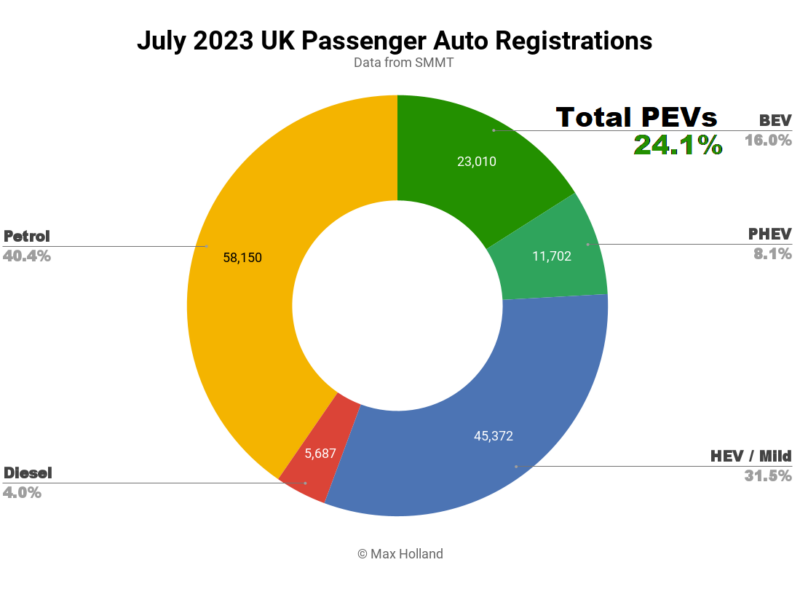

July saw the UK’s EV share at 24.1% of the auto market, up from 16.7% year on year. Full electrics were up in volume 88% YoY, to over 23,000 units. Overall auto volume was 143,921 units, up 28% YoY, though still below pre-2020 norms. The bestselling EV in July was again the Tesla Model Y.

July saw the UK’s combined EV share at 24.1%, comprising 16% full electrics (BEVs), and 8.1% plugin hybrids (PHEVs). This compares with shares of 16.7%, 10.9%, and 5.8%, a year ago. We can see that both categories of plugin have grown share at a decent rate, YoY.

July is always one of the UK’s quieter months of the year for EV share, and for auto volumes generally. Nevertheless, BEV volumes were up 88% over July last year, to 23,010 units. PHEV volume increased by almost 80%, to 11,702 units. Both were well ahead of the 27% volume recovery of the broader market.

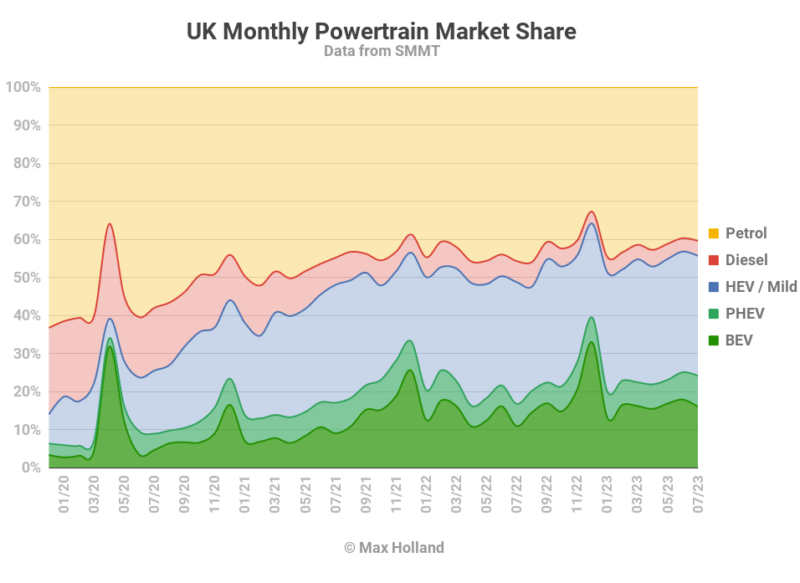

In this growing market, petrol-only powertrain volume was up just 13% YoY, which should be considered simply a market correction against 2022’s weakest July for decades (due to supply chain woes). Meanwhile, diesel-only volume declined by 8%. Both categories therefore lost share year on year, dropping to 40%, and 4%, respectively.

As discussed in last month’s report — even when we include the quick-fix of mild hybridisation of diesels — the sum of diesel based powertrains is still steadily losing volume.

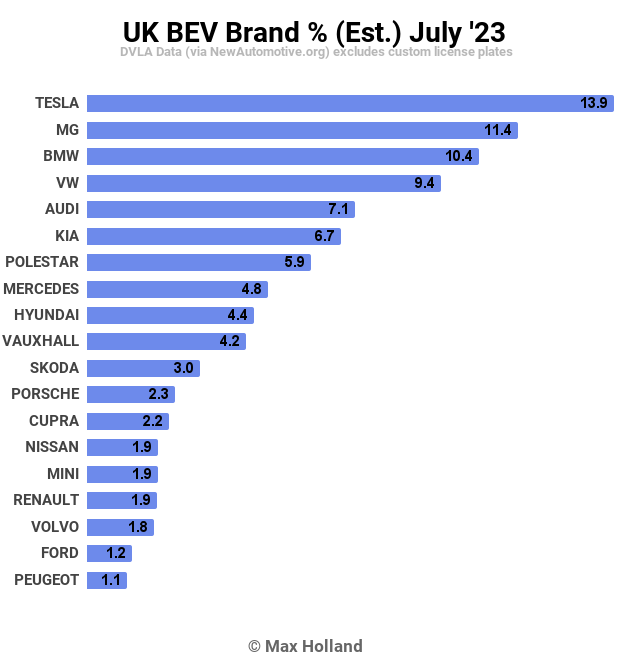

UK Bestselling Brands

Although not a peak Tesla delivery month, July still saw the brand leading the UK BEV market by a decent margin, with 3,141 units registered in total.

Over two thirds of Tesla’s deliveries were the Model Y (2,284 units). The rest were almost all the Model 3 (the company is no longer making RHD versions of the S and X).

In second and third spots were MG Motor, and BMW.

The top five were filled out by Volkswagen and Audi brands. We don’t have timely model data to specify whether any new BEVs entered the UK market in July. We can assume that the MG4, the BMW i4, and the BMW iX1 are all doing well.

The MG has just released a performance variant of the MG4, called the MG4 XPower, which adds a second, more powerful motor, taking output from the standard 150 kW, to a bonkers 320 kW (435 horsepower). The zero to 62 acceleration halves from the standard 7.9 seconds, to 3.8! And the price of this monster? £36,495 on the road. If the traffic light grand prix is your thing, no other vehicle at this price point comes close to this acceleration.

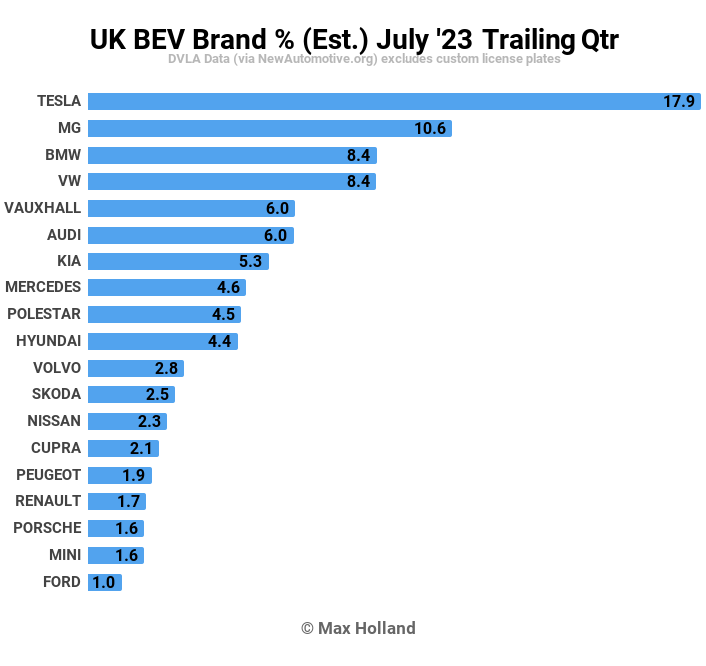

Let’s look at the 3 month picture:

In the trailing 3 month charts, Tesla’s strong lead is more clear, having a share (17.9%) not far from that of the #2 and #3 brands combined. However, its share is slightly down from the 18.4% of the prior period (February-April). Meanwhile runner up MG Motor’s share was up from 9.0% to 10.6%.

BMW has moved up to 3rd spot, from 6th previously, a great improvement. Vauxhall (Opel), was up from 10th to 5th. Volkswagen, Audi, and Kia, all lost one or two ranks.

It’s sad to see Nissan and Renault — both market leaders in the first years of the last decade — now towards the bottom of the pile. Renault has recently made a small upturn, whilst Nissan share has shrunk further.

Nissan’s old spirit of EV pioneering is Ghosn but not forgotten.

The company desperately needs a Leaf-like model with contemporary technology (rather than the 2010 technology the Leaf still uses today).

While Renault will launch the shiny new Renault 5 in 2024, the shared new CMF-EV platform it is based on, won’t make it into an equivalent from Nissan before 2026! Maybe that’s why Nissan keeps referring to it as a “platform of the future.”

Outlook

The UK’s auto market growth, mainly powered by plugins (and coming off a very low baseline), is a bright spot in an otherwise sluggish economy. UK Inflation rates remain very high (around 8%), and aren’t forecast to return to reasonable levels (e.g. the government’s 2% target) until 2025.

As a result, the Bank of England has recently increased interest rates for the 14th consecutive time, to a 15 year high (5.25%). On the other hand, the IMF are now predicting that the UK economy should grow by 0.4% in 2023, up from its earlier (April) forecast of negative 0.3%.

As for the auto market’s outlook, the UK industry body, the SMMT, are now predicting an overall volume of just under 1.85 million units this year, better than last year, but still well down from the 2.5 million norms, pre-2020. They also expect combined plugins to take 25% share in full year 2023. Next year’s market size is forecast for 1.95 million, with all the growth coming from plugins (estimated to take a combined 30.5%).

The continued growth of the UK plugin market is fairly certain in the context of the new zero emissions vehicle mandate that is set to become effective as of January 2024. We discussed this in detail in last month’s report, it aims for 38% ZEV by 2027, and 80% by 2030. I think the whole process will go a bit faster, but that’s okay, because the mandate is a backstop, rather than a speed limit.

What are your thoughts on the UK’s EV transition? Will it go faster than the mandate, or slower? Please join in the discussion in the comments section below.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …