Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

VW & Tesla Down, Mercedes Up.

The overall German auto market was down by 6% in November, to 245,701 units, which is still some 20% below pre-pandemic levels. Plugins have also disappointed, with the BEV market dropping 22% year over year, to 44,942 units, while PHEVs continue their long-running blues, crashing 59% YoY to just 18,124 units.

Share wise, BEVs in November had 18% of the auto market, the same number it has YTD in 2023. Plugin hybrids had 7.4% of the total market, which is approximately half of what they had a year ago. The recent pure electrics hangover is still visible in the BEV vs. PHEV sales breakdown, with pure electrics representing just 71% of all plugin sales in November, still 4 percentage points below this year’s average.

In total, plugins had 26% share of the auto market in November, keeping the year-to-date count at 24% (18% BEV). Expect December to be a strong month, in what will be a last hurrah! before the end of subsidies at the end of this year, followed by a difficult first half of 2024. The 3rd quarter of 2024 will possibly bring growth back to the German EV market, preluding a strong 2025, when the EV market is said to accelerate the pace significantly again.

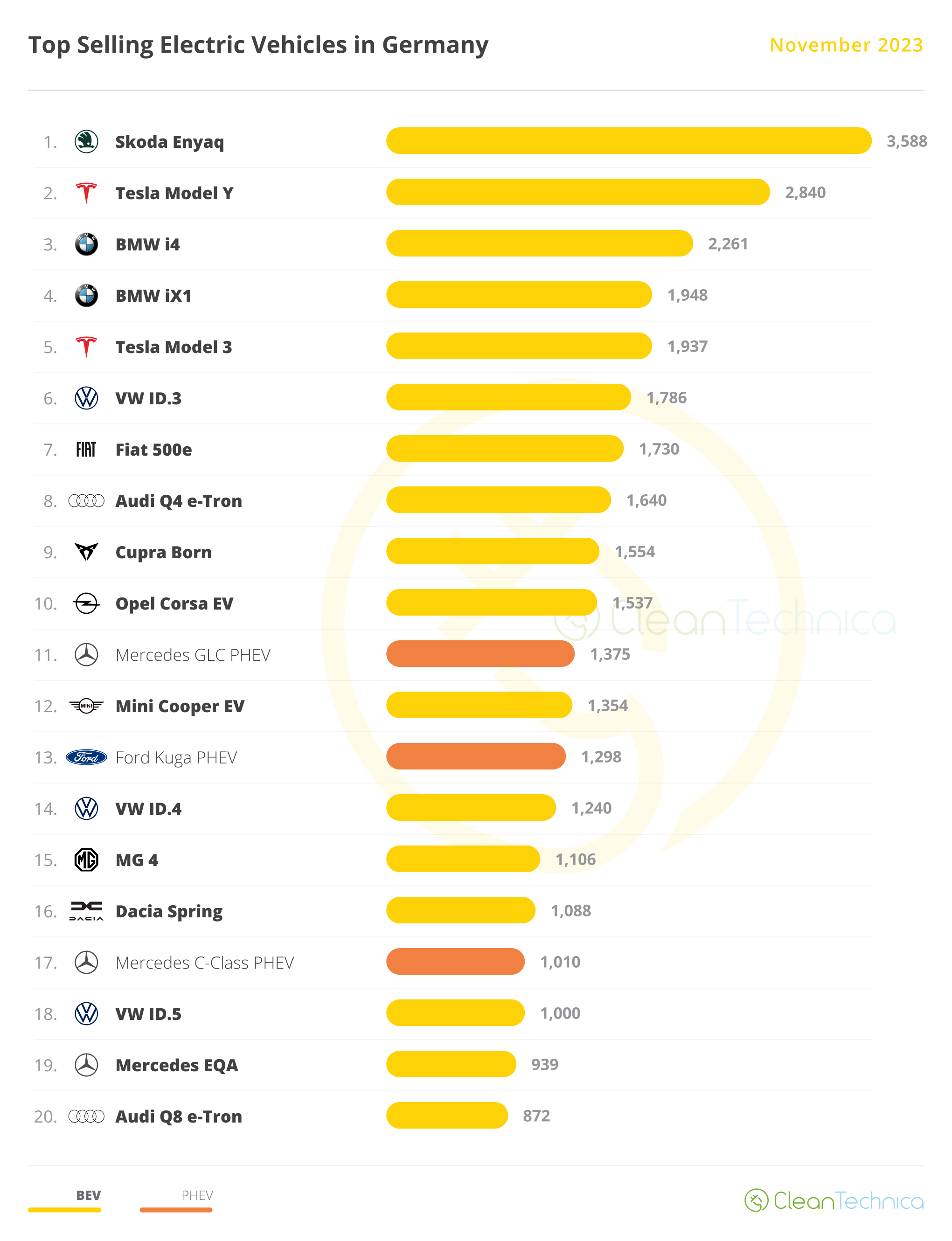

The 20 Best Selling Electric Vehicles in Germany — November 2023

The winner was something of a surprise. The Skoda Enyaq won the best seller trophy for the 2nd time in a row, allowing it to be #8 in the overall ranking. It had a record 3,588 registrations, beating not only the current sales king in Germany, the Tesla Model Y (2nd, with 2,840 units), but also its superior in rank, the VW ID.4, which ended the month in 14th. Now we get why VW was so worried about demand issues — its bread and butter company car market crashed with the end of company car subsidies, and with it, demand for its ID models. All while Skoda is having record performances….

BMW had a great month, with the liftback i4 scoring a record result thanks to 2,261 registrations, allowing the midsizer to win its first podium presence while beating its most direct competitors (the Tesla Model 3 was 5th with 1,937 registrations, and the Mercedes C-Class PHEV was #17 with 1,010 registrations). Not only that — the Bavarian make also placed its current star player in Europe, the compact iX1, just below the i4 in 4th. It had a near record 1,948 registrations. It seems BMW has found its dynamic duo.

The Mercedes GLC PHEV scored its best result of the current generation and the nameplate’s best score since December 2021, 1,375 registrations, allowing it to be November’s best selling plugin hybrid in the table. This shows again that when you use a decently sized battery (31 kWh in this case), PHEVs can become a valid alternative on the market, even without subsidies.

The remaining surprise was at the bottom of the table, with the Audi Q8 e-tron ending the month in #20 with 872 registrations, which was just enough to beat the 800 units of the Mercedes EQE sedan or the 612 units of the BMW rodent iX. By the way, BMW’s big SUV result was a year-best score, underlining the German make’s positive month.

Outside the top 20, a few models deserve mention, like the Smart #1 crossover scoring 613 registrations, which means that the China-made EV is close to surpassing the long running Smart Fortwo EV (725 registrations), with the tiny two-seater making its last laps before running into the setting sun, and into EV Heaven. Currently, it is the oldest nameplate in the EV industry, running uninterrupted since 2009. In 2024, its last year of production, the tiny two-seater will celebrate 15 years on the market.

And to think it all started as a crazy idea from a (S)watch maker’s owner….

A final note on the new VW ID.7: with the brand’s mainstream models, the ID.3 and ID.4, experiencing a demand valley, and the ID. Buzz not meeting initial expectations (just 652 registrations in November), many eyes are now on the liftback EV to change Volkswagen’s fortunes in its domestic market. So, it is important to highlight the 564 registrations of the mid-to-full size model in its second month on the market. Will the ID.7 bring some badly needed good news to the German make? Watch this space.

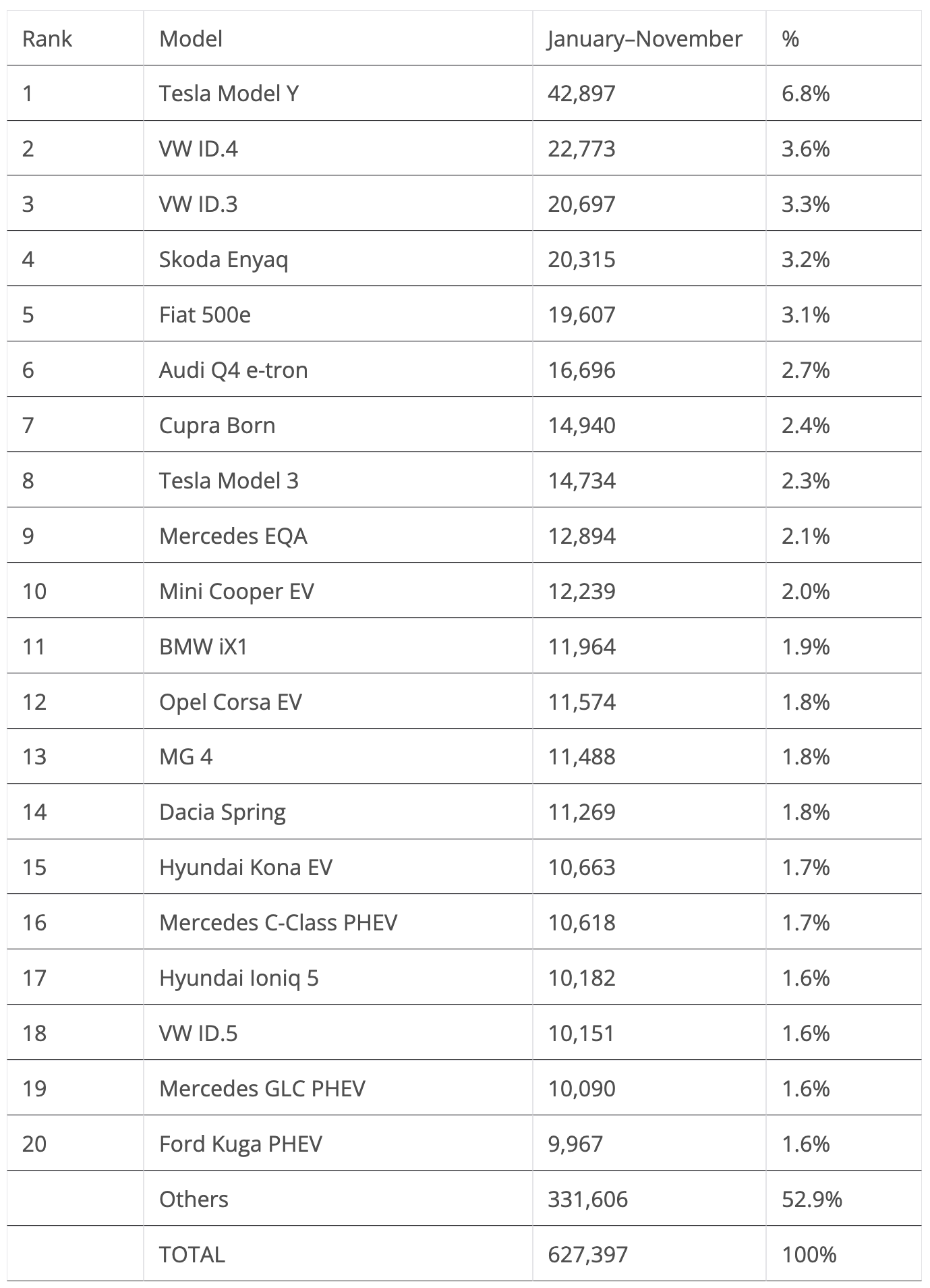

The 20 Best Selling Electric Vehicles in Germany — January–November 2023

Regarding the 2023 table, the Tesla Model Y sits well above everything else, with a 20,000-unit advantage over the runner-up VW ID.4. So, it is certain that the US crossover will win its second consecutive best seller trophy in this market. This is disruptive performance for a foreign model in German lands — not only in the EV category, but also in the mainstream market. Expect it to again be the main candidate for the 2024 best seller title, which would allow it to equal the Renault Zoe’s three-year winning streak (2018–2020).

The remaining podium positions are much more open to discussion. With the VW ID.4 and ID.3 suffering significant slowdown, their podium positions are in danger. The #2 VW ID.4 risks losing its first medal position in its domestic market due to the rise and rise of its Czech cousin, the Skoda Enyaq, which could jump from 4th to 2nd in the last month of the year. The #5 Fiat 500e could also surprise the German crossover in the last stage of the race.

The also slowing #3 VW ID.3 has also had its podium presence put in danger, with the Skoda Enyaq probably replacing it on the podium. Meanwhile, the Fiat 500e could also surpass it in December.

What about the refreshed Tesla Model 3, some might ask.

While the US sedan should climb some positions above its current #8 spot, it is some 6,000 units behind the #3 VW ID.3. And while it should experience a high tide in December, that shouldn’t be enough to cover the difference, especially considering that next month, Tesla will likely prioritize France due to the end of subsidies for China-made EVs on January 1, 2024.

This will mean that for the first time since 2018, and after two bronze medals (2019 & 2020), one gold (2021), and one silver (2022), we won’t see the Tesla midsizer on the German podium!

The second half of the table saw five position changes. The Climber of the Month was the BMW iX1. Thanks to a strong result in November, it surged four positions, into 11th, cementing its position as BMW’s new darling.

Just below, the Opel Corsa EV was up two positions in November, to 12th, with the Stellantis EV looking to surpass the #10 Mini Cooper EV in December to become the B-segment/subcompact king in the EV category in 2023.

Still on the topic of the YTD table, the sporty VW ID.5 joined the table in #18, thus partly compensating the losses of the more company-car friendly VW ID.4 and ID.3.

On a different note, plugin hybrids managed to add one more model to the table, with the Ford Kuga PHEV returning in #20. Meanwhile, the #19 Mercedes GLC-Class PHEV was up one position, to #19. Two months ago, only the Mercedes C-Class PHEV was representing plugin hybrids on the table.

And with the end of subsidies for BEVs in 2024, expect PHEVs to become a common sight again in the plugin table.

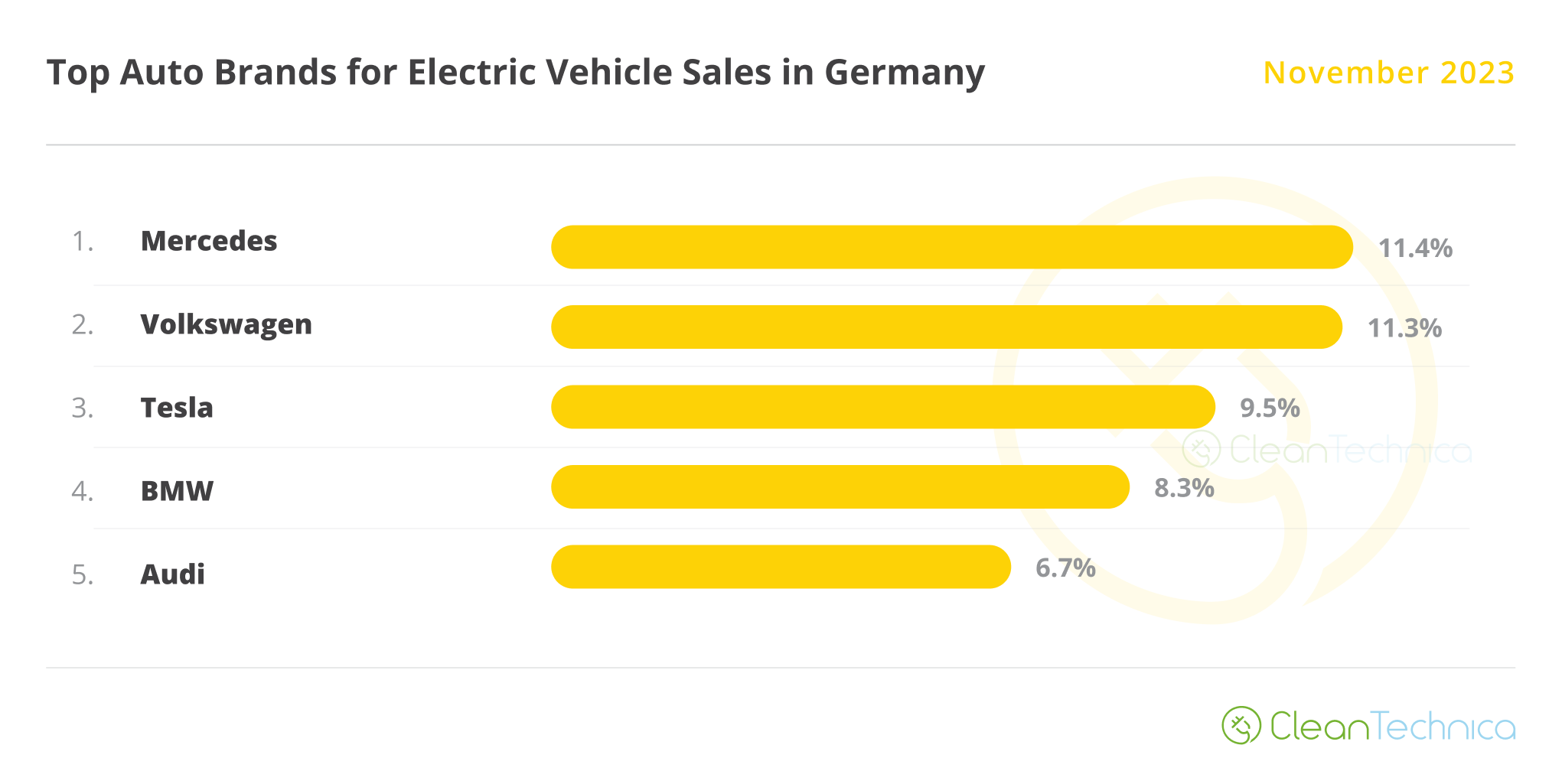

Auto Brands Selling the Most Electric Vehicles in Germany

In the brand ranking, Volkswagen (11.3%, down from 11.4%) lost the leadership spot, having lost a lot of share in the most recent months (it had 12.8% in July). This significant demand slowdown is endangering the title revalidation, preventing VW from winning its 4th title in a row.

On the other hand, Mercedes (11.4%, up from 11.2%) became the new leader and is now the favorite to win this year’s title, its first ever. After three consecutive silver medals, that should surely feel special. The Stuttgart company won on all fronts, while watching its most direct competitors — #2 Volkswagen and #3 Tesla — lose share. The US company dropped from 10% in September to its current 9.5%. Expect the US brand to recover in December — although, that recovery shouldn’t be enough to place it higher on the podium.

Another winner in November was BMW (8.3%, up from 7.7%). With the BMW i4 and iX1 at record heights, the Bavarian make is on the rise, having won a full 1% share in the last three months. Will BMW be back in the race for #1 in 2024?

#5 Audi (6.7%) should end the year in 5th and should have a uneventful December, something that #6 Hyundai (4.9%, down from 5%) cannot say, as #7 Opel (4.8% share) is closing in. Expect a close race for the 6th spot by year end. Fingers crossed.

Auto Groups Selling the Most Electric Vehicles in Germany

Looking at the OEM ranking, Volkswagen Group has its domestic market well in hand with 27.8% share, benefitting from the stellar performance from Skoda.

Volkswagen Group is followed at a distance by #2 Mercedes-Benz (13.8%). The OEM profited from a solid performance from its namesake brand to compensate for Smart’s loss of volume. Stellantis dropped its share to 12.3%, as most of its smaller models are still in transition for the new 54 kWh battery versions.

In 4th, we have rising BMW Group at 10.3%, up 0.6% share month over month, allowing it to surpass Tesla (9.5%). Expect the US make to rebound in December, but it shouldn’t be enough to reach BMW Group, especially now that the German OEM has found its mojo again.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.