The British government announced amendments to its emissions trading system (UK ETS) on July 3, 2023, that would cut the number of permits available to carbon emitters over the rest of the decade and extend the scope of the scheme to the domestic shipping and waste incineration sectors.

Despite these changes that will alter the landscape of the UK ETS in the coming years, some analysts are expecting the market to remain amply supplied. As part of the reforms, the overall cap on allowances issued over 2021-2030 will be cut down from 1.36 million United Kingdom allowances (UKAs) to 936 million UKAs. This reduction of around 30% would lead to an annual cap of 50 million UKAs in 2030, according to the UK ETS Authority.

Greg Idil, a senior carbon trader at Vertis Environmental Finance, said the market’s brief rally on July 3 following the reform announcements was an overreaction to long-awaited amendments to the UK ETS.

Despite a tightening of the cap in allowances through to 2030, Idil pointed out that the British government will designate a higher amount of free allowances for distribution to hard-to-decarbonize sectors at 40% of the overall annual cap, more than the current 37% designation.

Additionally, the government said it would release an additional 53.5 million UKAs between 2024 and 2027, a market injection that will also exert bearish pressure on the already well-supplied market, according to Idil.

“There was also a reality-check component [to the fall after Monday’s rally] since…the demand for UKAs currently remains very low. The manufacturing sector has continued to decline in June despite weakening price pressures — the U.K. Manufacturing Purchasing Managers Index (PMI) fell to 46.5 from 47.1 in May, which marked an eleventh consecutive month below the 50 threshold. It was the lowest reading this year and one of the weakest since the 2008-2009 financial crisis,” Idil said.

Benjamin Lee, a carbon analyst with Energy Aspects, told OPIS that the UK ETS reforms are bearish for carbon when compared to his previous price models due to the additional 53.5 million allowances that the government will auction from 2024 to 2027.

“This will lead to a market that will get looser over the next few years…despite the steeper cap. The growing oversupply should weigh on the UKA price over the next few years and we don’t see the UK market getting tight until the late 2020s,” Lee said.

Nicolas Girod, a founder of ClearBlue Markets, told OPIS that he expects the premium commanded by European Union emissions allowances (EUAs) to UKAs to narrow as demand for UKAs grows in the coming years even as the market is currently “oversupplied.”

Throughout much of 2022, UKAs were the most expensive carbon allowances in the world, trading at a premium to EUAs. That trend has reversed in 2023, with UKAs currently trading at a discount to EUAs and the spread between the benchmark contracts for the two emissions trading systems reaching as high as €15 ($16.35) in early May, according to Intercontinental Exchange (ICE) data.

“We’re bullish on EUAs as well. There might be some volatility but overall the EUAs market is also pretty tight if you look at the balances with industrial demand and the power sector,” Girod said. “There are fewer emissions but the [allowances] supply is tight and it should limit the downside until 2026.”

“We’re bullish on EUAs as well. There might be some volatility but overall the EUAs market is also pretty tight if you look at the balances with industrial demand and the power sector,” Girod said. “There are fewer emissions but the [allowances] supply is tight and it should limit the downside until 2026.”

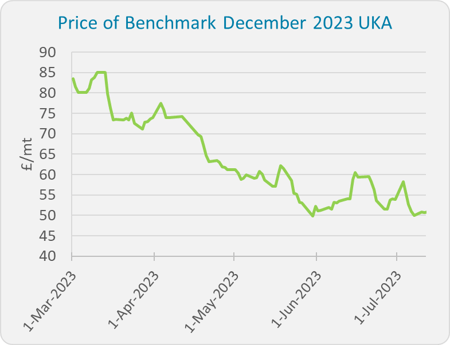

The day the reforms were announced, utilities bought into the hype, causing the benchmark ICE December 2023 UKA to rise by nearly 17% during intraday trading to £63.51 ($82.11) per metric ton.

However, the rally was short-lived, with prices settling at £50.96/mt by July 6, trading below the level before the reforms were announced, as the the market began to digest the bearish aspects of the reforms.

Free Allocations Phaseout for Aviation

The aviation sector has been subject to the UK ETS but has received millions of pounds in free allocations since the cap-and-trade system went live in 2021. With the reforms, the government is proposing to gradually phase out the sector’s free allocations between 2026 and 2030.

The aviation sector received 4.25 million free allowances in 2022, according to government figures. Based on the average 2022 UKA price of £79.18/mt, it amounts to approximately £336 million in free allocations.

According to 2022 verified emissions UK ETS data, the aviation sector accounted for approximately 8 million mt of carbon dioxide emissions that same year, or around 7% of the total 110.6 million mt of carbon emitted by entities subject to the UK ETS.

Girod sees demand for UKAs growing from the aviation sector in the coming years as a result of the reforms. “[The aviation sector] might start hedging a little bit more and that will mean additional demand to the market [to a greater extent] than [extra demand from the] shipping [sector]. Overall I think it’s supportive [of UKA prices],” Girod said.

UK Domestic Shipping Covered By 2026

The government will also expand the UK ETS in 2026 to cover the domestic maritime sector, specifically vessels weighing 5000 gross tons and above undertaking voyages that “start and end at the same port in the UK as well as those going from one UK port to another UK port.”

“Our current estimates for emissions to be included from the domestic maritime [sector] in the first year of inclusion in the UK ETS (2026) would be equivalent to around 2 million UK allowances, with decreasing amounts each year for the remainder of the phase [2021-2030], as consistent with delivering the above targets,” the government said in its consultation results.

According to the consultation report, vessels of 5000 GT and above emitted 2.4 million metric tons of carbon in 2019. Compared to the total verified emissions reported for 2022 under the UK ETS, the domestic shipping sector in the UK could amount to just over 2% of total verified emissions.

For the time being, the British government doesn’t seem inclined to include international shipping voyages in its ETS. “Given the importance of achieving a globally applicable policy measure to reduce emissions from international shipping, we fully support the work of the International Maritime Organization to achieve this and are focusing our efforts there,” the report said.

The UK Chamber of Shipping, whose 200-plus members comprise operators of small workboats to large container vessels, said that the government’s announcement is a significant step toward reaching net zero emissions but that international agreements are the best option for lasting change.

“It is important that as the details of the scheme become clear it helps, rather than hinders, the drive towards net zero,” the chamber said in a statement. “This means ETS funds raised from domestic shipping must be used to aid the transition to net zero for the sector. This should include supporting the development of zero-emission vessels, fuels and technology and associated port infrastructure.”

According to Tom Bartosak-Harlow, director of communications for the industry association, the British shipping industry could require up to £2 billion a year to fund the transition to net zero.

–Editing by Anthony Lane, alane@opisnet.com