Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Today I presented again to a large Indian audience, hosted by the India Smart Grid Forum. The theme was Electrify Everything Everywhere All At Once. This was within the frame of the presentation I gave at the India Smart Utility Week on March 14th. In honor of the start of the bi-weekly webinar series with India, here’s both the full presentation video for the plenary session along with the slides and a transcript of my presentation, lightly edited.

Thank you, Reji, thank you for having me. And thank you to the India Smart Grid Forum for inviting me. It’s a privilege to share my perspective with you. India is facing a wicked problem, continuing to bring its most disadvantaged out of poverty while simultaneously decarbonizing its economy. That requires low carbon economic growth, which thankfully, isn’t a paradox. Many of the historic pathways for economic growth were deeply wasteful and inefficient. It created a dependency on mining. Billions of tons of fossil fuels mostly be burned once, at significant direct and indirect expense. But the future doesn’t require that dependency. I hope over the next year and starting with this material and the short list of climate actions that will work, continuing with monthly discussions on specific topics, to assist you somewhat in finding a better path for India.

Much of this will be familiar to you, and much of it India is making good progress on. But it bears repeating in context the whole as Reji said, the first action is electrify everything. My apologies for using United States’ Sankey diagram of energy flows. I looked at the Indian ones. The American one illustrates a primary aspect. The best of all the Sankey diagrams I’ve looked at for context, primary energy, solar, hydro, natural gas, coal, and petroleum comes in on the left hand side, electrical generation. It goes through energy services, residential, commercial, industrial and transportation. Then you can see here that we have a very big box up here of what’s called rejected energy. Rejected energy is waste heat. Mostly it’s energy that wasn’t the primary energy. That does not do any good. It just goes away into the atmosphere. It’s entropy.

Virtually all of that rejected energy comes from fossil fuels. As we burn them, we get very little of the energy out of them in most cases. Plus we’re using them directly for heat in a well managed system. By comparison, we consider renewables and nuclear, then they are much more efficient going through electrified energy services. We can reduce our emissions quite substantially. We can reduce our rejected energy quite substantially. Now, let’s think through this, and I’ll give you some numbers at the end, but in this case, the United States continues to run about 100 quadrillion Btus every year of energy and throws away two-thirds of it. But if we electrify transportation, as you’ll see, this gray bar of rejected energy is much larger than the dark bar of actual energy services.

For cars and trucks, they’re about 20% efficient. Well-to-wheel 80% of energy for them is thrown away. While modern jets are miracles of efficiency, when they’re running at 38,000 ft and optimum cruising speed, they’re 50% efficient. But when they’re on the runway, it’s like pouring kerosene on the tarmac. Similarly, maritime shipping is very efficient when it’s operating, but when it’s sitting in a port with the auxiliary power units generating, it’s not doing very much.

Now, as we electrify all those things, we can also ask about, well, what about heat? And heat pumps are good for heat, and district heating and district cooling are good for all of commercial and residential heat needs, and those invert the actual rejected energy.

One unit of electricity for residential and commercial heat turns into three units of heat because we take two units of heat from the environment. The efficiency gains go up quite substantially. I did the work for the United States and I calculated if we pulled all the electrification levers, how much primary energy would we require? And it dropped by 50%. A modern economy can require 50% less energy coming on the left to create all of the economic value, all of the comfort, all of the safety, and deliver all of the health benefits of energy if we don’t use fossil fuels for that purpose. There’s a whole bunch of ancillary benefits for that as well. India is in a different position, and so it’s going to be quite interesting. Now, there are some of the ancillary benefits.

As Reji said, 40% of bulk shipping is fossil fuels today. Another 15% is raw iron ore. As such, we’re going to see a significant reduction in maritime shipping and a significant reduction in the requirement or fossil fuels for maritime shipping. That’s true across the board. At present, roughly 11% of all energy in the world is consumed by the fossil fuel industry to extract, process, refine, and distribute fossil fuels. Much of it is in a gray economy, where they extract and burn fossil fuels at lower efficiencies. Some of the unconventional oil extraction techniques have very low energy returns on investment these days as a result.

The point of this is that India should, as much as possible, skip the fossil fuel aspects wherever possible, leap to renewables and electrified energy services to avoid paying that middleman of the fossil fuel industry hand over fist for decades. Every new coal plant that you build does commit you, to a certain extent, to continuing to pay for that coal energy.

The next step, of course, is overbuild renewable generation. But that’s quite a lot less overbuild in context of the overall solution than most realize. And I’m speaking to the utilities of India. You’ve undoubtedly read the reports on this and read the various analyses. I am, as I say, repeating some stuff that’s pretty obvious. But there is a context here that’s important. There is the historical legacy concept of baseload, which is more and more becoming obsolete.

It emerged out of local generation for local needs, and typically a manufacturing base with ancillary benefits for residential and commercial lighting. Then it grew and grew and grew bigger, and grew bigger. Now baseload is interfering as a concept with what we need, which is flexible and firmed electricity. Now, flexibility and firming is interesting. As we think of wind farms, we think of their capacity factors as being 35% to 40%, but in reality, they are delivering electricity 85% of the year. They’re just delivering it below their optimal generation rate. Similarly, solar, we think of their capacity factors as being well below that of wind. But in New Delhi right now, they will start generating electricity at dawn and 12 hours later stop generating electricity as the sun falls.

There is a curve of electrical generation for both of these, which is much broader than most people think of. We tend to think professionally in capacity factors, but the hours of generation is much greater than the capacity factor indicates. As we overbuild wind and solar, those edge hours add up in ways which are not necessarily intuitive, but provide much more of the demand than we think of. With the other factors in the short list, a 25% overbuild of wind, solar and water is sufficient for the majority of demands. We have to do some other work as well.

Some of that work is building continent-scale grids and markets, spreading HVDC interconnects, especially broadly around the world. I like to say that high voltage direct current is a new pipeline.

And certainly a lot of other people are looking at it that way as well, because they’re comparing hydrogen pipelines versus HVDC. Most of those reports are bad. They’re framed poorly. They’re framed in a way which is giving far too much benefit to hydrogen over electrons flowing down HVDC. I’ve spent some time looking at India’s stuff in preparation for this discussion. You have more high voltage direct current lines than the United States. Right now, if my data sources are accurate, about 10,000 lines and 29 gigawatts of capacity compared to the United States’ 6000 gigawatts. Further, you’re already planning 8000 high voltage direct current and an additional 42,000 high voltage alternating current. This is exactly the right stuff to be doing, enabling electrons to flow from where they’re generated to where they’re needed over geographical distances.

India is a very broad country, and solar energy on one side of the country can be feeding high demand periods on the other side of the country quite usefully. You’re in a densely populated area with many opportunities for connecting to neighbors with HVDC. You know, some of these links that you can see on the screen, for example, from Australia up to Singapore, as a potential, that one is much longer than for some of the connections that you can make to neighbors. You already have transmission interconnections with neighboring countries today. So you’re already doing much of the good work here.

And you’re already working on the market side of things with the proposed market based and securities constrained economic dispatch models. So there’s a lot of good stuff there. You could be leaning more into some of these things. You could be accelerating them, but you’re moving in the right direction and moving there in a way that’s probably better than many other geographies.

The next action is to build pumped hydro and other storage. When I say pumped hydro, I mean a specific type of pumped hydro. At present, there’s some pumped hydro in Gujarat. There’s a facility that is attached to a river dam. So it’s pumping water uphill when the conditions are right for that. But the types of pumped hydro I’m talking about are off-river, closed loop pumped hydro.

And what that means is we find a site which has 400 meters or more vertical distance that has those sites within two to 3 kilometers of one another, and we build a reservoir at the top and a reservoir at the bottom, and a tunnel between them off of rivers, off of any waterways. That model enables us to avoid the environmental impacts of damming rivers. It enables us to have high vertical heights, which enables us to have high energy storage needs. Now, there is a plan right now for India to build more pumped hydrogen, 18.8 gigawatts by 2032, out of an identified Indian resource of 106 gigawatts. But this map is from the Australian National University’s GIS study of closed loop off-river pumped hydro. Resource opportunities are there. There’s vastly more resource in this model of pumped hydro than most people realize.

As you can see, it’s densely clustered near the very populous northern part of India, close to New Delhi, where most of the delegates are sitting today. There’s a strong opportunity to lean much further into pumped hydro. It is a resource that India is blessed with capacity for. India, you already know that it’s the largest form of electrical generation in the world, or electrical storage in the world, that’s just going to continue. We can see that very clearly. One of the things that I say is if we want to see what works economically, look to what China is doing at massive scale. Typically, they run the numbers and they end up building one of everything, but they build a lot of the stuff that works.

Now, China already has 19 gigawatts of pumped hydro in operation and 365 gigawatts under construction or planned for 2030. That’s an indicator. The United States, by comparison, has only ten older pumped hydro sites and only one under construction. So pumped hydro is a dominant way to firm electricity. Now, one of the things that people tend to say is that not every place is blessed with the right geography. Well, as we can see, India is. But secondarily, it’s a grid asset. It doesn’t need to be near the city that it’s serving. When I spoke to China Light and Power, Hong Kong’s utility, a couple of years ago, we were talking about their Guangdong province pumped hydro facility. It’s 120 km away on the mainland of China. It’s a lights-out facility.

It can provide up to 12 hours of electricity to power all of Hong Kong. It’s not right beside the city or in the city. As we think about it, we can think about building transmission to and from it, and taking advantage of this natural battery.

The next action is to plant a lot of trees. When I spoke to the Swiss researcher who did this study this graphic came from a few years ago, he was pointing out that we used to have about 6 trillion trees on earth. We’ve cut down half of that. If we return a trillion trees to the earth, we have a significant but slow carbon drawdown solution that basically just sits there and does its job and provides other co-benefits of cooler air, reduced air pollution, reduced particulate pollution, and a bunch of stuff like that.

But when I say plant a lot of trees, I also mean return lands to grasslands where possible, restore wetlands, and restore coastal vegetation. Now, in India’s case, the mangroves of India were your natural treasure, and 40% of them are gone. Now, in the age of increased climate, extreme weather, and increased sea level rise, mangroves provide strong coastal benefits. They moderate the force of winds coming off the ocean. They moderate storm surge, they slow waves and reduce coastal erosion. There’s a strong benefit to finding nature-based solutions for carbon drawdown. When I look at global carbon drawdown solutions, I find a stark contrast between countries which export fossil fuels and countries which do not export fossil fuels.

Countries with export fossil fuels inevitably have mechanical and industrial carbon capture and sequestration high in their list of items. Countries which do not have fossil fuel export economies all have nature-based carbon drawdown solutions. We start to think about why it is that is. But to be clear, nature-based or mechanical and industrial carbon capture solutions and carbon dry ion solutions are not going to help us with our 2050 goals. They are going to help us with 2100 and 2200 goals for reducing the long term impacts of global warming.

Aligned with this is changing agricultural practices. India still has quite a number of small farms and quite a lot of small manual labor on in its industry and aggregating smaller fields into bigger fields. Automating is a strong efficiency gain.

Now, India is already the biggest market for tractors in the world by a factor of five. But in some cases, that’s catching up with the rest of the world. Tractors still only work a fraction of India’s fields. But this drone is here for a reason. We’re now in an era where large-scale, heavy lift drones carrying up to 200 pounds of product can be seeding fields and spraying fields. It’s electrically powered. A couple of drones, a couple of big drones, can cover as much field with product as a $700,000 John Deere modern tractor in a day. They run off electricity. They’re carrying vastly less weight than the tractor, and they’re not compacting the fields, compressing the soil with their wheels. As such, they can go over fields that are wet, including rice paddies.

They can apply product to rice paddies to eliminate fungus and to eliminate pests during the growing season much more effectively than other approaches. Because they’re GPS-guided and have visual sensors, they have a much greater ability to provide precision agriculture, putting only the product that is required where it is necessary. Studies show that if you’re applying herbicides, pesticides, fungicides, and fertilizer with drones, because of the nature of the prop wash pushing the product down into the fields and the lack of overspray, it’s a 30% to 50% reduction in products for the same crop yields. This is a strong efficiency benefit. Where these things are available, farmers are buying them, not because of the climate benefits, not because of avoiding runoff, not because of avoiding burning diesel, but simply because they’re cheaper.

They produce better crop yields at less expense. India can leapfrog in agriculture to much more drone-based approaches. Similarly, low tillage agriculture reduces breaking up the underground network of mushrooms and other things which draw down carbon over time and keep it under the fields. But by reducing tillage in those approaches and using more drone-based things, agriculture’s carbon emissions become carbon drawdown opportunities. We also have some other technologies there. Agrigenetics enables us to do nitrogen fixing in the fields, nitrogen being the key building block for plants. One to 5% of a plant’s mass is made from nitrogen, and most of that nitrogen these days comes from artificial ammonia made from natural gas or coal. Making that fertilizer from hydrogen is clearly an obvious solution, but so is using agrigenetics to enhance the ability of microbes already in the soil to fix nitrogen themselves.

Pivot Bio out of the United States is doing that. They’ve got millions of acres of corn in the United States under their product, and they’re reducing fertilizer requirements by 25% already. They have a strong expectation of growing. The emissions of agriculture and the effort and expense of agriculture can be diminished. The labor of agriculture that is currently done by humans can be more and more done by drones and automation, enabling those people to provide more productive services to India’s economy.

Of course, we also have to fix concrete, steel, and industrial processes. Now, India, as you undoubtedly know, has been growing its steel industry massively. As of last year, China, of course, was number one and had half of all the steel manufacturing in the world.

But India was number two, and it surpassed the United Kingdom and the United States in terms of steel production. About 280 million tons a year, if memory serves. There’s also a strong opportunity here for further electrification. As Reji said, right now India is at 54% of using scrap steel in electric arc furnaces. That’s compared to the EU’s 40%. The EU is lagging badly on this metric. The USA has been at 70% for 20 years. As we think through what an advanced economy might look like, we see a very significant increase in electric arctic furnaces, scrapping old infrastructure.

And as Reji said, as we think about that very large crude carrier, as we think about the 912 of them that are floating around in the oceans, well, they’re surplus for requirements and all the steel in those furnaces and all the steel in those ships becomes steel which can be used in a more productive way for economies. Similarly, the pipelines carrying natural gas and oil around our planet are also going to become mostly surplus requirements and can become things we just dig up and put into electric arc furnaces. I worked out not too long ago that for the United States, about four years of steel requirements are embodied in their pipelines if they were dug up and put into electric art furnaces. But there are more opportunities.

While 75% of steel requirements are likely to be able to be met by scrapping, that’s still 25% of new steel. That’s required both for quality requirements and for growth. Right now, blast furnaces are a major factor in India. But we have some alternatives. Already globally, 100 million tons of steel is manufactured from using direct reduction of iron using synthetic gasses. It’s a process which Midrex and other technologies use. They create synthetic gasses, add process heat, and create iron out of iron ore and then steel out of the iron without coal. Now the advantage here is that the process heat can be provided by electricity, and the synthetic gasses can come from biological sources of methane. The great biomass waste that India has today can be used to create the steel of tomorrow in a low carbon way.

There’s a strong opportunity to move there. Now, this is technology that’s available today and is entirely possible to build today. Then we have the technologies that are emerging. Reji mentioned green hydrogen and green hydrogen reduction of steel. It’s the one growth area I see for hydrogen demand, actually, but it’s not guaranteed. Boston Metals and Fortescue are experimenting with electrochemical reduction of iron without the requirement for any external reducing agent, basically stripping the ions off to de-rust iron ore just using electricity and pH-balanced chemistry processes. I have a fairly strong belief that those combination of technologies will work. The statistics I have indicate that India has 127 iron mines producing 282 million tons of steel a year. Now, shifting that as rapidly as possible to more electrified production has another co benefit.

Right now you have a strong reliance on Australian coking coal, the high quality metallurgical coal for your blast furnaces. You could reduce your imports and generate a lot more of the energy and reduction of steel from locally produced resources. Now, similarly for cement, another core industrial product, well, electrification of limestone kilns, the term limestone into quicklime, a key ingredient of cement, is entirely viable. There were electrified limestone kilns 100 years ago. It’s just the cheap price of fossil fuels which has made them unprofitable. We have that opportunity. We can also electrify the rotating cement clinker kilns. This is one of the few places where I say carbon capture might have advantages.

When we bake limestone into quicklime, it does emit CO2 from the process of being heated in the presence of oxygen, and that carbon dioxide is fairly pure. It’s a place to slap on some carbon capture. But there are other cement opportunities emerging as well that just haven’t been cost effective until now, of course.

Next electrification of industrial heat. As Reji said, we have electrification technologies for every temperature of heat. We just need to apply them. This is a significant increase.

When I talk to global heating experts from companies like Kanthal, every time we electrify heat for industry, we find efficiencies because typically we see a lot more waste heat that is inappropriately applied or more broadly applied. So there are some real opportunities there.

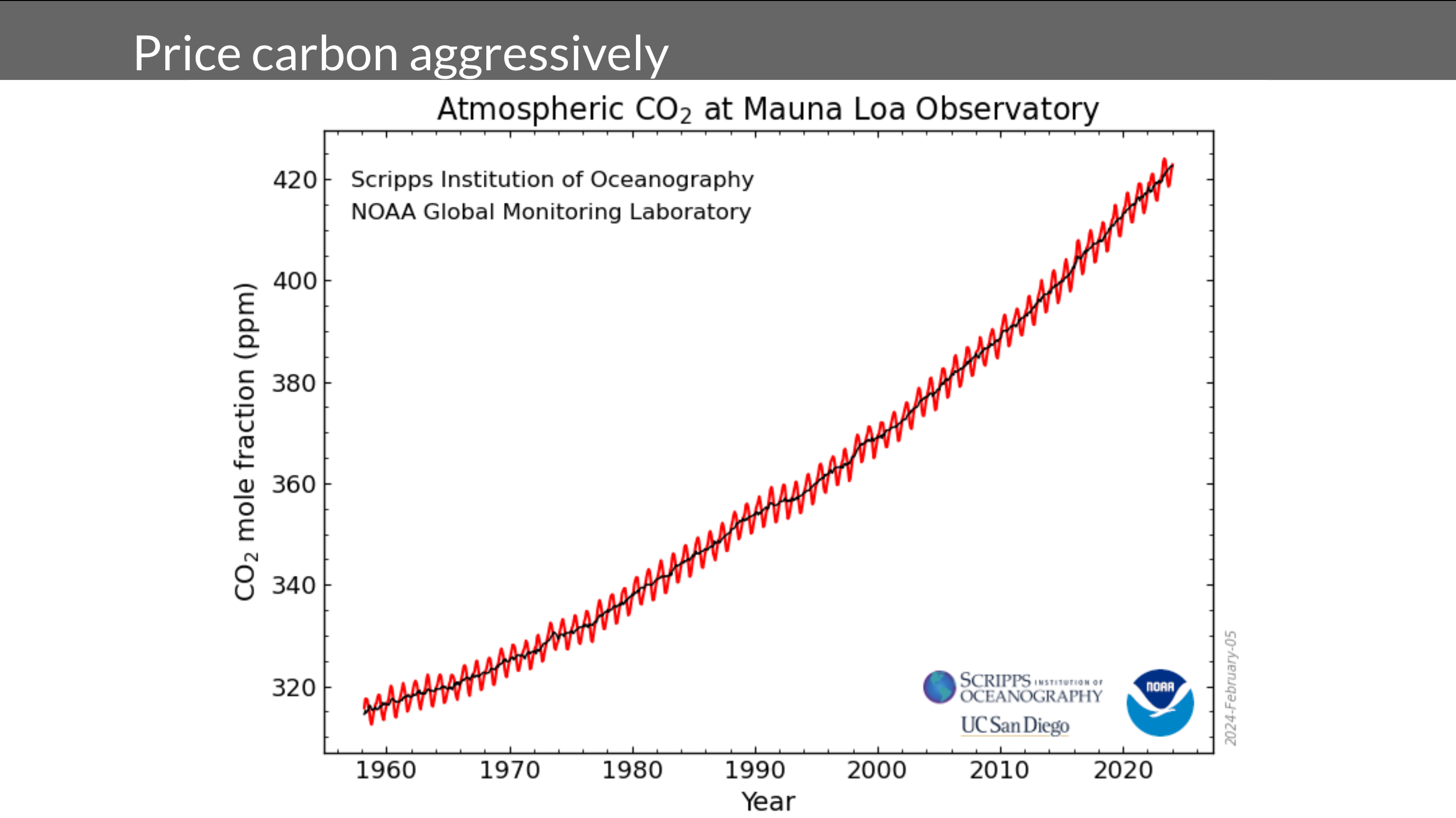

Of course, pricing carbon aggressively is critical. This rising curve, this accelerating curve of emissions as recorded at the Mauna Loa Observatory, is indicative that we have some problems right now. We’re at a point where the United States, Canada, and Europe have agreed and harmonized on the social cost of carbon. Right now it’s about $194 per ton. It’s growing to be just under $300 per ton by 2040. That means that every extra ton of carbon dioxide we emit or equivalent is costing the world hundreds of dollars. But we’re not pricing it there yet. A strong price on carbon is the biggest broom for climate change, but it has to be a formal, regulated carbon price. India’s current carbon market is voluntary and hence inadequate. There’s a strong opportunity to improve that.

Right now, India is exporting cheap carbon credits to richer countries, and that’s a mistake. If the carbon credits actually have value, they can’t be double-counted according to global standards that have emerged out of the climate conferences. India will have to buy those back at the social cost of carbon in 2040 and 2050 if it wants to meet its climate goals. So any carbon credits you sell now cheaply to the developed world are lost to you or the firms and regions which have sold them are going to have to break those contracts. So there’s something coming down the pike, which is what I spent a fair amount of time talking with Dr. Joe Romm about this subject. He and I, just before COP 28, were discussing his papers on this subject. I urge you to look them up.

India’s fuel excise tax is good, but it doesn’t cover industry or power. As we think through this, we start getting into the question about, well, what is a good carbon price? And the EU, the Economic Union, really does have the best carbon pricing structure on the planet that’s emerging. Canada’s is slightly better but lower priced. But EU is reducing the problems with it. Now, their carbon pricing guidance, as I’ve worked out in scenarios, makes all gas and coal plants unprofitable compared to renewables. So that drives the shift. Don’t have to do more than just price the coal and natural gas that’s going into those things for their emissions. Similarly in Canada, in Alberta, the carbon price by 2030 would have made coal four times more expensive for electrical generation.

Alberta shut down its coal plants seven years ahead of their intended shutdown. As we think across the world, China has a carbon market and it’s making it stronger and making it more expensive. Twelve US states have a carbon price. The EU has a carbon price. Now the EU is bringing in the carbon border adjustment mechanism. As we think about that carbon border adjustment mechanism, every country which exports to Europe is now going to be effectively paying the EU’s carbon price on what they send to it. The geographies which already have a carbon price get to discount that right now. Instead of embracing carbon pricing, India is fighting the carbon border adjustment mechanism with the World Trade Organization.

There’s an opportunity for India to do better around carbon pricing, to accelerate decarbonization, and avoid that trap of falling into that long term dependency on fossil fuels.

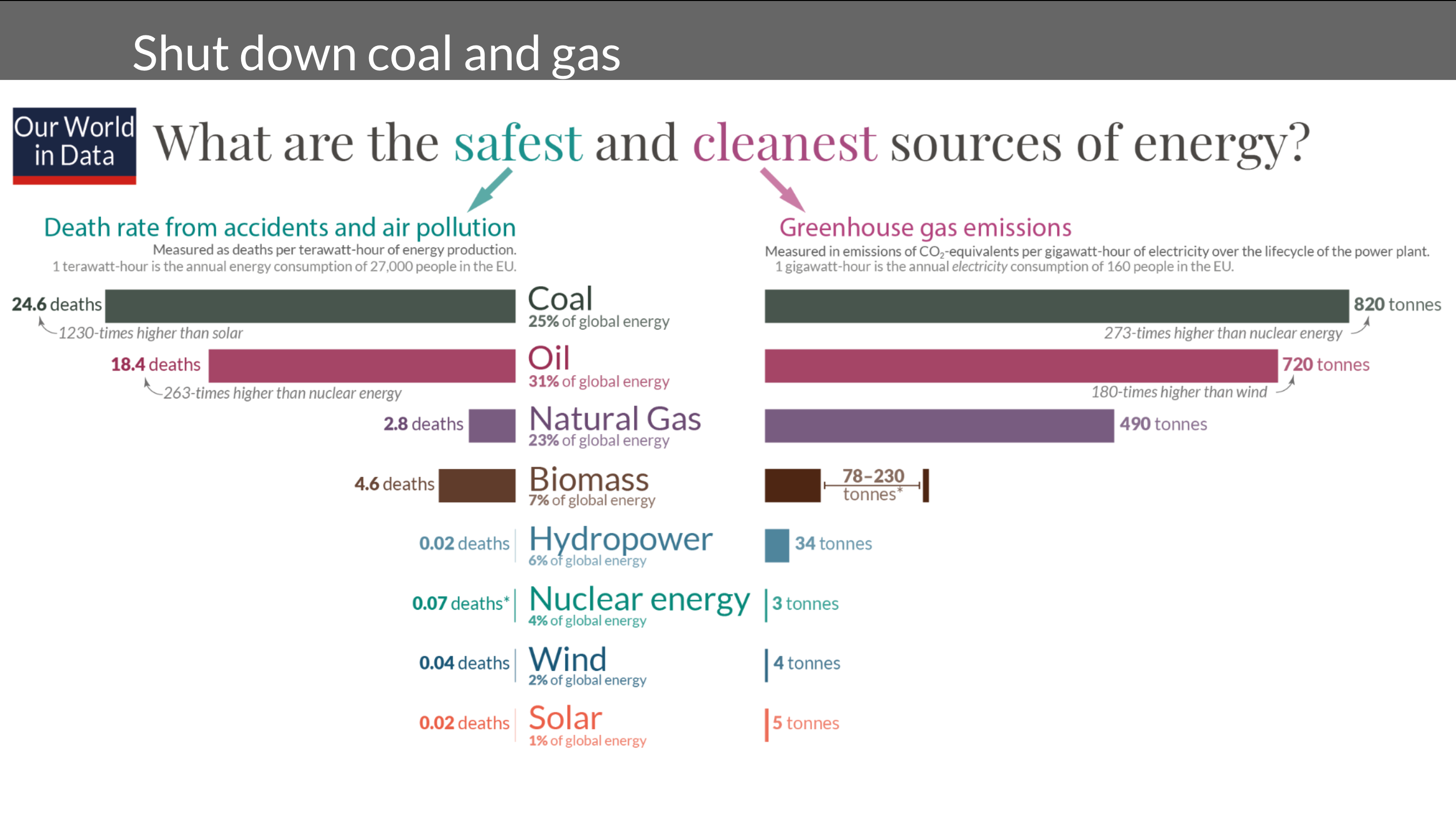

The next action is to proactively shut down the worst of coal and gas and oil plants. Now as we look at this chart which talks about some of the implications of burning coal and oil for energy on the left hand side of this graph, there is a real problem, which is that coal, while it provides electricity, kills a lot more people due to accidents and air pollution. My statistics say that every coal plant kills about 80 people a year. As we think about that, the people are dying because of emphysema and other lung diseases. Those people are less productive as they’re moving away.

Moving away from high pollution forms of energy increases economic productivity of a country of its human resources. There’s a real thread to follow through there. India is struggling with this, as China is, as the developing world is, because the benefits of generating electricity are very strong. But the disadvantages of generating it from coal and oil are also very strong. Now, accelerating the renewables generation, as India is doing, is strongly advantageous. Building the transmission that India is doing is strongly advantageous. It’s that balancing act that is a challenging one for every country. It’s one of the places where there’s room to accelerate as much as possible. But I’m certainly not going to be judging you for making sure that you have electricity for lights and hospitals and stuff like that.

But that said, there are worse and better coal and oil plants. If you characterize the coal and oil plants by quality and then have a national strategy to shut down the worst ones first, the most polluting ones first, the highest emission ones first, replace them with more efficient modern plants, then that’s an advantage.

And now there’s something else to think about from an economic perspective. Coal capacity factors and oil capacity factors and gas capacity factors will diminish over time as more renewables come on. There’s a problem with any investment in coal and oil, in that there’s a strong risk that they become stranded assets. As you electrify your economy and reduce primary energy requirements, the demand on those will go down.

We’re seeing this in the United States and China today, China uses its coal the way the United States uses its natural gas. Both of them are under 50% capacity factors annually. They are not baseload generation. The merit order says use them last. There’s a strong downward curve for the capacity factors of their generation assets, but yet they also must be preserved for strategic reserves, for electricity as you build out your storage and transmission. One of the question marks I don’t have an answer to, and I hope to discuss in the coming year, is what is India’s national strategy to preserve fossil fuel generation assets that would be economically unprofitable in the end game of decarbonization, but must be preserved until they’re no longer needed, until there’s sufficient storage of other types.

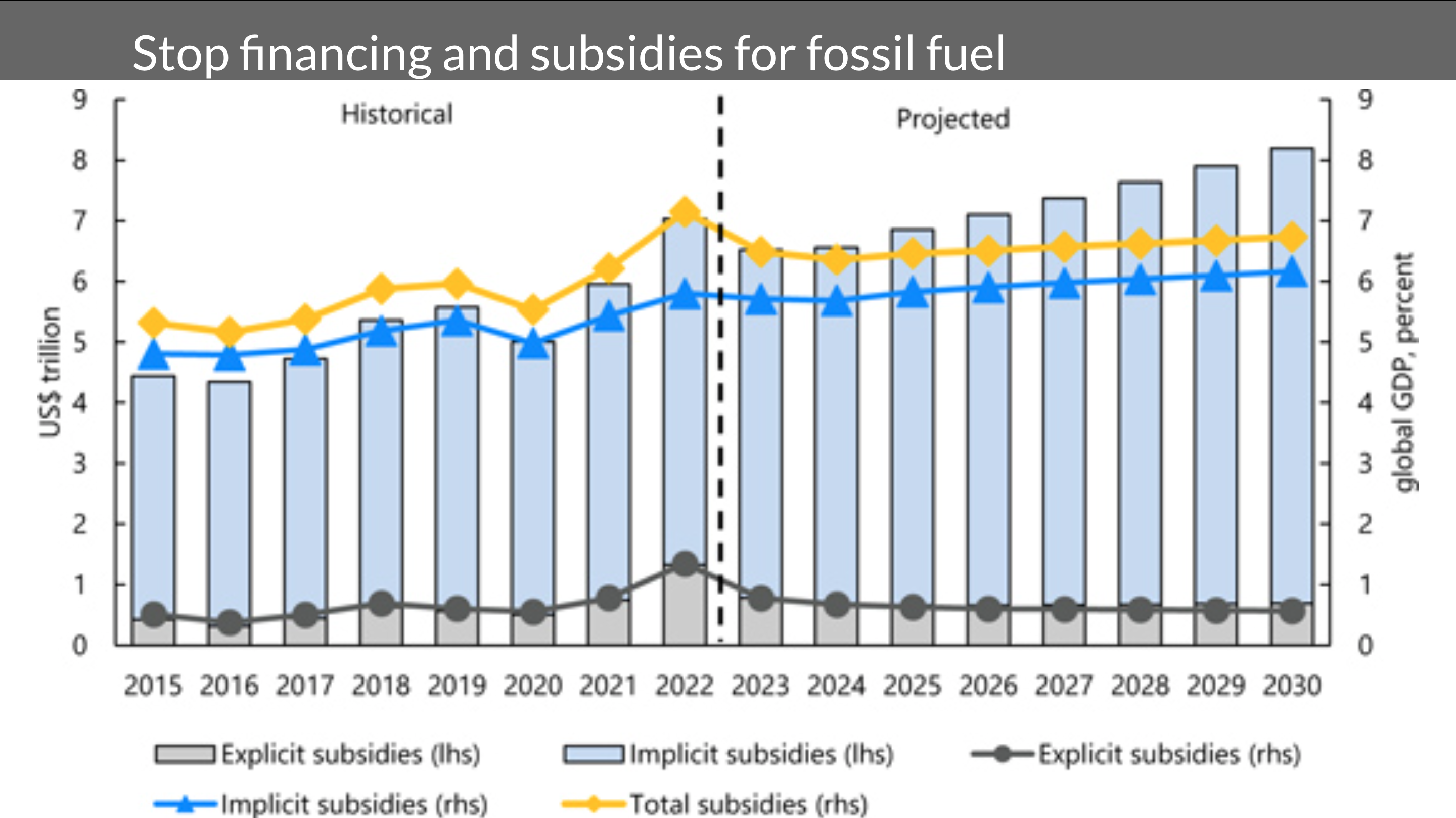

There’s an obvious one, stop financing and subsidies for fossil fuels. Right now, as of 2022, the IMF indicated that India was providing US$32 billion of subsidies to fossil fuels and $314 billion including indirect subsidies. That’s the negative externalities of mortality and climate change. That was 10% of the GDP in 2022. In 2023, because of the energy crisis in preceding years and the price caps on energy that India put in for very good reasons to prevent energy poverty among its populace, that subsidy actually jumped up to $39 billion. Obviously going the wrong way. India must next work hard to drive that down. Now, there’s good news as we go through its transition. The more renewables there are in grids, the cheaper the wholesale cost of electricity is most of the time.

More and more renewables and transmission and storage India stabilizes energy prices. More electrification will stabilize energy prices. But we are going through a period of additional volatility during the transition and during the geopolitics around the transition. Now, according to the IMF data, coal and diesel are about 50% of the price of an efficient market cost India. Adjusting the price points on coal and diesel to make them more effectively priced against comparisons is a strong lever. Now, typically, a carbon price will do that, but that can also be a regulated price, similar to the fuel excise taxes. There are other regulatory levers that can be pulled.

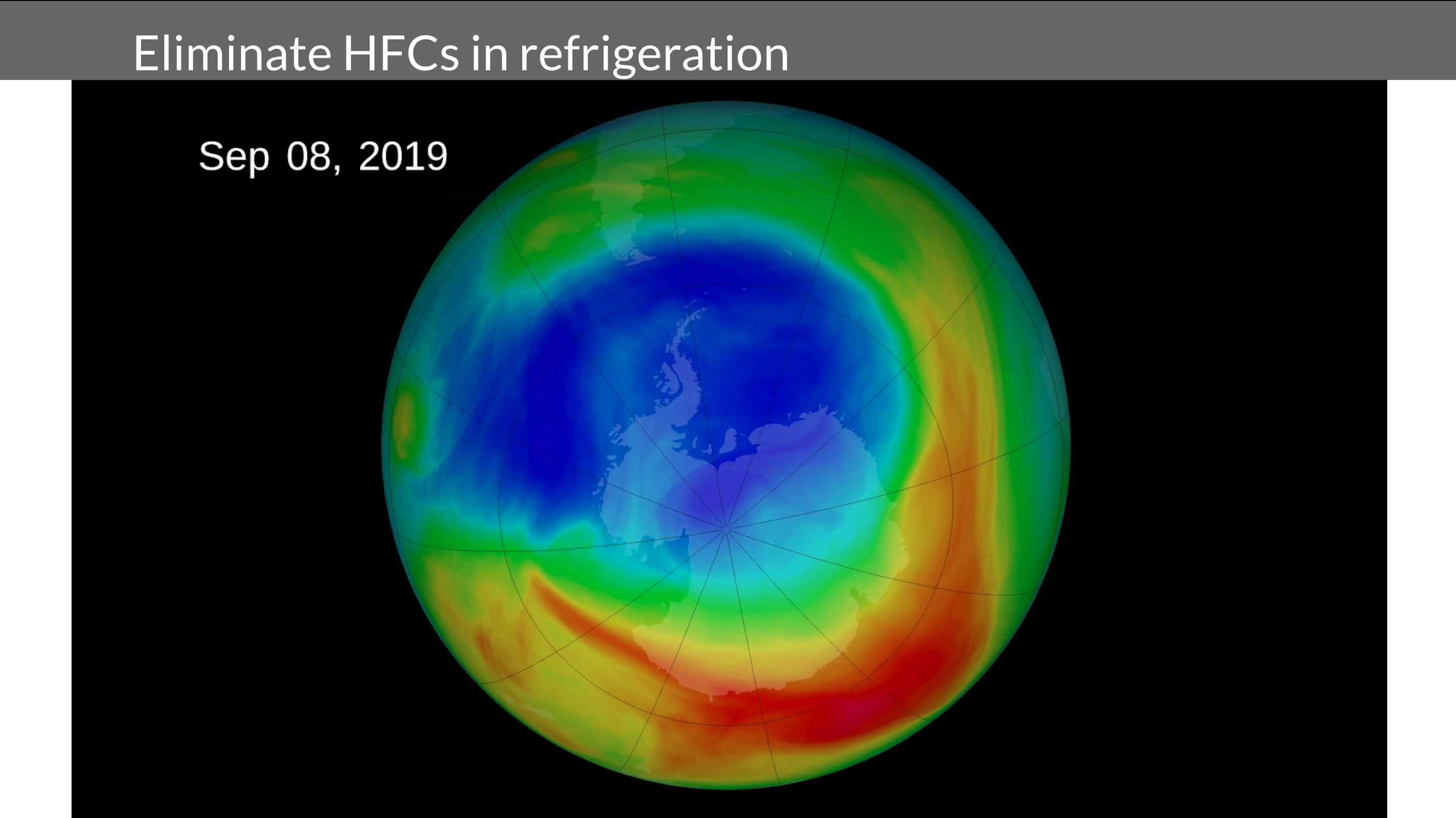

Next action is hydrofluorocarbons. A few decades ago, we discovered that a predicted event was occurring. Scientists had said, what are the impacts of chlorofluorocarbons on our atmosphere?

And they said, that’s probably going to cause destruction of ozone. Research was done and they put up satellites and other things, and they found, yes, indeed, there’s a growing hole in the ozone layer. That was significantly problematic for the southern hemisphere. The Montreal Protocol on Substances Which Harm the Ozone Layer was created and signed globally. The world moved from chlorofluorocarbons to hydrofluorocarbons, and that was advantageous for the ozone layer. But at the time, there was probably somebody like me who was putting up their hand saying, excuse me, hydrofluorocarbons are strong greenhouse gases, thousands of times stronger than carbon dioxide. You know, standard refrigerants like R410 are 4,390 times more powerful over 20 years, and they persist for hundreds of years in the atmosphere.

So in 2015, the world gathered in Kigali in Rwanda and formalized the Kigali amendment. India is signatory to the Kigali amendment. That amendment says we’re going to phase out hydrofluorocarbons for refrigerants which have low global warming potentials. Believe it or not, carbon dioxide is used significantly as a refrigerant these days, especially for industrial-scale cooling and for hot water. We have a lot of heat pumps for hot water use, CO2. But this is a place where India, being a signatory, is lagging for reasons that are related to geopolitics and export. China has taken a much more aggressive stance on phasing out hydrofluorocarbons. India has. The analysis I read indicated that was due to China’s much greater focus on exports and India’s much greater focus on a domestic market for HFCs.

But this is a place where India is lagging when it could be leading. As we look at the global statistics, there’s the Project Drawdown. The Project Drawdown project did a ranking by business case. What is the cheapest way to have the highest environmental impact? And reducing HFCs was the cheapest thing that could be done. So this is a place I would urge India to spend more time and effort reducing its HFCs. So those are the things which we should do.

And now I’m just going to talk briefly about things which are distractions and should be reduced in terms of the discussion. Reji mentioned one of them already. But let’s start with nuclear generation. Now, as a proud Canadian, I know that India’s nuclear reactor fleet are CANDUs, and they’ve served you well.

They’re only about 3% of your electrical generation per year, according to statistics I have. I will say, as a proud Canadian, I would not recommend buying more CANDUs. They have been ignored as a technology. They languished. The assets are now in the hands of a company that I would not choose to do business with. It’s not a great technology anymore. We have a situation where the question is, I like nuclear generation in general, but in liking nuclear generation, that doesn’t mean that it’s competitive with renewables.

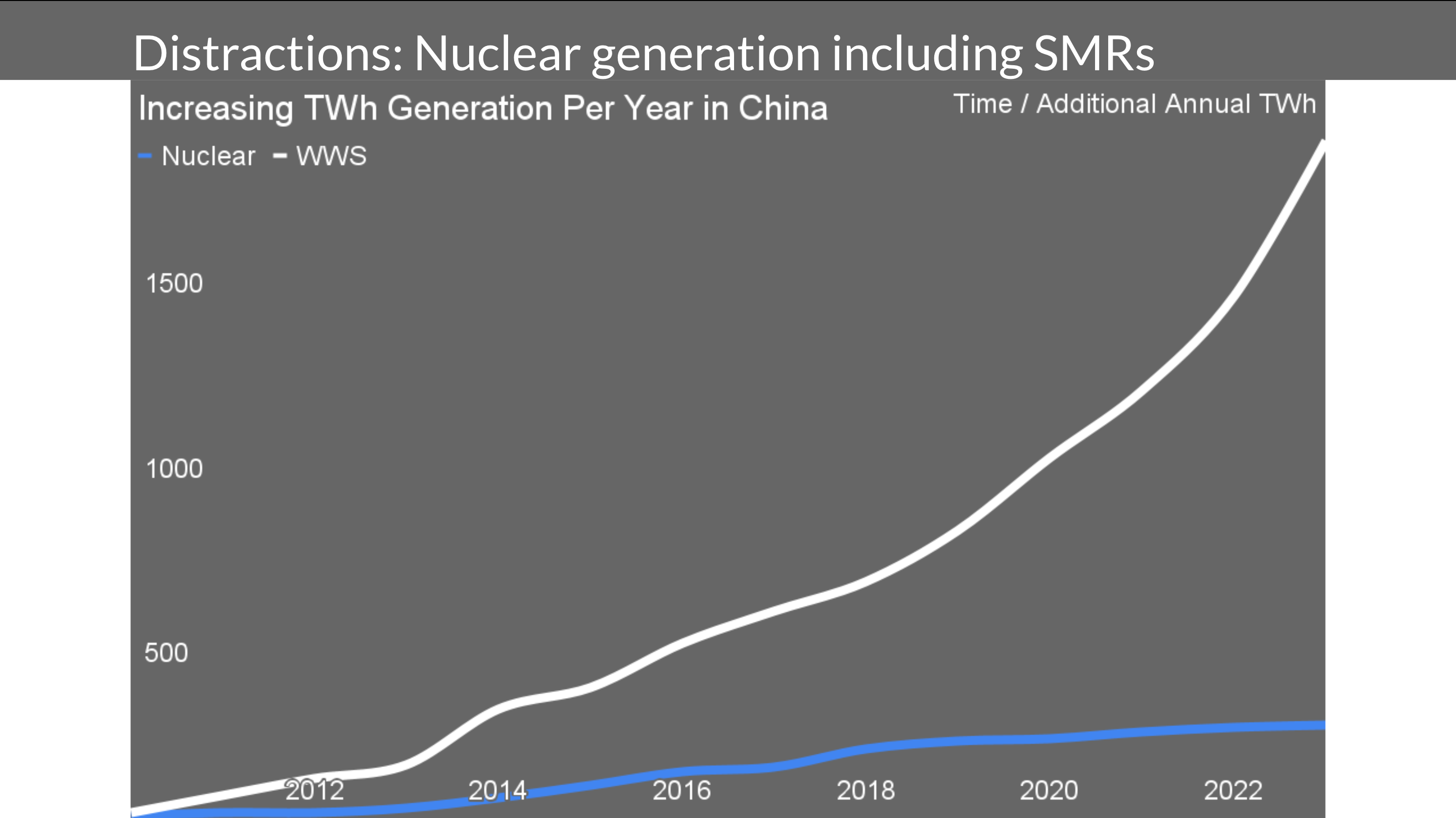

Now, for a decade, I’ve been looking at the natural experiment playing out in China. In the late 1990s, they established a nuclear program. In the mid two-thousands, they established a wind and solar program, and so I’ve been looking at those since 2014, and I’ve been recording data since 2010 about how much actual generation they’ve been putting in of those two technologies. Their nuclear program peaked in 2016 and 2018. That was when they added the most capacity. It was seven gigawatts each year. Since then they’ve been flatlining, they’ve been diminishing. They’ve averaged under three gigawatts of new capacity a year since then. It’s all good capacity. It’s going to be running at 91% capacity. Factors providing low carbon, low pollution electricity. But it’s almost a rounding error compared to that white line. That’s wind, water, and solar additions of actual terawatt hours. That’s the annual addition. If you think about the compounding air here, the vertical bar, the accelerating bar of renewables is practically straight up compared to nuclear.

The natural experiment is being played out. The country which knows how to build infrastructure and knows how to build technology at large scale clearly can scale renewables more than it can scale nuclear at that point. Now, some of this is because of the cost of megaprojects and the risks associated with megaprojects. I recommend anybody who hasn’t to read How Big Things Get Done, by Professor Bent Flyvbjerg and Dan Gardner, pick that up. He has a dataset of over 16,000 megaprojects projects that cost over a billion dollars globally. He’s categorized them into 25 categories. Nuclear generation is only worse than the Olympics and building nuclear waste facilities in terms of risks. So it is 23rd on the list of 25 in terms of cost overruns and long tailed risks. Many more things go wrong with nuclear programs.

Meanwhile, wind, solar, and transmission are in the top four by likelihood to achieve budget and schedule once construction starts. Risks associated with building wind, water, transmission, and solar are much lower than building nuclear energy, and we can’t wait. So as we think about it, that’s due to the risks and the conditions for success. Similarly, there’s a lot of buzz around small modular reactors right now. The modular reactors are interesting. So the conditions for success for a scaled nuclear program, which many countries have done in the past, is it be a national major strategy and budget. There’s military weapons alignment for nuclear weapons. It’s a nationally-run human resources program to create the certified and secured resources. Only one to two reactor designs are built. They’re at gigawatt-scale for the efficiencies of that technology, and it’s a two to three decade program.

Well, small modular reactors don’t align with most of those conditions for success, and so I do not consider them a wise choice to bet on in any numbers. Now, wisely, India didn’t sign up for the COP 28 nuclear pledge. Unfortunately, it also didn’t sign up for the renewables pledge, and that was due to the added feature of that pledge around coal generation. Obviously, India is pledging to expand renewables substantially and is finding its own path through this process.

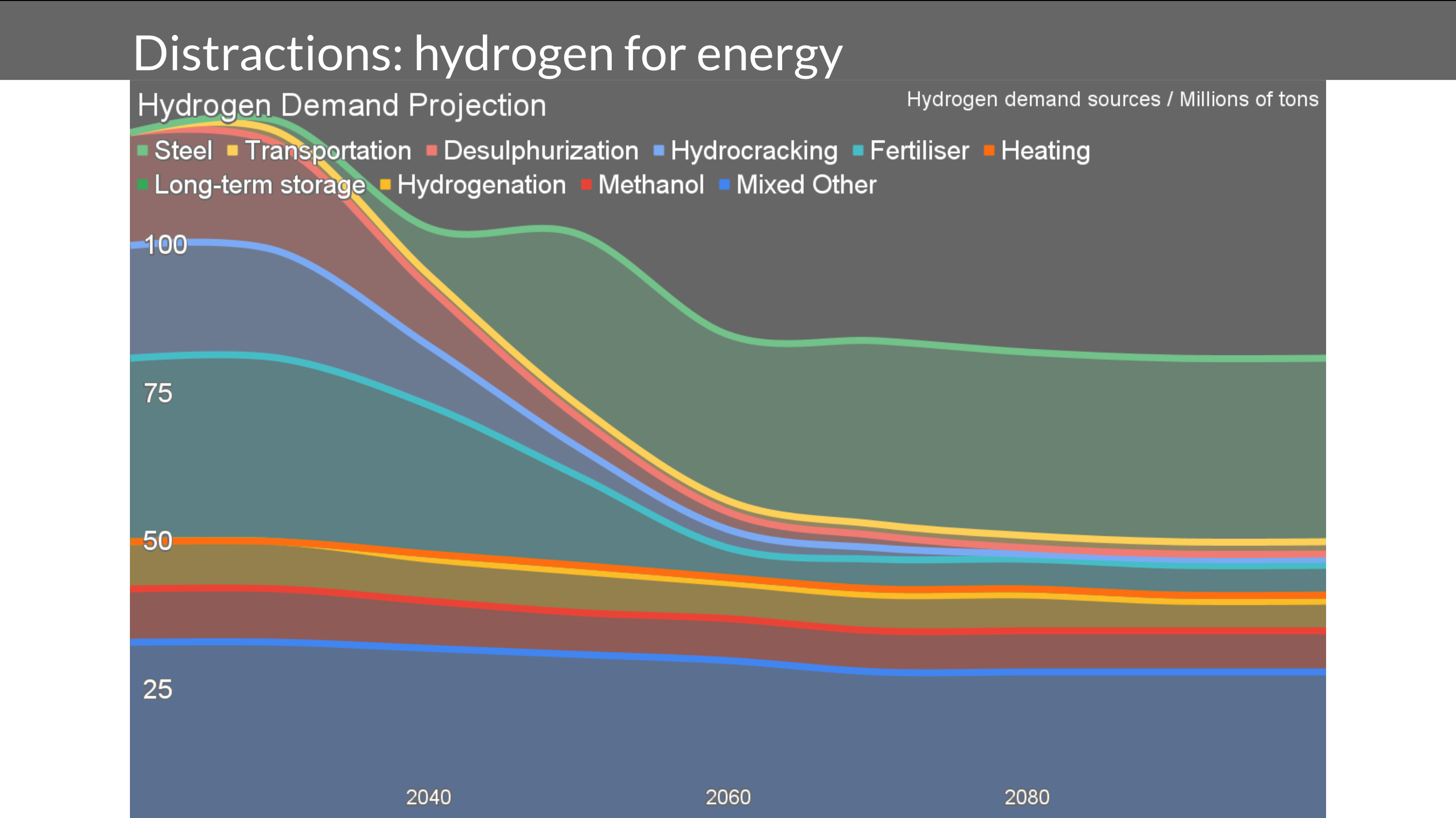

The next one is hydrogen for energy. Reji mentioned hydrogen for energy. I do projections through 2060 or 2100 of major climate areas and their solution spaces. This is the demand projection for hydrogen through 2100. As you’ll see, it’s falling. This is a heterodox projection.

It’s clearly not aligned with what a lot of countries thought was going to happen with hydrogen, because they thought they could just replace one set of molecules with another set of molecules and they’d manufacture them with renewables. Everybody’s now figuring out that it would take three times as much electrical generation or more to generate those molecules than just using electricity directly. That bloom is falling off that rose. The bump in the projection is steel, and it’s not guaranteed as I said. There are the Midrex, biomethanol, biomethane synthetic gas thread. There’s the direct electrochemical thread. That’s the only growth area. I see much of this for context.

A full third of global demand for hydrogen today is in oil refineries. That’s going to be going away, and it’s going to be going away much more quickly than most people realize, because the majority of hydrogen used in refineries is used on the heaviest and most sulfur-filled oils out of places like Mexico, Venezuela, and Canada, Alberta. Those are going to be first off the market as they’re required to decarbonize and clean up with more expensive hydrogen. So don’t spend a lot of time on hydrogen for energy. It’s not fit for purpose, for transportation. It’s much more expensive as a source of heat. It doesn’t have a place in commercial or residential buildings. We have direct electrical solutions for most heat. Where we need a burnable gas, once again, biologically-sourced methane is probably more suitable and cheaper.

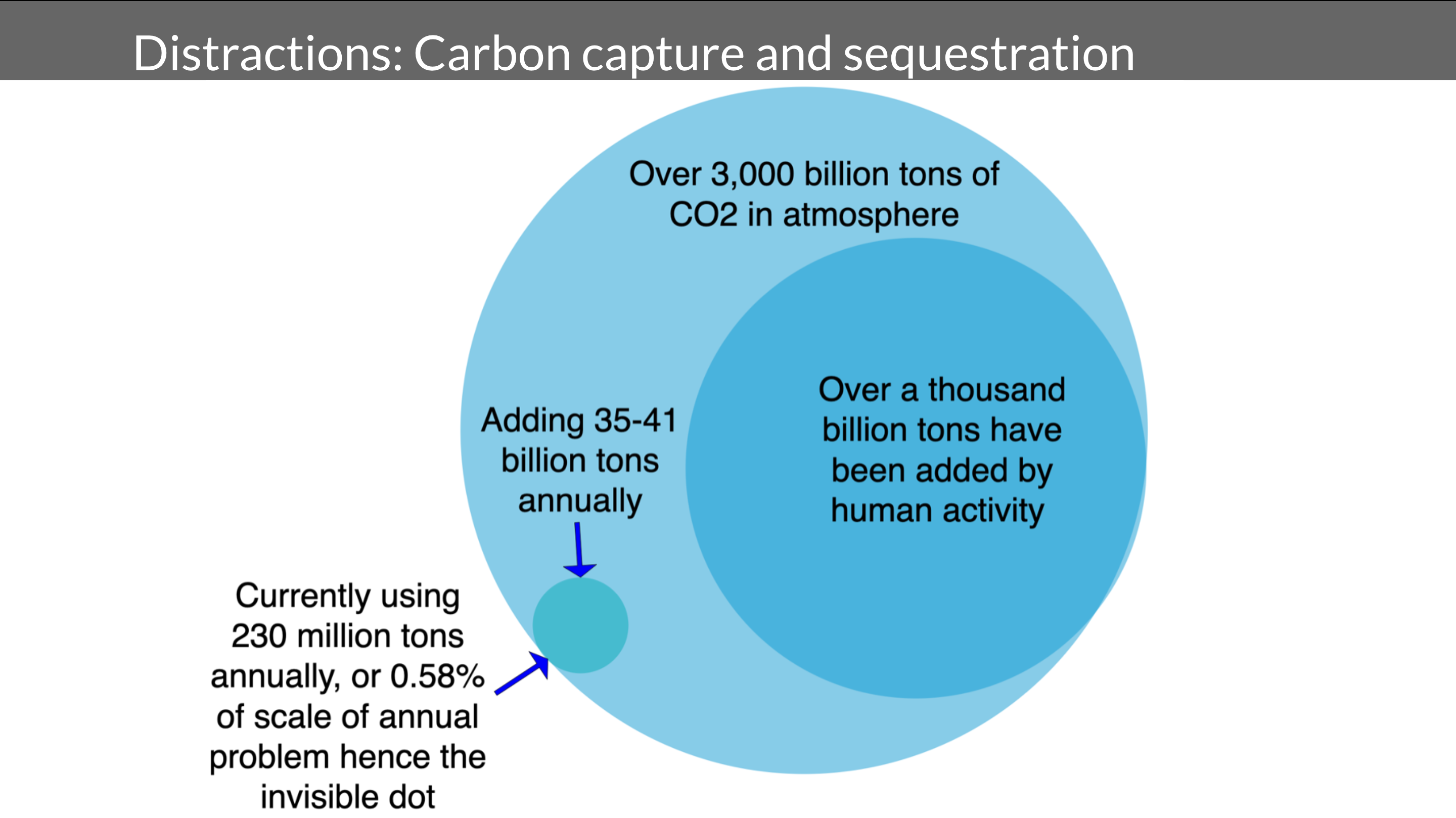

Carbon capture and sequestration is another distraction. This is a graphic I created years ago. We have about 3000 billion tons of carbon dioxide in the atmosphere. About 1000 billions of tons of that have been added by us since the start of the industrial revolution, and we’re still adding 35 to 41 billion tons annually. There’s an invisible dot down there. Our total market for all carbon dioxide in our economy is about 230 million tons, about 0.58% of a year’s emissions of CO2. We’re not going to grow that by orders and orders of magnitude to either reduce, to counter the 35 to 40 billion tons, or to start drawing down 1000 billion tons. Now, further, of that 230 million tons, 90 million tons of that is used for enhanced oil recovery, mostly in the United States.

As we think about that, what they’re actually doing is they’re taking geologically-stored carbon dioxide that is associated with natural gas. They’re stripping that off, and they’re piping it a few kilometers or miles, and they’re pumping it back underground to produce more oil. The vast majority of the carbon capture and sequestration that is touted today by Exxon Mobil and other countries is actually a shell game. It’s not something that can scale. Once again, nature-based solutions are a much more effective approach to this.

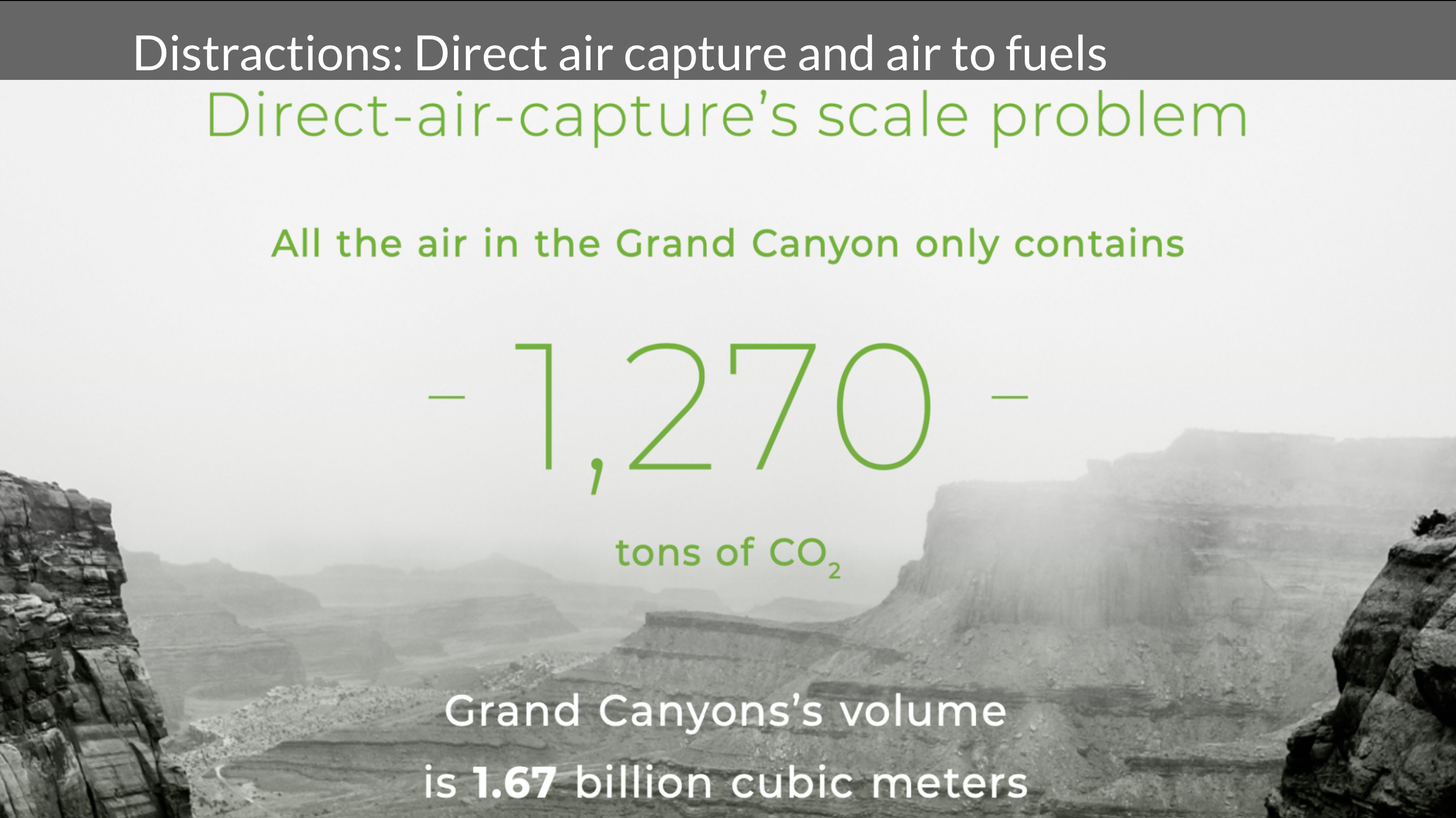

That applies to direct air capture and air fuels. A direct air capture where you use walls of fans just are thermodynamic nonsense, and they are fig leafs for the fossil fuel industry. It’s quite remarkable just taking the example. It isn’t a case where we’re trying to close the gate after the horse has already escaped.

Imagine, if you will, a huge beach of black sand. In that beach, there are 420 gray grains of sand. Every day someone is throwing another grain into the sand. Your job is to find those 420 grains and remove a third of them. That’s what carbon direct air capture is like. It’s just not effective. One of the leading companies in that place, is Carbon Engineering, now owned by Occidental, the major oil company. To get a million tons of CO2 a year, which is equivalent to a rounding error, the scale of problem requires 2 kilometers of fans 20 meters high and 3 meters thick. They power it by burning natural gas. Getting to anything appropriate to scale would wrap around the equator.

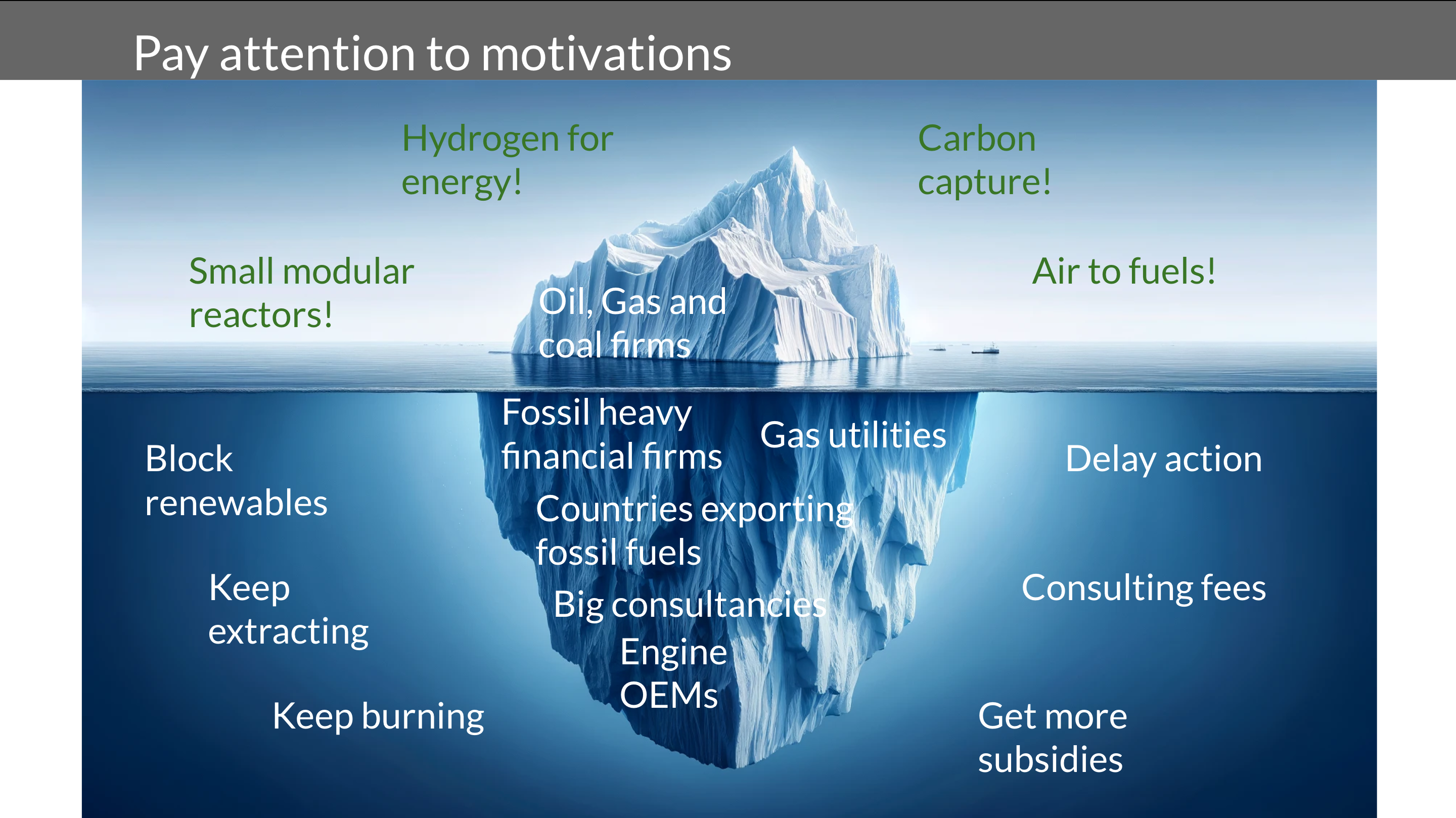

Finally, pay attention to motivations. This transition that we’re going through globally is a huge transformation of our economy. There are losers, and most of them know who they are, and there are winners, and some of them know who they are, and there are a lot of people who want to be winners, electrolyzer firms really want to be winners, and they’re going to be okay. Hydrogen fuel cell bus companies and hydrogen fuel cell manufacturers want to be winners. They’re not going to be. The oil and gas industry wants to convert its hydrocarbons into hydrogen, and so they want to preserve that extraction of molecules from underground. That’s not going to work out well for them. Gas utilities have a vested interest in preserving their business case against the. Against the utility death spiral. The big consultancies work for who pays them, and they give the results that they expect.

If you hear something that sounds potentially like it might be a great idea, find out why the person is talking about it. If they clearly have a vested interest, they’d be at least skeptical. A lot of the green hydrogen stuff doesn’t stand up to scrutiny economically, technically, and we start to see where the push for it is coming from. Small modular reactors, similar types of things. That’s the end of the shortlist of climate actions that will work.

Reji, happy to take questions if you have time for that.

Thank you, Michael. Anybody? Any questions? Girish? Rahul.

Question:

Really interesting talk. And of course, the wedges, they’re well known, as they’re called, or portfolio approach in the power sector, that you need a lot of things. Can you say a little bit about developing countries in the sense that they are a little different from the developed world? When we look at these trajectories, they’re further down the curve in the sense India’s net zero is planned for 2070, while Europe should ideally do 2035 or 2040 to give some carbon space for developing regions, for example. So is it that there are, I mean, the favorite buzz word is leapfrog, and it’s not entirely clear that’s available equally everywhere? Or do you really think that there is some of that, or are the development constraints such that it’s okay to wait a little and there’s too much to choose from?

There’s certainly some no-brainers, electrified everything and so forth. But can you speak a little bit more on the nuances of a country like India, or even more so countries in Africa, because their needs and objectives and aspirations aren’t exactly 100% the same. When you talked of a very high carbon price in the US, the societal cost of carbon for parts of Africa, if you do sub-national accounting, is much lower. Thank you.

Answer:

Certainly I’ll lead into a few bits of that. So let’s take one specific piece in terms of leapfrogging and explore. Let’s just take electrifying transportation right now. Bloomberg New Energy Finance pulled some numbers together last year and they found that we’re already seeing millions of barrels of oil a year avoided. But the interesting thing that was the biggest source of avoidance of burning oil was two- and three-wheeled small electric vehicles almost entirely in the developing world. Certainly in my travels in Indonesia and Malaysia, sometimes on gasoline-burning scooters, there were tremendous numbers of tiny vehicles there. They were cheap in one way to run, but a battery-electric one was also cheap and very effective, very efficient, and very low maintenance.

Now let’s lean into that maintenance thing. India, for example, is pledged to put 50,000 electric buses on its roads by 2027. When I talked to Reji and looked through some of the work that’s already been done, there’s been a great work in terms of India, in terms of right-sizing the batteries for the routes and so avoiding the developed world’s trap of falling into thinking it must be as good as a diesel bus is today, as opposed to it must be sufficient for the needs of the route. India has a lot more electric buses than it would otherwise because it did that analysis and said, we don’t need something that California thinks is absolutely perfect, we need something that works for us. That enables a secondary benefit of electrification to occur.

The global statistics on electric buses versus diesel buses versus gasoline buses are that electric buses are lower maintenance and they’re cheaper to operate than diesel. There’s the purchase price, which India is doing an effective job of right-sizing the bus batteries. That is another way to achieve that. But that is a place where you’re leapfrogging other countries. 50,000 electric buses is more than North America will have in 2027, is much more than Europe will probably have in 2027. Europe only has a few thousand electric buses now. This is another place where hydrogen is problematic. Hydrogen buses have maintenance costs that are 50% higher than diesel buses and fuel costs that are much higher.

There are definite places where you can leapfrog. The developing world already is, by electrifying the smallest transportation. Electric vehicles are problematic in the developed world because we want cars that will drive 500 kilometers, have air conditioning and have cruise control, and have all those things, whereas a small family in India has a scooter or two, and that’s a much more accessible form factor to electrify. Some of that leapfrogging is places where you can strongly lean into the different expectations of your populace. Even there is really fascinating stuff, like Tata’s Nanocar. Its relative failure was a fascinating case study in getting that wrong.

Reji:

Thank you. Just a statistic for you. In 2023, India, 56% of three-wheelers sold were electric. So what you’re saying is exactly right. I mean, by law, it can be sold without batteries being considered as fuel. So this is another pioneering work by ISGF. We have been arguing that three-wheelers and two-wheelers should be sold without batteries, and batteries should be leased from battery leasing agencies. That has given rise to the battery swapping station. So we have a challenge with the standardization of the battery swapping station, but that is coming. There are already over a dozen battery swapping operators, and we made a drop standard, but we couldn’t finalize it. There are some issues which we hope we’ll be able to solve this year.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.