Support CleanTechnica’s work through a Substack subscription or on Stripe.

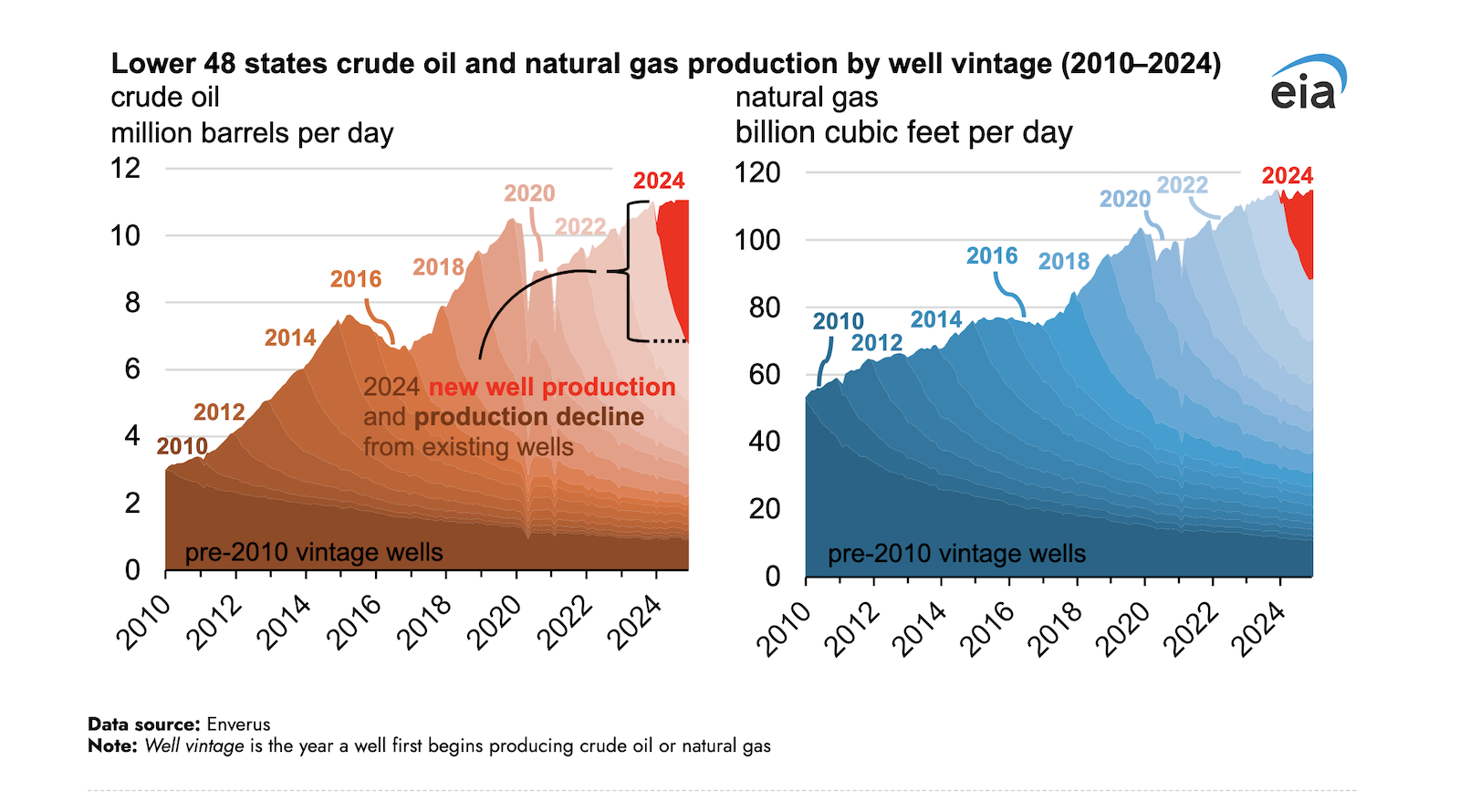

An interesting headline from the U.S. Energy Information Administration caught my attention last week. The title of the short story is: “Rapid declines from horizontal wells require more drilling to sustain production.” It sort of feels like an advocacy article of some sort to support our “oil economy.” Here’s the key pair of charts (one concerning crude oil and one concerning fossil gas):

“As U.S. crude oil and natural gas production have increased, so has the volume of production declines from existing wells. To offset the increasing declines, operators today must bring on new wells to sustain or increase production levels,” the EIA summarizes. “Between 2010 and 2024, hydrocarbon production from new wells in the Lower 48 states (L48) generally offset and exceeded declining production from existing wells. Because production from oil and natural gas wells declines over time as reservoir pressure decreases, new wells are required to maintain the same production level. The increasing number of horizontal wells has contributed to this trend because horizontal wells exhibit higher decline rates than vertical wells.”

So, basically, newer oil wells get drained faster, and thus need replaced quicker.

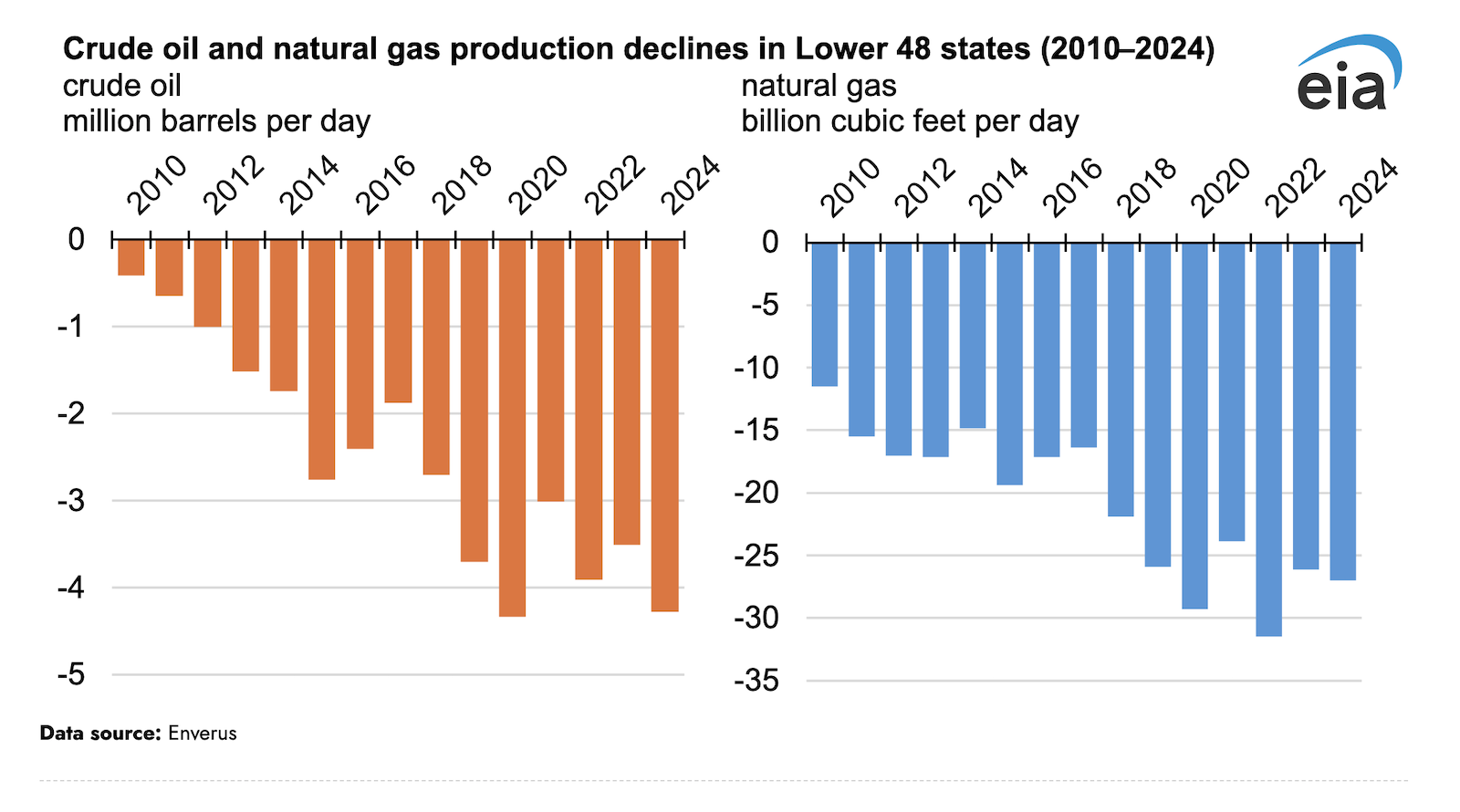

Here’s one more paragraph and pair of charts on this: “In December 2023, L48 crude oil production averaged 11.0 million barrels per day (b/d). Production from wells that came online in 2023 or earlier fell to 6.7 million b/d in December 2024, a decline of 4.3 million b/d. Those declines were offset by the more than 15,000 new wells that were brought online in 2024—about 11,700 of which were horizontal wells. The new wells produced 4.4 million b/d of crude oil, enough to overcome declines from existing wells, bringing L48 crude oil production to 11.2 million b/d in December 2024.”

Juan Diego Celemín Mojica recently wrote a story for us about weird things happening in the global oil industry and the possibility that we have actually now passed peak oil demand. There are different factors at play, but the fact that more than half of new vehicle sales are now plugin vehicle sales in China is a big one, as is the fact that this global trend toward vehicle electrification is expected to keep accelerating. Naturally, there is still an enormous amount of demand for oil, and there will be for years to come, but that doesn’t mean the oil industry isn’t approaching a potential crisis.

So, the issue is, if there is shrinking demand for oil, rather than growing demand, digging new wells in order to keep oil production increasing, or even just stable, doesn’t make much sense. The companies drilling these wells need to make a return on their investments or why would they drill them? But if oil demand is going down, how are companies going make their money back?

Now, of course, the oil market is global, and there are all kinds of agreements and secret backroom deals made in order to keep all of the oiligarchies relatively happy. But once oil demand is decreasing, who wants to give up their share of the pie? Circling back to the USA’s horizontal wells, there are other places in the world where it’s still much easier and cheaper to get oil out of the ground. So, why would they cut production to give US oil companies a helping hand? However, as I just wrote, there are all kinds of agreements and secret backroom deals made in order to keep all of the oiligarchies relatively happy, so who knows what is going to happen? Overall, though, the oil industry is facing a creeping problem or two, and the future will not look like the past. We’ll see what happens.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy