Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

It’s time for another look at how the US auto industry has changed in recent years, in this report focusing in on the 4th quarter and extending from 2024 back through 2019. Let’s dive in and see how things have changed across the industry first, before narrowing down to the auto brand level.

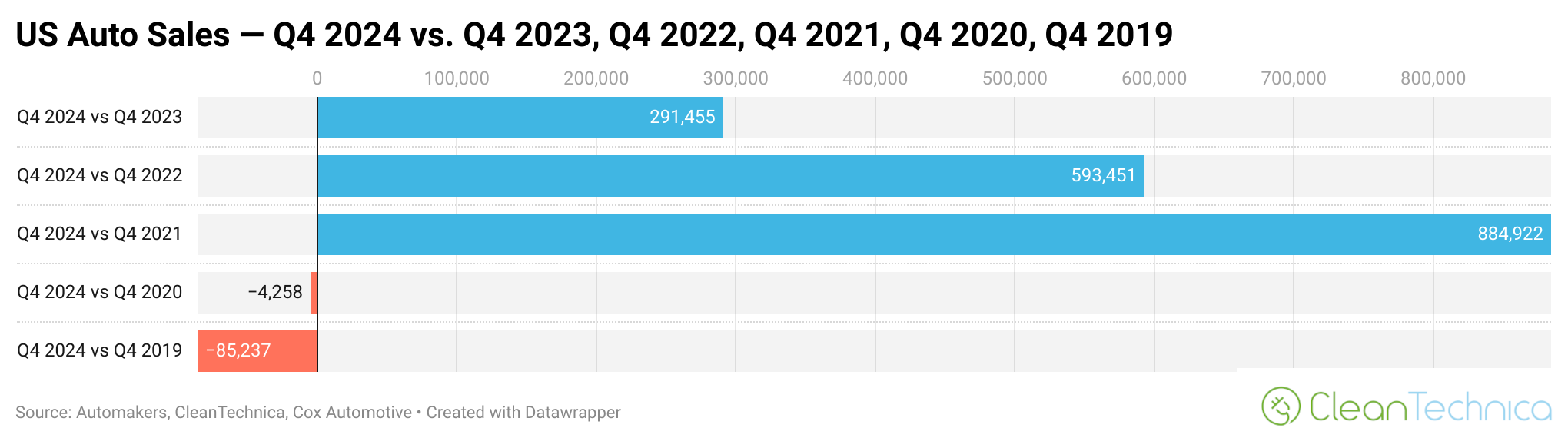

As you can see in those first two charts, post-COVID, the auto industry has been growing steadily and pretty strongly in the past three years. Auto sales grew 7% in Q4 2024 versus Q4 2023, 16% compared to Q4 2022, and 27% compared to Q4 2021. However, that said, the industry has not recovered to its pre-COVID level. Q4 2024 had 2% fewer sales than Q4 2019, or about 85,000 fewer sales.

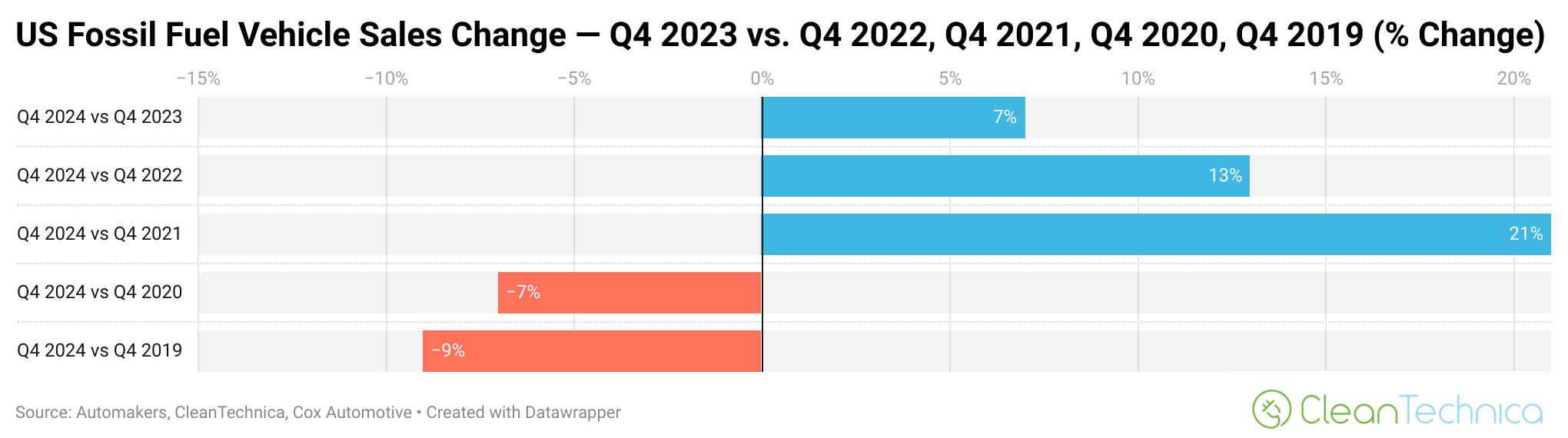

Zooming in on fossil fuel vehicle sales, we can see that the story is a bit worse for these “old-school vehicles.” Non-electric automobiles still had 7% more sales than in the 4th quarter of 2023, but had 13% more than Q4 2022 (compared to 17% more in the overall market) and 21% more than Q4 2021 (compared to 27% more in the overall market). That’s still growth, of course, but then compared to Q4 2020, sales were down 7%, and compared to Q4 2019, sales were down 9%.

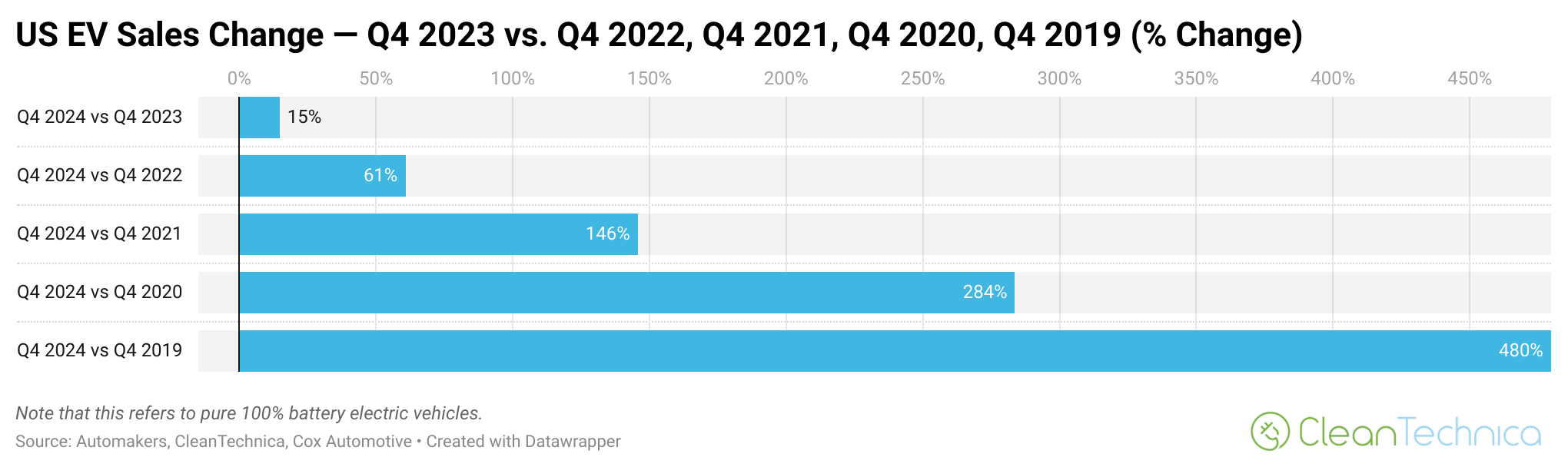

What does that mean? Naturally, that means EVs have seen strong growth over the past 5 years. EV (pure battery-electric vehicle) sales were up 15% in the 4th quarter of 2024 versus the 4th quarter of 2023, up 61% compared to the 4th quarter of 2022, up 146% compared to the 4th quarter of 2021, up 284% compared to the 4th quarter of 2020, and up 480% compared to the 4th quarter of 2019.

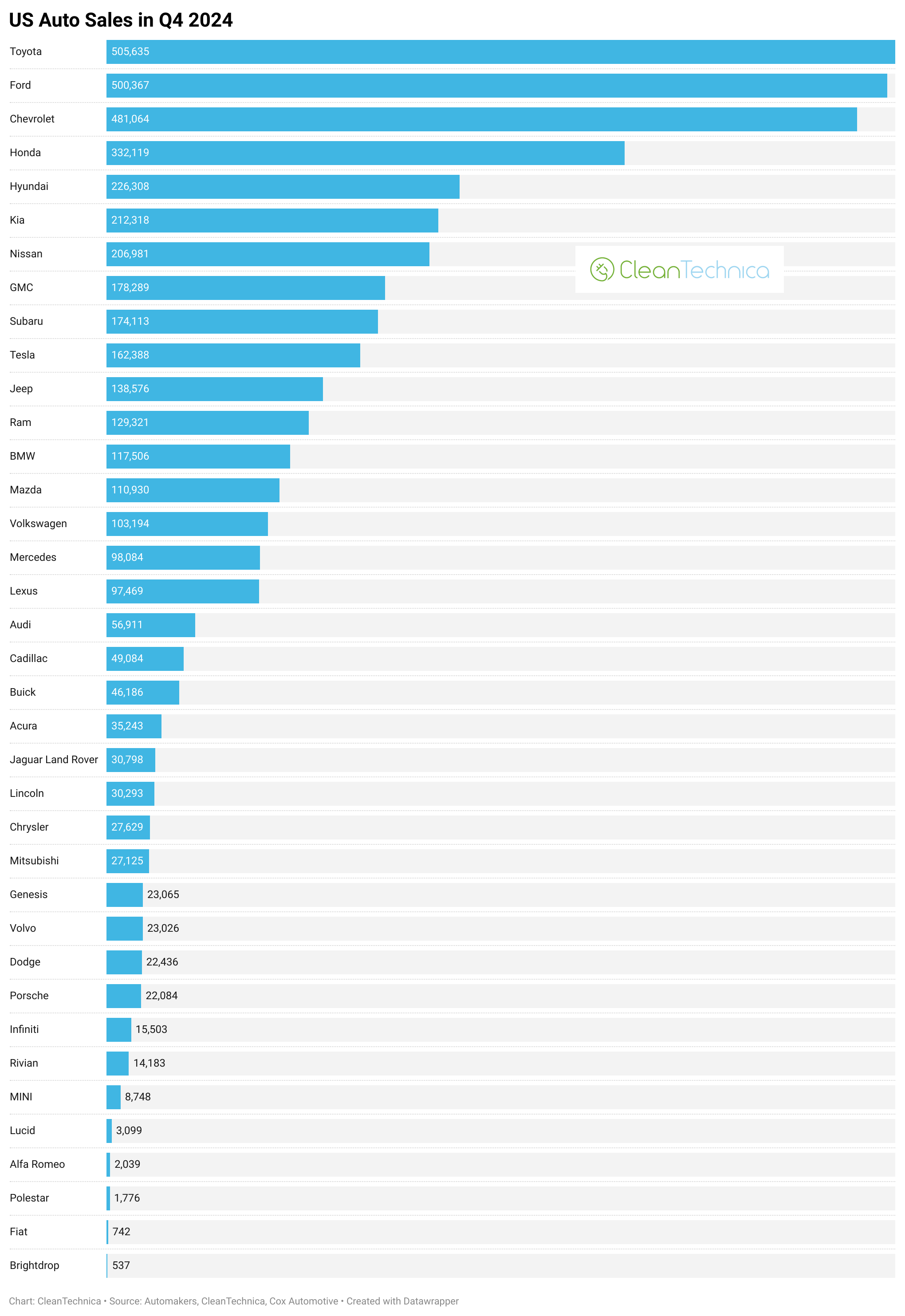

Just looking at 4th quarter 2024 sales by auto brand, Toyota, Ford, and Chevrolet sit well above the rest. Fully electric auto brand Tesla was down in 10th, at less than a third of Toyota and Ford sales and approximately a third of Chevrolet sales. Other fully electric brands are also on the market of course — Rivian, Lucid, Polestar, Brightdrop, and Fiat — but they are all down at or near the bottom of the sales chart (for now).

If you really want to spend 15 minutes or so looking at a chart, the one above has an enormous amount of detail. There’s also an interactive version of it on the bottom of this article.

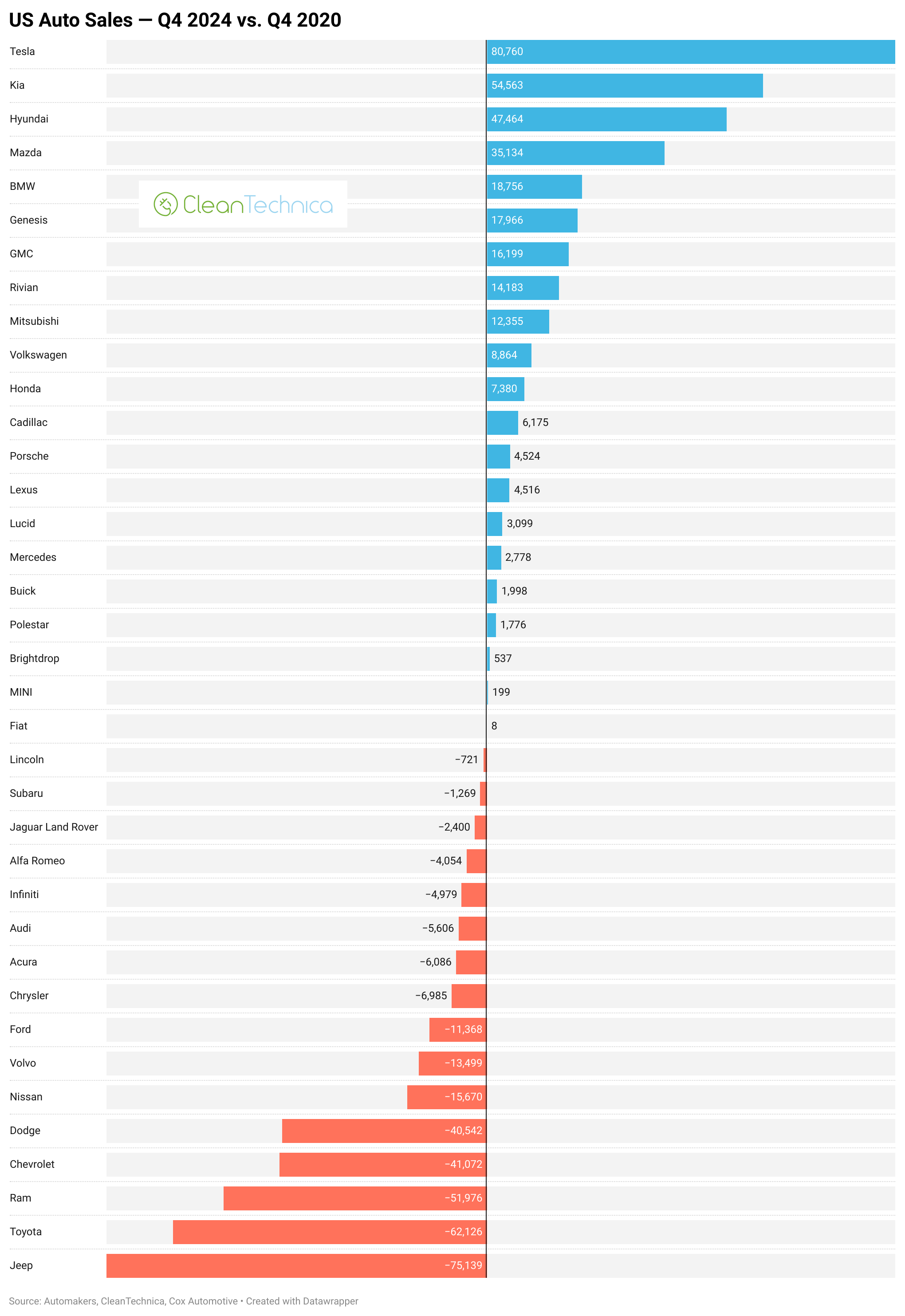

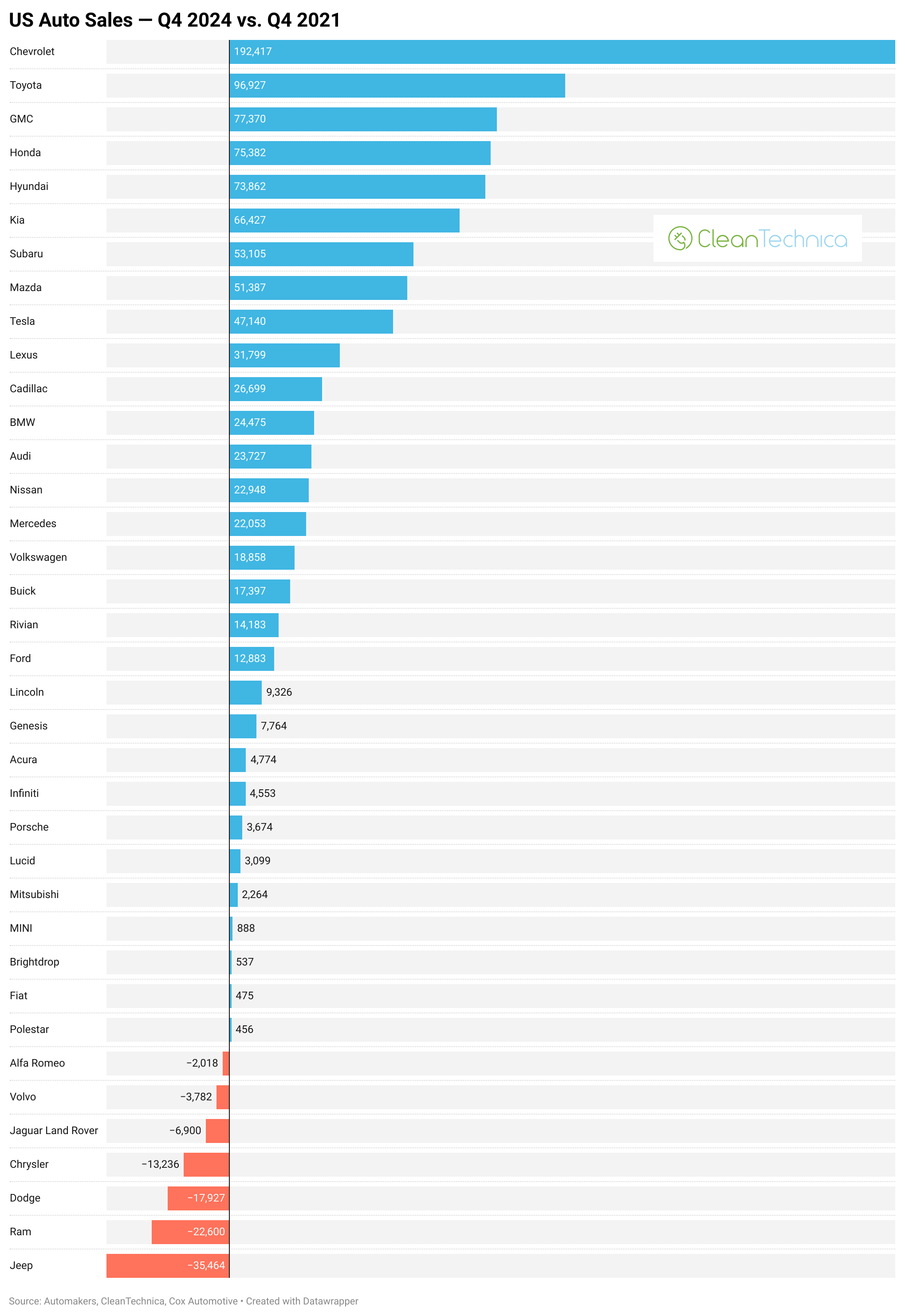

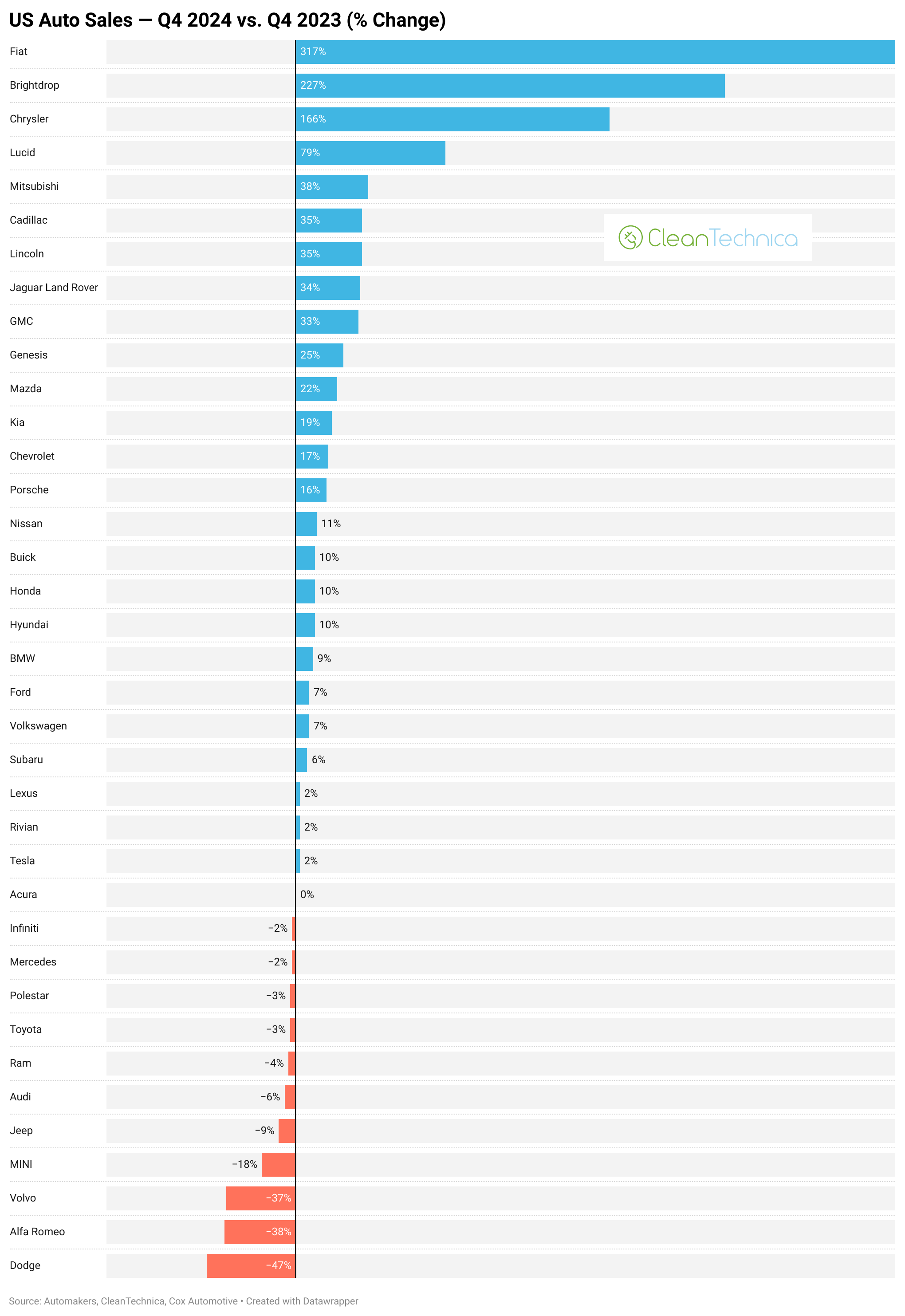

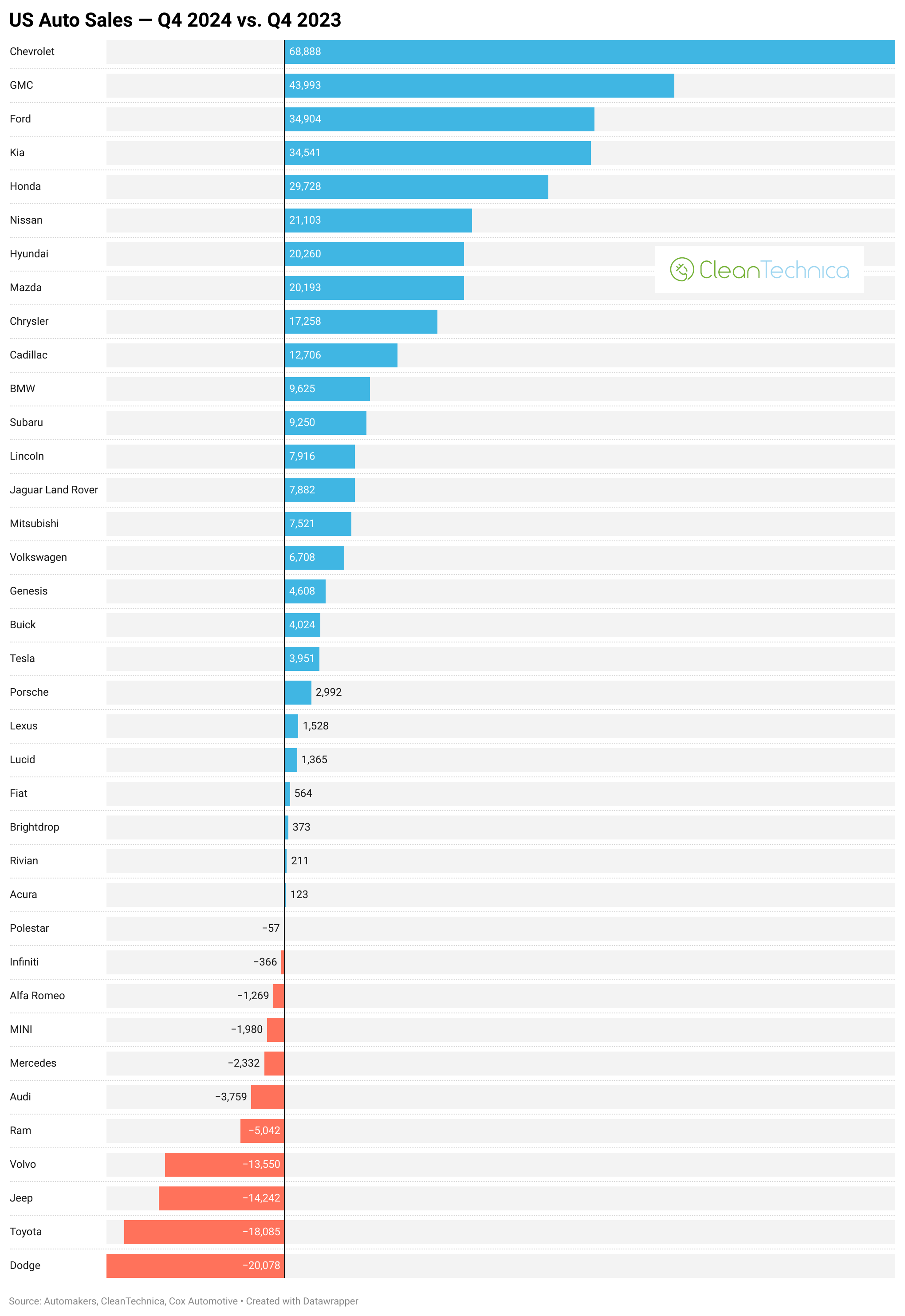

The next 10 charts look in more detail at the changes by brand quarter over quarter going back to 2019 (changes in both percentage terms and volume terms). I’ll start by looking back further (to Q4 2019) to highlight more dramatic changes in the market, but there are also notable changes in recent years.

Of course, Tesla grew a ton from 2019 to 2024, by 203%. Somewhat surprisingly, Genesis actually beat that with with 265% growth (but at a much lower volume). Meanwhile, there are big losses among various auto brands (Jeep, Dodge, Ford, Nissan, Ram, Alfa Romeo, Fiat, and Infiniti most notably).

It’s a similar story compared to Q4 2020, but Genesis had an even higher growth percentage! (352%) On a volume basis, it’s Kia and Hyundai that are right behind Tesla in terms of improvement over Q4 2019 and Q4 2020.

COVID clearly threw the market into a whirlwind for a few years. However, looking back to last year, we can get a more normal, steady-state market comparison. In this case, Chevrolet stands out with growth of nearly 69,000 sales in Q4 2024 compared to Q4 2023. GMC, Ford, Kia, and Honda also did quite well.

However, on a percentage growth basis, it was small players — especially electric ones — doing very well. Fiat, which is now 100% electric in the US, grew 317%. Brightdrop, a 100% electric brand from GM, grew 227%. Them after Chrysler growing 166%, 100% electric Lucid grew 79% year over year. Of course, these are all starting from very small levels, but it’s growth nonetheless. Interestingly, Cadillac was high up on that list as well and it’s been leading the legacy auto market for the percentage of its sales that are now electric car sales.

Any other big takeaways from these quarterly comparisons and the auto industry changes of the past 5 years?

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy