Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

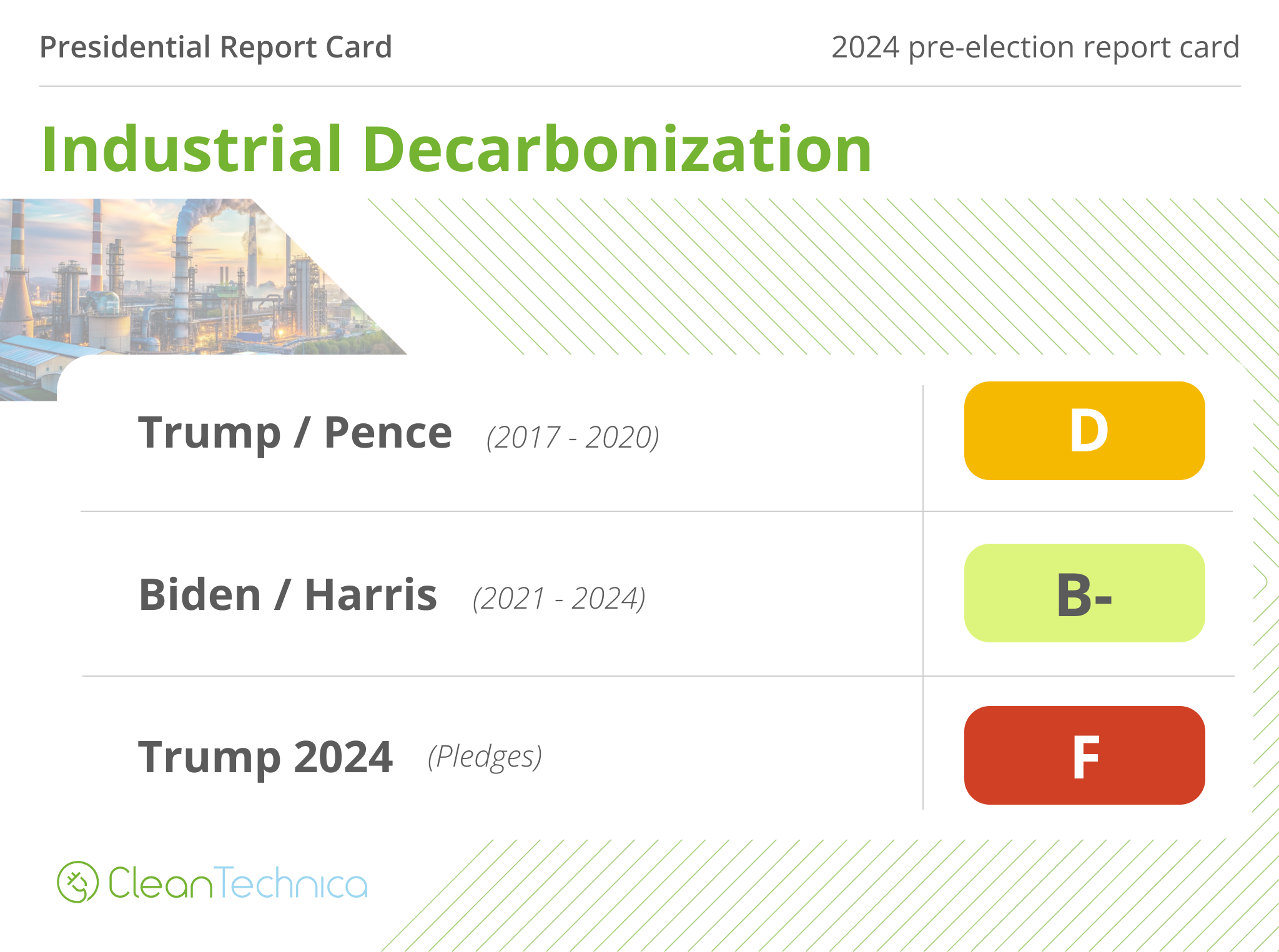

Four years ago, things looked bleak for federal action in the industrial sector.

Biden and Harris’ current plan is light on specific climate action for industry as well. The committed Kigali Amendment and Paris Accord ratifications will have flow-down impacts of course. There are research dollars for low-carbon concrete and further money to be thrown at carbon capture use and storage, but nothing substantive. Unfortunately, while Harris’ plan included a price on carbon, it’s unlikely to be on the table for the first term.

As noted earlier in this series, an attempt was made to bring a carbon price to the United States under the guise of an anti-China carbon border adjustment mechanism that snuck domestic pricing into the fine print, but fossil-Democratic pols like Manchin axed that before it made it to Congress.

While the carbon price died in committee, a price on leaked methane was introduced, $900 per ton starting in January 2024 for big emitters, equivalent to $36 per ton of CO2, rising to $1,500 in 2026. The Biden–Harris administration has also rolled out stringent new regulations targeting methane emissions from the oil and gas sector, aiming to slash this potent greenhouse gas by 74% from 2005 levels by 2035. The EPA’s rules mandate frequent inspections using advanced technologies like optical gas imaging cameras to detect leaks. Once identified, operators must repair leaks within 30 days and maintain detailed records of their activities. The regulations also require continuous emissions monitoring at larger facilities and comprehensive emissions reduction plans. Additionally, the rules seek to phase out routine flaring, a significant source of methane emissions. These measures apply to both new and existing wells and facilities, ensuring that older infrastructure is upgraded to meet modern standards.

The administration took decisive steps to restore funding, leadership, and integrity to the EPA, including significant budget increases to counter Trump’s cuts. Biden appointed Michael S. Regan, a seasoned environmental regulator, as the EPA Administrator, marking a shift towards science-based decision-making and robust regulatory enforcement. The administration also reversed several Trump-era policies that had undermined the scientific integrity of the agency, reinstating the use of comprehensive scientific data in regulatory processes.

The lack of a fiscally conservative, incrementally rising carbon price meant that supply subsidizing tax credits were required. The Inflation Reduction Act (IRA) introduces measures for the U.S. manufacturing sector with the Advanced Manufacturing Production Credit (45X) and the Clean Energy Manufacturing and Investment Tax Credit (48C). The 45X credit is designed to bolster domestic production of critical materials, including low-carbon steel and other advanced components, by offering substantial tax incentives. Complementing this, the 48C credit provides a 30% tax credit for investments aimed at re-equipping, expanding, or establishing manufacturing facilities dedicated to clean energy technologies.

45X includes critical minerals and renewable energy parts such as solar photovoltaic cells, wind turbine components, battery cells, and inverters. It also covers low-carbon materials and advanced energy components integral to energy storage and grid modernization, as well as electric vehicle batteries and fuel cells. However, the credit explicitly excludes fossil fuel-based products, materials for non-renewable energy technologies, non-critical minerals, and conventional manufacturing materials that do not align with clean energy or low-carbon objectives.

The USA already leads the world in the use of electric arc furnaces (EAF) to turn scrap steel into new steel, with 71% of demand met by EAFs in 2023, a figure that’s been fairly stable for decades. That’s in part because the USA imports so many products built from steel manufactured in China and elsewhere so has a big supply of to-be-scrapped steel entering the country, and in part because the USA’s deindustrialization has left a lot of steel sitting around rusting. However, those furnaces use cheap natural gas to preheat the metal before it has electrodes pushed into it for the final part of the process. Existing EAFs are eligible for 45X credits, so potentially some might fully electrify.

48C-eligible projects include those related to solar, wind, and battery production, advanced grid technologies, carbon capture and storage (CCS) systems, and energy efficiency improvements. Additionally, facilities producing components for electric vehicles, energy storage systems, and low-carbon materials also qualify. On the exclusion front, the 48C credit does not extend to facilities focused on fossil fuel-based energy production, conventional energy technologies, or non-renewable energy projects. Investments in traditional manufacturing materials that do not contribute to clean energy advancements are similarly excluded.

Sharp eyes will have noticed CCS rearing its discolored head, and it’s not the only place. The 45Q tax credit provides significant financial incentives for carbon capture, utilization, and storage (CCUS) projects, offering up to $50 per metric ton of CO2 sequestered in secure geological storage and up to $35 per metric ton for CO2 utilized in enhanced oil recovery, which the IRA lists as a beneficial use, contrary to climate value propositions. This credit includes investments in CCUS technologies deployed in various industrial processes, such as power plants, cement and steel production, and chemical manufacturing. It also covers direct air capture (DAC) facilities, which extract CO2 directly from the atmosphere. However, the 45Q credit excludes projects that do not meet stringent monitoring, reporting, and verification requirements, as well as those not achieving significant emissions reductions.

45Q’s CCUS tax credit is the big hope for the construction industry’s emissions it appears, as it’s the only measure with money and teeth attached to it. The Biden–Harris administration is funding limestone feedstock substitution initiatives to the tune of $189 million in a firm which is promoting basalt, diabase and dacite, rocks with calcium and oxygen but no carbon, as the sources of the lime required for cement. As noted in the recent series on global decarbonization of cement and concrete, that’s an expensive dead end as they have far less of the required lime components and cost more, leading to a minimum of ten times as expensive lime, the primary component in cement. More usefully, Sublime System’s cement recycling technology, while pre-commercialization, has strong merit for the USA, potentially enabling 25 million tons of cement a year against an annual demand of 85 to 100 million tons. Oddly, only $87 million went to the more promising solution. Those are, however research efforts, not deployment efforts.

As noted when looking at CCS for cement, the costs vastly outstrip the $50 per ton in most cases. Electrifying heat for the limestone kiln would make the carbon dioxide emissions much less expensive. Having a CO2 sequestration facility effectively at a plant’s doorstep reduces the costs as well. Only with those two conditions will CCS pencil out under $50 per ton, so the vast majority of the 107 plants in the USA will simply do nothing. Only a realistic carbon price will drive cement plants to adopt electrification and carbon capture, and only California has a price on emissions from cement (too low at $30), with no federal carbon price and none of the other states’ carbon prices including it.

As is unfortunately standard for the USA, the federal government isn’t building infrastructure itself or even planning it, just providing funding to private organizations and states for what they can get approved locally. Neither of the CO2 pipeline and sequestration projects that are under development lead from cement plants to sequestration sites, but are focused on ethanol, fertilizer, agriculture and blue hydrogen, not cement. As a result, cement plants that might want to electrify and capture the cleaner CO2 stream and sequester it have nowhere to put the stuff, and won’t be building it themselves. As a note, the CO2 emissions from ethanol plants are biogenic, so if these facilities go forward, they will actually be sequestering net new CO2, not resequestering fossil carbon.

In the United States, limestone kilns primarily rely on a mix of coal, natural gas, and petroleum coke, with alternative fuels also playing a role. Coal accounts for about 40-45% of the total fuel usage due to its high energy content and cost-effectiveness. Natural gas constitutes approximately 35-40% of the fuel mix. Petroleum coke makes up around 10-15%, utilized for its high carbon content and efficiency. Additionally, alternative fuels, including biomass and waste-derived sources, contribute about 5-10%, reflecting a shift towards sustainability. The natural gas will see higher costs per Btu due to the methane price, leading to some cement plants enhancing efficiency. However, due to the lack of a carbon price and how cheap coal is, the likelihood is more that they’ll switch back to coal instead, resulting in exactly zero benefit.

The big levers for construction are to avoid doing it entirely by reusing existing buildings instead of tearing them down and to pivot to mass timber construction. There are no tax credits or teeth associated with those levers, so while the administration promotes them, they aren’t really levers, just aspirations.

Several Direct Air Capture (DAC) plants in the United States have received funding and approval under the IRA. This includes $3.5 billion allocated for four regional DAC hubs, each designed to capture and sequester at least one million metric tons of CO2 annually. Projects like Project Bison in Wyoming and the Cypress DAC Hub in Louisiana are set to significantly scale up CO2 removal capabilities, supported by enhanced 45Q tax credits of up to $180 per ton of CO2 captured and sequestered. These initiatives aim to advance the commercialization and deployment of DAC technologies across the country.

A million tons is a nothing burger compared to emissions. In 2022, the United States’ greenhouse gas emissions totaled approximately 6,343 million metric tons of carbon dioxide equivalents. In the best case scenario, these DAC plants might sequester 0.1% of the USA’s annual CO2e emissions. The $180 per ton is a complete waste of money. And then there are the enhanced oil recovery plays with federal money. Projects like 1PointFive/Carbon Engineering and Occidental Petroleum’s South Texas DAC Hub — that’s fossil figleaf Carbon Engineering — are benefiting from the enhanced 45Q tax credits provided by the IRA.

Then there’s the money being poured into hydrogen. The biggest beneficiary is Manchin’s state, unsurprisingly. The U.S. Department of Energy has allocated up to $925 million to support the development of the Appalachian Regional Clean Hydrogen Hub (ARCH2), which is part of a larger $7 billion initiative to establish seven regional clean hydrogen hubs across the United States. The ARCH2 hub will span West Virginia, Ohio, and Pennsylvania, leveraging the region’s natural gas resources to produce blue hydrogen, with carbon capture and sequestration to ensure it qualifies as clean hydrogen.

The hydrogen hubs have very poor focus, with energy and transportation plays leading in many cases, instead of ammonia fertilizer, green steel and other industrial feedstock applications. That’s part of the problem that US Congress has created with the hydrogen strategy they mandated. Instead of sensibly assigning it to the Department of Commerce, which focuses on industry, they assigned it to the Department of Energy, which in turn focused far too much on energy plays. Further, Congress mandated that the primary focus be on making hydrogen from natural gas and coal, and that fossil fuel infrastructure must be preserved and leveraged.

As a result, a great deal of federal funding for industry is going to fossil fuel companies, effectively yet another subsidy for them to add to the long list. As noted earlier in this series, according to the IMF, in 2022 subsidies to the oil and gas industry exceeded the massive US military budget which is bigger than the next ten countries combined, both of which are obscene in the context of a trade-centric world dealing with a climate crisis.

Also in the industry section are the unprecedented tariffs on Chinese EVS (100%), batteries (25%) and solar panels (50%). Those deeply protectionist measures combined with the significant tax credits are aimed at enabling much more expensive US manufacturers to compete domestically. The optics of tariffs targeting Chinese subsidies combined with high US subsidies appear to be fun-house mirror ones.

However, at least the Biden–Harris administration has an industrial policy aimed at clean technologies, something that the USA set aside decades ago in favor of chasing the ball through the markets, as if short-sighted quarterly profit taking under Welchian capitalism was somehow going to do anything but make rich people richer in the short term. Unfortunately, it’s too little too late, and China’s manufacturing lead and supply chain dominance across most of the technologies required for clean technologies means that they will be the supplier to the world, and all Biden’s policies will do is to create an expensive walled garden with firms that can only compete domestically. The US is rich enough that this will only slow decarbonization, but it is a policy which distinctly takes its foot off of the accelerator pedal.

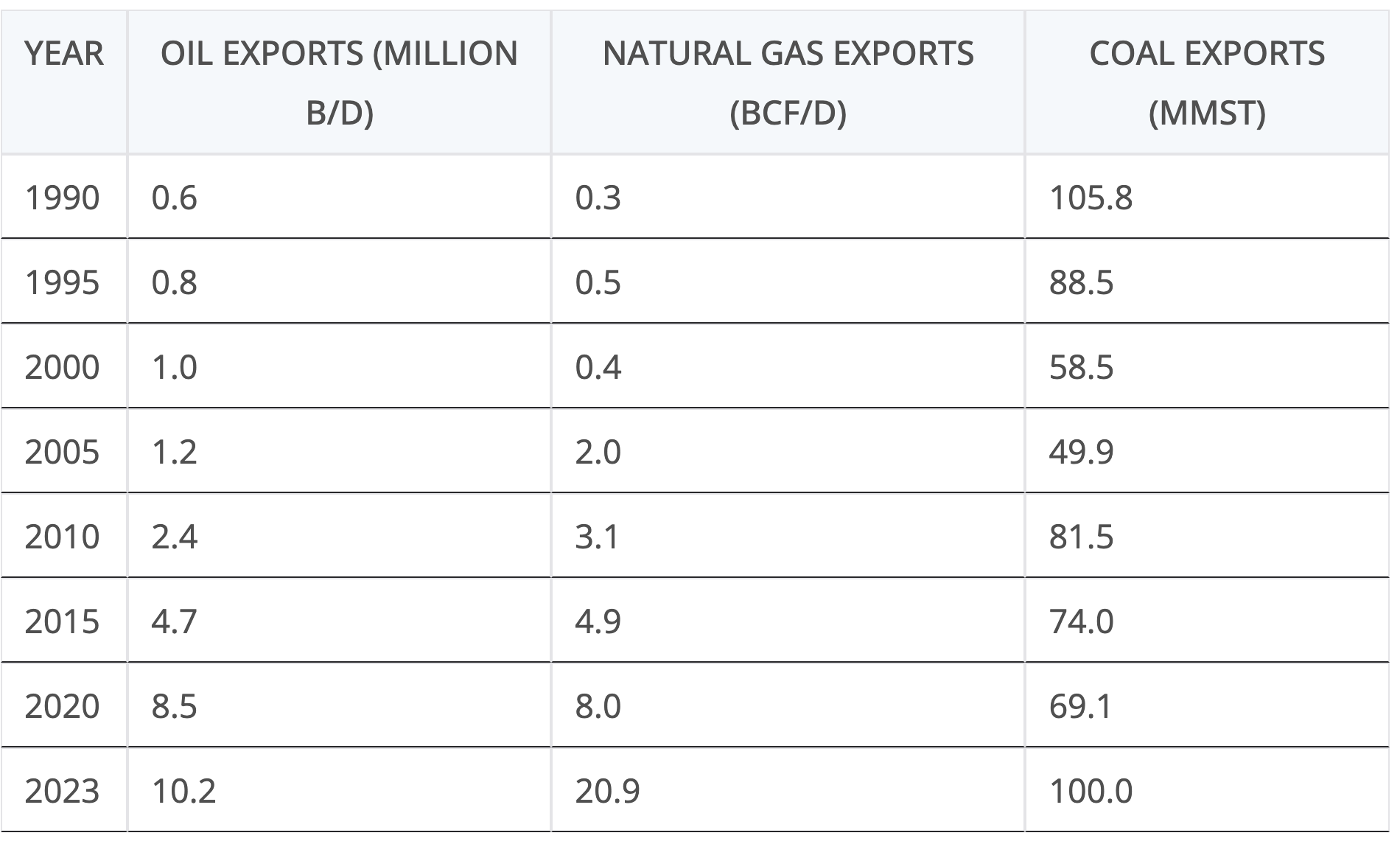

Then there’s the elephant on the climate dance floor, fossil fuel extraction and exports. Earlier in the series, it was pointed out that US primary energy has increased by 50% since 2010 while electrical generation demand for fossil fuels has fallen. US domestic consumption of fossil fuels increased significantly over this period, per the Lawrence Livermore National Laboratory Sankey diagrams. However, electrical generation didn’t go up. The USA was feeding its increasing energy habits with more fossil fuels.

Further, it was increasingly exporting them to other countries. As a reminder, the deal struck in 2015 to extend the investment tax credit for wind energy was to lift the ban on exporting crude oil put in place in 1975 after the OPEC Oil Crisis. Now the United States exports more oil than any other country in the world, 50% more than Saudi Arabia. It’s natural gas exports have gone up by two orders of magnitude since 1990.

There’s more as well. While coal has been displaced from electrical generation by natural gas to dubious benefits given the very high US methane leakage rates, that doesn’t mean the coal isn’t being left in the ground. Instead, the USA is shipping it to other countries to burn.

Even very dull eyes will note that under the Biden–Harris administration, fossil fuel exports of all types have shot upward to unprecedented levels. The pretense that the Biden–Harris administration has had some sort of war on fossil fuels doesn’t stand up to the slightest scrutiny. The administration is very happy to have its oil, gas and coal industries dig up more and more of the stuff that causes climate change and sell it to the highest bidder while claiming virtue.

And yet, as always, this deeply sub-optimal set of policies, with no carbon price, a methane price that might push industry back to coal, high tariff walls, massive exports of fossil fuels and expensive subsidies that will only enable US firms to compete domestically, is far better than the alternative.

During his administration, Trump took several actions that were seen as attempts to weaken the EPA and reduce its regulatory authority. Trump’s initial budget proposal in 2017 aimed for a 31% reduction in the EPA’s budget, threatening significant cuts in staffing and resources essential for environmental protection and enforcement. His administration rolled back numerous environmental regulations, including the Clean Power Plan, which targeted reductions in carbon emissions from power plants, and the Waters of the United States rule, which expanded protections for waterways under the Clean Water Act. Trump appointed Scott Pruitt, a known critic of the EPA, as its head, and later Andrew Wheeler, both of whom shifted the agency’s focus towards deregulation. Additionally, changes were made to restrict the types of scientific studies used in EPA decision-making, particularly those involving confidential health data, raising concerns about the integrity of the agency’s regulatory process.

That said, the Trump administration also passed the American Innovation and Manufacturing (AIM) Act with bipartisan support. That included a focused plan for scaling back HFC refrigerants in line with global efforts such as the Kigali Amendment, despite Trump’s administration not ratifying that treaty. The HFC plan features declining annual allowances and a market mechanism for trading HFC credits. The revitalized EPA under the Biden–Harris administration has been implementing, enforcing and deploying the solution, and results are promising, although significant quantifiable declines are hard to define in these early days.

Donald Trump’s 2024 campaign promises include a significant rollback of environmental regulations established during the Biden administration. He has pledged to lift the freeze on permits for new LNG terminals, auction more oil drilling leases in the Gulf of Mexico, and reverse restrictions on drilling in the Alaskan Arctic. Trump also aims to dismantle the EPA’s tailpipe emissions rules, which he argues limit consumer choice and increase costs. Analysts predict that these policies could result in a substantial increase in U.S. greenhouse gas emissions, potentially adding an extra 4 billion tonnes of CO2 equivalent by 2030. Additionally, Trump has proposed the creation of “Freedom Cities” on federal land to stimulate economic growth and innovation, including the development of vertical-takeoff-and-landing vehicles. He’ll likely leave the Kigali Amendment on general principles, but leave the HFC market in the AIM Act alone simply because it has strong Republican support.

See other US Election 2024 report cards here:

And the intro article about this series here:

US Election 2024: Setting The Stage For Climate Policy And Promises

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy