Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Some carmakers are already compliant two years prior or are close — and there are still many paths to reach the 2025 target.

Back in 2019, as the first meaningful emissions targets for the car industry were about to enter force, Brussels was flooded with gloomy predictions about the astronomical fines automakers would have to pay as they weren’t able to comply.

One such 2019 report by JATO Dynamics claimed that together, the EU carmakers would have to pay €34 billion. Then 2020 arrived and, instead of fines, the sales of battery electric vehicles jumped three times in one year. The EU was even ahead of China on the volumes of EVs sold while carmakers were making record profits.

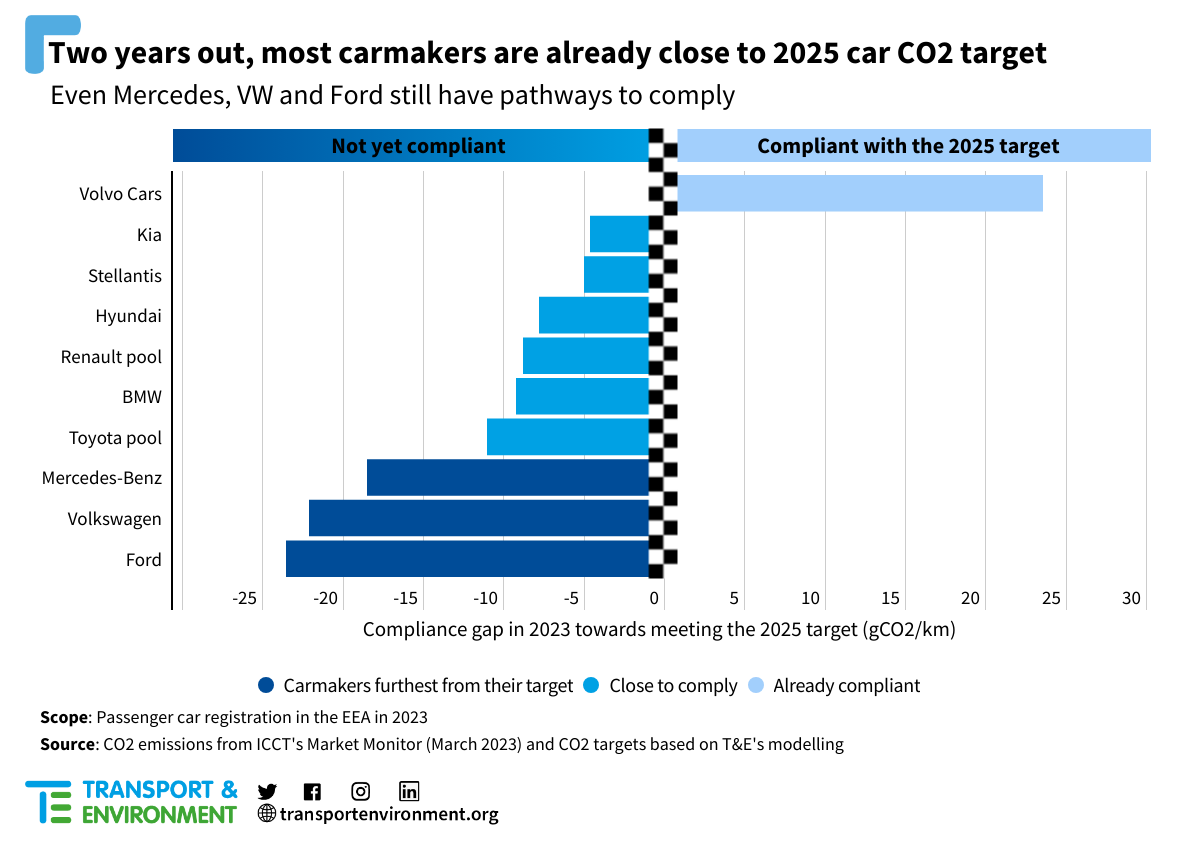

A similar tale is unfolding once again, as a moderate 2025 target of -15% CO2 reduction approaches. Judging by the 2023 sales data available to date, T&E analysis finds that Renault is 9g away from its target, Mercedes is 18g short and VW is one of the furthest with a gap of 22g.

This is causing a similar pushback. Some in public (like VW) and many in private have asked for the targets to be either relaxed or fines waived. They claim consumers are not buying EVs fast enough.

Once again, this line of argument is flawed.

Firstly, the key lesson of the 2020/21 target is that one cannot predict the ability to meet a future target by relying on the progress of two years prior. EV sales in the EU27 in 2018 were 1%, but jumped to 5.4% in 2020. In comparison, T&E predicts that EV sales will, on average, have to reach 20% in 2025, compared to 15% in 2023, an increase in market share of 31%.

31% might sound like a lot, but this is how the EU car CO2 law works. Instead of annual improvement, the higher target kicks in every five years. This – and not declining consumer enthusiasm – means quieter EV sales years in between as carmakers plan for the regulation. It’s as simple as adjusting pricing and dealer incentives or tweaking model availability when they need to sell more electrics.

True, the sales have been growing slower than expected. But the lack of affordable EVs for the mass market is to blame, not the cooling of appetites. Perhaps it is not surprising that more such compact models are slated to hit the market by 2025, including cheaper vehicles from Renault, Skoda and Citroën. 2025 will be a good year for those looking for a good EV deal!

Secondly, the EU car rules are not an electric vehicle sales mandate. The target of each carmaker is designed as an average CO2 value across its entire sales in 2025. That means there are many options to comply, including by selling mild and other hybrids – that improve the efficiency of conventional engines – or by downsizing the most polluting models.

While selling EVs is the best long-term strategy, T&E estimates that a higher efficiency scenario would reduce the number of EVs that need to be sold to meet the 2025 targets by more than a quarter.

Finally, the EU car CO2 rules come with many flexibilities. Carmakers can choose to “pool” their sales into one CO2 value, as Honda, JLR and Tesla did in 2022. Volvo Cars, whose unequivocal EV strategy is paying off, is already compliant with the 2025 target as of 2023 and can be another pooling candidate.

For example, in an EV only strategy, T&E estimates that 24% of VW’s sales in 2025 would need to be electric. Alternatively, if it maximised engine efficiency and pooled with Volvo Cars, 19% EV sales would suffice to avoid the fines, dropping to 15% if it pooled with Tesla.

The bottom line is that there are many options to reach the 2025 target. Some carmakers are either already compliant two years prior or are close. E.g. Stellantis is a similar mass market manufacturer to VW, but is a lot closer to its target thanks to its smaller and more efficient engine cars.

The 2025 target was always the easy one, proposed in 2017 and kept unchanged as a compromise on the way to higher 2030 ambition under the EU Green Deal.

Crucially, given the global race to dominate the EV market, relaxing the one policy that pushes European automakers to invest into electrification would be an own goal.

If the EU signals it will go easy on some carmakers, or will ease off on the fines, this will be noticed by other companies that will seek leniency in other areas. This could lead to the unravelling of the EU’s climate rules.

Rather than questioning the rules, European automakers should double down on their efforts to comply, showing both their competitors and shareholders that they are still in the race.

Some carmakers are already compliant two years prior or are close – and there are still many paths to reach the 2025 target.

By Julia Poliscanova, Senior Director, Vehicles & Emobility Supply Chains

Courtesy of Transport & Environment.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.