Money supply growth fell again in October, remaining deep in negative territory after turning negative in November 2022 for the first time in twenty-eight years. October’s drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years.

Since April 2021, money supply growth has slowed quickly, and since November, we’ve been seeing the money supply repeatedly contract year over year. The last time the year-over-year (YOY) change in the money supply slipped into negative territory was in November 1994. At that time, negative growth continued for fifteen months, finally turning positive again in January 1996.

Money-supply growth has now been negative for twelve months in a row. During October 2023, the downturn continued as YOY growth in the money supply was at –9.33 percent. That’s up slightly from September’s rate decline which was of –10.49 percent, and was far below October 2022’s rate of 2.14 percent. With negative growth now falling near or below –10 percent for the eighth month in a row, money-supply contraction is the largest we’ve seen since the Great Depression. Prior to this year, at no other point for at least sixty years has the money supply fallen by more than 6 percent (YoY) in any month.

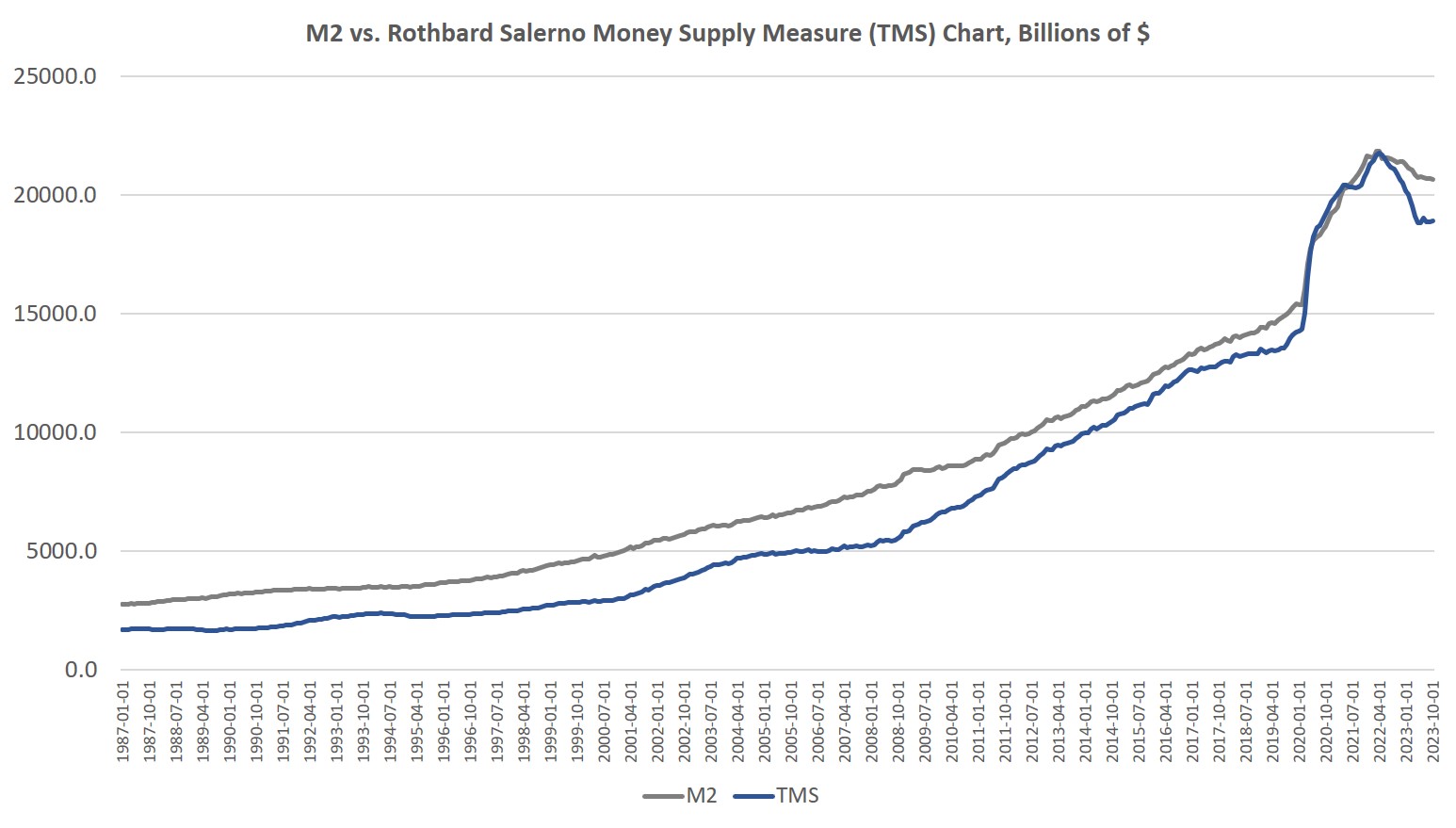

The money supply metric used here—the “true,” or Rothbard-Salerno, money supply measure (TMS)—is the metric developed by Murray Rothbard and Joseph Salerno, and is designed to provide a better measure of money supply fluctuations than M2. (The Mises Institute now offers regular updates on this metric and its growth.)

In recent months, M2 growth rates have followed a similar course to TMS growth rates, although TMS has fallen faster than M2. In October 2023, the M2 growth rate was –3.35 percent. That’s down from September’s growth rate of –3.35 percent. October 2023’s growth rate was also well down from October 2022’s rate of 1.42 percent.

Money supply growth can often be a helpful measure of economic activity and an indicator of coming recessions. During periods of economic boom, money supply tends to grow quickly as commercial banks make more loans. Recessions, on the other hand, tend to be preceded by slowing rates of money supply growth.

It should be noted that the money supply does not need to actually contract to signal a recession and the boom-bust cycle. As shown by Ludwig von Mises, recessions are often preceded by a mere slowing in money supply growth. But the drop into negative territory we’ve seen in recent months does help illustrate just how far and how rapidly money supply growth has fallen. That is generally a red flag for economic growth and employment.

The fact that the money supply is shrinking at all is remarkable because the money supply in modern times almost never gets smaller. The money supply has now fallen by $2.8 trillion (or 13.1 percent) since the peak in April 2022. Proportionally, the drop in money supply since 2022 is the largest fall we’ve seen since the Depression. (Rothbard estimates that in the lead-up to the Great Depression, the money supply fell by 12 percent from its peak of $73 billion in mid-1929 to $64 billion at the end of 1932.)

In spite of this recent drop in total money supply, the trend in money-supply remains well above what existed during the twenty-year period from 1989 to 2009. To return to this trend, the money supply would have to drop at least another $3 trillion or so—or 15 percent—down to a total below $15 trillion. Moreover, as of October, total money supply was still up 32 percent (or $4.6 trillion) since January 2020.

Since 2009, the TMS money supply is now up by nearly 186 percent. (M2 has grown by 141 percent in that period.) Out of the current money supply of $18.9 trillion, $4.6 trillion—or 24 percent—of that has been created since January 2020. Since 2009, $12.2 trillion of the current money supply has been created. In other words, nearly two-thirds of the total existing money supply have been created just in the past thirteen years.

With these kinds of totals, a ten-percent drop only puts a small dent in the huge edifice of newly created money. The US economy still faces a very large monetary overhang from the past several years, and this is partly why after eighteen months of slowing money-supply growth, we are only now starting to see a slowdown in the labor market. (For example, job openings have fallen 22 percent over the past year, but have not yet returned to pre-covid levels.) The inflationary boom has not yet ended.

Nonetheless, the monetary slowdown has been sufficient to considerably weaken the economy. The Philadelphia Fed’s manufacturing index is in recession territory. The Leading Indicators index keeps looking worse. The yield curve points to recession. Temp jobs were down, year-over-year, which often indicates approaching recession. Default rates are rising.

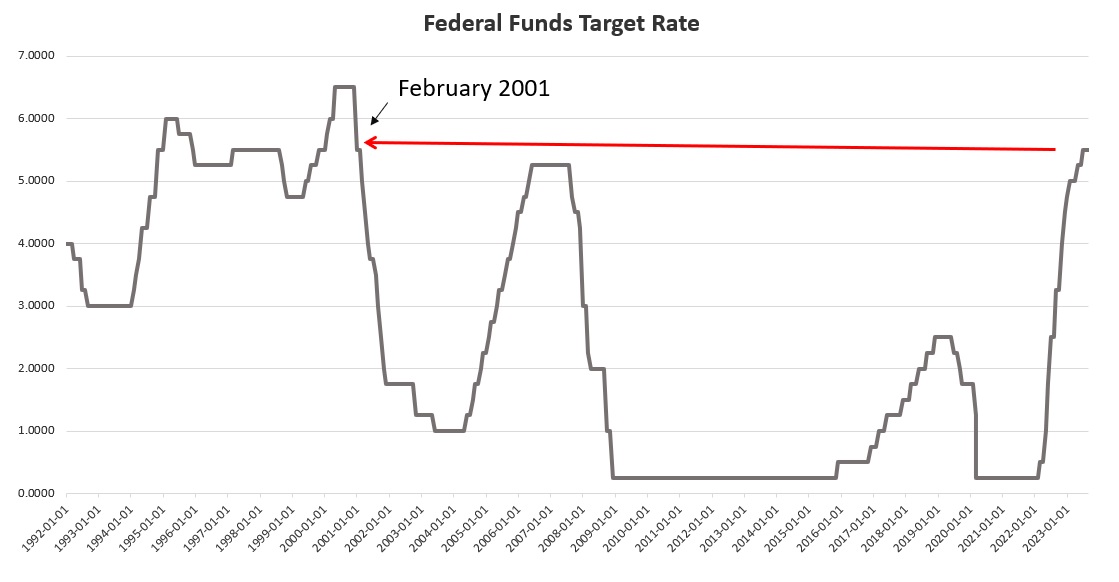

Money Supply and Rising Interest Rates

An inflationary boom begins to turn to bust once new injections of money subside, and we are seeing this now. Not surprisingly, the current signs of malaise come after the Federal Reserve finally pulled its foot slightly off the money-creation accelerator after more than a decade of quantitative easing, financial repression, and a general devotion to easy money. As of early December, the Fed has allowed the federal funds rate to rise to 5.50 percent, the highest since 2001. This has meant short-term interest rates overall have risen as well. In October, for example, the yield on 3-month Treasurys reached 5.6 percent, the highest level measured since December 2000.

Without ongoing access to easy money at near-zero rates, banks are less enthusiastic about making loans, and many marginal companies will no longer be able to stave off financial trouble by refinancing or taking out new loans. Commercial bankruptcy filings increased sizably during 2023, and continue to surge into the last quarter of the year. As reported by Monitor Daily:

The bankruptcy filing by WeWork in November propelled November commercial Chapter 11 filings to 842, an increase of 141% compared with the 349 filings registered in November 2022, according to data provided by Epiq Bankruptcy.

The case filed by WeWork on Nov. 6 included 517 related filings, according to analysis from the American Bankruptcy Institute, representing the third-most related filings in a case since the U.S. Bankruptcy Code became effective in 1979.

Overall commercial filings increased 21% to 2,252 in November, up from the 1,864 commercial filings registered in November 2022. Small business filings, captured as Subchapter V elections within Chapter 11, increased 79% to 181 in November, up from 101 in November 2022.

There were 37,860 total bankruptcy filings in November, a 21% increase from the November 2022 total of 31,187. Individual bankruptcy filings also registered a 21% year-over-year increase, as the 35,608 in November represented an increase over the 29,323 filings in November 2022. There were 20,250 individual Chapter 7 filings in November, a 23% increase compared with the 16,421 filings recorded in November 2022, and there were 15,280 individual Chapter 13 filings in November, a 19% increase compared with the 12,862 filings last November.

Lending for private consumption is getting more expensive also. In October, the average 30-year mortgage rate rose to 7.62 percent, the highest point reached since November 2000.

These factors all point toward a bubble that is in the process of popping. The situation is unsustainable, yet the Fed cannot change course without reigniting a new surge in price inflation. Although some professional economists insist that price inflation has all but disappeared, the sentiment on the ground is clearly one in which most workers believe their wages are not keeping up with rising prices. Any surge in prices would be especially problematic given the rising cost of living. Ordinary Americans face a similar problem with home prices. According to the Atlanta Fed, the housing affordability index is now the worst it’s been since 2006, in the midst of the Housing Bubble.

If the Fed reverses course now, and embraces a new flood of new money, prices will only spiral upward. It didn’t have to be this way, but ordinary people are now paying the price for a decade of easy money cheered by Wall Street and the profligates in Washington. The only way to put the economy on a more stable long-term path is for the Fed to stop pumping new money into the economy. That means a falling money supply and popping economic bubbles. But it also lays the groundwork for a real economy—i.e., an economy not built on endless bubbles—built by saving and investment rather than spending made possible by artificially low interest rates and easy money.

Courtesy of Mises.org

********