Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Yup, 2024 is a wrap. Looking back to determine the biggest electric vehicle stories of the year, I could look through thousands of stories to try to identify the biggest — and I’ll probably do that as well — but trying to answer that question just by digging through my memories, four big stories stand out to me. Let’s roll through them.

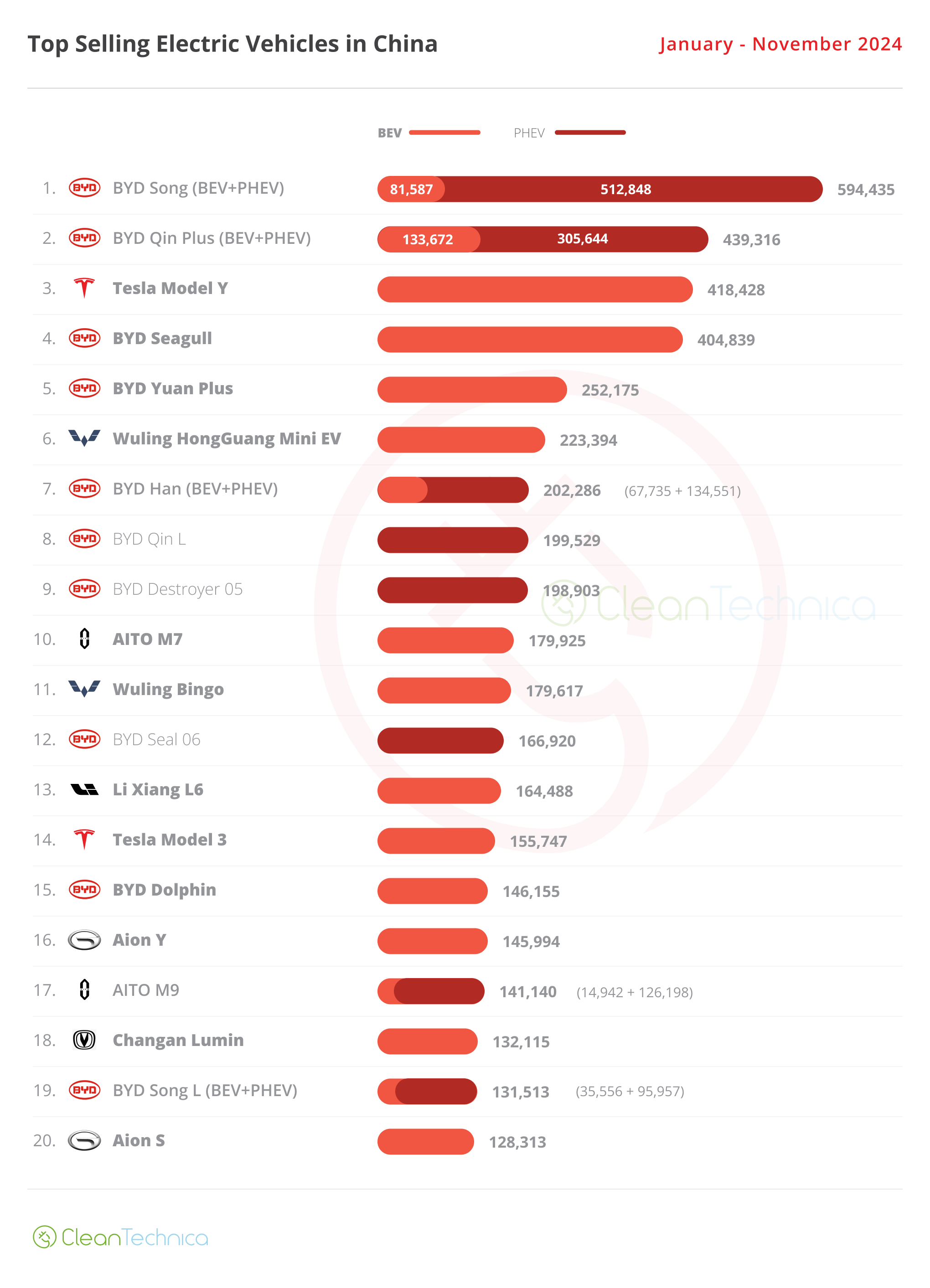

1. BYD’s rapid rise up the sales charts

BYD has grown its sales tremendously in the past year. It was already a large automaker in 2023, but the company has rolled out several new models, grown to dominate more and more of the Chinese EV market, and started exporting vehicle to numerous countries. As a result, it was the 2nd best selling auto company in the world in November! And it could rise from 4th in the first 11 months of the year to 3rd across the full calendar year. It’s a stunning achievement. Read more about it here.

2. Xiaomi’s stunning entrance on the EV market

Xiaomi is the 2nd best selling smartphone brand in the world, and it’s now using that large brand appeal and tech expertise to become a leader in the electric vehicle arena. In just nine months, its first model has gotten more than 130,000 sales! Every EV startup would dream of such an entrance and fast rise up the sales charts. As if this hot start wasn’t enough, Xiaomi wants to become one of the five biggest auto brands in the world. Given BYD’s success in achieving that, it’s a little easier to imagine Xiaomi achieving that target. How high will Xiaomi rise a year from now, and with more models on the market?

3. China EV sales surpass 50% of new vehicle sales

Yes, this ties in with both stories above, but it’s a tremendous macro story that deserved more headlines than it got in 2024. More than half of the new car sales in China, the biggest auto market in the world by far, are now plugin car sales! Those EV sales represent about half of global EV sales. While we’ve long been able to point to great growth in EV adoption — specifically, EV market share — in a few small-ish European countries, being able to show a rise to 50%+ of auto sales in the behemoth of the global auto industry says a lot more about the EV landscape, where EVs are headed, and how easy it is to electrify. You can follow China’s monthly EV sales trends here.

4. Tariffs on Chinese EVs

I almost forgot about this one, but it’s definitely been one of the top stories of the season. With European and US auto manufacturers scared of cheap but high-quality EVs from China, they’ve lobbied to block Chinese EV companies from their core home markets. The European Union seemingly tried to do an objective, fair analysis of how much support Chinese EV manufacturers got from the Chinese government in order to come up with tariffs for different automakers and then for remaining Chinese EVs overall. The US slapped a 100% tariff on them, which is definitely going a bit too far, but that’s where we are. You can read more about the tariffs here.

5. Tesla’s stagnation

It’s unfortunate to have an objectively negative story in this top five, but it’s got to be. Tesla’s sales have been anything but superb this year. While the company was supposed to be seeing 50% growth a year up through 2030, per CEO Elon Musk, its sales have been slightly negative this year. Through the first 9 months of the year, Tesla’s sales were lower than in that same timeframe in 2023. Can Tesla climb out of this period of stagnation and return to rapid growth? It’s hard to see that happening at the moment, but we’ll see what happens with Full Self Driving (FSD) and a potentially cheaper mass-market model in 2025.

Any other massive stories I’m missing?

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy