Updating gold ratios to other markets using associated ETFs.

Sure, gold is a pretty and heavy object that people fall in love with (and express their love with). But it is also a primary market indicator here in NFTRH land. When it rises vs. cyclical ‘risk’ markets it implies rising risk in those markets. When it rises vs. inflation sensitive markets, it implies waning inflationary pressure. Generally, when gold rises in relation to markets and assets positively correlated to the economy, the indication is for a counter-cycle, an economic contraction.

Here’s the most recent snapshot by daily charts.

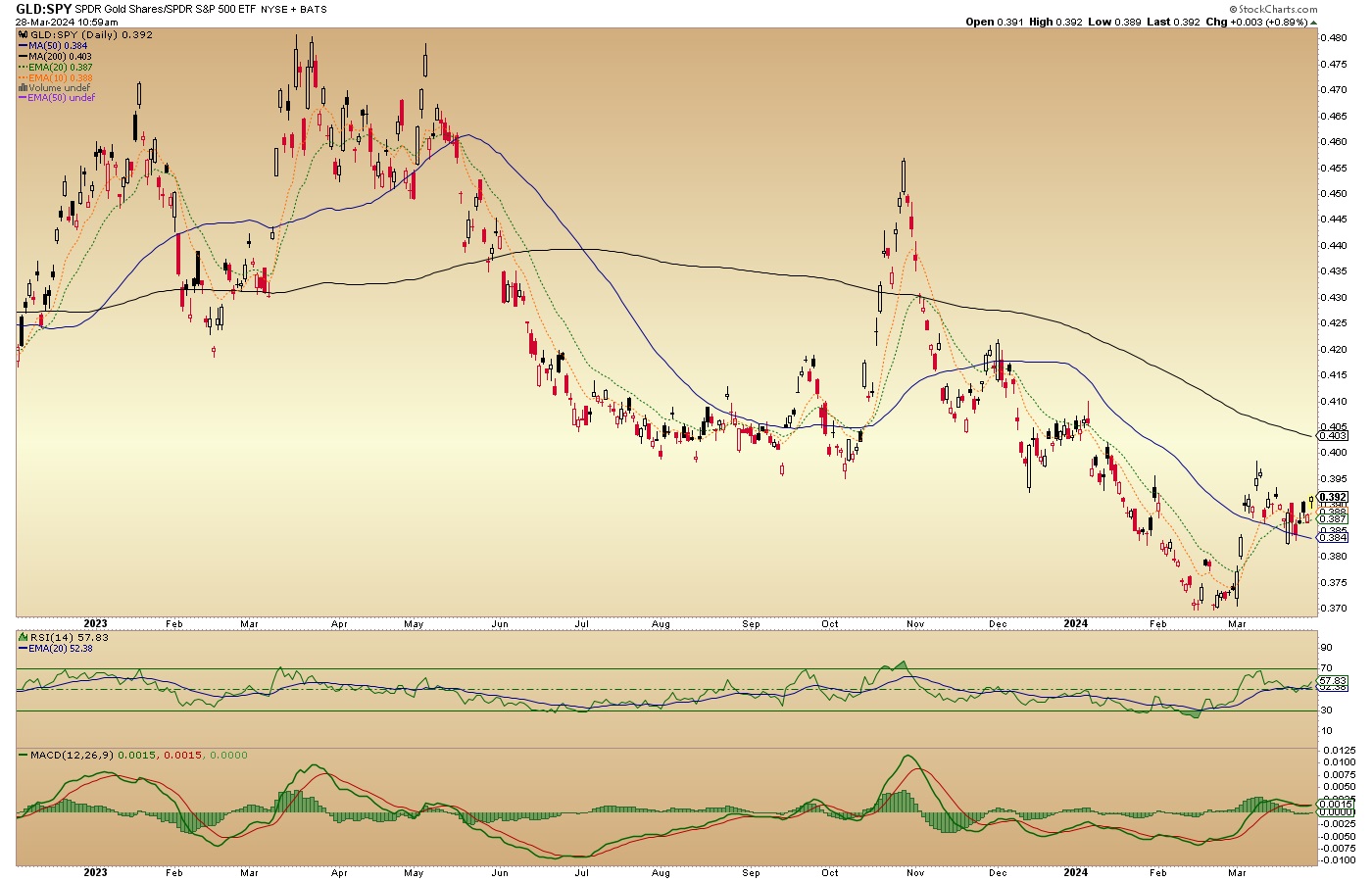

GLD/SPY is trying to bottom and turn up. It’s got a sneaky positive look to it with RSI and MACD both positive and neither overbought. It can’t be stressed enough how important Gold to stock market ratios are to the gold mining case. As yet, the trend is still down, but we should be on watch for that to change in the weeks/months ahead.

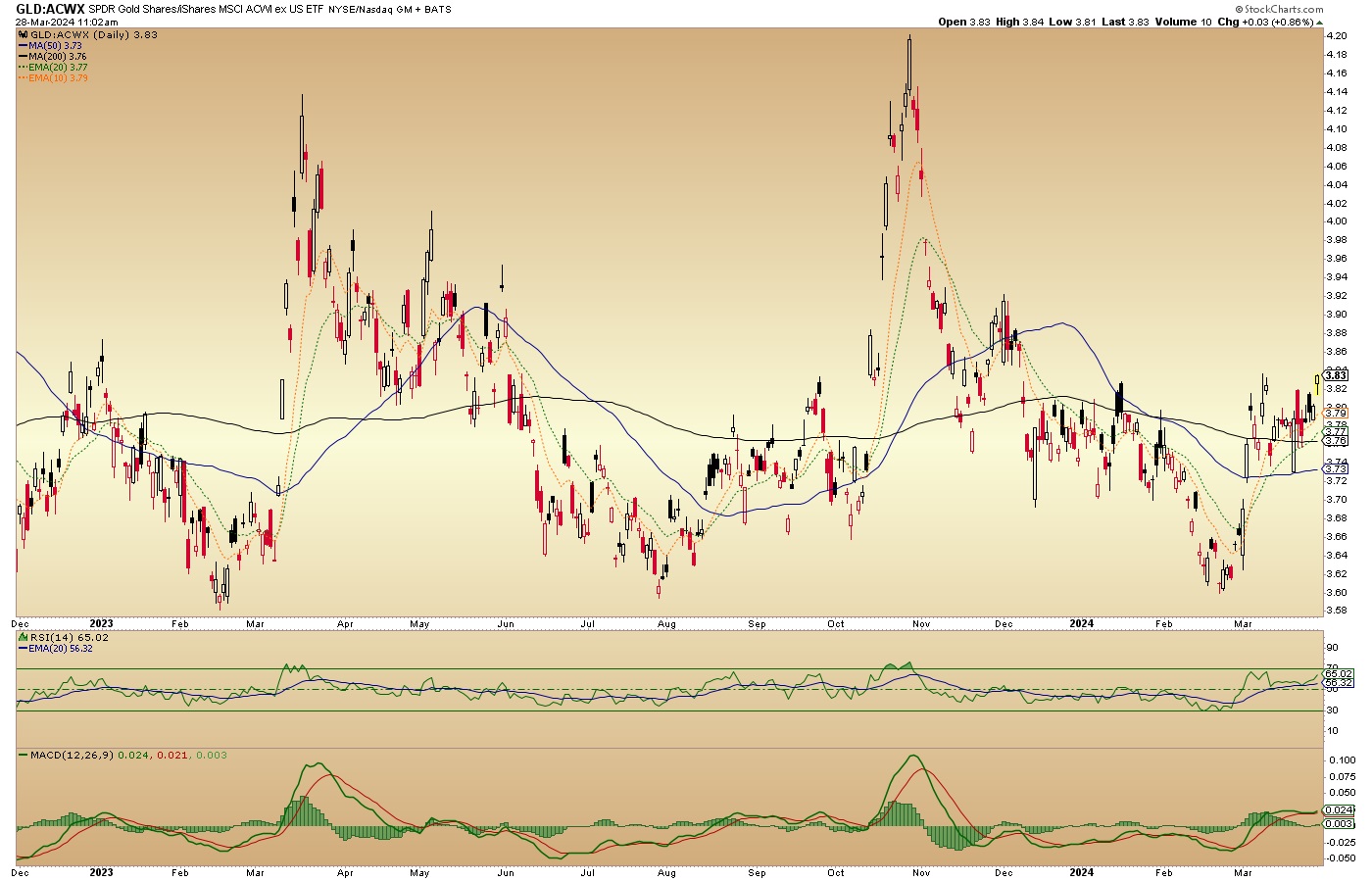

GLD/ACWX shows that gold is even better vs. global stocks (ex-US), breaking upward from a neutral trend (as opposed to the downtrend above).

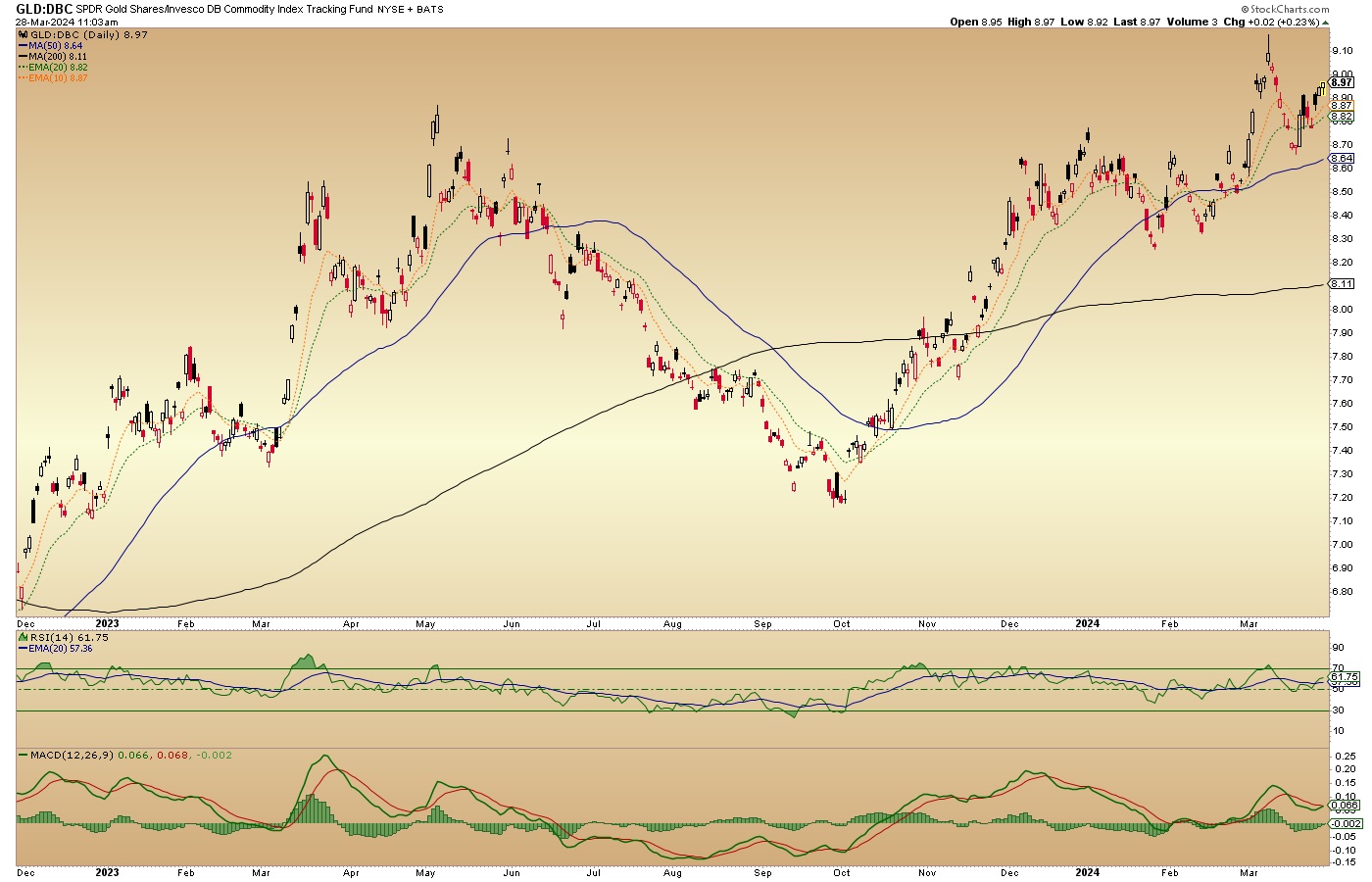

GLD/DBC has been bullish for a half a year now and it is still so. Gold/Commodities has consolidated away its overbought leadership and could be preparing for a new leg up, judging by the positive and non-overbought RSI and MACD.

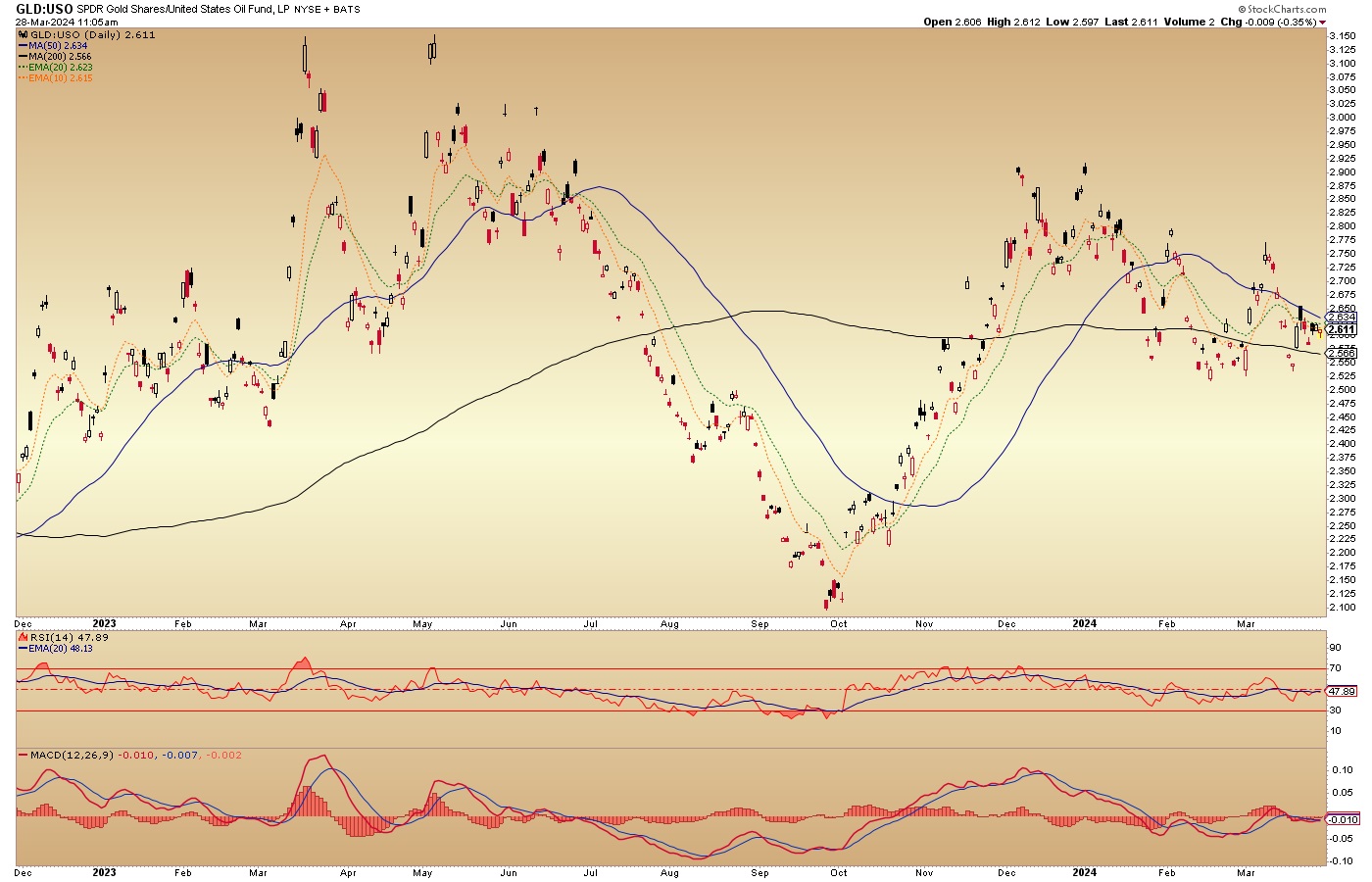

GLD/USO is in consolidation. We had noted the Q4, 2023 uptrend, which would generally be a tailwind to gold miner cost metrics, prior to the most recent gold miner reporting season, and I think that came to be. The subsequent downward consolidation could simply be in preparation for another leg up, although crude oil can be a wild card due to geopolitics, supply/demand, etc. Generally, it’s a middling indicator for the gold stock sector as it currently stands.

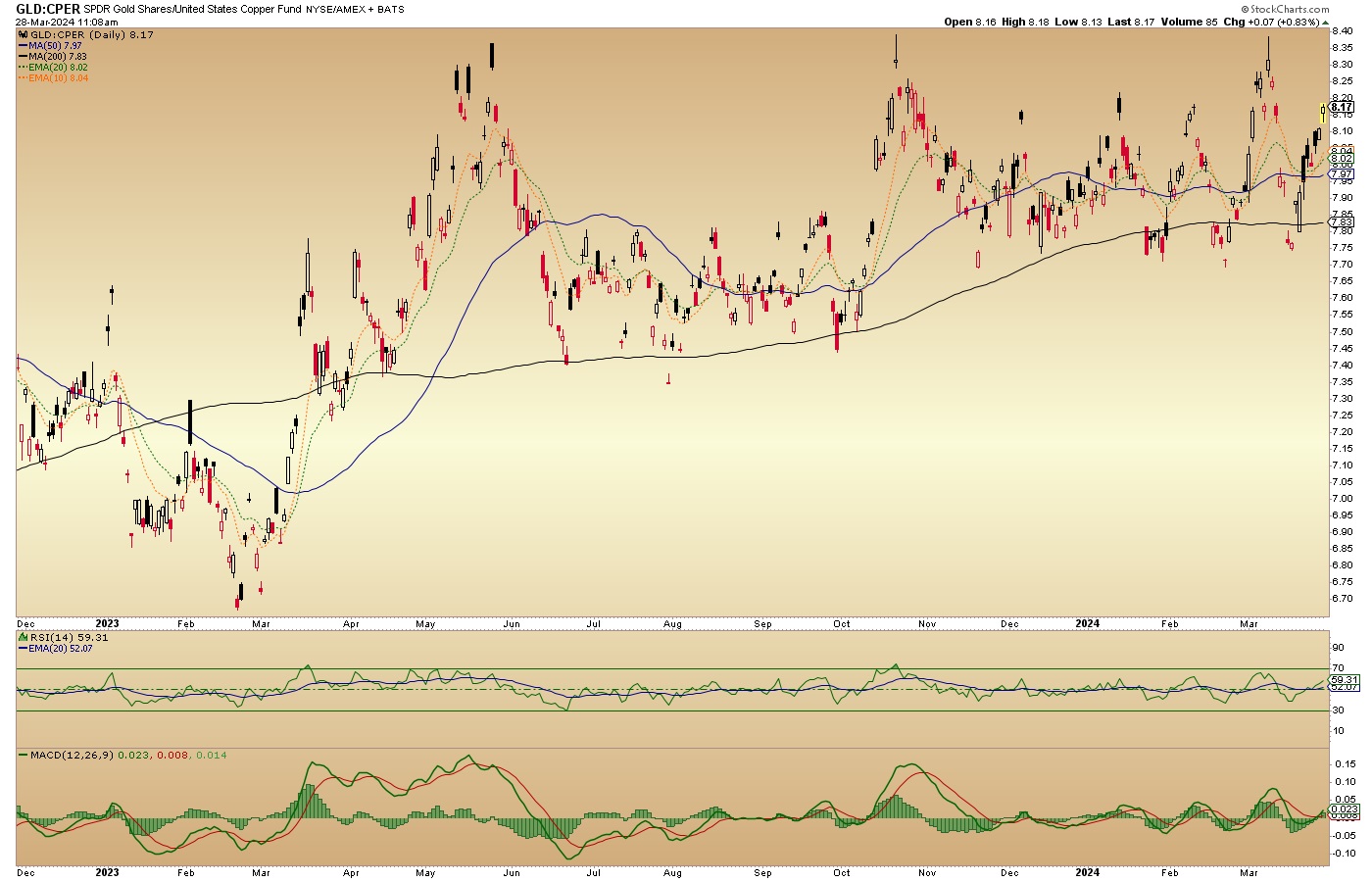

GLD/CPER shows the Gold/Copper ratio getting back on track to its gentle uptrend after recent hype about production cutbacks by China’s copper smelters spiked the copper price. With this uptrend intact, we still have a counter-cyclical signal (actually, more of a Goldilocks signal at this point) intact. Counter-cyclicality will be a fundamental positive for the gold mining industry, perhaps out in 2025.

GLD/RINF shows that gold in relation to a gauge of ‘inflation expectations’ was positively diverging the bombed out gold mining sector before the miners caught on and turned up hard in early March. This divergence was noted in NFTRH in real time and damned if it did not play out. Go figure. Our thesis has been for inflation expectations to fade over the course of 2023 and now well into 2024. Thus far, this has benefited Goldilocks. But she is expected to be temporary; a transitional condition to a future liquidity problem for the markets.

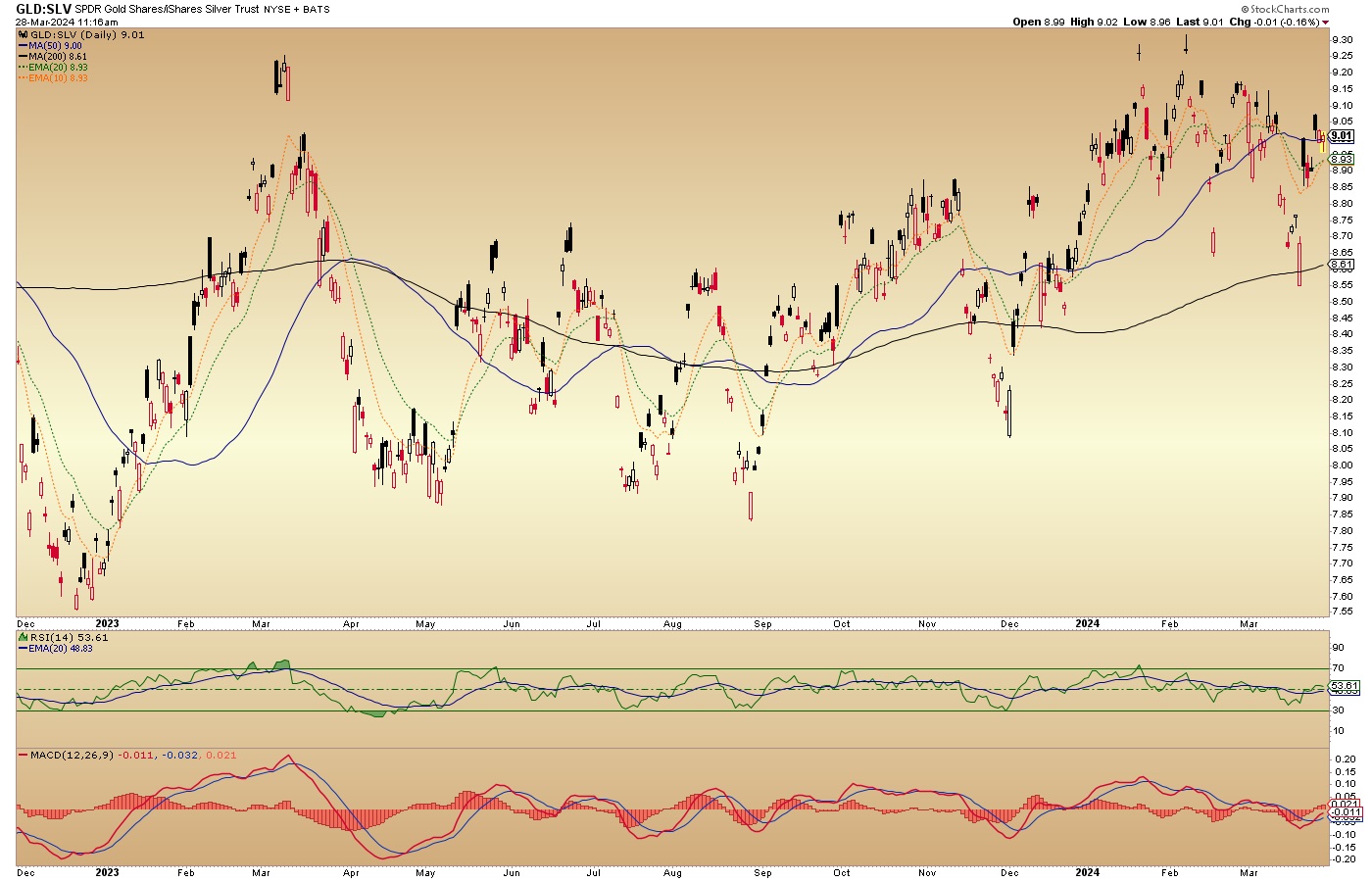

GLD/SLV shows that the monetary metal vs. the industrial/monetary metal is gently trending up. This too has aided Goldilocks (in its very gentleness, as opposed to impulsivity). From here and after whatever length of time it takes to bleed out Goldilocks, the Gold/Silver ratio will indicate market liquidity destruction by getting impulsive to the upside or an interim ‘inflation trade’ by continuing to be moderate or weak.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

********