Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

We’ve grown accustomed in Latin America to outrageous headlines claiming 500%, 700%, and even 1,100% growth year on year. But as good an omen as these numbers are, once you read the articles, you realize this amazing growth has only been possible because of a very low departing base: for example, Brazil’s BEV market share was only 0.3% in April 2023, so 1,100% growth brought it to 3% in April 2024: amazing growth for sure, and a sign that there is EV momentum, but not the signal of an immediate EV takeover of the Brazilian market.

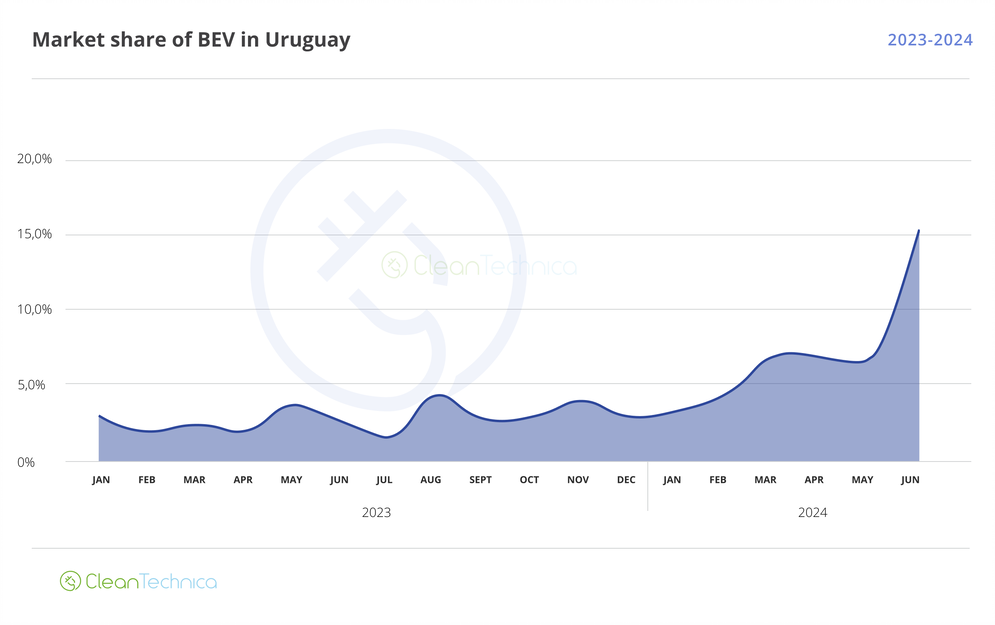

Uruguay, however, seems to be cut of a different cloth. BEV market share in June 2023 was already 2.5% (relatively high for the region), yet growth in June 2024 amounted to an amazing 477% YoY! This means Uruguay has just left every other country in the dust and competes now with Costa Rica for the title of Latin America’s most advanced EV market!

With an overall market that grew by only 2% in June, EVs are now commonplace enough to start eating into ICEV market share. Furthermore, since Uruguay has no data for PHEVs, this is pure BEV market share, meaning our southern champion is now officially ahead of most European countries! The transition is on!

General overview of the market

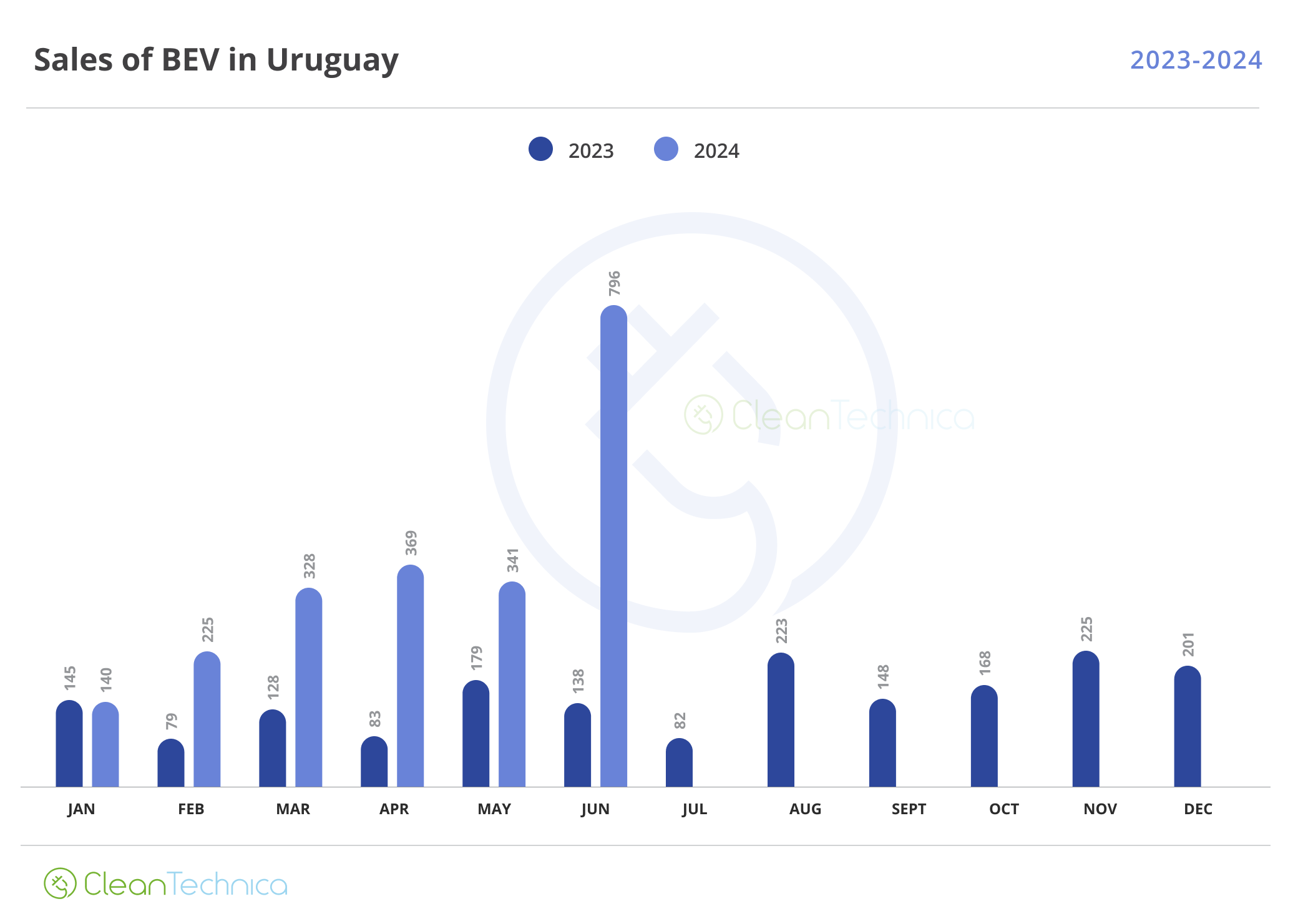

Uruguay is a small country, and, unsurprisingly, it has a very small car market, averaging some 60,000 units a year (between 4,000 and 6,000 a month). EV sales data is only available from 2023, and significant growth YoY can be seen even prior to June:

The first five months of 2024, it seemed like this would be a reasonable year for Uruguay, with ~200% growth YoY and constant increases month on month, perhaps closing the year somewhere around 7% market share.

Then, June happened.

EV sales exploded: 477% growth YoY (133% growth month on month) led to an impressive 15% market share. BEVs now amount to nearly 1 in every 6 cars sold in the country (this is including light and heavy vehicles), and due to generation being 99% renewable, their impact emissions-wise will be considerable.

It remains to be seen whether June was a fluke, or whether demand will remain at +10% levels for the rest of the year: hopefully, this isn’t a matter of a bunch of EVs arriving at once and cleaning the backlog, but a glimpse into the future of the auto market in Uruguay.

BYD is the undisputed leader

I don’t think there’s a market in Latin America … no, no, scratch that, I don’t think there’s a market in the world so blatantly dominated by only one automaker.

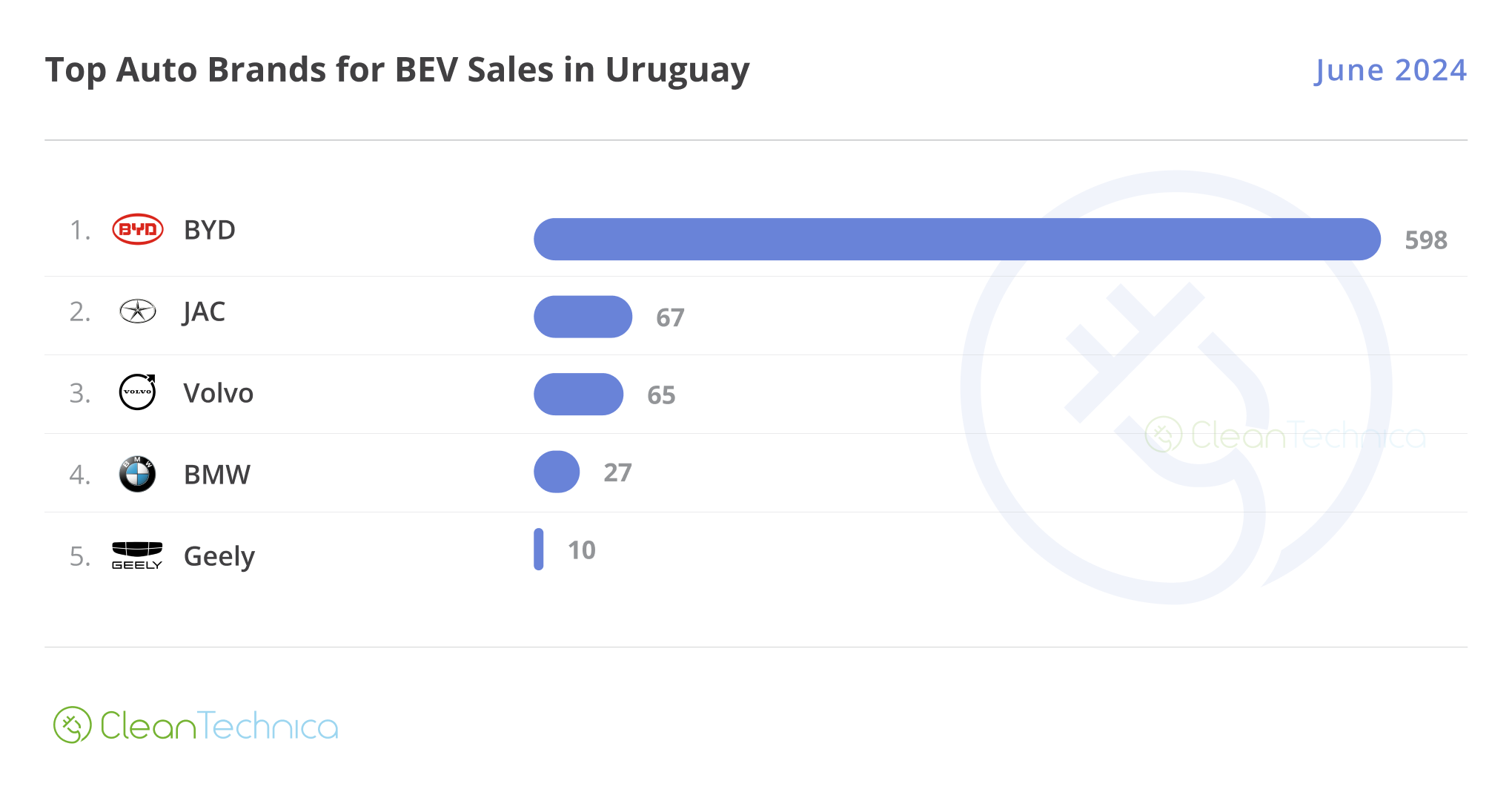

In June, BYD managed to get 75% of the market, give or take, with Chinese OEM JAC and Volvo in a distant second and third place, respectively:

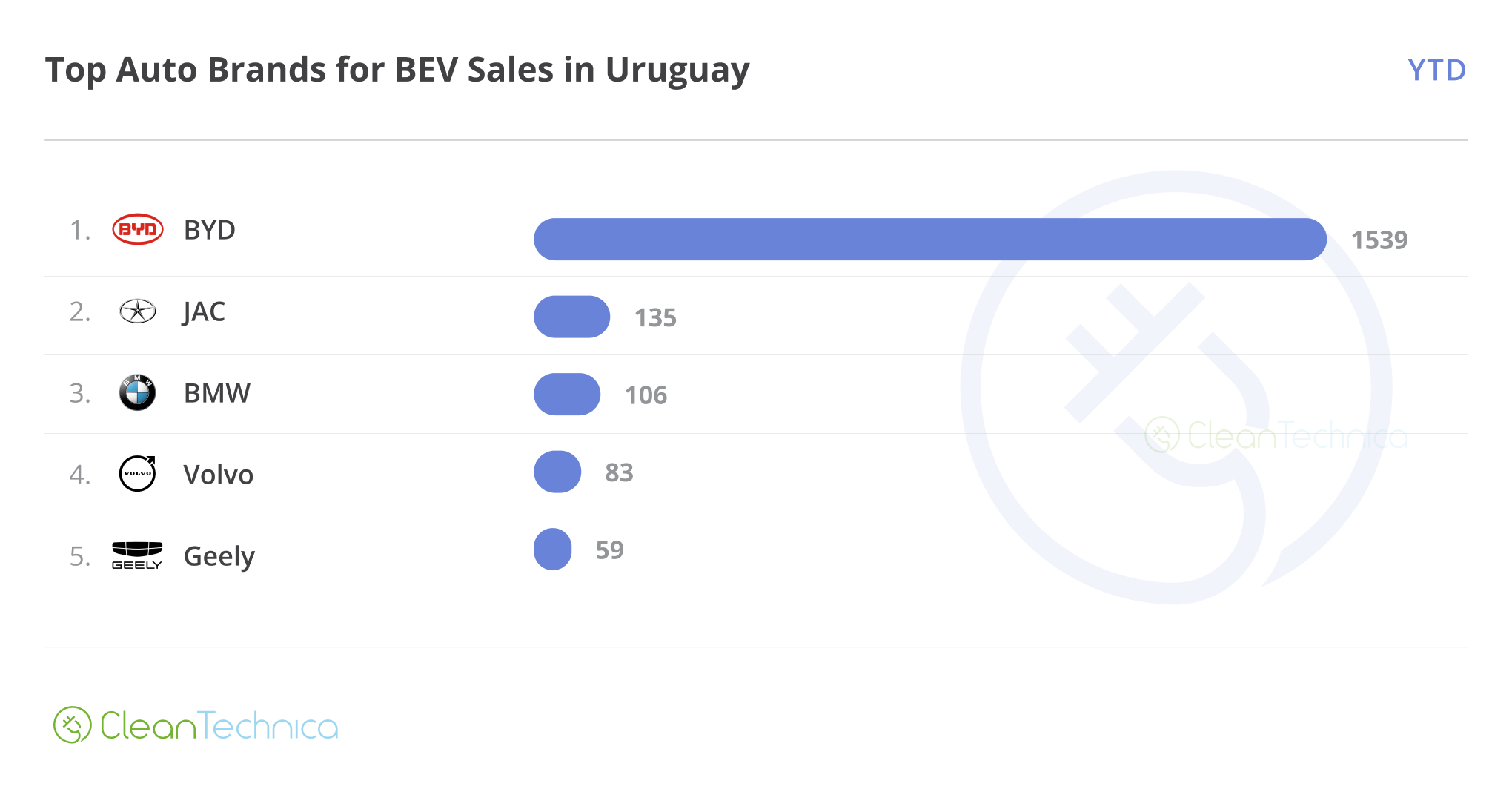

This wasn’t a fluke. BYD has gotten 70% of Uruguay’s EV market so far this year, which means that even though its share increased slightly in June, it has been the leader throughout all six months:

Now, even though BYD has 5 models in the top 10 during June, its dominance can be mostly traced to only two models: the successful BYD Seagull, and the BYD Dolphin, branded BYD E2 in the local market. As in many other markets, the Volvo EX30 completes the podium thanks to its great value for money.

It is notable that BYD’s other three models: the T3 Van, the Yuan Plus, and the D1 Taxi, are all well below in the list. JAC gets two cars in the top 10: the Dolphin competitor E-S3 and the Seagull competitor E-S1 (branded E10X in most other markets); meanwhile, BMW has the iX1 in sixth place, and Geometry (a brand owned by Geely) makes an appearance with the Geometry 6 … which, if we look closely, sold only 1/50 units, as did the Seagull.

Really, this is one of the most lopsided top 10 rankings I’ve ever seen.

Year to date, it looks very similar … except now BYD owns the whole podium (and #4), and we see the unexpected arrival of a car most of us hadn’t heard about in a long time, the Citroën Ami, in the 9th position.

At last, it’s worth noting that the JAC E-S3 only started deliveries in June, which means that if it maintains its pace, it could well end up in the top 3 by the end of the year.

Final thoughts

The first thought that came to my mind when I saw these results was: “Uruguay is going to electrify far faster than either Argentina or Brazil. How will people traveling from either country to Uruguay get gas in the future?”

Uruguay may look very small, but it isn’t. From the limit with Argentina to the limit with Brazil, there is nearly a 600-km drive. Of course, this isn’t a problem that will arise in the short or even medium term … but I feel that small countries becoming fully electrified can become a thorn in their neighbors’ ICEV sales once the previously plentiful gasoline infrastructure starts going bankrupt. This will also apply to regions within countries that electrify faster, something interesting to look for in the future.

As far as charging its EVs, Uruguay already has a decent charging network — though, early on, it deployed a lot of 40kW Type 2 AC plugs, and I don’t know how many of these cars can fast-charge using AC chargers (the Seagull is limited to 5kW as far as I remember).

At USD$7 a gallon, Uruguay has one of the most expensive gasoline prices in the region (and probably the world); meanwhile, renewable electricity is affordable and plentiful. Since the country also lacks oil reserves, replacing foreign-purchased gasoline with locally sourced electricity is no doubt a win for its economy and its energy security. Uruguay is wealthy enough not to worry about oil imports the way a country like Ethiopia would, but oil still accounts for over 15% of its imports.

How long until that goes down to 10%? 5%? Any bet takers? In any case, stay tuned in the following months as we wait for new data and check whether Uruguay’s EV market keeps growing at the same rates.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy

.jpg)