Support CleanTechnica’s work through a Substack subscription or on Stripe.

A few months ago, I was invited by Dr. Sebastian Husein of the Battery Centre Twente to speak at the University of Twente’s 2025 Climate Event, a hybrid discussion with multiple speakers engaging with an audience of academics in the Netherlands and neighboring countries. That event occurred on November 5th, and what follows is a lightly edited transcript of my presentation, the questions that were asked and answered during the session, and answers to additional questions that came in via email after the event. For those interested in a video, an MP4 can be found here.

Lightly edited transcript:

There’s a lot of noise in the climate space because many people are trying to preserve their industry or invent something new. A few years ago, I put together my first version of a short, simple list of climate actions that actually work, along with some of the common distractions. We’re going to run through them quickly today. My goal is to cut through the noise so we can focus on what truly makes a difference.

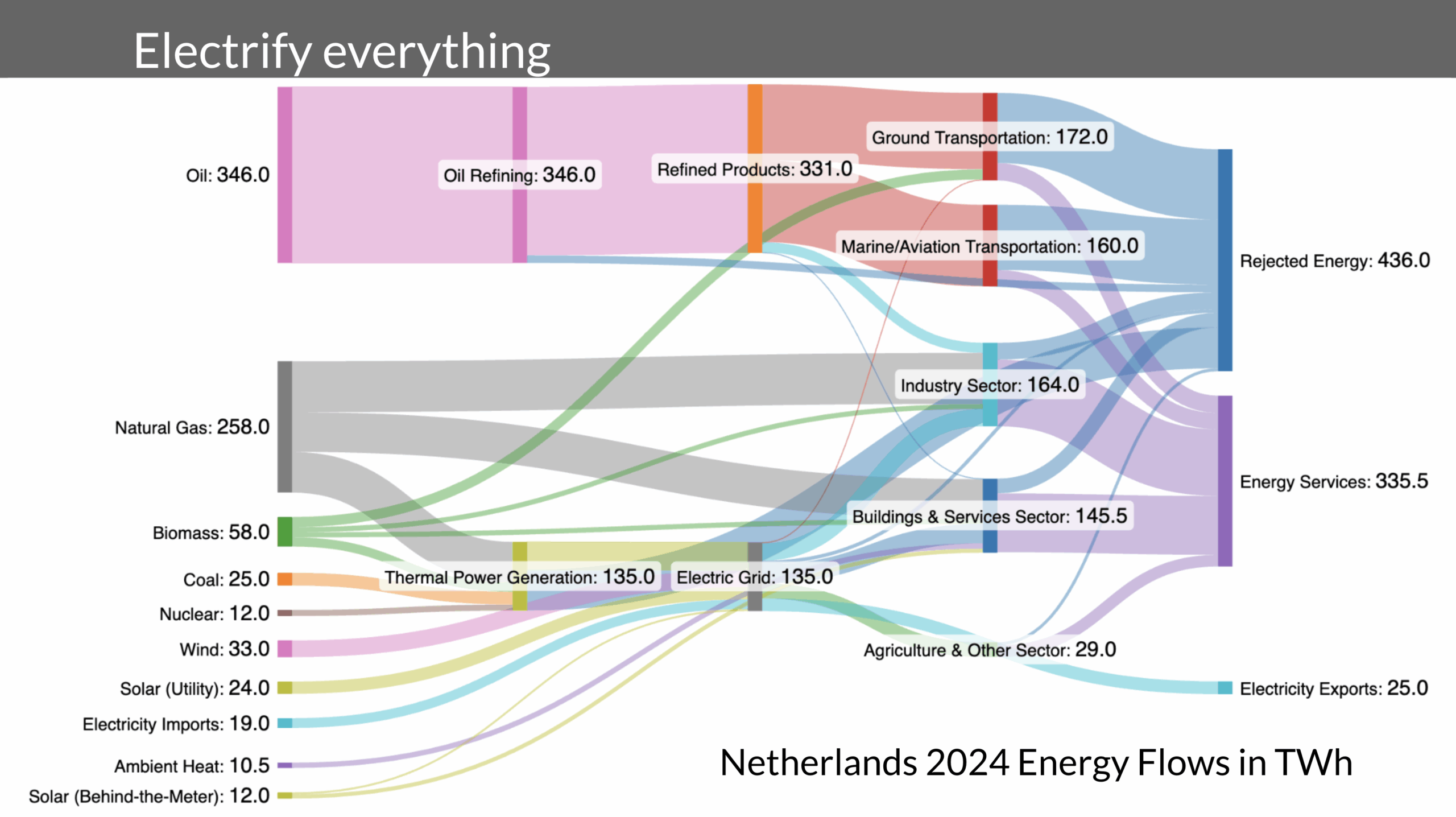

Let’s start with the obvious: electrify everything. When TenneT invited me this year to assist with their 2050 scenario planning and target grid strategic plan, one of the things I did in preparation was create a Sankey diagram for the Netherlands. It shows today’s energy flows in the country.

The big takeaway, when it comes to electrifying everything, is the massive amount of rejected energy, visible on the upper right as a majority flow of waste. Sankey diagrams often leave it out, perhaps because it looks bad, but Lawrence Livermore National Laboratory has set the standard by putting rejected energy front and center. When we burn things for energy, thermodynamics dictates that a lot of it turns into waste heat. All the oil we consume—much of it just becomes heat, not forward motion or useful work. The same goes for natural gas: a huge portion turns into rejected energy.

What we really need to focus on in the energy transition is energy services—how much energy is actually moving trucks, cars, and buses forward; how much is propelling ships and planes; how much is doing useful work in industry, whether that’s process heat or moving materials along a manufacturing line; and the same applies to buildings and the services sector. Even in the Netherlands, a much more efficient economy than North America, Canada, or Australia, rejected energy still vastly outweighs useful energy services.

As we electrify everything and shift to wind, solar, and electricity imports, and as we harness more ambient heat through heat pumps and geothermal systems, energy services can remain steady while rejected energy shrinks dramatically. When we electrify ground transportation, about 80% of the energy we currently waste drops to around 15%. That’s the real advantage of electrification—it’s by far the most efficient way to use energy.

Every time we convert energy from one form to another—especially when we turn electricity into something else, like hydrogen or synthetic fuels—we lose more energy. That creates more rejected energy and means we need to build much more wind and solar to meet the same needs. In contrast, renewables flowing through storage and transmission directly to energy services produce an efficient economy that delivers the right amount of output with far less waste.

These slides will be available for everyone after the session, so you can dig deeper and send me questions. We also created more complex, detailed Sankey diagrams as part of the TenneT process. It was fascinating work this summer in the Netherlands. I didn’t make it to your location, though I was invited—it would have required three train transfers, which wasn’t practical for that day.

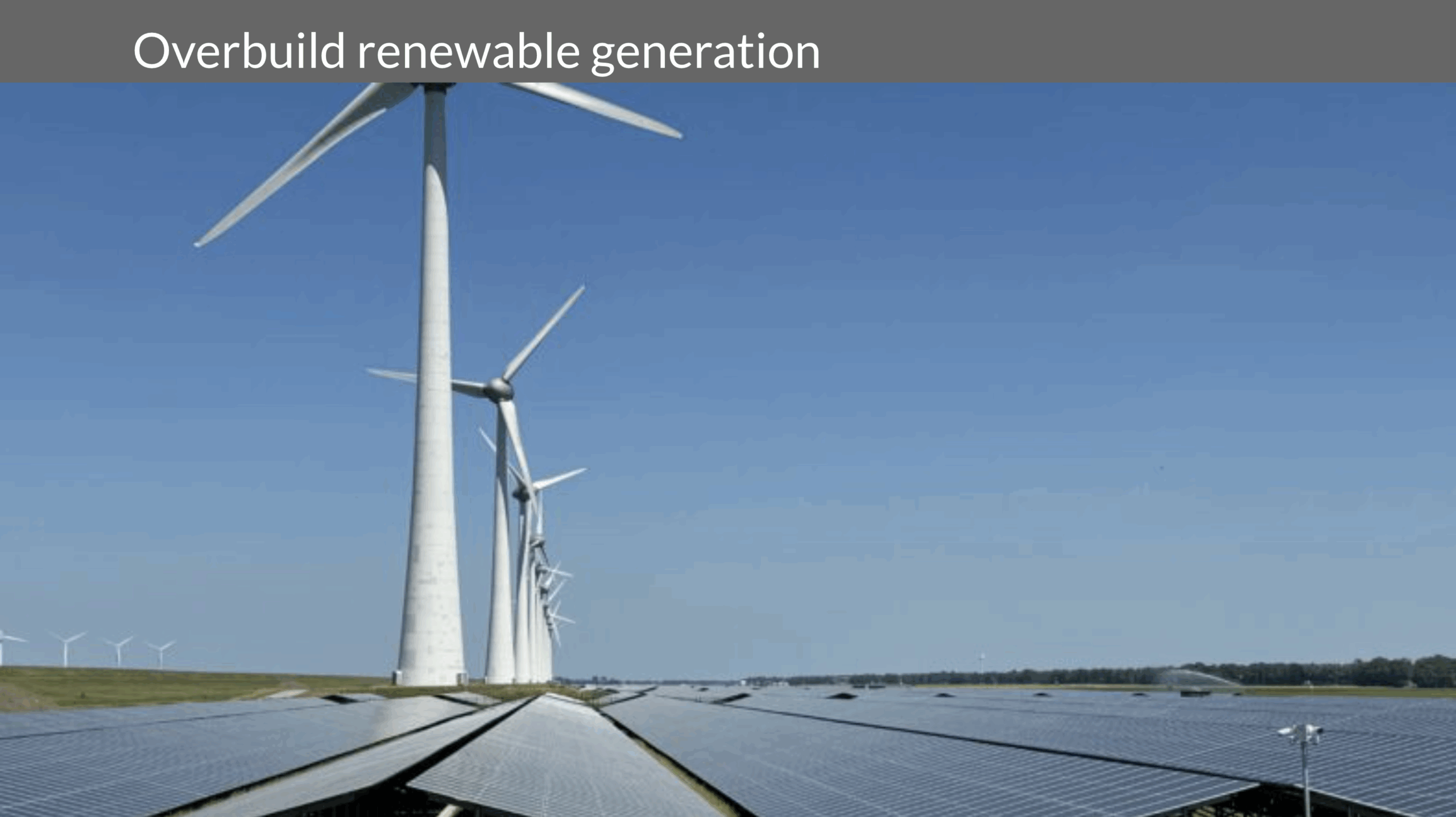

Next, overbuild renewable generation. This photo shows the onshore and offshore wind and solar farms in a polder in the northwestern Netherlands, where I was invited for a field trip. The turbines there are 7.5 MW each—the largest ever built on land—and the site also includes a large cluster of batteries, all connected behind a single grid connection. Altogether, it’s one gigawatt of combined wind, solar, and battery capacity.

That hybrid setup creates both firm and flexible power. As part of the TenneT project, we modeled and co-located grid batteries with wind and solar farms. It makes sense—it optimizes grid connections and minimizes curtailment.

When we talk about overbuilding renewable generation, we’re really only talking about around 25%. And that’s not unusual. We’ve done the same thing with almost every other generation type, except nuclear. Nuclear plants must run at full capacity to be economical—they typically operate around 90% capacity factors. We can’t overbuild nuclear because it’s far too expensive.

But overbuilding renewables gives us flexibility that no other generation source can offer. Yes, we’ll curtail some generation, just as we run our coal and gas fleets far below their notional capacity. The difference is that with renewables, that underuse isn’t waste—it’s a feature that enables resilience, stability, and abundance in a clean grid.

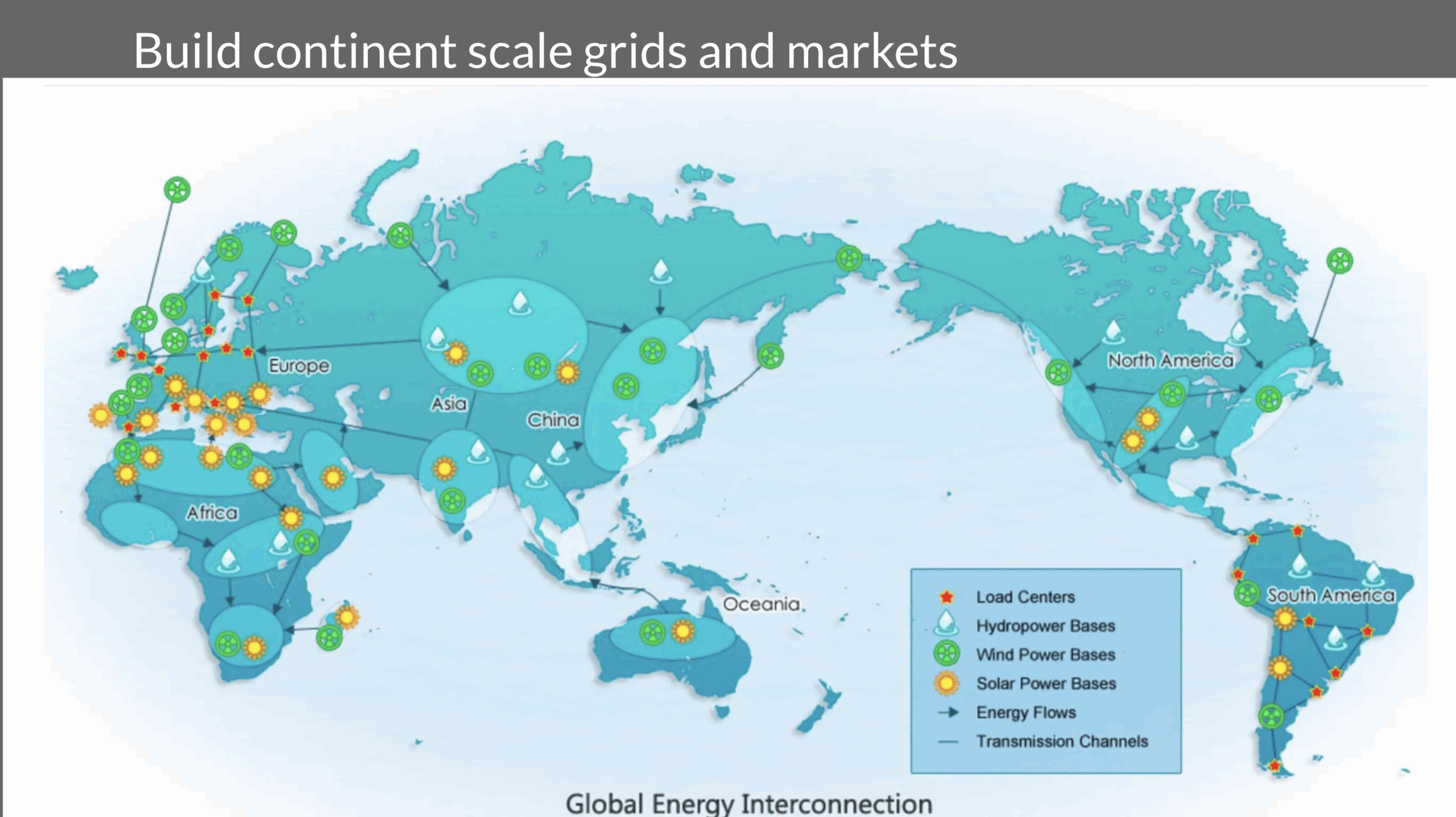

The next principle is to build continent-scale grids and markets. This diagram comes from the Global Energy Interconnection Development and Cooperation Organization, or GEIDCO, led by China. Their vision is an HVDC network connecting all continents. If you look at the lower left of the diagram, you can see Africa, with major planned transmission lines and renewable assets—solar and wind—integrated into the system.

This vision isn’t just aspirational. Under the Belt and Road Initiative, every African country for example has signed on, and many projects are already advancing. Two or three years ago, Chinese and African researchers, using European grid modeling software, conducted a study of a 12-country, 10,000-kilometer HVDC interconnection. It stretched from northwest Africa across to Kenya and then down the east coast to South Africa. They modeled generation and load across the corridor to test the technical and economic viability of a continental energy backbone.

China, of course, already operates a massive domestic grid and is now interconnecting with its neighbors while exporting HVDC expertise worldwide. For example, I recently spoke with energy professionals in Pakistan, where China helped build an HVDC backbone as part of broader collaboration. Pakistan, notably, added about 17 GW of rooftop solar last year, mostly residential and commercial installations.

In Europe, I worked last year with an organization focused on developing a mesh supergrid—an HVDC network designed to integrate offshore wind and balance power across the continent. The goal is to move beyond point-to-point connections and build a flexible system that shifts electricity from regions with surplus to those with shortfalls.

I’m also peripherally involved in efforts to establish a transatlantic HVDC connector between Europe and Canada, following roughly the same route as the original 1860s undersea telegraph cable. These projects reflect a global wave of HVDC development, creating unprecedented opportunities for renewable integration and grid resilience.

Europe, in particular, committed in May of last year to develop a unified European grid strategy and funding model, aimed at breaking down the silos between national transmission system operators. I’ve also been part of founding a new NGO, Super Grid Europe, based in Brussels, which is pushing this vision forward. There’s a lot of good work happening in this space, and momentum is clearly building.

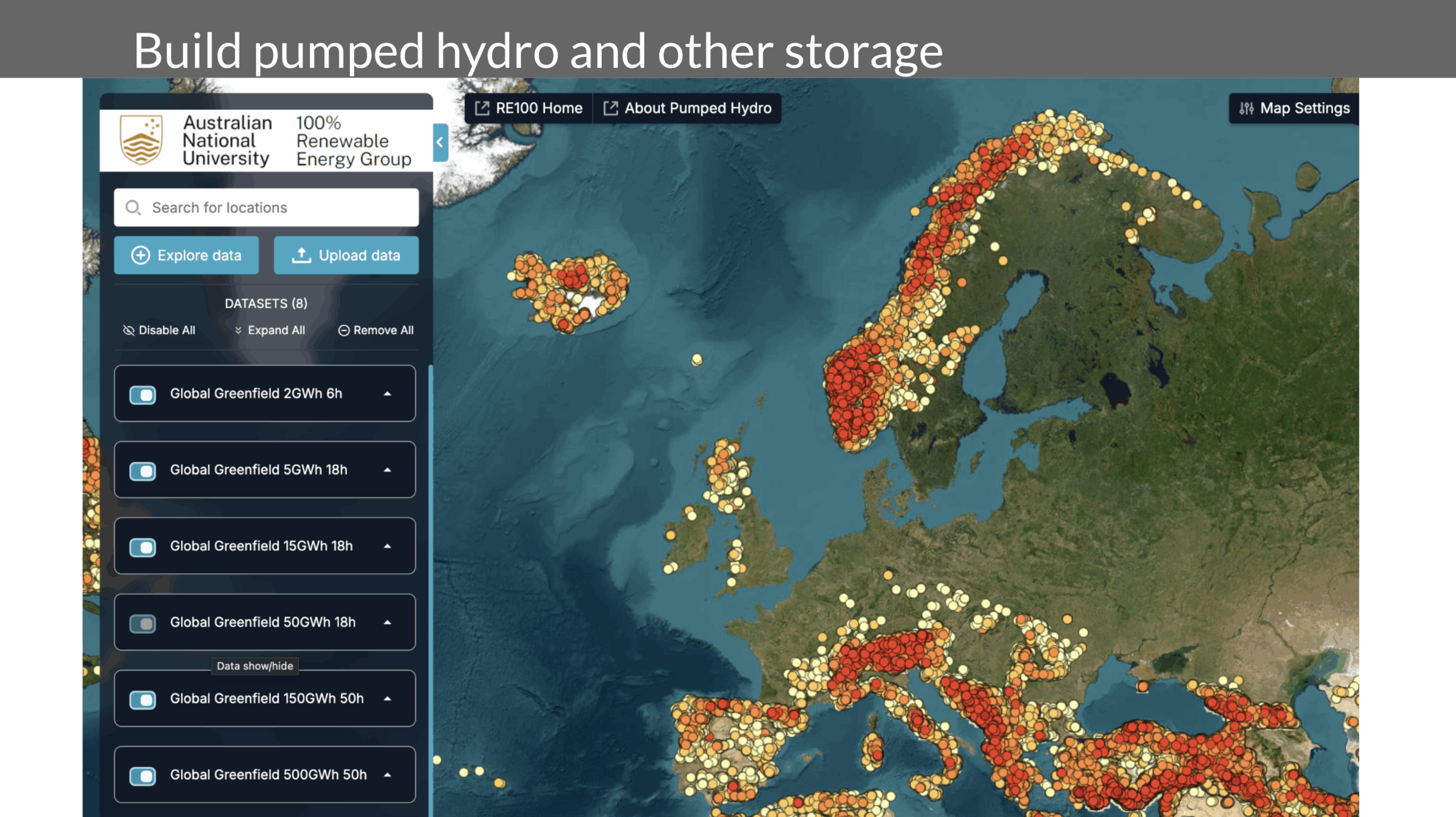

Grid storage components are the next major pieces. Batteries are getting a lot of attention right now—and rightly so. They’re extremely useful for short-duration storage and are expanding into longer-duration applications. But people often tell me there’s no room for pumped hydro. That’s simply not true.

A few years ago, researchers at the Australian National University conducted a comprehensive GIS study to identify potential off-river pumped hydro sites. They looked for paired Greenfield locations within two to three kilometers of each other, with an elevation difference of at least 400 meters, located outside protected areas and close to transmission lines. The results were astonishing: they found enough potential pumped hydro sites to provide more than 100 times the world’s total future energy storage needs. Every dot on that map represented a viable site.

So when people claim there’s no room for pumped hydro, I disagree. Of course, the Netherlands isn’t an ideal location for it—flat landscapes don’t lend themselves to large elevation differences—but that’s precisely what transmission is for. Power can move easily from regions with topography suitable for pumped hydro to flatter regions that need the storage. These systems are closed-loop and off-river, typically using dry gullies or valleys rather than natural waterways, which minimizes ecological impacts.

In Ireland, where I’m assisting with 2050 energy scenarios, there’s actually plenty of room for pumped hydro development. It will likely play a meaningful role in long-term storage there.

During our work with TenneT, we also looked at how to handle several days of dunkelflaute—those periods with little wind or sun. The solution we modeled involved diverting waste biomass, which currently decomposes into methane and contributes to global warming, into biodigesters to produce biomethane. That biomethane can then be stored in existing strategic gas reserves. The gas turbines we already have—reliable, cheap, and underused—can burn that biomethane when needed for backup generation.

When modeling the Dutch system, we examined combined heat and power (CHP) units that support greenhouse agriculture. These systems produce electricity, heat, and CO₂ for the greenhouses. Official plans had them all decommissioned, but we kept them in our model—not for continuous operation, and not to produce CO₂ for the greenhouses, but as part of the dunkelflaute reserve capacity. We’ll continue generating some industrial CO₂ anyway, and the CHP units can remain available as flexible backup assets.

As Paul Martin put it during our discussions, strategic energy storage must be cheap and stable—the fuel should just sit there until it’s needed. Methane, stored as biomethane, does exactly that. And we already have the infrastructure in place. The takeaway is simple: build lots of storage, including pumped hydro.

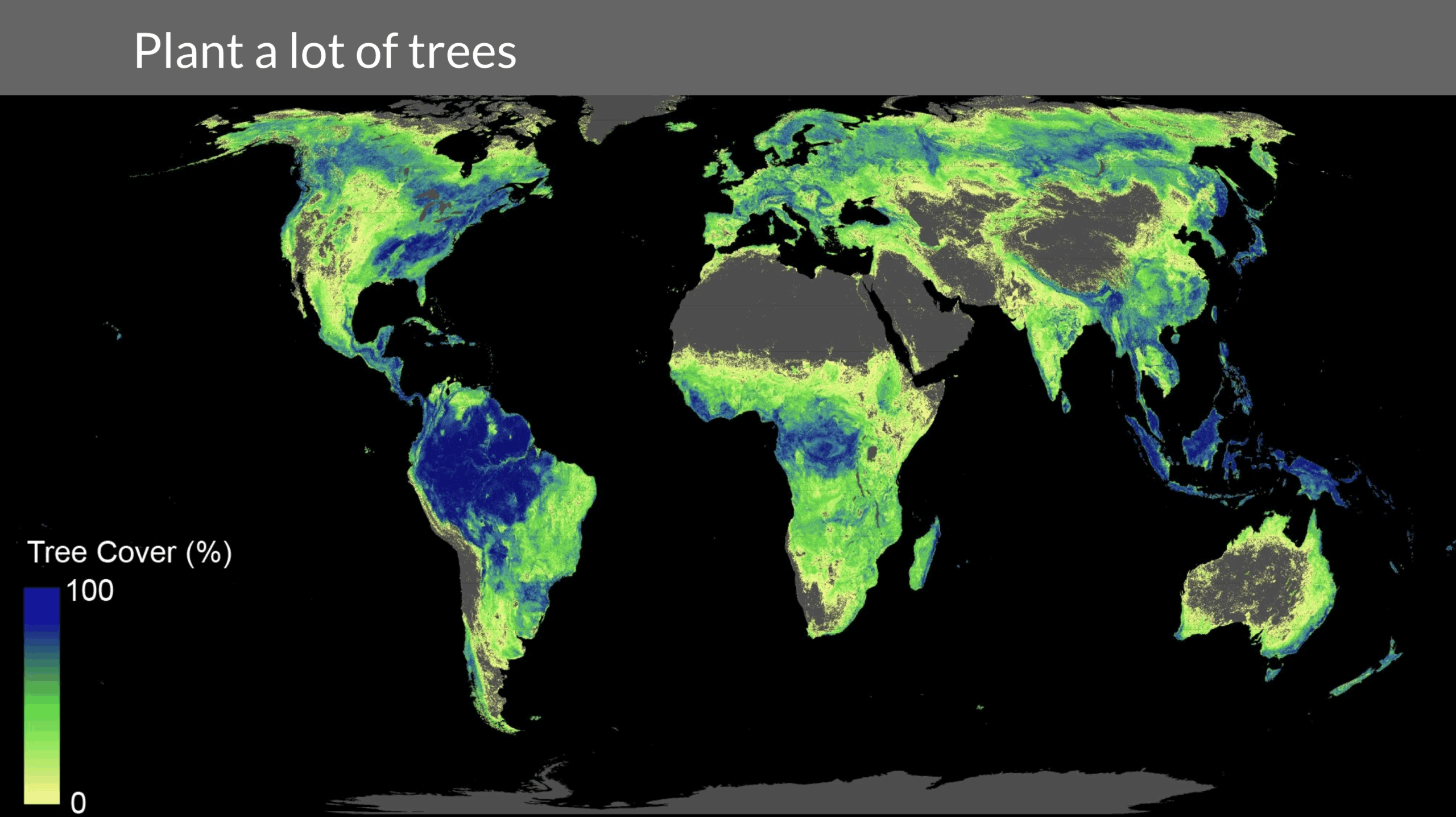

Next, we need to do a lot of work on the natural environment. Planting trees is part of that, but let’s be clear—it won’t help us meet our 2050 climate goals. It will, however, make a difference for our 2200 goals. Restoring wetlands, replanting forests, and revitalizing grasslands won’t decarbonize fast enough to hit mid-century targets, but they’re essential for long-term ecological recovery. It’s the right thing to do to begin reversing the environmental devastation caused by human short-sightedness.

China offers a compelling example. During Mao’s era, much of the country was deforested, but since then, China has reforested on a massive scale. The “Great Green Wall” now stretches across the country’s arid northwest, helping hold back desertification. Around northern cities, vast tree-planting programs have improved air quality and reduced dust storms while greening the landscape. Over time, China has reforested an area larger than France. It’s now the global leader not only in renewables, transmission, and storage, but also in reforestation—having gone from one of the world’s greatest deforesters to its most ambitious replanter.

That doesn’t make China virtuous in all things, but it does show what’s possible with scale and persistence. The Netherlands, by contrast, faces limits. It can’t soften its coastlines or restore wetlands easily—when your wind and solar farms sit five meters below sea level, removing dikes isn’t an option. But in many other parts of the world, it is. We’ll need to step back from certain coastlines, often moving wealthy property owners inland from vacation homes and seaside estates, to allow the natural environment to recover and function again.

Next, we need to fix agricultural practices. This is a heavy-lift spray drone—an incredibly capable electric machine that can carry about 90 kilograms of seed or agricultural product at a time. Studies show that drones like this can reduce the amount of product needed for spraying by 30% to 50% because the prop wash pushes the material directly into the crops, right where it’s needed, and pre-planning with drone-collected information on crop health enables precise placement of exact amounts of product. That efficiency applies not just to pesticides or herbicides, but also to fertilizers—especially ammonia-based ones.

Ammonia fertilizers are a double climate problem: they’re energy-intensive to manufacture and, once applied, they produce nitrous oxide, a greenhouse gas with about 270 times the global warming potential of CO₂. Reducing ammonia fertilizer use while maintaining crop yields is a major climate win, and drone-based precision application is one of the ways to achieve that.

Another promising approach is in agricultural genetics. One of the people I’ve spoken with, Karsten Temme, was a founder and CEO of Pivot Bio, a company focused on microbial nitrogen fixation. They work with naturally occurring soil microbes that live around plant roots—microbes that already fix nitrogen from the atmosphere. Pivot Bio’s innovation was to switch off the microbes’ nitrogen sensor so they keep producing nitrogen continuously rather than shutting down when ammonia fertilizer is present.

This approach is already deployed across about 15 million acres of corn in the United States, where it’s cutting ammonia fertilizer demand by 20% to 30%. Combined with regenerative agriculture, precision farming, and better nutrient recycling—turning waste biomass into useful products and returning nutrients to the soil—we have a whole suite of agricultural innovations that can dramatically reduce emissions while maintaining or even improving productivity.

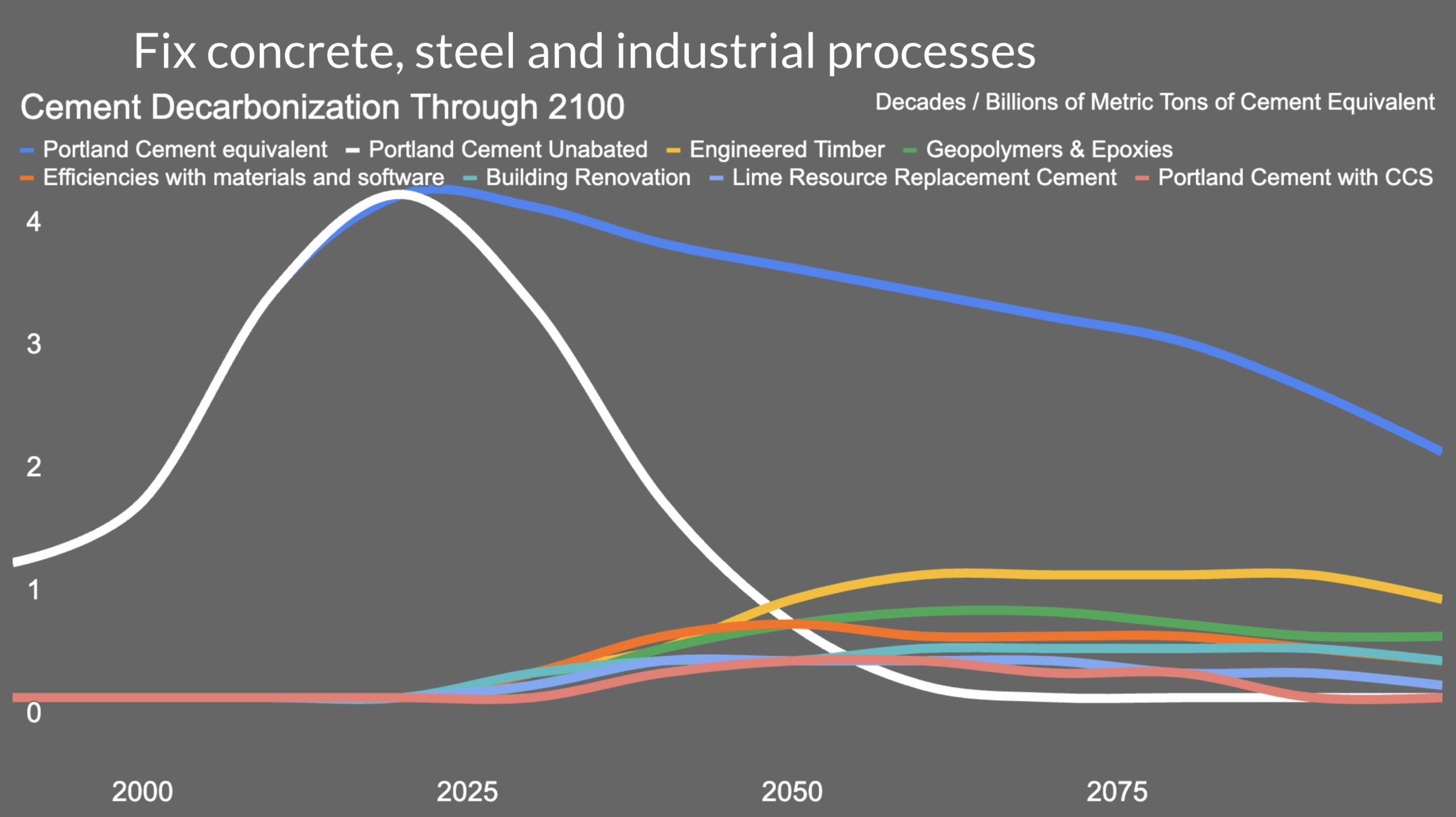

Next, we need to fix concrete, steel, and other industrial processes. This is one of the key reasons TenneT asked me to help them shape a realistic 2050 strategy. I build detailed decade-by-decade projections across entire demand and supply domains—aviation, concrete, steel, maritime shipping, grid storage, and more. I don’t pretend these models are perfectly accurate, but I do believe the direction of travel is correct. As I like to say, I don’t claim to be right, just less wrong than most.

From a concrete perspective, the challenge is enormous. Cement production—mainly Portland cement—is responsible for about 8% to 10% of global CO₂ emissions. The good news is that demand for cement is already starting to decline and will continue to do so through the end of the century. China, which produces about half of the world’s cement, is a leading indicator. Its decades-long infrastructure boom is winding down. The country already has 48,000 kilometers of high-speed rail, 177,000 kilometers of highways, and all the major ports and cities it needs. Like Europe and North America before it, China is shifting from rapid expansion to maintenance and replacement cycles, and that means less demand for both cement and steel.

The industry itself recognizes this. The World Cement Association published a white paper in December acknowledging that global demand will fall and asking how the industry would adapt. That awareness is rare and refreshing in an industrial sector. Meanwhile, substitutes like mass timber are gaining traction. I recently produced a major report on mass timber from a Canadian perspective, showing its potential to replace a meaningful share of cement use in buildings and infrastructure.

The same kind of transition is underway in steel. I’ve examined global steel production and the suite of solutions available, and the path is clear: electrify. Electric arc furnaces are already widespread and will dominate mid-century, especially as we dismantle fossil fuel infrastructure and recycle the recovered metal. New technologies such as molten oxide electrolysis and flash ironmaking are advancing quickly, particularly in South Korea and the United States.

Direct reduction of iron using biomethane is already at technology readiness level 9—commercially viable today. Tata’s new facility in the Port of Rotterdam, for instance, currently uses natural gas as a reducing agent, but it can easily switch to biomethane as supply scales up. Waste-derived biomethane, if left unabated, contributes to emissions, but when captured and repurposed for strategic storage or industrial feedstocks, it becomes part of the solution.

So the picture for heavy industry is not one of despair but of transformation. We know what the solutions are. The technologies exist, the pathways are proven, and now it’s a matter of scaling and aligning them with smart policy and market signals.

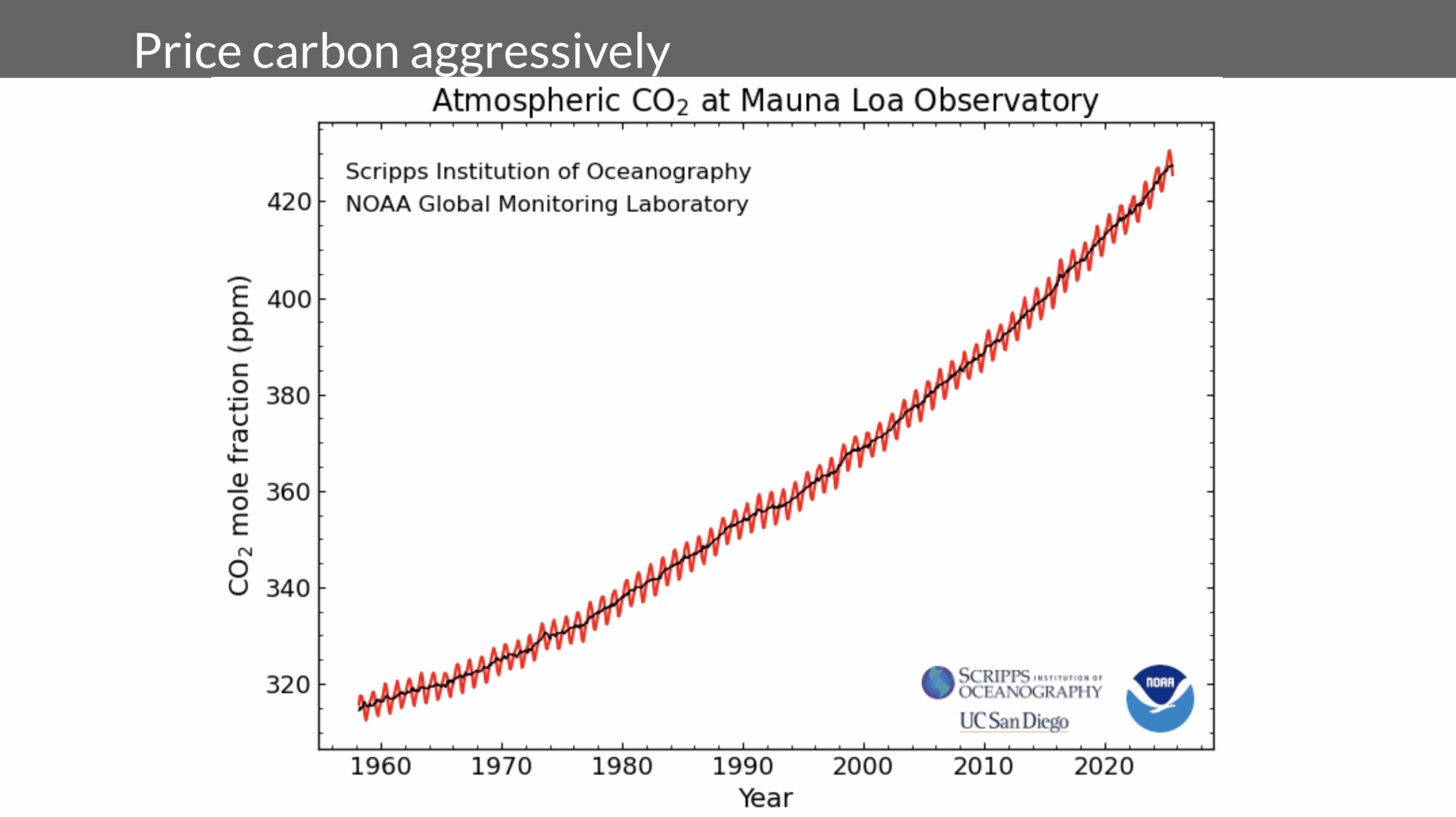

Next, we obviously have to price carbon. And for that, I have to say—thank you, Europe, for holding the line. As a Canadian, watching the consumer carbon price collapse this year was gutting. It’s a step backward at a time when we should be moving forward.

Europe’s carbon border adjustment mechanism is a game changer. The EU is the largest trading bloc in the world—it trades more with the rest of the world than either the United States or China. When you aggregate the European economy, it sits at the same scale as the other two global giants but with greater trade exposure. That makes the carbon border adjustment mechanism incredibly powerful.

It does two crucial things. First, it prevents carbon leakage by ensuring industries can’t escape regulation simply by moving production to high-emissions jurisdictions. Second, it effectively extends carbon pricing to every country that trades with Europe. Exporters who want access to the European market are required to decarbonize their own production to remain competitive.

In other words, Europe’s carbon pricing policies are putting a price on carbon for the entire world. And that influence is spreading. China already has a national carbon market and is now drafting its own carbon border measures. North America, meanwhile, is backsliding—but eventually, it will follow.

Pricing carbon is essential. We’ve treated the atmosphere as an open sewer for far too long, and that has to stop. Europe deserves credit for showing the resolve and consistency needed to make carbon pricing stick—and for using its economic weight to push the rest of the world in the same direction.

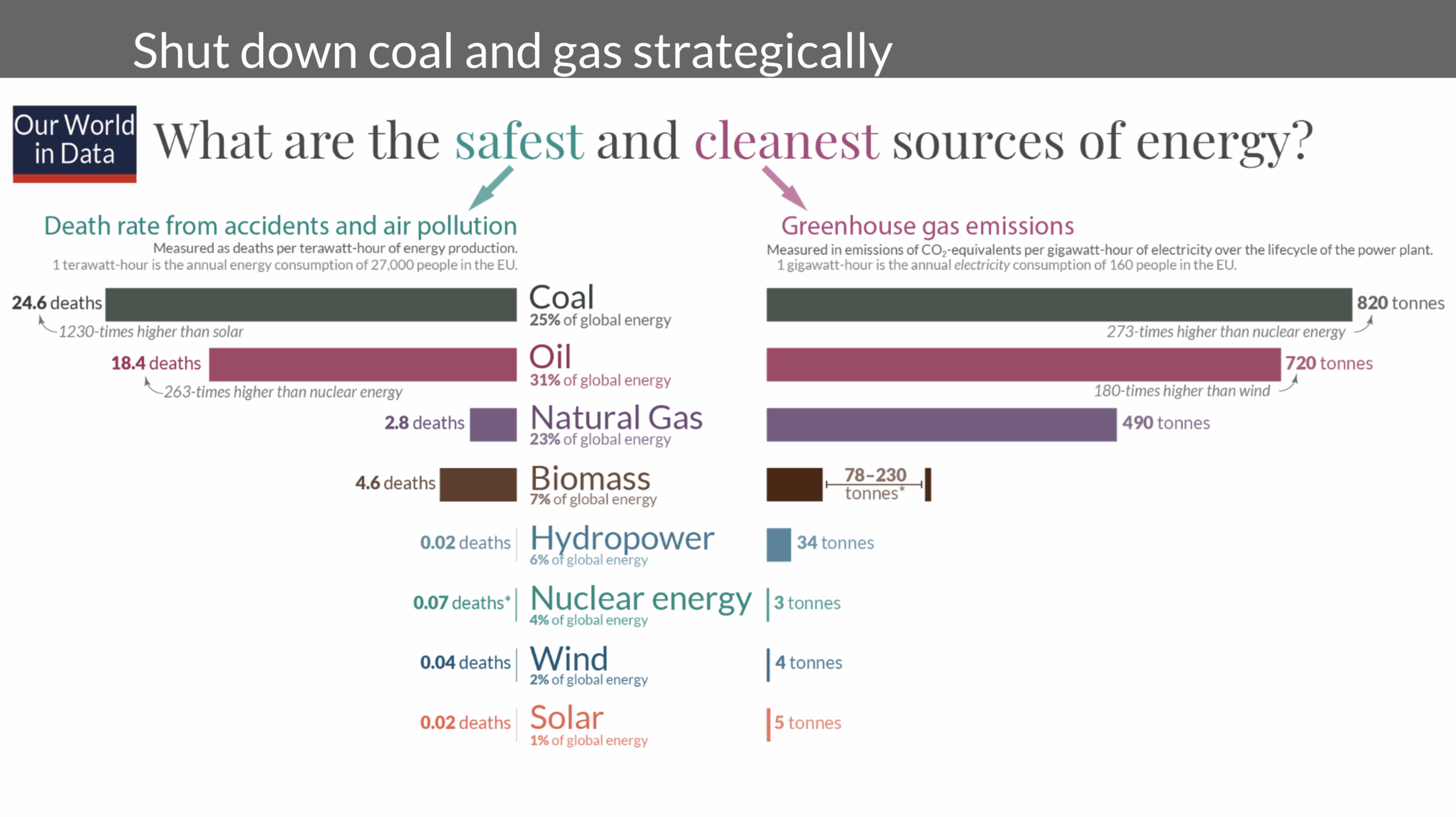

Next, we have to shut down coal and gas strategically. And I emphasize “strategically” because we still need generation capacity until the full transition is complete. The goal isn’t to flip a switch overnight—it’s to phase out fossil generation in a controlled, intelligent way, reducing its role year by year.

If we look at current trends, the United States and China are already partway there. In the U.S., natural gas plants are running at less than 50% capacity factors, and in China, coal plants are operating below that same threshold. They’re producing a shrinking share of electricity, and that share will continue to decline. The next step is to decide which plants to close first: the least efficient, highest-emitting, and those closest to population centers. China is already doing this.

One little-known fact about China’s coal story is that its recent “coal boom” included 775 gigawatts of projects that were either canceled, mothballed, or decommissioned. Yes, they’re still building, though that too is slowing, but they’ve also been retiring the dirtiest plants—especially those near cities where health impacts were worst. In their place, they’ve installed newer, slightly less polluting units. There’s no such thing as clean coal, but there is less-bad coal, and they’ve leaned into that distinction.

I modeled a similar approach for India last year while presenting to the India Smart Grid Forum. I mapped out which of their coal plants made the most sense to retire first and how to structure a staged shutdown plan that preserves grid reliability while cutting emissions and health risks. The principle applies everywhere: we need to keep enough generation capacity to cover rare gaps, but not more than that. If by 2050 gas plants only run five days a year, that’s a massive improvement. If by 2060 they run on biomethane stored in strategic reserves, that’s even better.

The economic challenge is how to preserve this backup capacity without leaving it stranded. In many cases, these assets will likely be nationalized or folded into major utilities to keep them available as infrastructure rather than profit-driven assets. That will require deliberate policy planning, but it’s already beginning to happen in several countries.

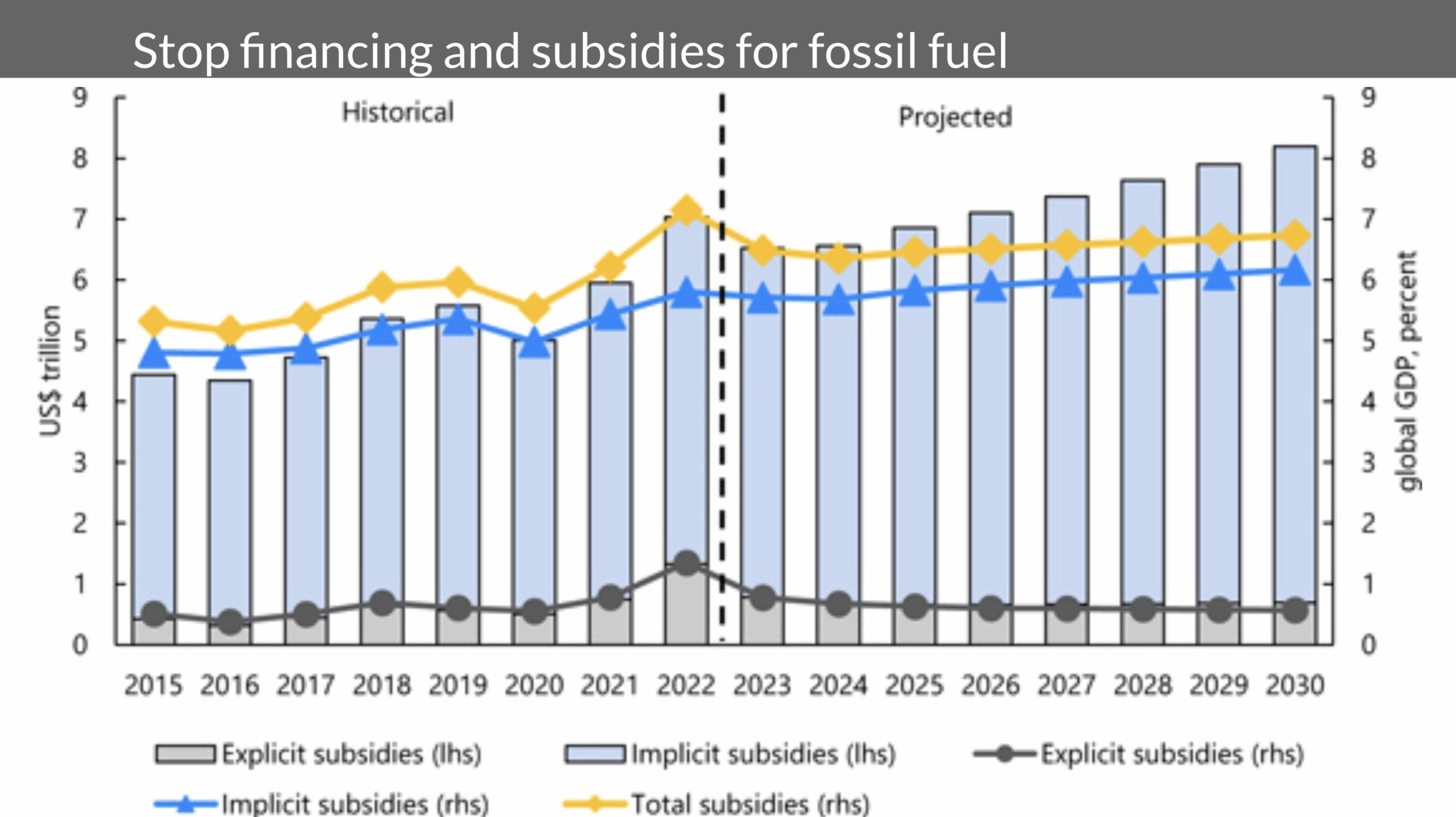

On the other side of the equation, we must stop financing fossil fuels. It makes no sense to acknowledge that oil and gas are the problem while continuing to subsidize them. Canada is a case study in contradictions: the federal government bought a failing pipeline, overspent massively on construction, and now subsidizes Alberta’s crude exports to the Pacific at about $2.5 billion a year. It has also supported LNG terminals on the British Columbia coast—projects that will almost certainly become stranded assets.

Globally, we already have more proven reserves than we can safely burn. If we simply used the oil and gas already developed, we’d still blow past the 2°C limit. Exploration and expansion are unnecessary and dangerous. The good news is that capital markets are beginning to respond. In 2024, Wall Street investment in fossil fuels dropped by about 27%, roughly $35 billion less than the year before. The shift is happening, but we need to accelerate it—and stop financing the past while we still have time to build the future.

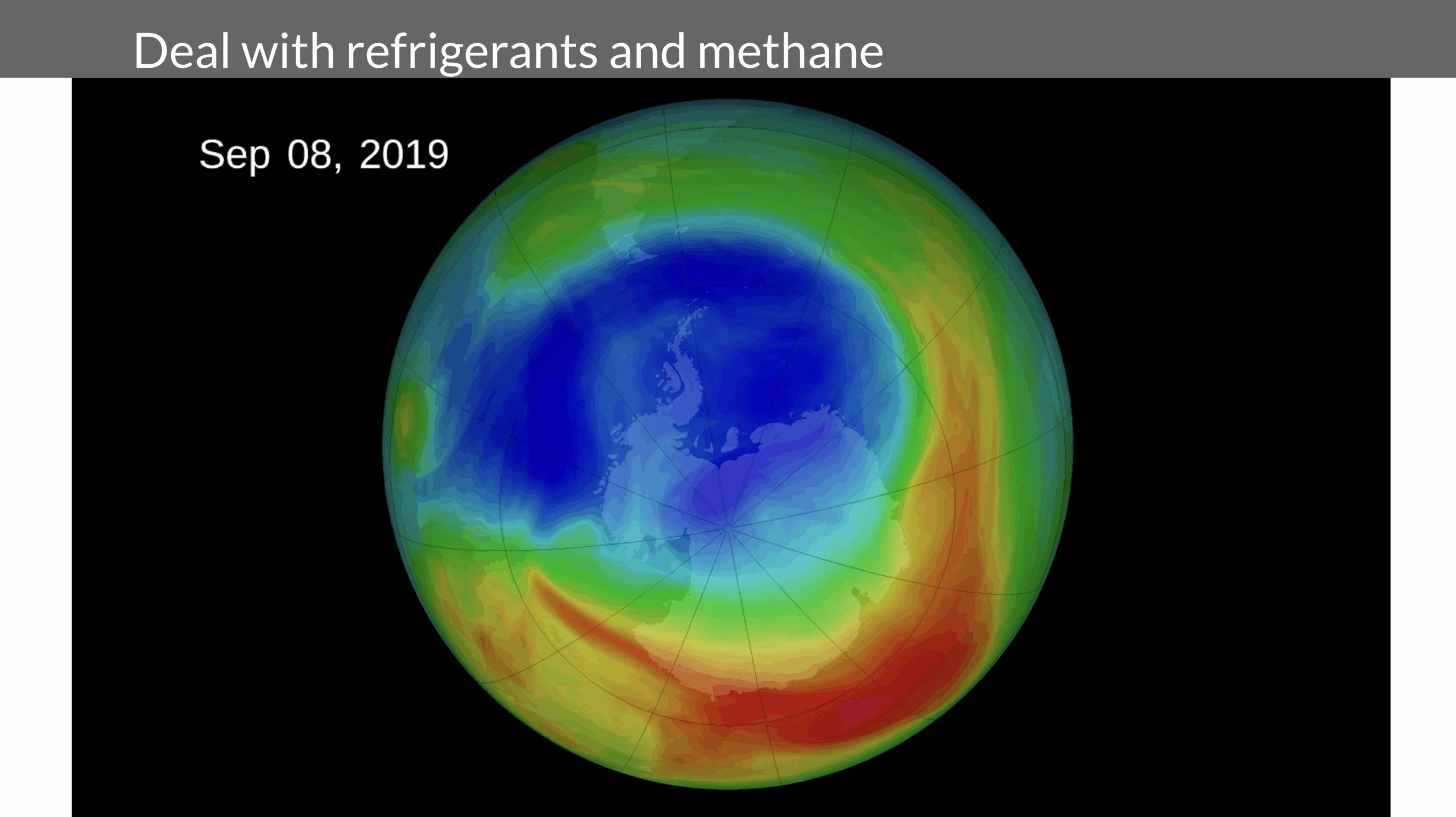

Next, we need to deal with the non-CO₂ gases—refrigerants and methane. The Kigali Amendment to the Montreal Protocol, signed in 2016 in Rwanda, addressed exactly this issue. Back in the 1970s, the world discovered a hole in the ozone layer caused by chlorofluorocarbons, or CFCs. Those were phased out and replaced with hydrofluorocarbons, or HFCs—and that’s where the new problem began. HFCs don’t destroy ozone, but they are extremely potent greenhouse gases, with global warming potentials thousands of times higher than CO₂, and they persist in the atmosphere for decades.

In other words, we fixed the ozone crisis but created a warming one. The small consolation is that HFCs are at least slightly less potent greenhouse gases than the CFCs they replaced. So we avoided a double disaster—no ozone hole and worse global warming—but now we need to phase down HFCs too. The good news is that the Kigali Amendment is driving this globally, and most countries are already implementing replacement programs with low-GWP refrigerants.

Here’s the ironic part: in the United States, the only effective carbon price currently in place is on HFC refrigerants. It was introduced under the Trump administration through the American Innovation and Manufacturing Act, one of his final legislative moves. That law effectively priced HFCs to accelerate their reduction.

Methane is the other major target. It’s a powerful greenhouse gas, with a global warming potential roughly 80 to 90 times greater than CO₂ over 20 years. But unlike CO₂, it’s short-lived—if we stop emitting methane now, global temperatures would respond within two decades, not centuries. Every tonne of CO₂ we emit lingers for 200 to 300 years, but methane decays relatively quickly, making it one of the fastest levers for slowing near-term warming.

And finally, hydrogen. It’s not a direct greenhouse gas, but it has an indirect warming effect because it slows the natural breakdown of methane in the atmosphere. Hydrogen also leaks easily—it’s the smallest molecule in the universe—and we will never fully contain it. So anyone betting on a hydrogen economy should keep this in mind: hydrogen leakage contributes to warming. It’s not the clean, consequence-free solution some imagine it to be.

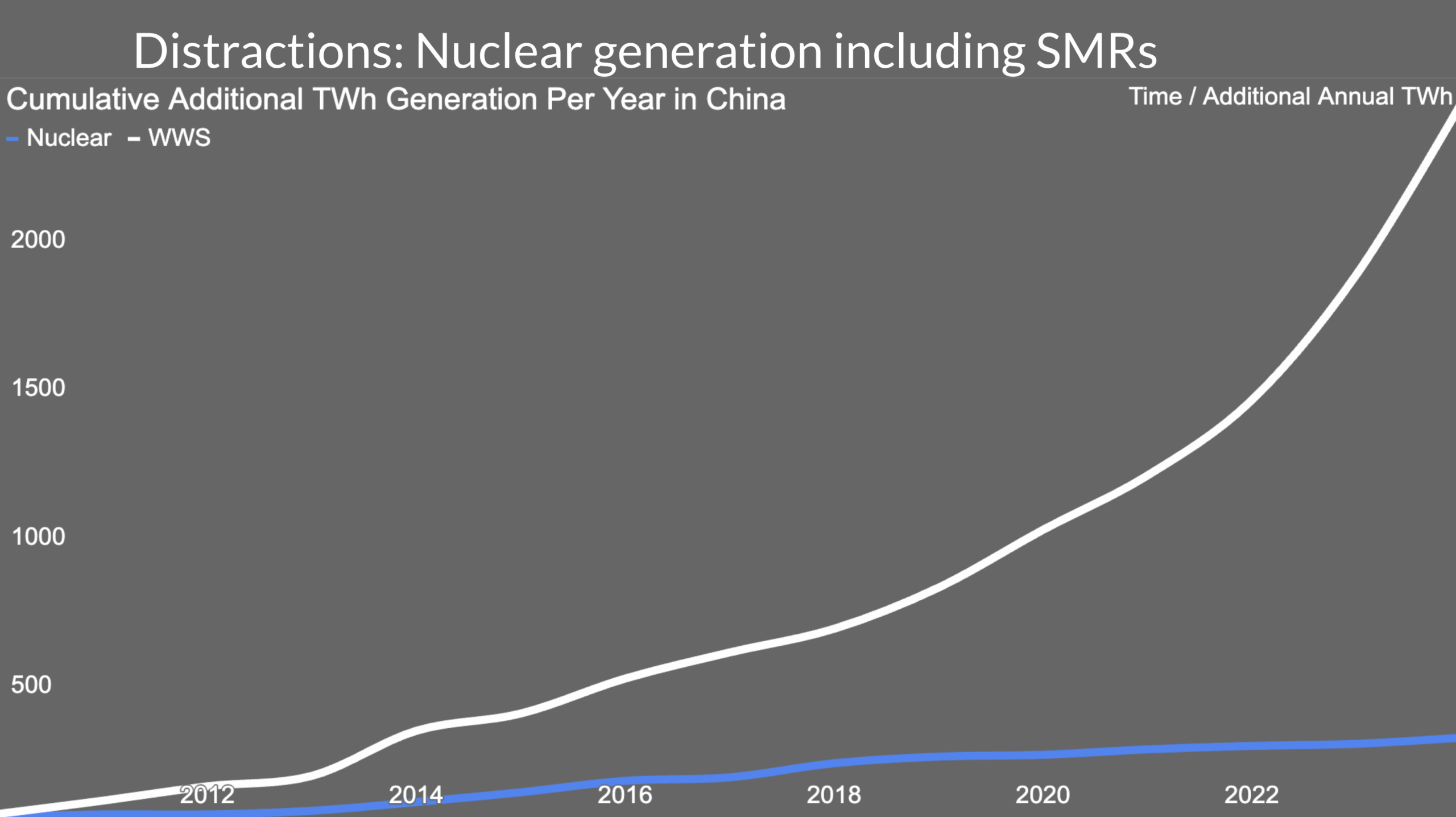

Let’s talk about distractions. The previous speaker mentioned nuclear power, and while I respect the technology, nuclear is a distraction. It’s not going to bend the global emissions curve in time.

This chart comes from material I began developing in 2014, when people were still saying that only nuclear could scale to meet global electricity demand. I thought that was nonsense then, and the data since has only confirmed it. To be clear, I like nuclear—it’s low-carbon, low-pollution, and very safe. It’s just a great 1970s technology that’s been overtaken by renewables. The problem isn’t the physics; it’s the pace. Nuclear takes too long to build and delivers too little too late.

The chart compares annual terawatt-hours of new electricity generation added in China from 2010 through 2023. Nuclear barely budged. Renewables, meanwhile, skyrocketed. Wind and solar are what scale. China—one of the few countries that can deliver megaprojects on an industrial timescale—has repeatedly missed every one of its nuclear construction targets. It only met its 2020 nuclear goal in 2024 and is already far off track for its 2025 and 2030 goals. Even if every planned plant is completed, China will still be about 40 gigawatts short by 2030.

By contrast, wind and solar massively exceeded their goals. China moved its 2030 renewable targets forward to 2025—and then hit them in 2024. It has now effectively met its 2030 renewable targets six years early, while its nuclear program continues to lag. That should be a wake-up call for Western nations, which don’t “eat megaprojects for breakfast” the way China does. If even China can’t scale nuclear fast enough, no one else can.

There are seven key conditions for successfully scaling nuclear, based on the experiences of South Korea, France, the UK, and the United States. No Western country today meets them, or even most of them. None is creating the policy or industrial environment needed for large-scale nuclear expansion—not even to the limited degree of China’s program, where the 2025 target was only 2% of grid capacity.

Small modular reactors are no better. We tried them in the 1950s and 1960s—pulled from submarines and aircraft carriers and installed on land—and they were far too expensive. That’s why we scaled up to gigawatt-class reactors in the first place: only at that scale do they become even marginally economical. SMRs ignore that historical lesson. They don’t meet the conditions for success, and they’re not necessary in a world where renewables are already cheaper, faster, and easier to deploy.

So yes, if there are nuclear enthusiasts in the audience, I’ve probably annoyed you—but the evidence is what it is. Nuclear isn’t the solution. It’s an elegant distraction from technologies that are already solving the problem.

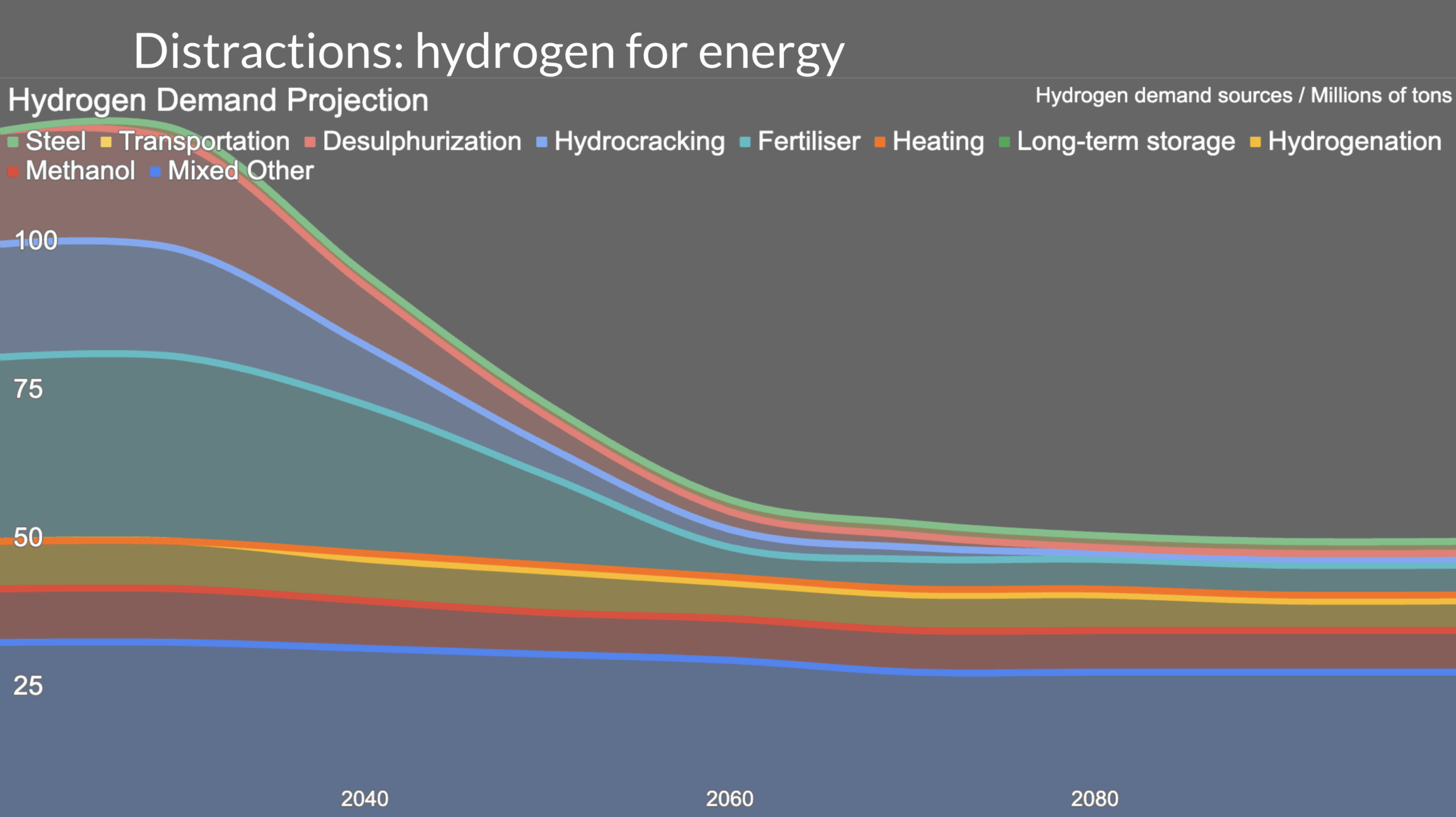

Similarly, hydrogen for energy is another major distraction. I’ve developed a heterodox projection of global hydrogen demand through 2100, mapping all the current and potential sectors of use. Today, global hydrogen consumption is about 120 million tonnes per year, and the single largest demand—roughly 40%—comes from oil refining. Hydrogen is used in hydro-treating to process crude oil, particularly heavy, sulfur-rich crude. That demand will largely disappear as the world moves away from refining fossil fuels.

We’ll still use hydrogen for certain industrial feedstocks, such as making olefins, plastics, and some chemicals, but we won’t be producing it from the heavy, dirty crudes of Alberta or Venezuela that require so much hydrogen to process. As one Schlumberger engineer agreed when I stepped through my calculations, refining a barrel of high-sulfur crude requires about 7.7 kilograms of hydrogen, while light, low-sulfur crude only needs around two. As hydrogen becomes more expensive to make cleanly, lighter and simpler feedstocks will dominate, and overall hydrogen demand will drop.

It’s worth noting that hydrogen production today is a massive climate problem—roughly equivalent in emissions to the entire global aviation industry. Producing hydrogen from natural gas and coal is highly carbon-intensive. Decarbonizing hydrogen production—whether through electrolysis powered by renewables or other pathways—will make it significantly more expensive, not less. As that happens, the world will naturally reduce hydrogen use wherever possible.

For a while, many thought steelmaking might be a growth area for hydrogen, through direct reduction of iron. But the economics don’t work. We already have better, cheaper alternatives: molten oxide electrolysis, electric arc furnaces, and biomethane-based direct reduction. These are proving more viable, while hydrogen-based steel projects continue to struggle or fail.

That leaves only one realistic growth area for hydrogen: hydro-treating biofuels, specifically the hydrogenation of vegetable oils and animal fats. These fuels will remain necessary in a few hard-to-electrify sectors—mainly long-distance maritime shipping and aviation. Beyond that, hydrogen demand is likely to shrink, not grow.

And even in aviation, electrification is advancing faster than many expected. Within the next two decades, we’ll see electric aircraft capable of flying ranges of up to 1,000 kilometers. That shift will change behavior too—short-haul routes will electrify entirely, and long-haul routes will rely on limited biofuels rather than hydrogen.

In short, hydrogen for energy isn’t the future. The infrastructure being proposed—the pipelines, the hubs, the global hydrogen trade—is going to be underused. Hydrogen will continue to matter in a few industrial niches, but it won’t be the universal energy carrier some are hoping for.

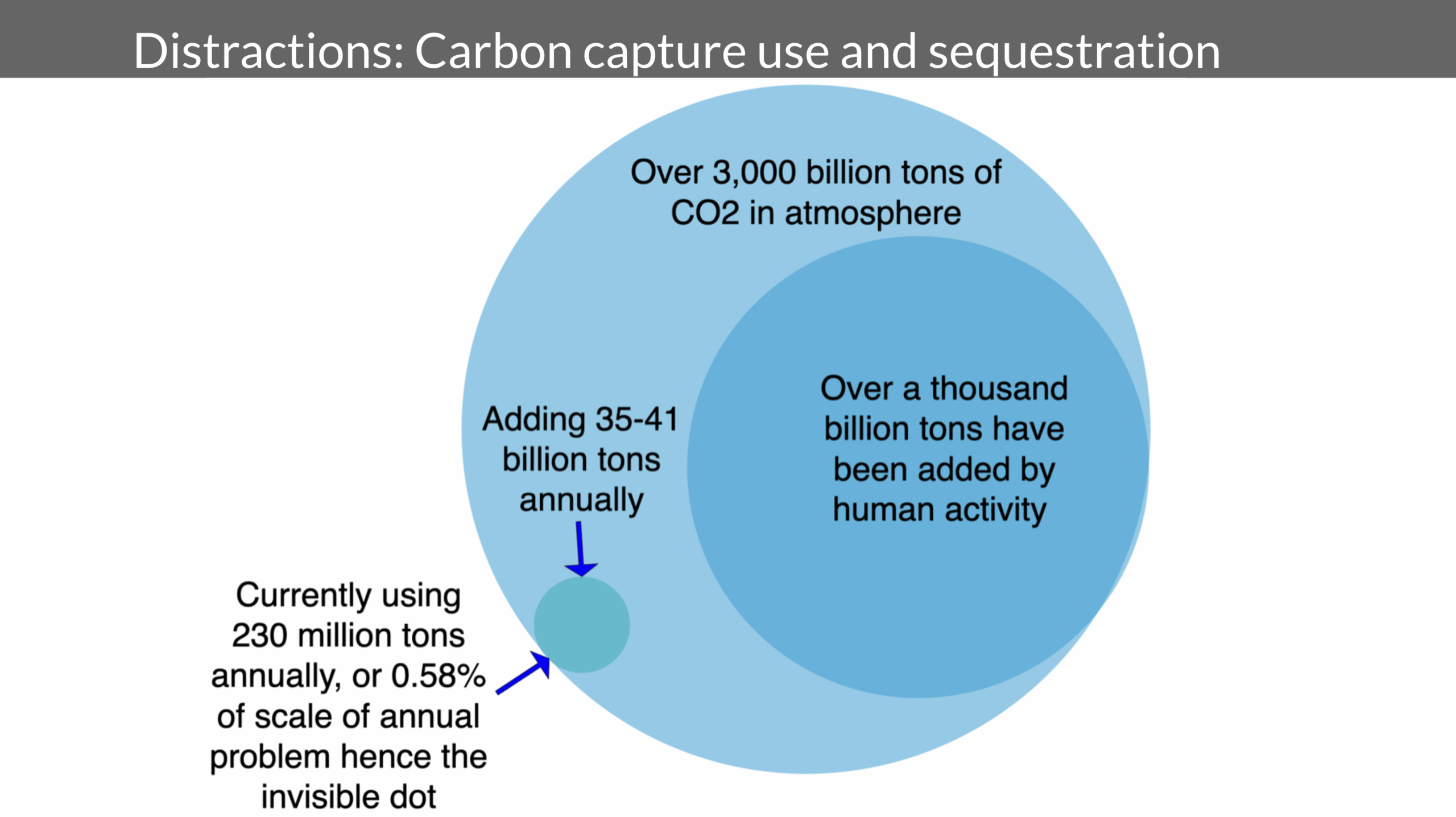

Next, carbon capture, utilization, and sequestration. I developed this chart about a decade ago, and the fundamentals haven’t changed. There are roughly 3,000 billion tonnes of CO₂ in the atmosphere today. Since the start of the industrial revolution, we’ve added about 1,000 billion tonnes, and we’re currently adding between 35 and 41 billion tonnes each year. In comparison, the total global market for CO₂ use is only about 230 million tonnes per year—a rounding error. Of that, roughly 90 million tonnes go to enhanced oil recovery, which isn’t a climate solution at all. That leaves only about 140 million tonnes of genuine CO₂ utilization.

Every time I examine carbon capture, I see overhyped economics and persistent technical failures. A good example is the small town of Satartia, Mississippi, where a liquid CO₂ pipeline burst just a meter and a half from the surface. The resulting cloud displaced oxygen, rendering dozens of people unconscious and sending many to hospital. CO₂ is an asphyxiant; it’s heavier than air and rolls downhill, collecting in low-lying areas. Despite this, Europe is planning to run CO₂ pipelines through dense population centers, including the Port of Rotterdam, which is surrounded by millions of residents. The safety implications are being dangerously underestimated.

Beyond safety, the storage potential is often exaggerated. Years ago, I pointed out that while there’s plenty of underground space, CO₂ is far less dense than the oil and gas we’ve been extracting. That means it takes up far more volume. Recent studies have confirmed this: the actual viable storage capacity for CO₂ is about one-tenth of what earlier optimistic projections claimed.

So let’s be clear—carbon capture, utilization, and sequestration aren’t going to fix the problem. The numbers don’t add up, the risks are high, and the economics don’t make sense. The only real solution is to stop emitting in the first place.

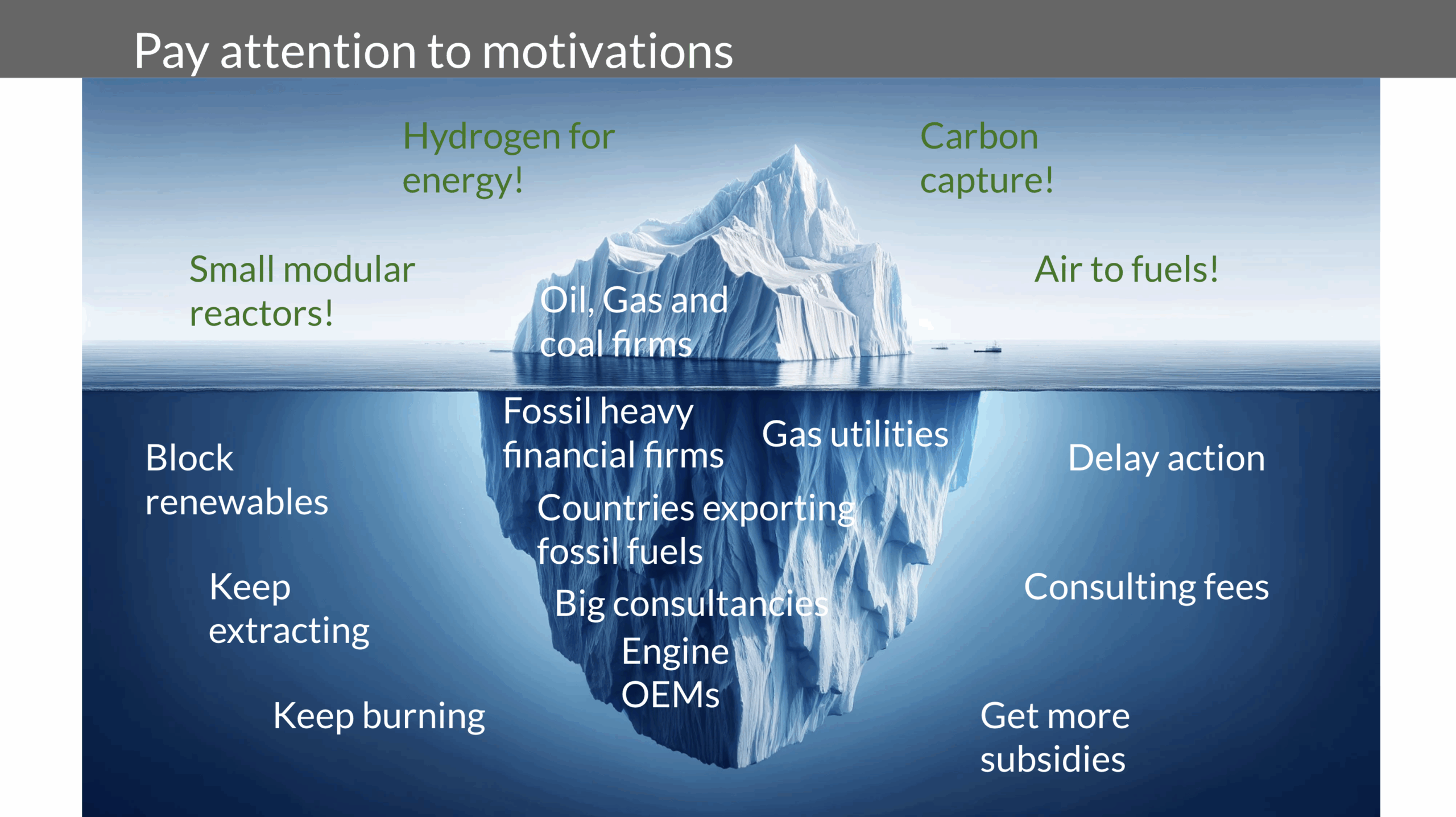

Last slide—pay attention to motivations. As I said at the beginning, many people in the climate space are trying to delay progress or preserve dying industries like internal combustion vehicles. Those sectors are already obsolete, but their defenders are still funding narratives to keep them alive.

There are powerful interests pushing technologies that don’t make sense—hydrogen for energy, synthetic e-fuels, small modular reactors. These aren’t transformative climate solutions; they’re financial strategies. They preserve the revenue streams and profits of major corporations and investors. In many cases, large consultancies are paid to produce reports validating those interests, reinforcing the illusion that these outdated or inefficient technologies are still essential.

These distractions slow the transition we actually need. So when you hear claims about miracle solutions or “bridge technologies,” look closely at who benefits. Follow the money. You’ll often find that the proposed solution isn’t about solving climate change at all—it’s about keeping old industries profitable for a few more years.

Question: Your presentation clearly showed that many of the things we’re spending time and money researching—like hydrogen for energy, e-fuels, and SMRs—are distractions that don’t achieve much. My question is: how can scientists and academics push back against the counterproductive subsidies and tax breaks that fossil fuel companies and polluters still receive? What role can universities and researchers play in shifting support toward real climate solutions instead?

Michael Barnard [MB]: The first thing I always say to any audience, academic or not, is simple: vote. Participate in shaping policy through your civic power. But beyond that, academics have unique platforms and credibility that can extend well beyond journals and conferences. One example is The Conversation—it’s a global outlet that partners with universities to publish work by researchers in a way that reaches the public, not just other academics. They don’t want peer-reviewed papers; they want well-founded, evidence-based arguments that shape how society thinks about issues like subsidies, pollution, and energy transition.

Look for opportunities like that. Engage with civil society directly. Talk to your representatives. And most importantly, organize collectively. Academic voices carry weight when they’re unified. When a group of scholars publicly calls out the absurdity of fossil fuel subsidies, or highlights how those funds could instead accelerate renewables, it gets noticed.

From a research perspective, there’s still a lot to do—especially in economics. If your background is in that area, the field is rich with opportunities to quantify the hidden costs of fossil fuel subsidies, the externalities they impose on developing regions, and the economic drag they create for clean innovation. That kind of analysis can influence policymakers and international financial institutions alike.

For those in the legal field, the International Court of Justice recently ruled that state-owned fossil fuel companies make their governments liable for emissions that cross borders. That opens a door to new kinds of legal actions—both against states and for greenwashing claims. The EU already has strong regulations on misleading environmental marketing, and academics can support enforcement by providing evidence and analysis.

Finally, support your students. Many of them are already on the front lines of climate accountability—participating in divestment movements, climate litigation, and public awareness campaigns. They often face institutional or legal resistance from entrenched interests. Helping them navigate and strengthen their advocacy is one of the most meaningful contributions academics can make.

So yes—research, publish, testify, litigate, and teach. But above all, organize and engage. The fossil fuel industry’s influence thrives on inertia, and academia’s role is to replace that inertia with informed, collective pressure for change.

Question: Here in the Netherlands, we’re in a unique situation—we’ve installed so much wind and solar that we’re now experiencing grid congestion. It’s become a major topic of discussion. One of the first climate actions you mentioned was to overbuild renewables, but as soon as we say that here, people respond negatively: “We already have too much solar.” From my perspective, that’s really an issue of system inflexibility, not solar itself. What’s your take on that?

MB: You’re absolutely right—it’s not a problem with solar or wind. It’s a problem with the grid. When I was working with TenneT this summer, one of the things they said was, “We have to get all this done in 15 years.” My response was that the time to do what we’re doing now was 15 years ago. Europe is behind on its grid buildup.

When I spoke in Brussels last year at the launch of SuperGrid: Super Solution, a handbook for Europe’s future HVDC mesh network, I made a point of comparing Europe’s situation to China and India. Both countries have far fewer issues with grid congestion and renewable curtailment because they understood early that generation capacity and transmission capacity had to be developed together. They built the “pipelines for electrons” in advance. Europe, by contrast, is now playing catch-up and must accelerate its transmission buildout dramatically.

One of the key things we did in our planning for TenneT was to co-locate grid-scale batteries directly with wind and solar farms. That way, when there’s congestion or curtailment, the excess energy is stored behind the grid connection rather than spilling onto the grid. It’s a simple structural fix that turns an operational problem into a resilience advantage.

There are also enormous opportunities in Europe for reconductoring existing lines. For example, when I was speaking with energy professionals in Pakistan earlier this year, I learned they had reconductored about 80% of their transmission network. Traditional steel-core lines sag significantly in heat, especially as climate change raises average temperatures, reducing throughput. By switching to carbon-fiber cores and annealed aluminum conductors, they’ve increased line capacity substantially without building new corridors.

Then there’s digital grid enhancement. Companies like Heimdall Power are deploying technologies such as the Neuron, a small sensor ball that can be installed on live lines by drone. It measures ambient and conductor temperatures and uses inductive power from the line itself—no batteries required. With that data, grid operators can calculate real-time dynamic line ratings instead of relying on conservative, static engineering limits set decades ago. In many cases, this boosts throughput by 30% or more without any new construction.

A study in the United States found that by combining reconductoring with these grid-enhancement technologies, the country could meet up to 85% of projected transmission needs simply by optimizing existing assets.

So yes—grid congestion isn’t a reason to slow down renewable deployment. It’s a signal that the grid needs to catch up. Europe has the technology, the engineering talent, and the capital to fix this. What’s required now is urgency and coordination.

Question: Electricity is difficult to transport long distances without major losses. How do you respond to that?

MB: My response is simple—that’s not a fact, it’s disinformation.

Right now, we have two mature, proven technologies for transmitting electricity over long distances, and both operate with very low losses—much lower than the energy lost when burning fossil fuels. The higher the voltage of an alternating current (AC) transmission line, the lower the resistance and therefore the lower the losses.

High-voltage direct current (HVDC) is even better. In the best-operated HVDC systems today, we see transmission losses of around 1.5% per 1,000 kilometers. Even when you include the energy needed to convert from DC back to AC at the endpoints, total losses are only about 5%. That’s negligible in system terms, especially compared to the inefficiencies of producing, transporting, and burning fuels.

So no, it’s not true that electricity can’t be moved efficiently across continents. We already do it. It’s reliable, efficient, and getting better all the time.

Every study that tries to claim hydrogen pipelines are a better option than HVDC is, frankly, nonsense. I’ve looked at all of them. They rely on unrealistic assumptions that make hydrogen look good on paper but fall apart in reality.

Hydrogen pipelines are not a credible solution for long-distance energy transmission. HVDC already does that job better, cheaper, and far more efficiently.

Question: You’ve focused here on the energy transition. Do you have a similar framework for the materials transition—something like your “must-do” actions and “distractions,” but applied to materials that can’t easily be electrified?

MB: The short answer is that I don’t have a parallel slide deck or framework specifically for materials yet. What I’ve done so far covers most of the key industrial processes—the ones that are hardest to decarbonize—but not every chemical pathway in detail.

Broadly, the materials we’ll use in the future will be the same as those we use today, but the feedstocks and production methods will change. For example, in the Port of Rotterdam’s chemical cluster, I’ve been working on pathways that shift from fossil feedstocks to bio-based ones, such as bio-methanol-to-olefin processes. That transition is already being explored seriously because it maintains the output materials industry needs while eliminating most of the upstream emissions.

Similarly, for ammonia—which is critical for fertilizers and commercial explosives—I’m looking at the transition to low-carbon ammonia produced either from blue or green hydrogen, depending on the context. Those are major industrial levers for decarbonization, but they don’t cover everything in the broader materials landscape.

For a deeper dive into the full range of material pathways—steel, plastics, cement, specialty chemicals, and so on—I’d recommend talking to Paul Martin. He’s done extensive work on this and has a far more granular view of the various chemical and materials transition options than I do.

So no, I don’t yet have a compact “must-do vs. distraction” summary for materials the way I do for energy—but it’s an area I expect to expand on in future presentations.

Question: I used to think hydrogen was a good energy storage solution, but from your talk I’m realizing there might be better options. What, in your view, are the most effective forms of energy storage for the future?

MB: Yes, hydrogen as an energy storage medium is heavily overhyped. It’s technically possible, but economically and energetically inefficient compared to other options.

For short- to medium-duration storage—say, 8 to 12 hours—batteries are by far the best choice. Battery energy storage systems, or BESS, are plummeting in cost and scaling rapidly around the world. They’re perfect for daily balancing: storing solar during the day and releasing it at night, or smoothing short-term fluctuations in wind output.

For medium-duration storage—roughly 24 to 36 hours—pumped hydro remains the most efficient and mature solution. It’s proven, it’s durable, and where the geography allows, it provides enormous capacity with minimal losses. There’s a reason that China has 365 GW, potentially 14 TWh of pumped hydro in operation, under construction or planned to start construction by 2030.

For long-duration or strategic backup—covering several days or even weeks—biomethane reserves are ideal. You can store biomethane in existing natural gas infrastructure and use it in the gas turbines we already have. It’s a cheap, stable form of stored energy that can sit unused for months until it’s needed for dunkelflaute events, those periods of low wind and sun.

Beyond that, you’re really getting into rounding errors. I’ve assessed nearly every proposed storage technology—compressed air, liquid air, flow batteries, gravity systems—and most don’t make much sense once you account for cost, scale, and round-trip efficiency.

But one area that deserves far more attention is heat storage. The Netherlands, for example, leads the world in aquifer thermal energy storage—using underground aquifers to store heat or cold seasonally. With modern heat pumps, you can shift energy between summer and winter, storing excess warmth or coolness underground for months. That’s a powerful form of seasonal balancing that’s still underappreciated.

Michael Liebreich has also emphasized the importance of ambient heat in energy systems, and I include it in all my Sankey diagrams. It was a key part of our TenneT modeling as well.

So if I had to summarize: my four big ones are batteries, heat storage, pumped hydro, and biomethane. Together, they cover everything from hourly balancing to seasonal resilience without needing hydrogen as a bridge.

Question: Thank you for the presentation—it’s a really compelling list of priorities and distractions. I’m curious, though: how did you come up with that list? It seems to cover a lot of the most important areas. What was your process for deciding which things to include?

MB: That’s a fair question. The short answer is that I’m a broad-spectrum nerd. About fifteen years ago, I returned to environmental work after a career as a global systems engineer and technologist managing programs worth up to a billion dollars across multiple continents. I’ve always approached problems systemically, and when I shifted my focus to climate and energy, I wanted to understand everything.

I don’t follow professional sports and I don’t have kids, so I had the time to dive deep. I read everything I could find—academic papers, techno-economic assessments, engineering reports—and worked through the numbers across every major domain: energy generation, transportation, industry, agriculture, and materials. Over time, I started to see clear patterns emerge. Some actions consistently delivered big, measurable impacts, while others—no matter how flashy—barely moved the needle or served mostly to delay progress.

That’s how the list was born. It’s not perfect, but it’s meant to be clear, evidence-based, and accessible to both technical and non-technical audiences. It distills the climate actions that actually work and identifies the distractions that consume time, money, and attention without delivering real results.

And yes, I’ll admit, I missed methane in the first version—it was an oversight I corrected in the most recent update. But overall, the structure came from years of reading, modeling, and cross-checking what was actually happening in the world. One day I just sat down and wrote an article titled “Here’s the Shortlist,” and it’s evolved from there.

Questions that arrived after the event via email.

Question: Tennet just announced that they cannot strengthen the grid fast enough in the Netherlands, to keep pace with growing demands of the energy transition. Are local, smart microgrids / so-called Smart Energy Hubs simply a short-term bandaid? Or are they a longer term way to unlock extra meaningful capacity and flexibility? For the first years, many assume we still need natural gas as part of that system. Is there a clash between the international supergrid vision and a bottom up, local-to-regional balanced microgrid vision?

MB: Let’s unpack the two components: the local smart‐microgrid (or Smart Energy Hub) strategy, and how it aligns (or conflicts) with the larger supergrid vision.

Yes—smart microgrids and smart energy hubs are absolutely useful and in many cases necessary. They play a key role in managing local flexibility, reducing congestion at the distribution or regional level, and improving resilience and reliability. In places where expansion of the transmission system is lagging (as was noted with TenneT’s announcement), microgrids can be a smart interim tool to relieve bottlenecks, optimise local consumption, pairing distributed renewables with local storage, demand response, and load shifts.

However—they are not a substitute for the backbone of the system, which is large-scale transmission and high‐capacity interconnections. They become a bandaid if we expect them to handle all the heavy lifting of long-distance balancing and large‐scale flows of wind and solar between regions. My published work shows that the countries that are scaling fastest—China, India, etc.—are doing the “pipes for electrons” in advance and building large grids, not only relying on small microgrids.

Microgrids can have a medium- to longer-term role in certain contexts—especially for local resilience, behind-the-meter storage, aggregated distributed energy resources, and fleet/charging hubs (which I have written about specifically). But for the core problem of enabling a highly-electrified system, with wind and solar contributing massive shares of generation, you need the economies of scale, the long‐distance flows, and the ability to move power from where the resource is strong to where demand is high. In that sense, microgrids are enabling, not the primary structural solution.

In the near to medium term we will still use natural gas capacity—albeit in diminishing volumes—as part of the transition. Microgrids can help reduce some of the load on gas peakers by better local balancing. But in the long run, we plan for a system that minimises gas generation and uses strategic reserves, storage, demand-side flexibility, electrification and interconnection. In other words: microgrids help, but they don’t change the fact that we need a system capable of handling large-scale flows and deep transformation.

It’s only a clash between supergrid vs microgrid visions if we think of them as either/or. They are really both/and. In fact, one of the major mistakes is to set up a false dichotomy: local-first vs global-backbone. In my view, the correct architecture involves a strong inter-regional/high‐voltage backbone (the “supergrid”) supporting massive volumes of wind and solar, plus a layered system of regional/interconnection hubs and local microgrids and Smart Hubs that optimise for flexibility, load modulation, storage, and resilience. The microgrids do not undermine the supergrid—they leverage it. And the supergrid gives the resource diversity that allows local hubs to rely less on back-up gas or isolated solutions.

Question: What should local regions and municipalities do to prepare for things such as an international supergrid? The complexities already at a local level are often beyond the in-house, municipality-level expertise, much less trying to prepare and plan for transcontinental structures and the evolving intraday trading markets.

MB: It’s a fair concern. The complexity of the energy transition already overwhelms many municipalities, and the idea of preparing for an international supergrid can sound completely out of reach. But the right approach isn’t to try to master the whole system—it’s to focus on building competence and capacity where the local level has real leverage.

Local regions and municipalities don’t need to plan the backbone of a supergrid. What they do need is to prepare their own systems to integrate clean energy, manage flexible demand, and interact with a much more dynamic electricity market. That means developing a clear understanding of their local grid’s constraints, demand patterns, and renewable potential—especially rooftop solar, district heating, and electric mobility—and then building relationships with their regional transmission operators and national grid planners. Local governments that can clearly articulate their own energy data, flexibility options, and infrastructure priorities become much more effective partners when the high-voltage connections arrive.

In practical terms, municipalities should be modernizing their local grid management and permitting systems, mapping where new substations or high-capacity feeders will be needed, and designing zoning and procurement policies that anticipate electrification and distributed storage. They should also start cultivating in-house expertise in energy data management and grid digitalization, even if that means sharing staff or forming regional energy agencies. One of the most powerful things a local authority can do is to ensure that its distributed energy resources—batteries, EV fleets, solar rooftops, heat pumps—can participate in flexibility markets and balancing mechanisms. That’s where local preparation meets the supergrid: the ability to send and receive not just power, but price signals.

And no, local authorities can’t do this alone. They should be forming partnerships with national regulators, transmission system operators like TenneT, and neighboring municipalities to coordinate regional energy planning. The future supergrid will operate across countries, but its benefits will depend on how well cities and local networks can connect into it. Municipalities that are proactive about flexibility, data, and collaboration won’t need to understand transcontinental trading algorithms—they’ll just need to be ready to plug into a larger, smarter system.

So the answer isn’t for local regions to try to think like transmission planners. It’s to focus on becoming intelligent, interoperable nodes in the wider energy ecosystem. When the supergrid arrives, the communities that have prepared themselves to be flexible, connected, and data-driven will find that they were already part of it all along.

Question: As we electrify more and natural gas is squeezed more, marginal cost pricing seems to be a huge vulnerability to the European market. Are there realistic strategies and efforts being made to decouple from the volatility of gas? Electrify everything is the overall strategic answer, but if marginal cost pricing remains, won’t imported gas will have more and more outsized cost impacts?

MB: You’re right that marginal cost pricing is becoming an increasingly visible weakness in European electricity markets. The system was designed in an era when gas and coal dominated, and it made sense to let the most expensive generator on the grid set the market-clearing price. But as renewables become the dominant source of electricity, the old model doesn’t fit. When natural gas is only a small slice of generation yet still sets the price, it creates disproportionate volatility—exactly what we’ve seen during the recent gas crises.

There are strategies being explored to fix this, though none of them are trivial. The simplest and most immediate is to accelerate the displacement of gas in power generation. The less gas that runs, the less often it sets the price. As storage, interconnection, and demand flexibility expand, the frequency with which gas plants are needed—and therefore the hours they influence pricing—falls dramatically. That’s already happening in markets with high renewables penetration, like Spain and Portugal, where gas often runs at single-digit capacity factors.

At a policy level, the European Commission and several national regulators are discussing structural reforms to the marginal pricing mechanism. Options include creating separate capacity markets or “two-tier” systems, where renewables and storage are compensated based on long-term contracts or fixed tariffs, while only residual balancing power trades at marginal cost. This hybrid structure preserves price signals for flexibility but insulates consumers from gas-driven price spikes. Another model under discussion is expanding Contracts for Difference (CfDs) for renewables and storage to stabilize long-term prices independent of short-term gas volatility.

Ultimately, though, the deeper fix is system-level diversification. Europe’s growing interconnections, including HVDC links to North Africa and the North Sea grid, broaden the market’s physical footprint and reduce local scarcity pricing. Add to that a more integrated storage ecosystem—batteries, pumped hydro, and demand-side management—and the marginal role of gas shrinks even further. Once gas is relegated to rare backup duty, its ability to distort prices fades.

So yes, marginal cost pricing is a vulnerability, but it’s a transitional one. The market architecture will evolve as generation mix changes, just as it did when liberalization began decades ago. “Electrify everything” still holds as the overarching strategy, but it has to be paired with market design reform and investment in flexibility so that gas’s last flickers don’t keep shocking the system. The goal isn’t just to replace molecules with electrons—it’s to update the economics so that electrons stop being priced as if they came from a gas turbine.

Question: The Netherlands is obsessed with its “growth markets”—innovations and technologies that they can develop then export. In particular, they are looking for the next ASML-like “control points in the value chain” in 6 chosen sectors: semicon, biotech, defense-related applications, digital services (particularly AI), mechanical engineering (equipment manufacturing), and innovative chemistry. This is partly in response to the Draghi report about European competitiveness to the EU Commission last autumn (2024). However, it seems systemic issues of the energy transition go largely unaddressed in this view; trying to create new economic building blocks without a firm foundation—a power system undergoing a massive transition, which TenneT estimates will cost €195 billion between now and 2040—seems like placing the wrong priorities. What should NL prioritize? Is sustainable heat something to figure out domestically and offers growth-market potential?

MB: The Netherlands is trying to skip to the punchline—new export champions—without finishing the setup, which is the power system. You can’t build ASML-scale control points on top of a constrained grid. TenneT’s €195 billion estimate through 2040 should be treated not as background noise but as the country’s single biggest industrial policy. If the backbone isn’t finished, everything else waits in line.

Priority one is to expand and modernize the grid—fast. That means more high-voltage corridors, meshed offshore HVDC connections, and the less glamorous but highly effective upgrades: reconductoring with advanced conductors, applying dynamic line ratings, co-locating grid batteries with renewables, and streamlining grid-connection queues so viable projects move within months instead of years. Couple that with capacity mechanisms and long-term contracts that keep backup gas available for rare peaks without letting it dictate annual power prices.

Priority two is electrifying and decarbonizing heat. This is where the Netherlands can both solve a domestic challenge and build a genuine export engine. Large industrial and district heat pumps, fourth- and fifth-generation heat networks, and seasonal aquifer thermal energy storage (ATES)—fields where the Netherlands already leads—form a coherent system the rest of northern Europe will need. Add waste-heat recovery from data centers and industry, aquathermal sources from canals and seawater, and better building envelopes, and you have a national program that reduces gas dependence, stabilizes bills, and unlocks grid flexibility by shifting loads intelligently. Done well, it’s also productizable: drilling, control systems, heat-as-a-service models, and integration software can all become export platforms.

Priority three is power electronics, grid digitalization, and offshore wind. The Netherlands sits at the intersection of these domains. If it wants ASML-level leverage, it should industrialize what it already knows: HVDC converter design, grid-protection software, substation automation, distributed-energy orchestration, and large-fleet charging control. The global grid is shifting from a few synchronous generators to millions of inverters; whoever keeps that system stable and affordable owns a critical layer of the value chain. Layer on the country’s world-class offshore wind expertise—planning, permitting, subsea cabling, foundation design, and maintenance logistics—and you have a second export franchise. Dutch firms are already operating in North Sea consortiums, and there’s growing demand for that skillset in the U.S., Japan, and the Baltic. Packaging those competencies into deployable services and digital twins could position the Netherlands as the world’s most reliable offshore-wind integrator.

So what should the Netherlands prioritize? Finish the grid. Scale sustainable heat. Industrialize flexibility at the grid edge. Turn HVDC, control systems, and offshore-wind integration into exportable platforms. The nation can still chase AI and semicon control points, but it should ground them in the boring, capital-intensive foundation that actually determines competitiveness. Sustainable heat and offshore-wind deployment expertise aren’t side stories—they’re Dutch growth markets hiding in plain sight.

Question: NL is updating its National Technology Strategies. In the category of Energy Materials, the two focuses are Batteries and Electrolyzers. Offtake for green H2 has not been realized and will not at the scale projected by hydrogen hopefuls. However, some green H2 will be needed via electrolysis, and that “some” could still be GWs of capacity. Does national-level investment in improving the performance of electrolyzer stacks make sense, even if green H2 demand is nowhere near the original EU target of “10 million tons domestic production by 2030”?

MB: At present, the Netherlands lacks the deep supply chain, large-scale production facilities, and cost position to compete with countries such as Germany, France, or major Asian players that already dominate electrolyzer manufacturing. Most of the critical materials and components—membranes, catalysts, and stack assemblies—are still sourced abroad. As a result, a national strategy centered on becoming a leading electrolyzer manufacturer would be a stretch from the current industrial base.

Where the Netherlands does have genuine differentiation is in system integration and applied engineering. Its industrial clusters, ports, and offshore wind networks offer ideal testbeds for coupling electrolysis with renewable generation and industrial demand. The country’s strength lies in designing and managing complex, interconnected systems rather than in mass-producing hardware. Focusing investment on integrating electrolysis into chemical and refining processes in Rotterdam or on developing hybrid systems that capture waste heat and manage grid variability would align far better with existing expertise.

There is also significant opportunity to specialize in the high-value components and digital systems that make electrolysis more efficient and flexible. Dutch firms could lead in advanced controls, predictive maintenance, and catalyst recycling—areas where technical knowledge and innovation matter more than scale. Using domestic deployment sites as living laboratories would allow Dutch companies to build exportable know-how in system operation, digital twins, and industrial heat integration, much as they have done in offshore wind and water management.

So while some targeted investment in improving electrolyzer performance is justified, it should be framed as part of a niche industrial strategy, not as an attempt to create a national mass-manufacturing industry. The Netherlands’ real advantage lies in integration, reliability, and digitalization—the connective tissue between technologies—rather than in the commodity hardware itself.

Question: How do economies and sectors afford this drastic transition? How do we maintain political willpower to keep going? Undoubtedly the costs of maintaining our current fossil-fuel addicted paths are even more painful. But that somehow doesn’t seem to ease the economic pains of the moment. Does the combo of declining demand in some sectors (cement, steel, etc.) plus their need to simultaneously electrify / become sustainable, mean expensive investments for a declining demand? While processes will be far more efficient in the end, how can upfront costs be covered? Is this just what we in developed nations need to expect in the coming several decades, is to “tighten the belt” and get on with the hard work? Very curious to hear your perspectives, as there’s a (strong) bloc of voters on the right blaming renewables and all these changes as the cause of high costs and system strain.

MB: That’s the essential question—how do we afford this transition, and how do we sustain the political will to keep going? The short answer is that the transition isn’t unaffordable; what’s unaffordable is pretending the fossil system can keep running as it does. The challenge isn’t just technical or financial—it’s moral and political.

The first step is to stop calling it a cost. This is an investment, and it replaces the money we already waste. Every euro we spend on oil, gas, or coal buys heat, pollution, and dependency. Every euro we spend on clean infrastructure buys productive capital that lasts for decades—solar, wind, storage, transmission, efficiency, and electrified heat. Once you electrify something, you pay once for the system and then you own the margin. There are no fuel bills, no imported commodities, no long tail of externalized damage. This is not belt-tightening; it’s asset-building.

Yes, there are sectors like steel, cement, and refining that have the hardest climb—declining demand on one hand, modernization costs on the other. But those are transitional pain points, not structural weaknesses. When they invest now, they’re building systems that will run cheaper and cleaner for fifty years. The payoff isn’t just lower emissions—it’s efficiency, lower volatility, and future competitiveness. That’s what every industrial transformation looks like: difficult up front, obvious in hindsight.

The political side is where it gets tricky. The opposition you mention—the bloc blaming renewables for high costs—feeds on short-term fear and identity politics. You don’t beat that with spreadsheets; you beat it by connecting climate action to values people already hold. The left tends to talk about climate through the lens of harm and fairness: protecting the vulnerable, saving the planet, righting wrongs. That resonates with some but alienates others. You have to speak across moral foundations.

For conservatives, the transition has to be about stewardship, stability, freedom from dependence, and pride in building something that lasts. For moderates, it’s about reliability and competitiveness. For progressives, it’s about justice and fairness. The physics don’t care about ideology, but people do, so framing matters. The message shouldn’t be “sacrifice for the planet”—it should be “build a stronger, cleaner, cheaper, more secure system.” Everyone can get behind that story because it’s true.

As for who pays, most of the money will come from the private sector once governments set clear, stable rules. The economics of clean energy are already better; capital just needs certainty. Governments’ role is to de-risk the path—long-term contracts, stable carbon pricing, modernized permitting—so investors can move without fear of political whiplash.

So no, we don’t need a decade of austerity. We need a decade of investment and renewal, framed in terms of pride, strength, and shared purpose. The right calls this chaos; it’s not. The real chaos is clinging to a fossil system that keeps breaking down and taking prosperity with it. The transition is not a burden—it’s the repair and renewal of our civilization’s foundation, and every society that leans into it will come out stronger.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy