Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

The decommissioning costs for the UK’s nuclear generation are coming home to roost, and they are laying golden eggs for the firms that won the business. For UK citizens, not so much. Despite the very high costs of both the new nuclear reactors at Hinkley Site C, the rapidly rising costs of clean up and the much cheaper alternatives available, the country’s current administration remains committed to the technology. Something is likely to give.

The UK is like the USA and France, a western nuclear military power. They built and operated four nuclear powered submarines with nuclear missiles and two nuclear powered aircraft carriers. That gave them one of the preconditions for success for commercial nuclear electricity generation.

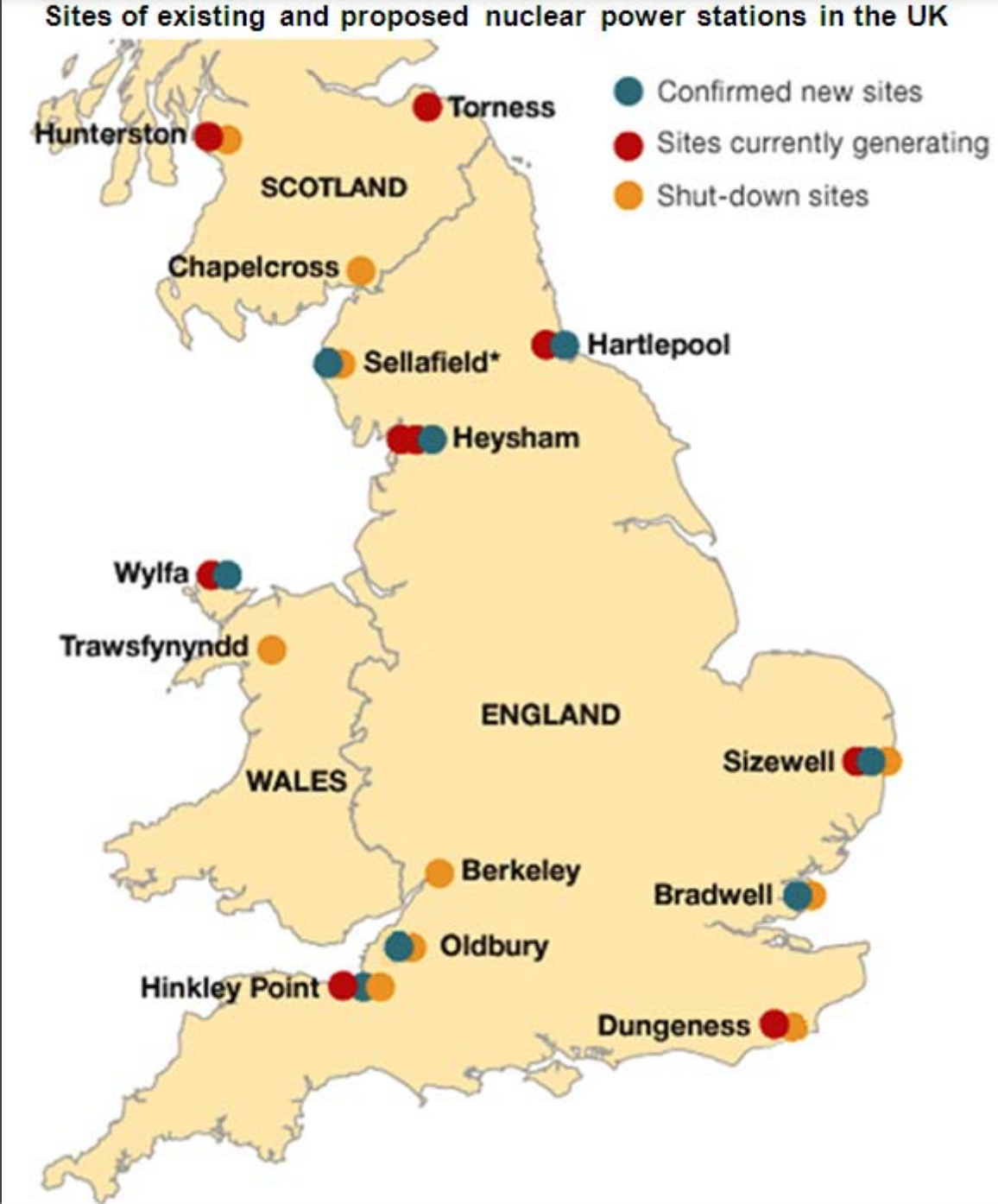

They built all of the 14 shut down and 9 currently operating nuclear generation plants between 1957 and 1995, satisfying the conditions of success of a three to four decade build out to maintain master builders, creation of a nuclear construction industry with skilled, certified and security validated resources, and building a couple of dozen reactors to amortize the national program across.

They built all reactors with a very narrow set of designs, first the Magnox which also created weapons grade plutonium and then the AGR which was a modified Magnox optimized for electricity generation, not plutonium manufacturing. The high similarity and only two designs across all 23 reactors satisfied another criteria for success of a nuclear program.

Like the USA, the earlier Magnox were smaller reactors, averaging 350 MW capacity, and in combination with their focus on manufacturing plutonium, created expensive electricity. The AGR redesign, just as in other countries, focused on GW scale reactors for thermal efficiencies, with most coming in around 1.2 GW. That satisfied another success criteria for nuclear generation.

Naturally, the nuclear program was a national strategic priority for the UK with bi-partisan support between the Conservatives and Labour, satisfying another condition of success.

This was a blueprint for a successful nuclear electrical generation program, and why nuclear generation is a poor fit for free market economics.

Despite no longer having the obvious conditions for success for a new nuclear program, the British government got behind the Hinkley Point C construction of two new EPR reactors with their unproven design. That program is years late and 50% over budget as a result. The reactors are GW scale, with 3.2 GW between the two reactors so have one condition for success out of six. The UK government also have planned two EPRs at the Sizewell site, with one of the innumerable Conservative Prime Ministers of the past decade committing €100 million of governmental money in a vain attempt to get any private investors interested. No schedule has been set for construction of those reactors.

But now the reactors are shut down or about to be shut down. Most of the remaining operating reactors will be off the grid by 2028, with only Sizewell B hanging on until 2035. All reactors had roughly a 40 year lifespan, not the 60 to 80 years often claimed by the industry, including the 60 year claim for Hinkley Point C.

How much will it cost to decommission those 23 reactors and the two Hinkley Point C reactors still under construction? The last time I looked at nuclear decommissioning costs and duration was three years ago. At the time, the average was roughly a billion US dollars and a century of duration per site.

Well, the UK’s nuclear program is definitely exceeding that. As of late 2022, the official estimate of the UK’s Nuclear Decommissioning Authority (NDA) was €149 billion. Assuming Hinkley Site C was rolled into that number, that would be a cost of €6 billion per reactor, or more than many nuclear advocates claim new nuclear can be built for.

However, Stephen Thomas, a professor of energy policy at the University of Greenwich and a regular analyst of the nuclear industry with a publication history on energy and nuclear programs with a global reach stretching back to 2004, has a slightly different expectation. He first published on the UK’s NDA in 2005 and has been tracking costs closely since, including with freedom of information requests to get accurate numbers.

His estimate in late 2022 was that the program was likely to cost €260 billion given the cost trends. That’s €10.4 billion per reactor, an order of magnitude higher than the industry average of three years ago.

Whether €6 billion or €10 billion, these numbers should be giving national energy policy makers pause. After all, those costs are going to be paid in the future in future value dollars that will be inflated. They won’t be getting magically smaller due to discounting, but should be included in cost cases with the discounting rates built in.

Given the magnitude of the costs, effectively every MWh generated by the UK fleet of reactors cost substantially more than it’s official stated cost. The price will be paid, after all.

If there were no alternatives to nuclear generation, then this wouldn’t be a problem compared to global warming. But, of course, this is 2023 and there are proven, effective, efficient and reliable forms of low-carbon electrical generation that do compete with nuclear energy, wind and solar. Offshore wind energy, despite the current western industry reset, is much cheaper per GWh than nuclear, and a GW of offshore wind energy is being built in 10 months now. The UK is doing very well with HVDC interconnectors to multiple European countries, and the XLink project is expected to bring 3.6 GW of wind and solar electricity from Morocco, firmed for 20 hours a day, at a third the cost per GWh.

Perhaps wind and solar decommissioning costs are as equally horrendous as nuclear? Should policy makers be concerned about this?

No. The US Department of Energy studied wind farm decommissioning across eight wind farms and found that costs were well below US$200,000 per turbine. That means decommissioning a GW scale onshore wind farm would cost perhaps $77 million dollars, a 13th of the 2020 industry average nuclear reactor decommissioning cost and a 130th of the likely UK nuclear decommissioning costs. The New York State Energy Research and Development Authority (NYSERDA) estimates that decommissioning a solar farm will cost about $30,000 per MW, so a GW scale solar farm’s decommissioning costs are around $30 million. Once again, a tiny fraction of the cost of decommissioning nuclear generation.

The full lifecycle costs of nuclear energy are fairly well established now, and they are much higher than for renewables, transmission and storage. The conditions for success for nuclear programs are well established as well, and there isn’t a single country in the world that has fulfilled them in the 21st Century. Even China has failed, in my assessment as their industrial policy of exporting nuclear reactors of any type foreign buyers might want overrode energy policy requirements to build only a single design.

It’s unclear to me what blend of ideology, tribalism and magical thinking are combining to make countries think that their nuclear programs are unique, and that they will succeed at them when there are clear alternatives.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Iontra: “Thinking Outside the Battery”

CleanTechnica uses affiliate links. See our policy here.