Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

There have been millions of words written since Elon Musk announced this week that Tesla has laid off 10% of its employees — roughly 14,000 people. What does the announcement mean? Will Tesla survive? Is the EV revolution dead? Will Elon sell X and devote more attention to Tesla? No one knows the answers, but that hasn’t stopped people from expressing their opinions.

Analysts at JP Morgan said, “the sweeping $TSLA layoffs announced yesterday, amounting to a reduction in crewed production capacity, should now leave no doubt that the decline in deliveries has been a function of lower demand and not supply … has far reaching implications for the hyper-growth narrative still embedded in Tesla’s share price, suggesting material downside risk for the stock. We estimate revenue may decline -13% y/y in the coming quarter.”

Translated into ordinary terms, what the analysts are saying is that for many years, Tesla’s lofty stock valuation has been pumped up by people’s expectations about Musk. Noted investors like Cathie Wood at ARK Investments have been banging the drum for Tesla for years, predicting its stock would be worth $2000 a share by the end of this decade. And maybe it will. Predicting the future is always a risky business.

But now we know that two longtime Tesla senior managers — senior vice president Drew Baglino and the company’s head of policy Rohan Patel — are also leaving. Is this normal or are Baglino and Patel abandoning a sinking ship, based on insider knowledge only they would be privy too? Once again, we don’t know, but as the saying goes, “the timing stinks.”

Thanks for everything you’ve done for Tesla. Few have contributed as much as you.

— Elon Musk (@elonmusk) April 15, 2024

The past 8 years at Tesla have been filled with every emotion – but the feeling I have today is utmost gratitude.

To our unbelievable customers and fans – I’m inspired by your passion and impact on @Tesla and the mission.

To @elonmusk for giving me the chance and…

— Rohan Patel (@rohanspatel) April 15, 2024

Tesla And The S Curve

Those who support the rise of electric cars often talk about the S Curve — a sinusoidal graph that purports to show how new innovations succeed. It starts slowly, as, at first, only risk takers agree to try the next new thing. Older readers may recall when flatscreen TVs first appeared. The early ones cost about $10,000 and few were sold. Several years later, the price was down to $2,000 and sales had ramped up considerably. Today, anyone can walk into a big box store and buy a 60″ flat screen TV for $500 or less.

The conventional wisdom is that when new technologies reach 5% of sales, that’s when the S Curve begins to turn sharply upward. EV sales are now at 5% or higher in many countries, and so the thinking is that the EV revolution has finally begun in earnest and all the hoopla about mandates and emissions regulations will become academic, since the market will decide to embrace EVs without all that external forcing.

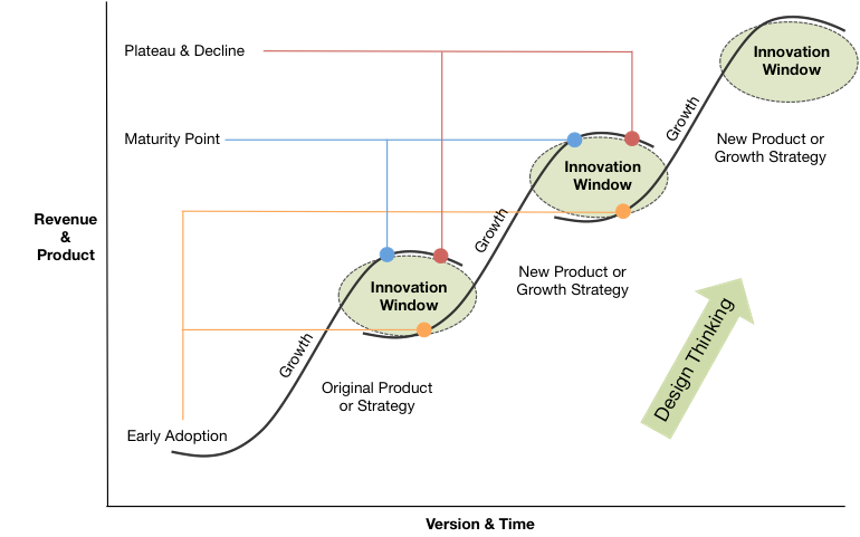

But take a look at the S Curve as depicted by Future Business Tech and you will see it is comprised of several smaller curves, each one leading to an innovation window. Many people make the mistake of thinking that once the curve starts trending sharply upward, the rest of the journey to fame and fortune is guaranteed. It is not, and those who think that way are destined to get a kick in the teeth from reality. Constant innovation is required to keep ahead of the competition, and it can be argued that Tesla has failed to achieve that in critically useful ways for its growth goals. (Many will disagree, of course. That’s what makes horse races.)

While Tesla was first out of the gate in many ways, it has attracted lots of competitors worldwide, competitors who are not content to simply play “Follow the Leader.” BYD in particular has taken the opposite approach. Where the American company chose to start at the top of the market and use the profits from its premium automobiles to fund development of lower priced cars, the Chinese company chose to focused on the bottom of the market — electric cars for the masses — and became the largest manufacturer of electric vehicles on the planet at the end of 2023.

Knowledgeable readers will recognize that the BYD plan is precisely how Volkswagen, Toyota, Honda, Hyundai, and Kia built themselves into major global automakers. Elon may have a Master Plan, but it runs counter to the path that some of the world’s most successful car companies have followed. An argument can be made that Tesla, under the guidance of its chief executive, has failed to take advantage of those innovation windows, choosing instead to chase rainbows — falcon-wing doors, rooftop solar tiles, residential battery storage, Class 8 trucks, robotaxis — which has allowed others to catch and even pass it.

Apple offers an interesting comparison. The iPhone is one of the most impactful new products of the 21st century, but the version Apple sells today is vastly different from the original. It has more memory, a better battery, and more camera lenses. A 2019 Model Y looks pretty much the same as a 2024 Model Y, and while it’s a great looking car, every other manufacturer is constantly bringing out new models and refreshing existing ones. One of the most powerful words in marketing is “new.”

Elon has placed all his chips on red (robotaxis) and let it ride. That is a very risky strategy, one that a seasoned business leader would likely avoid, but the captive Tesla board of directors apparently has decided its function is to lap up the pay and perks that come with serving and stay out of Elon’s way. The fate of the company now hangs in the balance.

Tesla & Layoffs

Shortly after news broke about the layoffs at Tesla, Zachary Shahan wrote a well reasoned and informed piece about what they mean. If you want a compendium of cogent opinions from CleanTechnica readers on the subject, check out the comments section of that article. Here is one in particular from someone I hold in the highest esteem:

“I personally feel that Tesla is not a real company when it comes to stock valuation. Instead, the value of its shares is an ongoing plebiscite about Elon Musk, a man who is deeply flawed as an individual. He, like many in the tech industry, believes he can rise above mere mortals simply by the power of his superior brain. I cannot shake the feeling that there is an obvious comparison between Musk in real life and the Wizard of Oz, standing at the controls of his empire to project a larger than life persona onto a entirely too credulous citizenry. The imagery of smoke and flames surrounding the disembodied image of the wizard is very much like the hyperbole for which Musk is now famous.

“But a carefully curated myth eventually needs to meet reality and this is what is happening now. The truth is that Musk runs Tesla like a private company, a one man fiefdom where he is the one and only true god. He is self important to the point of being pigheaded. He has assembled a weak board of directors who enjoy their lavish perks and proximity to the great man too much to ever challenge him. His employees have been lured into working for less than their unionized peers partly because they are eligible for some stock in the company. But what is the true value of that stock? Employees must be asking themselves whether they are truly benefiting when the stock price tanks.

“I can’t help feeling that the pruning of the Tesla workforce is just implementing the advice of Jack Welch, the former GE CEO, who simply fired 10% of the workforce every year, believing that was the way to keep a company profitable — and to incentify those remaining to work harder.

“Tesla is a victim of the S Curve. That theory posits that in order to achieve long term success, a company must constantly be aware of its competitive position and innovate constantly to stay ahead of the pack nipping at its heels. Tesla has failed to do that. It is still flogging its original innovations and ignoring that things change. Musk refuses to bow to anyone’s vision but his own. It is what got him where he is today, and it will prove to be his undoing.”

The Yellow Brick Road

The Wizard Of Oz is one of the best known and most loved movies of all time. It is based on a children’s book by Frank Baum that investigated the ideas of William Jennings Bryan, who was a staunch proponent of the gold standard — the idea that the currency of the United States should be backed by actual treasure so that any citizen could walk into a bank and exchange a dollar bill for a dollar’s worth of gold. Some say “Oz” is the popular abbreviation for “ounce,” the customary unit of measure for gold. The yellow brick road is an obvious analogy for gold.

In the end, the illusion of the Great And Powerful Oz is shattered by Toto, Dorothy’s dog, who pulls back the curtain to reveal that the Wizard is just a man (William Jennings Bryan himself, allegedly), who uses technology to create a public persona that shows him to be something much more than an ordinary person. Of course, once the secret is revealed, the illusion of the Wizard is shattered and he floats away in a hot air balloon. How appropriate, since hot air is all that kept the illusion alive in the first place.

The Takeaway

Perhaps the unkindest thing Elon Musk has ever done is to notify his employees by email in the middle of the night that they were fired — after cavorting with Kim Kardashian hours before. Many didn’t even know they were terminated until they found their employee credentials no longer worked. There is no excuse for firing people in such a cold, callous way. Musk should be ashamed.

It has been a tough year for Tesla. Deliveries are down, the stock is down, and now the air has gone out of the Tesla balloon. Clearly, there are no industry professionals in charge at Tesla; there is only one person running the show and doing it badly. This is not likely to end well.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.