US steel news sources and markets were abuzz on December 18 over Nippon Steel’s purchase of U.S Steel. The $14.9 billion investment represents a significant step in Nippon’s plan to expand its U.S. assets, and pushed the Japanese company from the fourth to the third-largest global steel producer. In total, it will now account for roughly 86 million tons per year of global production. For now, reports indicate that the expected sale close date will be in Q2 or Q3 of 2024.

The eye-watering, all-cash offer equates to a striking 7.3 times U.S. Steel’s 12-month EBITDA, which left some critical of the move. While Nippon beat out several other leading producers, including ArcelorMittal and Cleveland-Cliffs, their respective shares increased following the announcement amid investor relief. However, Nippon noted optimism within the U.S. market due to its long-term growth outlook, cheap energy, and infrastructure efforts that would fuel demand for high-grade steel.

Know how the U.S. Steel & Nippon Steel merger is going to impact your steel supply chain. Opt into MetalMiner’s weekly newsletter to receive ongoing, weekly updates.

US Steel News Sources Indicate Senators Frustrated with Deal

At one time, Cliffs appeared as the front runner in the sale. This company issued a starting bid of $7.3 billion, less than half of the final sale price. The steelmaker even boasted the support of the USW union. Had it been successful, this would have given Cliffs exclusive control over domestic BOF production, which feeds the auto sector.

US steel news sources indicate that United Steelworkers strongly opposed the sale to Nippon, noting it was “the same greedy shortsighted attitude that has guided U.S. Steel for far too long.” The union reportedly intends to lobby regulators over national security interest concerns amid the sale to a foreign-owned company. However, it’s important to note that Nippon agreed to honor all USW contracts and leave U.S. Steel headquartered in Pennsylvania.

Industry insiders tell MetalMiner that Cliffs CEO Lourenco Goncalves and U.S. Steel CEO David Burritt are not exactly friendly. Apparently, U.S. Steel won over 650k tons of long-term business after Goncalves hiked steel prices earlier this year. Furthermore, some claim the bid looked more like a hostile takeover than a competitive bidding process.

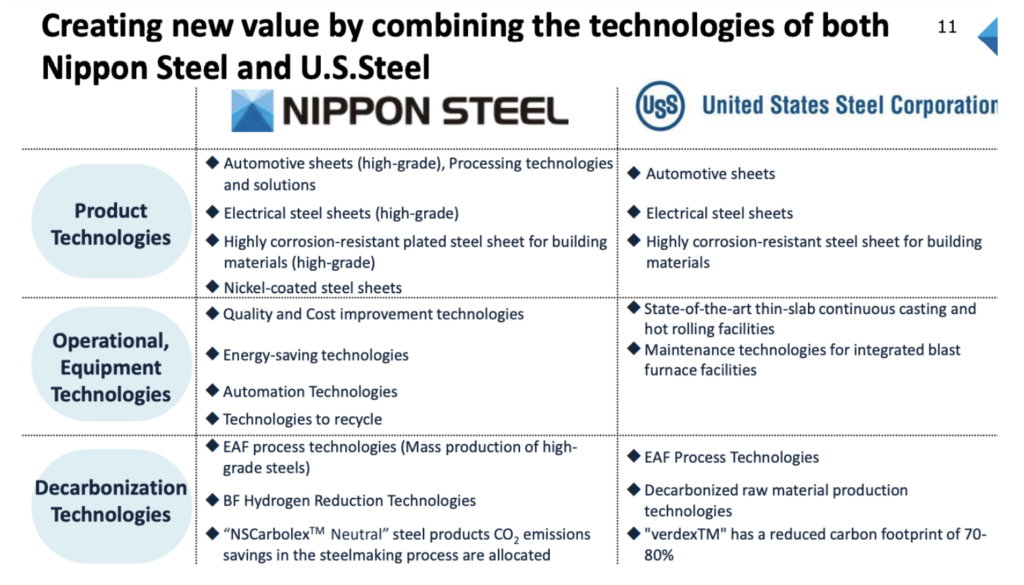

Value Created by Combining U.S. Steel and Nippon Steel

However, concern about the takeover has already started to gain political traction, with Senators Casey and Fetterman releasing separate statements opposing the decision. Sen. Casey stated, “From initial reports, this deal appears to be a bad deal for Pennsylvania and for Pennsylvania workers.” Meanwhile, Sen. Fetterman stated, “Steel is always about security – both our national security and the economic security of our steel communities.” Fetterman also said he is committed “to doing anything I can do, using my platform and my position to block this foreign sale.”

That said, MetalMiner does not believe the sitting senators from Pennsylvania will have much of a case to block the sale. Several other steel mills boast significant market share, and with Cliffs and ArcelorMittal owning additional BOF assets, the claim that this will impact national security appears weak. In addition, many other Japanese transactions have gone through. This makes it unlikely that the deal will see any serious opposition from the automotive or energy sectors, two key markets for Nippon/U.S. Steel.

Stay ahead of steel market shifts caused by the Nippon Steel/U.S. Steel merger. MetalMiner’s 2024 Annual Metals Outlook report provides comprehensive steel price forecasting for 12 months, along with 3 quarterly updates. Get a sample of the most recent report.

Most U.S. Steel Buyers See the Deal as Good News

While opposition could complicate the acquisition, other sectors could breathe a sigh of relief. A Cliffs deal would have created significant industry consolidation in BOF production (body-in-white for the automotive industry) and limited competition. US steel news indicated that the auto sector, in particular, will continue to benefit from ongoing domestic price competition between Nippon and Cliffs, though Nippon will likely not discount to the extent that U.S. Steel did.

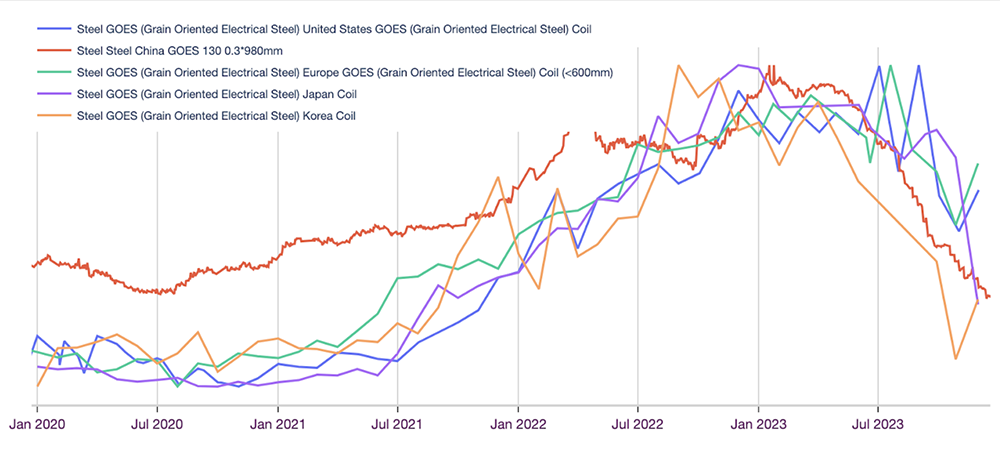

The move will also support domestic competition for GOES, as Nippon aims to capitalize on its expertise in the space. Indeed, GOES prices saw significant spikes starting in 2021, and only recently found a peak in September. Large power equipment manufacturers are also likely relieved that Cliffs will not serve as the monopoly domestic supplier of GOES. However, in 2023, the U.S. GOES price consistently traded higher than other global markets.

Of the various potential deal structures (no deal, ArcelorMittal as acquirer, Cliffs as acquirer, or Nucor + other as acquirer), the former would have been the only negative option for buying organizations. Indeed, any of the other scenarios could have significantly reduced BOF capacity. Finally, a recent Reuters article states that U.S. Steel will likely replace Cliffs as the slab provider to ArcelorMittal and Nippon’s Calvert plant in 2025.

Though many press accounts and MetalMiner industry sources believe Nippon overpaid for U.S. Steel assets, little attention has gone toward the Big River Steel NOES line and future investments in GOES lines. After all, the acquisition secures additional domestic capacity for the electrical steels needed to fuel electric vehicle growth, new grid capacity, and electricity upgrades. Nippon serves as an industry leader for these types of materials and applications. Therefore, U.S. buying organizations will be better off having Nippon guiding BRS and U.S. Steel investments.

Subscribe to MetalMiner’s free Monthly Metals Index report and use it to anticipate market changes for GOES and other steel forms in order to make strategic purchasing decisions.