Over the weekend, Donald Trump hinted that he’s planning to implement a new kind of mortgage. On Truth Social he posted an image showing Franklin Roosevelt under the phrase “30-year Mortgage.” Next to this, Trump posted an image of himself under the phrase “50-Year Mortgage.”

Aside from reminding us that Trump is a big fan of the Progressives’ hero Franklin Roosevelt, the image did indeed point to a new initiative from the administration. This was apparently confirmed on Monday by Federal Housing Finance Agency Director Bill Pulte. Pulte wrote on social media: ”Thanks to President Trump, we are indeed working on The 50 year Mortgage—a complete game changer.”

The politics behind the new proposal are fairly straightforward. Trump will promote the 50-year mortgage as a more affordable alternative to the 30-year mortgage. This seems plausible at a superficial level. The idea here is that the cost of the home is stretched out over a longer period of time, and therefore the monthly payment will be lower than it would be for a 30-year mortgage. In a new interview for Fox, Trump stated that “all it means is you pay less per month.” Trump went on to say that he’s inventing the new longer-term mortgage to address the “problem” of rising interest rates. Specifically, Trump blames the “lousy Fed person”—i.e., Fed Chairman Jerome Powell—for the fact that mortgage rates have returned to a more historically normal level of six to seven percent. Powell, presumably, has not forced down short-term interest rates enough—i.e., has not devalued the dollar and inflated the money supply enough—to suit the inflationist Donald Trump.

Unfortunately, the President’s scheme is unlikely to make homeownership more secure or affordable for ordinary Americans. It will further financialize the economy, enable more fiat-money fueled debt, and likely require more monetary inflation and more corporate bailouts down the line. That is, a fifty-year mortgage will require even more government intervention to guarantee loans and to keep interest rates at a politically acceptable level. In the end, this will all result in even higher home prices and more long term debt for borrowers. Given that few people ever live in a house for fifty years, this simply ensures that home “owners” will spend their entire lives making big interest payments to banks. People with 50 year mortgages will always essentially rent their homes from the bank.

For these reasons, Wall Street, banks, and homebuilders will benefit and will like the idea. Builders and real estate agents will sell more homes, and more Americans will be locked into paying even more interest to lenders.

It quickly becomes clear that Trump is right to compare himself to Franklin Roosevelt when talking about the 50-year mortgage. Roosevelt was a corporatist who wedded populist economic policy to the welfare-warfare state. His housing policy led to today’s inflation-fueled system of “too-big-to-fail.” It’s essentially a bankocracy cynically packaged as something to help the common man. Trump continues this tradition.

A Problem with 50-Year Mortgages

In order to understand the true cost of a 50-year mortgage, we must first look at how home loans are paid off over time.

Paying a mortgage is not simply a matter of paying off a little of the home’s cost each month. Rather, paying a mortgage involves paying a very large amount of interest on top of the principal. The total amount of interest paid gets larger the longer the mortgage term.

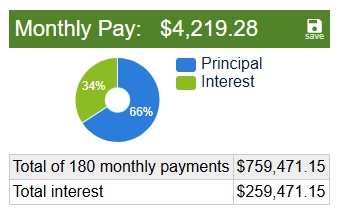

For example, if a home buyer borrows $500,000 for 15 years at 6 percent, the borrower will pay a total of $259,471 in interest over the life of the loan. So, he ends up paying nearly $760,000 in principal and interest combined (not including taxes and insurance).

Source: Calculator.net amortization calculator.

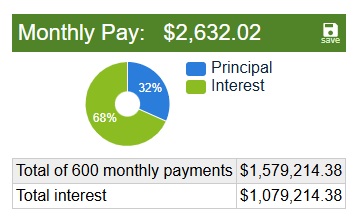

If the borrower opts for a 30-year $500,000 loan at 6%, the situation is notably different. In the 30-year case, the borrower pays $579,190 in interest, meaning he is actually paying more in interest than he pays for the principal. He ends up paying more than a million dollars for the $500,000 loan.

Source: Calculator.net amortization calculator.

But what about a 50-year loan? In the case of a $500,000 loan paid off over 50 years at 6 percent, the borrower pays more than twice as much in interest than he pays for the principal. So, the borrower ends up paying more than $1.5 million to pay off the $500,000. Moreover, because the borrower pays so much in interest, the monthly payment for the 50-year loan is only 350 dollars less than the payments for the 30-year loan.

Source: Calculator.net amortization calculator.

Now, some of my readers may be saying “hey, it’s no big deal. The home will appreciate, so it will all be a good investment in the end.”

A Home “Owner” With No Ownership

Well, that’s where things start to get very iffy with 50-year loans. A homeowner does not accrue equity nearly as quickly with a 50-year loan, compared to a 30-year loan. So, there is greater danger of ending up underwater.

Let’s go back to the three examples above. The shorter the loan term, the faster the borrower accrues equity in the home. So, with the 15 year loan, after ten years, the borrower has paid off more than $281,000 of the $500,000 loan. After five years, the total is $119,000.

With the 30-year loan, the borrower has paid off over $81,000 after ten years. That’s a lot less, but it’s a sizable chunk of the mortgage, and home prices would have to fall by quite a bit for the borrower to end up underwater. After five years, though, the total amount paid off is only $34,700.

With the 50-year loan, the borrower pays off less than $22,000 after ten years, and only $9,200 after five years. In soft housing markets, home prices can easily fall by that much over a few years, and the borrower will be in trouble.

A ten-year stint with a 50-year mortgage is the far more likely scenario than paying off the mortgage, of course, since the average length of homeownership in the United States is eight years.

So, if a person with a 50-year mortgage sells after the average tenure of eight years, he has paid off only about $16,000 of the loan. Here’s where a big potential problem emerges. Paying so little on the principle will only work fine so long as (1) home prices are rapidly climbing, (2) the borrower has not borrowed against the equity, and (3) the borrower has put down a sizable down payment.

But let’s say things aren’t that picture perfect. What happens when there is a recession, home prices fall, or the borrower suddenly finds that he must move because, say, he has lost his job? (We can assume that most people who need a 50-year mortgage are not putting down large down payments.) What then? If home prices have fallen in their particular market by even five percent, borrowers with 50-year mortgages are going to very often find that they have very little equity to show for their years of mortgage payments.

That’s when a large number of borrowers start mailing their keys to the lender. Why bother making payments when you have no actual equity in the home? After all, if you’ve spent the last five or eight or ten years paying little more than interest on your 50-year debt, there’s going to be little point.

When the Federal Bailout Comes

Naturally, when this happens, the Federal government will be called in to “fix” the problem. First, the federal government will attempt to swell demand for mortgage through monetary inflation and through forcing down interest rates. This will lead to consumer price inflation, but it will also lead to rising home prices.

But what if there are sizable job losses during a recession? Not even falling interest rates can raise demand when borrowers are losing their jobs. Many mortgages—and thus, many mortgage-backed securities will be in danger of becoming worthless. In this case, the “fix” will be to have the central bank buy up mortgage-backed securities to further inject liquidity into home markets. This will artificially raise demand (and thus, prices) for the mortgages held on the books by financial institutions. In other words, it will be a bailout for banks.

This, of course is what the central bank did during the financial crisis of 2008. After large numbers of homeowners were foreclosing—thanks, in part, to cheap mortgages and borrowers having so little skin in the game—the central bank bought up mortgage-backed securities to rescue investors. In a scenario like this, tomorrow’s 50-year mortgages will have a lot in common with the pick-your-payment mortgages and interest-only mortgages of yesteryear.

All these bailouts and easy-money schemes have led to today’s crisis in home affordability, but they have also padded the portfolios of investors and other wealthy asset owners.

Given all this, it’s difficult to see on what rationale Donald Trump is basing his claims that a 50-year mortgage will make people better off. Sure, it will become easier for many potential homeowners to go into debt and superficially become “homeowners.” For most, this will be ownership in name only, however. In reality few of these people will stay in one place long enough to be anything more than de facto renters, and will end up simply paying more for their homes, while accruing only small amounts of equity.

These ersatz home “owners” will also be making payments at higher interest rates, and for more costly homes. After all, if 50-year mortgages produce more home purchases—purchases, but not any real ownership—this will drive up prices. Moreover, interest rates for 50-year mortgages are likely to be higher, just as 30-year mortgages have higher interest rates than 15-year mortgages. It’s a mystery why Trump seems to think this plan addresses the issue of high interest rates.

There Will Ne No Private Market in 50-Year Mortgages

Some trump supporters are saying “What’s the big deal? You don’t have to get a 50-year mortgage if you don’t want one. Leave mortgage markets alone!”

But, there is no truly private market for 50-year mortgages. If the administration does succeed in creating a 50-year mortgage scheme, it will depend heavily on government intervention.

The same is true of 30-year mortgages, which are themselves heavily reliant on federal intervention in home markets. Modern 30-year mortgages are made possible by various types of federal mortgage insurance, such as that provided by the FHA program, and also indirectly by the government-sponsored enterprises Fannie Mae and Freddie Mac. The GSE’s for example, exist to constantly buy up mortgages in the secondary market so as to make it cheaper and easier for lenders to issue ever larger numbers of mortgages. Without these programs, interest rates would be higher, and loan terms would be shorter. Meanwhile, homes prices would be far lower and homes would be more modest.

In fact, as economist John Ligon at the Heritage Foundation has explained, government intervention in mortgage markets is exceptionally broad:

[G]overnment programs to boost homeownership in this manner have expanded nearly continuously since the 1930s. Currently, the federal government controls a dominant share of the U.S. housing finance system, and it encourages borrowing by guaranteeing the operations of Fannie Mae, Freddie Mac, and Ginnie Mae. The federal government also extends loan insurance through the Federal Housing Administration (FHA), the Veterans Affairs (VA) home-lending program, and the U.S. Department of Agriculture Rural Development Program. …

Yet, in spite of all this government meddling in the marketplace—meddling that will be absolutely necessary to sustain Trump’s 50-year mortgage plan—homeownership has not actually expanded. Moreover, the equity share enjoyed by homeowners has actually done down:

Yet, as government intervention has increased, the rate of U.S. homeownership has remained nearly constant over the past 50 years. On the other hand, the level of residential mortgage debt has increased nearly sixfold. …

Moreover, the level of equity that households have accumulated in their homes has trended downward since the 1980s and is approximately 20 percentage points lower than it was in the 1970s. While countless government programs are touted as boosting homeownership, most government policies actually increase mortgage ownership.

The creation of a 50-year mortgage program would only accelerate all these trends. Total mortgage debt will increase as actual ownership in equity will go down. If homeownership does increase, it will be “ownership” of the sort where the homeowner has little to no actual equity.

So, Trump supporters can claim it is all a “voluntary” program, but the reality is that, from day one, the 50-year year mortgage program will be based on constant federal intervention to force down interest rates, manufacture artificial demand through the GSEs and other programs, and to bailout the investors. The victims will be the taxpayers and the holders of dollars who will have to endure the additional price inflation and the corporate bailouts that will come when those 50-year mortgages start going belly up.

Courtesy of Mises.org

********