The most anticipated Fed decision in years occurs on Wednesday. The only real debate is whether it will be a 25bp or 50bp cut.

If it’s 50bp, does it mean that inflation is finished, or would it be an indication that something is badly wrong with the economy?

This US rates chart certainly suggests rates have peaked (for now), and the Fed is about to embark on a cutting cycle.

This is the US stock markets chart. The Industrials look ready to rally on a rate cut, and the Transports are starting to look better too.

This is the weekly chart of the Dow. It’s more concerning. RSI has been fading since 2020 with each new major trend high.

Tactics? Light buying could be done in the 37,000 zone, but I’m worried that the 2021-2025 war cycle, although in a late stage now… could come back to haunt stock market investors who are focused only on rate cut handouts from the Fed.

Throughout American history, October is when the worst crashes have occurred. It’s possible that a rally from Wednesday’s Fed announcement could be short-lived. The bottom line: The possible reward of being in the US stock market right now (with size) is not worth the much bigger seasonal risk.

What about gold? Well, gold is in a sweet spot where gamblers can buy, and investors who buy only weakness should simply enjoy their core positions ride.

With the Fed’s favourite inflation indexes dipping, rate cuts now could produce a stunning drop in real interest rates.

That would bring in Western ETF buyers who are obsessed with rate cuts. Sadly, that obsession caused them to miss the entire move from my solid buy zone of $1810 in Oct 2023 to the current level of $2580.

Their late to the party buying could trigger a parabolic blowoff, but one that could see gold rise to not only the inverse H&S pattern target of $3300, but to $4000 or $5000.

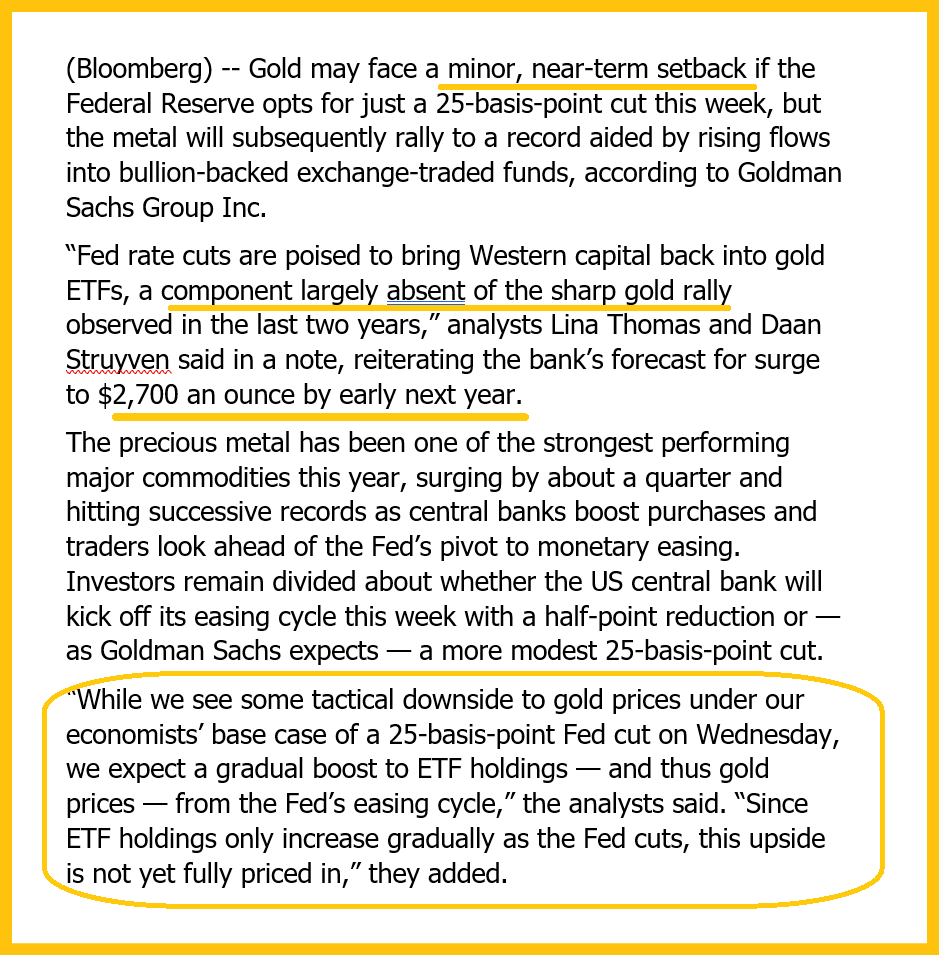

Analysts at Goldman also forecast a rise in ETF buying and their views carry a lot of weight with high net worth investors and funds.

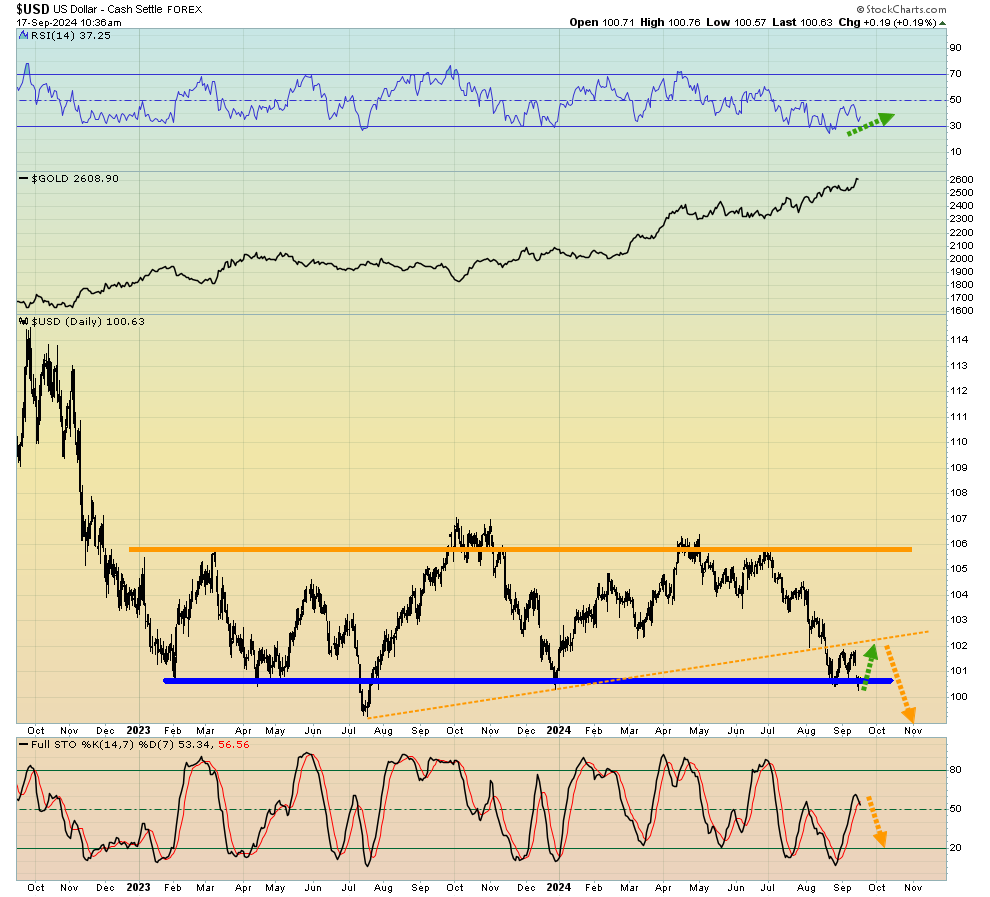

This is a disturbing US dollar chart. In the short-term the dollar is oversold and gold is overbought, but the big picture is ominous for the dollar.

US Democrats appear to be trying to fix the dollar problem with wars, sanctions and propaganda, and Republicans are waving a tariff tax tin can at the gold-oriented citizens of China… citizens who view America as a relatively small population nation whose time in the lead empire sun is essentially done.

These supposed solutions from US politicians are only going to create a much more intense wave of de-dollarization in the years ahead and… US money managers are becoming more focused on their government’s debt. In a nutshell, a fresh tumble in the dollar is going to change it from a respected international reserve currency into what is best described as lead clown in a not so funny fiat-oriented circus.

Gold could experience a pullback of significance after the Fed meet, but the price would be supported by ETF buying in the West… and by what could be the biggest surge in Indian demand in many years.

There hasn’t been a significant pullback in the gold price since the Indian government announced the duty cut, and citizens there are ready to pounce if it occurs!

Duty cuts, Western debt, and key buy zones are part of the big markets picture I cover 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

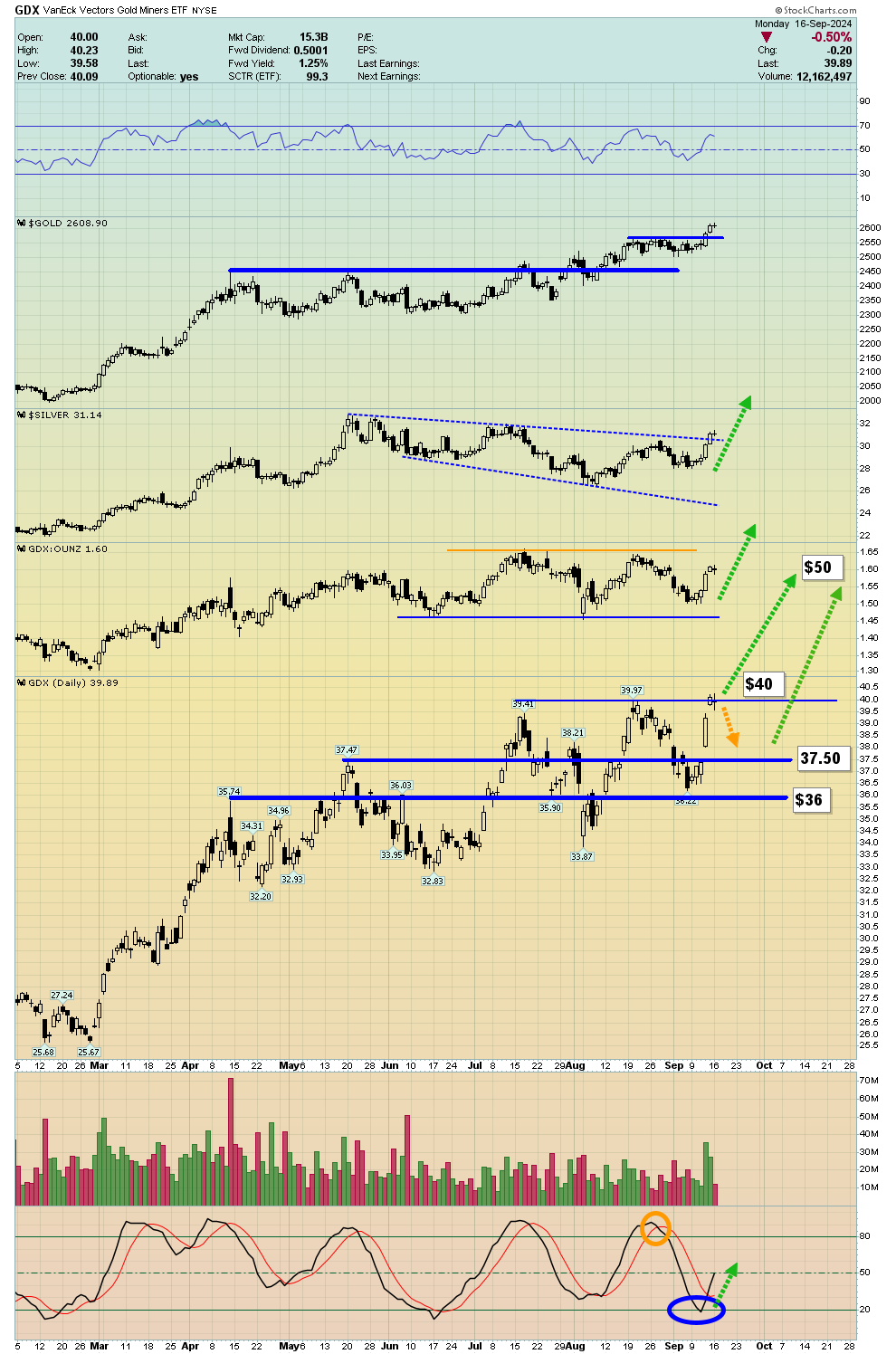

The target of the loose inverted H&S pattern is the $50 area highs. Silver tends to perform best when there is speculative froth in the market. That doesn’t exist now, but a surge in ETF buying would bring that froth.

If the Fed takes rates down towards 2.5% on the 10year bond, a silver price rally of $70-$100 over the next 12-18 months is realistic. A short-term pullback from “about here” is an ideal entry point for silver bullion enthusiasts.

Note the 14,7,7 series Stochastics oscillator at the bottom of this GDX chart. The latest rally has been strong, but the oscillator action suggests there’s still room to move higher before the next pullback begins.

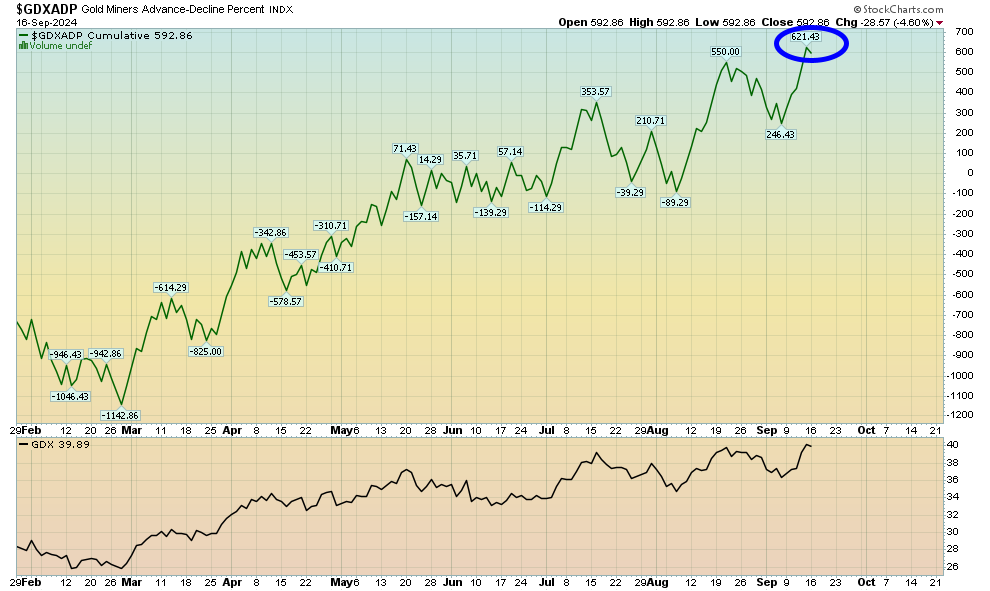

The advance/decline line for GDX is also positive. Note the higher highs in play.

An Elliott “C Wave” may be in play for GDX and it’s unlikely to end until well into 2025, and maybe 2026. The bottom line: Gold stocks are so undervalued against both fiat and gold that gold could fall $500, GDX could double… and GDX would still be in a state of significant undervaluation!

Gold held its ground against fiat from 2020 to 2023 while rates soared. In the coming years, gold stock investors can expect to see something similar with their holdings on gold price pullbacks of significance; the miners will hold their ground and then outperform magnificently, when the next rallies begin!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********