Courtesy of Proactive Investors

Courtesy of ENERGYminute

See more articles and infographics from ENERGYminute HERE

In almost every newsletter we’ve written since August of last year, the Inflation Reduction Act (IRA) has made an appearance one way or another, speaking to its impact. The signing of the IRA was the shakeup equivalent of five bombshells walking into the Love Island villa.

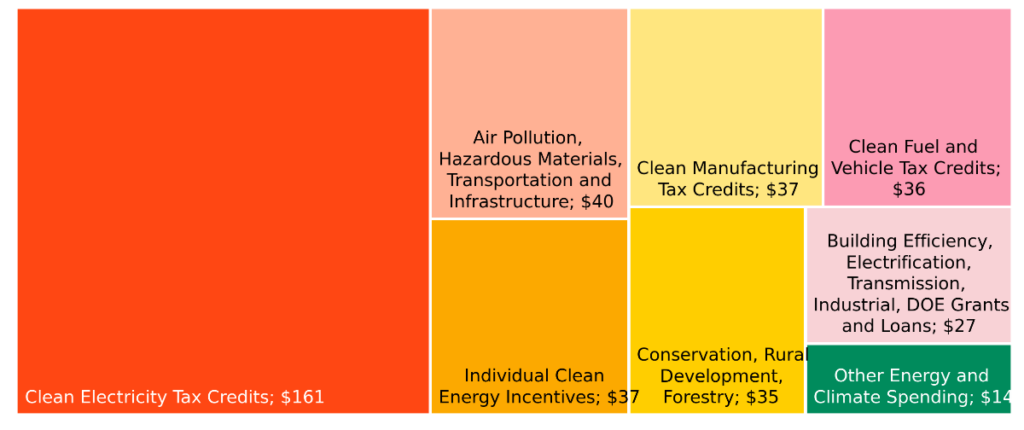

Background: The 730-page legislation filled with nearly $400 billion in subsides, grants, and loans was originally much larger, written as the $3.5-trillion Build Back Better Act. To get enough moderate Democrats onboard, it was watered down to just $394 billion.

Inflation Reduction Act by the numbers

billion USD

Courtesy of BlackRock

With the IRA, there are positives, some remaining hurdles, plus some not insignificant risks from the policy to think about.

The positives: There are clear benefits coming from all the spending. The first is the impact it will have on emissions reduction. According to a study published in Nature, the IRA will lead to an estimated 37% reduction in emissions from 2005 levels.

- That’s up from just 28% without the incentives. Still not meeting the country’s emissions goals, but not bad for the second largest emitting country in the world.

And bringing back blue-collar jobs

Western nations were a need of an industrial shakeup having sent many of the important production and manufacturing jobs abroad over the past several decades. The IRA is effectively a new American industrial strategy and an absolute boon for mining and manufacturing.

- According to Canary Media, ~100 new clean energy manufacturing facilities have been announced since the bill was signed.

Feeding all the new plants are mines. There continue to be partnerships between large manufacturers and mining firms.

Some recent examples include South Korea’s LG Energy signing a deal with Canadian mining junior Electra Battery Materials for cobalt and General Motors inking a partnership with Brazil’s Vale for battery-grade nickel.

- It should be said, there is still some local hesitation and a mismatch for big projects. Every community wants a gigafactory, no one wants a nickel mine.

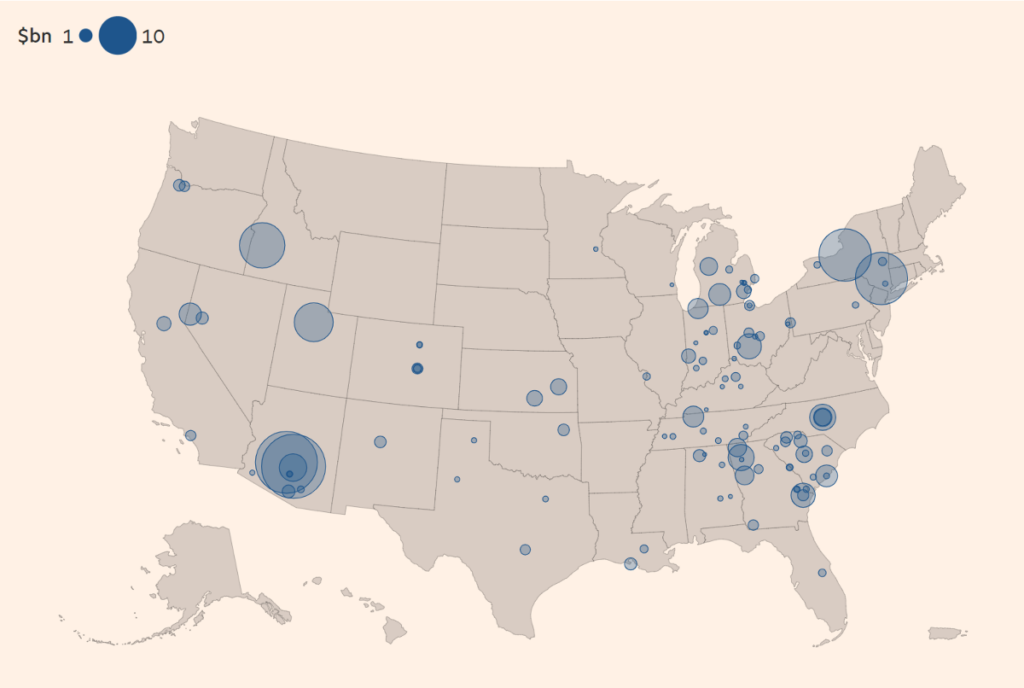

In total, with more than 100 projects each worth more than $100 million announced since August of last year, there is promise to creating 100,000 new jobs. And more than 80% of the money from the IRA and the Chips and Science Act is headed for Republican congressional districts, according to the Financial Times.

Location and size of IRA projects

Courtesy of the Financial Times

Remaining hurdles: The first process that could stall the roll out of the IRA is permitting.

In a recent review by the Council on Environmental Quality, completing an Environmental Impact Statement in the US takes an average of 4.5 years. After that, projects typically face an army of environmental litigators and protestors that rivals anything Sauron could put in the field in Middle Earth.

- Democratic Senator Joe Manchin is moving forward with a new permitting reform bill looking to address these issues and speed up the project approval process.

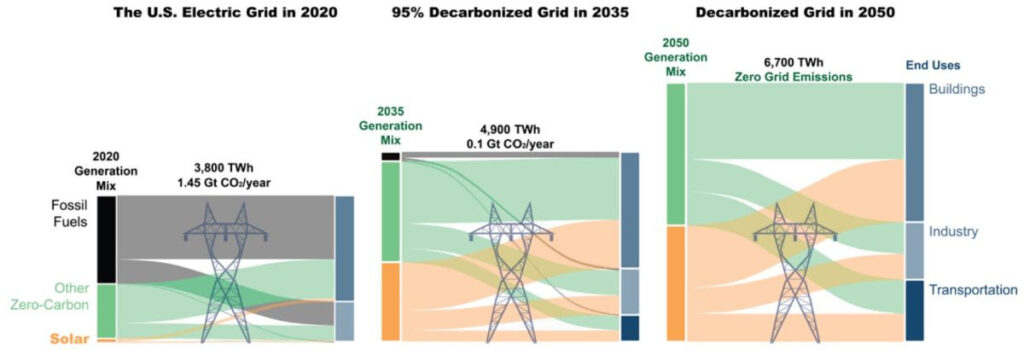

Powerlines are also a key bottleneck. According to the Rocky Mountain Institute, the transmission grid needs to double or even triple where it’s at today. Without a massively expanded grid, there’s little value in adding significant renewable capacity to the system.

Courtesy of the US Department of Energy

The last hurdle is politics. The IRA is still somewhat unpopular with Republicans.

- Florida governor and presidential candidate Ron DeSantis has rejected all support from the IRA for the state, estimated to be worth $377 million for the state.

A Republican government could stall or revoke parts of the IRA after next year’s election. Given the country’s interest payments on its debt are expected to exceed US defense spending later this decade, the eye-popping cost of the IRA makes it an easy target for future reductions.

The risks: It’s a bit of a gamble to completely build out a new energy system based on subsidies. The hopes are that costs of a wide range of technologies come down over time.

Like signing up for a cell phone plan on a reduced rate for the first year only to discover the full cost is too expensive later, if the energy subsidies go away and costs are still high, prices for everything will suddenly surge. Or the facilities will simply shut down, leaving the US with a bunch of stranded assets.

Bottom line: The IRA has had a tremendous impact even globally. Canada and Europe have both tried to introduce their own subsides to stop companies and money from leaving for the US. When the IRA eventually hits its tenth birthday, we’ll have a better sense of how it all turned out.

Oh, and apparently the Biden administration is having naming regrets over its landmark climate bill. But at least they didn’t call it Daenerys.

Share This:

Next Article