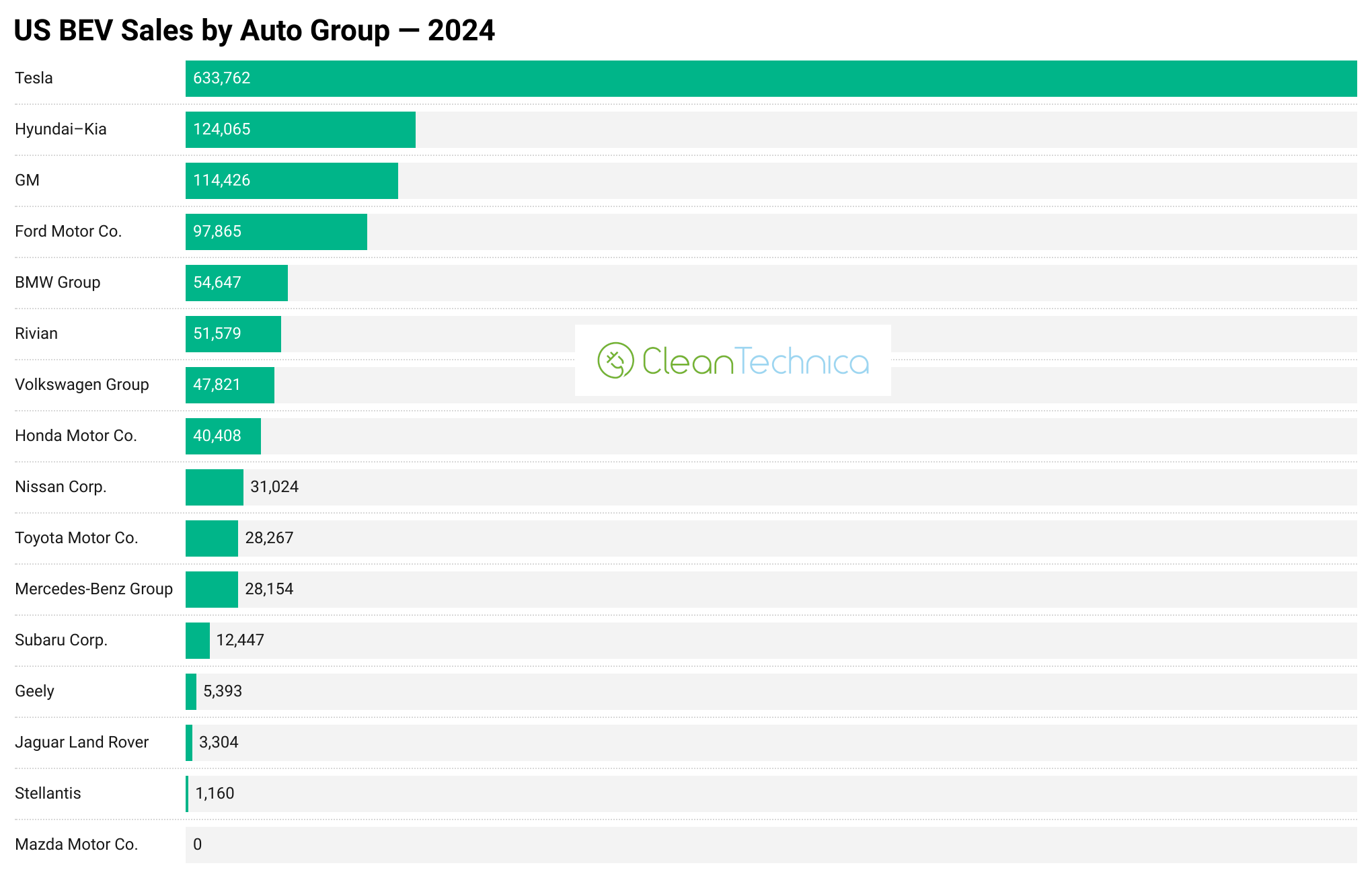

Looking by automotive group (or overly complicated alliance), Hyundai–Kia came in second, a bit above GM, and two full percentage points above Ford. Combined, those four brands accounted for about 75% of US EV sales last year.

Any other thoughts from these charts and stats?

Thanks to Cox Automotive and Kelley Blue Book for pulling in some of the EV sales data certain automakers don’t provide.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy