U.S. demand for oil will fall dramatically over the next three decades, thanks to the Inflation Reduction Act (IRA) and other state and federal transportation policies, according to new modeling. Over the same time, U.S. exports of crude oil, as well as natural gas, will rise significantly. These important new findings make clear that the United States does not need new offshore oil and gas leasing to meet our national energy needs.

The Department of Interior’s Bureau of Ocean Energy Management (BOEM) is charged with assessing the country’s energy needs when it makes future offshore leasing plans under the Outer Continental Shelf Lands Act (OCSLA). The Biden administration is poised to finalize a proposed plan for the next five years of offshore leasing in September. The final plan is expected to go into effect by the end of the year.

NRDC asked OnLocation, an independent energy analytics firm, to conduct projection analyses of how several different policy scenarios, including with respect to offshore leasing, would affect certain energy, economic, and climate-related outcomes—such as U.S. oil and natural gas production, demand, imports/exports, and greenhouse gas (GHG) emissions—over a 30-year time period from 2020 to 2050. Our policy scenarios of interest included new offshore leasing—or “business-as-usual”—versus no new offshore leasing. The chosen policy scenarios also included “with vs. without” implementation of the most recent state and federal clean energy policies for the transportation sector, including tax credits under the Inflation Reduction Act (IRA), electric vehicle targets adopted by California and five other states under the Advanced Clean Trucks rule, and the Environmental Protection Agency’s (EPA) proposed GHG standards for cars and trucks. We were interested to see how these clean energy policies interacted with leasing policy, such as whether any demand drop due to the efficiency policies was more or less than any production drop due to no new offshore leasing.

Based on our policies of interest, OnLocation developed four scenarios for analysis. These scenarios differ in two ways: first, whether or not they include new offshore leasing; and second, which transportation and clean energy policies they account for. Virtually all new offshore U.S. oil leasing would occur in the Gulf of Mexico. As a result, the effects of no new offshore leasing in the Gulf on outcomes like oil production and demand are essentially the same as the effects of no new offshore leasing anywhere in the U.S.

By analyzing four different scenarios, we can see the impacts of no new offshore leasing and new transportation policies on oil and gas production, demand, and other outcomes. The scenarios are the following:

- The reference scenario (Ref) includes business-as-usual offshore leasing through 2050, and some transportation policies from the IRA, consistent with the U.S. Energy Information Administration’s Annual Energy Outlook 2023 model.

- The no new leasing (NNL) scenario assumes that no new offshore leases are issued in the Gulf of Mexico after May 2021, and includes the same transportation policies as the reference scenario.

- The transportation policy (POL) scenario assumes business-as-usual leasing through 2050. Unlike the Ref and NNL scenarios, it includes additional IRA tax credits, new electric vehicle targets under the Advanced Clean Trucks rule, and the EPA’s proposed GHG standards for cars and trucks.

- The no new leasing plus transportation policy (NNL+POL) scenario assumes that no new offshore leases are issued in the Gulf of Mexico after May 2021, and includes the same transportation policies as the transportation policy (POL) scenario.

There are several key takeaways from the results of OnLocation’s analysis.

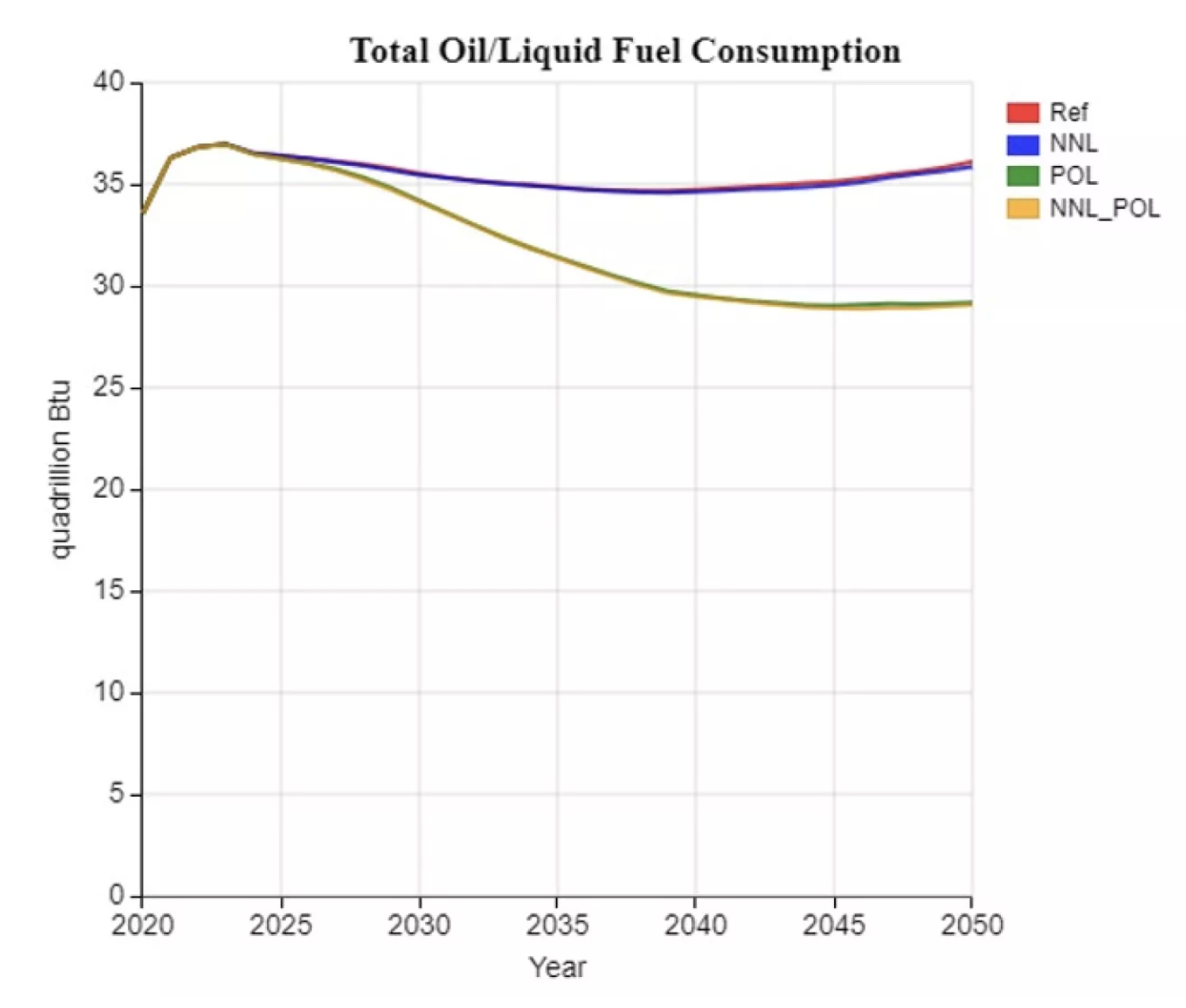

Demand for oil is likely to drop under new transportation policies.

- In 2035, overall U.S. oil consumption is 10% lower in the scenarios that reflect new clean transportation policies (POL and NNL+POL), compared with the straight business as usual (Ref) or straight no new leasing (NNL) scenarios. Notably, demand for oil decreases even with no new leasing in the Gulf.

- By 2050, oil consumption is 19% lower in POL and NNL+POL than in the other two scenarios. By encouraging sales of electric vehicles and hastening the transition to renewable sources of energy, the clean transportation policies included in the third and fourth scenarios (POL and NNL+POL) drive a decreased demand for oil. The figure below shows the difference in oil consumption from 2020 to 2050 in the clean transportation policy scenarios (green and yellow lines) and the reference and NNL scenarios (red and blue lines).

Figure 1: U.S. oil demand from 2020 to 2050. Credit: OnLocation for NRDC.

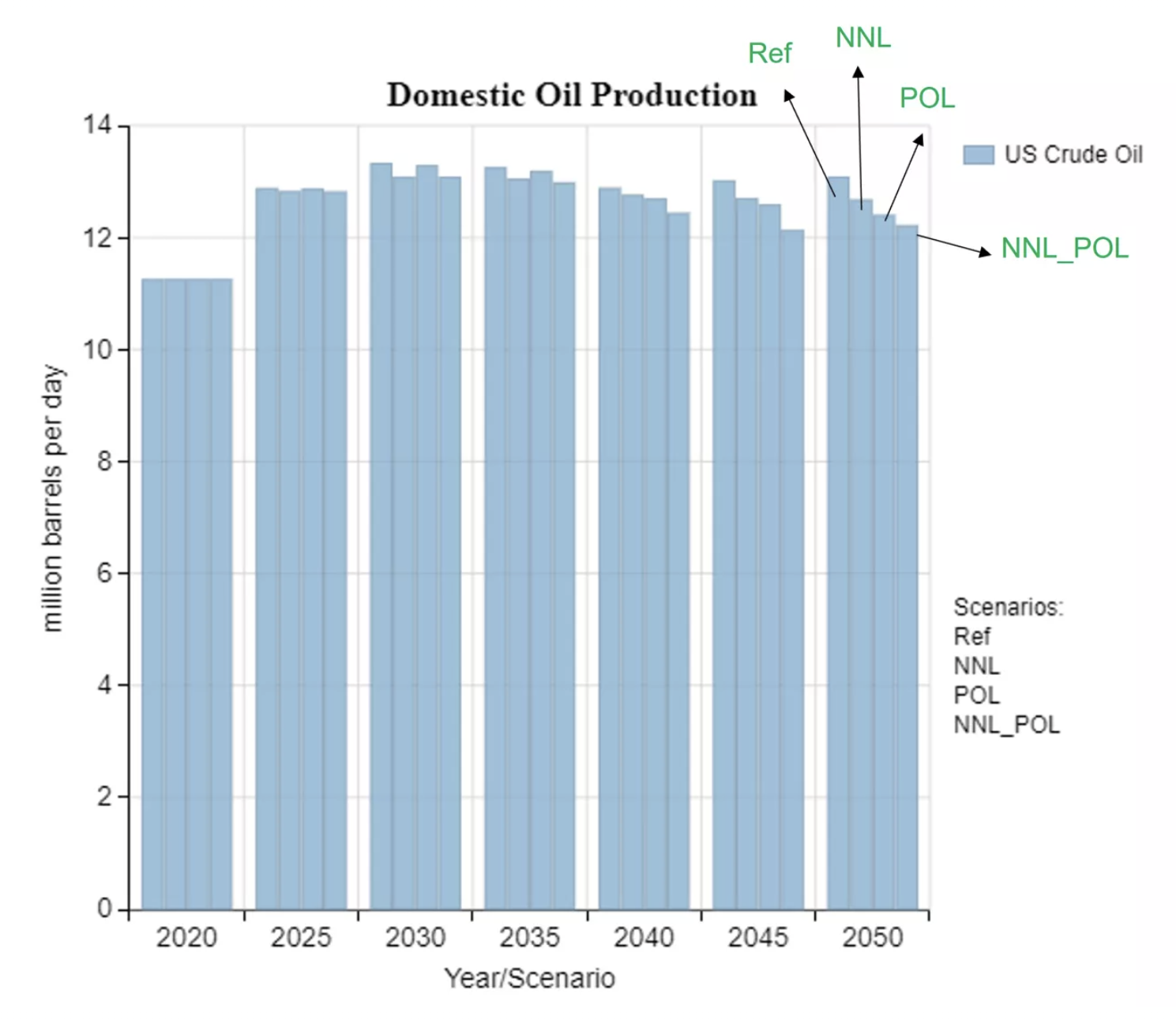

Even with no new leasing in the Gulf, U.S. oil production remains robust through 2050.

Although no new leasing in the Gulf would reduce the number of new offshore oil and gas leases issued, this policy would have only a mild impact on U.S. oil production over the next 30 years.

- As shown in Figure 2 below, even under the no new leasing scenario, U.S. oil production tends to increase from 2020 to 2035.

- Through 2040, annual production in the no new leasing scenario is higher than 2024 production in both the NNL case and the reference case.

- U.S. oil production remains robust through the entire period of analysis. Projected production in the no new leasing scenario is still higher in 2050 than it is in 2023.

This sustained production is due in part to the staggering number of existing offshore leases: there are currently 559 producing offshore oil and gas leases, in addition to 1,685 non-producing but active leases, in federal waters. Moreover, offshore leases can continue to produce oil and gas for decades.

Figure 2: U.S. oil production from 2020 to 2050 under the four scenarios analyzed. Credit: OnLocation for NRDC.

Declines in U.S. oil production over time match the decreasing demand for oil.

- As described and shown in Figure 1 above, new transportation policies are projected to drive down overall oil consumption by 10% in 2035 and 19% in 2050.

- As demand falls, oil production will also decline. Over the analysis time period, new clean transportation policies will drive down the price of crude oil, causing U.S. production to decrease.

- No new offshore leasing is also projected to decrease domestic oil production slightly. Nevertheless, for every year through 2050 and as noted above, annual oil production is higher under the no new leasing scenario than current (i.e., 2023) annual oil production under the reference case.

- Across the no new leasing and clean transportation scenarios, the reduction in oil production is small in the near-term. In 2035, oil production in the NNL, POL, and NNL+POL scenarios is only 1.5%, 0.5%, and 2% lower, respectively, than oil production in the reference case.

- By 2050, these differences increase to 3%, 5%, and 6.5%, respectively.

- Because oil supply will fall at the same time as demand, a no new offshore leasing policy would not prevent the United States from meeting national energy needs.

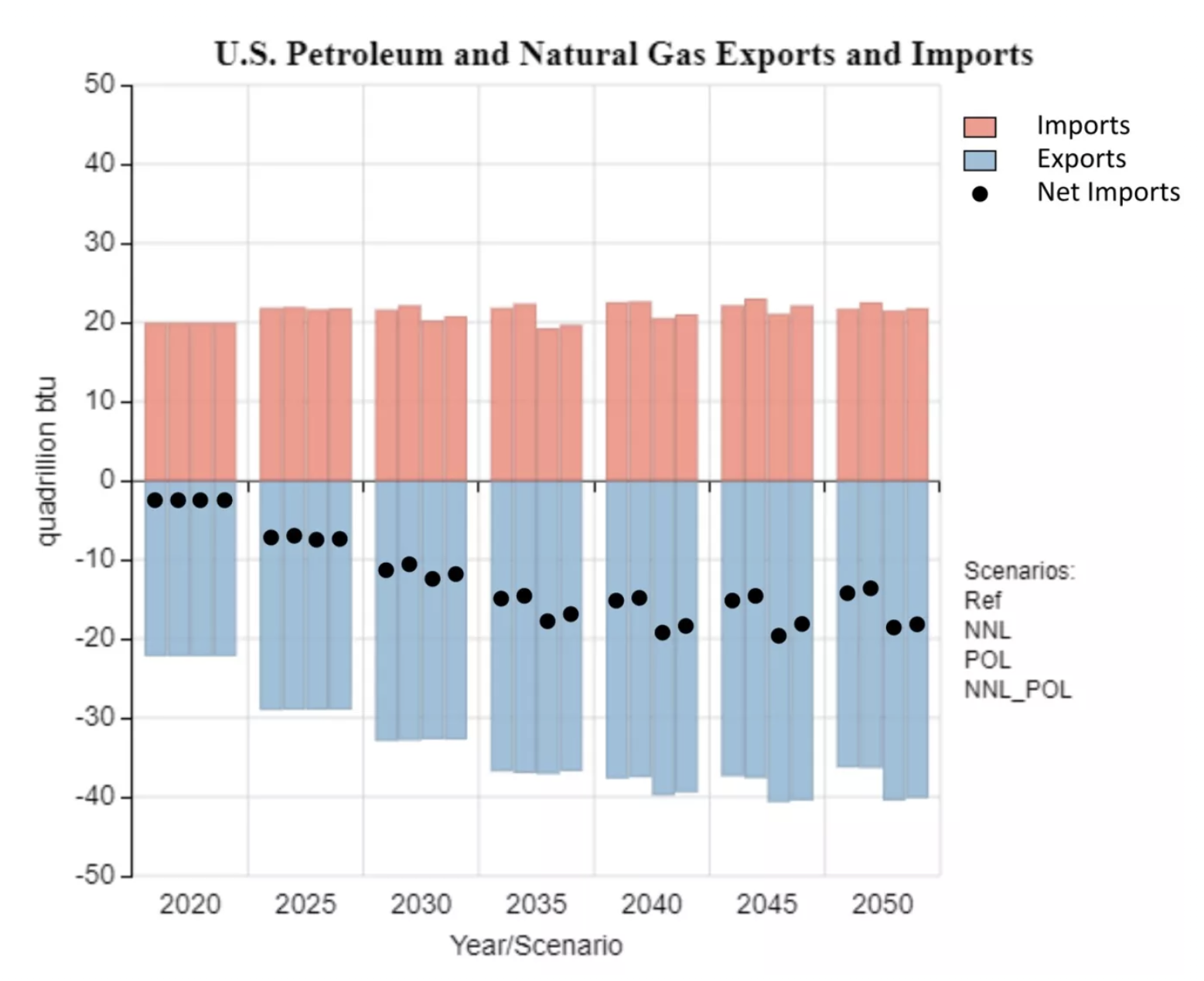

A drop in U.S. demand for oil and gas is projected to yield an increase in net exports, even with no new offshore leasing.

- The U.S. is already a net exporter of oil and natural gas and will become much more of one in the future. Net U.S. exports (exports minus imports) of oil and natural gas combined (measured in BTU as a common unit) are higher in 2050 than in 2020 under all four scenarios.

- From 2030 to 2050, new transportation policies (under the POL and NNL+POL scenarios), and the ensuing drop in domestic demand, will drive an increase in combined U.S. net exports of oil and natural gas, compared with the reference scenario. Even in 2025, imports do not increase with no new offshore leasing and the new transportation policies (NNL+POL) compared to the reference case.

- By 2050, oil and gas exports are 11% to 12% higher in the transportation policy scenarios than in the reference scenario. Because the new transportation policies reduce overall demand for oil, combined U.S. imports of oil and gas are also lower in the transportation policy scenarios compared with the reference scenario from 2025 to 2045. So new transportation policies drive down net imports (imports minus exports) of oil and gas, regardless of whether there is new offshore leasing or not.

- Starting in 2030, because of the drop in domestic demand, exports of crude oil alone increase under the transportation policy scenarios (POL and NNL+POL) compared to the reference case. By 2050, exports of crude oil alone are 95% higher in both transportation policy scenarios than in the reference scenario.

Figure 3 shows U.S. combined imports of oil and natural gas in pink and combined exports in blue. It depicts net exports using black dots. Within each year shown on the figure, there are four bars for imports and exports. From left to right, the bars and dots within each year represent the reference scenario, NNL scenario, POL scenario, and NNL+POL scenario.

Figure 3: U.S. combined oil and natural gas exports and imports from 2020 to 2050 under the four scenarios analyzed. Credit: OnLocation for NRDC.

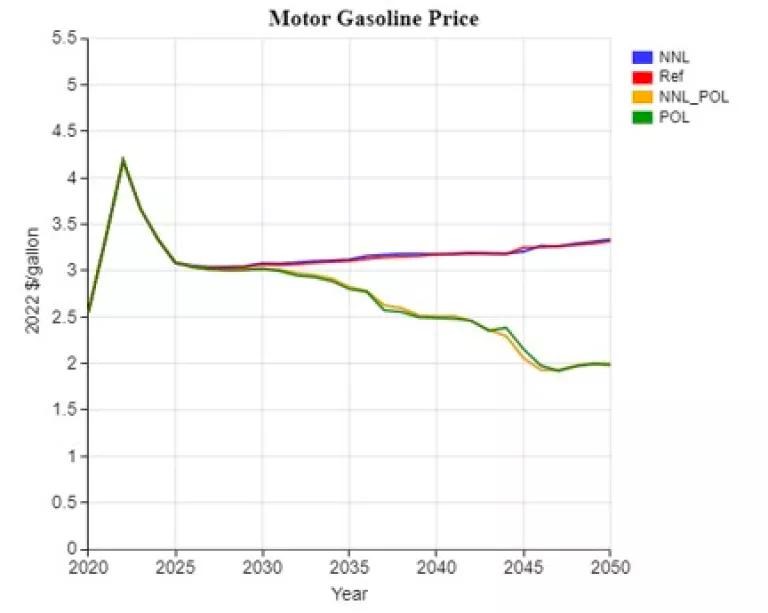

Thanks to clean transportation policies, gasoline prices are projected to decrease over time even with no new leasing in the Gulf.

By driving down gasoline demand, policies that advance EVs and speed up the transition to renewables are also likely to decrease the price of gas. Figure 4 below shows gas prices from 2020 to 2050 under the four scenarios. Under the transportation policy scenarios (POL and NNL+POL), gas prices continuously decrease after 2029, while they gradually increase under the reference and NNL scenarios. From 2029 through 2050, gas prices in the transportation policy scenarios are from 5 cents to $1.35 lower per gallon than gas prices in the reference scenario.

What’s more, gas prices under the NNL+POL scenario are remarkably similar to gas prices under the POL scenario, demonstrating that no new leasing in the Gulf would not substantially weaken the demand-reducing impact of clean transportation policies.

Figure 4: Gasoline prices from 2020 to 2050 under the four scenarios analyzed. Credit: OnLocation for NRDC

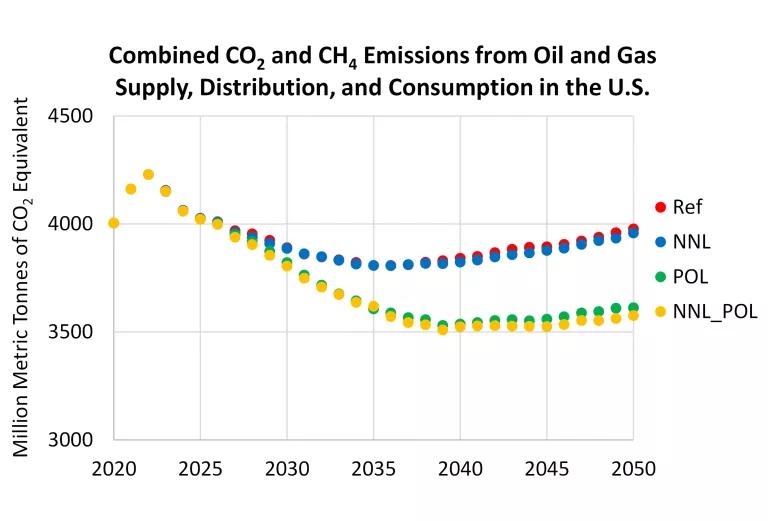

No new offshore leasing would reduce greenhouse gas emissions, and so would new transportation policies.

Setting a policy of no new leasing in the Gulf of Mexico would prevent 290 million metric tons of U.S. GHG emissions (CO2 equivalent) from 2020 to 2050, compared with the reference case. These GHG savings are equivalent to taking 64 million cars off the roads for a year. New clean transportation policies will have an even more dramatic effect on GHG emissions. The POL and NNL+POL scenarios would prevent 5.6 billion and 6.2 billion tons of GHG emissions from 2020 to 2050, respectively, compared to the reference case. By 2050, annual GHG emissions would be 9 to 10% lower in the transportation policy scenarios, compared with the reference case. No new offshore leasing and clean transportation policies represent significant contributions to meeting national climate goals.

Figure 5: Combined greenhouse gas emissions from 2020 to 2050 under the four scenarios analyzed. Credit: OnLocation for NRDC.

The conclusion is clear: Domestic demand is slated to drop so dramatically over time that the country will not need any oil or gas that would flow from an expansion in offshore leasing today. As the government continues to incentivize adoption of electric vehicles, a decreasing demand for oil will compensate for any reduced production from a decision now not to expand offshore leasing. If the Biden administration authorizes new leasing under its forthcoming five-year program, much of the oil produced will likely be exported, instead of being used to meet U.S. energy needs.

This new analysis shows huge promise ahead for climate action—as the Inflation Reduction Act jumpstarts the country to clean energy, consumer demand is shifting too. With people seeking to power their cars and their lives using clean energy over the coming decades, we simply can’t justify sacrificing marine life and coastal communities by subjecting our oceans to any expansion of dirty, dangerous, and unnecessary offshore drilling.

This blog provides general information, not legal advice. If you need legal help, please consult a lawyer in your state.

By Rebecca Loomis, NRDC.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …