Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

The hydrogen for transportation community is all abuzz about a late-year report from a working group of the UK’s Hydrogen Delivery Council and the Department for Energy Security & Net Zero. The working group, made up almost entirely of professionals whose entire career, livelihood, and indeed the future of the firms they worked for required that there be a role for internal combustion engines, remarkably found just that, as long as they were burning hydrogen.

The report is Powering Growth: The role of hydrogen internal combustion engines in non-road mobile machinery. Sharp eyes will note that they appear to have given up on road applications, but that’s merely the scope of this document. Despite the scope and not covering road vehicles at all, they recommend hydrogen internal combustion vehicles for road applications as well.

The UK’s Hydrogen Delivery Council and the Department for Energy Security & Net Zero have established several Task and Finish Groups to tackle what they consider key challenges in the hydrogen sector. The Hydrogen Propulsion Manufacturing Taskforce aims to enhance the UK’s investment in hydrogen propulsion systems, while the Critical Minerals Group examines supply risks critical to hydrogen technology. Other initiatives include the Bioenergy with Carbon Capture and Storage group, which assessed carbon-negative solutions, and the Green Jobs Delivery Group, which focuses on workforce development for the green economy. This all preceded the current administration which just came in, so it’s unclear whether any more reports like this from the hydrogen-happy Conservatives will surface.

Remarkably, all of these groups start with the assumption that hydrogen will have a major role in the UK’s energy future, and then even more remarkably find that it does.

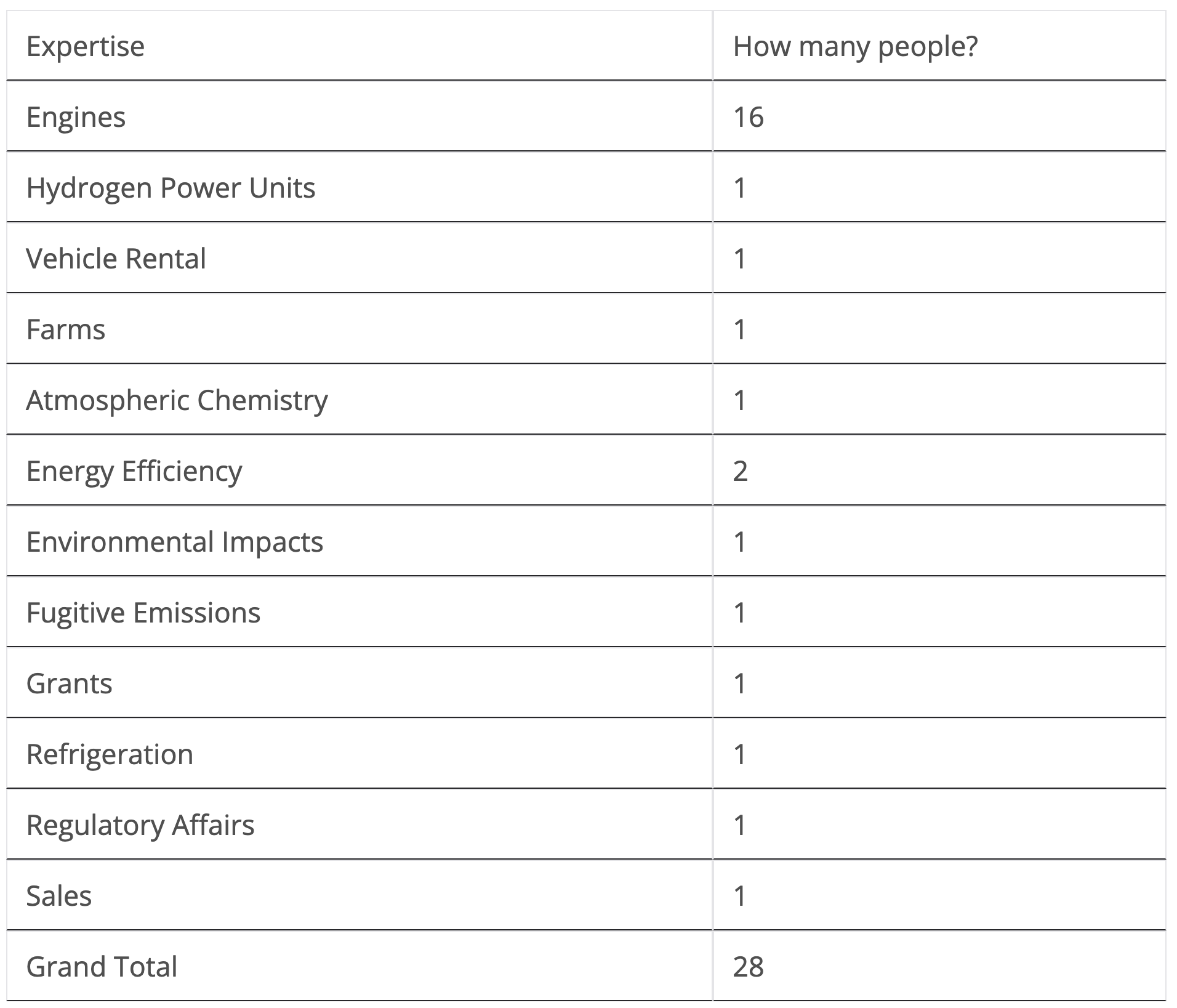

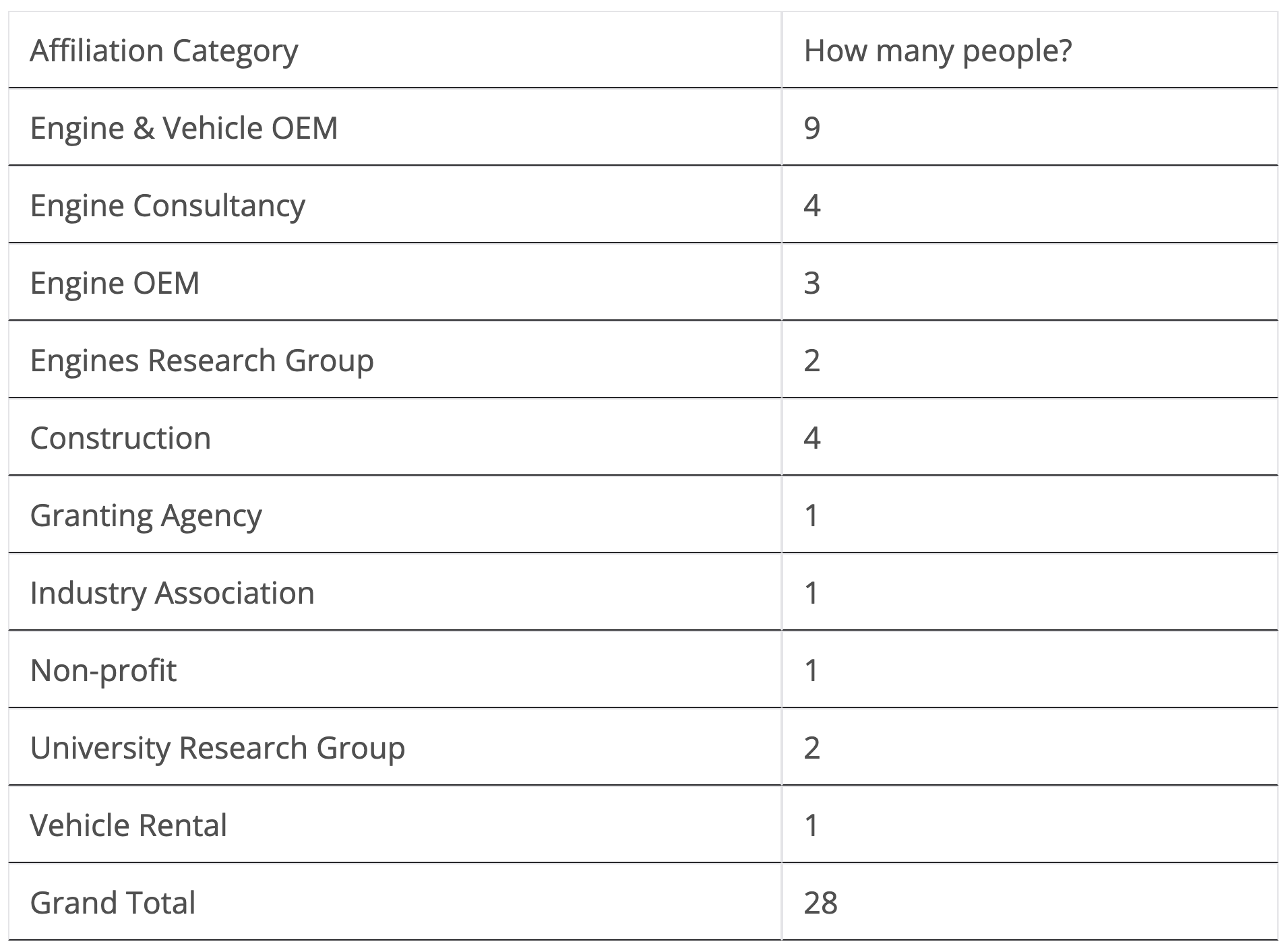

Let’s look through the list of people on the non-road working group. I won’t name names, although they are there in the report for anyone to see, but will identify professional affiliations and expertise.

Yup, of the 28 people listed in the working group, over half are explicitly professionals in engines or bits of engines.

It gets a bit more unbalanced when the question of professional affiliation is asked.

18 of the 28 representatives are of firms and institutions which build their own internal combustion engines for their own vehicles, build engine components, usually emissions control, for engines, consult on the design of engines or research the design of engines. That’s 18 of 28 whose entire professional future depends on burning stuff in engines, and remarkably that majority of participants found that it was essential that stuff got burned in engines.

Unsurprisingly, JCB was front and center, with four representatives, 14% of the total. JCB is local to the UK, so there’s that, but Lord Bamford, son of the founder, has been very vocal about hydrogen, in part because JCB has zero intellectual capital that isn’t related to internal combustion engines. He even has his own son in on the game, as that chip off the block owns Wrightbus, which somehow managed to get a big contract for hydrogen buses from London’s transit agency just when it was suffering severe financial difficulties. Cummins and Volvo are the other big vehicle OEMs, and they had 2 and 3 representatives between them.

Even among the others, there’s a lot of hydrogen sprinkled in, so this is quite a bit more of a bubble than even this lopsided material shows. Of course, who else is going to waste professional time with their employer’s blessing on the dead end of highly inefficient hydrogen internal combustion engines except those highly motivated to have them become real?

Well, there are the atmospheric chemistry and fugitive emissions representatives. They have a strong interest in this, especially because hydrogen is now known to be a potent greenhouse gas, 13 to 37 times as potent as carbon dioxide over 100 and 20 years respectively per the most authoritative source, a 2023 Nature paper that they don’t cite, preferring one which lists the previously understood 11 times at 100 years, which rather understates the concern.

And the study is careful to omit everything before the engine, concerning itself solely with engine emissions in operation, specifically of NOx and hydrogen.

“Because a GHG emission has the same impact wherever it is emitted, it is important to consider GHGs on a “life cycle” basis, which includes not just emissions from the vehicle or machine, but also from the production or distribution of fuel, and manufacture and disposal of the vehicle or machine. […] However, life-cycle considerations are not considered here”

The report makes it completely unclear — 5.1.5 Engine Performance is a masterpiece of confusing text — that you can have low NOx or low hydrogen slippage, but not both. They have a data point which makes it clear than in at least one case one of the manufacturers have demonstrated that the combination of NOx and H2 emissions is below the EU heavy road vehicle CO2 requirement from EU Regulation (EU) 2019/1242 of 1 gCO₂/kWh, which to be clear is mostly achievable by electric vehicles and is still only tank-to-wheel, the wrong metric.

However, these emissions aren’t even tank-to-wheel, but engine-to-wheel. Only the emissions of the hydrogen engine are tested, and this assumes that no hydrogen leaks as it moves from the highly pressurized or cryogenic hydrogen fuel tank to the engine which requires the hydrogen at a very different pressure and temperature.

Hyundai had to recall all of its hydrogen cars because of serious risk of hydrogen leakage, including telling owners to park them outdoors.

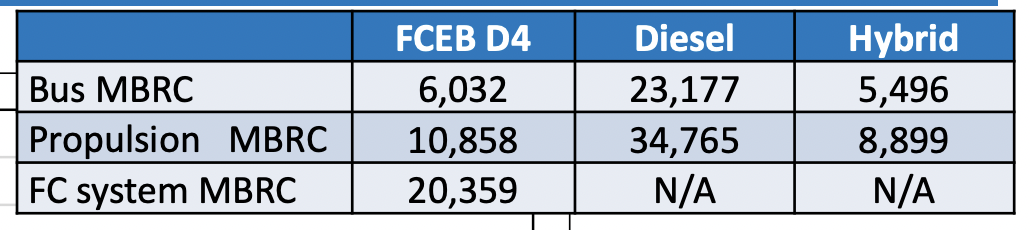

California’s buses manage to drive about two-thirds as many miles as a diesel before the fuel cell system needs repair, and reports show 50% higher maintenance costs than their diesel buses. At the pressures of 300 atmospheres common to these buses, a lot of those failures undoubtedly involve failing seals, something that plagues the entire hydrogen value chain, where compressor seals failures are about 50% of the very high maintenance costs.

But it’s not just in the engine emissions or vehicle’s tank to engine that leaks will occur. Peer-reviewed research is now emerging that’s making it clear that in the best case scenario every time hydrogen gets touched 1% or more of it leaks, and in any big hydrogen economy, that will be 7-8 times for likely leakage in the 10% range. One California refueling station saw 35% leakages which they managed to get down to only 2% to 10% after multiple interventions over a couple of years. The DOE makes it clear that in the best case scenario there will be 2% boil off and leakage from trucking liquid hydrogen to very big refueling stations, and 10% for small deliveries more typical of off road construction and farming situation.

This is all for road vehicles where the roads are paved, of course, and hydrogen tanks, compressors, lines and thermal management on an offroad internal combustion vehicle are going to get a lot more vibration, not only from the surface, but from the big engine that’s burning the hydrogen. It’s kind of the worst case scenario for the degree of leakage, but at least from a safety perspective the hydrogen is mostly going to escape to the open air. That’s also the worst case for greenhouse gas emissions, of course.

My working assumption for offroad hydrogen vehicles of any type is likely closer to 15% well-to-wheel leakage of hydrogen. The only facilities where hydrogen leakage is low are industrial chemical processing plants where hydrogen is manufactured at the point of consumption as a feedstock, where it is manufactured in exactly the amount required for the process when it is needed. Everything in that facility is monitored and maintained by professional and certified facilities engineers.

So the report from all the engine types carefully excluded pretty much every source of leakage and found low emissions from these vehicles, when no one else appears to be studying getting hydrogen to off road sites. They assert that other groups are studying hydrogen production and distribution, presumably the CCUS and Hydrogen task and finish group, but I can’t find even a terms of reference for them and the jobs program that it was part of has been shut down with the change in government.

Of course, there’s the real stickler, which is hydrogen internal combustion efficiency. There’s just no way to make an internal combustion engine achieve even the mediocre maximum 60% efficiency of a hydrogen fuel cell, which is far under that of battery round trip efficiencies of 85% to 95%. The report claims that a high-pressure direct injection engine can get up to 50% brake thermal efficiency, meaning 50% of the energy in the hydrogen translates into forward motion. However, that’s peak efficiency at optimal revolutions per minute, and average efficiency is going to be well under that, likely 40% in the best maintained engines.

What this means is that hydrogen internal combustion engines well-to-wheel are going to have low efficiencies after electricity is inefficiently turned into green hydrogen, then compressed for storage or liquified — another third of the energy in a kilogram of hydrogen for that process —, then pumped into trucks for distribution, then pumped into more tanks or vehicles. That’s before the leakage is counted.

40% losses in electrolysis, 10% to 33% losses for compression or liquification and distribution, 15% losses due to leakage and 60% losses due to engine inefficiency is a lot of losses. In the best possible case, if green hydrogen made from low-carbon electricity — actually low-carbon hydrogen — is used, only 20% to 25% of the electricity gets to the wheels in terms of movement. That’s about four times less than just using the electricity in battery powered equipment and even worse for tethered equipment. That means that just energy costs are going to be in the range of four times as high, but delivering hydrogen is very expensive, so total fuel costs are probably going to be eight to ten times as high for hydrogen vehicles.

For agricultural equipment over the lifetime of the vehicle, fuel costs are 50% to 70% of expenses, with capital costs being 20% to 40%. Increasing the biggest expense line item substantially just isn’t going to go over well with buyers and operators, especially when electricity lowers that line item. Fundamentally, operational expenses beats capital expenses hands down in this case.

You wouldn’t know it from this report, however. The price that owners and operators will pay for hydrogen isn’t present anywhere. There are lots of pound figures, but it’s about all of the value of the OEM’S revenues to His Majesty’s budget and how low the capital costs of hydrogen internal combustion engines will be, only 25% more than diesel engines initially and then, should they convince literally every potential customer to spend four times as much on the fuel, eventually get down to where diesel is today.

Instead, in the section on total capital costs, the report pretends that hydrogen will be the same price as diesel, despite overwhelming results from 2023 and 2024 hydrogen deals show that fantasies of cheap hydrogen are just that, fantasies, and the reality that offroad hydrogen supply will be more expensive than refueling station hydrogen supply which ranges from $15 to $35 per kilogram for the blackest of hydrogen. They pretend that electric vehicles will be heavily constrained by critical minerals availability, despite the collapse of critical mineral prices in the market before they published and the clear statements in the IEA Global Critical Minerals Outlook 2024 that they cite that the problem isn’t resources or reserves, it’s simply investment in the critical minerals sector.

“Electrification of NRMM is highly likely to be limited by raw material availability, given the size of batteries that would be required by such equipment.”

The segment is a rounding error in battery demand and battery minerals substitution is occurring at a tremendous pace. Lithium, phosphate and iron are common minerals and the basis of lithium iron phospate (LFP, duh) batteries, currently dominating a lot of grid- and EV-battery chemistries because they are cheaper and have an even lower chance of thermal runaway. Sodium based batteries are coming on line, and they promise to free up lithium for electric vehicles from grid applications because sodium is even cheaper.

The statements about critical minerals in the hydrogen internal combustion report, in other words, are the most self-serving possible view of the critical minerals situation. I had that conversation with Gavin Mudd, director of critical minerals intelligence at the British Geological Survey the other day as I recorded a podcast with him on the subject. He’s one of the leading experts on the subject, having done original research with global collaborators on most of the periodic table over the past 20 years. His take: there’s no shortage of resources.

Basically, the report pretends that hydrogen will be cheap, batteries will be rare and expensive and the defining factor will be the capital cost of the power unit, so hydrogen internal combustion engines will win. Since at no point do they calculate total cost of ownership with any scenario modeling of prices of hydrogen, this is basically an attempt to ignore reality.

Meanwhile, batteries keep getting cheaper and cheaper and holding more and more electricity. That’s why there is announcement after announcement about major electrically powered equipment being ordered in the sectors this report was about. Fortescue’s billions of dollars of orders for hundreds of pieces of battery and tethered mining equipment makes it clear that money is flowing, and not to hydrogen. Vale and BHP’s announcements that hydrogen has no place in mining is in this category as well. There’s Sandvik’s LH514E tethered 14-ton electric loader to consider, as Sandvik has been delivering tethered mining electrical vehicles for 35 years.

There are a lot of electric farm equipment as well, both being delivered and in operation, far more than any working hydrogen farm equipment, whether internal combustion or fuel cell. For construction equipment, 10% to 15% is expected to be battery electric or hybrid in a year or two. One of my favorite pieces of kit is a huge scoop shovel which has a cable running to batteries on a trailer which gets hauled away for charging, with a new trailer hauled in with charged batteries to keep it going, combining battery electric and tethered operations for something which just doesn’t move that far in a day.

The heavy offroad consumers, in other words, are voting with their pocket books to avoid hydrogen and use electricity more directly, mainly because they know the operational vs capital expense ratio and can do the simple math required for total cost of ownership too. They aren’t going to be fooled by this study. The representatives from Skanska, the National Farmers Union and Balfour Beatty weren’t bean counters, and the report dodged the entire question so they probably think the fuel is going to be cheap somehow, but regardless, they were vastly outnumbered by the OEMS who are desperate to find a way to avoid driving their vehicle companies over the coming cliff.

Despite all of this, what is the report’s recommendation?

“It is strongly recommended that H2ICE is accepted as an appropriate net zero emissions technology for rapid decarbonisation of the NRMM sector with the cobenefits of significantly improved air quality.

Given the level of reduction in both GHG and regulated emissions available, it is also recommended that H2ICE should be considered a net zero emissions technology for other sectors including on-road applications.

H2ICE is considered to be the least inflationary approach to delivering decarbonisation at scale in the NRMM sector and within the timescales of net-zero.

This will also offer a great opportunity to kick-start demand for hydrogen, both within the sector and the hydrogen economy as a whole, in support of the immediate ambition for clean growth in the UK-wide economy.”

This is what all the headlines are blaring about, claiming that the UK government is saying this. However, the report also says something else:

“This report represents the views of the Hydrogen Internal Combustion Engine Subgroup and its members and does not represent the views of the Department for Energy Security & Net Zero or the UK Government.”

Yes, close reading and a little context make it clear that the report is ginned together nonsense by a self-selected group who won’t have jobs in a few years unless their recommendations come true. The outcome was foreordained and the scope and framing was carefully selected to enable what isn’t true to appear true.

It’s remarkably unsurprising to me given the number of self-serving reports I’ve seen like this from hydrogen working groups comprised of self-selected hydrogen economy companies with nary a dissenting voice allowed to enter the meeting rooms. Hydrogen strategies virtually all fare as badly when examined, and the participants are just as stacked.

As a recommendation to governments establishing groups like this, include budget to have independent expertise be engaged to frame the terms appropriately, ensure accurate information is part of the discussion, critique the drafts and generally keep it from being a self-serving bubble report by vested interests. Whatever this report cost, the money was wasted.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy