The NY Fed has recently published a study on bank failures in the U.S., examining the reasons why banks fail. For this study, the regulator constructed a large database with balance sheet information for most U.S. banks dating back to the Civil War. This dataset is truly unique, as other studies on bank failures have focused only on the period since 1976. As a result, the longer time horizon of this study allows it to include data on over 5,000 bank failures.

The study draws the following conclusions about the causes of bank failures.

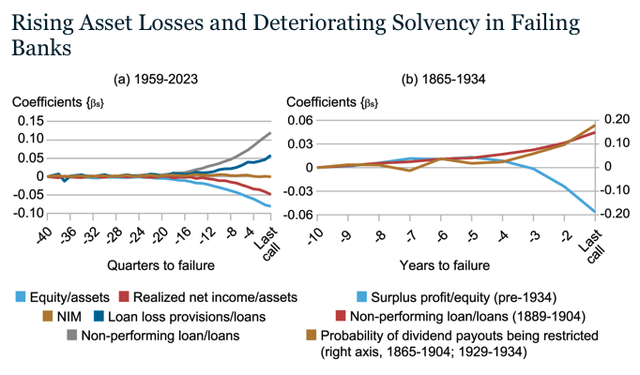

First, failing banks typically experience rising losses and deteriorating solvency before failure. Non-performing loans increase, leading to higher loan loss provisions, which ultimately result in lower profitability and reduced equity-to-assets ratios.

If you’re familiar with our methodology for identifying the safest banks, you know that it includes not only the metrics mentioned above but also other important factors. We assess banks based on 20 different metrics, which enhances the accuracy of our predictions compared to the Fed’s study.

NY Fed

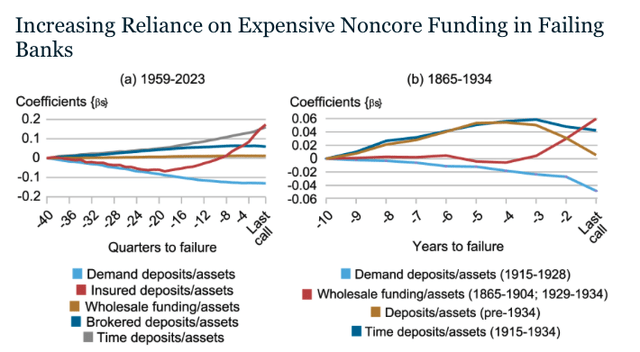

The second key takeaway from the study is that failing banks increasingly rely on noncore funding.

NY Fed

Again, when we published our methodology in early 2022, we emphasized that those 20 metrics are just one part of our analysis. The most crucial aspect is identifying the “red flags” and excluding banks that exhibit them. Here’s what we had to say about noncore funding:

We have excluded banks that have significant exposure to non-deposit funding as those are very likely to face liquidity issues in a volatile environment.

We prefer banks with a high share of non-interest bearing demand deposits. History shows that these deposits are “more sticky” and less sensitive to interest rate changes.

The third conclusion from the Fed’s study is that failing banks tend to follow a boom-bust cycle. They experience rapid growth, both in absolute terms and relative to their peers, up to three years before failure, after which they begin to contract. This asset growth is primarily driven by loan growth.

NY Fed

If you follow our banking articles, you’re aware that we have published several pieces about asset and credit growth in the banking system. Recently, most lending growth has been concentrated in just three sectors: shadow banking, credit cards, and commercial real estate. All of these lending segments are highly risky. Needless to say, the current rapid growth of loans in these areas poses significant threats to the stability of the financial system.

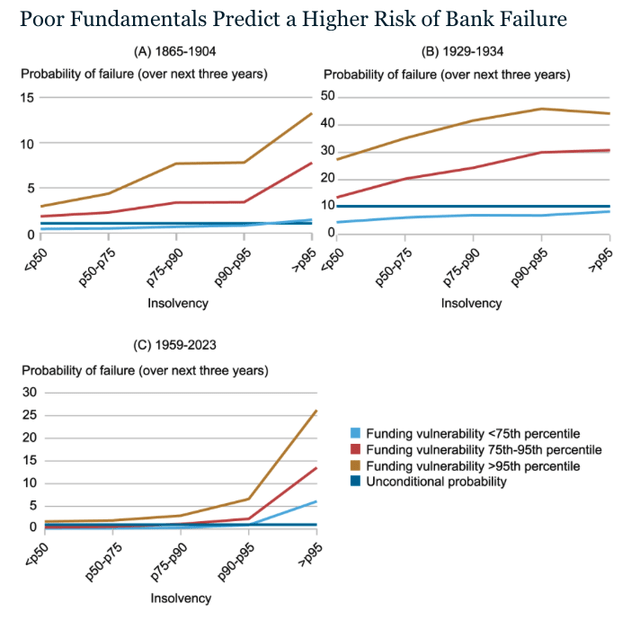

Finally, the Fed concludes that:

Bank failures are remarkably predictable based on simple accounting metrics from publicly available financial statements that measure a bank’s insolvency risk and funding vulnerabilities.

NY Fed

We fully agree with this conclusion, which is why we developed our methodology.

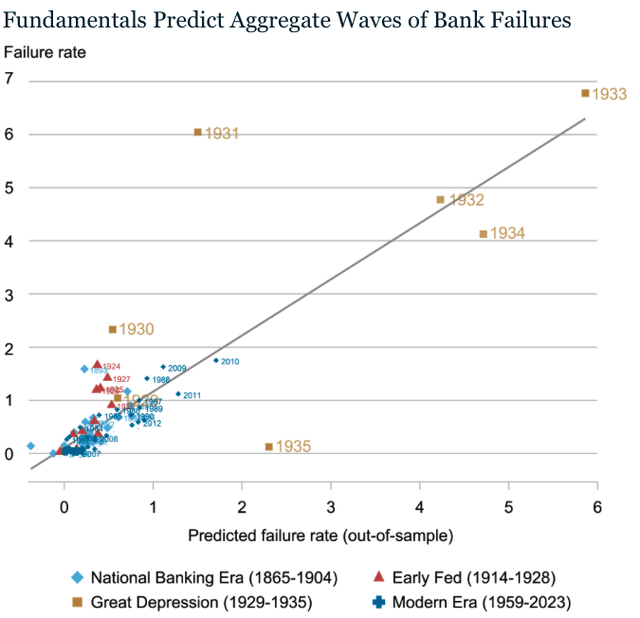

So, the Fed has a dataset going back to 1853, containing information on over 5,000 bank failures. The regulator has statistically proven that bank failures are predictable based on accounting metrics from publicly available financial statements. As the chart below demonstrates, there is a very strong positive correlation between predicted and realized failure rates.

NY Fed

Given all of this, the obvious question is: Why isn’t the Fed publicly disclosing predicted failure probabilities for the modern banking system? We believe that, based on the latest financial statements, the majority of the banking system—especially larger banks—likely faces a high probability of failure. The Fed is presumably aware of this, which is why it has not disclosed these numbers. If the situation were otherwise, the Fed would likely make these figures public to reassure depositors that the banking system is safe and sound.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets.

These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we’re not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it’s absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It’s now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we’re speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you’re relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It’s time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to review and utilize our due diligence methodology here.

*******