(Reuters Breakingviews) – The green energy boom is facing new headwinds. Falling costs, cheap capital and supportive politicians helped propel a headlong rush into renewable power. Now fracturing supply chains and higher interest rates are pushing up prices – and testing the resolve of consumers and governments.

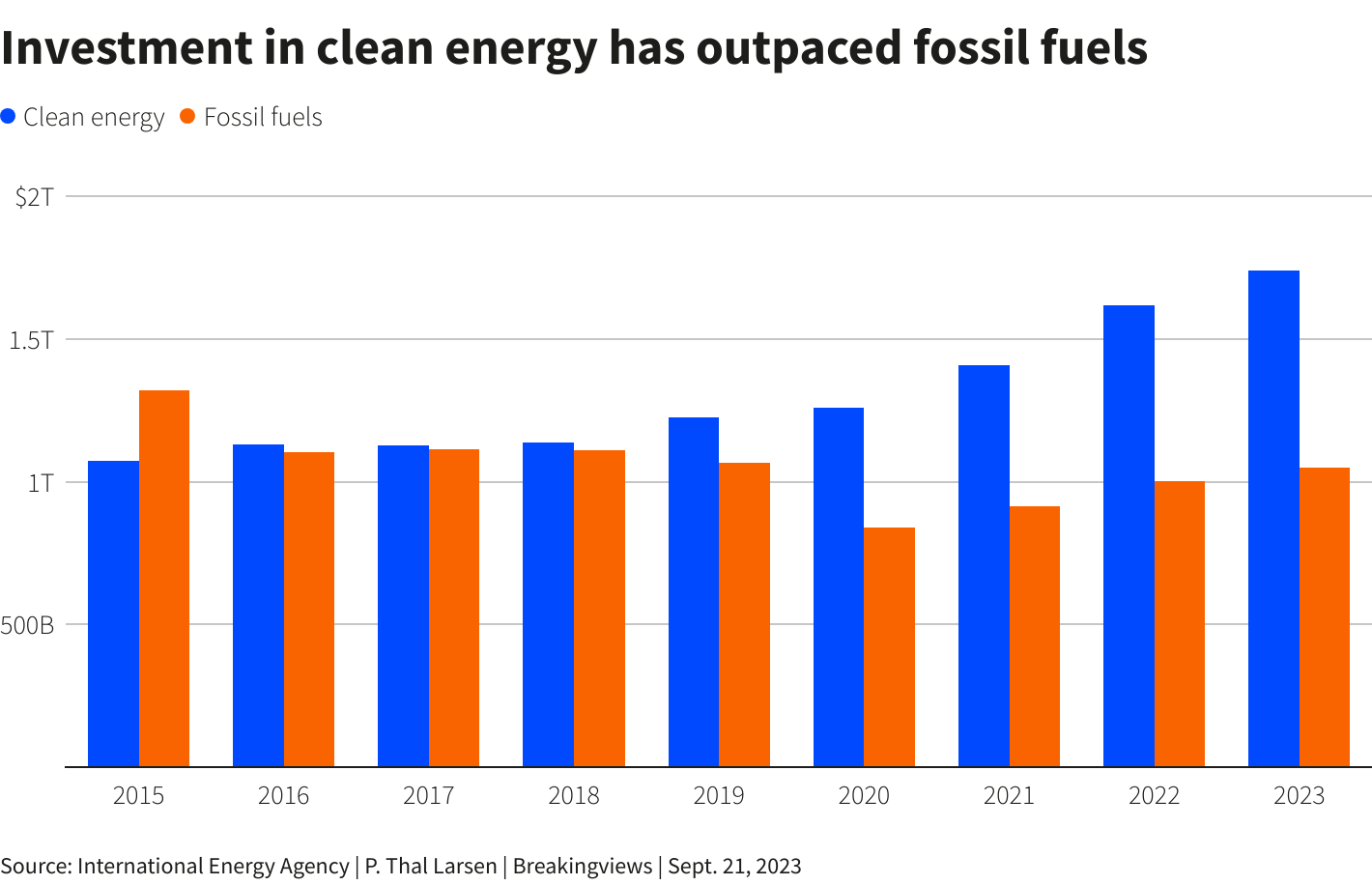

It took a while for the world to wake up to the need to replace fossil fuels. Yet in the past five years or so, the push to replace electricity generated by burning coal and oil with solar and wind power turned into a headlong rush. Global investment in clean energy between 2019 and 2023 will exceed $7 trillion, according to the International Energy Agency, outpacing spending on fossil fuels.

The increasingly urgent threat of global warming provided the main impetus. But three factors helped. The first was falling prices. The cost of electricity generated by solar panels in 2020 was less than a fifth of the figure a decade earlier. The cost per megawatt hour of wind power more than halved over the same period, according to the International Renewable Energy Agency. Second, ultra-low interest rates encouraged more private investors to finance ambitious new projects.

Finally, the falling costs of reaching net-zero carbon emissions – which the UK budget watchdog estimated at just 0.4% of GDP a year up to 2050 – persuaded governments that the shift to renewable energy could boost economic activity and employment. Russia’s invasion of Ukraine offered another urgent reason to become less dependent on imported fossil fuels. The trends combined in U.S. President Joe Biden’s Inflation Reduction Act of 2022, which earmarked around $400 billion for climate and energy spending over the next decade.

These helping hands have now become handicaps. The cost of wind power has risen since 2019, mainly due to the higher price of steel used to make the giant turbines’ blades. The lithium-ion batteries that power most electric vehicles have also stopped becoming more cost-effective. At the same time, rising interest rates pushed up the cost of capital, prompting investors to reassess existing energy projects and demand higher returns from new ones. Shares in Orsted (ORSTED.CO), the $25 billion Danish energy group that was once the European poster child for renewable power, have halved in less than two years. A recent UK government auction of rights to develop new offshore wind farms attracted no bidders.

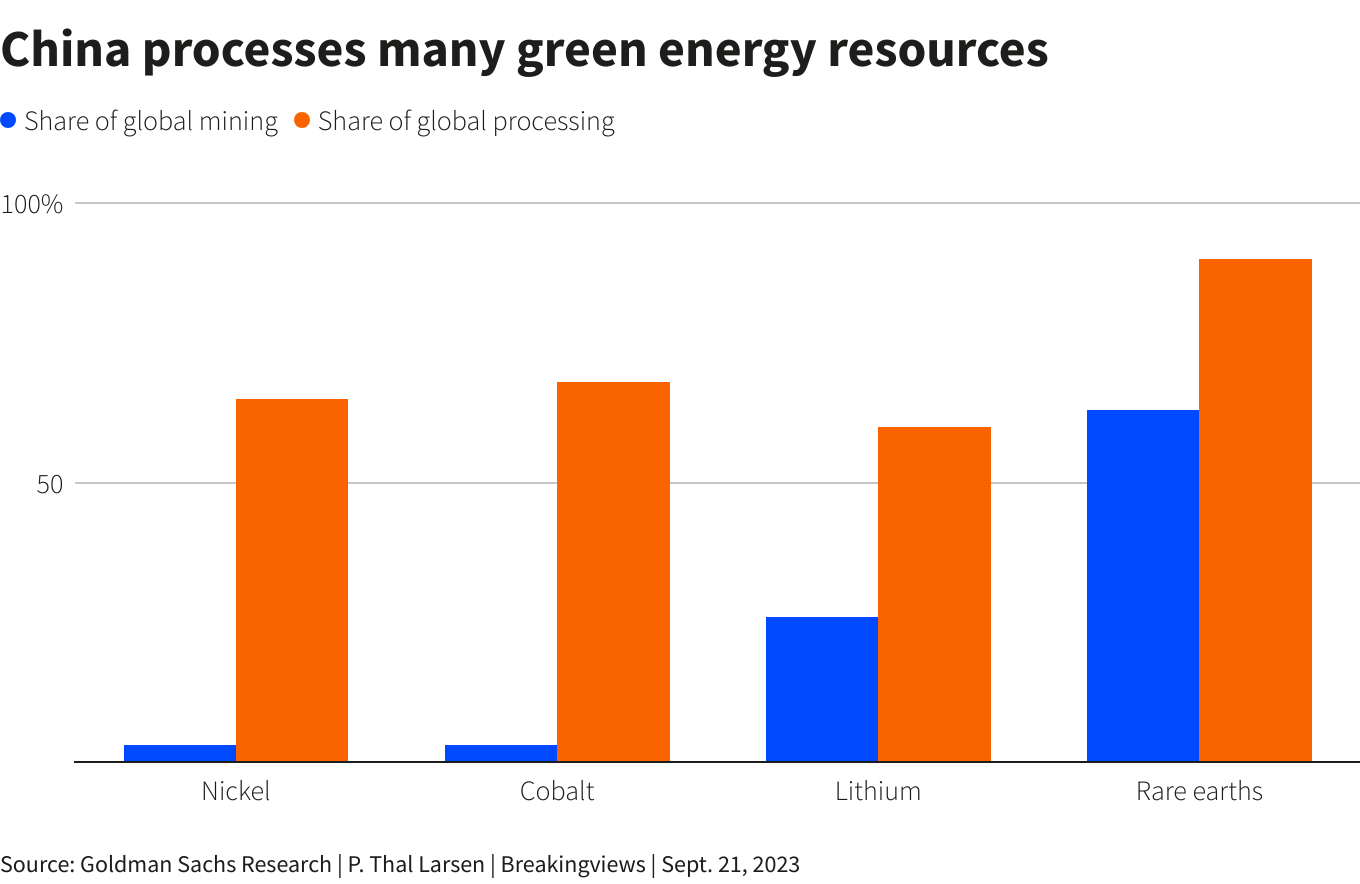

Rising geopolitical tensions add further complication. As relations with China deteriorate, the United States and Europe are increasingly concerned about the country’s grip on parts of the green energy supply chain. For example, more than 80% of the polysilicon used in solar panels comes from the People’s Republic, which also makes 70% of the finished modules, according to the Energy Transitions Commission. China accounts for up to 90% of refining capacity for so-called rare earth elements used in electric motors, wind turbine generators and other green energy products. This process is notoriously expensive and dirty, which helps explain why there are currently only five rare-earth refineries outside China, says Jared Cohen, co-head of the Office of Applied Innovation at Goldman Sachs.

None of these barriers are insurmountable. In recent roundtable discussions moderated by Breakingviews on both sides of the Atlantic, participants expressed optimism about the momentum of investment in green energy. Wind power projects are likely to restart when governments adjust the guaranteed price of power, allowing operators to earn a better return on capital. Manufacturing of solar panels and EV batteries could shift to developed countries or more friendly partners like Vietnam or Mexico. In some cases, commercial considerations may override geopolitical concerns: witness carmaker Ford Motor’s recent decision to spend $3.5 billion on a U.S. battery plant using technology from China’s Contemporary Amperex Technology.

Companies could adapt to rising costs by refining existing technologies or developing new ones. Higher prices of raw materials like copper and lithium could spur new mining projects and encourage more recycling. And the normalisation of interest rates could help attract more stable long-term finance.

However, most of these solutions come with important caveats: they will take time, and they will come at a price. Rising costs will lead to two outcomes. Either companies will pass them on to consumers, or taxpayers will have to shell out more in subsidies. Both these developments will challenge public support for the energy transition.

The backlash is already underway. British Prime Minister Rishi Sunak’s decision this week to push back the UK deadline for phasing out combustion engines is an early indicator of how some politicians may seek to exploit public reservations about the cost of the green transition.

A bigger test will be next year’s U.S. elections. The IRA has unleashed a green energy boom. In the 12 months to June, U.S. investment in “clean manufacturing” such as batteries and electric vehicles more than doubled to $39 billion, according to figures compiled by Rhodium Group and MIT’s Center for Energy and Environmental Policy Research.

As many of these projects are creating jobs in traditionally Republican-supporting areas, support for Biden’s green subsidies might survive a change of administration. However, concerns about the impact on the U.S. deficit could prompt a backlash from budget hawks. The University of Pennsylvania’s Penn Wharton Budget Model calculates the cost of climate and energy subsidies in the IRA at around $1 trillion over the next decade – more than twice the official estimate.

The world can ill afford to relax its embrace of green power. To reduce carbon emissions to net zero by 2050, global use of electricity will have to quadruple over the next three decades, with more than three-quarters of that coming from wind and solar power, the Energy Transitions Commission reckons. The investment boom of the past few years is therefore only a start. To keep going, however, it will have to battle powerful headwinds.

Share This: