Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Annual U.S. biodiesel imports doubled from 2022 to 2023 to 33,000 barrels per day (b/d) and continued to rise in the first two months of 2024, according to the most recent data available. Much of the increase in biodiesel imports has come from Germany, and the remaining increase has come mostly from elsewhere in Europe, where a biodiesel surplus has lowered prices.

How much biodiesel was the United States importing before the recent increase?

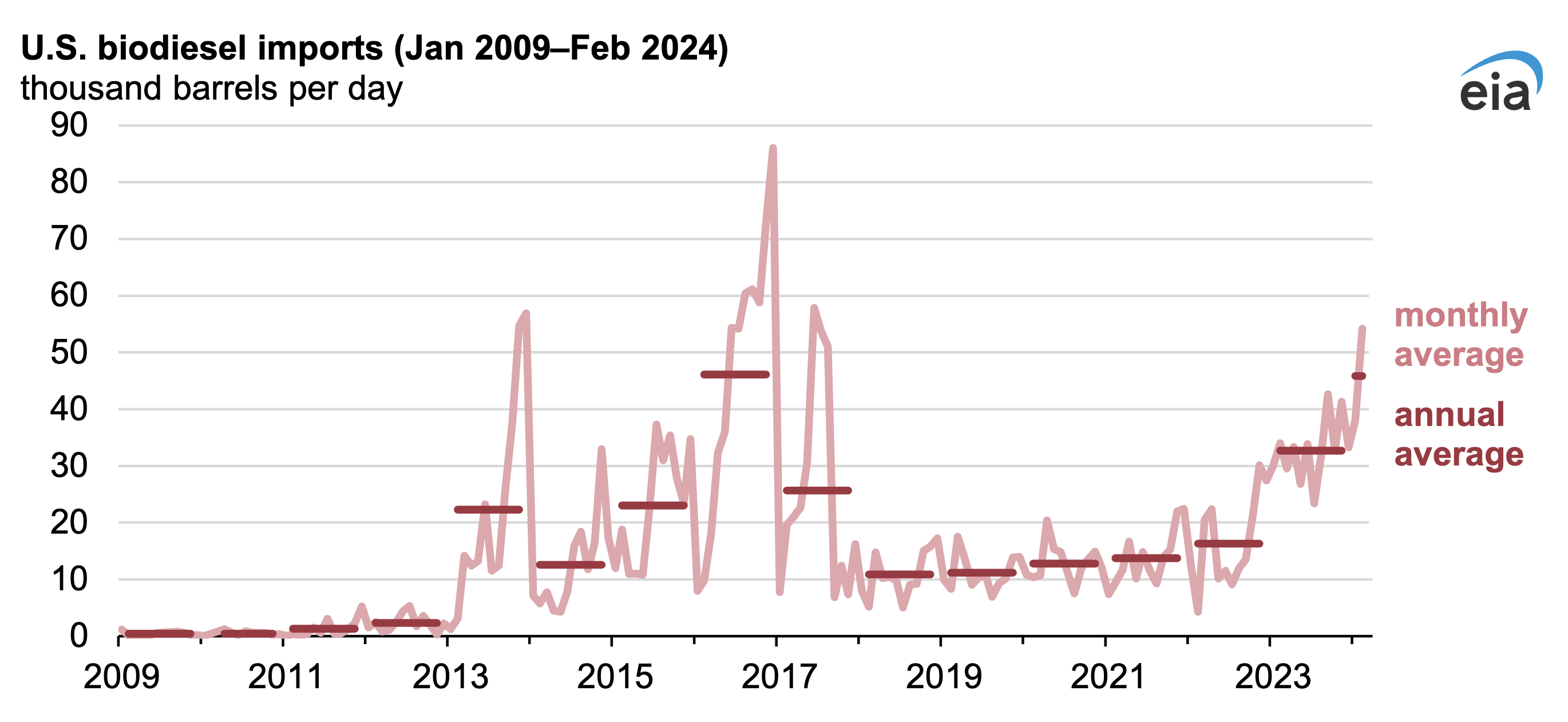

U.S. imports of biodiesel, a transportation and heating fuel typically blended with petroleum diesel or heating oil, averaged 12,000 b/d between September 2017 and October 2022.

The U.S. Renewable Fuel Standard program underpins biodiesel demand in the United States. In the early years of the program, which was enacted in 2005, required blending volumes for renewable fuels such as biodiesel were very low, and imports were minimal. As the program has matured, biofuel blending requirements have gradually increased, leading to increasing biodiesel consumption, imports, and production.

Annual U.S. biodiesel imports increased between 2013 and 2017 to 27,000 b/d because of subsidized biodiesel from Argentina and Indonesia. In response to these subsidies and increased imports, the U.S. Department of Commerce and International Trade Commission initiated trade investigations in April 2017 that resulted in antidumping duty and countervailing duty orders that put duties on biodiesel imports from these countries to offset the effects of the subsidies. Because imports from Argentina and Indonesia made up almost three-quarters of total U.S. biodiesel imports between 2013 and 2017, U.S. biodiesel imports decreased significantly after the investigation and orders.

How much biodiesel has the United States been importing recently?

The recent increase in U.S. biodiesel imports began in November 2022, when imports of biodiesel reached 30,000 b/d. U.S. biodiesel imports continued to grow in 2023 to 33,000 b/d and have increased further in 2024. In February 2024, the United States imported 54,000 b/d of biodiesel, the most for any month since June 2017.

Why have biodiesel imports increased?

U.S. biodiesel imports have increased mostly because of low biodiesel prices in Europe, which have made importing biodiesel from Europe economically attractive. Biodiesel prices in Europe have been low because of policies related to the EU’s Renewable Energy Directive, which drives renewable energy targets.

An updated Renewable Energy Directive (RED II) capped the biofuels portion of the European renewables target in transportation at 7%, although each EU member state implements its own regulations. Many EU member states allow advanced biofuels, which the EU defines as biofuels produced from used cooking oil or other specified feedstocks, to count twice toward blending targets.

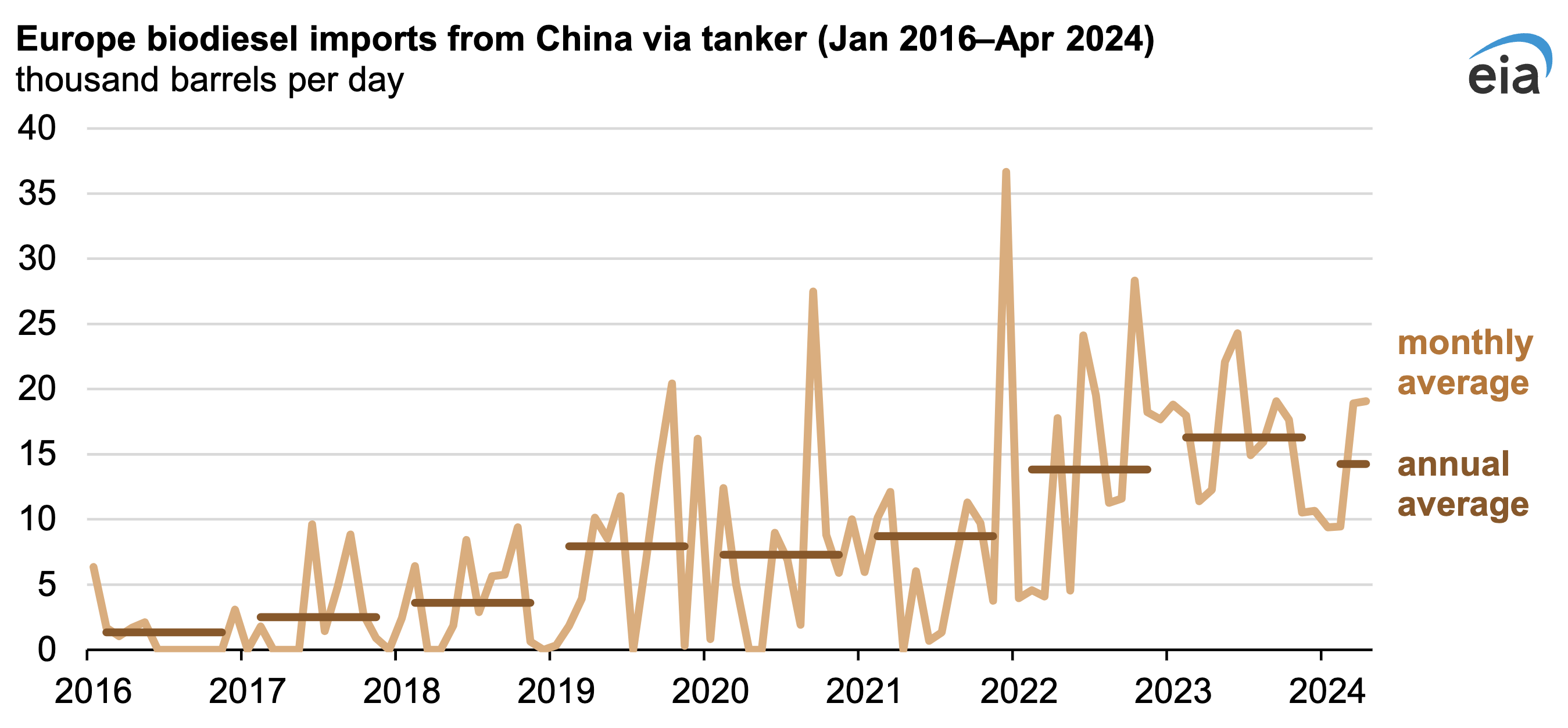

Increased biodiesel imports into the EU from China, increased renewable diesel consumption in place of biodiesel to meet EU blending targets, and reduced biofuel targets have all contributed to lowering biodiesel prices in Europe:

- Increased renewable diesel consumption: Because RED II and EU member state regulatory programs do not differentiate between renewable diesel and biodiesel, renewable diesel consumption can be used instead of biodiesel to meet blending targets. Renewable diesel is fully interchangeable with petroleum diesel. It can be blended into diesel in any amount, unlike biodiesel, stimulating production growth in recent years that has brought many EU countries close to the EU’s 7% total biofuels cap.

- Biofuel target reductions: Some EU member states have cut biofuel targets in response to high inflation. The most notable of these target cuts was in Sweden, which previously had more ambitious targets than the EU required. In 2023, Sweden announced it would reduce the required share of biofuels in diesel for 2024–26 from 30.5% to 6.0%. In addition to Sweden, other EU member states have implemented various measures to reduce biodiesel requirements and, therefore, consumption in Europe.

As biofuel margins have narrowed in Europe, some biofuel producers have looked to the United States to obtain higher prices. U.S. biodiesel imports began increasing in late 2022 when prices for compliance credits known as renewable identification numbers (RINs) were near record highs and biodiesel prices in Europe started to decline. As biodiesel prices in Europe fell further in early 2023, U.S. RIN prices remained relatively high. Although RIN prices have decreased since mid-2023 to three-year lows in 2024, the increase in flows from Europe to the United States indicates that biodiesel in the United States is still selling at a premium to biodiesel in Europe.

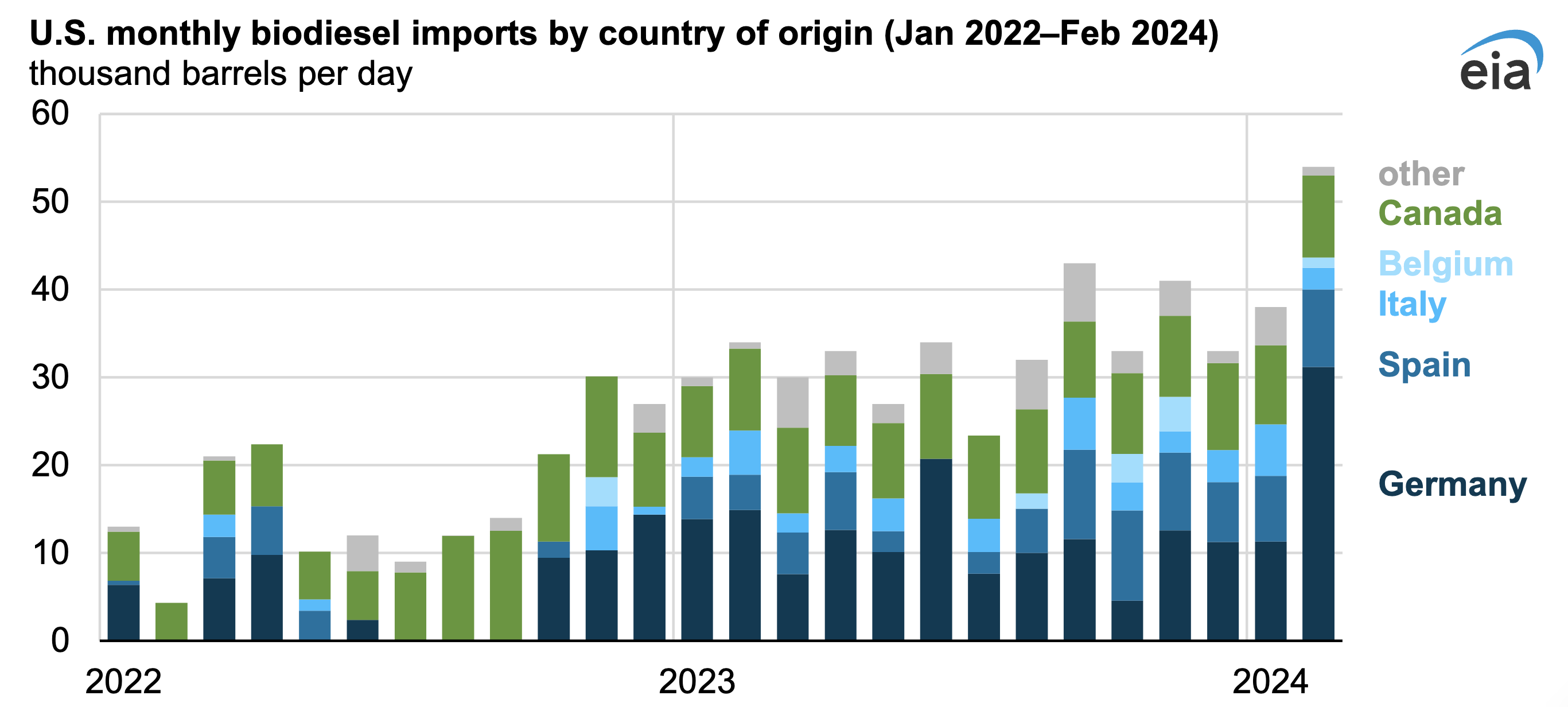

Where has the United States increased imports from?

Much of the increase in U.S. biodiesel imports has come from Germany. From 2022 to 2023, U.S. biodiesel imports from Germany more than doubled to 11,000 b/d, making it the top source of U.S. biodiesel imports. Most of the remaining increase in U.S. biodiesel imports was from Spain, Italy, and Belgium, with small increases also coming from South Korea and Brazil.

The distribution of U.S. biodiesel imports reflects production in those countries. Germany produces significantly more biodiesel than any other country in Europe and imports the second most. Spain, Italy, and Belgium are also biodiesel-producing countries and major biodiesel exporters.

Distribution of U.S. biodiesel imports also reflects the geographic footprint of biofuel companies taking advantage of arbitrage opportunities. For example, company-level import data show that Archer-Daniels-Midland (ADM)—an international agricultural processing and commodities trading company with biodiesel plants in Germany, Canada, Brazil and the United States—has been the importer of record for most of the U.S. biodiesel imports since November 2022, including all the biodiesel from Germany. ADM owns an export terminal in Hamburg, Germany, connected to its oil-seed processing plant, which is Europe’s largest. This terminal has been the source of all U.S. biodiesel imports from Germany since 2022, according to Vortexa tanker tracking data.

How have imports affected biodiesel production and consumption in the United States?

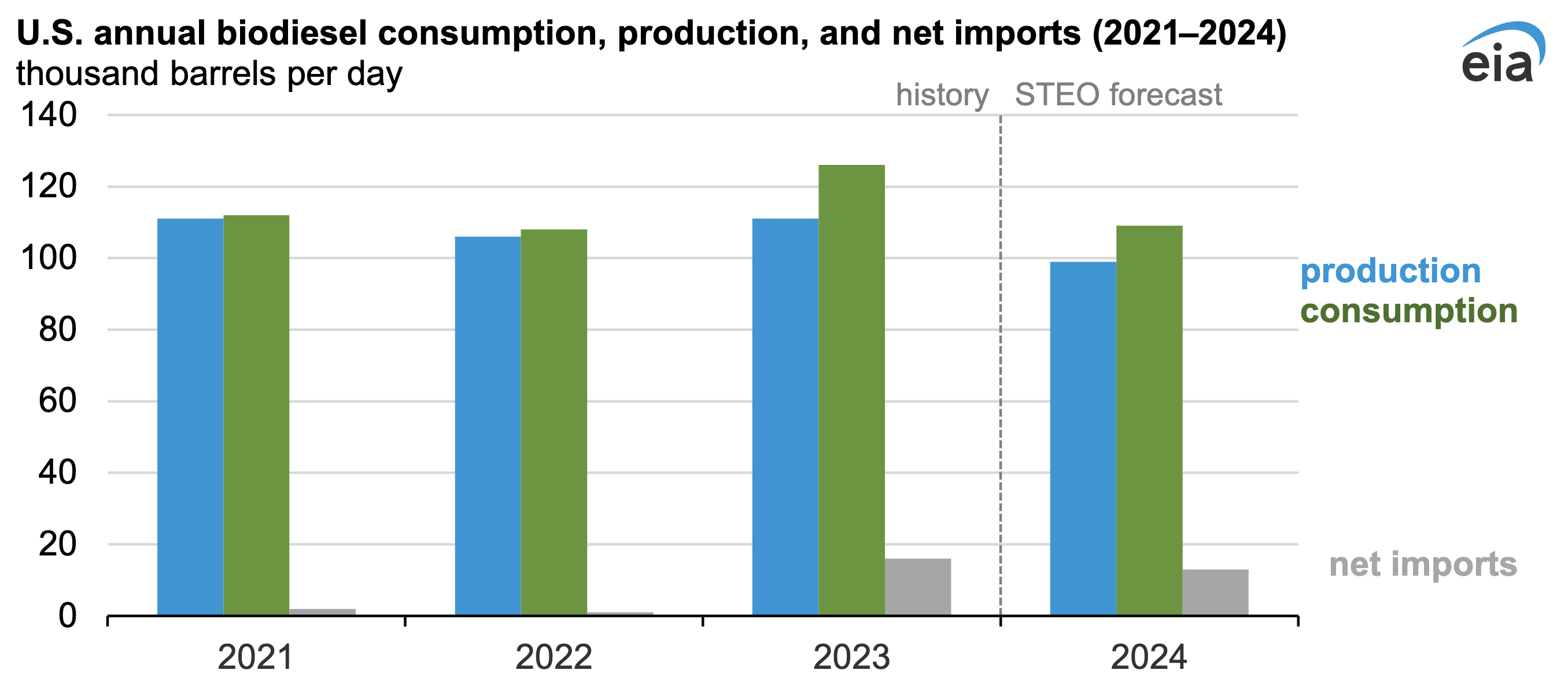

Despite growing imports and increased competition from the production of renewable diesel, U.S. biodiesel production increased by 5% in 2023 from 2022. Because of increasing imports and domestic production, the most biodiesel was consumed in the United States in 2023 than in any year since 2017.

However, we forecast U.S. biodiesel production to decrease in 2024 because we assume that blending margins will be lower than in 2023, mostly due to lower RIN prices. Although increased production of renewable diesel is the primary reason for our assumption of lower RIN prices and blending margins, high biodiesel imports are also a contributing factor.

Although we do not explicitly forecast biodiesel imports, we do forecast net U.S. imports of biodiesel (imports minus exports). We forecast net biodiesel imports to be about the same in 2024 as in 2023 because of high imports early in the year and continued reduced demand in Europe. However, we expect net imports to level off over the course of the year as growing production of renewable diesel increases domestic biofuel supply.

Principal contributor: Jimmy Troderman. From Today in Energy.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.