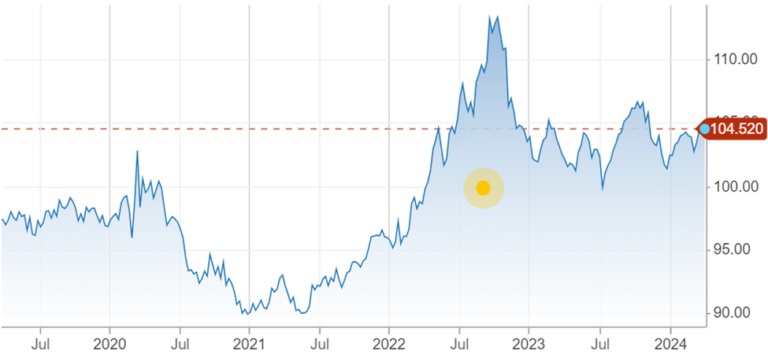

Spot gold gained 13% in 2023 and so far this year, is up 6%. Thursday March 28th, gold ended the day at US$2,233.00 oz, a strong performance given the headwinds facing the precious metal.

These include a strong US dollar, positive real yields (Treasury yields minus inflation above zero), investors selling their gold ETFs, and inflation coming down from 40-year highs.

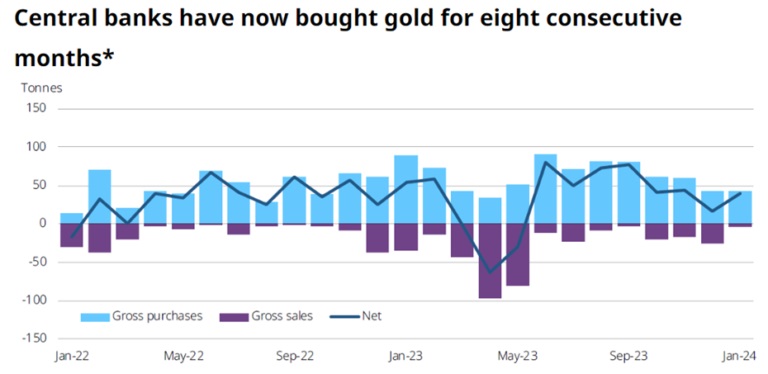

Demand is being driven by strong central bank buying, with developing nations in particular stocking up on bullion as insurance against having their foreign currency reserves frozen like happened to Russia after it invaded Ukraine; and geopolitical instability, with wars in Ukraine and Gaza still raging and there’s China’s positioning on Taiwan causing stress. Commercial shipping in the Red Sea continues to come under attack from Houthi rebels.

The gold price started to kick higher in October when market sentiment began pricing in three quarter-point rate cuts in 2024. This was confirmed at the Fed’s December meeting, and made even more explicit at the March 19-20 meeting that just took place.

Source: Kitco

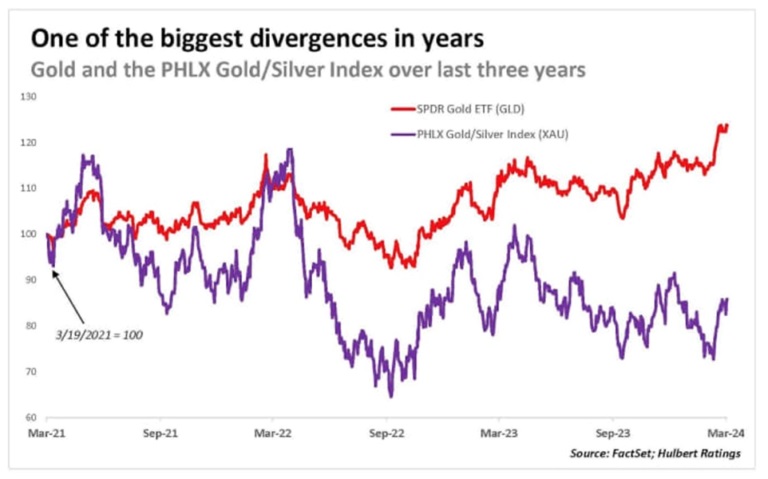

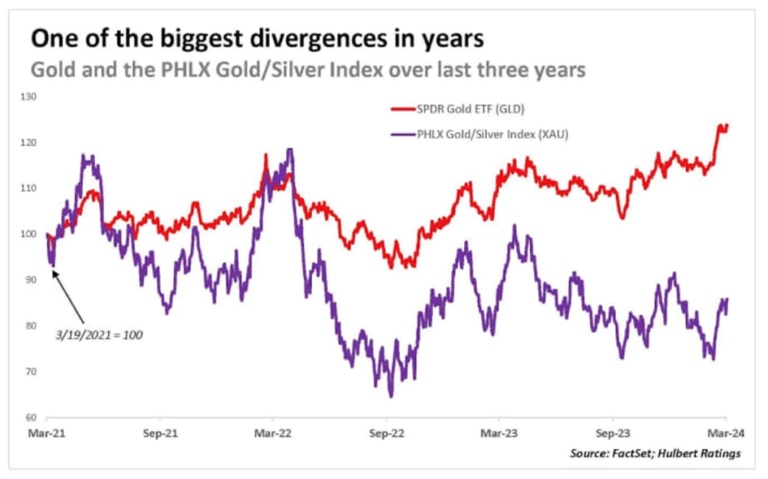

Normally when gold rises, gold stocks follow, but since 2021, this has not been the case.

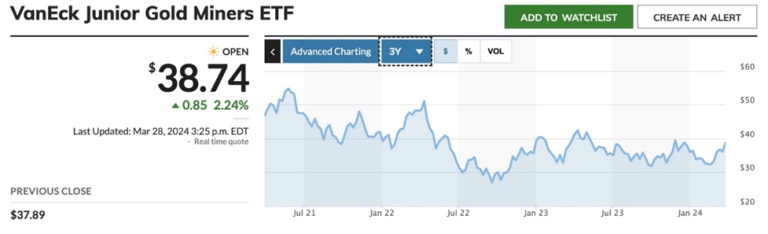

Large-cap gold mining stocks, represented by the VanEck Gold Miners ETF (GDX) are down 2% over the past year; junior gold miners’ stocks, represented by the VanEck Junior Gold Miners ETF (GDXJ) are down 1.17% over the same period.

Source: MarketWatch

Source: MarketWatch

As the chart below shows, the PHLX Gold/Silver Index (XAU), a grouping of 30 gold and silver mining companies, is below where it was three years ago.

Notice what is happening here. The purple line representing XAU and the SPDR Gold ETF (GLD) in red converged twice, in March 2021, and a year later, in March 2022. Since then, GLD and XAU have been drifting apart — though recently ticking up in tandem.

The fact that gold stocks are lagging the gold price is a real thorn in the side of resource investors right now, and there has been no shortage of commentary on why this might be the case.

John Hathaway, senior portfolio manager at Sprott Asset Management, calls it “the greatest disconnect I’ve ever seen” in 25 years of tracking the metal. He blames crypto for diverting investment in gold mining stocks, but said the main culprit is gold ETFs, which have “cannibalized demand for gold mining equities”.

Tech stocks and more recently, those with a focus on artificial intelligence, have gobbled up a large amount of investment capital that previously went into gold equities. DRDGold CEO Niël Pretorius noted that shares are being disposed of despite the fact that they are trading at significantly better multiples than the technology stocks.

Argonaut PCF vice chairman Liam Twigger told Stockhead, Historically, junior explorers and developers might trade at $60 an ounce and as you make more progress, you get up to $200 an ounce. But these guys are under $20 an ounce and there’s a huge amount of leverage.”

Michael Gray, partner at Agentis Capital, says a lack of liquidity is the main problem facing the junior resource sector. Interviewed at the Vancouver Resource Investment Conference, he said, “The institutions are not coming down into the explorers and developers. Part of it is that they’re seeing redemptions, they have concentrated portfolios. Ten or 15 years ago they had 80 positions, now they’ve got 35, for some of the main resource funds in Canada and the US, so that’s part of it. They’re seeking to manage liquidity, and the juniors just don’t have liquidity.”

Back to the chart above comparing GLD, the fund representing physical gold, and XAU, the fund representing gold and silver miners. According to one analyst, the fact that gold has outperformed gold equities over the past three years by one of the largest margins in decades, is actually good news for gold-mining shares. How can this be?

Because historically, gold mining stocks have performed well following periods when they have significantly trailed bullion.

MarketWatch columnist Mark Hulbert analyzed what happened in the wake of large divergence between gold and gold-mining shares using data going back to the mid-1980s.

His two findings were that divergences are a short-term phenomenon and eventually resolve themselves; and that the resolution of divergences occurs primarily by the gold equities performing well or poorly.

Most importantly, Hulbert observes that, following periods in which shares have lagged gold, like they have over the past two years, the gold shares tend to perform well rather than gold performing poorly.

The divergence may have already begun. Hulbert points out that over the past month through March 20, the XAU index gain has been double that of gold, 12.5% versus 6.3%, respectively, leading to his bottom-line conclusion: If you want to bet on gold in coming weeks and months, you may want to favor gold-mining shares over gold bullion.

Gold analyst Adam Hamilton says gold stocks’ spring rally has proven their strongest seasonal one during gold’s modern bull-market years.

For example the GDX, while down 2% year on year, is up 22% since Feb. 28, while the GDXJ has gained 14.5%.

Remember that a big reason for the gold price doing so well of late is the expectation of three 0.25% interest rate reductions by the Fed, likely starting in June.

Jeff Clark, founder of TheGoldAdvisor.com, wanted to know what happens to gold and gold stocks during periods of monetary easing. Looking back at 11 such periods since the 1970s, Clark found that in nine of those periods, the gold price rose.

He also referenced above-mentioned John Hathaway of Sprott, who put out a report showing that gold stocks as a group climbed up to 400% during the last three rounds of Fed easing.

The last word on bullion versus gold stocks goes to Morningstar, which recently quoted the chief market strategist at Purpose Investments saying that investors may do better picking up gold stocks rather than the physical bullion. Basinger sees more opportunity on that front… “We did pivot some of our exposure from bullion into gold mining stocks, he acknowledges.” There is a greater margin of safety in stocks, he believes, and better upside potential.

At AOTH we believe not only is there huge potential upside in beaten-down gold and silver equities, but copper juniors as well.

For the first two weeks of March, copper rallied 4.1%, hitting its highest level since April 2023.

A couple of factors identified by us at AOTH indicate that 2024 will be a great year for copper. Most important is supply failing to keep up with demand. The second factor is a weakening of the US dollar if market expectations of monetary easing come to pass.

If the Fed lowers rates, the dollar will weaken, as it has done in the past during monetary easing. Commodity and precious metal prices have an inverse relationship with the dollar; a lower dollar typically means higher commodity/ gold and silver prices.

US Dollar Index CNBC

Copper Kitco

Copper is used in a plethora of manufacturing processes, so commodity analysts keep a close eye on economic growth and manufacturing to get an idea in which direction copper prices are headed.

Global purchasing managers’ indices show that factory orders bottomed in January and are moving back up.

The JPMorgan Global Manufacturing PMI was a neutral 50 in January — anything above 50 reflects an expansion — halting a 16-month streak of sub-50 readings, and ticked up to 50.3 in February.

The S&P Global US Manufacturing PMI was 52.2 in February, with US manufacturing conditions improving at the fastest pace since July, 2022, and bettering January’s 50.7. The March numbers were even better, rising to a 21-month high of 52.5.

S&P Global US Manufacturing PMI. Source: Trading Economics

The two charts below are bullish on copper and commodities in general. The Global X Copper Miners ETF (COPX) has gained 24% since Feb. 13, with the Bloomberg Commodity Index advancing 3%.

Source: MarketWatch

Source: MarketWatch

In China, there are too many smelters and not enough imported raw copper ore to feed them.

With treatment and refining charges (TC/RCs) near zero, smelters have been forced to cut production, reducing refined copper supply. According to Oilprice.com, in early March, 19 companies agreed to cuts via maintenance outages, lower output rates, and delays in new operations.

Chinese smelter overcapacity is not the only reason for higher copper prices. In recent years, the mining sector has faced output constraints, plagued by protests, closures, water shortages and lower ore grades.

Nearly 600,000 tonnes of copper supply didn’t come to market last year due to the Panama government’s closure of Cobre Panama — a large copper mine that only recently came online — and a strike at the Las Bambas copper mine in Peru.

Anglo-American announced that its 2024 Chilean production would disappoint between 210,000 and 270,000 tonnes owing to head grade declines and logistical issues at its Los Bronces mine. (Goehring & Rozencwajg)

Chile’s copper output has been dented by a long-running drought in the country’s arid north. Codelco’s 2023 production was the lowest in 25 years.

Goldman Sachs has said it predicts a copper deficit of over half a million tonnes in 2024 due to mining disruptions. “The supply cuts reinforce our view that the copper market is entering a period of much clearer tightening,” analysts at the bank wrote, via Oilprice.com.

Benchmark Mineral Intelligence (BMI) forecasts global copper consumption to grow 3.5% to 28 million tonnes in 2024, and for demand to increase from 27 million tonnes in 2023 to 38 million tonnes in 2032, averaging 3.9% yearly growth.

According to the International Energy Agency (IEA), to keep the world on a path to net zero carbon emissions, copper must rise from 25 million tons to 35 million tons by 2030.

In 2023, mines only produced 22Mt globally.

Copper is essential to the energy transition from fossil fuels to electrification and decarbonization.

Along with the usual applications in construction wiring and plumbing, transportation, power transmission and communications, there is now added demand for copper in electric vehicles, EV charging stations, and renewable energy systems.

Conclusion

Copper is forecasted at $10,000 (below the $11,000t incentive price to build new mines) a ton by year’s end, from the current $8,860, and gold is seen hitting a new record-high $2,300 an ounce.

Investing in juniors has historically been a good way to leverage rising copper and precious metals prices.

Juniors help the majors to replace the ore that they are constantly depleting in their operating mines, thereby helping to overcome the supply shortfall that is coming for several metals.

The case for copper, gold, silver, and all commodities, rests upon the US dollar. Once the Fed starts cutting interest rates, the dollar will weaken and the entire commodities complex will strengthen.

Of course, if the Fed doesn’t lower rates — either keeps them on pause or raises them, say due to a spike in inflation — our case falls apart. But inflation has come down substantially and despite current “stickiness”, we believe it will continue to move closer to the Fed’s 2% target, allowing the Fed to give borrowers some relief through lower rates.

John Hathway says the decline in gold stocks is linked to the popularity of gold ETFs which have “cannibalized” gold equities. Maybe so, but when the Fed starts lowering rates and gold/copper stocks as a basket rise, investors will feel more comfortable picking stocks again, especially with their outsized historical returns compared to “play it safe” ETFs.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

*********