Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

It’s time again to look back on quarterly US auto sales, comparing Q3 2024 to Q3 2023, Q3 2022, Q3 2021, Q3 2020, and Q3 2019. In other words, we’re going way back to try to get a good picture of auto sales trends in the country. Of course, a few years there were really disrupted by COVID-19 as well as the Russian invasion of Ukraine, which is part of the reason why I like looking back to 2019. Keep that in mind when checking out some of the charts. To start with, let’s look at the big picture, comparing Q3 2024 sales to all of those quarters above in two charts.

As you can see, overall auto sales were down by 365,000 units, or 8%, in Q3 2024 compared to Q3 2019. They were also down slightly, by 9,641 units or 8%, compared to Q3 last year. They were up slightly compared to Q3 of COVID year 2020, and up massively compared to Q3 2021 and Q3 2022.

Electric car sales, of course, have grown every year. They were up 8% compared to Q3 2023 and up 474% compared to Q3 2019.

For another big picture view, below is an extremely large chart showing these trends going back to Q3 2019 for each automaker. An interactive version of the chart is available on the bottom of the article for easier viewing. The key thing here overall is that you can see many automakers have seen their sales decline significantly since 2019, but some automakers have bucked that trend, especially in 2024, and grown their sales. Of course, Tesla’s sales are up multiple times over, and other EV startups have risen from nothing (0 sales) to where they are today.

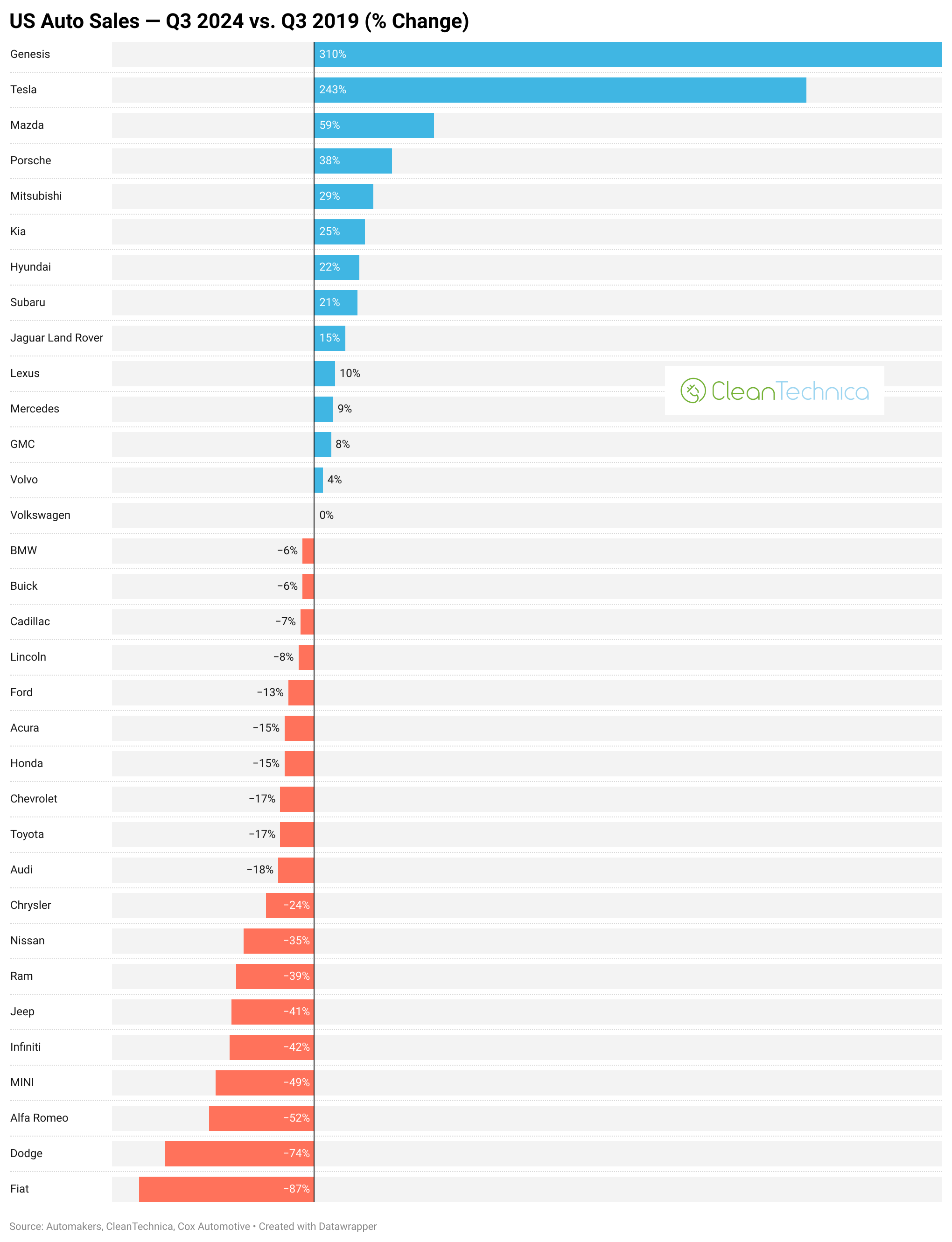

For a more detailed look, let’s dive into quarter-over-quarter comparisons. We’ll start way back in 2019.

Comparing Q3 2024 to Q3 2019 sales, Tesla sales are up massively — by more than 118,000 units and 243%. Mazda, Subaru, Kia, and Hyundai also saw a notable rise. On the flip side, eight automakers declined significantly in volume terms (Nissan, Jeep, Toyota, Chevrolet, Dodge, Ford, Ram, and Honda), and several small auto brands declined dramatically in percentage terms (Fiat, Alfa Romeo, MINI, and Infiniti).

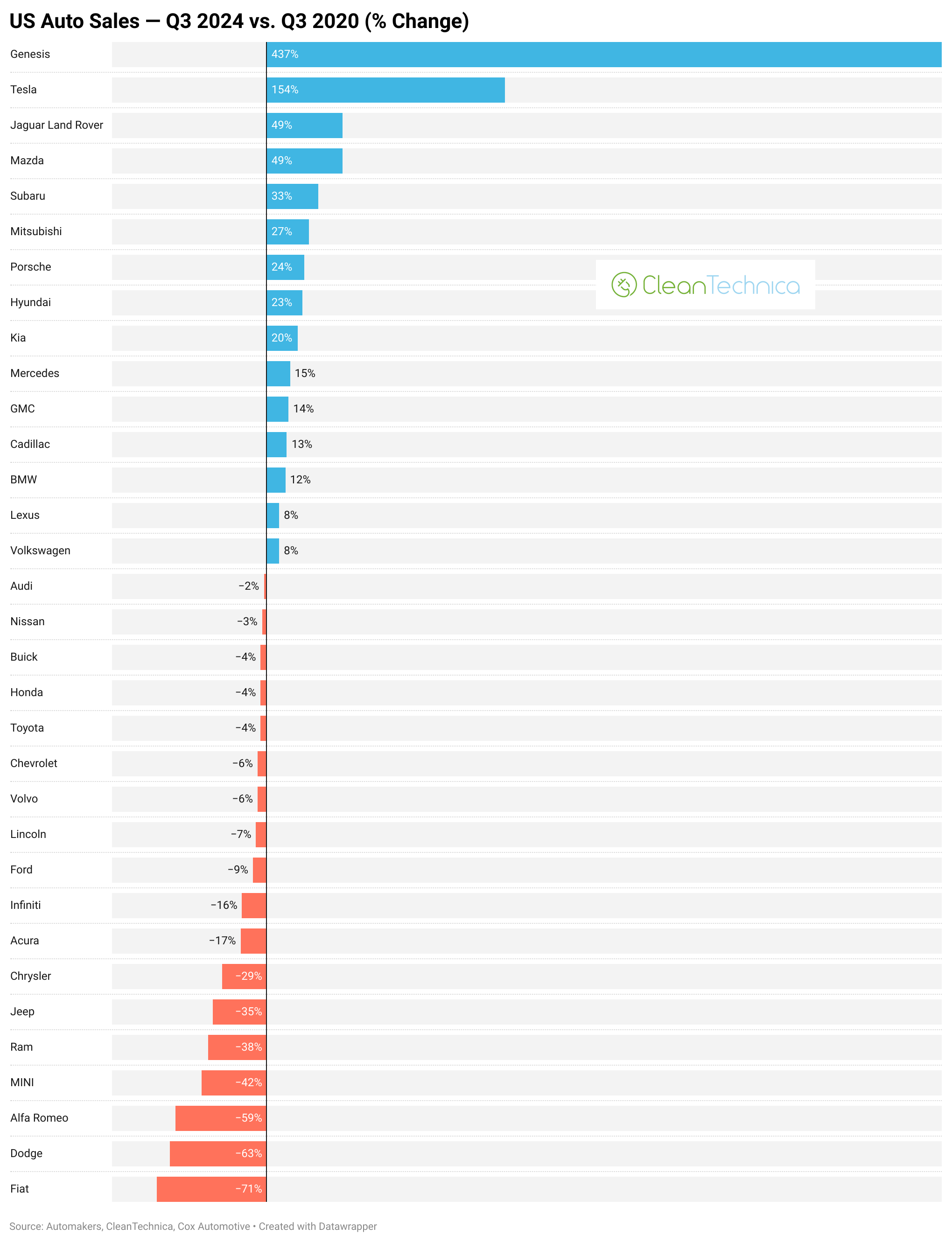

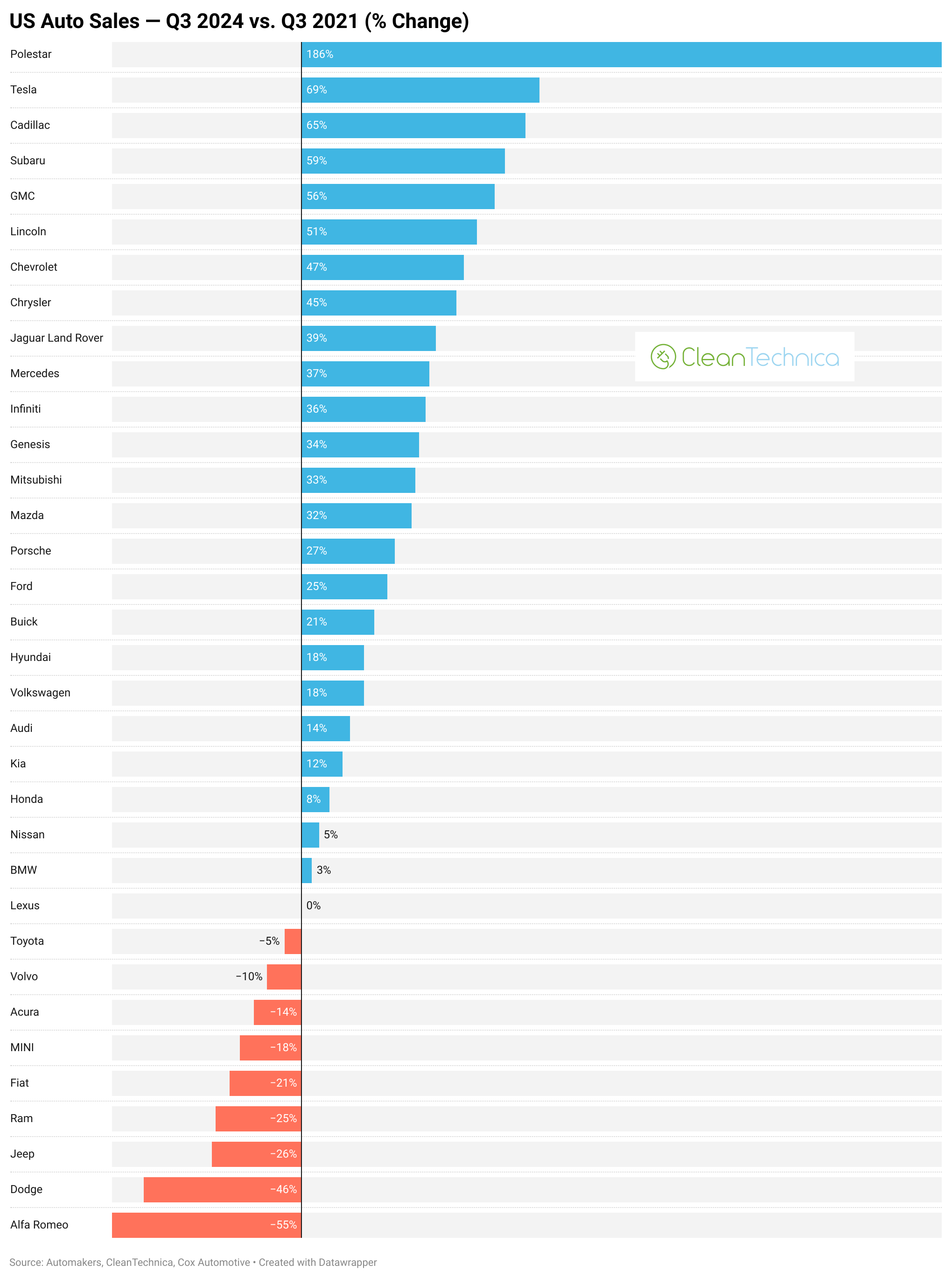

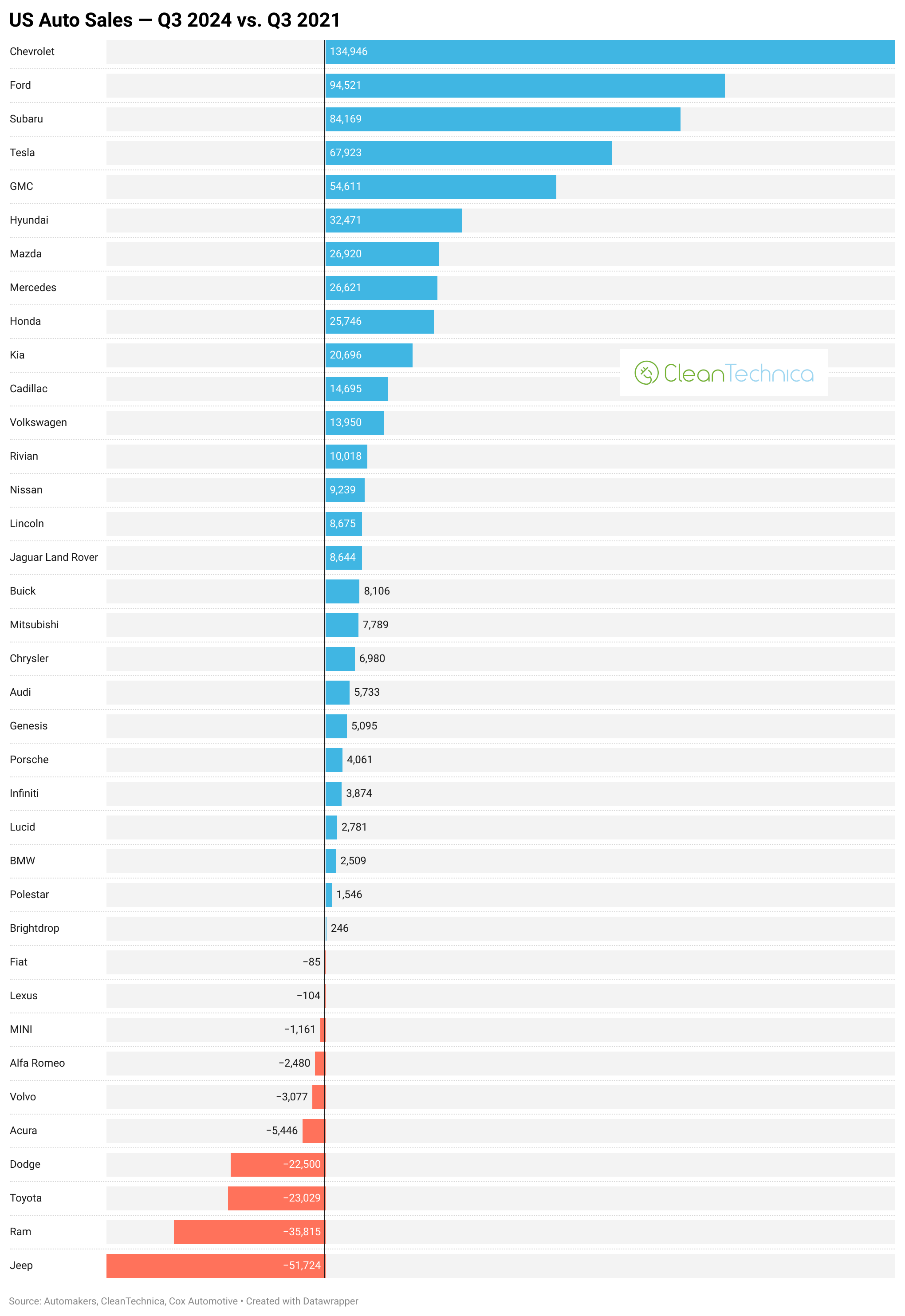

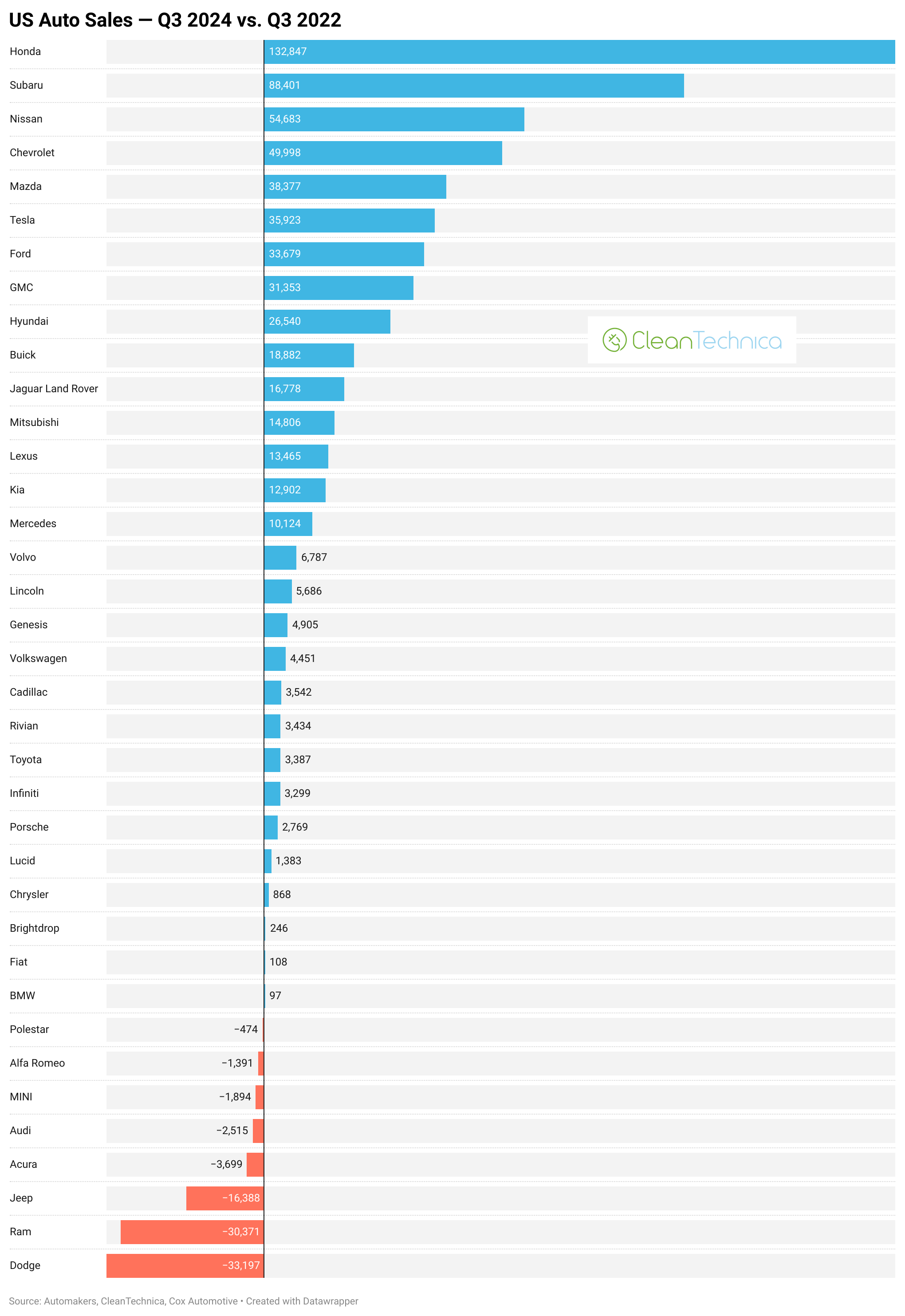

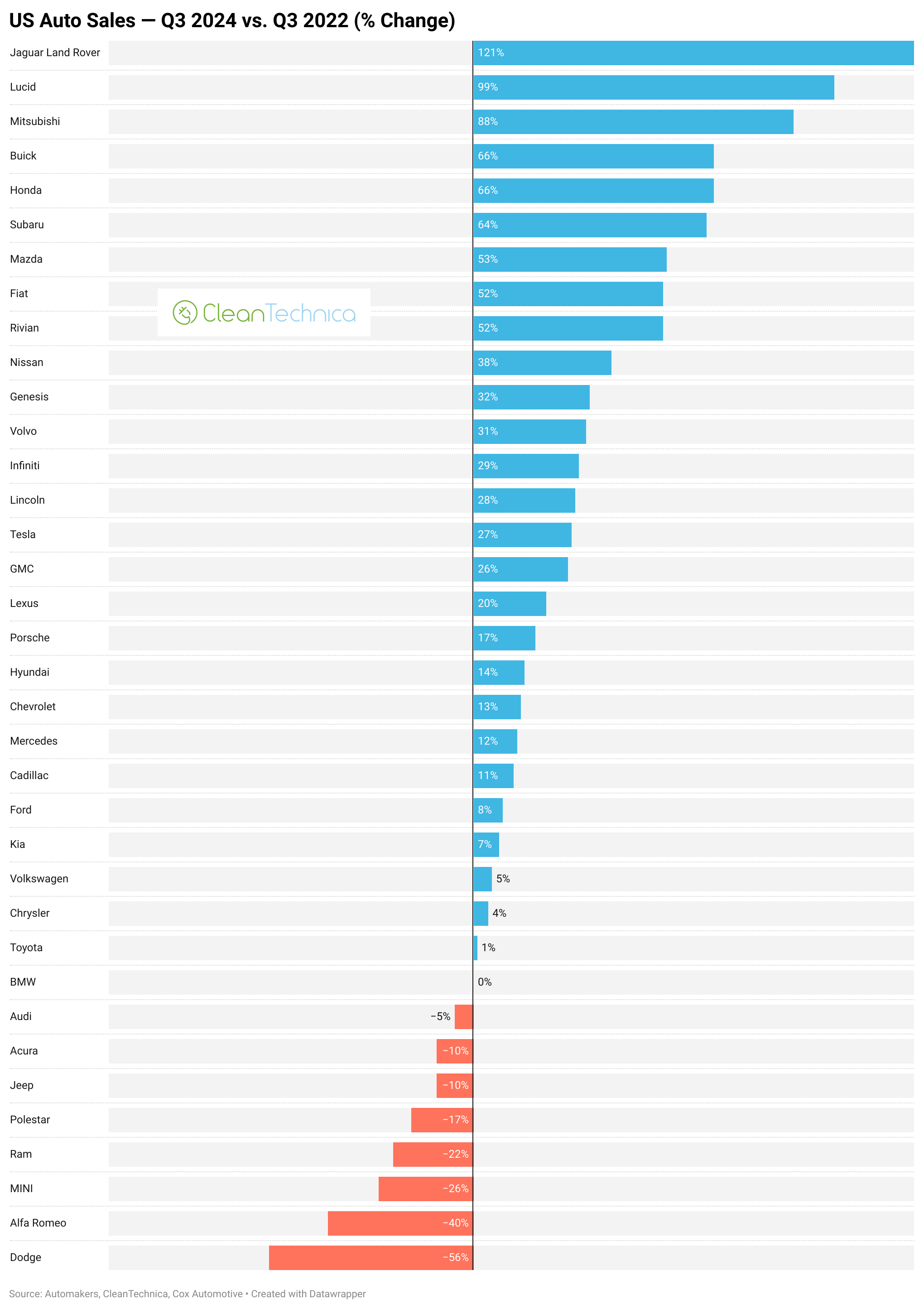

I’m going to skip discussion of the next few years since they were warped so much by big macro issues, but will include the charts below. I’ll catch back up with you to discuss comparisons to Q3 2023 way down below all of these charts.

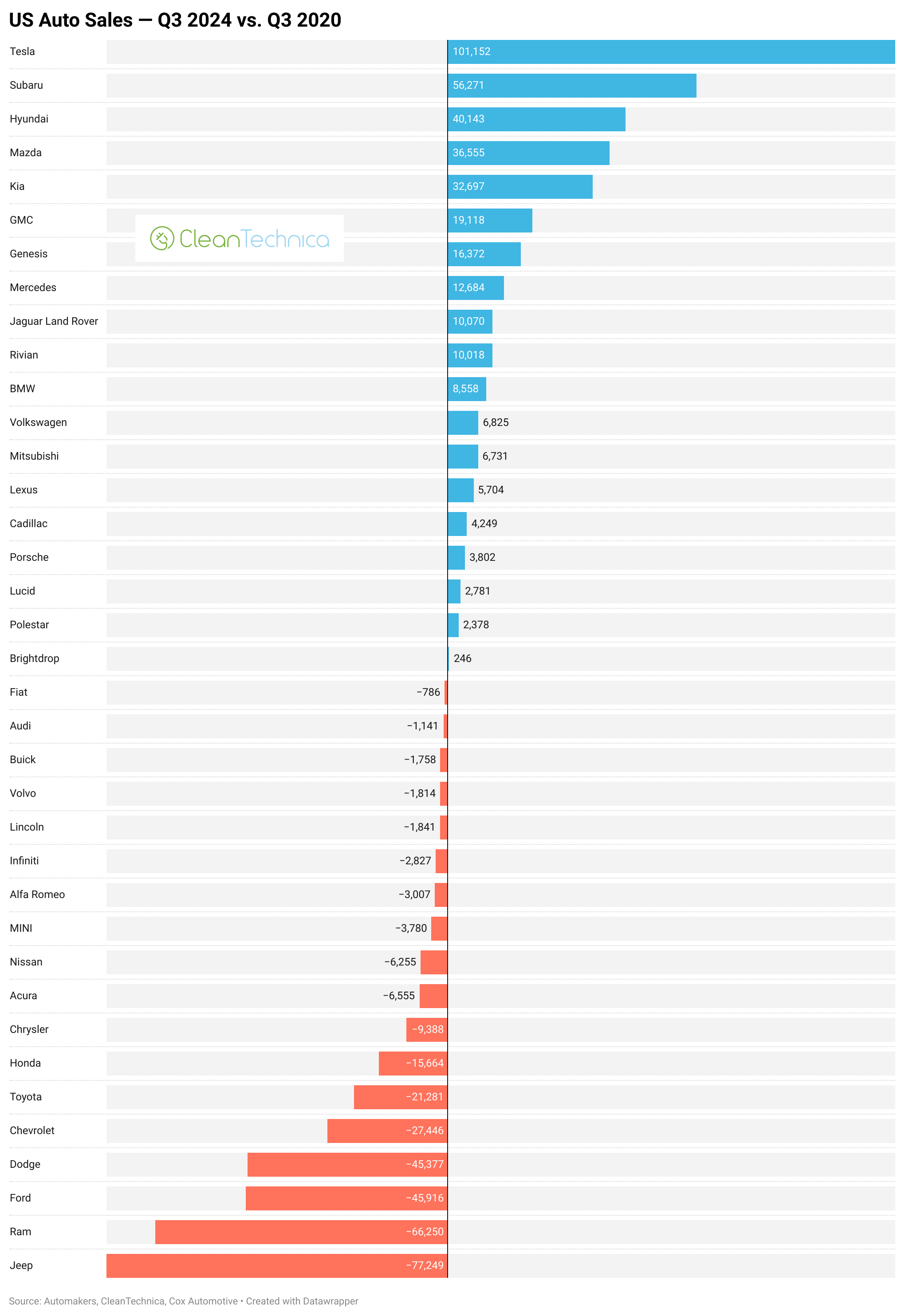

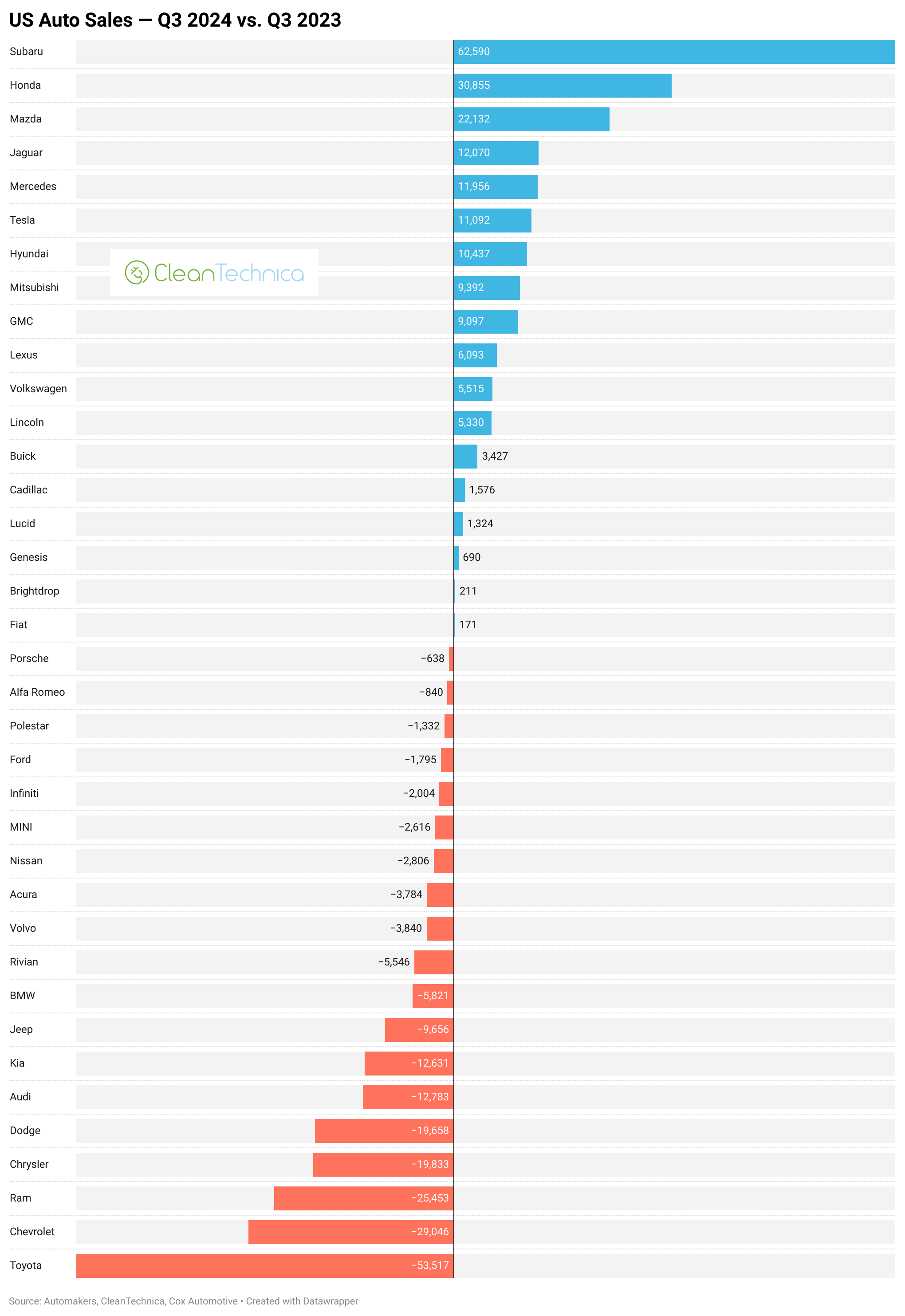

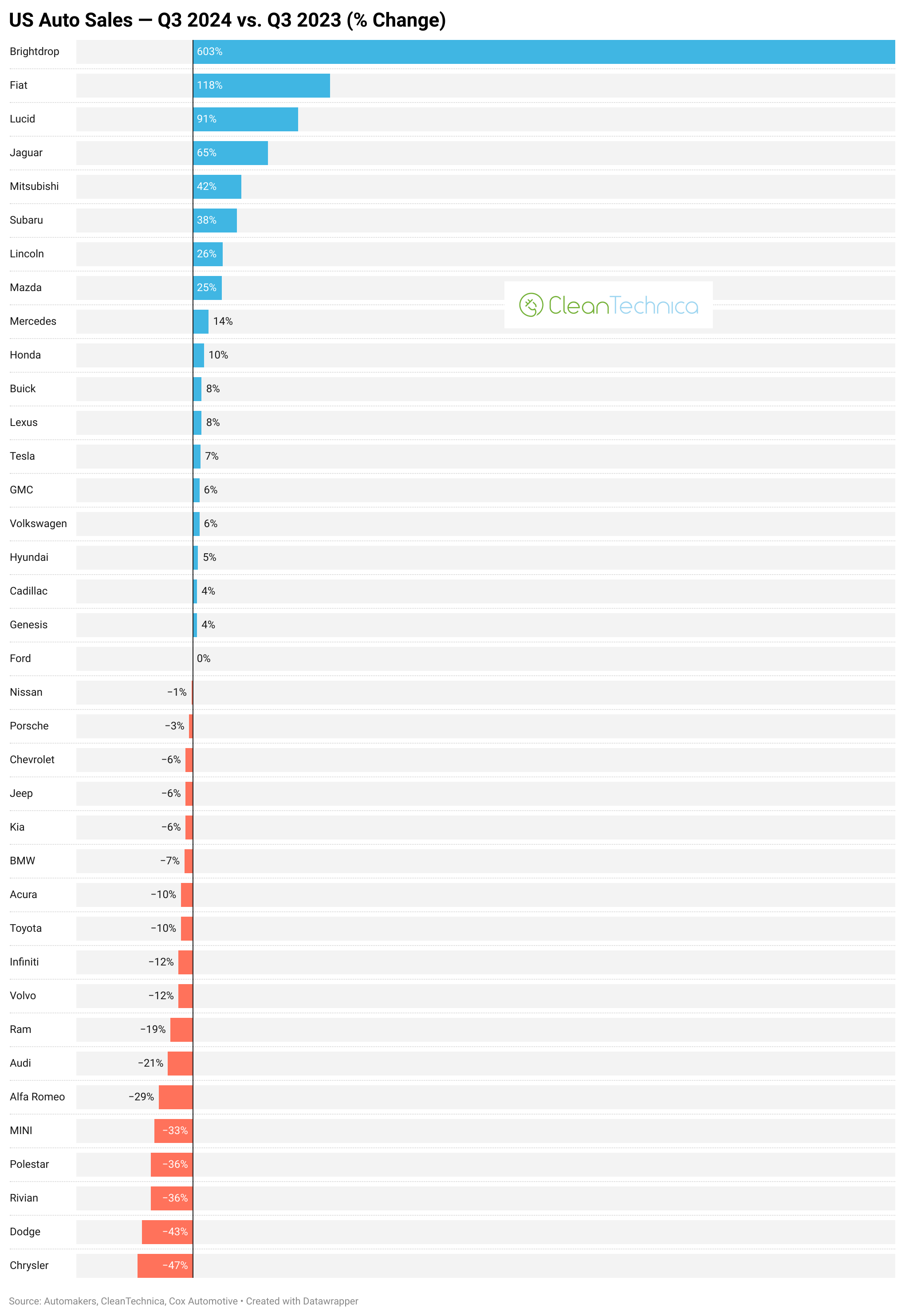

The big changes here are probably a bit more surprising or out of the blue. Subaru sales have jumped tremendously. Honda and Mazda sales are up quite a bit. And then Jaguar Land Rover, Tesla, Mercedes, and Hyundai sales are up by more than 10,000 units.

On a percentage basis, a few small brands — Brightdrop (EVs), Fiat, Lucid (EVs), and Mitsubishi — saw a nice bounce, as did Jaguar Land Rover and Subaru again.

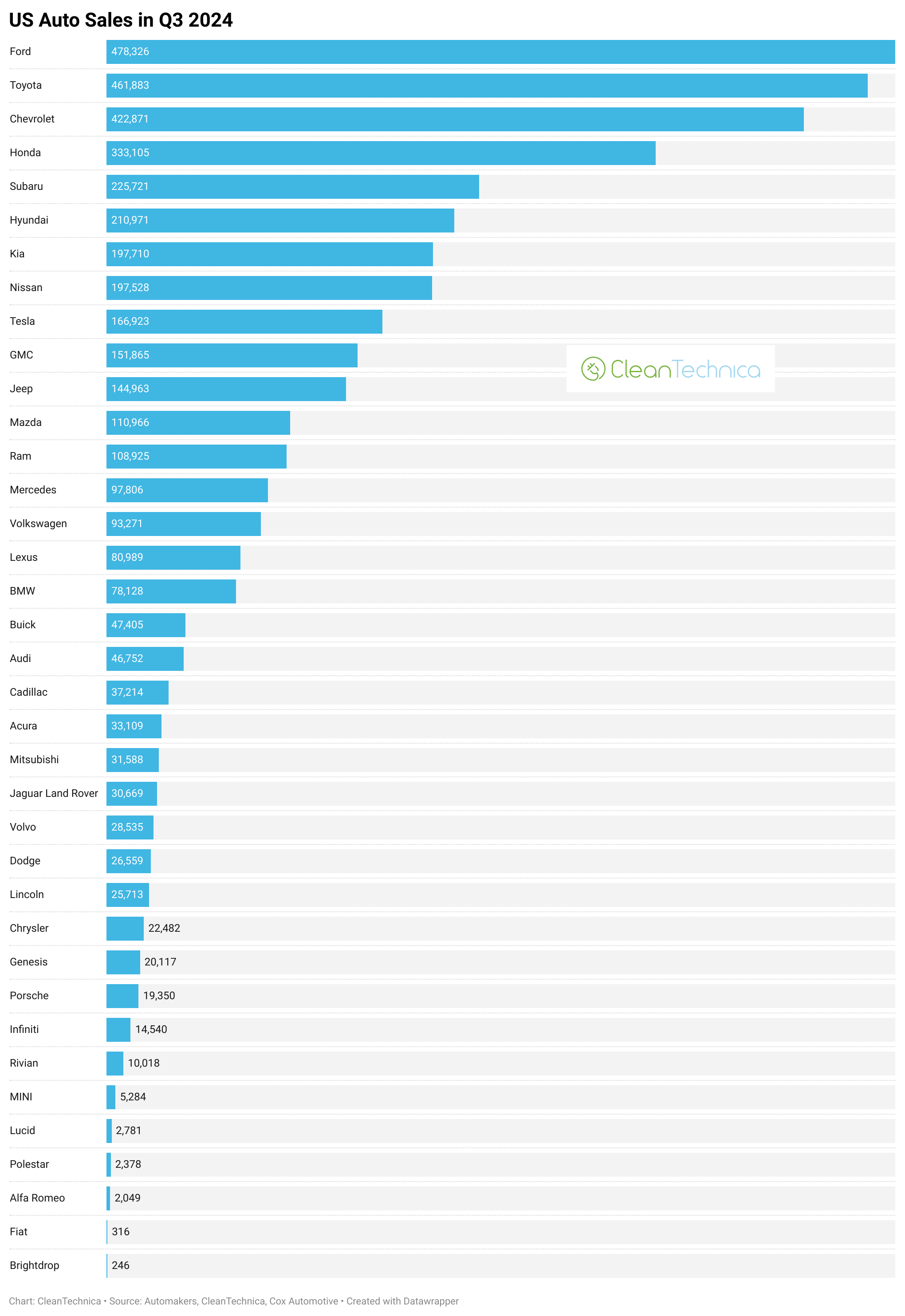

Just looking at total auto brand sales in Q3 2024, Ford is still king of the hill, Toyota is close behind, and Chevrolet has a clear grip on 3rd place if it doesn’t find a way to climb above Ford and Toyota. Honda’s solidly 4th before you get to the mid-tier remainder of the top 10 — Subaru, Hyundai, Kia, Nissan, Tesla, and GMC.

I’ll dive into the EV portion of sales and EV trends compared to fossil fuel vehicle trends in another article or two. Stay tuned! In the meantime, here’s that interactive chart I mentioned above (best viewed on a real computer):

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy